Score

AAAFx

Saint Vincent and the Grenadines|5-10 years|

Saint Vincent and the Grenadines|5-10 years| https://aaafx.com/global/?Lang=en-US

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

AAAFx-FX-Demo

Influence

AA

Influence index NO.1

Canada 9.09

Canada 9.09MT4/5 Identification

MT4/5 Identification

Full License

United States

United StatesInfluence

Influence

AA

Influence index NO.1

Canada 9.09

Canada 9.09Contact

Licenses

Licenses

Licensed Institution:SIKHULA VENTURE CAPITAL (PTY) LTD

License No.:49299

- The number of the complaints received by WikiFX have reached 12 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed AAAFx also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

Website

Most visited countries/areas

Cote d'Ivoire

Morocco

Greece

aaafx.com

Server Location

United States

Most visited countries/areas

Egypt

Website Domain Name

aaafx.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

0001-01-01

Server IP

198.107.197.24

Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| AAAFx Review Summary in 10 Points | |

| Founded | 2007 |

| Registered Country/Region | No license |

| Regulation | Saint Vincent and the Grenadines |

| Market Instruments | Forex, indices, commodities, stocks, cryptocurrencies |

| Demo Account | Available |

| Leverage | 500:1 |

| EUR/USD Spread | 0.1 pips |

| Trading Platforms | MT4/5 |

| Minimum deposit | $100 |

| Customer Support | 24/5 live chat, phone, email, online messaging |

What is AAAFx?

AAAFx, a trading name of Alpha Global Ltd, is a multi-asset broker founded in 2007 and registered in Saint Vincent and the Grenadines that claims to provide its clients with various tradable financial instruments with flexible leverage up to 500:1 and floating spreads from 0.0 pips on ActTrader, MT4, MT5, and ZuluTrade trading platforms via four different live account types, as well as 24/5 customer support service. However, it's worth noting that AAAFx currently operates without a valid regulatory license, and traders are advised to carefully consider the associated risks before engaging with the platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Multiple trading assets | • No regulation |

| • Demo accounts available | • Reports of difficulties in withdrawing funds and potential scams |

| • Flexible leverage options ranging from 1:1 to 500:1 | • Regional restrictions |

| • Tight spreads | • Commission charged |

| • MT4 and MT5 supported | |

| • Free deposits and withdrawals |

AAAFx Alternative Brokers

TD Ameritrade - A reputable and well-established broker with a wide range of investment options, making it suitable for both beginner and advanced traders.

Interstellar FX - An unregulated broker with limited information available, caution is advised when considering trading with this platform.

JFD - A regulated broker offering a comprehensive range of trading instruments and platforms, making it a reliable choice for traders seeking a professional and transparent trading experience.

There are many alternative brokers to AAAFx depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is AAAFx Safe or Scam?

AAAFx currently has no valid regulation, but it claims to offer certain protection measures such as Negative Balance Protection. It's advisable to conduct thorough research and consider the risks associated with trading on an unregulated or partially regulated platform.

Market Instruments

AAAFx provides a diverse range of trading instruments to cater to the needs of its clients. Traders can access over 200 financial instruments, including major and minor currency pairs in the Forex market, popular stock indices from around the world, a selection of commodities such as gold, silver, and oil, a variety of individual stocks from different global exchanges, and even cryptocurrencies like Bitcoin, Ethereum, and Litecoin. This wide range of instruments allows traders to diversify their portfolios and take advantage of various market opportunities across different asset classes.

Accounts

AAAFx offers a range of account types to accommodate different trading preferences and needs. Traders can start by practicing their strategies and familiarizing themselves with the platform using a demo account, which allows them to trade with virtual funds in a risk-free environment. For those ready to trade with real money, AAAFx offers four live trading account options. The ECN account is suitable for most traders, requiring a minimum deposit of $100 and providing access to competitive spreads and fast execution.

The ECN Plus account is designed for more experienced traders, with a higher minimum deposit of $1,000 but offering lower spreads and additional features. The ECN Zero account is tailored for high-volume traders, with a minimum deposit requirement of $50,000 and offering even tighter spreads. Additionally, AAAFx offers an Islamic account for traders who adhere to Islamic principles, which operates in compliance with Sharia law.

| ECN | ECN plus | ECN zero | Islamic | |

| Minimum Deposit | $100 | $1,000 | $50,000 | $100 |

| Minimum lot | 0.01 | |||

| Margin Call | 100% | |||

| Stop-out | 70% | |||

| Minimum Order Distance | No | |||

Leverage

AAAFx provides flexible leverage options, allowing traders to choose the level of leverage that suits their trading style and risk tolerance. With leverage ratios ranging from 1:1 to 500:1, traders can effectively amplify their trading positions and potentially increase their potential profits.

| Leverage | Nominal Trade Size | Margin Required |

| 500:1 | $100,000 | $200 |

| 200:1 | $100,000 | $500 |

| 100:1 | $100,000 | $1,000 |

| 50:1 | $100,000 | $2,000 |

| 25:1 | $100,000 | $4,000 |

| 10:1 | $100,000 | $10,000 |

| 5:1 | $100,000 | $20,000 |

| 2:1 | $100,000 | $50,000 |

| 1:1 | $100,000 | $100,000 |

However, it is important to note that higher leverage also comes with increased risk, as it amplifies both potential gains and losses. Traders should exercise caution and carefully consider their risk management strategies when utilizing leverage.

Spreads & Commissions

AAAFx offers competitive spreads and commission structures tailored to different account types and trading instruments. The spreads are variable and depend on the chosen account type and trading instrument. On the ECN, ECN plus, and ECN zero accounts, the spreads start from 0.0 pips, providing traders with tight and competitive pricing. However, on the Islamic account, the minimum spread is slightly higher at 1.8 pips. For the popular EUR/USD currency pair, the spread is floating around 0.1 pips, indicating favorable trading conditions.

In terms of commissions, AAAFx charges commissions on certain account types, with the ECN and Islamic accounts having a commission rate of $2.5 per $100,000 traded, the ECN plus account with a commission rate of $1.5, and the ECN zero account with no commission.

| ECN | ECN plus | ECN zero | Islamic | |

| Minimum Spread | 0.0 pips | 1.8 pips | ||

| Commission | ||||

| Forex (per $100k) | $2.5 | $1.5 | $0 | $2.5 |

| Indices & Commodities (per $100k) | $2.5 | $1.5 | $1 | $2.5 |

| Stocks (per lot) | 0.09% | 0.08% | 0.07% | 1% |

| Cryptocurrencies (per lot) | 0.001*Price | 0.0008*Price | 0.0007*Price | 0.002*Price |

Trading Platforms

AAAFx offers a range of robust and user-friendly trading platforms to cater to the diverse needs of traders. The popular MetaTrader4 (MT4) and MetaTrader5 (MT5) platforms are available for desktop, web, Android, and iOS devices. These platforms are well-known for their advanced charting capabilities, technical analysis tools, and automated trading options. Traders can access a wide range of trading instruments, execute trades with ease, and monitor their positions in real-time.

Additionally, AAAFx provides the ActTrader platform, which offers a user-friendly interface and a variety of trading features. The ActTrader platform allows traders to customize their trading experience and offers seamless execution of trades. For those interested in social trading, AAAFx supports the ZuluTrade platform, which enables users to follow and copy the trades of successful traders.

With AAAFx's diverse range of trading platforms, traders have the flexibility to choose the one that best suits their trading style and preferences, ensuring a smooth and convenient trading experience.

See the trading platform comparison table below:

| Broker | Trading Platforms | |

| AAAFx | MT4, MT5, ActTrader, ZuluTrade | |

| TD Ameritrade | thinkorswim, Web Platform | |

| Interstellar FX | MetaTrader 4 | |

| JFD | MetaTrader 4, MetaTrader 5 | |

Trading Tools

AAAFx provides traders with a range of useful trading tools to enhance their trading experience. The trading calculators, including the Swap Calculator, Margin Calculator, and Pip Calculator, are valuable tools for risk management and position sizing. Traders can easily calculate their potential swaps, required margins, and pip values, enabling them to make informed decisions when executing trades. These calculators help traders assess and manage their risk exposure effectively.

Additionally, AAAFx offers an economic calendar, which provides essential market news, events, and economic indicators that can impact the financial markets. This tool enables traders to stay updated with upcoming events and make more informed trading decisions based on fundamental analysis.

Overall, AAAFx's trading tools contribute to a comprehensive trading environment that empowers traders with the necessary information and resources to make informed trading choices.

Deposits & Withdrawals

AAAFx provides traders with a variety of convenient deposit and withdrawal methods to cater to their diverse needs. Traders can choose from options such as bank cards, wire transfers, APM (Alternative Payment Methods), e-wallets, and cryptocurrencies.

The minimum deposit requirement is set at a low threshold of $10, making it accessible for traders with different budget sizes. Opening an account requires a minimum deposit of $100, ensuring that traders have sufficient capital to start trading. The minimum withdrawal amount is also set at $10, allowing traders to withdraw their funds as needed.

Base currencies

: USD/ EUR/ CAD/ AUD

AAAFx minimum deposit vs other brokers

| AAAFx | Most other | |

| Minimum Deposit | $100 | $100 |

Importantly, AAAFx does not charge any commission for deposits and withdrawals, which adds to the convenience and cost-effectiveness of using their platform. While wire transfers and VIRTOALPAY deposits/withdrawals may take 1-2 business days for processing, other deposits/withdrawals are processed instantly, allowing traders to start trading without unnecessary delays.

See the deposit/withdrawal fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee |

| AAAFx | Free | Free |

| TD Ameritrade | No deposit fee | $0 for ACH, $25 for wire transfer |

| Interstellar FX | No deposit fee | No withdrawal fee |

| JFD | No deposit fee | No withdrawal fee |

Please note that fees may vary depending on the specific account type, payment method, and other factors. It's always recommended to check with the respective brokers for the most up-to-date and accurate fee information.

Customer Service

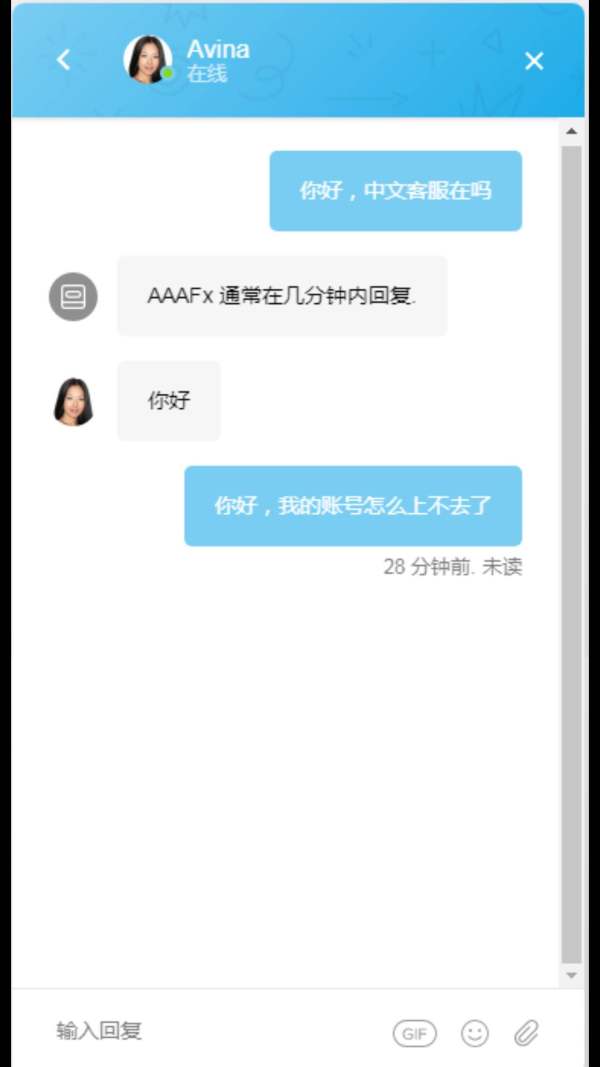

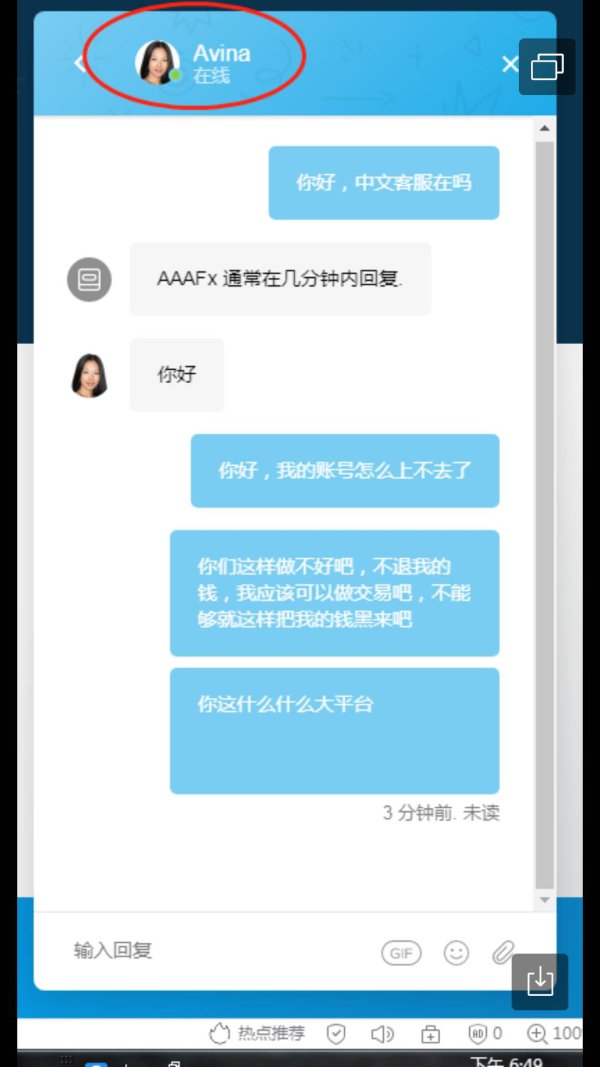

AAAFx places a strong emphasis on providing excellent customer service to its clients. Traders have access to a range of communication channels, including live chat, phone support, email, and online messaging, ensuring that assistance is readily available 24/5 from Monday to Friday.

The inclusion of a comprehensive FAQ section further enhances the self-help options for traders, allowing them to quickly find answers to common questions.

Additionally, AAAFx maintains an active presence on various social media platforms, including Twitter, Facebook, Instagram, and LinkedIn, where traders can stay updated with the latest news and announcements from the broker. The company's commitment to transparency is evident in the open disclosure of its physical address, establishing a level of trust and accountability.

Overall, AAAFx strives to provide prompt and reliable customer support, ensuring that traders receive assistance whenever needed and have access to relevant information through multiple channels.

| Pros | Cons |

| • 24/5 multi-channel support | • No 24/7 customer support |

| • Availability of FAQs for common inquiries | |

| • Active presence on social networks | |

| • Open disclosure of company address |

Note: These pros and cons are subjective and may vary depending on the individual's experience with AAAFx's customer service.

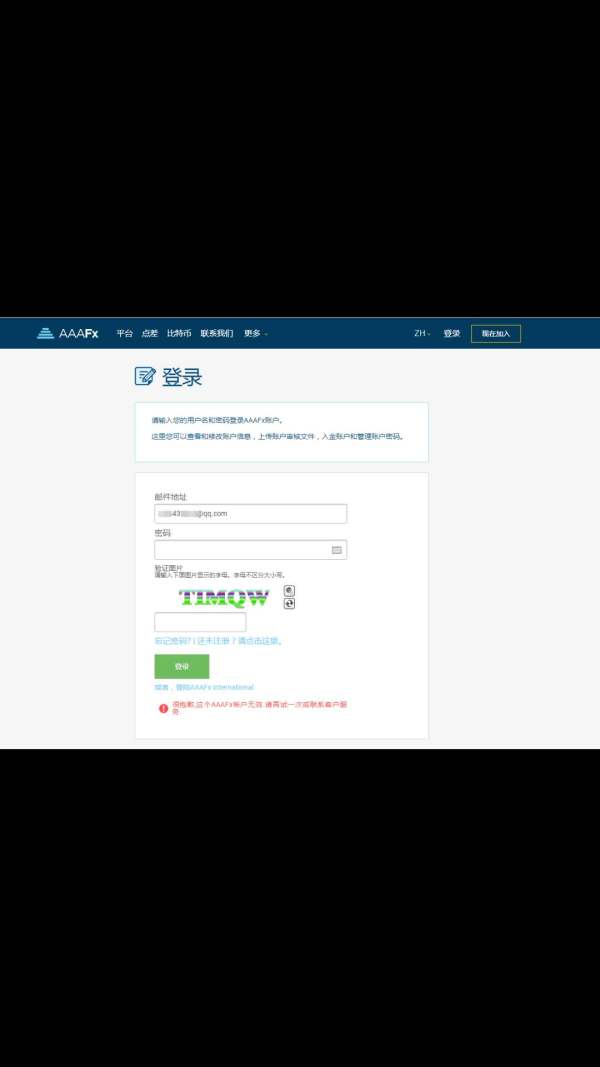

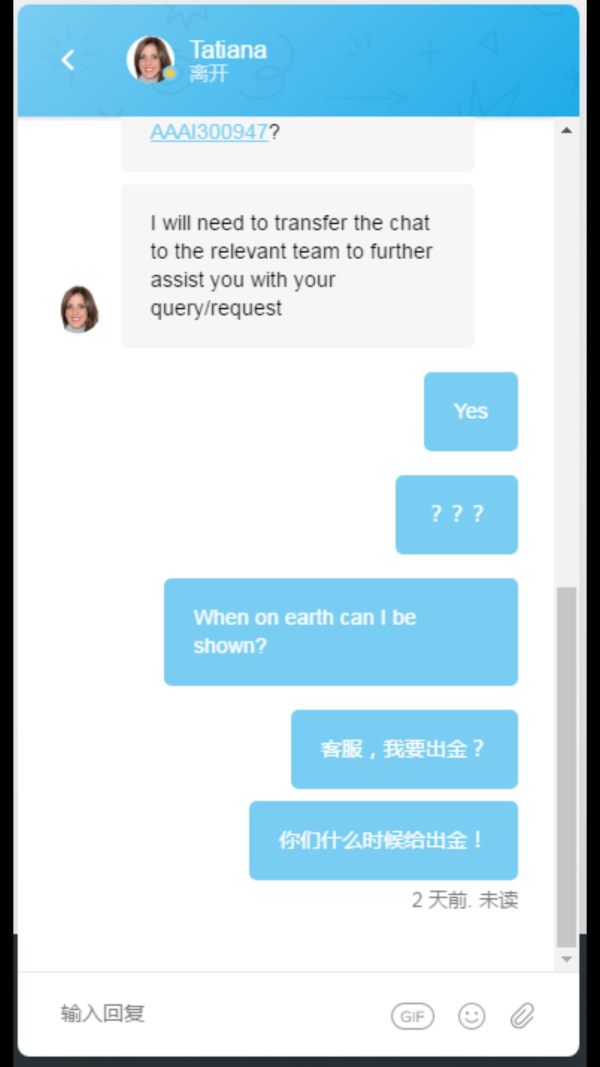

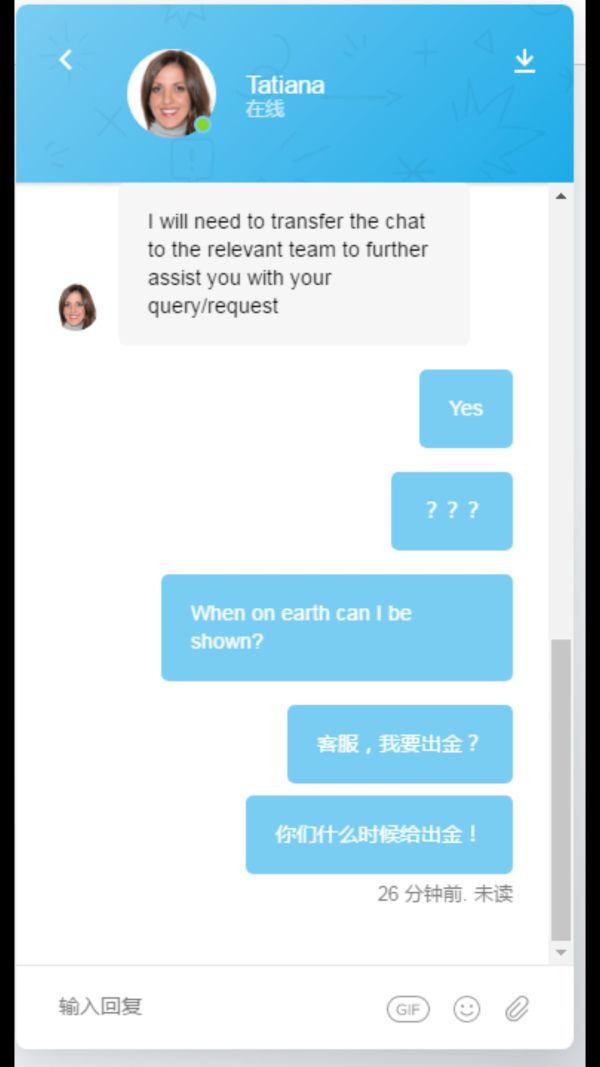

User Exposure on WikiFX

On our website, you can see that some reports of unable to withdraw and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

In summary, AAAFx offers a diverse range of trading instruments and account types, providing traders with various options to suit their needs. The flexible leverage and availability of popular trading platforms enhance the trading experience.

However, the lack of a valid regulatory license raises concerns about the safety of client funds. Reports of withdrawal difficulties and potential scams further highlight the risks associated with trading on this platform. While AAAFx provides convenient deposit methods and active customer service, traders should exercise caution and conduct thorough research before considering this broker. It is advisable to explore regulated alternatives with a proven track record of safety and reliability.

Frequently Asked Questions (FAQs)

| Q 1: | Is AAAFx regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | At AAAFx, are there any regional restrictions for traders? |

| A 2: | Yes. AAAFx does not provide services to residents of the USA, Puerto Rico, Quebec(Canada), United Kingdom, Sri Lanka, New Zealand, Japan, India, Afghanistan and to residents of OFAC sanctioned countries, and any other country or region where such services are contrary to local laws and regulations. Please note that this list is subject to change according to regional and international regulations, and as a result is not exhaustive. Additionally, AAAFx does not provide services to European Union and European Economic Area residents. |

| Q 3: | Does AAAFx offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does AAAFx offer the industry leading MT4 & MT5? |

| A 4: | Yes. It supports MT4, MT5, ActTrader, and ZuluTrade. |

| Q 5: | What is the minimum deposit for AAAFx? |

| A 5: | The minimum initial deposit to open an account is $100. |

| Q 6: | Is AAAFx a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners. Though it advertises well, it lacks valid regulation. |

Keywords

- 5-10 years

- Regulated in South Africa

- Financial Service Corporate

- MT4 Full License

- MT5 Full License

- Global Business

- Suspicious Overrun

- High potential risk

Review 21

Content you want to comment

Please enter...

Review 21

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Gökhan 7430

Turkey

He gave me a 200 dollar bonus and never let me use it. My money was always liquid because of him, and some people don't even give their profits.

Exposure

2024-04-09

12584612

United Arab Emirates

IB name: cocoinvest99@gmail.com Sales name: Fateh. Before I introduce clients to AAA, both parties have agreed to pay rebates every Friday. I have been waiting for 1 month so far. But they don't pay. I don't know if this platform is going out of business. I suspect they are doing a scam.

Exposure

2023-07-03

FX2150998169

Hong Kong

I knew teacher Li at the end of 2018. And the teacher said he was a professional teacher with forex and he helped people invest. I’m a new hand. So I became so curious and asked him how? The teacher said it was hard to explain it clearly. Simply put, you give us your money and we help u profit on a no-risk basis. And the teacher should be giver 30% of the profit. This teacher kept posting the profitable screenshots and telling me how good his team was. So I believed him. I deposited in early March, 2019. And the teacher helped me trade everyday cuz I knew nothing about the investment. The teacher changed my login password and told me I could see the operate situation. At about 19:00, March 12, 2019, the teacher asked me add more money cuz the XAU/USD market was bullish! The teacher just pressured me and asked me to login to QQ and he would instruct me. I transferred 67,800 that day. There was another teacher arranged by the teacher Li helped me invest since march 13. But the price of my order went down since April 4! And the teacher bought over 10 lots of XAU/USD which were unprofitable on April 8! I lost from over $1,000 to $9,000! I was so worried that I asked the teacher what should I do? And my family didn’t support me! The teacher asked me to trust him and he wouldn’t let me lose!!!

Exposure

2021-03-12

如意10214

Hong Kong

There is $8000 or so left in my account, while it was scammed by the platform.Hope you select the platform wisely.

Exposure

2019-12-04

如意10214

Hong Kong

The platform continue the practice of withdrawing refusal. Its foreign customer service support said he couldn’t speak Chinese and asked me to contact Chinese customer support. However, when I replied in English, he is gone...

Exposure

2019-08-03

FX3548826967

Hong Kong

My money deposited in formax was transferred into aaafx. Having tried to enquire the customer service personnel about that several times, I wasn’t able to withdraw any money.

Exposure

2019-08-03

如意10214

Hong Kong

I have failed to contact the customer service for several months.No matter how long the customer service always didnt reply.Withdrawal was also unavailable.Please keep away from this platform.Anyway,I don't know why they don't respond.

Exposure

2019-07-27

如意10214

Hong Kong

It must be a fraud platform since it refuses my application for withdrawal several times and its customer service personnel give me a cold shoulder. I can’t get in touch with them both by Wechat or on the website. That’s really arrogant!

Exposure

2019-07-20

如意10214

Hong Kong

I have contacted the customer supports several times, asking for withdrawing, but they make no answer. However, the platform will send you an email everyday on time to inform the profitability.

Exposure

2019-07-13

如意10214

Hong Kong

I continued to contact the customer service this week, but they still ignored me. Do you think I will give up in this way? No, it only reinforces the fact that I keep exposing them until I can withdraw. To prevent more people from stepping into their trap, I insist on exposing them once a week.

Exposure

2019-07-05

如意10214

Hong Kong

The platform gives no access to withdrawal with grinding reasons these months.The customer service is out of contact totally.Exposure of AAAFx!

Exposure

2019-06-30

陈梦

Hong Kong

Formax Forex gives no access to withdrawal, privately transferring the amount in the account to AAAFx , and then says that only 4% of the full amount can be paid each month, and then it becomes a new payment plan to ban withdrawing money to before a new plan carried out. Now it requires 30% of clients’ withdrawal privately.

Exposure

2019-03-21

FX3089772123

Hong Kong

The withdrawal of gold can only be 4% of the full amount, and it is necessary to pay the service charge, so that it is not enough to pay the charge with the fund.I hope everyone will stay away from this pitted platform!

Exposure

2018-10-10

Daily Life

Ecuador

Reports of difficulties in withdrawing funds and potential scams add to the caution. Regional restrictions and commission charges are additional considerations in this complex trading landscape. I'm weighing the pros and cons carefully as I navigate my way through the markets with AAAFx.

Neutral

2023-12-04

XGOLD

Belarus

The availability of demo accounts is a great feature, providing a risk-free space for honing trading strategies. The flexible leverage options, ranging from 1:1 to 500:1, cater to both conservative and more aggressive traders. The tight spreads are a definite advantage, making transactions cost-effective. Plus, supporting both MT4 and MT5 platforms gives me the flexibility to choose what suits me best. On the downside, the lack of regulation is a concern, and I've heard murmurs about potential difficulties in withdrawing funds and encountering scams. I'm proceeding with caution, keeping an eye on developments.

Neutral

2023-12-01

㭍

Indonesia

Here is what I say: Trading with AAAFx is destined to lose your money. Order execution on this platform was extremely slow! What the hell they are doing? This disgusting, shady broker!

Neutral

2023-02-20

繁星空

Malaysia

The most basic account type can be opened with only $10, and whose spread & commission are very low. There is even a 100% deposit bonus. But all this is just their side story. They don't offer free demo accounts, so you can't test their real trading conditions at all.

Neutral

2022-11-28

Hachi

Thailand

I am someone who has been in the Forex industry for many years. There are quite a few brokers that I have tried. I think that each broker has both advantages and disadvantages. which makes me It is not specific to use a single broker for investing. Because I like diversification more. I started using AAAFx broker about 6 months ago and I am quite a heavy investor, but I have never had any problems with withdrawals. Especially during this period when brokers have top-up activities as well. The money I added Still get a bonus It gives me money to invest in more risks. I avoid reading bad and unrealistic comments because I firmly believe that brokers with more than 16 years of experience like AAAFx will definitely not ruin their name by not being able to withdraw money.

Positive

2023-11-09

big4846

Thailand

After I tried the services of AAAFX broker for a period of time. I have to admit that this broker is definitely one of the trustworthy brokers. Including easy and convenient trading on the widely popular MT4 and MT5 platforms. Also, the lowest commission of 0 here is a great consideration for those just starting out in trading. Trustworthiness: AAAFX broker has a years-long track record and a reliable reputation in the trading industry. This helps build confidence among customers. MT4 and MT5 Platforms: These platforms offer traders the convenience to start and execute trades. Zero Percent Commission: Zero percent commission is attractive to new traders who may want to try trading without the high costs.

Positive

2023-10-06

Pietro8832

Italy

The speed of order execution at this broker makes me think I made the right choice when I opened a trading account with this company. I knew that such trading conditions would help me to succeed. And as it turned out I was right.

Positive

2023-06-08