Score

FOREXimf

Indonesia|5-10 years| Benchmark A|

Indonesia|5-10 years| Benchmark A|http://www.foreximf.com/

Website

Rating Index

Benchmark

Benchmark

A

Average transaction speed (ms)

Influence

B

Influence index NO.1

Indonesia 8.03

Indonesia 8.03Benchmark

Speed:D

Slippage:B

Cost:C

Disconnected:A

Rollover:AAA

Influence

Influence

B

Influence index NO.1

Indonesia 8.03

Indonesia 8.03Contact

Licenses

Licenses

Basic Information

Indonesia

IndonesiaAccount Information

Users who viewed FOREXimf also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IronFX

- 15-20 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Benchmark

Website

Most visited countries/areas

Brunei

Indonesia

Malaysia

foreximf.com

Server Location

Indonesia

Most visited countries/areas

United States

Website Domain Name

foreximf.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2013-04-23

Server IP

202.158.123.133

Company Summary

| Registered in | Indonesia |

| Regulated by | ICDX, BAPPEBTI |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Forex pairs, commodities |

| Minimum Initial Deposit | Rp 2,5 Juta/ Rp 20,000 |

| Maximum Leverage | 1:400 |

| Minimum spread | 0.2 pips onwards |

| Trading platform | MT4 |

| Deposit and withdrawal method | Information not available |

| Customer Service | Email, phone number, address, live chat |

| Fraud Complaints Exposure | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of FOREXimf

Pros:

Offers a wide range of account types with varying spreads and commissions to suit different trading needs and budgets.

Provides a demo account for traders to practice and familiarize themselves with the platform.

Offers educational resources such as webinars, videos, and market reports to help traders improve their knowledge and skills.

Offers a high maximum leverage of up to 1:400 for the Lite account.

Provides multiple channels of customer support including live chat, email, and social media platforms.

Cons:

Limited information on the deposit and withdrawal process.

Limited trading instruments, with only forex pairs, precious metals, and energies available for trading.

Only regulated by Indonesian regulatory bodies, which may limit its appeal to international traders.

Limited options for customer support, with no phone support outside of business hours.

Lack of transparency on trading conditions, such as order execution speeds and slippage.

What type of broker is FOREXimf?

| Advantages | Disadvantages |

| FOREXimf offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, FOREXimf has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

FOREXimf is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, FOREXimf acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that FOREXimf has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with FOREXimf or any other MM broker.

General information and regulation of FOREXimf

FOREXimf is an Indonesia-registered forex broker that is regulated by both the Indonesian Commodity and Derivatives Exchange (ICDX) and the Commodity Futures Trading Regulatory Agency (BAPPEBTI). The broker offers various trading instruments, including forex pairs, precious metals, and energies, with different account types and useful trading platforms. Additionally, the broker provides educational resources and customer support services, including a demo account, economic calendar, market reports, video tutorials, online courses, 24/7 live chat, and social media presence.

In the following article, we will analyse the characteristics of this broker in all its dimensions, providing you with easy and well-organised information. If you are interested, read on.

Market instruments

| Advantages | Disadvantages |

| Diverse range of tradable instruments | Limited asset classes compared to other brokers |

| Access to trading precious metals and energies | No access to trading stocks, bonds or futures |

| High leverage available for forex trading | Higher volatility and risk with precious metals and energies |

| Low spreads on major forex pairs | Lack of diversity in commodity offerings may not suit some traders |

Foreximf offers its clients a range of trading instruments consisting of forex pairs, precious metals, and energies. This provides traders with a diverse range of asset classes to trade on their platform. However, compared to other brokers, Foreximf's limited asset classes may not suit all traders. One of the advantages of trading with Foreximf is the high leverage available for forex trading, which can magnify profits. Additionally, the low spreads on major forex pairs can save traders on transaction costs. However, trading precious metals and energies may come with higher volatility and risk. Overall, the range of tradable instruments offered by Foreximf is suitable for traders who are primarily interested in trading forex and commodities.

Spreads and commissions for trading with FOREXimf

| Advantages | Disadvantages |

| Competitive spreads and commissions | Higher commission fees for Pro account |

| Variable spreads allow for greater flexibility in trading | Higher spreads for Standard and Lite accounts |

| No hidden fees or charges | Commission fees for Standard and Lite accounts can add up |

| Low minimum deposit requirements across all account types | |

| Wide range of deposit and withdrawal methods |

Lite account: spreads from 1.4 pips, commission of 5 USD

Standard account: spreads from 2.7 pips, commission of 1 USD

Pro account: spreads from 0.2 pips, commission of 10 USD

Overall, FOREXimf's spreads and commissions are competitive with other brokers in the market, and there are no hidden fees or charges. However, traders should be aware that the commission fees for Standard and Lite accounts can add up over time, and the higher commission fees for the Pro account may not be worth it for all traders.

Trading accounts available in FOREXimf

| Advantages | Disadvantages |

| Multiple account types to choose from | High minimum deposit of Rp 2,5 Juta |

| Demo account available | |

| Competitive spreads and commissions |

FOREXimf offers three different account types - Lite, Standard, and Pro.

The Lite account offers the highest spreads but also has the lowest commission fee, making it a good option for those who are just starting out in trading or have smaller budgets. The Standard account has a lower spread than the Lite account but a slightly higher commission fee, making it a good choice for those who want to trade more frequently. The Pro account has the lowest spreads but also has the highest commission fee, making it best suited for professional traders who trade in high volumes.

Overall, FOREXimf offers a range of account types to suit different trading needs and preferences.

Trading platform(s) that FOREXimf offers

| Advantages | Disadvantages |

| User-friendly interface | Limited number of technical indicators |

| Advanced charting tools | No web-based platform |

| Support for automated trading | Limited news and research tools |

| Multiple order types supported | Limited customization options |

| Mobile trading platform available | No support for hedging |

Foreximf provides the MetaTrader 4 (MT4) trading platform, which is a popular choice among traders worldwide. The platform is known for its user-friendly interface, advanced charting tools, and support for automated trading through the use of expert advisors. Multiple order types are supported, including market orders, limit orders, and stop orders. Additionally, Foreximf offers a mobile trading platform for traders on-the-go. However, the platform has a limited number of technical indicators and customization options. There is also no support for hedging, and the platform is not available in a web-based version. News and research tools are also limited, which may be a disadvantage for some traders.

Maximum leverage of FOREXimf

| Advantages | Disadvantages |

| Higher potential profits with lower initial investment | Higher leverage can lead to higher risks and losses |

| Access to larger positions in the market | Lack of understanding of leverage and risk management can lead to overtrading and significant losses |

| Allows for more flexible trading strategies | Limited to certain regulatory restrictions and may not be available for all traders |

| Can be useful for experienced and knowledgeable traders | Inexperienced traders may find leverage overwhelming and difficult to manage |

FOREXimf offers a maximum leverage of up to 1:100 for standard and pro accounts and up to 1:400 for lite accounts. Leverage allows traders to open larger positions with smaller amounts of capital, potentially leading to higher profits. However, it is important to note that higher leverage also increases the potential risks and losses of trading. Traders should have a good understanding of leverage and proper risk management to make use of this feature effectively. Additionally, regulatory restrictions may limit the availability of leverage to certain traders.

Deposit and Withdrawal: methods and fees

| Advantages | Disadvantages |

| No withdrawal fees | Limited information available |

| Withdrawals processed within 24 hours | Bank administration fees charged to clients |

| Automated deduction of bank fees | Withdrawals only processed on business days |

FOREXimf offers limited information on their website regarding deposits and withdrawals. Withdrawals can only be made on business days and any withdrawals above 12.00 WIB will be processed on the next business day. No fees are charged for withdrawals from FOREXimf activities, however, bank administration fees will be charged to the client. Funds received from the withdrawal process will be automatically deducted from the administration fee by the bank concerned. One advantage is that there are no withdrawal fees and withdrawals are processed within 24 hours. However, the lack of detailed information on the website may be a disadvantage for potential clients. Additionally, bank administration fees are charged to the client, which may add up to a significant amount depending on the amount being withdrawn. Finally, withdrawals are only processed on business days, which may delay the process for some clients.

Educational resources in FOREXimf

| Advantages | Disadvantages |

| Wide range of educational resources available | No personalized coaching or mentoring |

| Free access to economic calendar, market reports, analysis, and news | Some resources may be more basic and not suitable for advanced traders |

| Variety of formats, including video tutorials, eBooks, webinars, and online courses | Overwhelming amount of information may be difficult for beginners to navigate |

| Regularly updated with fresh content | Limited interactive features for hands-on learning |

| Includes glossary of trading terms and concepts | No dedicated mobile app for accessing educational resources on-the-go |

FOREXimf provides a robust collection of educational resources to assist traders at all levels in enhancing their knowledge and skills. The platform offers a diverse range of educational materials, including market reports, analysis, video tutorials, webinars, online courses, eBooks, and a glossary of trading terms and concepts. These resources are regularly updated with fresh content and are available to all users free of charge. While the vast amount of information may be overwhelming for beginners, the platform provides a comprehensive learning experience for those seeking to improve their trading abilities. However, FOREXimf does not offer personalized coaching or mentoring services, and there is no dedicated mobile app for accessing educational resources on-the-go.

You may also see some educational videos on their official YouTube channel.

Customer service of FOREXimf

| Advantages | Disadvantages |

| Multiple channels of communication | Limited phone support hours |

| 24-hour online chat support | No dedicated phone line for international customers |

| Active social media presence | No information on response times |

| Email support available |

FOREXimf offers a variety of customer care options, including phone, email, and 24-hour live online chat support. Additionally, the company has an active social media presence on various platforms such as TikTok, Facebook, Instagram, YouTube, and Twitter. While the phone support hours are limited to weekdays from 08:00-24:00 (WIB), the online chat support is available 24/7. However, there is no dedicated phone line for international customers, and no information on response times is available. Overall, FOREXimf seems to offer a decent level of customer care with multiple channels of communication and an active presence on social media.

Conclusion

Overall, FOREXimf appears to be a well-regulated forex broker that provides traders with a range of account types, trading instruments, and educational resources. The broker's focus on customer support and user-friendly trading platforms also adds to its appeal. However, the lack of transparency regarding deposit and withdrawal methods, as well as the absence of an extensive range of trading instruments, may be a disadvantage for some traders. In summary, FOREXimf may be a suitable choice for those looking for a regulated forex broker with a variety of account types, trading instruments, and educational resources, but potential users should weigh the pros and cons carefully before making a decision.

Frequently asked questions about FOREXimf

What is FOREXimf?

FOREXimf is a forex broker based in Indonesia that offers trading services in forex pairs, precious metals, and energies.

Is FOREXimf a regulated broker?

Yes, FOREXimf is a regulated broker by the Indonesia Commodity and Derivatives Exchange (ICDX) and the Commodity Futures Trading Regulatory Agency (BAPPEBTI).

What are the account types offered by FOREXimf?

FOREXimf offers three account types: Lite, Standard, and Pro, with different spreads, commissions, and minimum deposits.

What is the maximum leverage offered by FOREXimf?

The maximum leverage offered by FOREXimf is up to 1:100 for Standard and Pro accounts, and up to 1:400 for the Lite account.

What trading platform does FOREXimf use?

FOREXimf uses the popular MetaTrader 4 (MT4) platform for trading.

Are there educational resources available for traders at FOREXimf?

Yes, FOREXimf provides a variety of educational resources, such as economic calendars, market reports, video tutorials, webinars, news, and analysis, to help traders improve their skills.

Keywords

- 5-10 years

- Regulated in Indonesia

- Retail Forex License

News

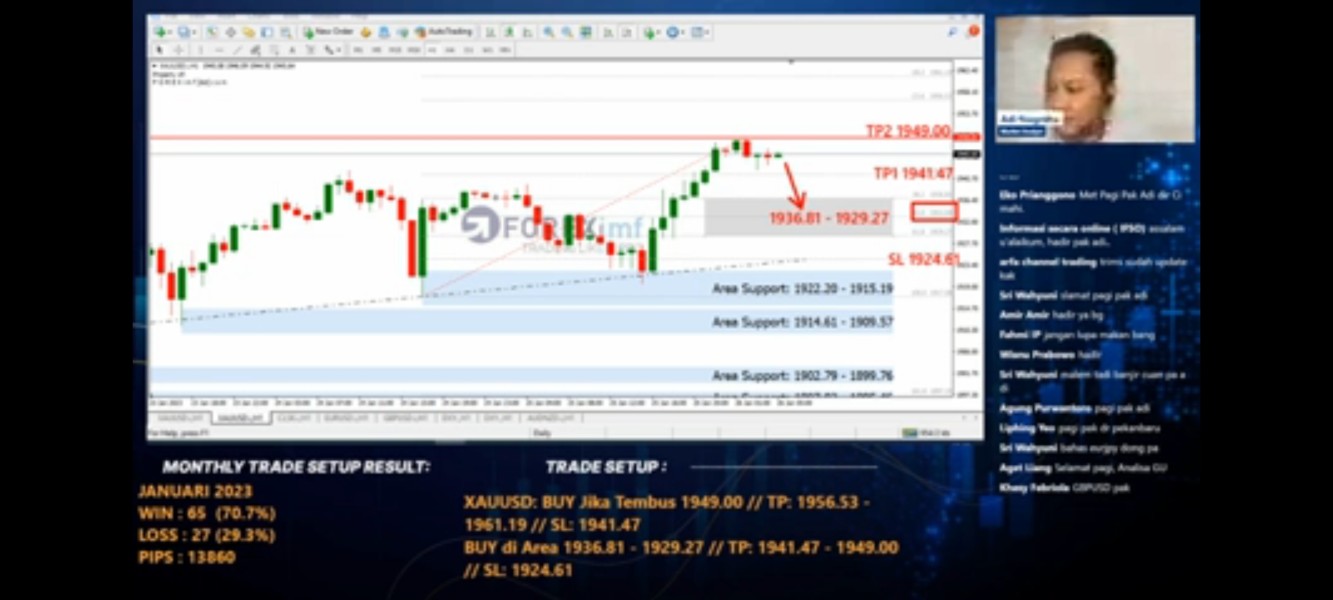

News GOLD GOING TO $2000?

Gold Trading: As predicted by many market players, the Fed has finally raised its interest rate again by 25 bps. However, there is an anomaly where even though the Fed's interest rate has increased, the price of gold has actually increased.

2023-08-04 10:50

News 5 WAYS TO LIMIT THE RISK OF FOREX TRADING THAT ARE STILL FREQUENTLY FORGOTTEN

Forex trading is one of the most popular forms of investment in the world, especially amongst young people. It is relatively low-cost, available 24 hours a day, and can be accessed from both mobile devices and computers. Anyone with a mobile phone and 10 dollars to spare can get involved.

2023-04-06 10:18

News TRADER IS PROHIBITED TO COMPARE YOURSELF WITH OTHER TRADER, WHY?

Trading on your own is the best way to experience your success and failure. Although most traders are ultra-competitive by nature, comparing yourself to other traders is not in your best interest. In the world of work, newcomers are bound to be compared to old people.

2023-02-21 10:13

News 4 TIPS TO SURVIVE THE MARKET CRASH

A stock market crash is usually defined by a drop of at least 10% on a stock exchange or major stock index within a single trading day. This usually starts within a particular sector or industry but can expand to the wider stock market, depending on the situation.

2023-02-21 10:04

News STILL BELIEVE IN FOREX TRADING IS GAMBLING? READ THIS

For some people, trading financial instruments is a great way to make money, while others believe that trading currency pairs is gambling.

2023-02-09 18:33

News 5 EXIT STRATEGY, HAVE YOU USE THEM?

Traders spend hours fine-tuning entry strategies but then blow out their accounts taking bad exits. In fact, most of us lack effective exit planning, often getting shaken out at the worst possible price. We can remedy this oversight with classic strategies that can enhance profitability.

2023-02-01 11:30

Review 13

Content you want to comment

Please enter...

Review 13

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

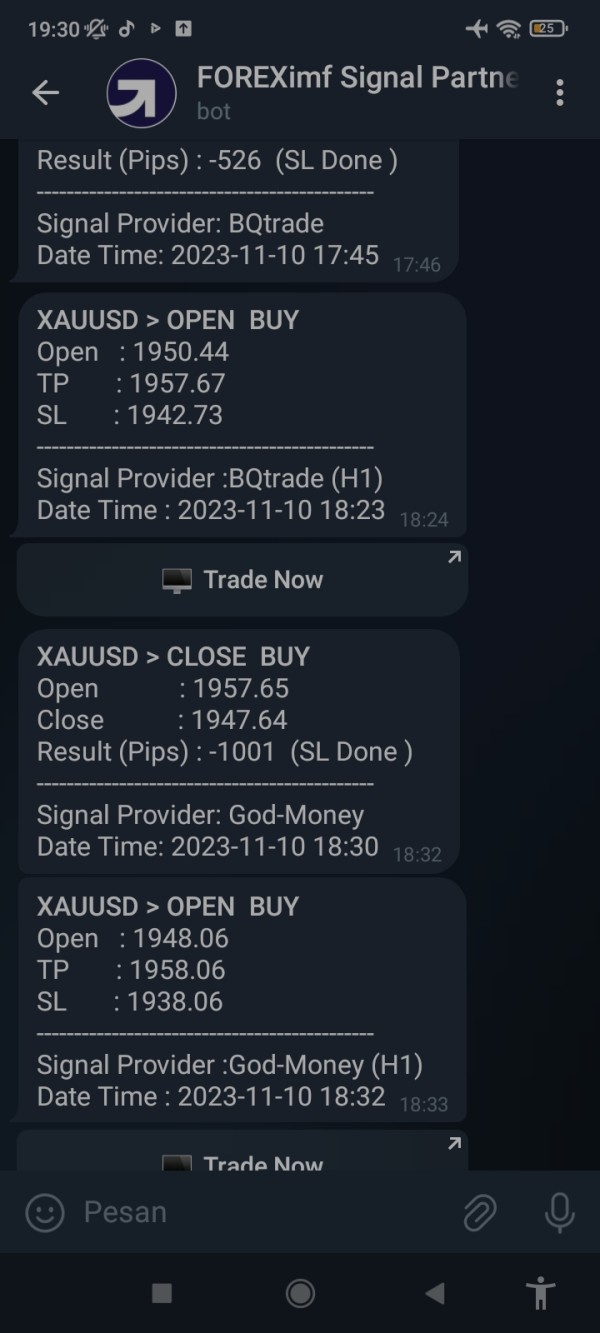

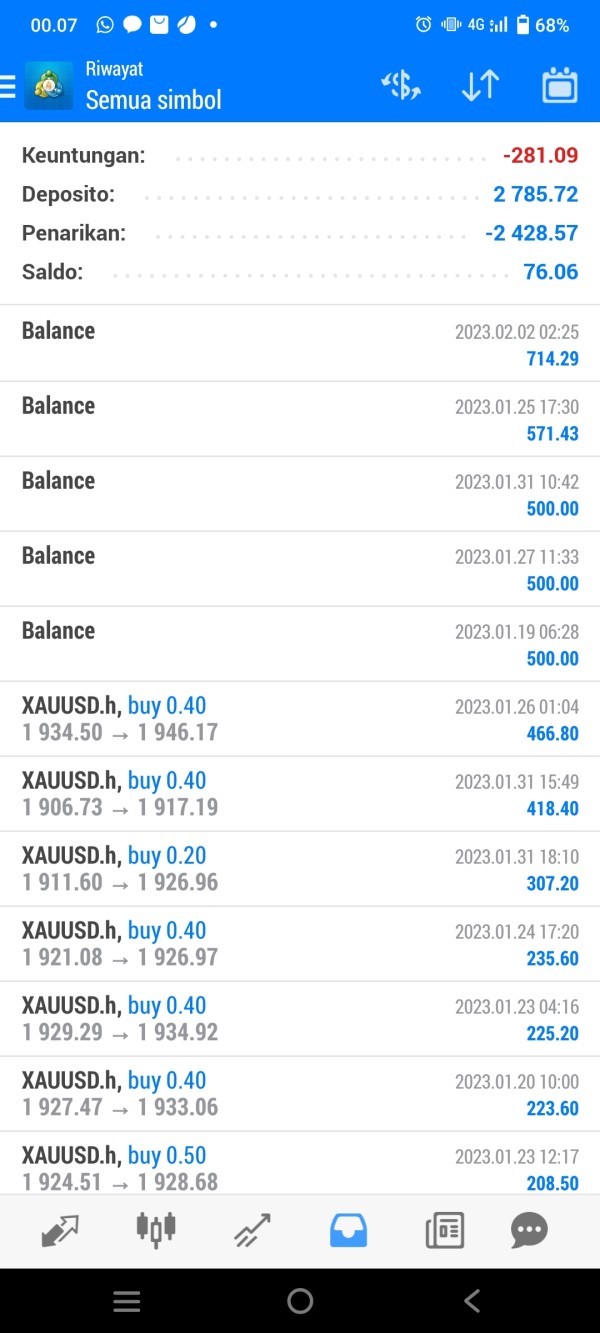

farhan9547

Indonesia

Providing misleading information, false and misleading signals

Exposure

2023-11-10

Anto2921

Indonesia

This forex broker is not friendly and is not responsible for the customer. The instructions given to the customer always lose from the trade. The trading instructions are always not right.

Exposure

2023-02-03

FX1038470953

Ecuador

I tried several times with a demo account at FOREXimf and gave up because I didn't think the transaction cost was very friendly. On the one hand, I have to pay a fixed commission, on the other hand, the spread is not very low.

Neutral

2022-11-24

FX1023795160

United Kingdom

Trading with this broker requires an initial deposit of $250 on its most basic account, a high amount compared with many other brokers… the broker provides the industry leading MT4, high leverage up to 1:400. However, for your safety of funds, you’d better open a demo account to test its real trading environment first…

Neutral

2022-11-21

Dania2928

Indonesia

I like the feeling of security when I want to withdraw funds, so far FOREXimf has never failed to pay or make it difficult. There are also many educational facilities offered, such as live trades, channels, and VIP. The fees are quite low compared to other foreign brokers. What's important is that I feel safe because I know where their office is located. Especially the QuickPro application, I really like it because it is very practical and helps me with trading.

Positive

2024-08-27

Rendy5143

Singapore

Trusted and highly educational official broker. I am greatly assisted by the Quickpro By foreximf application which has super complete features

Positive

2024-07-05

Amir8557

Indonesia

Best and trusted local broker. Have been using foreximf for almost 1 year, smooth withdrawal without any problems

Positive

2024-07-05

Rendy5143

Indonesia

For now, FOREXimf has provided a micro account with a minimum deposit of only Rp 100Rb. I am very helped by the indicators provided by FOREXimf and also the quite complete application, QUICKPRO. In addition to being able to trade in the application, I am greatly helped by the high impact news updates provided in QUICKPRO By FOREXimf in the Market insight and News menu. The application can also be downloaded on Playstore.

Positive

2024-06-11

FX3906715515

Indonesia

FOREXimf broker TOP, execution is fast and low commission.. there is also an additional application called QuickPro, which is really awesome. The most important thing for me is being able to see market insight and economic calendar there to check from the fundamental side..

Positive

2024-06-11

Enny3552

Indonesia

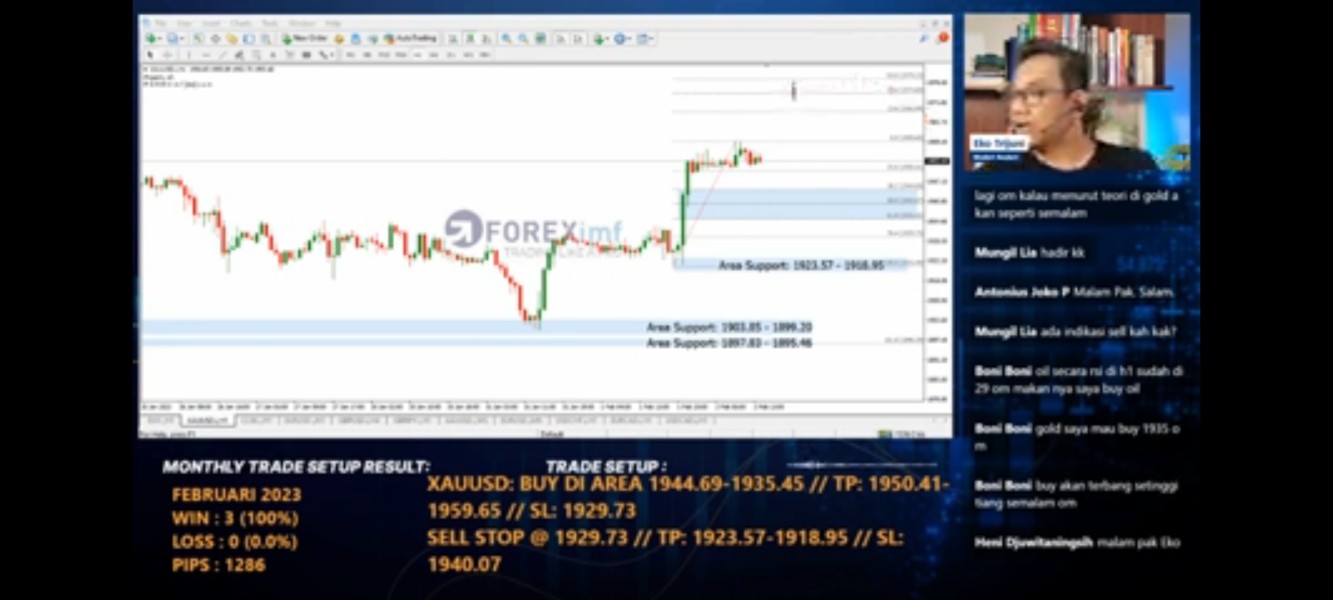

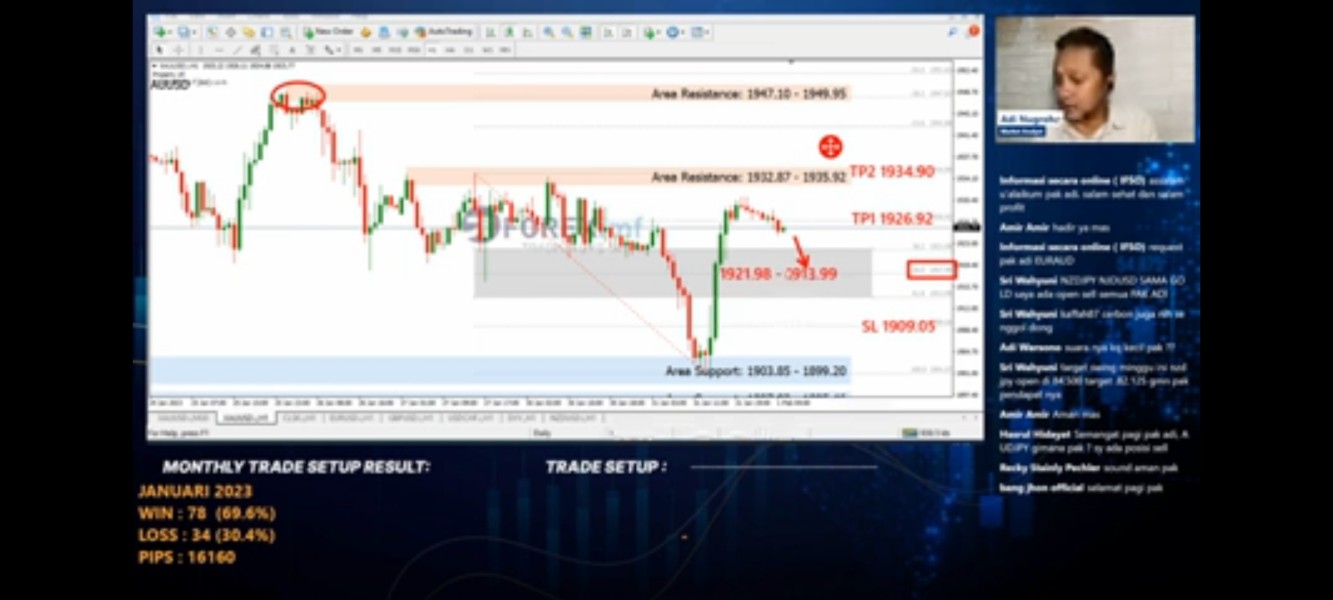

Now you can deposit with only Rp 100,000 or about $6. More friendly for retail traders and the minimum lot size is now 0.01. There is a live trade session every day, so far it seems to be the only Indonesian broker that dares to broadcast live trades on YouTube every day. Analysis may sometimes be off, but overall it is still good if followed consistently.

Positive

2024-06-11

Enny3552

Indonesia

Nice broker with outstanding service. They provide a telegram forum group where we can share our opinion about the market with other traders and analysts. They also run a YouTube channel with so many trading tips. What's best for me is they have Live analysis twice a day at Asia and US market session, sharing plenty of trading setups with amazing results.

Positive

2023-02-17

Toro1543

Indonesia

So far foreximf is the ideal broker for me, the indicators and signals they provide can make my trading easier. What's more, the VIP group provided is quite exciting, you can have discussions between members and ask questions to those who are more expert. Foreximf is fun.

Positive

2023-02-17

Erwin1157

Indonesia

FOREXimf is a good broker. Many taught me who was still a beginner. The live analysis and trading signals that are presented really help me trade.

Positive

2023-02-17