Score

LEADING ALLIANCE

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.leading-alliance.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomAccount Information

Users who viewed LEADING ALLIANCE also viewed..

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

leading-alliance.com

Server Location

United States

Website Domain Name

leading-alliance.com

Server IP

104.31.67.116

Company Summary

Note: LEADING ALLIANCEs official site - https://www.leading-alliance.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| LEADING ALLIANCE Review Summary in 10 Points | |

| Founded | N/A |

| Registered Country/Region | United Kingdom |

| Regulation | NFA (unauthorized) |

| Market Instruments | Forex, CFDs, and Commodities |

| Demo Account | N/A |

| Leverage | 1:500 |

| EUR/USD Spread | 3 pips (Std) |

| Trading Platforms | MT5 |

| Minimum Deposit | $100 |

| Customer Support | Phone, email |

What is LEADING ALLIANCE?

LEADING ALLIANCE is an unregulated forex and CFD broker that offers online trading services to clients. The broker offers access to Forex, CFDs, and Commodities trading through the MT5 platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

LEADING ALLIANCE has both positive and negative aspects to consider. On the positive side, the company offers three account types to suit different trader preferences. The availability of multiple funding methods and customer support channels is also a convenience for clients.

However, there are some drawbacks to be aware of, including the lack of regulatory authorization and the high deposit fee for credit card funding. Traders should exercise caution and conduct thorough research before engaging with LEADING ALLIANCE. It is crucial to consider the risks associated with trading on an unregulated platform and carefully evaluate the company's offerings and services.

| Pros | Cons |

| • Multiple account types | • Unauthorized NFA license |

| • MT5 supported | • Unavailable website |

| • Popular payment methods offered | • Reports of scams and unable to withdraw |

| • Limited trading instruments | |

| • Wide spreads | |

| • Deposit fees are charged |

LEADING ALLIANCE Alternative Brokers

Rakuten Securities - A reputable broker with a wide range of trading instruments and advanced platforms, suitable for both beginner and experienced traders.

LegacyFX - A reliable broker offering competitive trading conditions and comprehensive educational resources, making it a good choice for traders looking to improve their skills.

TigerWit - A innovative broker with a unique social trading platform, allowing traders to follow and copy successful traders, making it a compelling option for those interested in social trading.

There are many alternative brokers to LEADING ALLIANCE depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is LEADING ALLIANCE Safe or Scam?

LEADING ALLIANCE is unauthorized by the National Futures Association (NFA, License No. 0532875), it raises concerns about the legitimacy and regulatory compliance of the company. The NFA is a reputable regulatory authority overseeing the activities of financial firms in the United States. When a company is not authorized or regulated by a recognized regulatory body, there is a higher risk of potential scams or fraudulent activities. It is advisable to exercise caution and conduct thorough research before engaging in any financial transactions with such entities. It is recommended to choose regulated and authorized brokers to ensure the safety of your investments.

Market Instruments

LEADING ALLIANCE provides a range of market instruments including Forex, CFDs, and Commodities. Forex, or foreign exchange, involves the trading of different currencies against each other. Traders can speculate on the price movements of major currency pairs such as EUR/USD, GBP/USD, or USD/JPY, aiming to profit from fluctuations in exchange rates.

CFDs, or contracts for difference, allow traders to speculate on the price movements of various financial instruments without owning the underlying assets. Traders can take advantage of market volatility and potentially profit from both rising and falling prices.

Commodities trading involves the buying and selling of physical commodities like gold, silver, oil, or agricultural products. Traders can speculate on the price movements of these commodities, seeking to profit from changing supply and demand dynamics.

Accounts

LEADING ALLIANCE offers three types of trading accounts: Standard, Pro, and ECN. The Standard account is designed for beginners and traders who prefer a more straightforward trading experience. It requires a minimum deposit of $100 and offers competitive spreads, allowing traders to access a wide range of financial instruments.

The Pro account is suitable for more experienced traders who require advanced trading features and faster execution. It requires a minimum deposit of $1,000 and offers tighter spreads compared to the Standard account. Traders with the Pro account can enjoy lower trading costs and access to additional trading tools and resources.

The ECN (Electronic Communication Network) account is ideal for professional traders and those seeking direct market access. It requires a minimum deposit of $10,000 and provides traders with access to deep liquidity from multiple liquidity providers. The ECN account offers the tightest spreads and transparent pricing, allowing traders to benefit from competitive pricing and potentially lower trading costs.

Each account type offers different features and benefits tailored to the specific needs and trading styles of traders. LEADING ALLIANCE aims to provide a range of account options to accommodate traders at various skill levels, allowing them to choose the account that aligns with their trading goals and preferences.

Leverage

LEADING ALLIANCE offers varying levels of trading leverage depending on the specific instruments being traded. For forex trading, the maximum leverage available is up to 1:500. This means that traders can control positions that are up to 500 times the size of their trading capital.

When it comes to trading indices and commodities, LEADING ALLIANCE provides a maximum leverage of up to 1:100. This leverage level allows traders to control positions that are up to 100 times the size of their trading capital.

Higher leverage allows traders to potentially amplify their trading profits, but it also increases the risk of losses. Therefore, it is crucial for traders to use leverage wisely and understand the associated risks.

Spreads & Commissions

LEADING ALLIANCE offers different spreads and commissions across its various trading accounts. In the Standard account, the spreads start from 3 pips. Spreads refer to the difference between the buying and selling prices of an asset, and a wider spread implies a higher cost for traders to enter and exit positions. The Pro account offers tighter spreads, starting from 2 pips. This means that traders in the Pro account may benefit from lower trading costs compared to the Standard account.

On the other hand, the ECN (Electronic Communication Network) account operates on a different pricing model. Instead of spreads, the ECN account charges a commission of $10 per lot traded. This commission-based structure is typically favored by more experienced traders who value direct market access and potentially lower overall trading costs. In the ECN account, traders can experience spreads as low as 0 pips, which indicates that there is no markup on the interbank prices.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| LEADING ALLIANCE | From 3 pips (Std) | $10 per lot (ECN) |

| Rakuten Securities | From 0.5 pips | No |

| LegacyFX | From 0.6 pips | No |

| TigerWit | From 0.6 pips | No |

Please note that the spreads and commissions mentioned are approximate values and may vary depending on various factors. It's always advisable to consult the official websites or contact the brokers directly for the most accurate and up-to-date information.

Trading Platforms

LEADING ALLIANCE provides the popular trading platform MetaTrader 5 (MT5) to its clients. MT5 is a powerful and versatile platform that offers advanced trading features and a user-friendly interface. It is widely recognized and utilized by traders worldwide for its comprehensive range of tools and functionalities.

With MT5, traders can access a wide range of financial markets, including Forex, commodities, indices, and more, allowing for diversified trading opportunities. The platform offers real-time price quotes, advanced charting capabilities, and a variety of technical indicators and drawing tools to help traders analyze the market and make informed trading decisions.

One of the key strengths of MT5 is its ability to support automated trading. The platform allows users to develop and implement their own trading strategies using the built-in MetaQuotes Language (MQL5). Traders can create and test Expert Advisors (EAs), which are automated trading systems, as well as custom indicators and scripts. This feature enables traders to automate their trading activities and execute trades based on predefined criteria.

Additionally, MT5 provides a secure trading environment with robust encryption protocols and secure data transmission. It also offers multiple order types, including market orders, limit orders, and stop orders, allowing traders to execute trades according to their preferred trading strategies.

Overall, with the MT5 trading platform, LEADING ALLIANCE aims to provide its clients with a reliable and feature-rich trading experience, empowering them to trade efficiently and effectively in the financial markets.

See the trading platform comparison table below:

| Broker | Trading Platform |

| LEADING ALLIANCE | MetaTrader 5 (MT5) |

| Rakuten Securities | Rakuten FX |

| LegacyFX | MetaTrader 5 (MT5) |

| TigerWit | TigerWit Trading App |

Deposits & Withdrawals

LEADING ALLIANCE offers its traders a range of convenient deposit and withdrawal methods to facilitate their financial transactions. Traders can fund their trading accounts using various payment options, including Visa, MasterCard, Neteller, Skrill, PayTrust, and Bank Wire.

LEADING ALLIANCE minimum deposit vs other brokers

| LEADING ALLIANCE | Most other | |

| Minimum Deposit | $100 | $100 |

To deposit funds, traders can choose their preferred payment method and initiate the deposit process. The minimum deposit amount required by LEADING ALLIANCE is $100, ensuring accessibility to a wide range of traders. It's important to note that deposits made using credit cards are subject to a 7.2% deposit fee, which should be taken into consideration when planning the funding of the trading account.

When it comes to withdrawals, traders can request to withdraw their funds using the same payment method they used for depositing. LEADING ALLIANCE aims to provide a smooth and efficient withdrawal process. The minimum withdrawal amount is also set at $100, ensuring flexibility for traders to access their funds when needed.

It's worth noting that the withdrawal processing time may vary depending on the selected payment method. While LEADING ALLIANCE strives to process withdrawals promptly, the exact duration can depend on factors such as transaction volume and the specific financial institution involved. Traders can expect their withdrawals to be processed in a timely manner, generally within a few business days.

Customer Service

LEADING ALLIANCE places importance on providing efficient and responsive customer support to assist its clients. Traders can reach out to the customer support team through multiple channels, including telephone and email. The provided telephone number, +441618507899, allows traders to directly contact the support team for immediate assistance with their queries or concerns. Additionally, traders can also communicate with the customer support team by sending an email to support@leading-alliance.com.

Moreover, LEADING ALLIANCE openly provides its office address, located at 43 Perkins House, Wall Wood Street, London, England, E147AH, United Kingdom. This transparency in sharing the company's physical address can enhance trust and confidence among traders, as it allows for direct communication and potential face-to-face interactions if necessary.

| Pros | Cons |

| • Multiple-channel customer support | • No 24/7 customer support |

| • Office address is revealed openly | • Absence of a live chat option |

| • No social media presence |

Note: These pros and cons are subjective and may vary depending on the individual's experience with LEADING ALLIANCE's customer service.

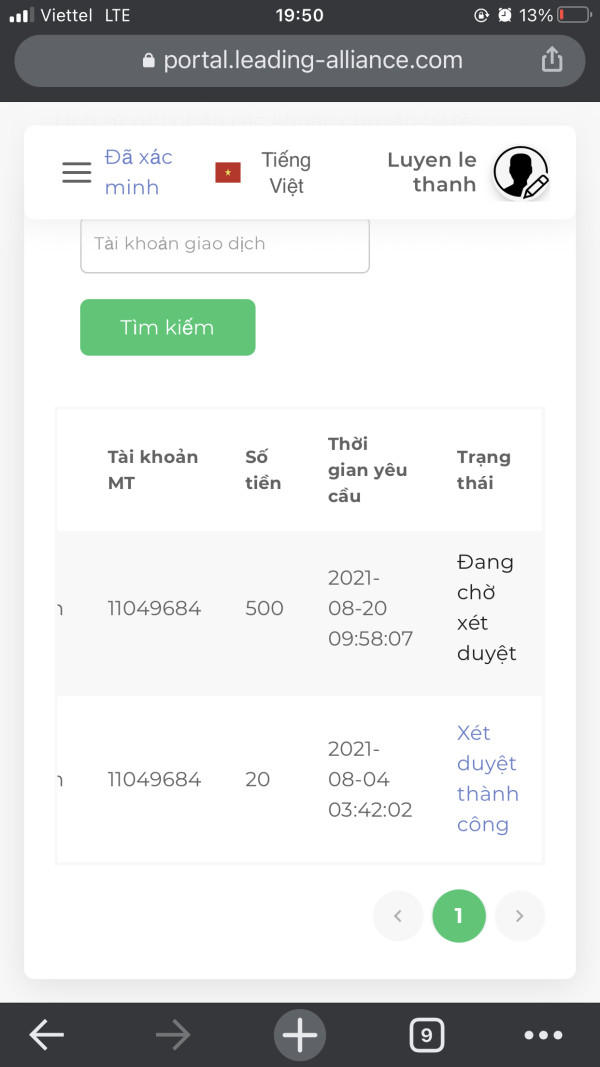

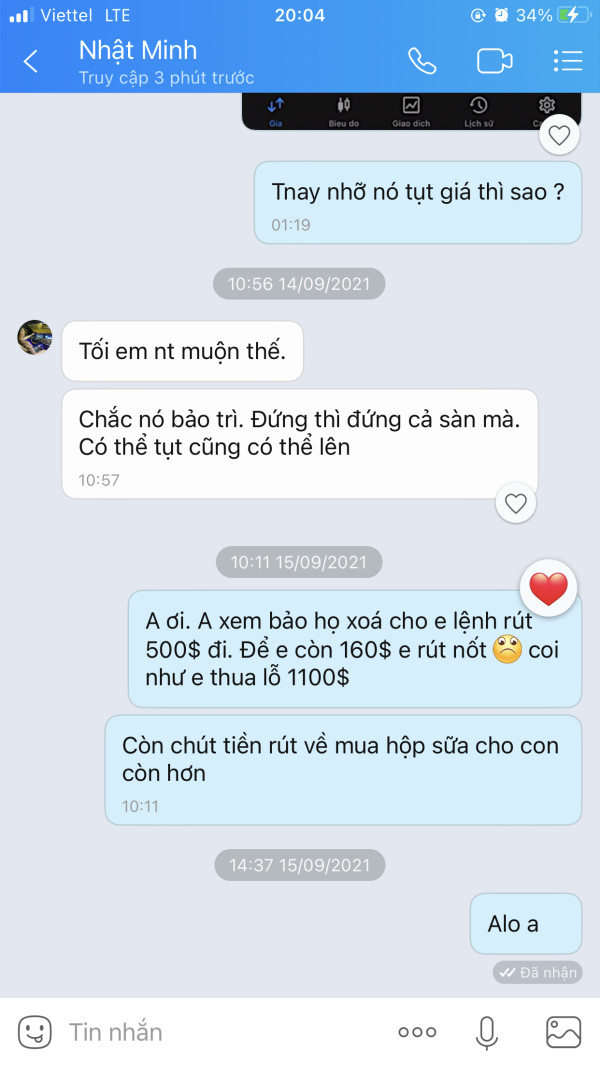

User Exposure on WikiFX

On our website, you can see that reports of scam and unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

LEADING ALLIANCE is an unregulated broker with an unauthorized NFA license. Traders are advised to proceed with caution and consider the risks associated with trading on an unregulated platform. It is recommended to choose regulated and reputable brokers that prioritize client protection and offer transparent trading conditions. Conducting thorough research and due diligence before engaging with any brokerage is crucial to safeguarding your funds and ensuring a secure trading experience.

Frequently Asked Questions (FAQs)

| Q 1: | Is LEADING ALLIANCE regulated? |

| A 1: | No. LEADING ALLIANCE National Futures Association (NFA, License No. 0532875) is unauthorized. |

| Q 2: | Does LEADING ALLIANCE offer the industry leading MT4 & MT5? |

| A 2: | Yes. It supports MT5. |

| Q 3: | What is the minimum deposit for LEADING ALLIANCE? |

| A 3: | The minimum initial deposit to open an account is $100. |

| Q 4: | Is LEADING ALLIANCE a good broker for beginners? |

| A 4: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now