Score

Capitalix

Seychelles|2-5 years|

Seychelles|2-5 years| https://www.capitalix.com/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Oman 4.14

Oman 4.14Contact

Licenses

Licenses

Licensed Institution:4 Square SY Limited

License No.:SD052

- The number of the complaints received by WikiFX have reached 21 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

Seychelles

SeychellesUsers who viewed Capitalix also viewed..

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

capitalix.com

Server Location

United States

Website Domain Name

capitalix.com

Server IP

99.84.206.6

Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Information |

| Registered Country/Region | Seychelles |

| Regulation | unregulated |

| Market Instrument | forex, cryptocurrencies, stocks, indices, commodities and metals |

| Account Type | Basic, Silver, Gold, Platinum and VIP |

| Demo Account | Yes ($100,000 virtual fund) |

| Maximum Leverage | 1:200 |

| Spread | Vary on the account type |

| Commission | no |

| Trading Platform | web |

| Minimum Deposit | N/A |

| Deposit & Withdrawal Method | credit cards (Visa/MasterCard/Maestro), Swift, and SEPA |

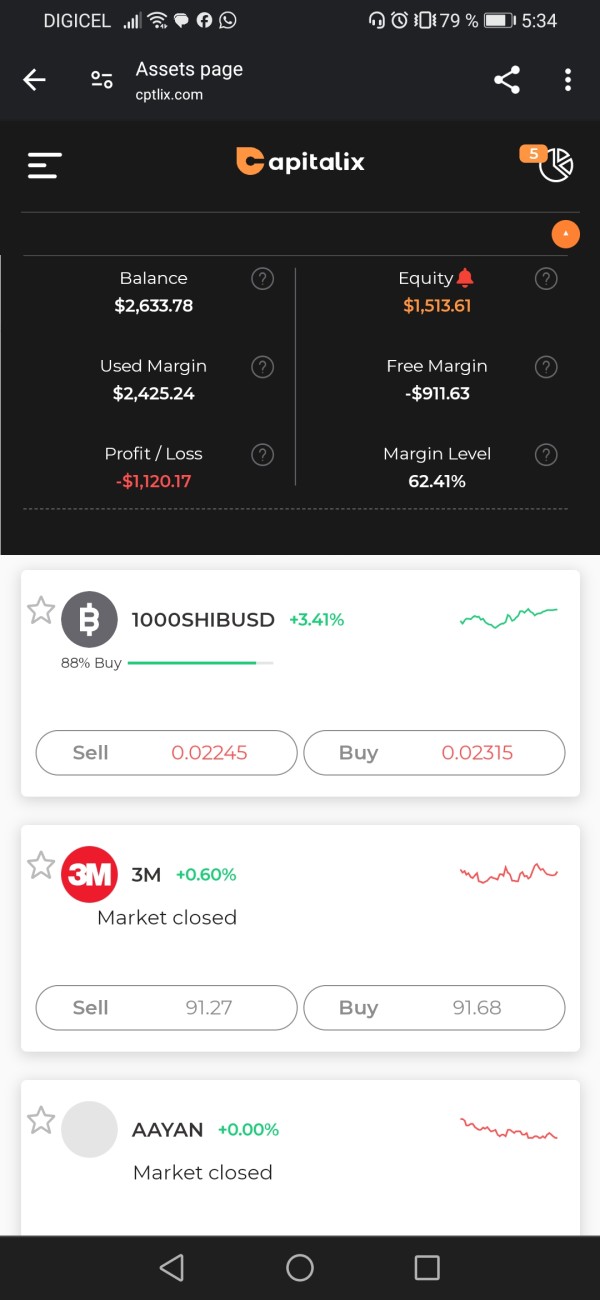

Capitalix, a trading name of 4Square SY Ltd, is allegedly a forex broker registered in Seychelles with a registration number 8426168-1 and licensed by the FSA (offshore) with a license number SD052.

The broker offers a wide range of market instruments, including forex, cryptocurrencies, stocks, indices, commodities, and metals. Traders can access over 150 trading assets across these markets. Capitalix provides multiple account types, including BASIC, SILVER, GOLD, PLATINUM, and VIP, catering to different trading needs. Leverage options range from 1:5 to 1:200, depending on the asset class. The broker does not charge commissions on trades.

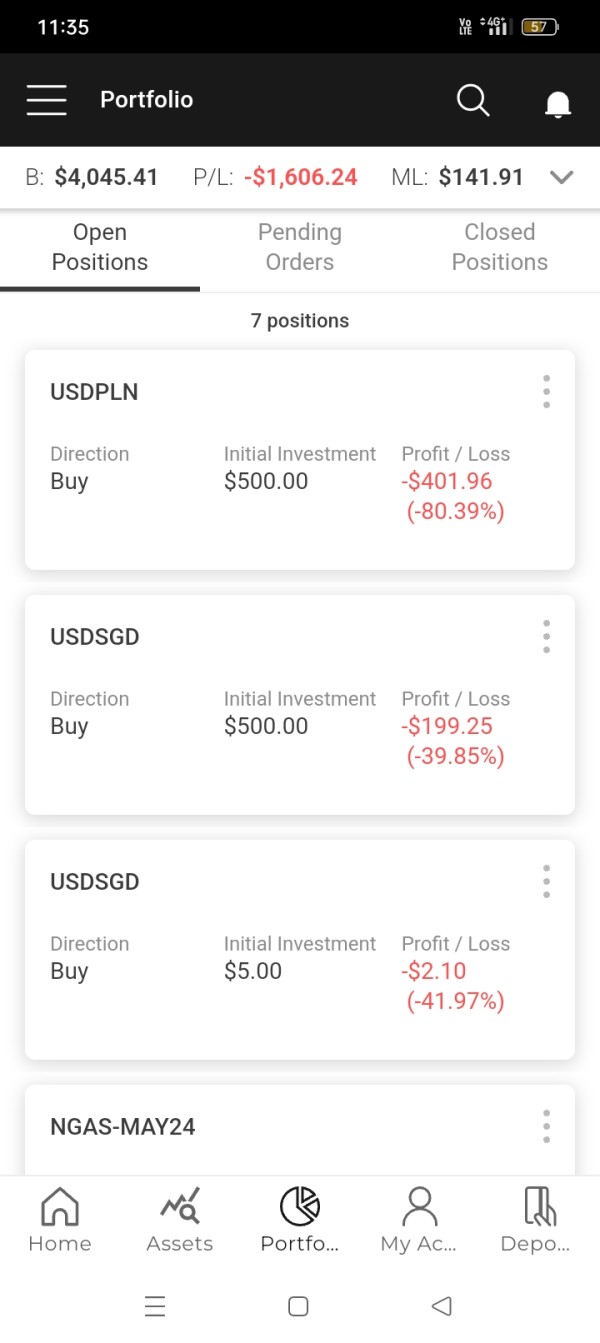

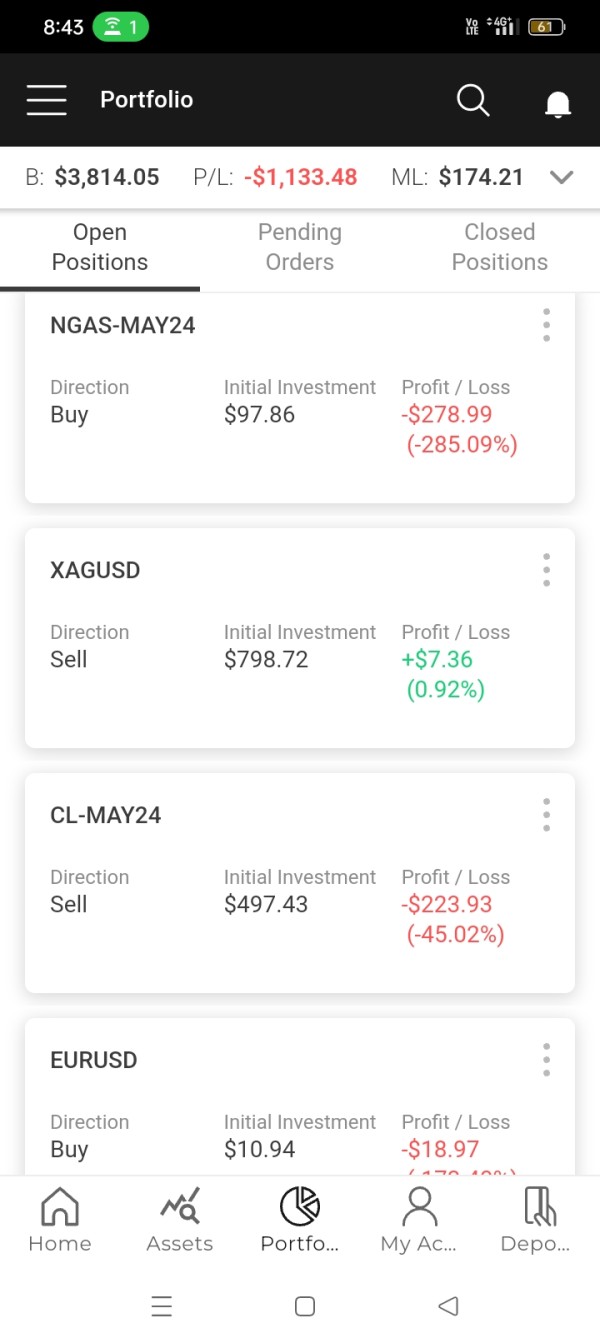

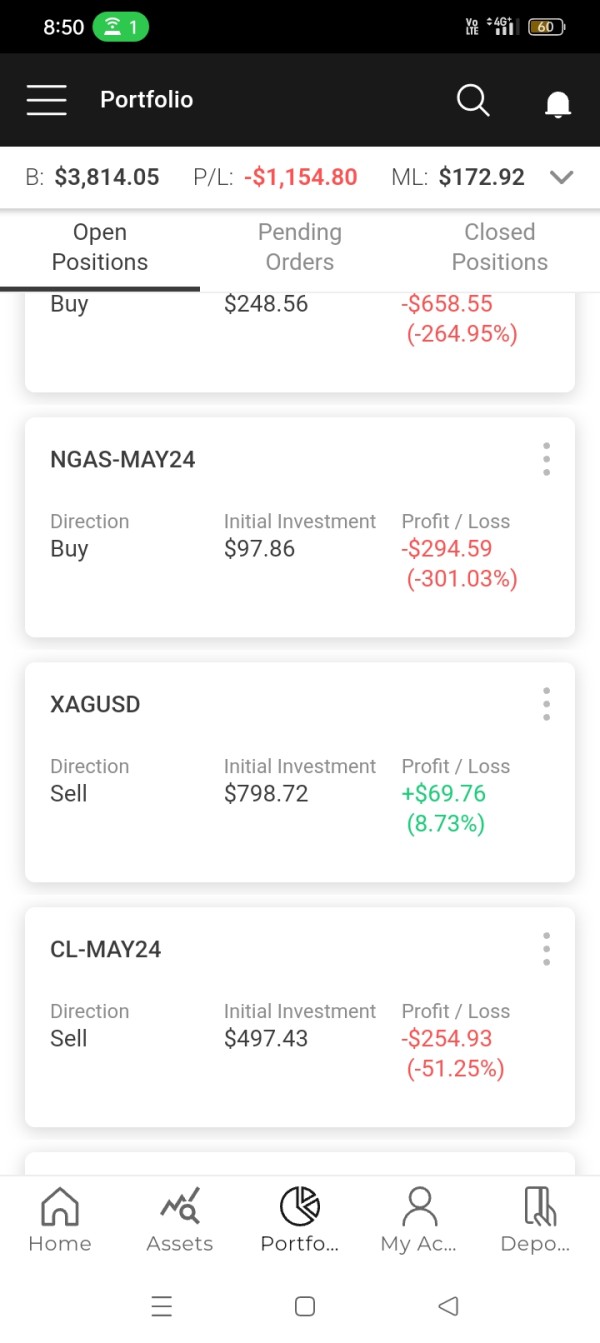

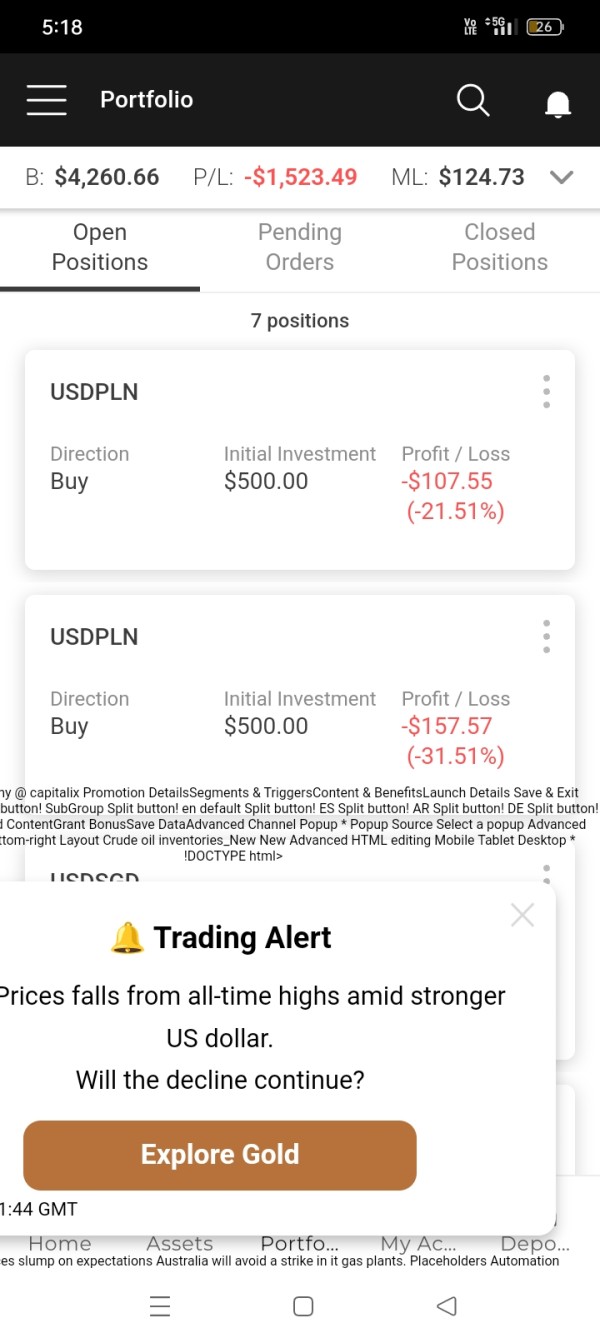

While Capitalix provides the WebTrader platform, MetaTrader 4 (MT4), and a mobile application for trading, reviews and feedback from traders on platforms like WIKIFX have been predominantly negative, with warnings to stay away from the broker. Complaints include issues related to targeting inexperienced traders, draining accounts, and poor customer support. Given these factors, it is essential to exercise caution and conduct thorough research before engaging in financial activities with Capitalix or any other offshore broker.

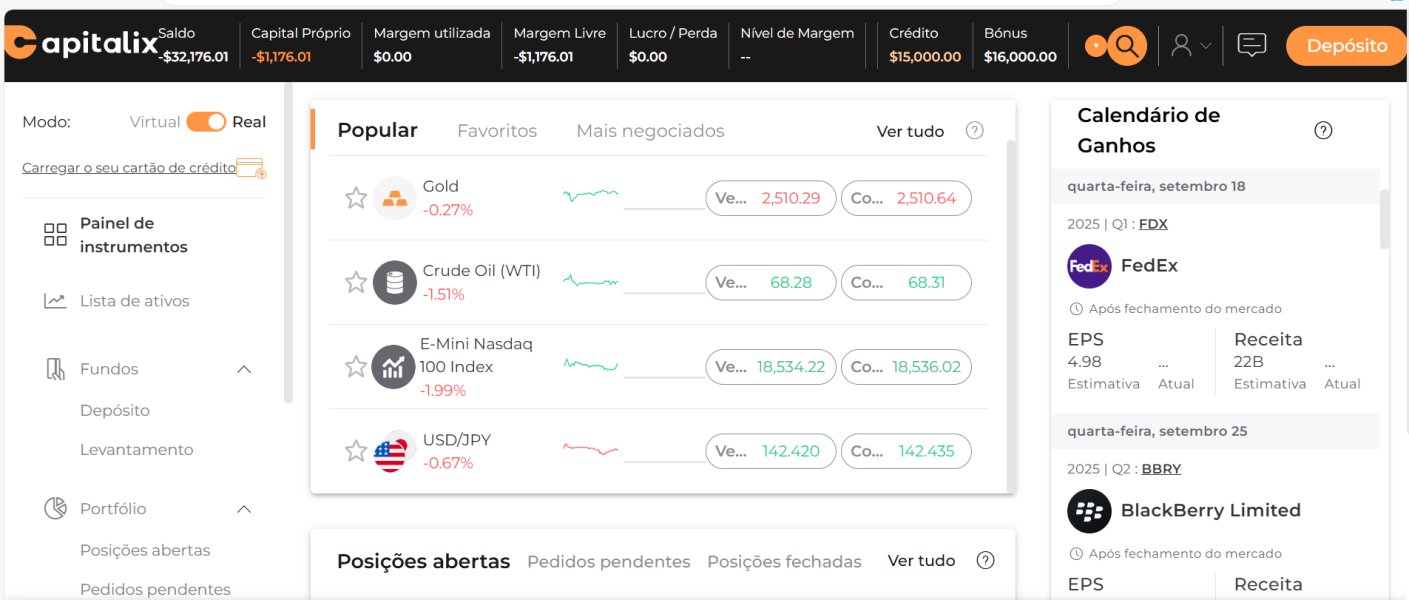

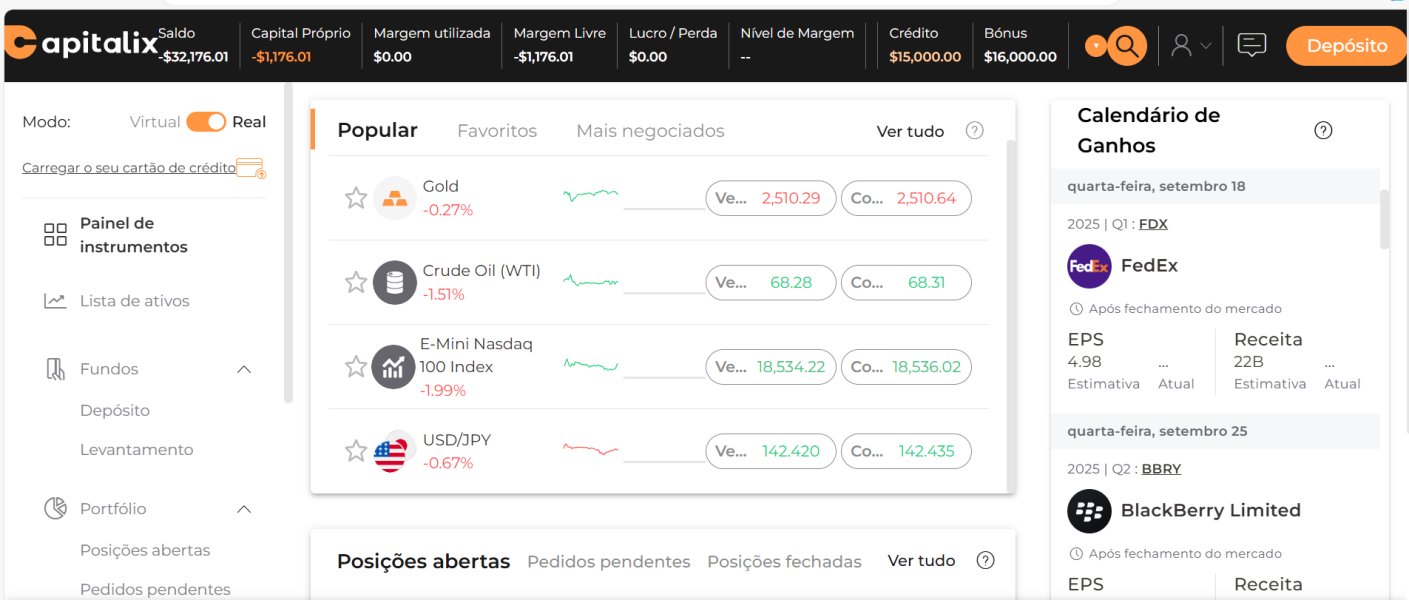

Here is the home page of this brokers official site:

Pros and Cons

Capitalix is a financial platform that offers a range of investment options. One advantage of Capitalix is its user-friendly interface, which makes it easy for individuals to navigate and manage their investments. Additionally, the platform provides access to a diverse selection of investment products, allowing users to diversify their portfolios. On the downside, Capitalix may lack advanced analytical tools that some experienced investors require. Furthermore, the platform's customer support services may not always meet the expectations of users, potentially leading to frustration in resolving issues. It is also important to note that Capitalix's fees and charges can be higher compared to some other investment platforms.

| Pros | Cons |

| User-friendly interface | Lack of advanced analytical tools |

| Diverse selection of investment products | Potentially subpar customer support services |

| Customizable investment options | Higher fees and charges compared to competitors |

| Availability of educational resources | Limited options for advanced trading strategies |

| Integrated portfolio tracking and reporting | Limited access to real-time market data |

| User-friendly mobile app | Potential limitations in account types available |

| Automated investment features | Limited availability of customer research |

| Integration with external accounts | Limited options for social trading |

Is Capitalix Legit?

Capitalix, regulated by the Seychelles Financial Services Authority (FSA) with license number SD052, operates as an offshore regulated entity. As an offshore regulatory license, it falls under the jurisdiction of the Seychelles. The licensed institution associated with Capitalix is 4 Square SY Limited, located at CT House, Office 4B, Providence, Mahe, Seychelles.

However, it is important to note that as of the provided information, there is no effective date or expiry date mentioned for the license. Additionally, the contact details such as the phone number of the licensed institution are not available.

The mention of “No Sharing” under the license type suggests that Capitalix does not have permission to share their license with others. This might indicate that they are not authorized to provide financial services to clients beyond the scope of their own entity.

The provided information also mentions that Capitalix does not have a trading software. This could be an important factor to consider when evaluating the suitability of the broker for your specific trading needs.

It's crucial to exercise caution when dealing with offshore regulated entities, as the regulatory standards and investor protections might differ from those in more established financial jurisdictions. Conducting thorough research and due diligence is recommended before engaging in any financial activities with Capitalix or any other offshore broker.

Market Instruments

Capitalix advertises that it offers more than 150 trading assets in financial markets, including forex, cryptocurrencies, stocks, indices, commodities and metals.

Forex: Capitalix allows trading in major currency pairs such as EURUSD, USDJPY, GBPUSD, AUDUSD, EURGBP, EURJPY, and USDCHF. Forex trading provides opportunities to speculate on the fluctuations in currency exchange rates.

Cryptocurrencies: The platform offers trading in popular cryptocurrencies like Bitcoin (BTCUSD), Ethereum (ETHUSD), Litecoin (LTUSD), and Ripple (XRPUSD). Cryptocurrencies have gained significant attention and offer potential for high volatility and returns.

Stocks: Capitalix provides access to well-known stocks from major companies such as Facebook, Apple, Microsoft, Google, Netflix, Canopy Growth Corporation (CGC), and Alibaba. Trading stocks allows investors to participate in the ownership and potential profits of these companies.

Indices: Traders can engage in index trading with Capitalix, including popular indices like FTSE-SEP23, NK-SEP23, and CAC-SEP23. Indices represent the performance of a specific group of stocks and provide an opportunity to speculate on the overall market trends.

Commodities: Capitalix offers trading in commodities, including Brent crude oil (BRNT-AUG23), crude oil (CL-JUL23), cotton (LCTT-JUN23), natural gas (NGAS-JUL23), and sugar (SUG-JUL23). Commodity trading allows investors to participate in the price movements of various raw materials.

Metals: The platform enables trading in metals such as copper (COPP-JUL23), platinum (PLAT-JUL23), silver (XAGUSD), and gold (XAUUSD). Metals are considered valuable assets and can serve as a hedge against inflation or economic uncertainty.

| Pros | Cons |

| Wide range of market instruments | Potential for volatility and risk |

| Diversification opportunities | Limited regulatory oversight |

| Access to popular stocks and cryptocurrencies | Lack of detailed information on trading terms |

| Exposure to global market trends | Offshore regulatory status |

| Potential for profit in different market sectors | Limited customer support |

Account Types

Apart from the virtual account with a $100,000 virtual fund, there are five live trading accounts offered by Capitalix, namely Basic, Silver, Gold, Platinum and VIP. However, the broker didnt reveal any information about the minimum initial deposit requirement to open an account.

BASIC Account: The BASIC account type is the entry-level option provided by Capitalix. It offers a leverage of 200 and various trading assets, including FX Majors, FX Crosses, FX Minors, FX Exotics, Indices, Metals, Commodities, Shares, and Crypto. The spreads for different asset classes range from 3 pips to 70 pips. This account type does not mention any specific bonus.

SILVER Account: The SILVER account type provides spreads for various assets, ranging from 2.4 pips to 56 pips. The leverage remains at 200. Traders with a SILVER account can access all the available trading assets, including FX Majors, FX Crosses, FX Minors, FX Exotics, Indices, Metals, Commodities, Shares, and Crypto. Additionally, this account type may offer a bonus of up to 40%.

GOLD Account: The GOLD account type further enhances trading conditions with spreads, ranging from 1.8 pips to 42 pips. Traders with a GOLD account can enjoy the same leverage of 200 and access the full range of trading assets provided by Capitalix. Additionally, this account type offers a potential bonus of up to 60%.

PLATINUM Account: The PLATINUM account type is designed for traders seeking more favorable trading conditions. It provides spreads, ranging from 1.2 pips to 28 pips, while maintaining a leverage of 200. Traders with a PLATINUM account have access to all the trading assets offered by Capitalix and may be eligible for a bonus of up to 80%.

VIP Account: The VIP account type is the highest tier offered by Capitalix, providing the most advantageous trading conditions. It offers spreads, ranging from 0.3 pips to 7 pips, with a leverage of 200. Traders with a VIP account can trade all available assets and may be eligible for a bonus of up to 100%.

| Pros | Cons |

| Spreads as low as 0.3 pips | Limited information on bonuses |

| Wide range of trading assets available | Lack of specific details for each account |

| Graduated account options to suit traders' needs | Limited information on additional features or services |

| Leverage of 200 provided across all account types | Lack of information on account requirements or minimum deposits |

Leverage

Capitalix provides its clients with flexible Leverage ranging from 1:5 - 1:200. In particular, the maximum leverage is 1:200 on forex and metals, 1:100 on indices and commodities, 1:20 on shares and 1:5 on cryptocurrencies.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

On the home page of Capitalixs official site, the broker advertises to offer low spreads from 0.5 pips with no commissions. Also, different account types can enjoy quite different spreads. For example, the spread on forex majors is 3 pips for the Basic account, 2.4 pips for the Silver account, 1.8 pips for the Gold account, 1.2 pips for the Platinum account and 0.3 pips for the VIP account.

Trading Platform

WebTrader:

Capitalix offers the WebTrader platform, which is a popular and advanced trading platform suitable for every trader. One of its key advantages is that there is no need to download additional software. As long as you have a reliable internet connection and a web browser, you can access the platform. WebTrader provides features such as market indicators, an economic calendar, latest news alerts, asset sentiments, a user-friendly interface, and a one-click trading feature.

MetaTrader 4 (MT4):

Considered one of the best and most advanced trading platforms of the decade, MT4 is highly regarded by both beginner and professional traders. It offers a range of features including advanced analytical tools, an economic calendar, real-time market updates, take profit and stop loss functions, quick trading sessions, market indicators, and the ability to set stop loss and take profit levels across multiple timeframes.

Mobile Application:

Capitalix also provides an advanced mobile application for traders who prefer to trade on the go. The mobile app is available for both iOS and Android devices, and it has received positive reviews from existing customers. It offers features such as a range of market indicators, an economic calendar, latest news alerts, asset sentiments, a user-friendly interface, real-time market alerts, and one-click trading.

| Pros | Cons |

| User-friendly interfaces | Limited customization options for platform layout |

| Access to popular platforms (WebTrader, MT4) | Lack of support for other trading platforms |

| Availability of advanced analytical tools and indicators | Limited range of technical analysis tools |

| Range of market indicators | Absence of advanced order types (e.g., trailing stop) |

| Mobile application for trading on the go | Limited charting capabilities on the mobile application |

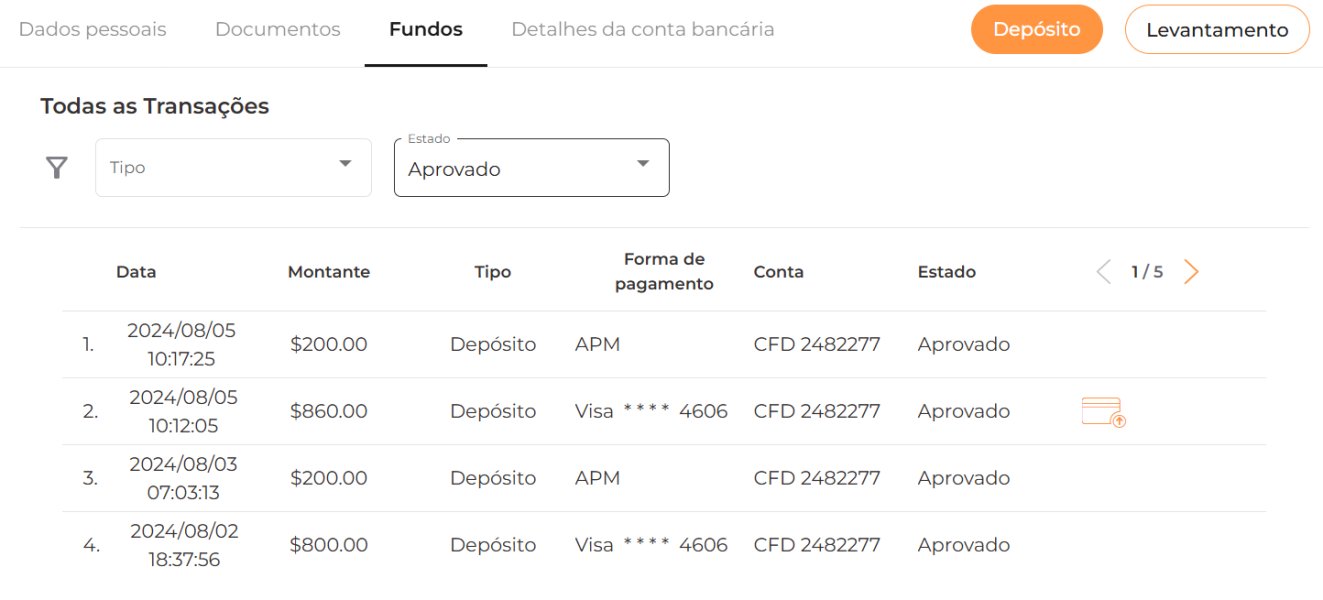

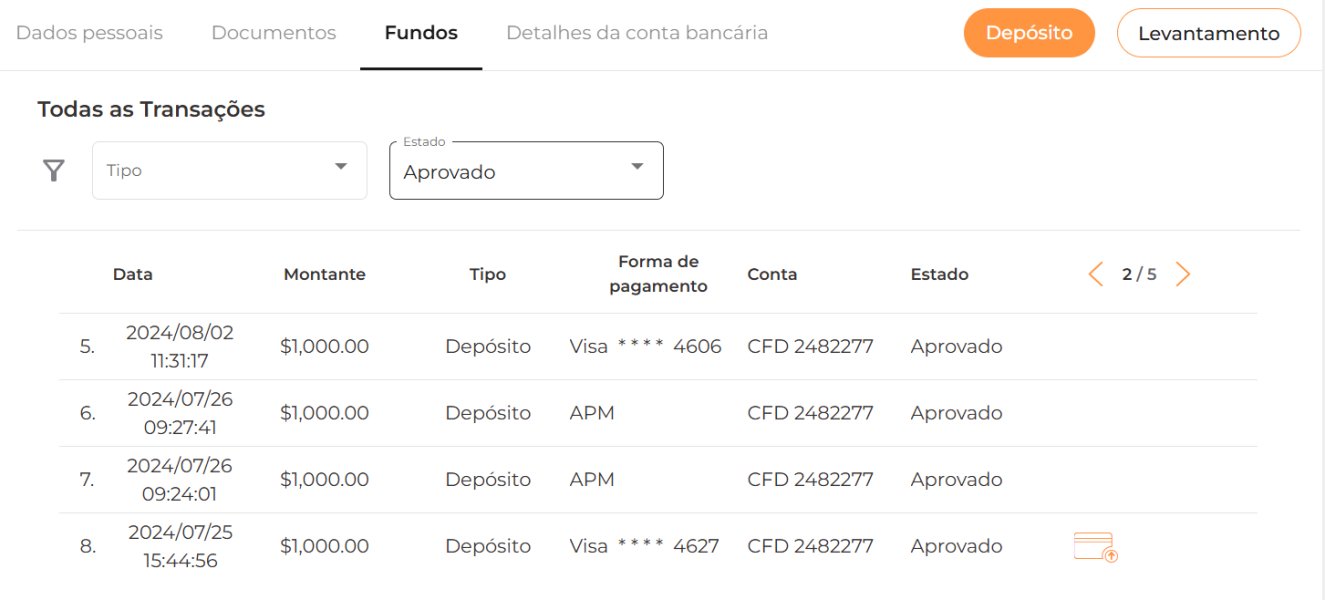

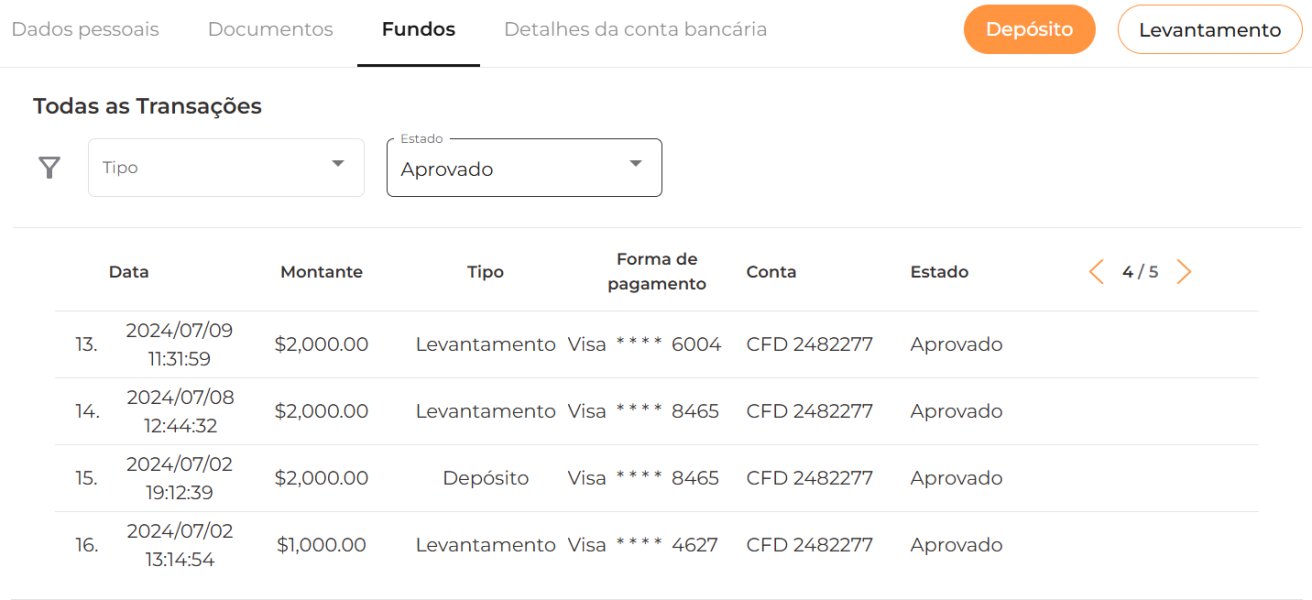

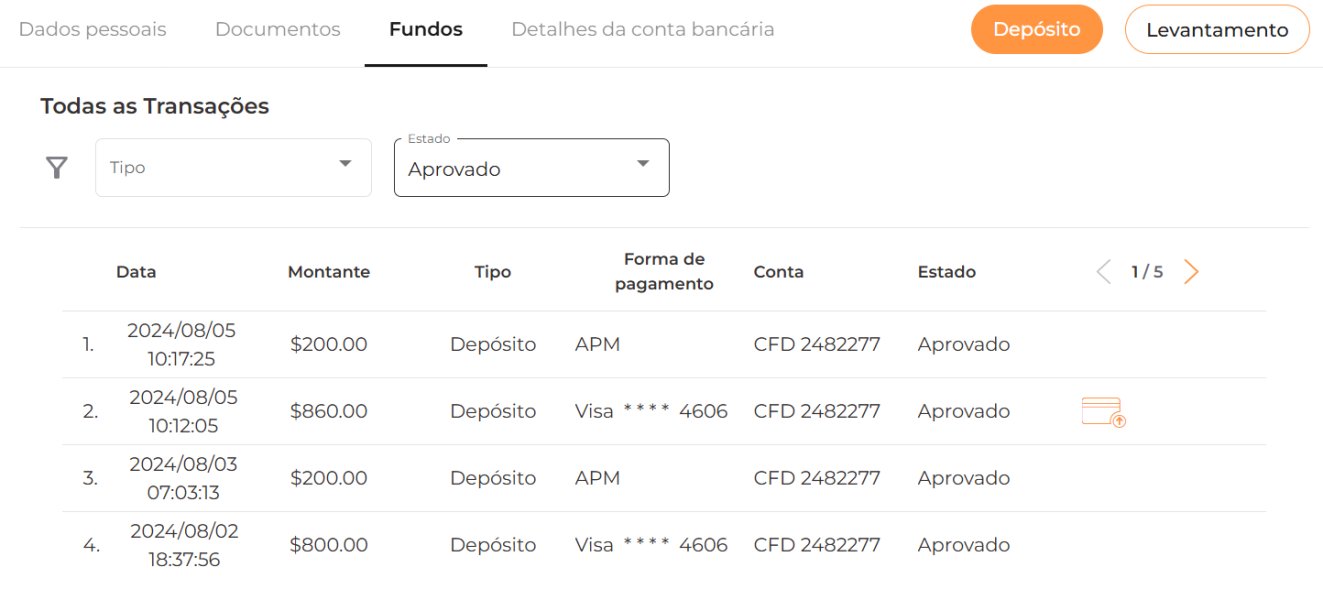

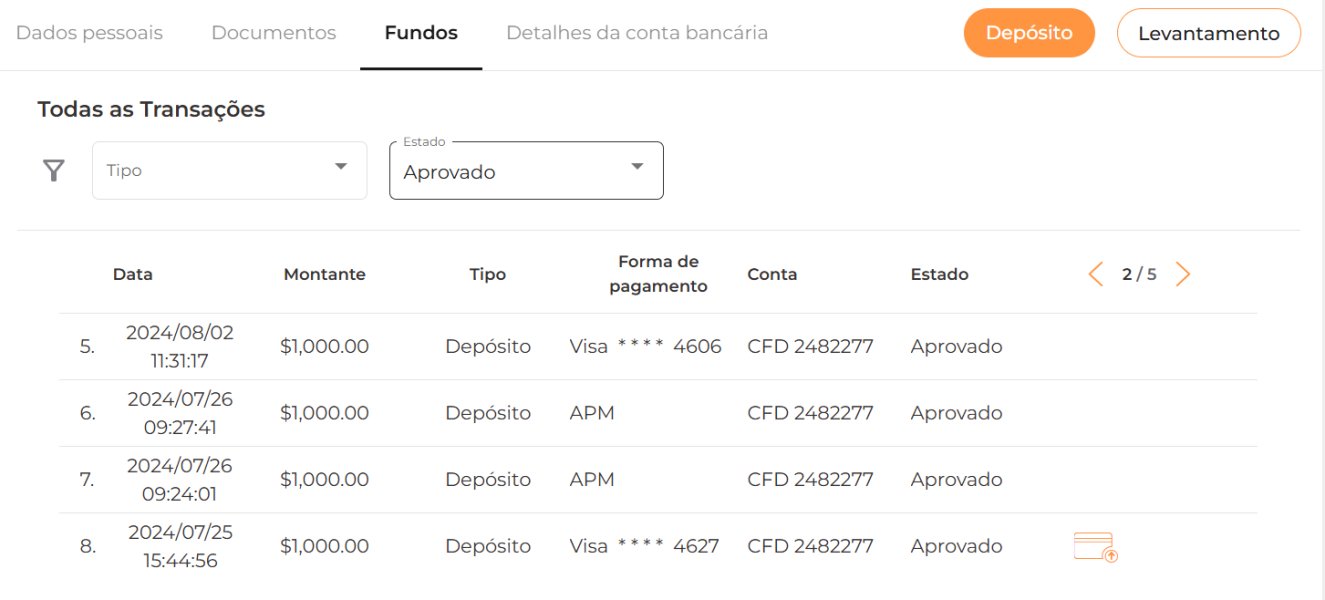

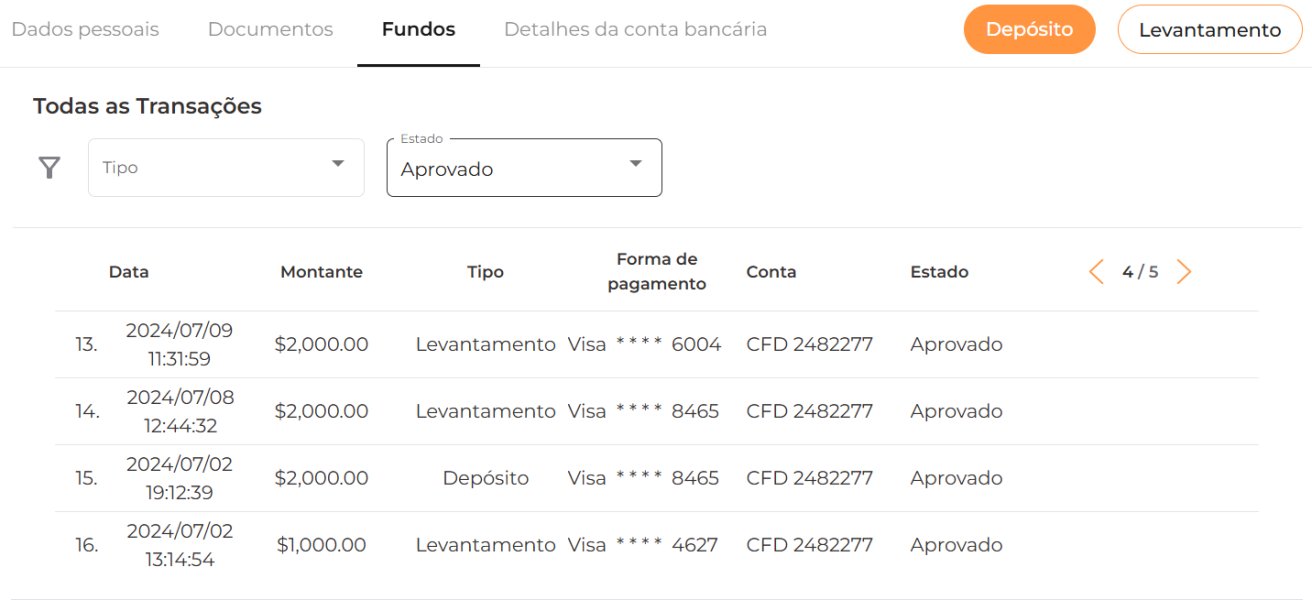

Deposit & Withdrawal

Capitalix offers a simple and user-friendly funds management system, allowing users from anywhere in the world to easily deposit and withdraw funds. They provide a wide range of payment methods to cater to different user preferences. Users have the option to use credit cards (Visa, Mastercard, Maestro) or bank wire transfers (SWIFT and SEPA) to fund their accounts. Being a regulated broker with an FSA license, they adhere to industry standards and protect customer funds through SSL encryption.

However, in order to comply with regulatory requirements, users are required to complete the Know Your Customer (KYC) process. This involves confirming their identity and providing identification and address documentation. Customers can contact the Capitalix Customer Support team for assistance with this process.

DEPOSIT

Capitalix accepts deposits in EUR and USD currencies. The deposit methods available are credit cards (Visa, Mastercard, Maestro), SWIFT wire transfer, and SEPA wire transfer. There are no fees or commissions charged for deposits. The processing time for deposits is stated as 3 business days, providing users with a reasonably quick turnaround.

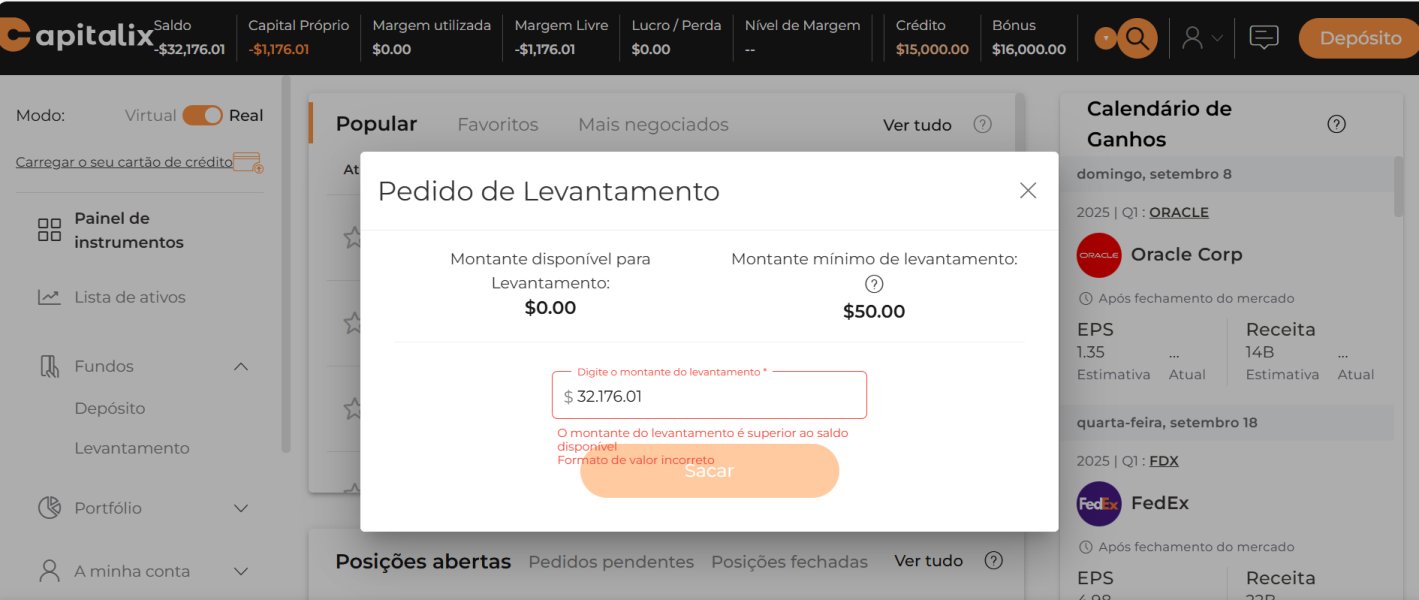

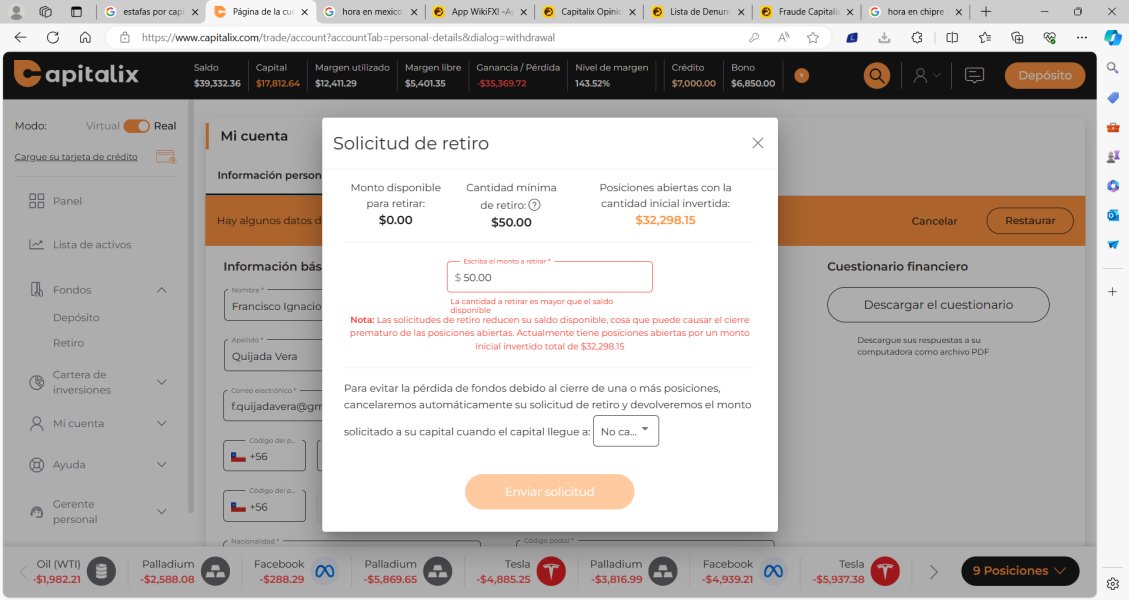

WITHDRAWAL

Similarly, withdrawals can be made in EUR currency. The withdrawal methods available are credit cards (Visa, Mastercard, Maestro), SWIFT wire transfer, and SEPA wire transfer. Capitalix does not charge any fees or commissions for withdrawals. The processing time for withdrawals is also mentioned as 3 business days. However, it's worth noting that the asterisk (*) indicates that the processing time for withdrawals may vary.

| Pros | Cons |

| Wide range of payment methods | No information on minimum deposit |

| No deposit or withdrawal fees | Processing time for refunds |

| Funds with SSL encryption | Varying processing time for withdrawals |

Bonuses

Capitalix claims to offer some bonuses, which vary depending on account types. In particular, the bonus is up to 20% on the Basic account, 40% on the Silver account, 60% on the Gold account, 80% on the Platinum account and 100% on the VIP account.

Customer Support

Capitalixs customer support can be reached by telephone: +971 4574 1810 (AE), +54 11 5236 2375 (AR), email: support@capitalix.com, live chat, Telegram or send messages online to get in touch. Company address: CT House, Office 4B, Providence, Mahe, Seychelles.

Trading Tools & Educational Resources

Trading Tools & Educational Resources at Capitalix include Daily Market Analysis, and an Economic Calendar.

Daily Market Analysis: Capitalix provides daily market analysis, covering various asset classes such as commodities, cryptocurrencies, indices, individual stocks like Apple, European markets, oil reserves, and Wall Street. These analyses offer insights into market trends, recent developments, and potential trading opportunities. Traders can stay updated with the latest information to make informed decisions regarding their investments.

Economic Calendar: Capitalix provides an economic calendar as a tool to help traders stay informed about forthcoming major economic information. The calendar includes events such as the consumer price index, private medical insurance rates, and nonfarm payroll releases. By monitoring these events, traders can make informed trading decisions and stay ahead of market shifts.

| Pros | Cons |

| Provides comprehensive market analysis | Lack of interactivity within the platform |

| Offers informative news articles and featured content | Limited availability of additional educational resources |

| Includes an economic calendar to track important events |

Trading Hours

The trading hours at Capitalix offer clients options to engage in trading activities around the clock, providing access to the markets 24 hours a day, five days a week. This allows traders to execute trades at their convenience, regardless of their geographical location or time zone. It's important to note that specific holidays and events can impact the trading hours, leading to early market closures or complete shutdowns on certain dates.

During UK Bank Holidays, such as the one on May 29th, 2023, trading in UK equities (FTSE-JUN23) is closed. Similarly, on Memorial Day in the United States, which also falls on May 29th, 2023, trading in various US equities and commodities, including DOW-JUN23, NK-JUN23, XAUUSD, and others, closes early at 20:00 GMT+3. Additionally, on the same day, Pentecost in Switzerland results in the closure of Swiss equities.

Customer Support

Customer Support at Capitalix offers various channels for assistance. They provide personal and customized Live Customer Support, ensuring that you receive tailored assistance for your specific needs. Their support team operates 24/5 and is available in multiple languages, aiming to deliver an exceptional level of service.

For written communication, you can reach out to them via email at support@capitalix.com. This allows you to send them any inquiries or concerns you may have.

In addition to email, Capitalix offers live chat as a means of contacting their customer support. This real-time chat feature allows for immediate interaction with a support representative, enabling swift resolutions to your queries.

Alternatively, you have the option to reach their customer support team via telephone. They provide contact numbers for different regions, including +971 4574 1810 for the United Arab Emirates (AE) and +54 11 5236 2375 for Argentina (AR). By calling these numbers, you can directly communicate with their support staff.

Apart from traditional channels, Capitalix also provides the option to connect with their customer support team through Telegram or by sending messages online.

It's important to note that the company address of Capitalix is located at CT House, Office 4B, Providence, Mahe, Seychelles. This information can be useful if you need to reach out to them through traditional mail or for reference purposes.

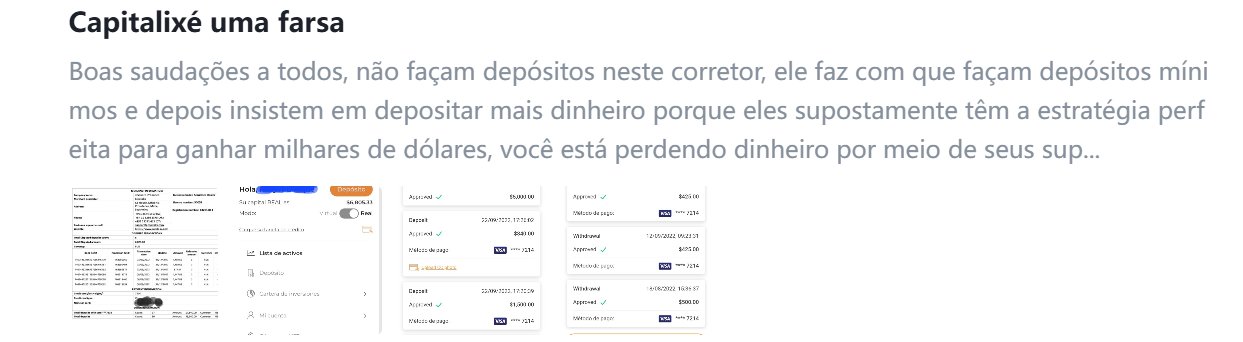

Reviews

Reviews on WIKIFX for Capitalix are relatively negative, with warnings to stay away from the broker. Traders claim that Capitalix targets inexperienced individuals, drains their money through misleading account managers, and refuses withdrawals. Scam allegations, fraudulent practices, and manipulation of trading information have also been reported, indicating a high level of risk and unreliability associated with Capitalix.

Conclusion

In conclusion, Capitalix is a financial service provider that offers online trading services to its clients. It provides a range of investment options and tools to facilitate trading activities. Some advantages of Capitalix include a user-friendly platform, access to multiple markets, and various financial instruments. However, it is important to note that Capitalix has some drawbacks. These include potential risks associated with trading, limited customer support, and potential complexities in navigating the platform. It is crucial for individuals considering Capitalix to thoroughly research and assess the suitability of its services before engaging in any trading activities.

Q: What are the trading hours at Capitalix?

A: Capitalix provides 24/5 trading hours, allowing clients to access the markets around the clock. However, specific holidays and events can impact trading hours.

Q: How can I contact customer support at Capitalix?

A: Capitalix offers various channels for customer support, including email (support@capitalix.com), live chat, telephone, Telegram, and online messaging. Their support team operates 24/5 and is available in multiple languages.

Frequently Asked Questions (FAQs)

| Q 1: | Is Capitalix regulated? |

| A 1: | No. Capitalix is offshore regulated by the Seychelles Financial Services Authority (FSA). |

| Q 2: | At Capitalix, are there any regional restrictions for traders? |

| A 2: | Yes. Capitalix does not offer CFDs to residents of certain jurisdictions including the USA, Iran, Canada, Iran, Iraq, and North Korea. |

| Q 3: | Does Capitalix offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Does Capitalix offer the industry-standard MT4 & MT5? |

| A 4: | No. Instead, it offers a web-based trading platform. |

| Q 5: | Is Capitalix a good broker for beginners? |

| A 5: | No. Capitalix is not a good choice for beginners. Though it advertises very well, it lacks legitimate regulations. |

Keywords

- 2-5 years

- Regulated in Seychelles

- Retail Forex License

- Suspicious Scope of Business

- High potential risk

- Offshore Regulated

News

Exposure Complaint against Capitalix

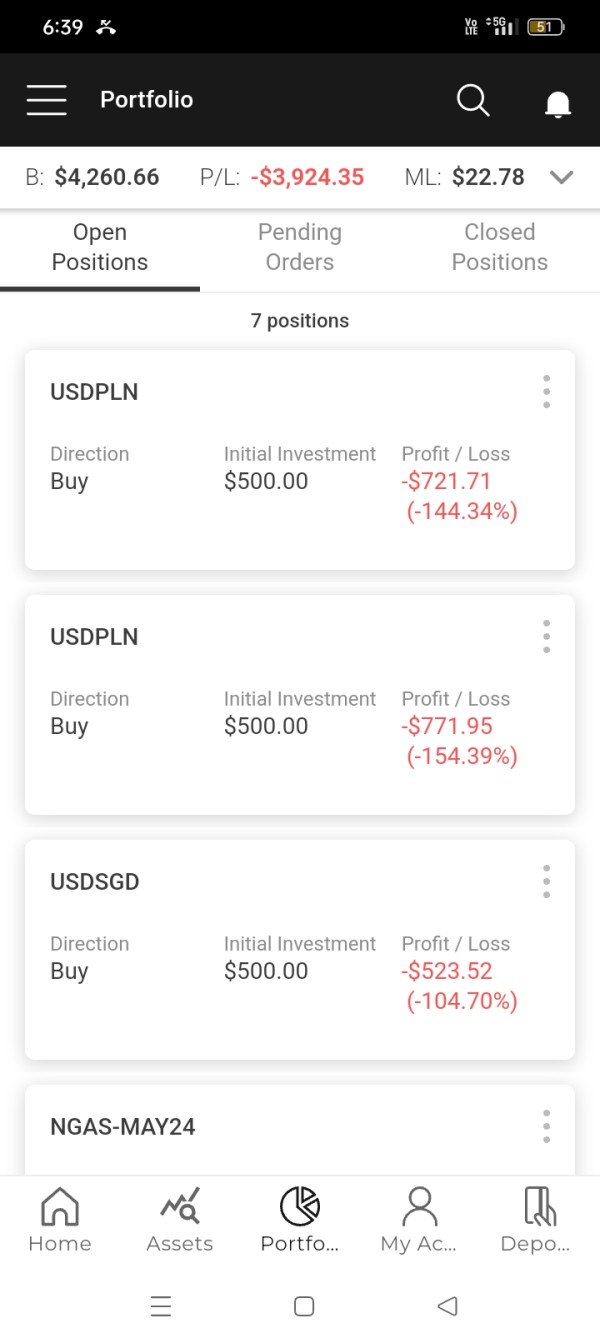

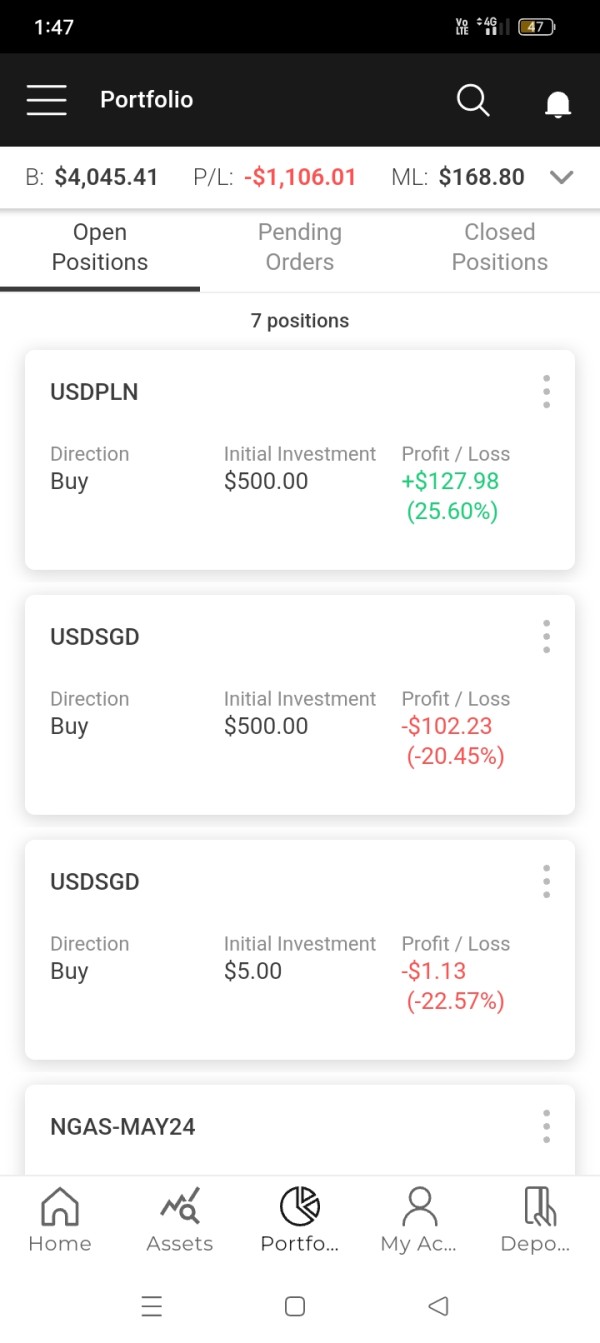

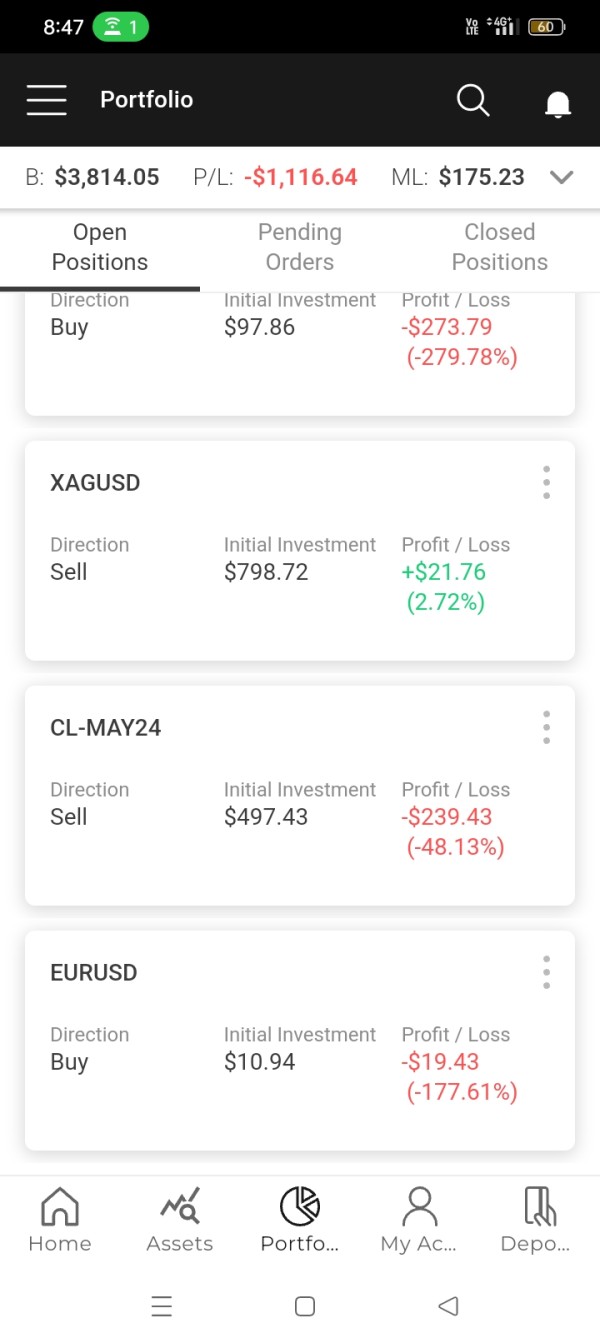

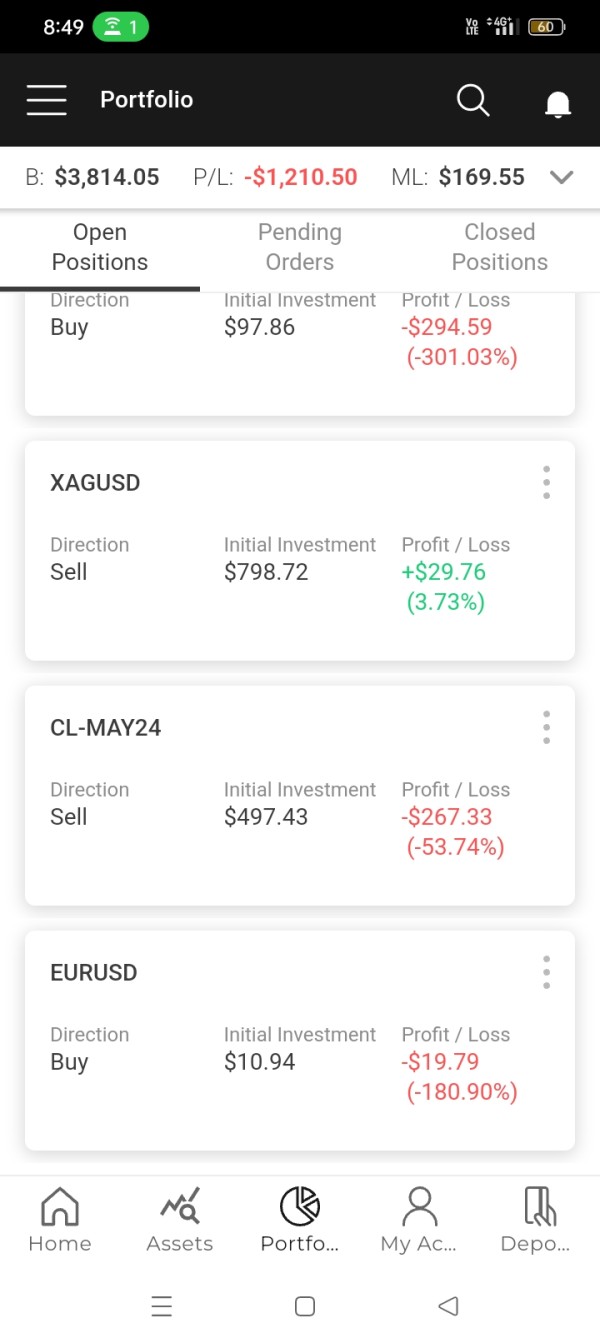

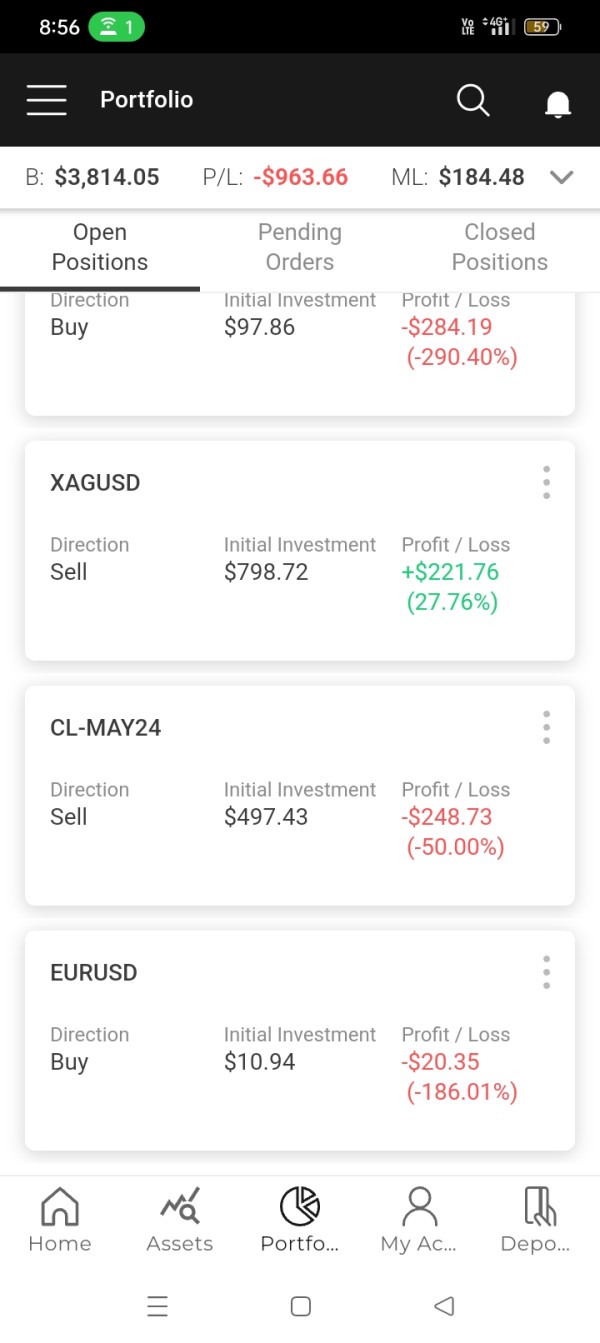

On April 17, 2024, a complainant filed a complaint with WiKiFX. He began investing funds with Capitalix. He invested $3500.

2024-04-18 15:50

Exposure WikiFX Review: Is Capitalix Reliable?

This article is about to shed light on the broker named Capitalix

2023-12-21 18:17

Review 46

Content you want to comment

Please enter...

Review 46

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX1195942667

Brazil

Open an account at capitalix to invest in stocks, where the person who claims to be the account manager made me invest in stocks of a company that never increased in value, then he said that I had lost. In order for me to withdraw, I would have to invest more money. These companies are already known for committing these types of frauds and I didn't know, fell for it and now I can't recover my money.

Exposure

2024-09-10

FX1195942667

Brazil

This organization makes money by deceiving and ruining the dreams of honest people. They make you invest every last penny, telling you to invest in stocks of companies that only go down instead of going up, until you become negative. Then they ask for more money, saying that you need to have margin. They keep calling you several times a day to deposit more money, and when you request to withdraw, they say that you don't have enough margin for withdrawal. It's a scam, it's a fraud. I don't know how the authorities allow such a company to operate within Brazil, I believe they don't even have representation in Brazil. This so-called broker, Capitalix, is a fraud.

Exposure

2024-09-07

FX4503567642

Chile

Good afternoon I would like to expose Capitalix, they won't let me withdraw my money and they tell me that I need a required margin of 12,000 dollars to be able to withdraw and that therefore I must deposit money, the funny thing is that at first they asked me for 4 thousand dollars, then they told me that the market fluctuates so now I need to deposit more capital, exactly about 10 thousand dollars to which I told them that I had no more, then I received another call in which they told me that now I only needed 2. 500 dollars but that I had to do it in a maximum of 2 hours and I could withdraw my money, and we did it and then they told me that I needed 7 thousand dollars more, they are a joke;

Exposure

2024-05-03

FX3995843283

Salvador

Good afternoon, could you support me? Capitalix won't let me withdraw my money and they induced losses. Now they tell me that to withdraw I must pay more. I need the money.

Exposure

2024-04-19

Govindaraj

India

I had invested this flatform 3500 £ that means INR 3 lakhs hard earned money,They were guided wrongly to invest forex trading.Intially only grape is showing profit.However we want to withdraw our funds means not allowing to withdraw the personal manager they will convince not to withdraw the amount.Totally fraud flatform don't invest this app.They are class one scam company. Our personal manager sham very much talent to brings the the funds to invest the forex trading account.He won't allow to withdraw our funds.They were talking nicely to invest more fund in our account any time you can withdraw your funds they were convinced nicely.

Exposure

2024-04-16

Gabriel 7534

Mexico

I opened an account at CAPITALIX looking to make money in the world of investments. I started with an account with $200 dollars and I deposited more as I saw that money was being made. Days later I requested 50 dollars at the request of my maker so that he could see if I could withdraw money. I continued investing and depositing more and more at the advisor's suggestion. the amount they changed for me as the days went by, then I made another withdrawal and then another both for $400 dollars. I continued investing in assets and I was winning but some positions went negative and the positions in the red increased. The psions were always at the suggestion of the advisor who once the positions were made he told me like this, leave them later I'll talk to you and he didn't talk to me until two or three days later when the position was already negative and he said don't worry, we'll do it. to recover what was not happening. The moment came when the account was in danger and he told me you have to deposit because your account is going to burn, and he made me deposit more and the account now had more free margin but the negative positions continued to grow and Until the account was in danger, he spoke to me, as the manager said, pressuring me and yelling at me, you have to deposit it, but I no longer had any money and you told me you have to get it, if your account is not going to burn, get $4000 dollars and I will give you a bonus of $6000 and we have stabilized the account and you withdraw what you got. That never happened, the account was burned, I deposited more than $12,000 dollars and in earnings I had more than $28,000, said person already spoke to me just to tell me your account was burned. She told me to put three positions of the same asset, two in favor and one against, all three always reported in negative even though two of them, one against the other, had a difference of two minutes. Both reported over $5000 in negative.

Exposure

2024-03-23

Carmen Galicia

Mexico

I tell you that I received a call from Capitalix, with client number: 1824725098, to invest with 200 dollars on December 16, 2023, and from there they begin to explain that you can earn more if there is more investment, but great detail does not explain the details and they call you all the time until they convince you and I invested 7,600 dollars invested. Two weeks ago they sent me to the finance area to close the account, return money and profit for more than $11,000 dollars, they asked me for 20% of the loss, which was $2,200 dollars (they talk like 7 times a day) and informed that in 72 hours they made the refund in two parts for an amount of over $5,000 dollars and they absorbed 80% of the losses. They called me on TUESDAY 02/20/2024 and told me to deposit more money than I requested. The last account advisor told me that he did not know how to buy and sell shares, he bought natural gas shares and e-mini nasdaq 100 , he made you execute those operations and asked him that you didn't know anything about the exchange market, he only told me that you want your money to do what I told you and from there, I marked for my investment to be returned and they told me that I lost everything, today in Today I have a large debt in the bank and I am desperate because these people are fraudsters and extortionists.

Exposure

2024-03-19

Marcello9342

Brazil

Guys, be careful when clicking on a link and landing on an investment site called CAPITALIX! By doing so, you are deceived by an advertisement for FOREX investments and sneakily induced to invest to try it out. After that, they ask for your details such as telephone, email, and documents, making it appear that everything is very serious and trustworthy. With this, you are approached by a well-trained Group of con artists and orchestrated to take all the money you have and what you don't have. They do not care! I started investing 500USD to try it out and when I mentioned to my supposed investment manager that I had money in fixed income, he immediately convinced me to put it there, with that money “miraculously” I had gains beyond expectations, encouraging me to believe that I could increase it up to 50% my capital. After 2 days I received a call from a certain Thomas (supposedly my manager's boss), advising me to invest more money to take advantage of the market, and for every 10,000USD I would receive 3,000 in bonuses. So I was convinced, little by little, I reached the 30,000USD I had available in an investment fund. But as always their objective is to take your money, not help you win, my wallet strangely started to turn red, and then Rodrigo (my supposed manager) told me that to save it I would need another 10,000 dollars, I put in 7,000 and Guided me in buying and selling more assets. As always it wasn't enough for them, they found another excuse to force me to invest even more. They invented that if I totaled 50,000USD, end of year promotion, I would be entitled to a so-called “ISLAMIC” account with which I would be exempt from fees and that there were only 12,500USD left, so I did it in the hope that it would be more than enough to They would leave me alone and I would just enjoy the supposed gains. I made the mistake of commenting that before the end of the month, I would withdraw 11,500USD to cover card expenses, as the day approached, my investment portfolio turned completely red, and due to the amount of negative assets the system (which I believe is manipulated by them) prevented me from having margin for withdrawal, that is, it is easy to deposit and difficult to withdraw. Having nothing else to come up with, they called me at work saying it was urgent and that I should put in even more so that the market wouldn't liquidate me by closing my positions, but this time I said enough was enough, as a result of which my balance suddenly became negative -17,000.00 and they didn't give me any more satisfaction, since I don't deposit anymore, they lost interest, and after a couple of weeks they called me asking me to send them 20 thousand dollars to activate the insurance to get my money back, in other words, if I agreed I would lose another 20 thousand. It is clearly a criminal organization disguised as a broker. My luck is that I didn't invest everything, and I have the knowledge, resources, and influence to get it all back from them through a well-known and efficient stolen asset recovery company, as well as eventually making them famous on two television networks. If you've already fallen for it, do as I did, type a report, document everything, screenshots of deposits, and statements from the first day, and hire an agency specialized in recovering stolen assets that work, I've used it before. Don't negotiate with swindlers, they don't feel sorry for you! They are destroyers of dreams and other people's lives.

Exposure

2023-12-26

Gabriel 7534

Mexico

The company IS NOT Capitalix, it is called My.inverlion.com I put the name Capilix because I couldn't find a way to register this company. I have an active account with Inverlion from which I cannot withdraw my money, the account has a capital of 12,085.92 dollars of which I deposited a little more than eight thousand dollars and the rest is profits. This company forced me to deposit 3,800 dollars deceitfully, saying that it was working to open the channels to deposit me 1,000 dollars that I was requesting. They asked me for 6000 Mexican pesos to be able to deposit and I deposited it, then they told me to deposit $5000 more and I refused so no one answered my call anymore. I request your help to get my money back. Thank you in advance.

Exposure

2023-12-18

mau5823

Mexico

Alexandra and Camilo called me and asked me for 200 dollars to start investing but then they called me and asked me for a higher amount. The most I could give to buy Netflix shares that were expecting a rebound due to their latest report. These people who posed as experts asked me to deposit the maximum because they lied to me that it would be a great opportunity. Then they asked me for more to buy more shares to the point that I deposited almost 2,000.00 dollars. When I wanted to withdraw, they told me that I should deposit more as soon as possible for a imbalance in the market. They demanded and threatened that at any moment I would lose everything. When I did not deposit close to 1,500.00 dollars that they asked me to. And they said they would return all my money in less than a week. I did not do it. They were rude. I closed my positions assuming loss and I tried to withdraw 789.00 dollars which was what I had left. But they did not let me, they asked me to continue making movements to recover that money. I lost everything. I was manipulated. I only ask to recover what I can. My financial situation is at a critical point. I sent my request by mail as they asked me, then they asked me to make more movements but they did not allow me to withdraw. It was on purpose so that the account was consumed. My family found out and I was made a fool of, due to the psychological damage caused. I deleted my images and my account has a negative balance. I send a capture of all my deposits to your capitalix account. The truth is I deposited every cent but now I do not have access to the account. Everything adds up to a total of 32,494.00. It is impossible that the money was lost from March to early June, emptying the account. I consider it to be false, please help me.

Exposure

2023-10-20

Maryluna

Guatemala

I opened an account at the end of January 2023. They have been requesting more and more deposits in order to recuperate my funds which are up to 171$ grand. They ask me to pay taxes in order to withdraw which I did with great effort and now they still will not return my funds. Please help me.

Exposure

2023-10-20

mau5823

Mexico

I deposited 1,850 dollars. At the beginning, I deposited 200 because I thought it was not fraud. Then they asked me for more. In the end they did not let me withdraw and they put the account at zero. I have deposits and there was a clarification with my bank. I have proof. I asked them for money by mail and I never received anything.

Exposure

2023-10-19

Joshy

Mexico

I have been trading with this company for 3 weeks, everything was going well, only now I find that I am losing in the 11 positions that they told me to open, and they are also asking me for more money to invest. I ask to redeem my invested capital, since I am not interested in continuing to work with this company. help me what can I do? It is the first time I have invested and I have been paying attention to them, however I get the impression that they are manipulating the results. They take a long time to return the money, I am beginning to realize that there are many bad comments and I want to recover the money I have invested. I have already deposited $1,200.

Exposure

2023-10-18

Sergio 153

Guatemala

Good morning, I would like to receive support regarding malpractice from Broker Capitalix. At first, everything was normal but then they began to charge higher commissions for opening positions, reaching up to $135. In addition, the supposed advisors indicated positions to enter into losses. Even so, I managed to leave $2,250.00 in the account that they refused to return to me with several excuses, among them that they gave me a bonus of 2,000 dollars and that I must use to cover a minimum number of lots. But given the high commissions, they want me to end up losing what I have left. My name is Sergio Esteban Cariñes Taltique

Exposure

2023-10-12

Alondra Belmont

Mexico

In May of this year I registered with the company Capitalix and they immediately assigned me a manager who during the following days dedicated himself to convincing me how convenient it would be to invest with them given their level of experience and professionalism. The manager called me every day and I started with an initial investment of $200. With which I got hooked because those first days were all about profits, a few days later the manager told me that it was convenient for me to try to invest $1000. Because that would give me many more possibilities of winning and not losing money in taxes, a topic that I had not mentioned until that moment. He convinced me after showing me graphs and attending company webinars and I invested that money. He knew that I had to withdraw it in a month and he told me that there would be no problem, during that month the investments continued to prosper, but at the end of the period they could never be withdrawn for different excuses, on the contrary he began to pressure me to deposit $3000 dollars . the ones that he and his boss finally convinced me to get. To encourage me they gave me a bonus of $1000. With which I would have a Gold account, which they told me would reduce taxes to a minimum and the money would multiply 1 to 50. They convinced me again and I did it. The next day after sending the money, my manager began, like every day, to tell me what to invest in, I did everything he told me, which positions to open and which to close. From that moment on, all the positions that were opened were always negative. My manager told me that it was normal, that it would take days to turn a profit. The following week it was already very evident how the account was decreasing and that was when they told me that the market had collapsed and they would return my initial investment if I refunded the bonus and I did, and at that point they told me that I owed them $700 more but now I didn't send them, from that day on they cut off all communication with me. They stole $6000 from me.

Exposure

2023-10-08

Cuichi

Mexico

Fake advisors are contacted to ask for more money deposited on that page and they insist on several calls using inappropriate vocabulary. Unfortunately, I was a victim of this deception and in the end they wanted me to deposit more I told them that I no longer agreed and they responded in a bad way. I had to deposit mandatory that if not something was going to happen to me and I already had my personal information, I felt threatened by those criminals, unfortunately I had a very bad experience in falling into this type of situation, getting away, I was defrauded with a total of 2,100 dollars apart. everything to be left with nothing

Exposure

2023-09-17

Cuichi

Mexico

I was a victim of fraud/scam with a total of 2,100 dollars, which is equivalent in my country to 35,973 Mexican pesos per phone call, I was allegedly manipulated by an advisor from this company, according to help people who have no experience. Unfortunately I fell for this and every time they call me, they insist on I had to deposit more money and the times I deposited there was more loss and lately to make a withdrawal. I get 0.00 and I have screenshots of the deposits I have made, the safest thing is that they want to more and more people join in.

Exposure

2023-08-29

Cuichi

Mexico

On August 2nd, I was browsing the Internet, and an advert to invest in Amazon appeared, which caught my attention. Well, in good faith, I put my name, number, and email, and the next day I received a call from this number 6629184158 during the call. he downloaded the application called capitalix then the subject tells me to fill out forms with all my personal information later he transfers the call to me supposedly the manager who explains to me how these actions work, later I receive the call again but to another number 442039960319 at that time the subject persuades me that I am going to earn double or more than that I was going to invest total that this told me to make a deposit of 200 dollars and after making the deposit to open more positions to operate and they pass days and I receive the call again from the same subject number 442039960319 in that course that is explaining in detail about a balance graph and then it turns out that I invested in oil that I made another deposit of all my savings, well then I told him no I agreed that I used my savings for a project, then the subject insisted that he would give it 1,000 dollars, which he did, he told me that he would contact me later but the next day I would open more positions to invest and continue operating and several years pass days that I was really suspicious of this, I communicated to customer service telling them that I already wanted to unsubscribe and what could be done, later they pass me on to the manager and I told him that I wanted to recover what I had deposited and he told me that I was leaving He helped me recover my money, well, which got me tangled up by saying that my account capital was very low, that once again it was stable, I needed to make another deposit of 400 dollars and that I should give a bonus and to request the withdrawal and end the call, they contacted again saying the same as deposit 500 dollars total that they defrauded me with 2,100 dollars

Exposure

2023-08-27

mahmoud6716

United Arab Emirates

I have a balance of 1181 dollars, and I cannot complete withdrawal process, and withdrawal process is rejected.

Exposure

2023-07-08

Fatma Rashed

United Arab Emirates

I fell victim and got scammed for 3830 dollars from an application called capitalix that has a fraudulent scheme of faking shares and playing with the numbers, I have screenshots of everything and what happened was when I saw the shares going up and I checked online the shares didn’t move, They even made me buy shares that were on at the moment but in the app they were as if they are closed. I didn’t realize all this was happening until I reached the withdraw and it said I have 0$ when I already sent around 3830$ I talked to my bank about the application being fraudulent but they told me that the money has already been sent, all they do is deceive the investors and when it comes to withdraw they need a photo of my credit card from front and back? That’s not possible to withdraw money they don’t need my credit card at least they need a bank account number, looking at trusted applications such as etoro its simple to withdraw and deposit and the shares are all real but when you go back to capitalix they have shares of companies that don’t even have shares to be bought such as “SALIK” shares that’s impossible SALIK don’t even have shares that you can buy from, after I told them ill make a complaint they allegedly told me they wanted to give me a bonus that was 3800$ bonus and 1000$ free if I deposited 3800$, and that’s after they scammed… the picture in In Arabic before they robbed me and in English after the theft 💔💔💔

Exposure

2023-06-10