Score

Trade Markets

Cyprus|10-15 years|

Cyprus|10-15 years| https://www.trademarkets.eu/?lic=eu&lang=en

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:T Markets EU Limited

License No.:208/13

Single Core

1G

40G

1M*ADSL

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

Basic Information

Cyprus

CyprusAccount Information

Users who viewed Trade Markets also viewed..

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

trademarkets.eu

Server Location

Germany

Website Domain Name

trademarkets.eu

Server IP

162.55.183.146

Genealogy

VIP is not activated.

VIP is not activated.NBH MARKETS

NBH Markets

Nexgreenorx

Company Summary

| Trade Markets Review Summary | |

| Company Name | NBH Markets EU Ltd |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC (Regulated) |

| Services | Brokerage Services, Portfolio Management, Concierge Trading |

| Market Instruments | Forex Trading: Digital Currencies, CFD Trading: Commodities, Stocks, Indices |

| Demo Account | Yes |

| Leverage | 1:30 (Maximum) |

| Spread | from 3-25 pips (Forex) and 0.1 variable floating spreads |

| Commission | 7-20 per trade (€/$/£) |

| Trading Platform | Trade Markets MetaTrader 4 |

| Minimum Deposit | €250 |

| Regional Restrictions | No CFD for the USA and UK, etc. No Leveraged CFD in Belgium. |

| Customer Support | Contact Form, Live Chat, 1 on 1 Meeting, Tel: +35722090061,+35722090060; Email: support@trademarkets.eu, Social Media: Facebook, Instagram, YouTube, X, TikTok, LinkedIn |

| Company Address | NBH Markets EU Ltd., Agias Zonis & Thessalonikis, 1, NICOLAOU PENTADROMOS CENTER, Floor 7, Office 701-704, 3026, Limassol, Cyprus |

What Is Trade Markets?

Trade Markets, operated by NBH Markets EU Ltd and based in Cyprus, is regulated by CYSEC. As a regulated entity, Trade Markets provides relatively higher transparency and compliance.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Pros:

Regulated by CYSEC: Trade Markets is regulated by the Cyprus Securities and Exchange Commission (CYSEC), ensuring compliance with financial regulations and providing a level of security and transparency for clients' investments.

Demo Account Available: Clients have the option to access a demo account, allowing them to practice trading strategies, familiarize themselves with the platform, and test the broker's services without risking real funds.

Multiple Customer Support Channels: Trade Markets offers various customer support channels, including live chat, telephone, email, and social media platforms, providing clients with convenient options to seek assistance and resolve inquiries.

MT4 Supported: Trade Markets supports the MetaTrader 4 (MT4) trading platform, a widely recognized and popular platform known for its advanced features, charting tools, and automated trading capabilities.

Several Security Measures Applied: Trade Markets implements several security measures, such as segregated funds, membership in the Investor Compensation Fund, and tight risk management controls, to safeguard clients' funds and ensure a secure trading environment.

Cons:

Loose Spreads for Forex: Trade Markets have loose spreads (from 3 to 25 pips) for forex trading, which impacts trading costs for clients, leading to higher expenses or reduced profitability in certain trading scenarios.

High Commission Charged: Trade Markets charges high commissions of up to 20 (€/$/£), which can add to the overall trading costs for clients.

Is Trade Markets Safe or Scam?

Regulatory Sight: Trade Markets operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC), holding a Market Making (MM) license type with license number 208/13. This regulatory status signifies that Trade Markets adheres to the rules and requirements set forth by CySEC to maintain transparency, integrity, and investor protection within the financial markets.

User Feedback: Users have reported instances of fraud associated with Trade Markets, where they were misled by promises of high winning rates and easy profits. These users joined groups or platforms claiming to offer expert guidance in stock and forex trading, only to realize later that they were scammed. Issues include difficulties in withdrawing funds, inability to contact customer service or platform administrators, and the use of non-regulated channels.

Security Measures: Trade Markets' client funds are held in segregated bank accounts, ensuring they remain separate from the company's operational funds and are protected in the event of bankruptcy. Additionally, as a member of the Investor Compensation Fund maintained by the Central Bank of Cyprus, Trade Markets offers clients an extra layer of protection. The company follows rigorous risk management protocols, including partnering only with regulated banking and payment institutions and conducting thorough background checks on employees and suppliers. Transparent and ethical practices are integral to Trade Markets, with clear information provided on all costs and conditions associated with its services, promoting trust and transparency with its clients.

Market Instruments & Services

Trade Markets offers a range of products and services tailored to meet the diverse needs of traders and investors. These include brokerage services, allowing clients to trade various financial instruments such as stocks, forex, commodities, and indices.

Additionally, Trade Markets provides portfolio management services, where professional investment managers oversee and optimize clients' investment portfolios to help them achieve their financial goals. Moreover, the platform offers concierge trading, providing personalized assistance and guidance to clients seeking tailored trading strategies and support.

Account Types

Trade Markets offers six distinct account types tailored to meet the varying needs and preferences of traders - Trader, Basic, Bronze, Silver, Gold, and Premium. All account types come with access to a practice account, online chat support, and all trading platforms. Additionally, a stop-out level of 50% is applied to all accounts to prevent excessive losses. Additionally, Trade Markets provides a demo account, which is particularly beneficial for beginners who can practice trading without risking any real money.

| Account Types | Minimum Deposit |

| Trader | €250 |

| Basic | |

| Bronze | €1,000 |

| Silver | €2,500 |

| Gold | €5,000 |

| Premium | €50,000 |

Leverage

For all account types except the TRADER account, the maximum leverage provided is 1:30 across various financial instruments. However, the leverage for certain assets varies based on their classification and market conditions. In this case, users need to take both account types and instrument types into consideration.

| Account Types | Leverage |

| Trader | 1:1 |

| Basic | 1:30 |

| Bronze | |

| Silver | |

| Gold | |

| Premium |

| Financial Instrument | Max. Leverage |

| Major forex pairs (e.g., USD/JPY, EUR/USD, GBP/USD) | 1:30 |

| Minor forex pairs (e.g., USD/MXN, EUR/CZK, GBP/SGD) | 1:20 |

| Spot gold | |

| Major indices (e.g., US30, DAX30, FTSE100) | |

| Spot silver | 1:10 |

| Futures (hard & soft commodities) | |

| Energy products (e.g., Brent vs USD) | |

| Minor indices (e.g., ASX, HSI) | |

| Shares of US, UK, French & German listed companies | 1:5 |

| Digital assets (e.g., BTC/USD, ETH/USD) | 1:2 |

Spreads & Commissions

Trading with Trade Markets, a variable floating spread of 0.1 pip is offered for all account types, which is tight and competitive. However, for forex trading, the spreads are applied differently from 3 to 25 pips, which are considered very loose in the industry, and for CFD trading, detailed information on spreads is not available. Different commissions are charged according to the account types from 7-20 per trade (€/$/£). Users can check the tables below to have a better understanding.

| Forex Asset Class | Majors | Minors | Exotics |

| Currency Pairs | EUR/USD, GBP/ USD, +5 | EUR/GBP, CHF/ JPY, +12 | USD/MXN, EUR/ TRY, +31 |

| Spreads From* | 3 pips | 4 pips | 25 pips |

| Leverage Up To* | #:1 | ||

| Account Types | Variable Floating Spread | Commissions |

| Trader | 0.1 pips | 20 €/$/£ |

| Basic | 12 €/$/£ | |

| Bronze | ||

| Silver | 11 €/$/£ | |

| Gold | 10 €/$/£ | |

| Premium | 7 €/$/£ |

Trading Platform

Trade Markets offers its clients access to the Trade Markets MetaTrader 4 platform, a widely recognized and trusted trading platform in the industry. This platform allows users to execute trades, analyze markets, and manage their accounts efficiently. Users have the flexibility to access the platform directly from a web browser, making it convenient for trading on the go. Additionally, the MetaTrader 4 platform is available for desktop users who prefer a more comprehensive trading experience. It also supports mobile trading, enabling users to trade seamlessly from their Android or iOS devices, providing flexibility and accessibility to the markets anytime, anywhere.

Deposit & Withdrawal

Trade Markets offers a variety of payment methods to facilitate deposits and withdrawals for its clients. These methods include:

Bank Transfer: Processed by Nuvei Limited, an Electronic Money Institution authorized and regulated by the Central Bank of Cyprus.

Visa/MasterCard: Also processed by Nuvei Limited.

SOFORT: Processed by Nuvei Limited.

iDEAL: Processed by Nuvei Limited.

Giropay: Processed by Nuvei Limited.

NETELLER: Operates under Paysafe licenses, offering electronic money services.

PayPal: PayPal (Europe) S.à r.l. et Cie, S.C.A., a credit institution authorized and supervised by Luxembourgs financial regulator.

Each payment method is supported by licensed and authorized payment processors based in Europe, providing a certain level of security and compliance with regulatory standards. Clients can initiate deposits and withdrawals through a reliable, user-friendly client portal, allowing for swift account funding operations. The supported currencies, minimum and maximum transaction limits, and processing times vary for each payment method, providing flexibility for clients based on their preferences and needs. Users are encouraged to refer to the provided table for detailed information regarding specific payment methods.

For Deposit:

| Payment Methods | Currency | Min. transaction | Max. transaction | Processing time |

| Bank Transfer | EUR, USD, GBP | 250 | 50,000 | 3-10 business days |

| Visa/MasterCard | $100,000 | Instant | ||

| SOFORT | €12,000 | |||

| iDEAL | EUR | €20,000 | ||

| Giropay | USD | €10,000 | ||

| NETELLER | EUR, USD, GBP | 30,000 | ||

| PayPal |

| Payment Methods | Currency | Min. transaction | Max. transaction | Processing time |

| Bank Transfer | EUR, USD, GBP | None | 24 Hours | |

| Visa/MasterCard | ||||

| SOFORT | ||||

| iDEAL | ||||

| Giropay | EUR | |||

| NETELLER | EUR, USD, GBP | |||

| PayPal | ||||

Customer Support

Trade Markets provides multiple customer support channels to assist clients with their inquiries and needs. These include:

Contact Form: Clients can submit specific queries or requests through the contact form available on the Trade Markets website.

Live Chat: Instant messaging support is available for real-time assistance and quick responses to queries.

1-on-1 Meeting: Trade Markets offers personalized meetings for clients who prefer a more direct and customized approach to address their concerns or inquiries.

Telephone: Clients can contact Trade Markets via telephone at +35722090061 or +35722090060 for direct assistance and support.

Email: Clients can reach out to the support team via email at support@trademarkets.eu for detailed inquiries or assistance.

Social Media: Trade Markets maintains an active presence on various social media platforms, including Facebook, Instagram, YouTube, TikTok, and LinkedIn, allowing clients to connect, engage, and receive updates on the latest news and developments.

Company Address: Clients have the option to visit the company's physical address located in Limassol, Cyprus, for in-person support or consultations if needed.

Conclusion

Trade Markets provides customers with brokerage and other services, with several advantageous trading features available. It is a regulated broker under the oversight of CYSEC. However, the high commission and loose spreads offered by this broker are not competitive in the industry, so users need to give serious consideration before engaging trading with Trade Markets.

Frequently Asked Questions (FAQs)

Q: What is the minimum deposit of Trade Markets?

A: It is €250.

Q: Is a commission charged when trading with Trade Markets?

A: Yes, a commission from 7-20 (€/$/£) will be charged per trade.

Q: Can I open a demo account?

A: Yes, you can. Demo accounts are available.

Q: Does Trade Markets support MT4/5?

A: Yes, it does support MT4.

Q: Can I trade CFD using leverage in Belgium?

A: No, you can't, because it is prohibited.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 10-15 years

- Regulated in Cyprus

- Market Making(MM)

- Suspicious Scope of Business

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

一會

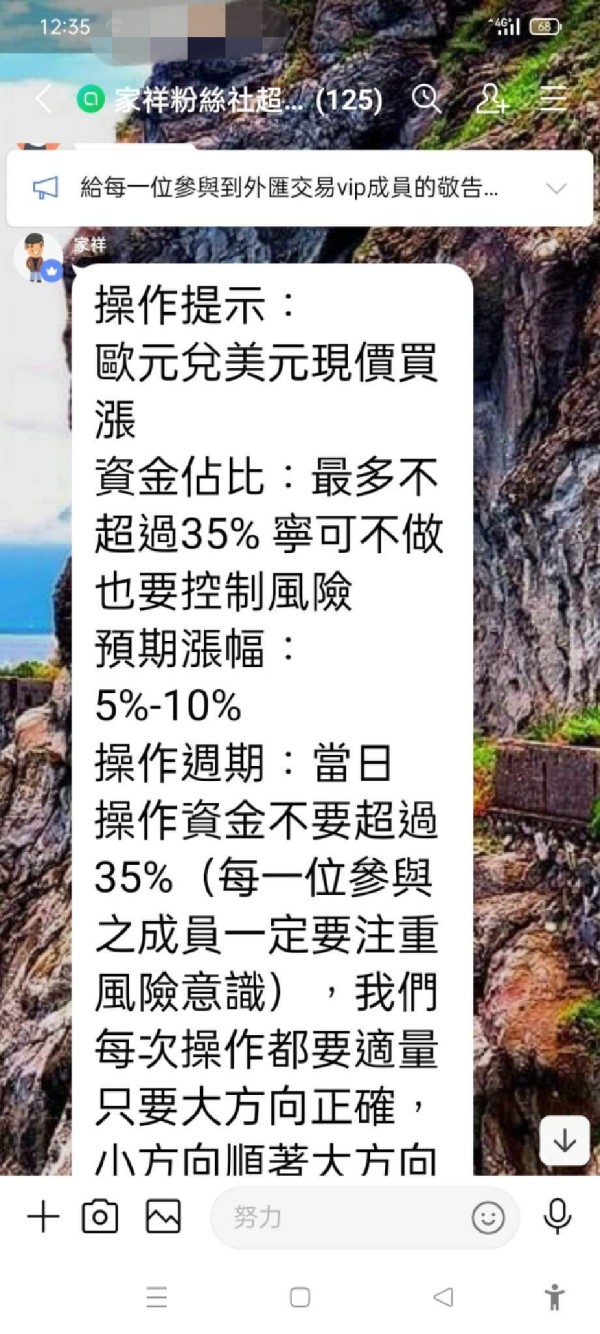

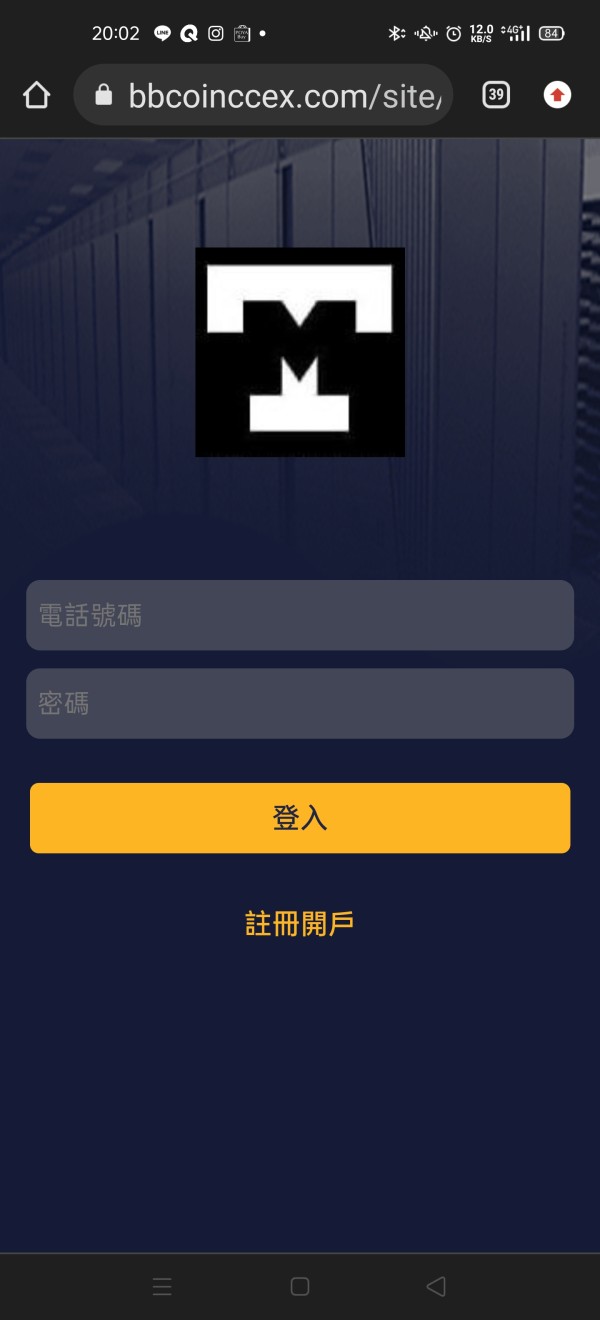

Taiwan

In May of this year, I joined a line group that claimed to be Teacher Yang Jiaxiang. At the beginning, I took everyone to operate stocks. In the last two months, I started to teach you how to operate foreign exchange. The winning rate is almost 100%. The teacher provides a black platform for everyone to log in and follow along. Many people in it followed the operation and felt that some were stilted. Later, I also joined and followed the operation. The winning rate is almost 100%. But on 12/24, I asked for the first withdrawal. Group and the black platform can no longer log in to contact the teacher. The personal line and TMarkets online customer service did not respond. I realized that I was scammed. Now there is no way to deal with it. I am ready to file. I hope no one will be deceived again.

Exposure

2022-12-28

Richie Fx

Taiwan

Trade Markets looks great, I think the most important thing is that it has a qualified regulatory license from cysec, and its leverage is limited within 1:30. Leverage is something that all traders should take seriously because it can amplify both risk and loss.

Neutral

2022-12-14

as6836

Germany

Good and useful platform overall! Professional advice and people.

Positive

2023-05-08

° 生性凉薄

United Kingdom

It is a sharply regulated and trustable broker with a well-established company. Account opening is smooth and fully digital, there is a great range of markets and instruments, good trading and professional trading platforms with education and research.

Positive

2023-02-21