WellLink Information

WellLink, founded in 2012 and based in Hong Kong, is a financial services provider specializing in margin financing, securities, and futures trading. It operates under the oversight of the Securities and Futures Commission (SFC) of Hong Kong.

Pros & Cons

Pros:

- Regulated: WellLink is regulated by reputable authorities the Securities and Futures Commissionof Hong Kong (SFC).

- Extensive Instruments: WellLink provides a broad range of trading services, including margin financing, securities, and futures.

Cons:

- Lack of Transparency on Certain Details: Some aspects, such as trading platforms, minimum deposit requirements, and specific spreads, are not clearly mentioned.

- Lack of Demo Account: There is no mention of a demo account, which can be a drawback for new traders wanting to practice without financial risk.

Is WellLink Legit?

WellLink is regulated by the Securities and Futures Commissionof Hong Kong (SFC) with license number AMB404, specifically authorized for Dealing in Futures Contracts. This regulatory framework ensures that the company adheres to stringent financial standards and provides a secure trading environment.

Products

Margin Financing: WellLink offers flexible margin financing for Hong Kong stocks, with annual interest rates starting at H+3.9%. Investors can access up to 10 times leverage on their investments. Interest is charged only for the duration of the loan, with no minimum borrowing period and no interest for same-day repayment. Terms include variable loan-to-value ratios and potential re-pledging of collateral, with Well Link retaining the right to adjust or suspend services.

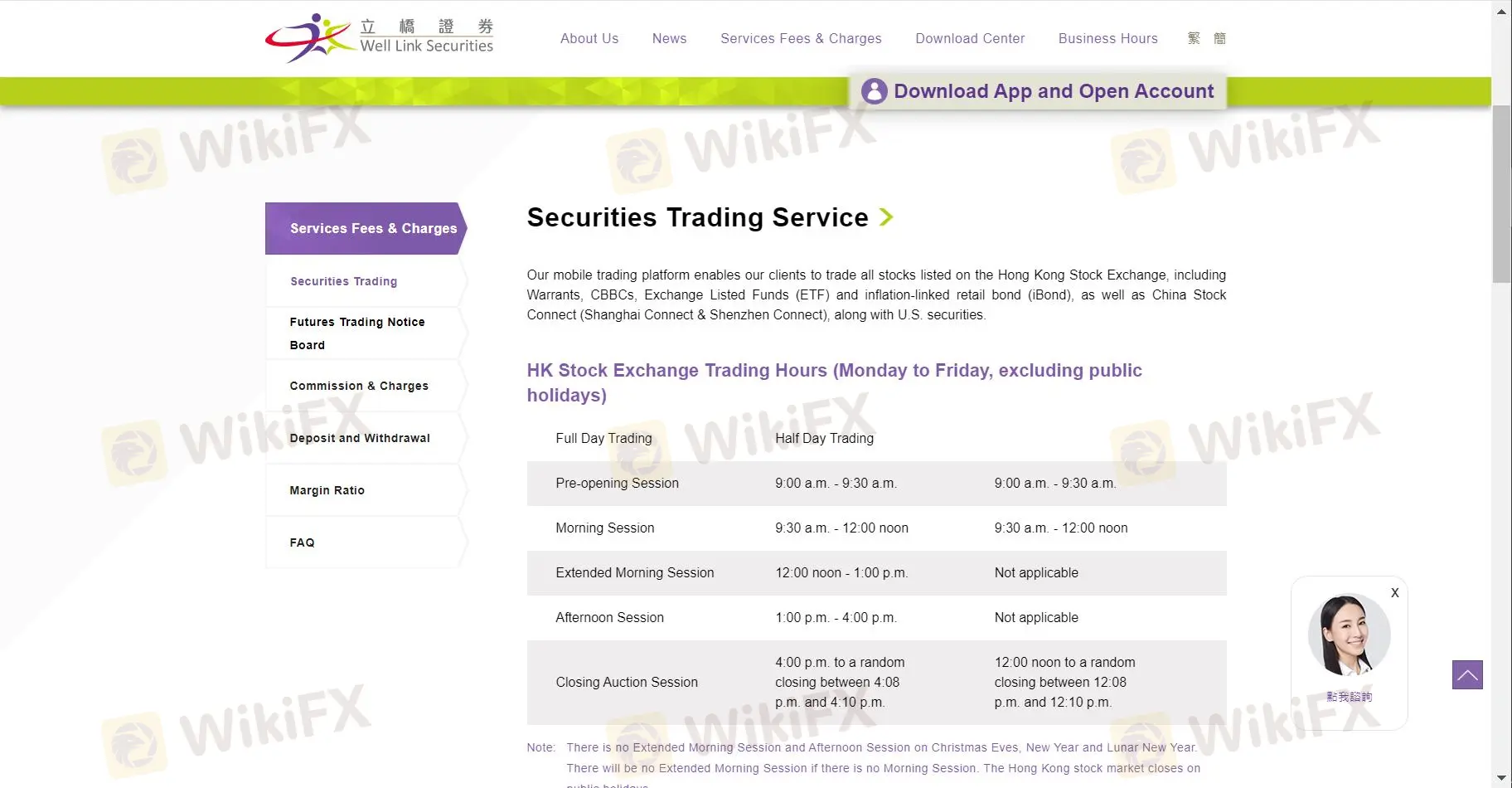

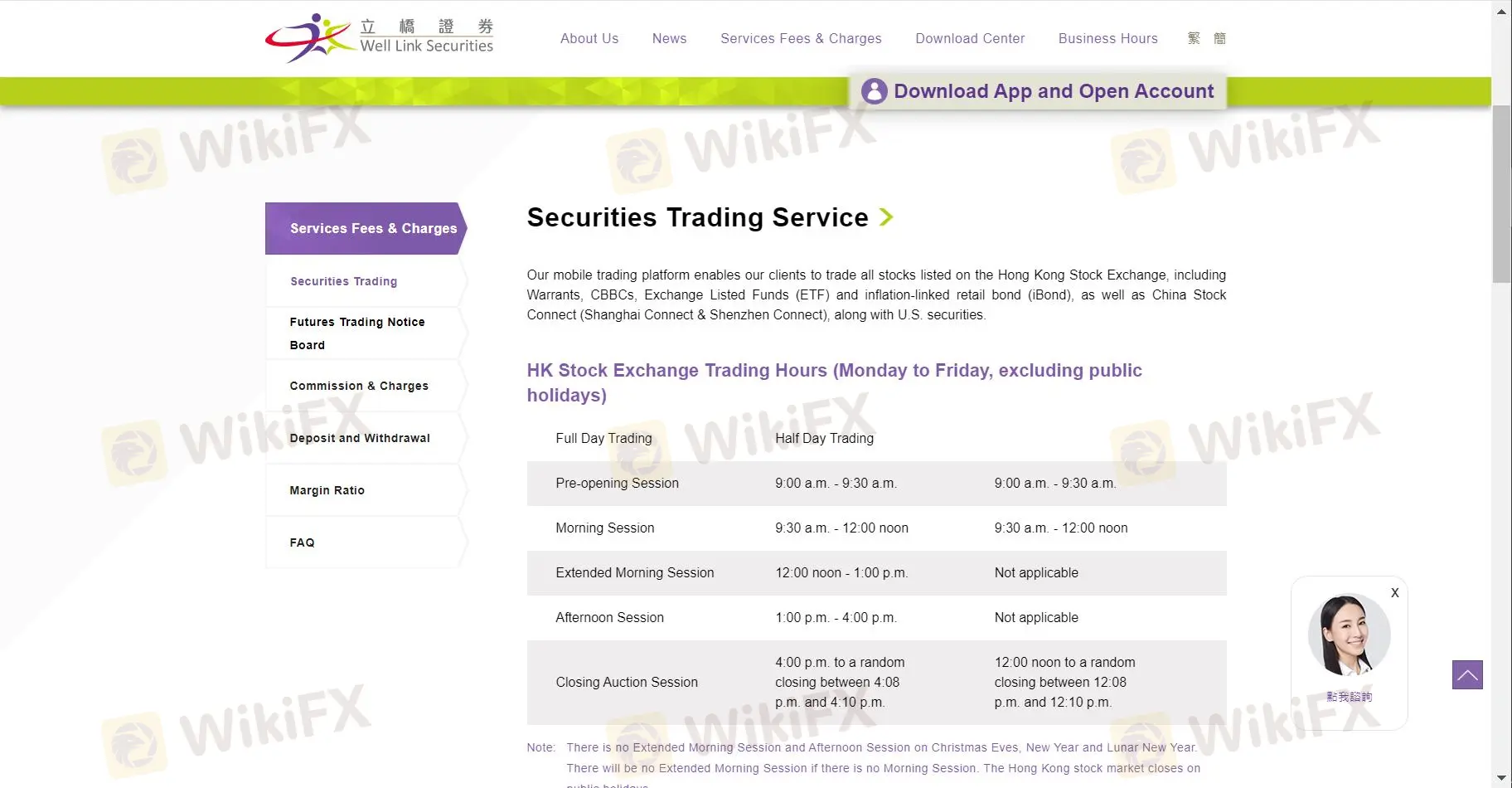

Securities: WellLink offers a comprehensive securities trading service. Clients can trade Hong Kong-listed stocks, including Warrants, CBBCs, ETFs, and iBonds, as well as U.S. securities and China Stock Connect shares. Hong Kong trading hours include pre-opening, morning, extended morning, afternoon, and closing auction sessions, with specific timings for full and half-day trading. U.S. stocks are traded during EST or Hong Kong time (DST and WT) with T+1 settlement and no physical script deposits. China Stock Connect trading is available for A-shares with specific quotas and restrictions, including limits on trade orders and settlement in RMB.

Futures: WellLink offers futures contracts including Hang Seng Index Futures, H-Shares Index Futures, Mini Hang Seng Index Futures, Mini H-Shares Index Futures, and Hang Seng Tech Index Futures. These contracts have varying contract multipliers and are traded during regular and extended hours. Settlement is typically cash-based, and margins are required for both opening and maintaining positions.

Leverage

Well Link Securities offers margin financing with a leverage ratio of 1:10, enabling clients to control a larger position with a smaller amount of capital. While this enhances potential returns, it also magnifies risks, making losses as significant as gains if market conditions are unfavorable.

Commissions & Fees

WellLinks fee structure is clarity and transparency across its services. For Hong Kong futures, brokerage commissions and transaction levies vary by product, with additional fees for electronic trading and real-time price quotes. Global futures have a standard brokerage fee per contract, and specific fees for auto-exercise and settlement. For US stocks, commissions are based on a per-share basis with minimums applied, and additional SEC and FINRA fees are incurred. Trading in China Connect A Shares involves a range of fees, including commissions, handling charges, and various management and transfer fees. Bond transactions incur handling fees up to 1% of the face value, with custodian fees and transfer charges also outlined.

Futures Service Charges Table (Hong Kong Futures)

Futures Service Charges Table (Global Futures)

Shanghai/Shenzhen China Connect A Shares Service Charges

US Listed Securities Trading Services Charges

SSE/SZSE China Connect A Shares Service Charges

Bond Service Charges

Customer Support

WellLink offers comprehensive customer support to its clients:

- Telephone: For general inquiries, call the Customer Service Hotline at +852 3150 7728 (Hong Kong), +86 755 8206 0899 (Mainland China), or +853 8796 5888 (Macau). For complaints, use the Complaint Hotline at +852 3150 7733.

- Email: For customer service, email to cs@wlsec.com, and for complaints, contact co@wlsec.com.

- Fax: +852 3150 7668

- Live Chat: For those seeking an immediate response, WellLink provides a live chat service available 24 hours a day, 7 days a week.

- Address: Unit 1113-1115, 11/F., China Merchants Tower, Shun Tak Centre, 168-200 Connaught Road Central, Sheung Wan, Hong Kong

Conclusion

In conclusion, WellLink, regulated by the Securities and Futures Commission of Hong Kong (SFC), offers a robust trading platform with services including margin financing, securities, and futures. Hope this information helps you in making a well-informed choice.

Q&A

Is WellLink regulated ?

Yes, WellLink is regulated by Securities and Futures Commissionof Hong Kong (SFC).

What products can I trade with WellLink?

You can trade Margin Financing, Securities and Futures with WellLink.

How about the fee structure of WellLink?

It's complex and you can find detailed info in 'Spreads & Commissions' section.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.