Score

NFX

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.nfx.ae/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+44 2039116216

Other ways of contact

Broker Information

More

NFX Trading CO

NFX

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum Deposit | Min Deposit(USD): 50,000 |

| Minimum Spread | From 0.8 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 1.0 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:100 |

| Minimum Deposit | Min Deposit(USD): 25,000 |

| Minimum Spread | From 1.4 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:100 |

| Minimum Deposit | Min Deposit(USD): 10000 |

| Minimum Spread | From 1.8 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:100 |

| Minimum Deposit | Min Deposit(USD): 100 |

| Minimum Spread | From 2.2 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed NFX also viewed..

XM

AUS GLOBAL

STARTRADER

IC Markets Global

NFX · Company Summary

| Aspect | Information |

| Company Name | NFX |

| Registered Country/Area | United Kingdom |

| Founded Year | 2020 |

| Regulation | Not regulated |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:200 |

| Spreads | From 0.8 pips |

| Trading Platforms | MT5 and IRESS |

| Tradable Assets | Forex, cryptocurrencies, shares, precious metals, energies, indices |

| Account Types | Standard, Premium, Prime, Professional account |

| Customer Support | Phone: +44 2039116216, Email: support@nfx.ae |

| Deposit & Withdrawal | Stripe, Razorpay, Bitcoin, Tether |

| Educational Resources | Basic FAQs available, limited educational materials |

Overview of NFX

NFX, founded in the United Kingdom in 2020, is a cryptocurrency and forex trading platform. It's important to note that NFX operates without regulatory oversight, which may raise concerns about transparency and user protection. Despite this, NFX offers several advantages, including a diverse range of financial instruments, competitive spreads, and commission-free trading. Traders can choose between the MetaTrader 5 and IRESS platforms, and there are multiple account types available with varying leverage options.

Is NFX legit or a scam?

NFX is not regulated by any regulatory authority, which may raise concerns about the transparency and oversight of the exchange.

Unregulated exchanges lack the oversight and legal protections provided by regulatory authorities. This can lead to a higher risk of fraud, market manipulation, and security breaches. Without proper regulation, users may also face challenges in seeking recourse or resolving disputes. Additionally, the absence of regulatory oversight can contribute to a less transparent trading environment, making it difficult for users to assess the legitimacy and reliability of the exchange.

Pros and Cons

| Pros | Cons |

| Diverse Range of Financial Instruments | Limited Educational Resources |

| Competitive Spreads and Commission-Free Trading | Limited Research Tools |

| Choice of MetaTrader 5 and IRESS Platforms | Lack of Regulatory Oversight |

| Diverse Range of Account Types with Varying Leverage | |

| Multiple Customer Support Channels |

Pros:

Diverse Range of Financial Instruments: NFX offers a wide variety of financial instruments, including forex, cryptocurrencies, shares, precious metals, energies, and indices. This diversity allows traders to build diversified portfolios and explore various market opportunities.

Competitive Spreads and Commission-Free Trading: The platform provides competitive spreads, which can help traders optimize their trading costs. Additionally, NFX does not charge commissions on trades, enhancing cost-effectiveness.

Choice of MetaTrader 5 and IRESS Platforms: These platforms offer advanced features, technical analysis tools, and real-time market data, catering to different trading preferences.

Diverse Range of Account Types with Varying Leverage: NFX offers multiple account types, including Standard, Premium, Prime, and Professional, each with different leverage options.

Multiple Customer Support Channels: NFX provides various customer support channels. This accessibility ensures that traders can receive assistance and address their concerns promptly.

Cons:

Limited Educational Resources: NFX lacks comprehensive educational resources. While it offers basic FAQs, traders seeking in-depth educational materials to enhance their trading knowledge may need to explore external sources.

Limited Research Tools: The platform does not provide an extensive set of research tools, which can be a drawback for traders who rely heavily on market analysis and insights for their trading strategies.

Lack of Regulatory Oversight: NFX operates without regulatory oversight, raising concerns about transparency, security, and user protection.

Market Instruments

NFX provides a diverse array of financial instruments, catering to a wide range of investor preferences. Here's a breakdown of the various asset types available on the platform:

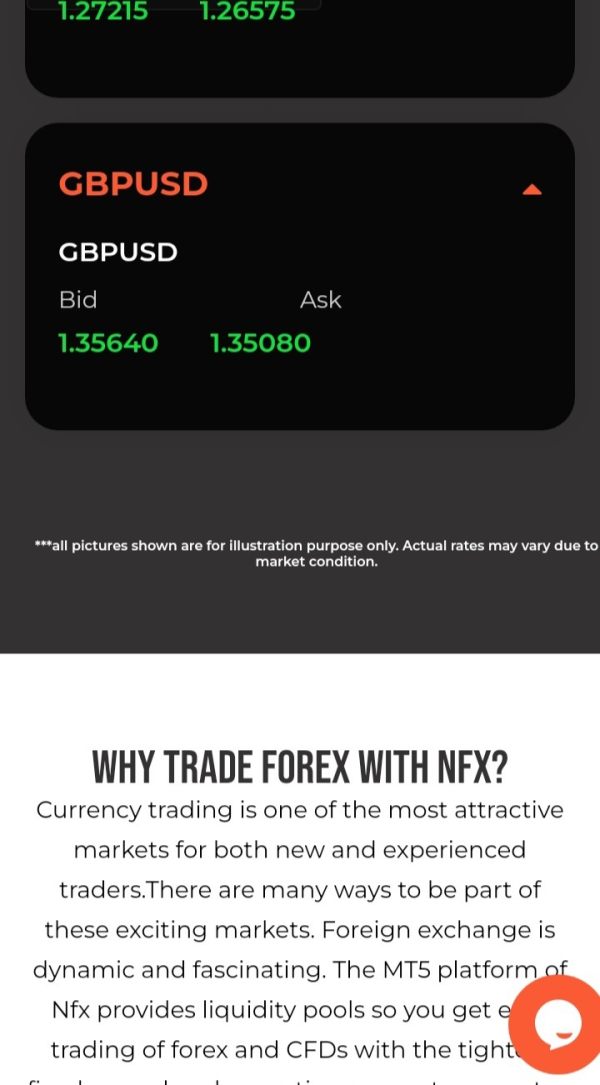

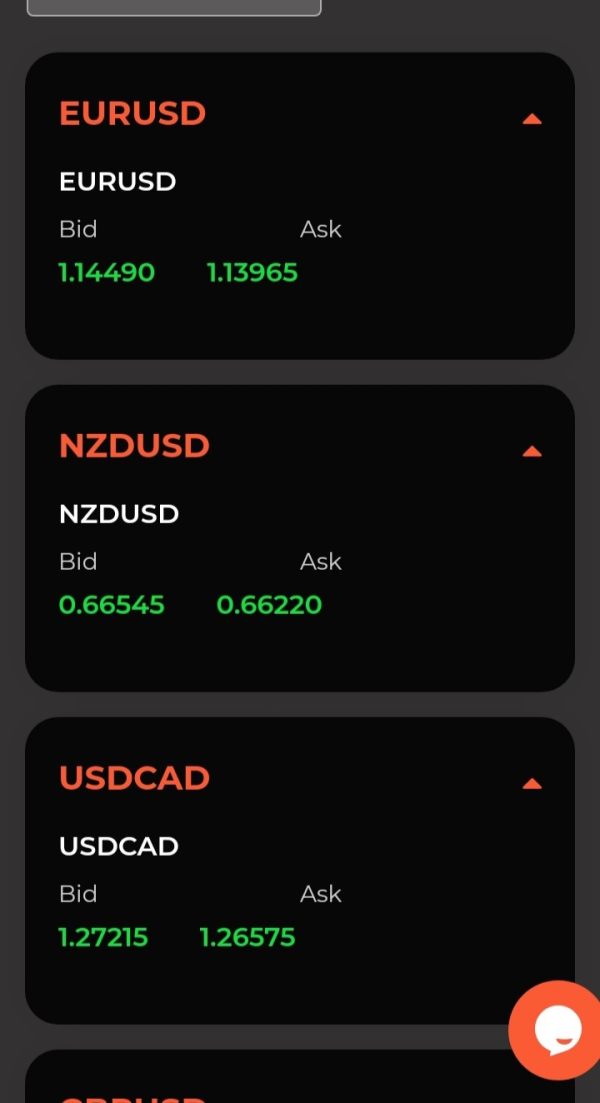

Forex (Foreign Exchange): NFX allows traders to engage in the forex market, where they can buy and sell currency pairs. This includes major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as numerous exotic and minor pairs, providing opportunities for traders to speculate on global currency movements.

Cryptocurrencies: NFX offers access to the dynamic world of cryptocurrencies. Traders can trade popular digital assets like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and many others. Cryptocurrency trading on NFX allows for both long and short positions, enabling traders to profit in both rising and falling markets.

Shares: Investors looking to diversify their portfolios can trade a wide range of shares from various global stock exchanges. Whether it's tech giants like Apple (AAPL), traditional financial institutions, or emerging startups, NFX provides access to a comprehensive selection of shares.

Precious Metals: For those interested in precious metals, NFX offers trading opportunities in assets like gold, silver, platinum, and palladium. These metals are considered safe-haven assets and can be valuable additions to a diversified investment strategy.

Energies: NFX caters to energy market enthusiasts by offering commodities like crude oil and natural gas. Traders can capitalize on price fluctuations in these vital energy resources, influenced by factors such as geopolitical events and supply-demand dynamics.

Indices: NFX allows investors to engage in index trading, providing exposure to global stock market indices like the S&P 500, NASDAQ, FTSE 100, and more. Trading indices allows traders to speculate on the overall performance of a basket of stocks, providing diversification and reduced risk.

Account Types

NFX offers a range of account types to cater to diverse trading preferences.

The Standard account provides traders with leverage of up to 1:100, making it accessible for traders of all levels. With spreads starting from 2.2 pips, it offers competitive trading conditions.

The Premium account, requiring a minimum deposit of USD 10,000, maintains leverage up to 1:100 and offers improved spreads starting from 1.8 pips.

The Prime account, requiring a USD 25,000 minimum deposit, retains the same leverage and further tightens spreads, starting from 1.4 pips.

For seasoned traders, the Professional account with a USD 50,000 minimum deposit offers a substantial leverage of up to 1:200 and the most competitive spreads, starting from just 0.8 pips.

Additionally, all account types are commission-free, providing cost-effective trading opportunities.

| Feature | Standard | Premium | Prime | Professional |

| Leverage | Up to 1:100 | Up to 1:100 | Up to 1:100 | Up to 1:200 |

| Spread | From 2.2 pips | From 1.8 pips | From 1.4 pips | From 0.8 pips |

| Commission | None | None | None | None |

| Minimum deposit | USD100 | USD10,000 | USD25,000 | USD50,000 |

| Demo account | Yes | Yes | Yes | Yes |

| Trading tool | MetaTrader 5 (MT5), IRESS | MetaTrader 5 (MT5), IRESS | MetaTrader 5 (MT5), IRESS | MetaTrader 5 (MT5), IRESS |

| Customer Support | 24/7 live chat, email, phone | 24/7 live chat, email, phone | 24/7 live chat, email, phone | 24/7 live chat, email, phone |

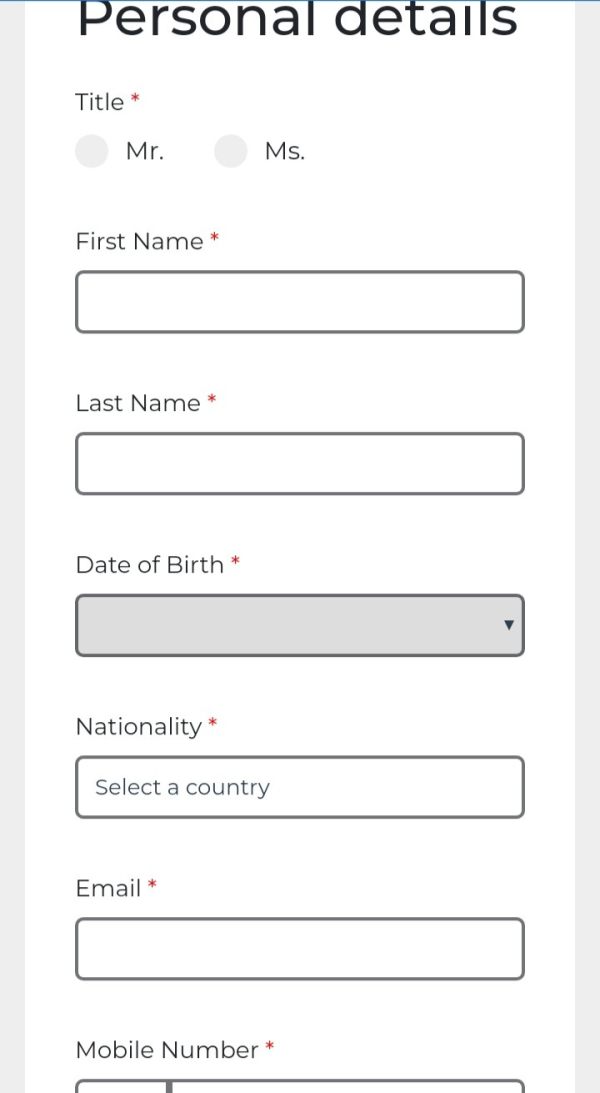

How to Open an Account?

Opening an account with NFX is a straightforward process. Here are the six steps to guide you through the procedure:

Visit the NFX Website: Start by visiting the official NFX website (https://www.nfx.ae/).

Registration: Look for the “Sign Up” or “Open an Account” button on the website's homepage and click on it.

Personal Information: You'll be prompted to provide your personal information. This typically includes your full name, email address, phone number, and country of residence. Make sure the information you provide is accurate and matches your official documents.

Choose an Account Type: NFX may offer different account types to cater to various trader profiles. Select the account type that aligns with your trading needs, such as Standard, Premium, Prime, or Professional.

Identity Verification: To comply with regulatory requirements, NFX may require you to verify your identity. This often involves submitting a copy of your government-issued ID, passport, or other identification documents. Follow the platform's instructions for document submission carefully.

Fund Your Account: Once your account is approved, you can proceed to fund it. NFX typically accepts various deposit methods, such as credit cards, bank transfers, and cryptocurrencies. Choose the method that is most convenient for you and follow the provided instructions to make your initial deposit.

After completing these steps, your NFX trading account will be activated, and you can start exploring the platform and executing trades.

Leverage

NFX offers flexible leverage options, allowing traders to amplify their positions according to their risk tolerance and account type. Leverage ratios range from up to 1:100 for Standard, Premium, and Prime accounts, while the Professional account offers an impressive leverage of up to 1:200, providing advanced traders with greater trading power.

| Feature | Standard | Premium | Prime | Professional |

| Leverage | Up to 1:100 | Up to 1:100 | Up to 1:100 | Up to 1:200 |

Spreads & Commissions

At NFX, traders benefit from competitive spreads tailored to their chosen account type. The Standard account offers spreads starting from 2.2 pips, providing accessible trading conditions for beginners.

With the Premium account, traders can enjoy tighter spreads, starting from 1.8 pips, making it an appealing choice for those with a minimum deposit of USD 10,000.

The Prime account further enhances trading conditions with spreads beginning from 1.4 pips.

For experienced traders, the Professional account offers the most favorable spreads, starting from just 0.8 pips, catering to those willing to invest USD 50,000.

| Feature | Standard | Premium | Prime | Professional |

| Spread | From 2.2 pips | From 1.8 pips | From 1.4 pips | From 0.8 pips |

| Commission | None | None | None | None |

Trading Platform

NFX offers clients the opportunity to engage in trading activities using the MetaTrader 5 (MT5) and IRESS platforms. These platforms are accessible across various devices, including desktop computers, web browsers, Android, and iPhone, providing traders with flexibility in how they choose to trade.

The MetaTrader 5 (MT5) platform is a popular choice among traders, known for its user-friendly interface and comprehensive set of trading tools. It offers a wide range of financial instruments and allows for technical analysis, automated trading through Expert Advisors (EAs), and real-time market data.

IRESS, another platform available on NFX, is favored by some traders for its advanced features and capabilities. It is known for its comprehensive market data and analytics, making it suitable for traders who require in-depth research and analysis tools to make informed trading decisions.

Both platforms offer a variety of order types, charting tools, and indicators to assist traders in their trading strategies. They also provide options for trading on various asset classes, including forex, commodities, indices, and more.

While NFX provides access to these platforms, it's essential for traders to conduct their research and due diligence before using them. The choice between MT5 and IRESS should be based on individual trading preferences and requirements, as each platform has its strengths and weaknesses.

Deposit & Withdrawal

NFX offers a variety of payment methods to accommodate traders' preferences. Funding options include Stripe, Razorpay, Bitcoin, and Tether, ensuring flexibility and convenience in depositing and withdrawing funds.

NFX exclusively processes payments in four major currencies: EUR, GBP, USD, and NZD. Traders can choose the currency that aligns with their trading needs, reducing the need for currency conversion and associated fees.

To start trading with NFX, traders need to make an initial deposit. The minimum deposit requirements vary depending on the chosen account type: Standard (USD 100), Premium (USD 10,000), Prime (USD 25,000), and Professional (USD 50,000).

| Feature | Standard | Premium | Prime | Professional |

| Minimum deposit | USD100 | USD10,000 | USD25,000 | USD50,000 |

One notable advantage of using NFX is its fee structure. The platform itself does not impose any fees on deposits or withdrawals, allowing traders to manage their funds without incurring additional costs directly from NFX. While NFX maintains a fee-free policy, it's essential to be aware that third-party entities, such as banks and e-wallet providers, may charge fees related to currency conversion or transaction processing. Traders should consider these potential fees when conducting financial transactions.

Customer Support

NFX provides responsive customer support to assist traders with their inquiries and concerns.

For direct communication, traders can reach NFX's English-language customer support team at +44 2039116216.

Additionally, traders can contact NFX via email at support@nfx.ae for assistance and information.

NFX aims to ensure that traders have access to reliable support channels, enhancing their overall trading experience and addressing any issues promptly and effectively.

Educational Resources

It's important to note that NFX currently lacks an extensive collection of educational resources. The platform offers basic FAQs to address common queries, but there is limited availability of comprehensive educational materials for traders seeking in-depth knowledge and skill development. Traders looking for a more robust educational experience may need to supplement their learning with external sources or educational platforms to enhance their trading expertise while using NFX as their trading platform.

Conclusion

In conclusion, NFX is a relatively new player in the financial trading industry, founded in the United Kingdom in 2020. While it offers several notable advantages, including a diverse range of financial instruments, competitive spreads, and commission-free trading, there are also significant drawbacks to consider. One of the major concerns with NFX is the lack of regulatory oversight, which can raise transparency and security issues. Additionally, the platform falls short in terms of educational resources and research tools, potentially limiting traders' ability to enhance their trading knowledge and make informed decisions.

FAQs

Q: What is NFX, and when was it founded?

A: NFX is a financial trading platform founded in the United Kingdom in 2020.

Q: Is NFX regulated by any regulatory authority?

A: No, NFX is not regulated, which may raise concerns about transparency and oversight.

Q: What financial instruments can I trade on NFX?

A: NFX offers a wide range of financial instruments, including forex, cryptocurrencies, shares, precious metals, energies, and indices.

Q: Are there any fees for trading on NFX?

A: NFX offers commission-free trading, but third-party entities like banks or e-wallets may charge fees.

Q: What account types are available on NFX?

A: NFX provides multiple account types, such as Standard, Premium, Prime, and Professional, each with varying leverage options.

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now