简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The Impact of the Stock Market on the Forex Market

Abstract:When people discuss the stock market, they often use a stock market index to describe the market's performance. A stock market index is just a carefully selected collection of stocks. This stock list can be used to gain an information on what's going on in the stock market.

Let's take a look at how the FX market affects the stock market, most especially the stock indices.

When people discuss the stock market, they often use a stock market index to describe the market's performance.

A stock market index is just a carefully selected collection of stocks. This stock list can be used to gain an information on what's going on in the stock market.

In this lesson, we'll look at how currencies affect two variety of stock indexes:

The Nikkei 225, often called the Nikkei, the Nikkei index, or the Nikkei Stock Average, is a Japanese stock market index that observes the performance of the Tokyo Stock Exchange's top 225 businesses (TSE).

The Dow Jones Industrial Average, sometimes called the Dow Jones or just the Dow, is a stock market index in the United States that tracks the operations of 30 large American corporations listed on the New York Stock Exchange (NYSE) and the NASDAQ.

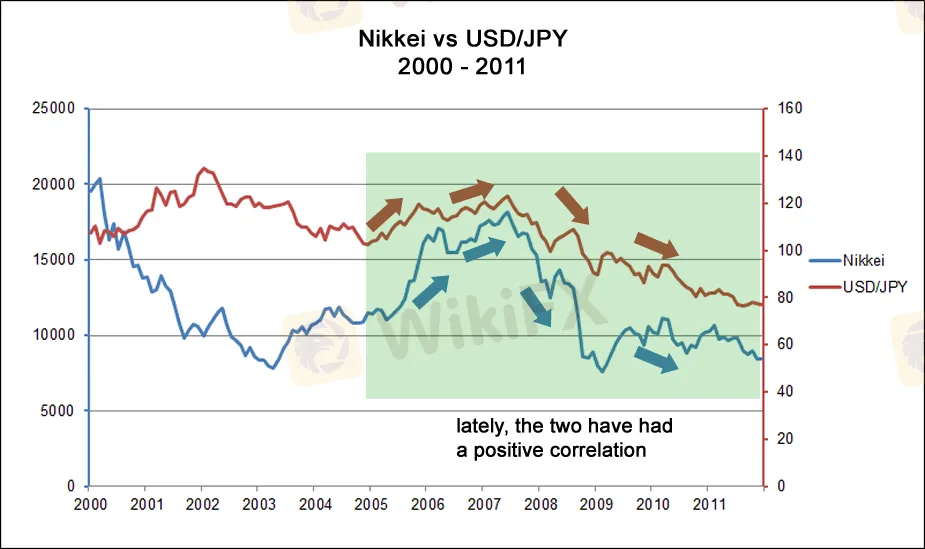

The Nikkei and the USD/JPY

The Nikkei and the USD/JPY were unfavorably joined previously before the global economic recession that began in 2007, when most economies had successive quarters of negative GDP growth.

Because investors assumed that the success of the Japanese stock market represented the country's status of affairs, a rally in the Nikkei resulted in the yen growing up.

The opposite was true too. Whenever the Nikkei fell, the USD/JPY rose with it.

However, when the financial crisis struck, the relationships exploded like Lindsay Lohan's.

The Nikkei and the USD/JPY, which used to move in opposite directions, now move together.

Isn't it astonishing, true?

Who'd have guessed that stocks would be involved in the FX market?

Correlation Between the USD/JPY and the Dow Jones Industrial Average

Observe the USD/JPY connection with the Dow Jones Industrial Average.

The strength or weakness of the dollar has an impact on the stock market in the United States, predominantly equities of large multinational firms (MNCs).

A rising US currency can stifle profitability for huge US businesses that propose goods and services internationally.

It makes a difference for such companies if the dollar is strong because it makes it difficult for them to raise prices or even maintain existing sales levels.

However, you might expect the USD/JPY and the Dow to be closely associated.

However, a glance at the graph below reveals that this isn't the case. While there is a positive association, it isn't as important as it could be.

Take a peek at the Dow Jones Industrial Average (blue line).

It reached a high of 14,000 in late 2007 before plummeting in 2008.

The USD/JPY (orange line) plummet at the same time, but not as much as the Dow.

This serves as a reminder that fundamentals, technical, and market opinion should all be considered, so always read up!

Take correlations with a grain of salt because they aren't always accurate!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex is a game that I enjoy playing

These champions have one thing in common: they not only work their butts off, but they also enjoy what they do.

Wait patiently. Maintain your discipline

"Patience is the key to everything," American comic Arnold H. Glasgow once quipped. The chicken is gotten by hatching the egg rather than crushing it."

There isn't a Holy Grail to be found!

Ask any Wall Street quant (the highly nerdy math and physics PhDs who build complicated algorithmic trading techniques) why there isn't a "holy grail" indicator, approach, or system that generates revenues on a regular basis.

Concentrate on the Process. Profits aren't a priority

We've designed the School of WikiFX as simple and enjoyable as possible to help you learn and comprehend the fundamental tools and best practices used by forex traders all over the world, but keep in mind that a tool or strategy is only as good as the person who uses it.

WikiFX Broker

Latest News

What is a Stop Out Level?

Challenges of A-Book Execution

Japanese Candlestick Anatomy

What is the difference between support and resistance?

Candlesticks with Support and Resistance

Dual Candlestick Patterns

Basic Japanese Candlestick Patterns

How to Place Your Stop Using Fibonacci to Lose Less Money

What is the Difference Between Double Tops and Double Bottoms?

Bearish and Bullish Pennants and How to Trade Them

Currency Calculator