Score

Rubix FX

Australia|5-10 years|

Australia|5-10 years| https://www.rubixfx.com

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- This broker bas been verified to be stoppage of business, and it has been listed in WikiFX's Stoppage of Business list. Please be aware of the risk!

Basic Information

Australia

AustraliaAccount Information

Users who viewed Rubix FX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

Algeria

Pakistan

Australia

rubixglobal.com

Server Location

Hong Kong

Website Domain Name

rubixglobal.com

Website

WHOIS.VERISIGN-GRS.COM

Company

-

Server IP

47.52.58.3

rubixfx.com

Server Location

Australia

Most visited countries/areas

Indonesia

Website Domain Name

rubixfx.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

0001-01-01

Server IP

103.250.23.184

rubixfxasia.com

Server Location

China

Website Domain Name

rubixfxasia.com

Website

GRS-WHOIS.ALIYUN.COM

Company

ALIBABA.COM SINGAPORE E-COMMERCE PRIVATE LIMITED

Domain Effective Date

0001-01-01

Server IP

116.62.211.10

Company Summary

Note: Rubix FXs official site - www.rubixfx.com is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| Rubix FX Review Summary in 10 Points | |

| Founded | 2014 |

| Registered Country/Region | Australia |

| Regulation | No license |

| Market Instruments | Forex, Commodity and Index |

| Demo Account | N/A |

| Leverage | 1:400 |

| EUR/USD Spread | From 1.0 pips |

| Trading Platforms | MT4 |

| Minimum Deposit | $500 |

| Customer Support | Phone, email |

What is Rubix FX?

Founded in 2014, RubixFX is an unregulated forex broker, offering over 55 forex currency pairs, equity indices and commodity for trading on two types of accounts with a leverage of up to 1:400 through the MetaTrader4. Note that this company is currently stoppage of business.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • MT4 supported | • Unregulated, numerous reports of fraudulent activity, severe slippage, and difficulty in withdrawing funds |

| • Offers various methods for depositing and withdrawing funds | • Website is unavailable |

| • Limited trading instruments | |

| • High minimum deposit |

Rubix FX Alternative Brokers

FXOpen - offers a range of trading platforms and competitive spreads, making it a good option for traders looking for variety in their trading experience.

Eightcap - With a focus on transparency and competitive pricing, Eightcap is a solid choice for traders looking for a reliable, regulated broker.

Valutrades - offers low spreads and fast execution, making it a good option for traders who prioritize speed and efficiency in their trading.

There are many alternative brokers to Rubix FX depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Rubix FX Safe or Scam?

Rubix FX is an unregulated broker with numerous reports of fraudulent activity, severe slippage, and inability to withdraw funds. As such, it is likely unsafe to work with this broker and traders should exercise caution and avoid it altogether. It is essential for traders to prioritize safety and security when working with any broker and to conduct their own research and due diligence before depositing any funds.

Market Instruments

Rubix FX offers a range of over 70 tradable instruments, including forex, commodity, and index trading. Forex trading allows traders to buy and sell currency pairs, such as USD/EUR or GBP/USD, in order to profit from price fluctuations in these currencies.

Commodity trading involves buying and selling physical commodities, such as gold, oil, or wheat, with the goal of profiting from changes in supply and demand or other market factors.

Index trading involves buying and selling baskets of stocks, either through exchange-traded funds (ETFs) or other financial instruments, with the aim of tracking the performance of a particular group of stocks or the larger market.

Accounts

Rubix FX offers both Standard and ECN accounts for traders. The first grade STP account requires a minimum deposit of $500, while other accounts may require higher levels of initial deposits. The STP account allows for trading in a range of instruments, including forex, commodities, and indices, and offers variable spreads, no commissions, and no requotes. The ECN account, on the other hand, offers tighter spreads, lower commissions, and faster execution speeds.

Leverage

Rubix FX offers its customers the ability to use a maximum leverage of 1:400, which is considered high and carries greater risk. The standard leverage offered by the company is set at 1:100. Leverage is the amount of funds that a trader can borrow from a broker to open a position and magnify potential profits or losses. While higher leverage can potentially lead to larger profits, it also increases the risk of significant losses, especially when trading in volatile markets. It is essential for traders to exercise caution when using leverage and to understand the risks involved.

Spreads & Commissions

Based on the information provided, Rubix FX offers two types of accounts - Standard and ECN. The Standard account has no commissions and offers variable spreads that vary between 1.0-1.5 pips for EUR/USD starting from 1.0 pips. On the other hand, the ECN account requires a commission of $3.5 per standard lot and offers tighter spreads that start from 0 pips.

It is important to note that spreads and commissions are an important aspect of trading as they directly affect a trader's potential profits or losses. While tighter spreads may seem attractive, the commission attached to the ECN account should also be taken into consideration.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| Rubix FX | 1.0-1.5 pips | No commissions (Std) |

| FXOpen | 0.0-1.5 pips | $3.5 per lot on ECN accounts |

| Eightcap | 0.0-1.2 pips | No commissions |

| Valutrades | 0.3-1.6 pips | No commissions |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Trading Platforms

Rubix FX uses the standard MetaTrader 4 Forex trading platform. MT4 provides plenty of tools and functions which are necessary for a trader: a number of technical indicators, an extended charting package, a wide range of expert advisors (EAs) and opportunities for backtesting. In addition, CopyFX (an investment system for copying transactions) is also available for a broker. The AutoTrade technology enables a trader to use this function.

Overall, Rubix FX's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Rubix FX | MetaTrader 4 |

| FXOpen | MetaTrader 4, MetaTrader 5, cTrader |

| Eightcap | MetaTrader 4, MetaTrader 5, WebTrader |

| Valutrades | MetaTrader 4, WebTrader |

Deposits & Withdrawals

Rubix FX offers its clients multiple methods for depositing and withdrawing funds, including credit card (AUD, USD, and EUR), wire transfer (base currencies: AUD, USD, EUR, CAD, GBP, and SGD), Neteller, and China UnionPay payment systems (USD only). The company does not charge any fees for depositing or withdrawing funds through direct operations.

Rubix FXminimum deposit vs other brokers

| Rubix FX | Most other | |

| Minimum Deposit | $500 | $100 |

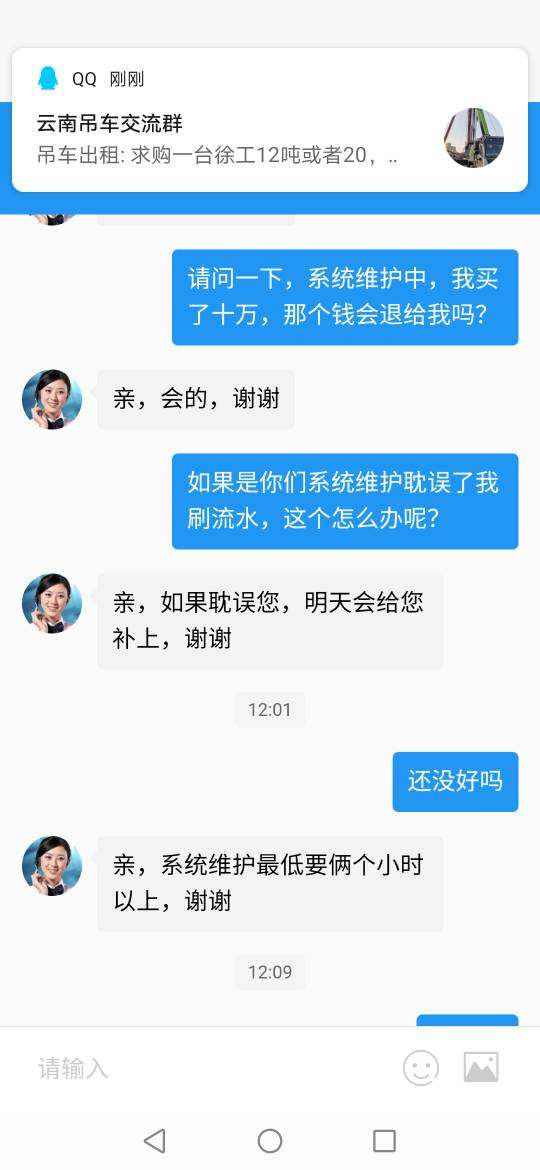

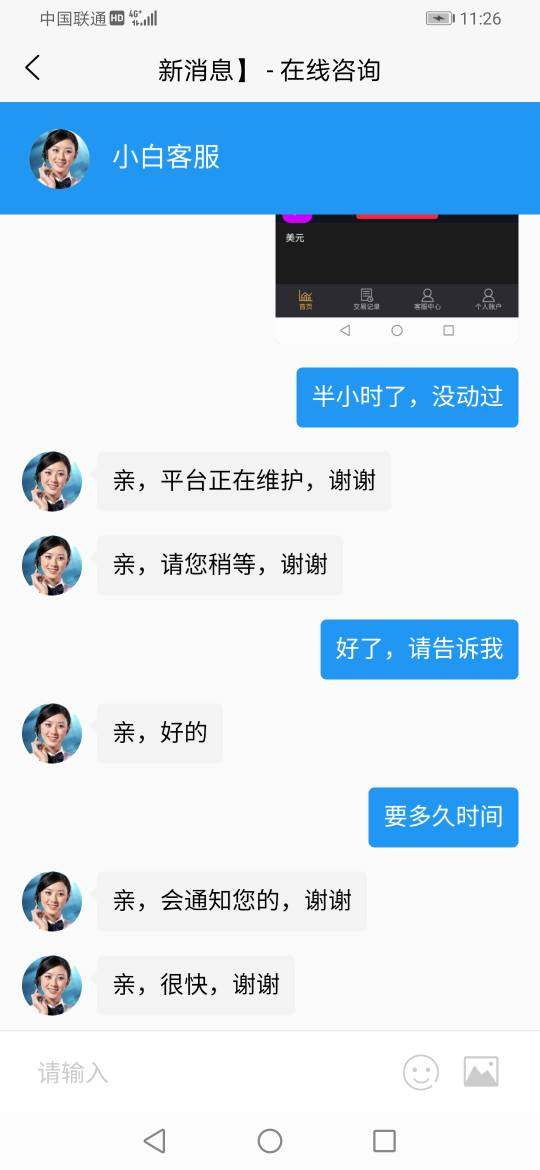

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw, severe slippage and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Customers can contact the company at +61 (02) 8039 7366 or by sending an email to service@fxtrading.com. No more specific info on customer service due to the inaccessibility of website.

Conclusion

Based on the information provided, the conclusion of a Rubix FX review is that traders should exercise caution when considering this broker. While it offers the industry-standard MT4 trading platform and various methods for depositing and withdrawing funds, it is unregulated and has numerous reports of fraudulent activity, severe slippage, and difficulty in withdrawing funds. Traders should prioritize safety and security when working with any broker and conduct their own research and due diligence before depositing any funds. It is also recommended to consider regulated brokers for increased safety and security.

Frequently Asked Questions (FAQs)

| Q 1: | Is Rubix FX regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Does Rubix FX offer the industry leading MT4 & MT5? |

| A 2: | Yes. It supports MT4. |

| Q 3: | What is the minimum deposit for Rubix FX? |

| A 3: | The minimum initial deposit to open an account is $500. |

| Q 4: | Is Rubix FX a good broker for beginners? |

| A 4: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website and negative user reviews. |

Keywords

- Stoppage of Business

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 15

Content you want to comment

Please enter...

Review 15

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

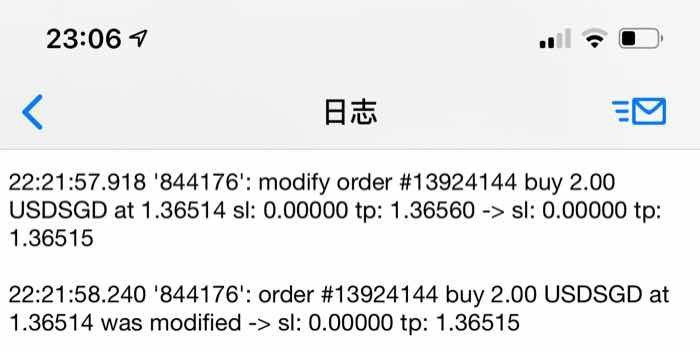

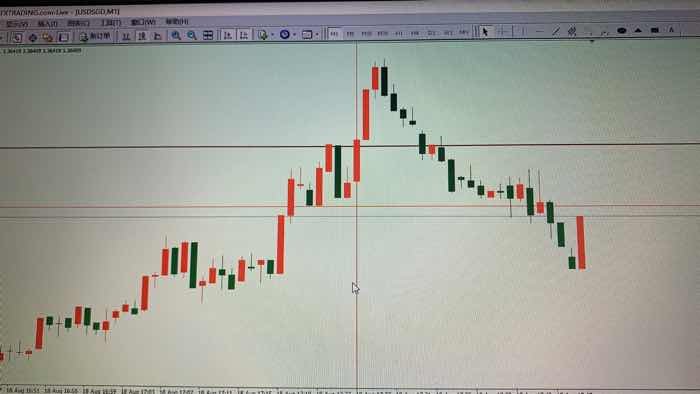

zuanqianaoaokuaile

Hong Kong

I set the stop-loss at 22:21, while Rubix FX stopped it at 505. What made me more furious was that it made a Yang line cocking up at the 28 minute through manipulation. Is it ready to run away?

Exposure

2020-08-18

FX1216877462

Hong Kong

My 400 thousand was doomed on Rubix FX .

Exposure

2020-06-03

一切皆有可能63971

Hong Kong

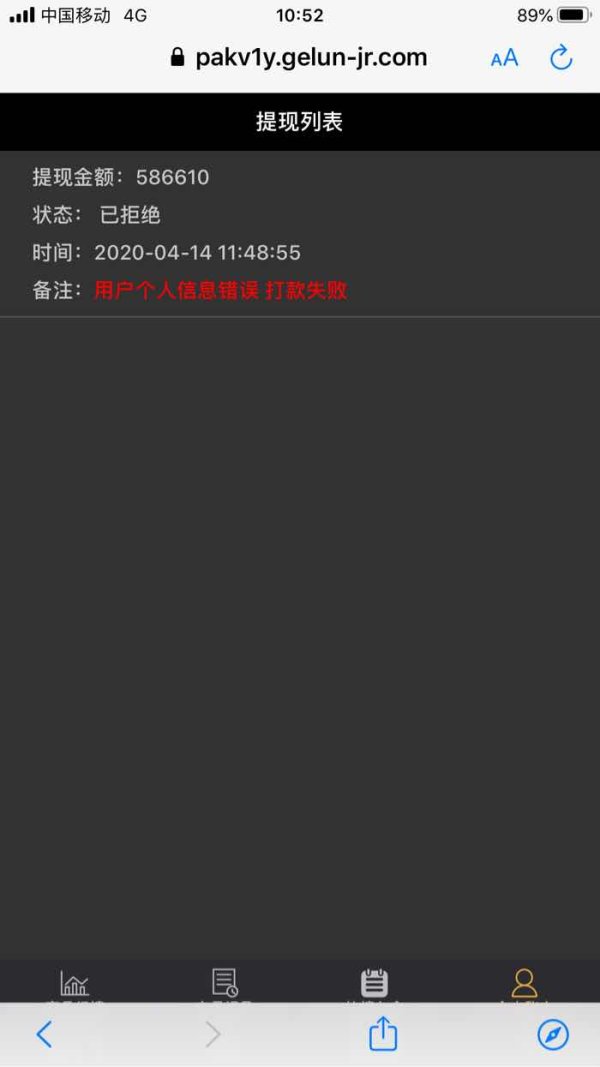

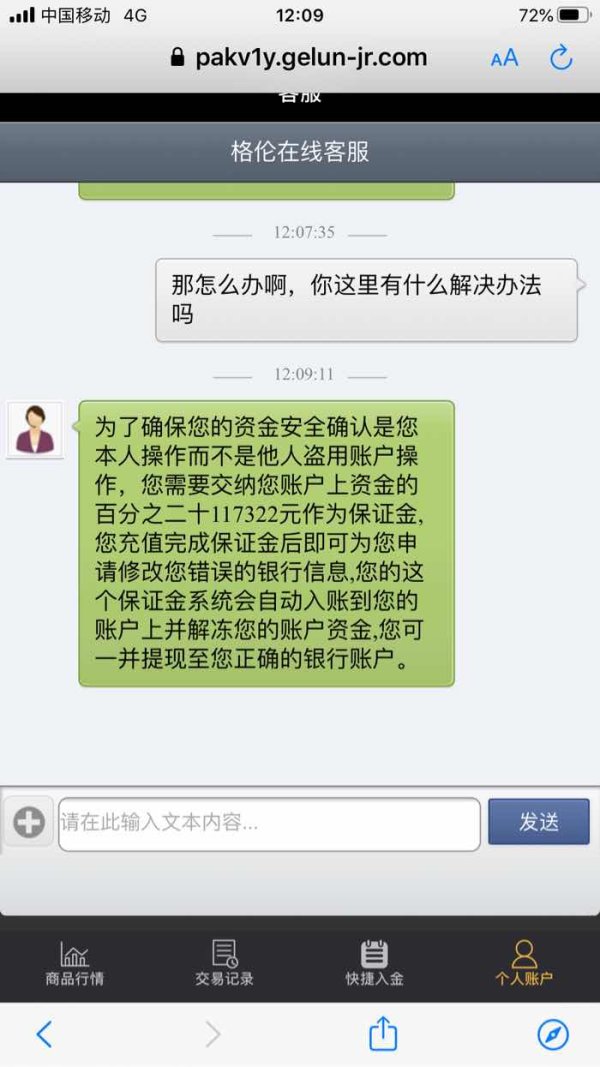

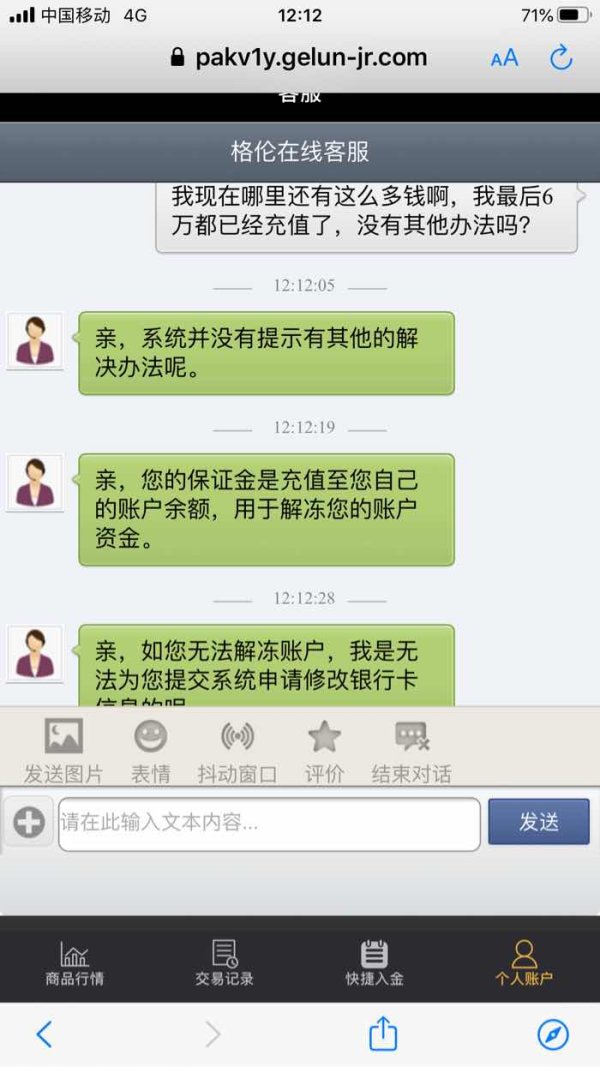

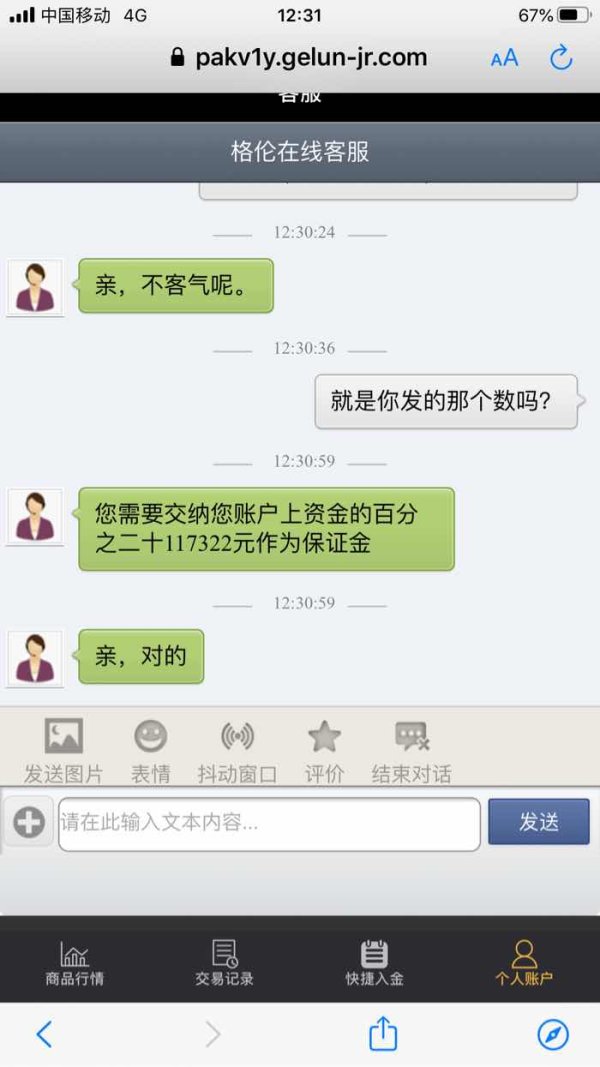

I deposited 50 thousand. When it came to withdrawal, the service asked for margin, saying that my bank information was wrong. After do so, I was asked for credit score raising fee and other fee. What a phony.

Exposure

2020-06-01

FX3359877381

Hong Kong

I deposited 30 thousand. Having applied for the withdrawal, I was asked to pay over 110 thousand as individual tax. Then the service asked for 35% margin, claiming that my bank information was wrong. If it wasn’t done, the funding channel would be closed.

Exposure

2020-05-28

༄ེིོུ 想念ཉ྄ིོུ࿐

Hong Kong

I deposited 60 thousand RMB. When I wanted to make withdraw, I was told to pay 20% of the fund as a margin due to wrong information, and then to add fund to raise credit score. Give back my hard-earned money!

Exposure

2020-04-15

z-

Hong Kong

I deposited 120 thousand RMB in Rubix FX . When making a withdrawal, I was asked to pay 20% margin since my bank information was wrong. After that, I was asked to pay 100 thousand due to insufficient credit score. Fraud platform, give back my hard-earned money.

Exposure

2020-04-06

FX3319284811

Hong Kong

Both the withdrawal and the MT4 are unavailable.

Exposure

2020-02-15

FX3739866665

Hong Kong

Rubix FX cleared my profit with the excuse of wrong quotation. Such a scam platform.

Exposure

2020-02-14

dadiya

Hong Kong

Ultrahigh inventory fee! The rollover of 1.5-lot GBP/USD is over $40.

Exposure

2019-12-31

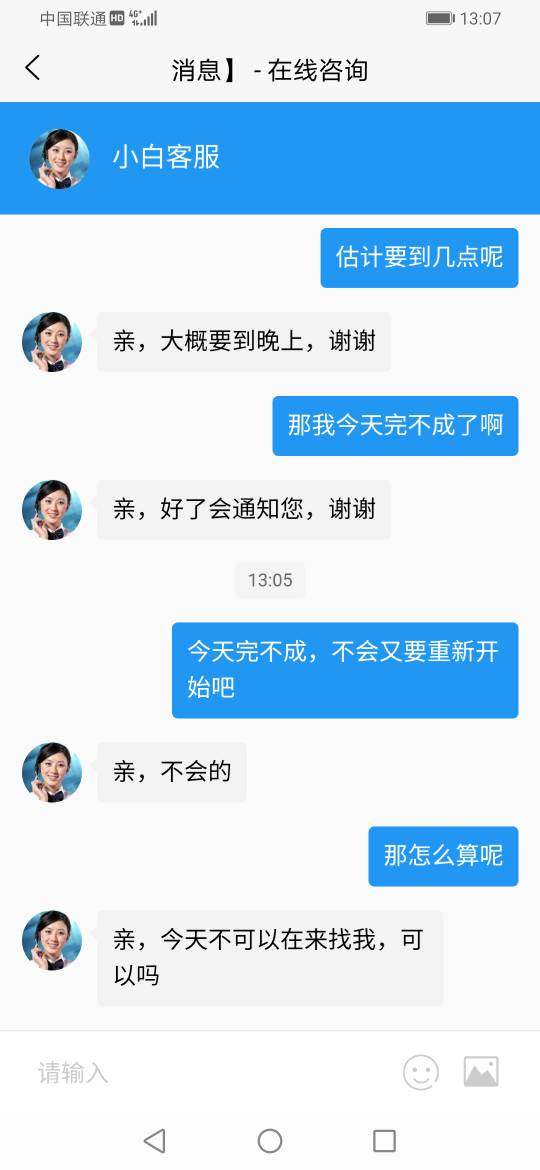

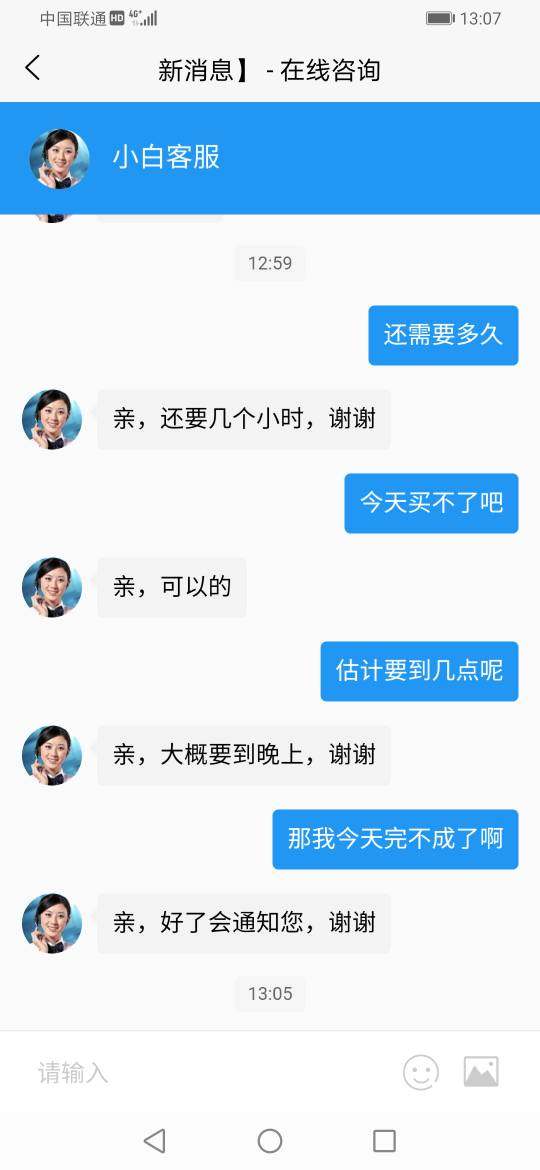

渡边

Hong Kong

I couldn’t deposit in this platform for month. The customer service keeps holding off time. Is it to covet my fund?

Exposure

2019-12-27

bious

Hong Kong

The market slipped nearly 10 pip after I set the stop-loss price.Slippage occurs to each order.Be careful.

Exposure

2019-11-18

程婕维权

Hong Kong

In 2017, forex and futures trading platforms like “Zhongguan Fortune” “Rubix FX” was introduced by people with family names of Wang, Zhou, Hou. They always allow investors to gain profits by back-stage operations and gave them reverse order recommendations then. When you suffered losses, they will keep inciting you to invest in until you lost all.

Exposure

2019-09-09

静悟

Hong Kong

They scammed me on 2018.09.14-17. They forcibly liquidated my position. Scam!

Exposure

2018-09-17

Ahmad Aldebsi

India

What has happened with my account? My Fund? My account is disabled, and I cannot login to my account, my trades are disabled. All this after 1 day of opening the account with this broker.

Neutral

2022-12-19

FX1195099519

United States

I was hesitating, and suddenly I saw so many negative reviews about this broker on WikiFX, serious withdrawal problems, high slippages, etc. This stops my trading with this broker. All I want to say is that, it is necessary to check real traders’ feedback, which will save you lots of trouble.

Positive

2023-02-13