Score

Capital Index

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.capitalindex.com/uk/eng/pages/home

Website

Rating Index

MT4/5 Identification

MT4/5

White Label

CapitalIndexUK-Live

Influence

B

Influence index NO.1

Mexico 3.01

Mexico 3.01MT4/5 Identification

MT4/5 Identification

White Label

Singapore

SingaporeInfluence

Influence

B

Influence index NO.1

Mexico 3.01

Mexico 3.01Contact

Licenses

Licenses

Licensed Institution:Capital Index (UK) Limited

License No.:709693

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 6 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

United Kingdom

United KingdomA Visit to the Foreign Exchange Capital Index in UK- Finding No Office

The survey team went to London, UK, to visit the the dealer Capital Index and found no office at the publicly displayed business address, which means the given business address might be fake. Investors are advised to choose this dealer carefully.

United Kingdom

United KingdomA Visit to the Foreign Exchange Capital Index in UK- Finding No Office

The survey team went to London, UK, to visit the the dealer Capital Index and found no office at the publicly displayed business address, which means the given business address might be fake. Investors are advised to choose this dealer carefully.

United Kingdom

United KingdomAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Capital Index also viewed..

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

South Africa

capitalindex.com

Server Location

Ireland

Most visited countries/areas

South Africa

Website Domain Name

capitalindex.com

Website

WHOIS.TUCOWS.COM

Company

TUCOWS DOMAINS INC.

Domain Effective Date

2003-06-07

Server IP

52.212.135.148

Company Summary

| Review Summary | |

| Founded | 2003 |

| Registered Country/Region | United Kingdom |

| Regulation | Regulated |

| Market Instruments | Forex, Indices CFDs, Commodities CFDs, Shares CFDs |

| Demo Account | ❌ |

| Leverage | Up to 1:200 |

| Spread | From 1.4 (Advanced Account) |

| Trading Platform | MarketBOOKMT4 |

| Min Deposit | 100 GBP/EUR/USD |

| Customer Support | Phone: +44 20 7060 5120 |

| Email: support@capitalindex.com | |

| Social Media: Facebook, X, Linkedin | |

| Physical Address: Capital Index (UK) Limited75 King William St London EC4N 7BECapital Index (Cyprus) LimitedArchbishop Makarios Avenue 89, 3020 Limassol | |

Capital Index Information

Capital Index is a brokerage company incorporated in 2003. Currently, under the supervision of the FCA, it offers Forex and CFDs trading to traders, as well as two trading platforms including MT4. In addition, there are 2 trading accounts to choose from, not to mention a common demo account.

Pros and Cons

| Pros | Cons |

| Be regulated | Demo accounts are not available |

| 50+ forex | |

| MT4 is available |

Is Capital Index Legit?

| Regulated Country/Region |  |

| Regulated Authority | FCA |

| Regulated Entity | Capital index (uk) Limited |

| License Type | Market Making(MM) |

| License Number | 709693 |

| Current Status | Regulated |

What Can I Trade on Capital Index?

The Capital Index allows you to trade 50+ forex, divided into Majors, Minors, Australasia, Scandinavian, Exotics. In addition, 11 Indices CFDs,5 Commodities CFDs and multiple shares CFDs are available for trading.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices CFDs | ✔ |

| Commodities CFDs | ✔ |

| Shares CFDs | ✔ |

| Bonds | ❌ |

| ETF | ❌ |

Account Types

Capital Index has two account types : Advanced Account and Pro Account.

Their minimum deposits are 100 GBP/EUR/USD and 1,000 GBP/EUR/USD respectively. In terms of Min trade size and Trade size increment, the two accounts are consistent.

| Account Types | Advanced Account | Pro Account |

| Spreads from | 1.4 | 1 |

| Minimum deposit | 100 GBP/EUR/USD | 1,000 GBP/EUR/USD |

| Min trade size FX | 0.01 lot / £0.10 | 0.01 lot / £0.10 |

| Min trade size non-FX | 0.1 lot / £0.10 | 0.1 lot / £0.10 |

| Trade size increment FX | 0.01 lot / £0.10 | 0.01 lot / £0.10 |

| Trade size increment non-FX | 0.1 lot / £0.10 | 0.1 lot / £0.10 |

| Commission Equity CFD | 0.02/unit/trade (min £10 (UK)/€10 (EU)/$15 (US) per trade) | 0.02/unit/trade (min £10 (UK)/€10 (EU)/$15 (US) per trade) |

It takes less than 5 minutes to apply for an account online. You can find the “Create Account” button on the official website to operate, refer to the following process.

Leverage

The maximum leverage of the Capital Index and the Global Capital Index is 1:30 and 1:200 respectively.

Capital Index Fees

The spread of Advanced Account and Pro Account is from1.4 and from 1, respectively, and the commission requirement is the same as 0.02/unit/trade (min £10 (UK)/€10 (EU)/$15 (US) per trade).

In the Forex pairs, the EUR/USD spreads for the two accounts are 1.1 and 1.5 respectively, while the spreads for the remaining forex pairs range from 1.1 to 164.8 and from 1.6 to 170.9.

| Symbol | Pro Spreads | Advanced Spreads |

| FX Majors | ||

| AUDUSD | 1.1 | 1.7 |

| EURCHF | 2.3 | 3.1 |

| EURGBP | 1.2 | 1.6 |

| EURJPY | 2.2 | 2.4 |

| EURUSD | 1.1 | 1.5 |

| GBPUSD | 1.6 | 2 |

| NZDUSD | 2.2 | 2.6 |

| USDCAD | 1.7 | 2.7 |

| USDCHF | 1.5 | 2.5 |

| USDJPY | 1.9 | 2.1 |

| FX Minors | ||

| CADCHF | 3.2 | 4.4 |

| CADJPY | 2.7 | 4.1 |

| CHFJPY | 3.6 | 4.6 |

| EURCAD | 3 | 5.8 |

| GBPCAD | 6 | 7.8 |

| GBPCHF | 4.6 | 5.2 |

| GBPJPY | 3.7 | 4.7 |

| GBPSGD | 13.9 | 15.3 |

| USDSGD | 3.7 | 5.7 |

| FX Australasia | ||

| AUDCAD | 2.7 | 3.7 |

| AUDCHF | 3.1 | 3.9 |

| AUDJPY | 2.6 | 3 |

| AUDNZD | 3.2 | 4.2 |

| EURAUD | 2.4 | 3.8 |

| EURNZD | 3.8 | 5.8 |

| GBPAUD | 5.6 | 6.8 |

| GBPNZD | 6.1 | 7.5 |

| NZDCAD | 5.3 | 6.3 |

| NZDCHF | 3.5 | 4.7 |

| NZDJPY | 3.2 | 3.6 |

| NZDSGD | 4.7 | 7.2 |

| FX Scandinavian | ||

| EURNOK | 72.1 | 83.1 |

| EURSEK | 83.7 | 99.7 |

| GBPNOK | 94.5 | 134.5 |

| GBPSEK | 90.1 | 100.1 |

| USDNOK | 50.6 | 100.5 |

| USDSEK | 56.1 | 66.1 |

| FX Exotics | ||

| EURCZK | 34.9 | 40.9 |

| EURHUF | 38 | 51 |

| EURMXN | 219.6 | 269.6 |

| EURPLN | 58 | 61 |

| EURTRY | 236.4 | 241.4 |

| EURZAR | 159 | 174 |

| GBPMXN | 22.9 | 24.3 |

| GBPPLN | 39.5 | 79.5 |

| GBPZAR | 181.8 | 261.8 |

| USDCNH | 36 | 41 |

| USDCZK | 34.4 | 39.4 |

| USDHUF | 29.6 | 49.6 |

| USDMXN | 126.9 | 141.9 |

| USDPLN | 38.3 | 43.3 |

| USDTRY | 164.8 | 169.8 |

| USDZAR | 105.9 | 170.9 |

The indices spreads for the two accounts ranged from 1.5 to 12.6 and 0.8 to 17.6, respectively.

| Indices Symbol | Pro Spreads | Advanced Spreads |

| .AUS200 | 4.6 | 5.6 |

| .FRA40 | 2.4 | 3.2 |

| .GER40 | 1.5 | 2.5 |

| .HK50 | 9.8 | 12.8 |

| .JAPAN225 | 12.6 | 17.6 |

| .NAS100 | 2.2 | 2.8 |

| .SP500 | 0.6 | 0.8 |

| .SPAIN35 | 6.5 | 8 |

| .STOXX50 | 2.3 | 3.9 |

| .UK100 | 1.6 | 2.6 |

| .US30 | 2.7 | 4.3 |

The commodity spreads for the two accounts ranged from 0.3 to 26.6 and 0.5 to 38.6, respectively.

| Commodities Symbol | Pro Spreads | Advanced Spreads |

| XAGUSD | 0.3 | 0.5 |

| XAUUSD | 0.3 | 0.5 |

| XPTUSD | 26.6 | 38.6 |

| WTICrude | 3.5 | 6.3 |

| BrentCrude | 3.7 | 6.7 |

Trading Platform

Capital Index has two trading platforms: MarketBOOK and MT4, both of which support desktop and mobile versions.

| Trading Platform | Supported | Available Devices | Suitable for |

| MarketBOOK | ✔ | Desktop, Mobile | All traders |

| MT4 | ✔ | Desktop, Mobile | All traders |

| MT5 | ❌ |

Deposit and Withdrawal

Capital Index enables traders to make bank transfers and card deposits through one of two secure payment service providers. Bank transfers on the same day will be charged £15 / EUR/USD. The minimum deposit is 100 units of base currency.

Keywords

- 5-10 years

- Regulated in United Kingdom

- Market Making(MM)

- White label MT4

- High potential risk

Review 9

Content you want to comment

Please enter...

Review 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

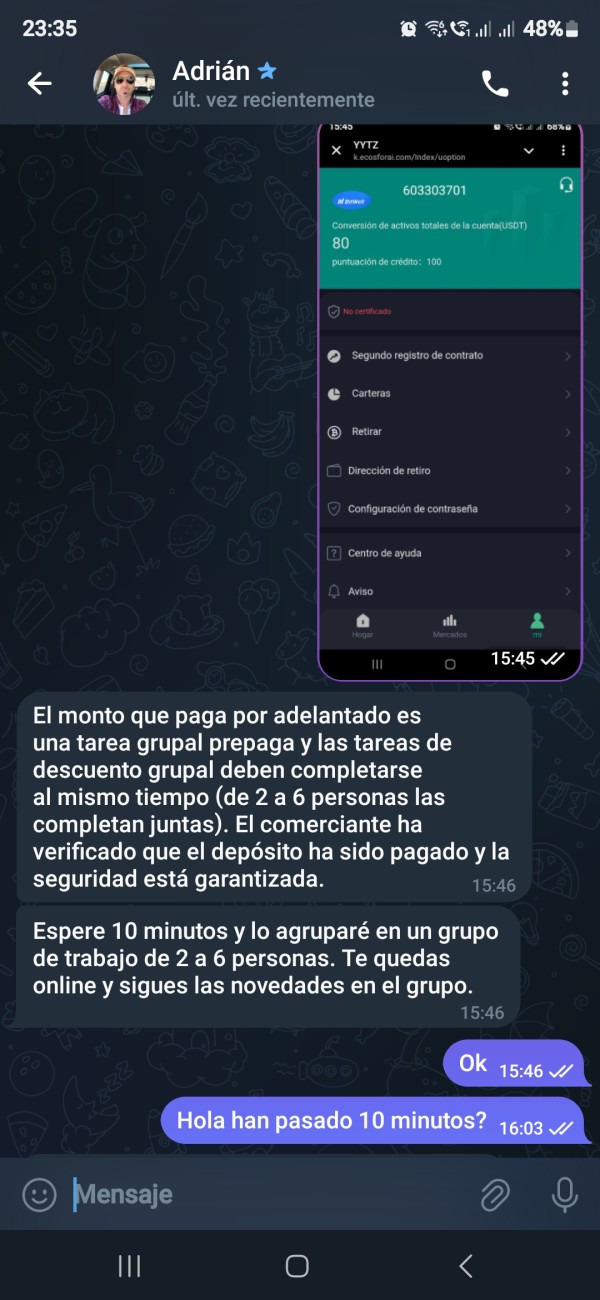

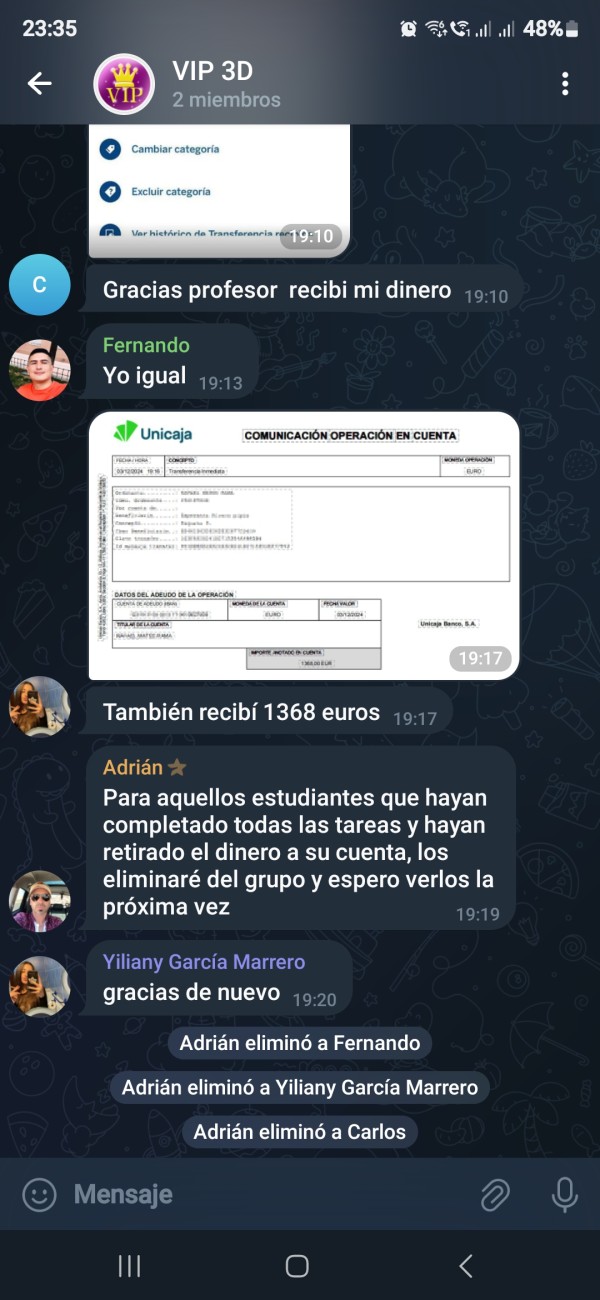

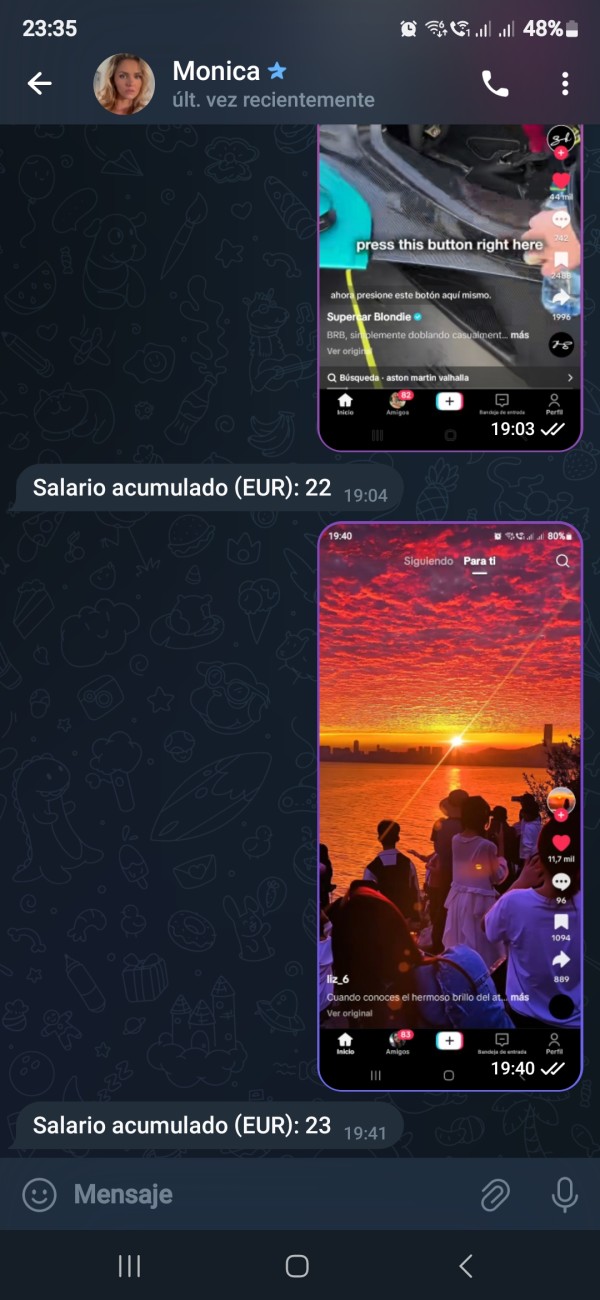

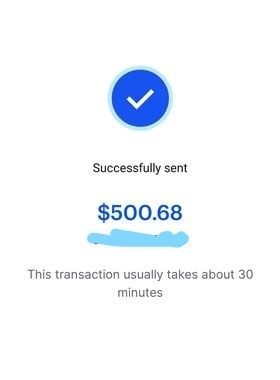

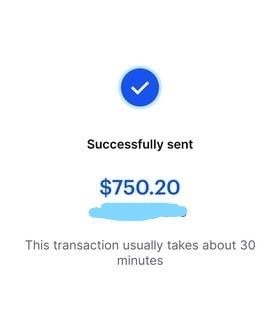

FX3264091358

Spain

I have been scammed and my money is being held in a cryptocurrency platform. At first, they pay you for tasks through Bizum, and then the tasks increase in level, which means you have to deposit money to complete the mission. This continues until you reach a point where you have no more money, and the deposited money cannot be withdrawn because you haven't completed the task. They claim to accumulate your salary until you complete the final task and can withdraw your money, but it's not true. I don't know what to do or how to recover my money.

Exposure

2024-12-05

Kaba4121

Ecuador

I deposited my savings and they have not returned my money, help me because they are asking me for more, it is a scam

Exposure

2024-05-15

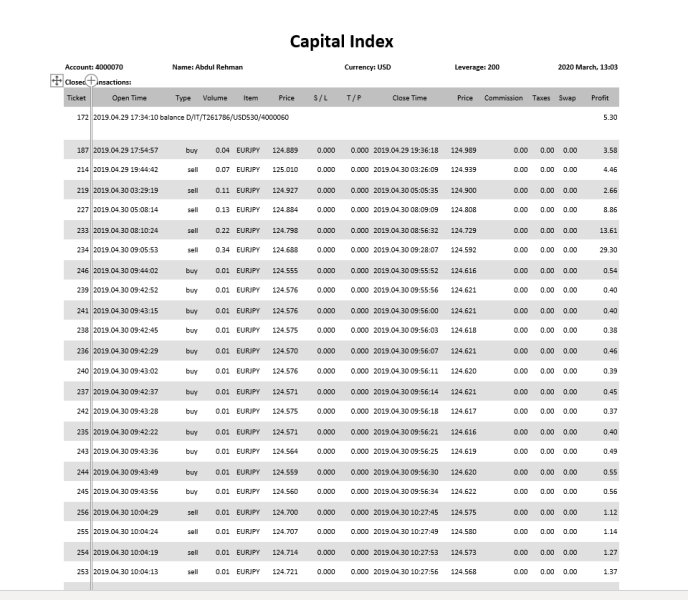

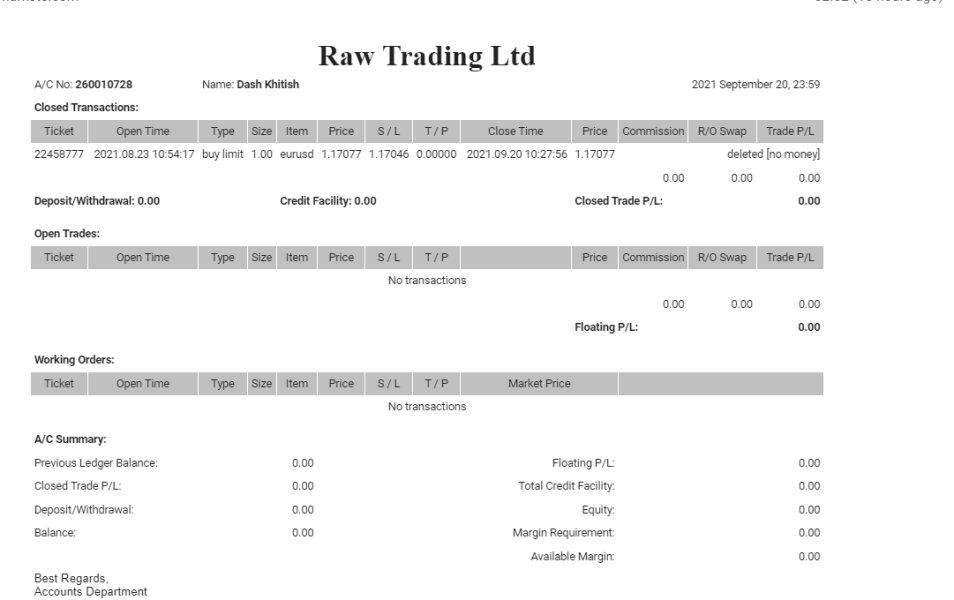

Khitish Dash20293

India

Hi i am abdyul rehman from India and i have deposited $450 with capital index with raw tight spread account but then again they blcoked my account when i tried to withdraw money they simply ignored my email and one day i called my account manager he said he is no more works in that company and they scammed my money.

Exposure

2021-09-23

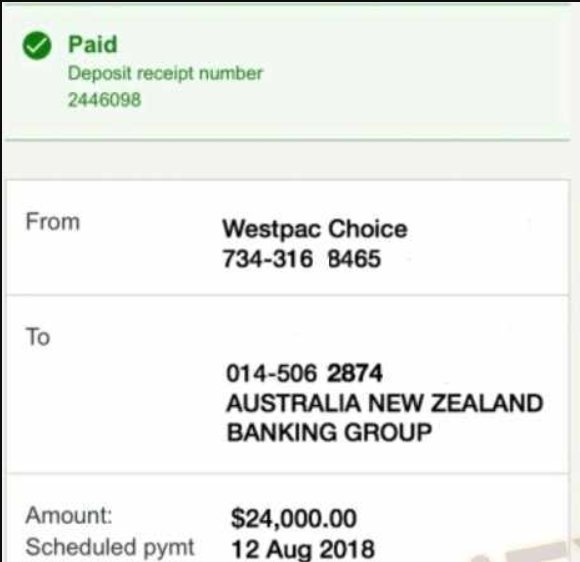

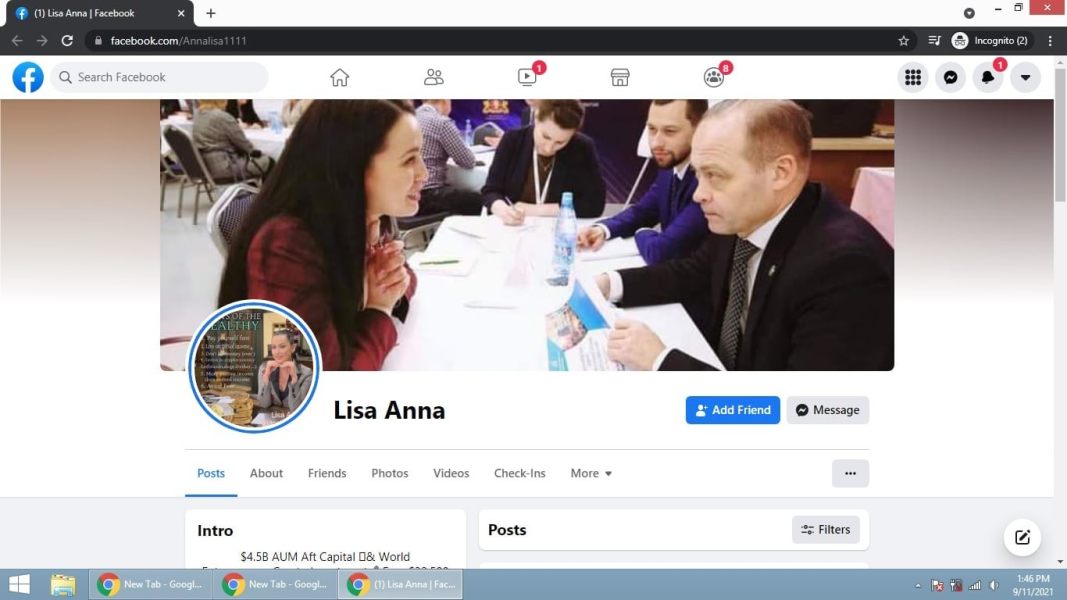

FX5944873722

Malaysia

Lisa Anna said she was the manager of capital index and stole $30,000 from me. She told me to increase deposit again and again.

Exposure

2021-09-22

FX2046354843

Philippines

Nothing is good about capital one, All staff trained to scam, When you request a withdrawal the staff who claimed to be your account manager will switch and an unknown staff will take you up again to find a fault with your trading. they either say the bonus they gave was added to your capital instead of equity. They may even find fault with your deposit method or trading method. These are the different types of flimsy excuses they gave all our clients we referred. They even refused to pay any clients that made deposits via us as IB. They do this because they are not registered nor REGULATED. some 23,000$, 12,000$, 5000$, 1000$. All clients that made deposit through us as IB were denied withdrawal including their deposits. BEWARE!!.We have all these proofs in JPEG.

Exposure

2021-09-21

FX2046354843

Philippines

Yes , Capital is a scam broker I asked them 4 times to withdraw my money and failed every time!!! but they always send me the email shows withdraw successful. They put me ONHOLD for more than 4 months without any reasons and every time when I ask the chat support they said is a different department and we cant do anything. I sent 4 times this department and no one answer me.

Exposure

2021-09-18

炽焰

South Africa

Capital Index is the best broker at this time. They offer an excellent online trading platform, charge a low brokerage fee, and are the most transparent forex broker. Continuous improvement and innovation made them the fastest-growing company...

Positive

2023-02-20

FX1242182816

Singapore

It's hard to believe that a company regulated by the UK's FCA is still doing scams! I think we should collect as much information as possible before choosing a foreign exchange company to avoid falling into a trap.

Positive

2023-02-16

May.

Malaysia

I've been using many brokers starting from last year, but with Capital Index, I have noticed some differences when it comes to the spread and minimum deposit. I'm ready to invest more of my time and money with this broker and see how far can I go. Good luck.

Positive

2022-12-19