Score

BGC

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.bgcg.com/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Hungary 2.67

Hungary 2.67Contact

Licenses

Licenses

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

Basic Information

United Kingdom

United KingdomUsers who viewed BGC also viewed..

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

bgcg.com

Server Location

United States

Website Domain Name

bgcg.com

Server IP

107.162.154.46

bgcpartners.com

Server Location

United States

Website Domain Name

bgcpartners.com

Website

WHOIS.CORPORATEDOMAINS.COM

Company

CSC CORPORATE DOMAINS, INC.

Domain Effective Date

2004-04-13

Server IP

107.162.154.46

Company Summary

| Aspect | Information |

| Company Name | BGC |

| Registered Country/Area | United Kingdom |

| Founded Year | 2004 |

| Regulation | Regulated by the FCA |

| Market Instruments | Over 200 financial products including fixed income securities, foreign exchange, equities, energy, commodities, shipping, and futures. |

| Account Types | Institutional, E-Commerce Solutions |

| Minimum Deposit | $20,000 |

| Maximum Leverage | Up to 40:1 (FX); Varies for other assets (BGC Trader) |

| Spreads | Variable and negotiated, range from 1-3 pips for major pairs. |

| Trading Platforms | BGCPro |

| Customer Support | Media inquiries via press@bgcg.com, twitter via https://twitter.com/bgcpartners |

| Deposit & Withdrawal | Wire Transfers, Clearing House Payments, Direct Payments |

| Educational Resources | BGC Investors, BGC News, Press Releases, Press Coverage |

Overview of BGC

Founded in the United Kingdom in 2004, BGC is a global brokerage firm specializing in over 200 financial products, including fixed income securities, foreign exchange, equities, energy, commodities, shipping, and futures. BGC's advantageous features encompass a diverse range of trading assets and institutional accounts, providing clients with specialized solutions.

However, complexities arise from a dynamic spread/commission structure, a high minimum deposit for BGC Trader, and the need for negotiation regarding fee structures.

With headquarters in London and New York, BGC is regulated by the Financial Conduct Authority (FCA), ensuring adherence to regulatory standards in the financial industry.

Is BGC legit or a scam?

BGC operates under the regulatory oversight of the Financial Conduct Authority (FCA) in the United Kingdom, holding an Institution Forex License with License No. 454814.

The FCA is a reputable regulatory agency that ensures financial markets are fair, transparent, and protect the interests of consumers. The regulatory status of BGC as “Regulated” signifies compliance with established industry standards and regulatory requirements, providing a level of assurance to traders on the platform. The Institution Forex License specifically authorizes BGC to conduct forex-related activities in a regulated manner.

Pros and Cons

| Pros | Cons |

| More than 200 financial products | Complex and Dynamic Spread/Commission Structure |

| Institutional and Specialized Accounts | High Minimum Deposit for BGC Trader ($20,000) |

| BGCPro Trading Platform | No Demo Account for BGC Trader |

| Global Customer Support | Negotiation Required for Fee Structure |

| Comprehensive Educational Resources |

Pros:

More than 200 Financial Products:

BGC specializes in over 200 financial products, providing clients with a diverse range of options for investment, including fixed income securities, foreign exchange, equities, energy, commodities, shipping, and futures.

2. Institutional and Specialized Accounts:

BGC offers institutional and specialized accounts such as BGC Trader and E-Commerce Solutions, catering to the specific needs of institutional investors and clients requiring tailored solutions for risk management and optimization.

3. BGCPro Trading Platform:

The BGCPro trading platform stands out as a comprehensive solution for the inter-bank and broker community. Its integration of voice and electronic price execution services, along with features like thin-client technology, enhances efficiency and flexibility.

4. Global Customer Support:

BGC provides global customer support from its headquarters in New York and London, ensuring clients have access to assistance and information on an international scale.

5. Comprehensive Educational Resources:

BGC offers a robust array of educational resources through BGC Investors, BGC News, press releases, and press coverage. These resources empower investors with accurate information and provide media professionals with a comprehensive understanding of BGC's activities.

Cons:

Complex and Dynamic Spread/Commission Structure:

The pricing structure for spreads and commissions at BGC is complex and dynamic, varying across asset classes, account types, and negotiation. This complexity may pose challenges for clients in understanding and predicting transaction costs accurately.

2. High Minimum Deposit for BGC Trader ($20,000):

BGC Trader, catering to institutional clients, requires a high minimum deposit of $20,000. This entry barrier might limit accessibility for smaller investors or those with more conservative capital allocations.

3. No Demo Account for BGC Trader:

BGC Trader does not offer a demo account, limiting prospective users from exploring the platform's features and functionalities in a risk-free environment before committing to actual trading.

4. Negotiation Required for Fee Structure:

The fee structure at BGC is not standardized, and negotiation is required for both transaction fees and non-trading fees like account maintenance or inactivity charges. This negotiation aspect may introduce uncertainty and require additional effort from clients.

Market Instruments

BGC, through its various affiliates, specializes in brokerage services for a diverse range of products, including Fixed Income (Rates and Credit), Foreign Exchange, Equities, Energy and Commodities, Shipping, and Futures.

Fixed Income Securities: BGC offers fixed income securities as part of its product portfolio, catering to clients seeking investment opportunities in this asset class.

Interest Rate Swaps: BGC facilitates trading in interest rate swaps, providing clients with the ability to manage and hedge their interest rate exposure.

Foreign Exchange: BGC provides a platform for trading in the foreign exchange market, allowing clients to engage in currency transactions.

Equities: BGC includes equities in its product offerings, enabling clients to invest in stocks and equity-related products.

Credit Derivatives: BGC supports the trading of credit derivatives, offering clients the opportunity to manage credit risk through derivative instruments.

Commodities: BGC allows clients to trade commodities, providing exposure to the energy and commodities markets.

Futures: BGC offers futures trading, allowing clients to participate in the futures markets across various asset classes.

Account Types

BGC provides diverse account types tailored to meet the unique needs of its clientele, offering specialized platforms designed for institutional investors and those seeking versatile solutions across different financial products.

BGC Trader:

BGC Trader is designed for institutional clients, featuring a versatile platform with varying leverage based on the asset class. In the case of foreign exchange (FX), users can leverage up to 40:1, enabling control of larger positions with a relatively smaller capital outlay. The platform offers a variable and negotiable spread, especially for larger trade sizes and established clients, with indicative spreads ranging from 1-3 pips for major FX pairs. The commission structure is subject to negotiation, providing flexibility in fee arrangements based on the notional value of the trades. The minimum deposit requirement for BGC Trader is $20,000.

E-Commerce Solutions:

Focussing on specific risk management and optimization needs, BGC offers a range of E-Commerce tools through separate accounts. These include compression services like ColleX for OTC instruments, or clearing and risk management platforms for specific asset classes. Fees in these accounts are typically transaction-based or usage-dependent, making them cost-effective for clients seeking targeted solutions.

This account type is suitable for clients seeking specific risk management or optimization tools beyond basic trading. The fee structure, based on transaction frequency, may be beneficial for users with infrequent but larger trades.

| Aspect | BGC Trader | E-Commerce Solutions |

| Account Type | Institutional | Varies by Product |

| Leverage | Up to 40:1 (FX); Varies for others | N/A |

| Spread | Variable,range from 1-3 pips for major pairs. | Fee per Transaction |

| Commission | Negotiated | Per Transaction |

| Minimum Deposit | $20,000 | $20,000 |

| Demo Account | No | No |

| Trading Tools | Compression Tools, Risk Management Systems | Compression Tools, Risk Management Systems |

How to Open an Account?

Visit BGC's Official Website:

Start by visiting the official BGC website to access accurate and up-to-date information about account opening procedures.

2. Navigate to the Account Opening Section:

Explore the website to locate the section specifically dedicated to account opening.

3. Choose the Desired Account Type:

Select the type of account that aligns with your trading needs. BGC offers various account types, such as BGC Trader for institutional clients, and E-Commerce Solutions for specific risk management tools.

4. Complete the Online Application Form:

Fill out the online application form with accurate and relevant information. This may include personal details, financial information, and trading preferences.

5. Submit Required Documentation:

Upload or submit the necessary documents for account verification. This often includes proof of identity, address, and financial statements.

6. Await Verification and Approval:

Once you've submitted the application and required documents, BGC will review and verify your information. Upon successful verification, your account will be approved, and you'll receive instructions on funding and accessing your trading platform.

Leverage

The maximum leverage offered by BGC varies considerably across different asset classes.

For foreign exchange (FX) trading, clients have access to leverage as high as 40:1, indicating the ability to control a larger position with a relatively smaller amount of capital.

Conversely, for other asset classes such as bonds or derivatives, the maximum leverage limits are typically much lower.

Spreads & Commissions

BGC's pricing structure for spreads and commissions is complex and dynamic, varying across asset classes, account types, and negotiation.

BGC Trader:

Spread: Negotiated based on asset class, volume, and client relationship. Expect tighter spreads for larger trade sizes and established clients. For FX, indicative spreads may range from 1-3 pips for major pairs.

Commission: Also negotiable, often as a percentage of notional value. For some asset classes, like bonds, a fixed commission per bond might apply.

Suitable for: Institutional clients looking for flexible execution options and potentially advantageous pricing through negotiation. Requires significant trading volume and capital to leverage benefits.

2. E-Commerce Solutions:

Fee: Per transaction, typically a fixed amount or percentage depending on the specific product and functionality used. For example, ColleX (compression tool) may charge a fee per compressed trade.

Suitable for: Clients seeking specific risk management or optimization tools beyond basic trading. Transaction-based fees are beneficial for users with infrequent but larger trades.

Trading Platform

BGCPro, the primary trading platform offered by BGC, caters to the inter-bank and broker community with a comprehensive set of features.

The platform integrates voice and electronic price execution services, incorporating a user-friendly and feature-rich front-end. Notably, BGCPro employs thin-client technology, enhancing delivery efficiency while facilitating managed product updates, ultimately contributing to improved speed, availability, and system resilience.

A key strength of BGCPro lies in its versatility, allowing users to choose between voice or electronic access. This flexibility extends to supporting a diverse range of products, including fixed income, European corporate cash, credit default swaps, i-Traxx, and FX options. BGCPro's design facilitates seamless accommodation of both electronic and API-based transactions, creating an integrated and neutral marketplace accessible through an interactive screen.

The platform boasts a highly customizable interface, enabling permission-based access to multiple products within a unified platform. BGCPro ensures full Straight Through Processing (STP) compliance, ensuring a smooth transition from automated trade capture to settlement. The implementation of thin-client technology not only streamlines updates and deployment but also minimizes IT support overheads, contributing to the platform's overall efficiency and user-friendliness.

In terms of market coverage, BGCPro provides real-time and historical price information globally, with regional desks offering coverage across a diverse array of products. The platform's efficient page layout maximizes exposure to prices and instruments, creating an optimal trading environment. Additionally, broker-managed products are presented as “view only” prices, enhancing transparency in the trading process. Collectively, these features position BGCPro as a comprehensive and accessible trading platform, meeting the discerning needs of the financial community.

Deposit & Withdrawal

BGC primarily serves institutional clients, thus the availability of specific payment methods differs compared to retail brokerages.

Wire Transfers: This is the standard method for large institutional transactions, offering security and flexibility. Processing times may vary depending on banks and locations but typically range from 1-3 business days.

Clearing House Payments: BGC facilitates trades through various clearing houses depending on the asset class. Settlement often occurs through clearing house-specific payment mechanisms, streamlining the process and potentially accelerating settlement.

Direct Payments: In some cases, direct payments to BGC accounts may be accepted, particularly for smaller transactions or specific regional arrangements. Payment rails and processing times for these options will vary based on the agreement.

As BGC focuses on institutional clients, their services are often tailored to individual client needs and involve larger trading volumes. They assess financial resources and risk profiles during onboarding to determine suitable account structures and trading parameters.

BGC's fee structure isn't standardized and relies on negotiation and individual client agreements. This applies to both transaction fees and non-trading fees like account maintenance or inactivity charges. The overall cost of service depends on:

Asset Class: Fees can vary significantly between different asset classes like FX, bonds, or derivatives.

Account Type: Prime Brokerage accounts might have different fee structures compared to other client types.

Trading Volume: High-volume traders often enjoy negotiated discounts on fees.

Additional Services: Access to premium data feeds or other specialized services might incur additional charges.

Therefore, understanding your specific trading needs and negotiating with BGC for a customized fee structure is crucial for managing your costs effectively.

Customer Support

BGC Group offers global customer support from its headquarters in New York and London.

In New York, clients can contact BGC Group Inc. at 499 Park Avenue or BGC Financial, L.P. at 55 Water Street. For international clients, BGC Brokers L.P. in London is located at 5 Churchill Place, Canary Wharf. The contact details include telephone and fax numbers.

Additionally, BGC provides avenues for media inquiries via press@bgcg.com and handles career-related queries through recruitmentlondon@cantor.com (UK, Europe & Asia) and careers@bgcg.com (US, Canada & South America). These contact options aim to facilitate effective communication and support for clients, media, and prospective employees.

Educational Resources

BGC provides a robust array of educational resources for investors and media.

BGC Investors offers a comprehensive platform for investors to access relevant information about the company. BGC News delivers real-time updates and insights, keeping stakeholders informed about the latest developments. The press releases section provides official announcements, ensuring transparency.

Additionally, BGC Press Coverage compiles media reports, offering a broader perspective on BGC's market presence.

These resources collectively serve to empower investors with accurate information and provide media professionals with a comprehensive understanding of BGC's activities, fostering transparency and trust in the financial community.

Conclusion

In conclusion, BGC, founded in 2004 and regulated by the Financial Conduct Authority, stands as a global brokerage firm offering a diverse array of over 200 financial products. The advantages of BGC lie in its comprehensive market instruments, primarily serving institutional clients with specialized account types, and a robust trading platform in BGCPro. The company's commitment to global customer support, varied deposit and withdrawal options, and comprehensive educational resources contribute to its appeal.

However, BGC presents certain challenges, including a complex and dynamic spread/commission structure, a high minimum deposit requirement for BGC Trader, and the need for negotiation regarding fee structures. These disadvantages may impact accessibility and transparency for some traders.

FAQs

Q: What financial products does BGC specialize in?

A: BGC specializes in over 200 financial products, including fixed income securities, foreign exchange, equities, energy, commodities, shipping, and futures.

Q: How is BGC regulated?

A: BGC is regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

Q: What account types does BGC offer?

A: BGC offers institutional accounts, such as BGC Trader, and specialized accounts like E-Commerce Solutions.

Q: What is the minimum deposit required for BGC Trader?

A: The minimum deposit for BGC Trader is $20,000.

Q: Does BGC provide a demo account for BGC Trader?

A: No, BGC Trader does not offer a demo account.

Q: Where is BGC headquartered?

A: BGC has headquarters in both London and New York.

Keywords

- 5-10 years

- Regulated in South Korea

- Financial Service

- Suspicious Scope of Business

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Rollin

Taiwan

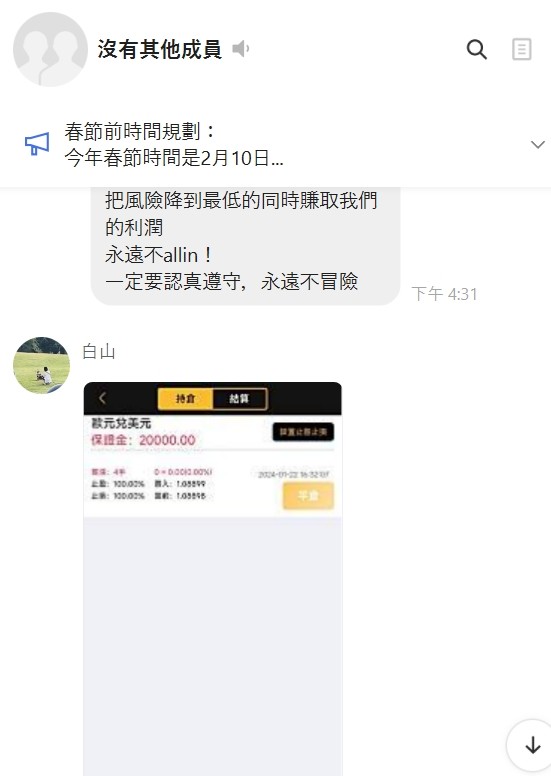

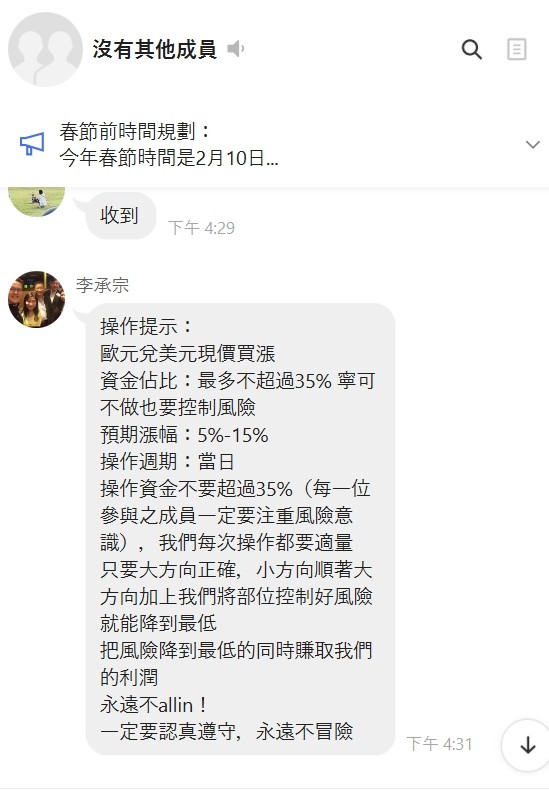

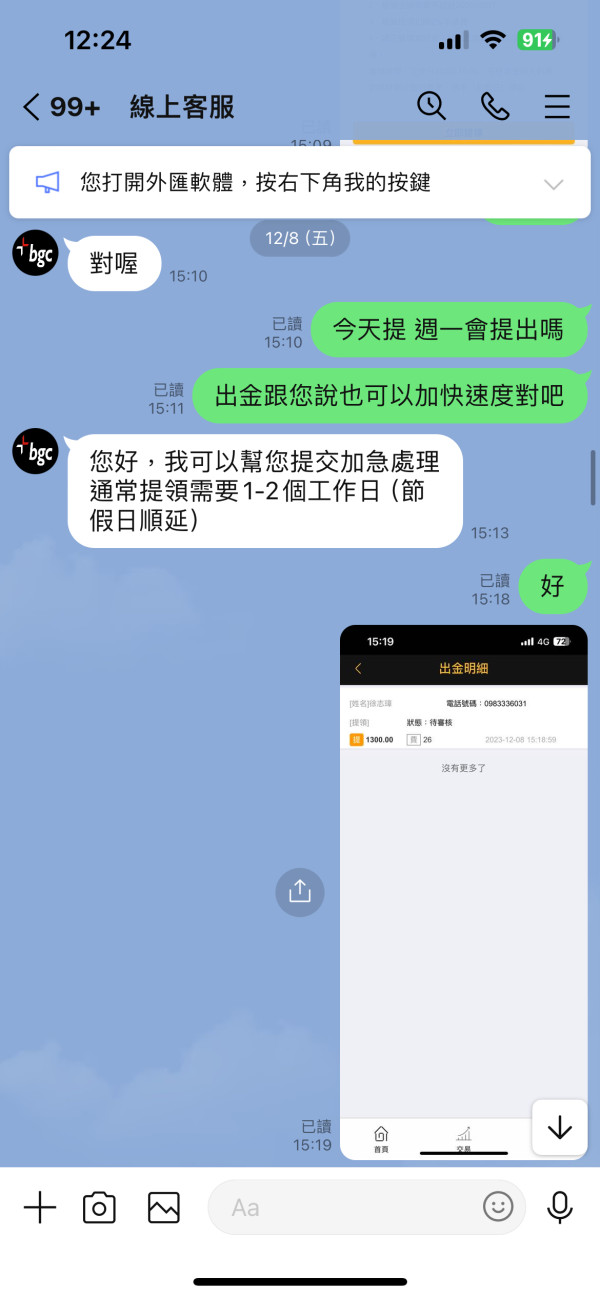

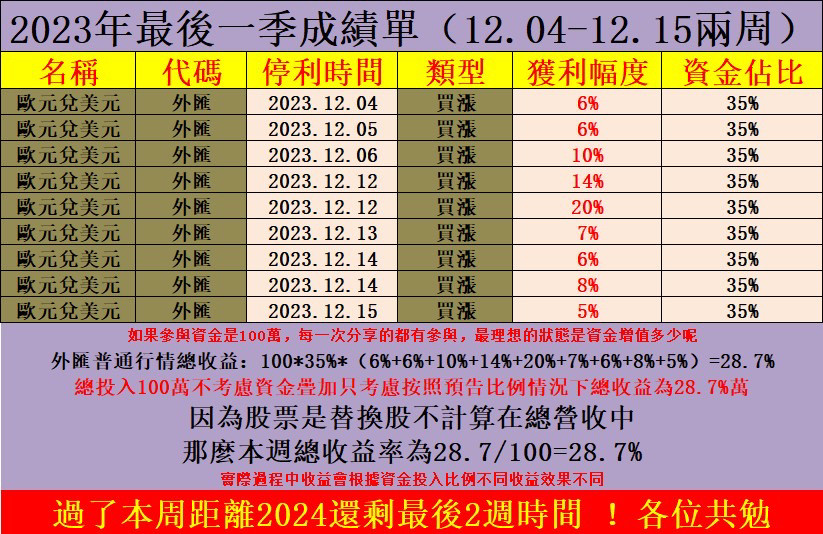

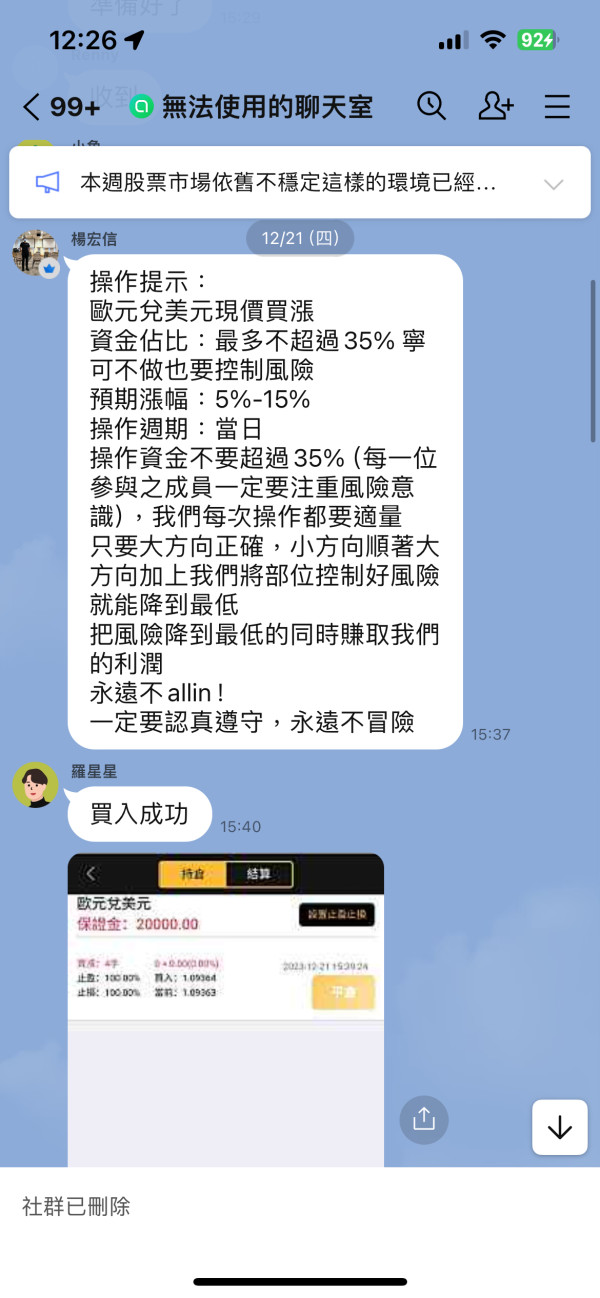

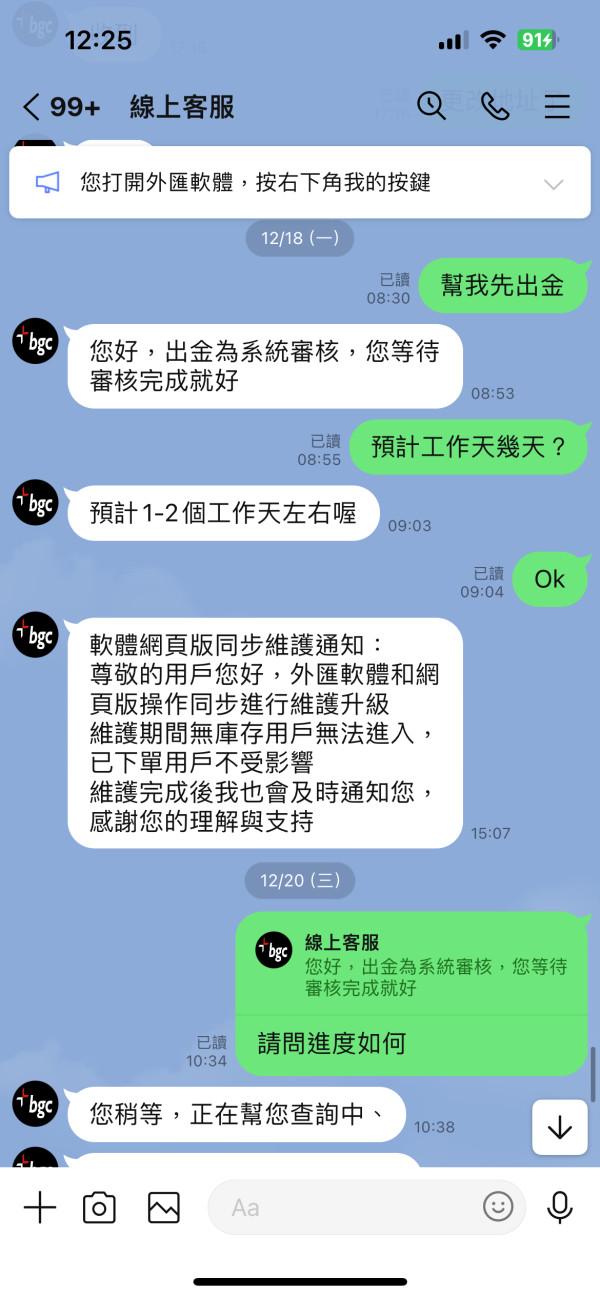

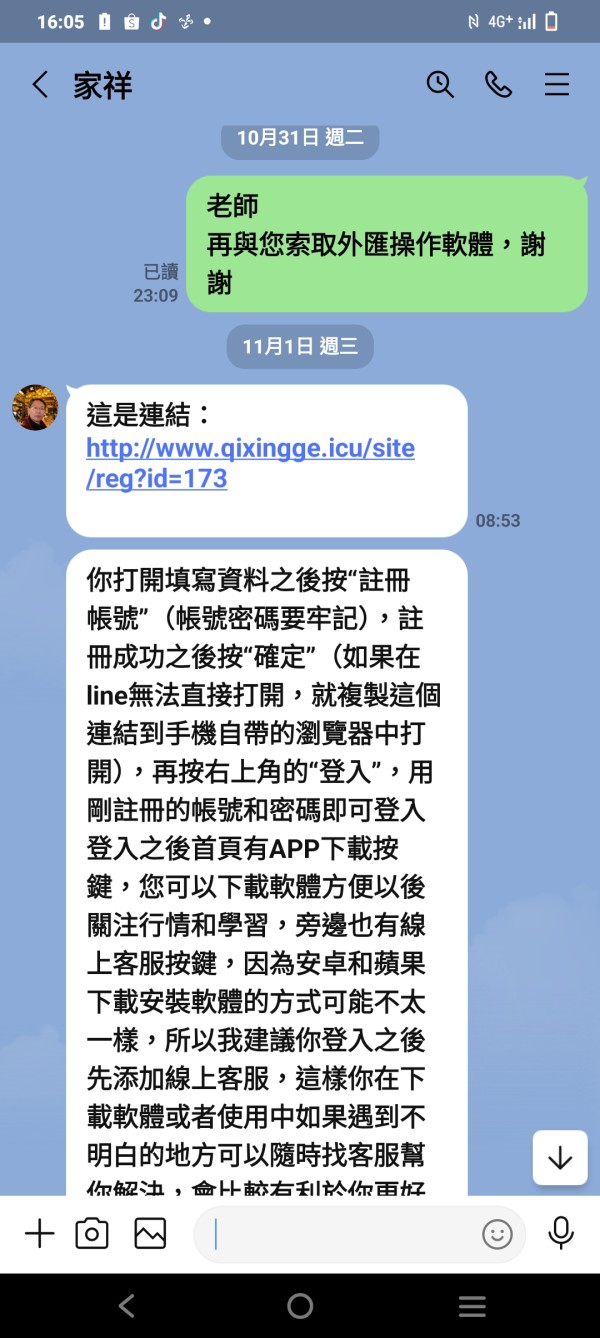

Situation description 1. Joined the stock investment LINE group where Li Chengzong is the moderator for about a year, and started soliciting foreign exchange transactions. After relying on the moderator privately, the moderator provided a LINE online customer service account, and the online customer service guided the registration and account opening, and provided a deposit wallet. Address and transaction URL that can be logged in after registration. 2. The transaction URL is displayed as a BGC webpage, which often requires maintenance and suspends transactions. 3. The general trading time is mostly led by the moderator Li Chengzong from Monday to Thursday every week, choosing to trade in the afternoon or evening, choose the foreign exchange transaction of the euro against the US dollar, trade with the virtual currency USDT, the first-hand margin is 5000 USDT, and the transaction fee is 200 USDT. 4. The profit of each order is about 5~15%, and the trading method is to earn the price difference. 5. When I applied for a withdrawal on January 21st of this month, the system showed that it would take 1-2 days for the account to be credited. The result was not even reviewed. After contacting customer service for a reply, they will submit a review and wait for a reply. As a result, there was no message at all after that. Please contact us again. The moderator did the same and later determined it to be a fraud and immediately reported it to the police.

Exposure

2024-01-26

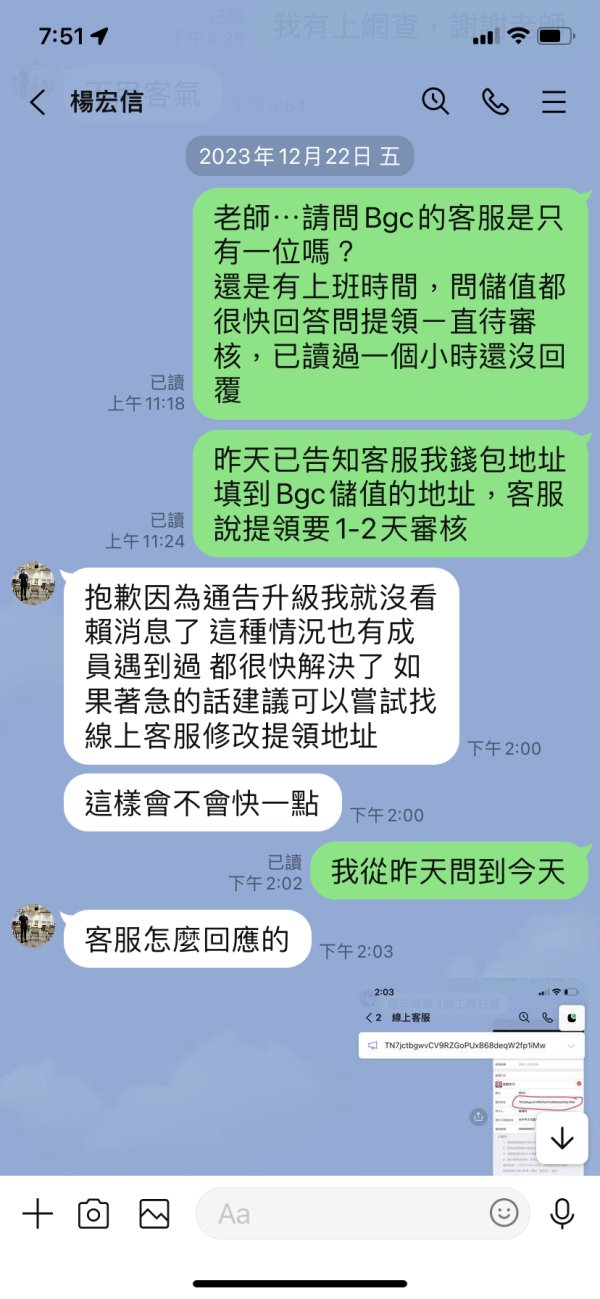

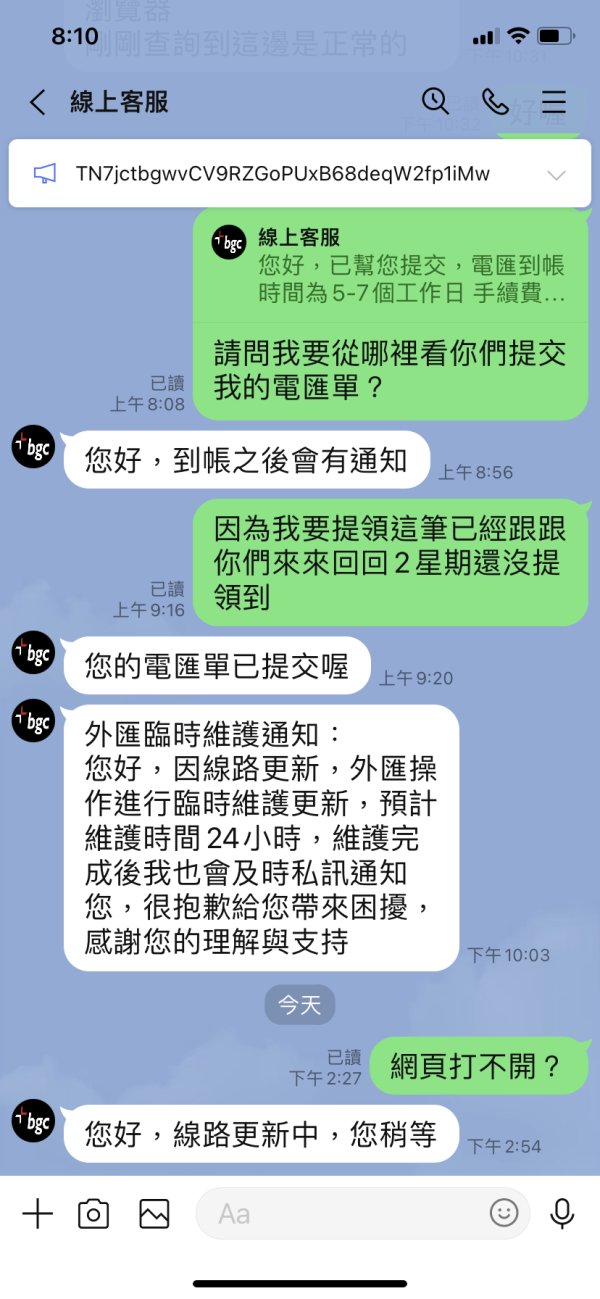

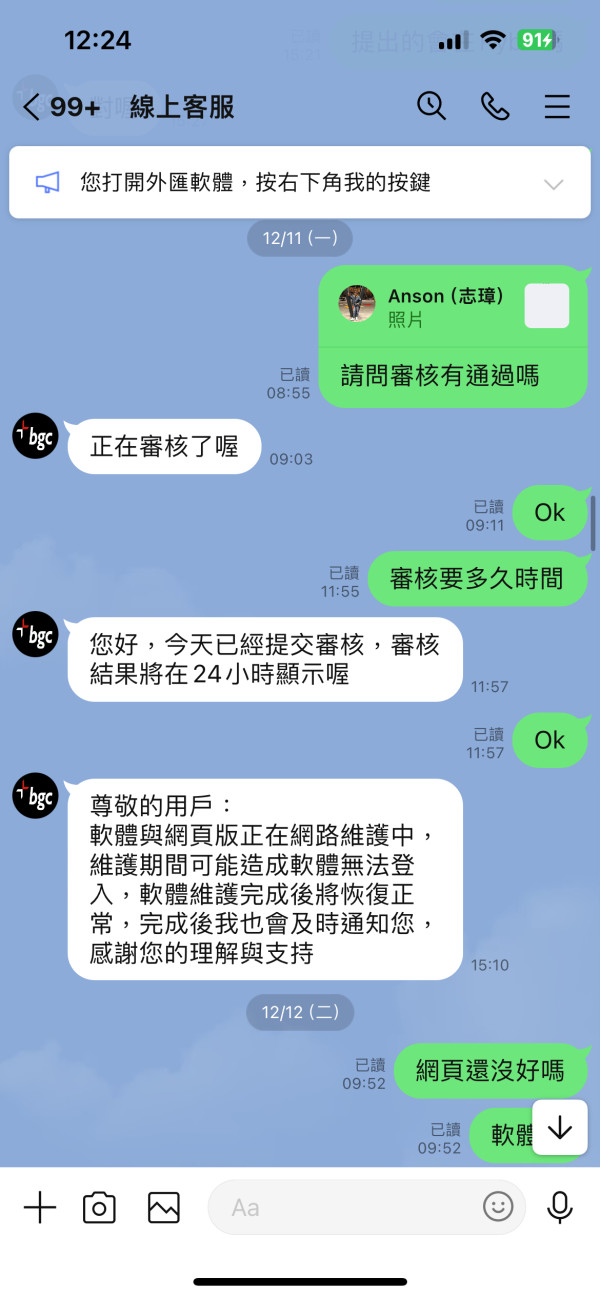

Huang423

Taiwan

Yang Hongxin told everyone about a forex software with fast, stable and reliable withdrawals. 112.12/18 After joining the platform, he frequently upgraded the network and changed lines. It took 2 weeks to withdraw USDT2000, but I was told that the withdrawal website needs to be confirmed (confirmation requires 24-hour feedback). At the end of the year, many people choose to withdraw via wire transfer. When I asked them to give me a wire transfer form, they only said that it had been submitted. I asked Yang Xinhong if there is only one customer service staff? Questions about deposited value were quickly answered. Questions about withdrawal were pending review. It has been read for an hour and cannot be read back. Yang Xinhong asked me to contact the customer service staff. What happens after recharging is different from what Yang Xinhong said. Everyone, please don’t be deceived.

Exposure

2024-01-02

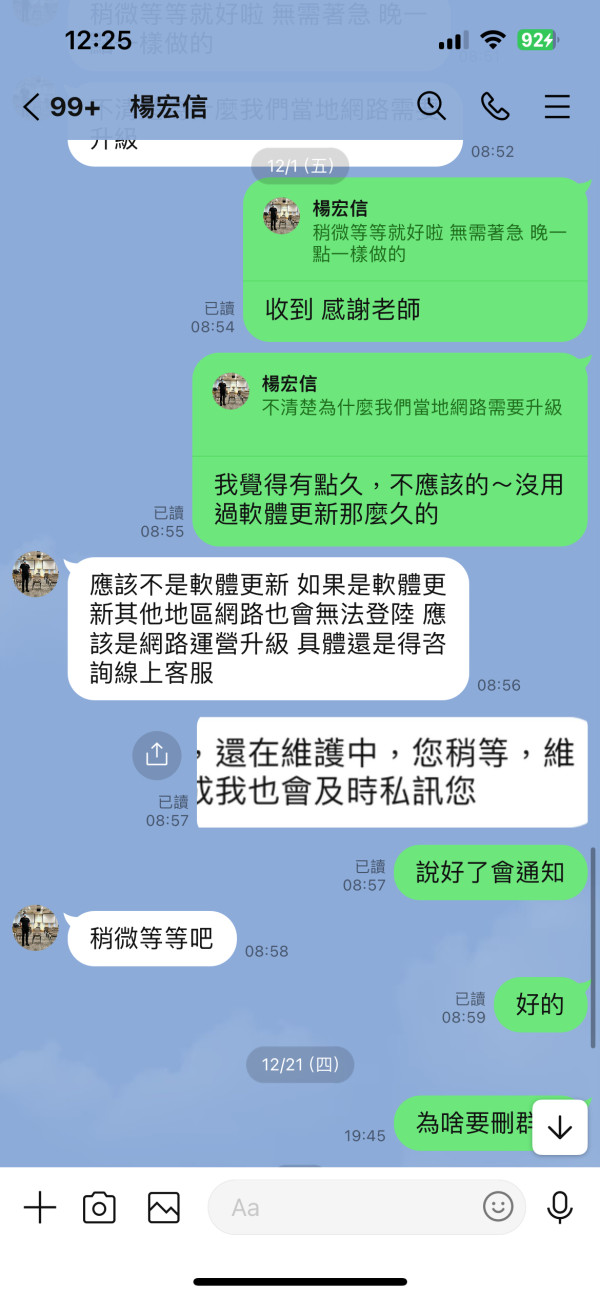

Anson7920

Taiwan

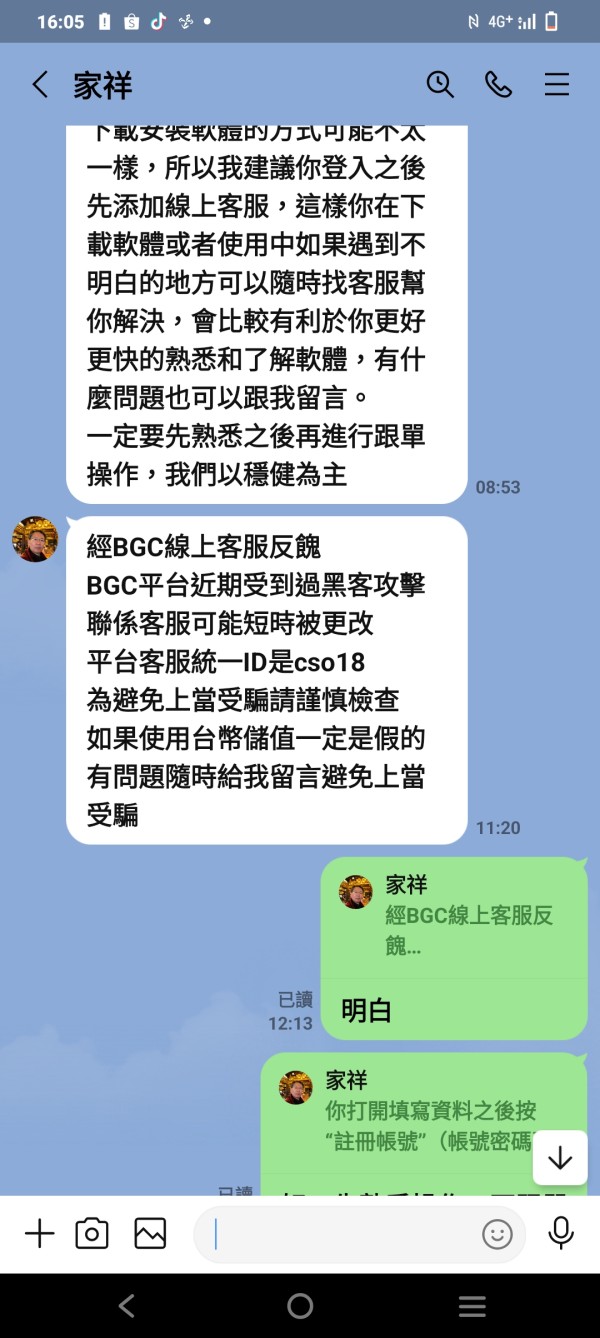

I saw the reminder from netizens too late. Let me share my painful experience on 2023/11/28. I started practicing BGC customer service deposits. I made normal profits at the beginning. Later, I had a direct liquidation of 5,000 USDT and lost money instantly. I still had almost 2,000 USDT on hand. When I wanted to withdraw money, I started to delay the customer service for various reasons. In the end, the customer service ignored me and the operation group was deleted. Yang Xinhong disappeared from the world and lost almost NT$170,000. I remind you not to be deceived again. The following are the same keywords shared by netizens: Yang Xinhong/Forex/BGC/USDT/Stock Profits were originally seen on Facebook or in the community - teacher Yang Xinhong led the line group. At the beginning, the teacher shared so-called high-quality stocks and provided accurate stock entry times and follow-up The profit trading time will be informed, and indeed the accuracy of each transaction is very high. Later, Teacher Yang Xinhong invited to join the paid group (paying virtual USDT, no New Taiwan Dollar) based on his trust in stock raising and high profits in the growth period. Due to the poor stock market, members can use forex to compensate for the fact that during the period, many members were idle. Through the forex operation platform provided by the teacher, profit orders were posted continuously. The transactions ranged from one hand/second hand/three hands/four hands. (Each lot is 5,000 USDT, each USDT is equivalent to 1 US dollar). Each operation will control the profit at 5% to 15%, and repeatedly emphasizes not to chase the profit every time and the funds are not all in., so as to take off the guard. Because it is not a huge profit in an instant. After all, the profit from short or long positions in the stock market will also exceed 5%. After downloading the software provided, the version of the scam in 2023 is, you will be asked to join the customer service account of the software and how to purchase virtual currency in the future. Regarding how to deposit funds into the forex platform BGC, if you check online that BGC is real and has been officially certified, the forex platform they operate for you is fake. I encountered a lot of situations when I started to withdraw money, and at the same time I asked for help. Teacher Xiang also asked me to actively contact customer service. The problems I encountered when withdrawing money are as follows: 1. The customer service said that the wallet information for my withdrawal was abnormal and I could not withdraw money. 2. It said that the channel for applying for a withdrawal was crowded and I needed to wait. 3. It said that the blockchain Crowded, waiting continuously, the status of the withdrawal application has been reviewed, and the follow-up is pending remittance 4. The customer service began to disappear, at least 10 hours or more 5. The customer service provides that after re-depositing, the speed of withdrawal can be accelerated, and it can be opened Fast track for large withdrawals 6. The customer service apologized and was willing to provide a one-time fee for delayed withdrawals 7. The follow-up continued to hit the wall, indicating that the withdrawal was still waiting for the remittance. At the same time, the trading website of the forex platform It was closed. At the same time, customer service said that the website was under maintenance. There were members who were asked to enter the group. It was later revealed that the forex trading website is still operating and trading, and internal members (stakeholders) continue to share operations and profit rates. Once someone enters the group, follow If everyone warns them, they will leave the group and throw their money into the sea. Alas, if you don’t have a greedy mentality, it will be easy to suffer misfortune.

Exposure

2023-12-23

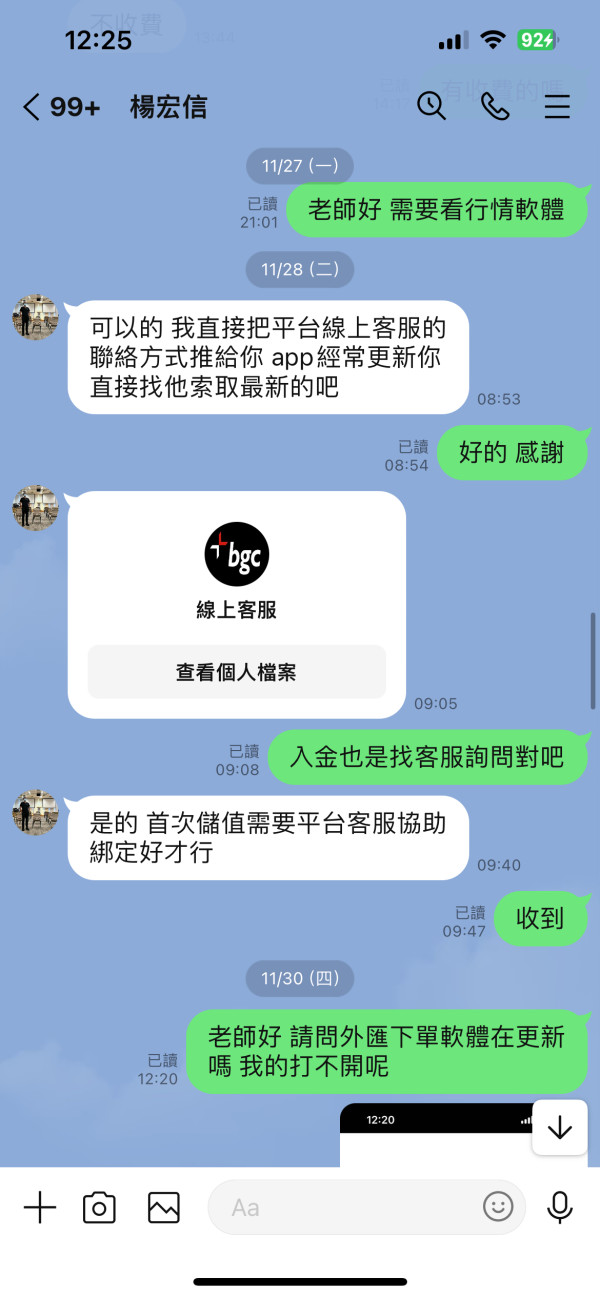

翩翩

Taiwan

I hope I can remind you to stay away~ (There are currently new groups in working) It is roughly estimated that the total amount defrauded by the former group is close to NT$3 million. Keywords: Yang Jiaxiang/Jiaxiang/Forex/BGC/USDT I originally saw it on Facebook or in the community - Teacher Yang Jiaxiang leads a line group. In the beginning, the teacher shares the so-called high-quality stocks, provides accurate stock entry times, and later informs the profit-making exit times. Every transaction is indeed accurate. Later, Teacher Jiaxiang said that his account had been fraudulently used and he wanted to reorganize a new group, so the number of people in the group dropped from more than 200 to more than 100. Later, a super VIP group was established to make long-term profits through cultivation. Invite your trust to join the paid group (pay virtual USDT, not NT$). During this period, many members were shills, and they kept posting profit orders through the forex operation platform provided by the teacher. The transactions ranged from one hand/second hand/three hands/four hands (each hand was 5,000 USDT, and each USDT was equivalent to 1 US dollar). , each operation will control the profit to 5% to 15%, and repeatedly emphasize not to chase the profit of each operation and the funds are not all in. Then take off your guard, because it is not a huge profit in an instant. After all, shorting in the stock market Or the profit from going long will exceed 5%. After downloading the application provided by Mr. Jiaxiang, the 2023 version of the scam will ask you to join the application’s customer service account and learn how to purchase virtual currencies and deposit funds into the forex platform BGC. You can check online to see if BGC is real and valid. Officially certified, but The Forex platform they operate for you is fake. I encountered a lot of problems when I started to withdraw money. At the same time, I asked Teacher Jiaxiang for help, and he also asked me to actively contact customer service. Problems encountered when withdrawing funds are as follows: 1. Customer service said that the wallet information I used to withdraw money was abnormal and I could not withdraw money. 2. It means that the channel for applying for withdrawal is full and you need to wait. 3. Indicates that the blockchain is congested and is continuing to wait. The status of the withdrawal application has been reviewed and will be remitted later. 4. Customer service started to disappear, at least for more than 10 hours. 5. Customer service provides that after re-depositing funds, the speed of withdrawal can be accelerated, and a fast channel for large withdrawals can be opened. 6. The customer service apologized and was willing to provide a one-time fee for delayed withdrawals. 7. Follow-up messages keep pending, indicating that the withdrawal is still waiting for remittance. What’s crazy is that when I started to seek confirmation from other members of the group about their withdrawal status, Mr. Jiaxiang began to disband the original super VIP group and set up a new group and then excluded me because he knew If I ask him publicly, it will affect his plan to let others be played for suckers. At the same time, the trading website of the forex platform was closed. At the same time, customer service said that the website was under maintenance. Some members who were asked to enter the group revealed that the forex trading website is still operating and trading, and internal members (stakeholders) continue to share operations and profit rates. Once someone enters the group to warn everyone, they will remove the person who warned them from the group. Currently, both groups that have been alerted have been removed from the group. I entered the fund at the beginning of November this year. I found out that I was defrauded and started applying for a withdrawal on December 1, but I found that I could not successfully withdraw the money. I completed the reporting procedure this afternoon. I understand that the police can only help so much, so I would like to post here. I can remind you by turning my hard-earned money into experience. After checking websites and associations online, I found that in May 2022, someone had already described being deceived in a similar situation. The method has not been upgraded to the BGC forex platform.

Exposure

2023-12-15