Score

Trading212

United Kingdom|10-15 years|

United Kingdom|10-15 years| https://www.trading212.com/en

Website

Rating Index

Influence

Influence

AAA

Influence index NO.1

Czech Republic 8.42

Czech Republic 8.42Contact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

Basic Information

United Kingdom

United KingdomUsers who viewed Trading212 also viewed..

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

United Kingdom

Bulgaria

Poland

trading212.com

Server Location

Germany

Most visited countries/areas

United States

Website Domain Name

trading212.com

Website

WHOIS.VERISIGN-GRS.COM

Company

-

Server IP

217.163.18.9

Genealogy

VIP is not activated.

VIP is not activated.DCF

TAIYAU FOREX

WIN4TRADER

Company Summary

| Registered Country/Region | United Kingdom |

| Regulation | FCA, CYSEC |

| Minimum Deposit | $1/R16 |

| Maximum Leverage | 1:300 |

| Minimum Spreads | From 1.2 pips on EUR/USD |

| Trading Platform | Proprietary platform and a Web-based Version |

| Demo Account | Available |

| Trading Assets | Forex Currencies, Indices, Commodities, Stocks, Cryptocurrencies |

| Payment Methods | Crredit Cards, Debit Cards, Skrill, Dotpay, Giropay, Carte Bleue, Direct eBanking, Bank Wire Transfer |

| Customer Support | 7/24 Customer Support |

Overview of Trading212

Trading212 is a UK-based forex broker that offers various financial instruments for trading, including Forex currencies, indices, commodities, stocks, and cryptocurrencies. The company is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CYSEC), providing clients with an added layer of security and reassurance.

Traders can start with as little as $1/R16 and enjoy a leveraged trading experience of up to 1:300. The minimum spreads start from 1.2 pips on EUR/USD, ensuring competitive pricing for traders. Trading212 operates through a proprietary trading platform and a web-based version, both of which offer advanced trading tools and features to clients. The platform also provides a demo account for traders to practice their strategies before investing real funds. In terms of payment methods, Trading212 offers various options, including credit cards, debit cards, Skrill, Dotpay, Giropay, Carte Bleue, Direct eBanking, and Bank Wire Transfer.

These multiple payment options provide traders with flexibility and convenience in managing their trading accounts. Finally, Trading212 offers 7/24 customer support through various channels, ensuring that clients can seek help and receive timely assistance whenever needed. Overall, Trading212 is a reputable and regulated trading platform that provides clients with a diverse range of financial instruments and advanced trading tools.

Is Trading212 legit or a scam?

Trading212 holds a comprehensive range of licenses, highlighting their commitment to regulatory compliance and customer protection. In the United Kingdom, Trading212 possesses a full license granted by the Financial Conduct Authority (FCA) under the license number 609146, showcasing their adherence to stringent standards and regulations. Furthermore, they have obtained a forex license from the Cyprus Securities and Exchange Commission(CYSEC) under the license number 398/21, further solidifying their global presence and dedication to providing top-notch services to their clients.

Pros & Cons

Trading212, an online trading platform, has both advantages and disadvantages. On the positive side, the company is regulated by reputable financial authorities such as the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CYSEC), ensuring a certain level of trust and security for users. Additionally, Trading212 offers demo accounts, allowing users to practice trading without risking real money. They also provide 24/7 customer support, ensuring assistance is readily available.

However, there are some limitations to consider. Trading212 has a limited product portfolio, which may restrict the variety of investment options available to users. Moreover, the platform does not allow scalping (a trading strategy) and does not permit the use of Expert Advisors (EA), which might disappoint users who prefer these techniques. Additionally, Trading212 charges an inactivity fee, meaning users may incur charges if their account remains inactive for an extended period. Lastly, while they provide a zero-commission trading environment, their research selection is somewhat limited.

| Pros | Cons |

| FCA & CYSEC regulated | Limited product portfolios |

| Demo accounts available | Scalping & EA not allowed |

| Minimum deposit from $1 | Inactivity fee charged |

| Zero-commission trading environment | Limited research selection |

| Ideal for beginners | |

| 7/24 customer support |

Market Instruments

Tradable financial instruments that can be traded online with Trading212 includes currency pairs, commodities, stocks, and indices.

Stocks: Trading212 offers the opportunity to trade a wide range of stocks, allowing users to engage in both long and short positions. This includes popular and well-known stocks like Tesla, Game Stop, and AMC, providing ample options for users to invest in.

Indices: Users can also trade on various global indices through Trading212. This includes renowned indices such as the S&P 500, Dow Jones, and FTSE 100, enabling users to participate in the performance of major stock market indexes.

Commodities: Trading212 provides access to commodities trading, allowing users to invest in precious metals, oils, and niche agricultural products. This diverse range of commodities includes assets like gold, silver, oil, as well as unique options such as lumber and cattle.

Forex: With over 180 currency pairs available for trading, users can engage in the forex market through Trading212. The platform offers 24/5 trading hours, enabling users to participate in currency trading around the clock, providing ample opportunities for forex traders to take advantage of global market movements.

Account Types

Trading212 offers investors three different investment options on its platform, including the Trading212 INVEST account, Trading212 ISA account, and Trading212 CFD account. However, it is important to note that each account type has its own unique features and benefits that cater to different trading styles and preferences. It is recommended that investors thoroughly research and understand the details of each account type before deciding which one to choose.

How to Open an Account?

Opening an account with Trading212 is a straightforward process that can be completed in a few simple steps:

1.Visit the Trading212 website and click on the “Open account” button.

2.Fill in the required personal information, such as your name, email address, and date of birth.

3. Verify your identity by providing a copy of your passport or other accepted identification documents.

4. Once your account is verified, fund your account with a minimum deposit of $1/R16. Select the payment method you prefer, such as credit card, debit card, Skrill, or bank wire transfer.

5. After funding your account, you can start trading by selecting the financial instruments you want to trade and executing your trades through the Trading212 platform.

6. If you encounter any issues or need help with the account opening process, Trading212's customer support is available 24/7 through various communication channels, such as phone, email, live chat, or web form.

Demo Accounts

Trading212 offers traders, especially beginner traders, access to demo accounts. These accounts can be utilized in various ways. It is seen as a practice account for beginner traders who wish to improve their trading skills and experience in a risk-free environment using virtual funds.

A demo account is also beneficial to traders who wish to test their trading strategies in a mimicked live trading environment without risking their capitals.

Minimum Deposit

One of the most attractive features of these accounts is that they all require a minimum initial deposit of $1, making it accessible for most regular traders to get started.

Leverage

Trading 212 offers varying maximum leverage ratios for different trading instruments. For retail traders, the maximum leverage is set at 1:30. The leverage ratios provided by Trading 212 are as follows:

1. Major Currency Pairs: Retail traders can access a maximum leverage of 1:30 when trading major currency pairs. This leverage allows traders to control larger positions with a smaller amount of capital.

2. Minor Currency Pairs: When trading minor currency pairs, Trading 212 provides a maximum leverage of 1:20. This slightly lower leverage ratio still offers traders the potential to amplify their trading positions.

3. Gold: Retail traders have access to a maximum leverage of 1:20 when trading gold. This leverage ratio allows traders to speculate on the price movements of gold with increased exposure.

4. Other Commodities: For trading other commodities, Trading 212 grants a maximum leverage of 1:10. This leverage ratio applies to commodities other than gold and provides traders with the opportunity to participate in the commodity markets.

5. Equity CFDs: When trading equity CFDs (Contracts for Difference), retail traders can utilize a maximum leverage of 1:5. This lower leverage ratio for equity CFDs reflects the potentially higher risks associated with trading individual stocks.

6. Index CFDs: Major index CFDs are available with a maximum leverage of 1:20, providing traders with exposure to broader market indices. Minor index CFDs can be traded with a maximum leverage of 1:10.

These leverage ratios offered by Trading 212 are subject to change and may vary based on regulatory requirements and market conditions. It is important for traders to carefully consider the risks involved and manage their positions accordingly when utilizing leverage in their trading activities.

Spreads & Commissions

Trading 212's spreads start from 1.2 pips on EUR/USD. This broker does not charge any commissions for trade executions but collects a brokerage fee from he spreads.

Trading Platforms

Trading212 offers investors not the most popular MT4/MT5 trading platforms but a mobile application that can be downloaded from the App Store or Google Play.

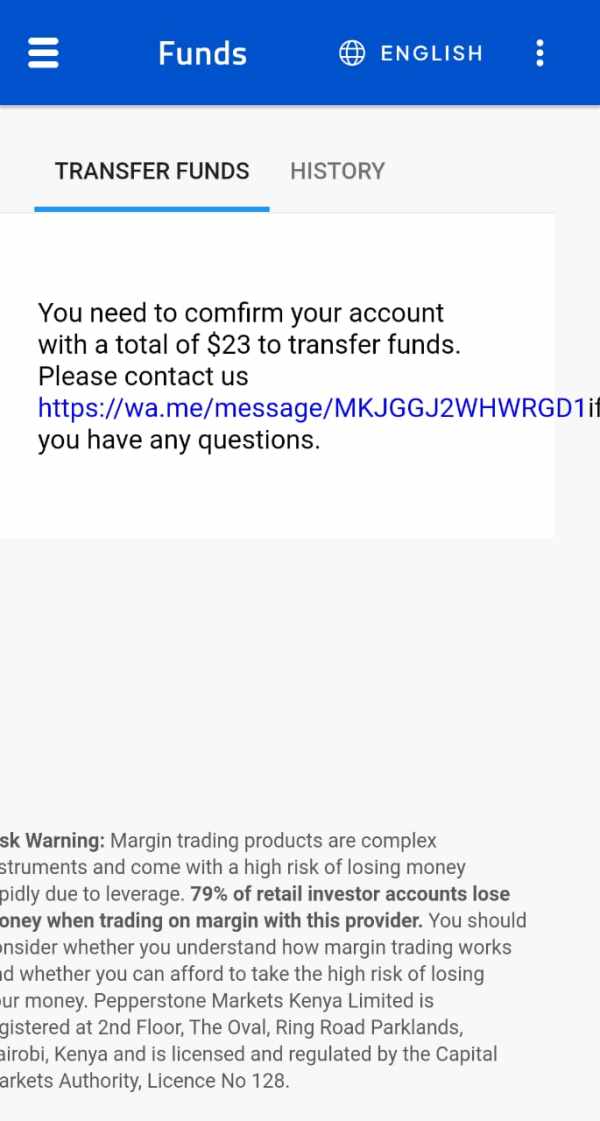

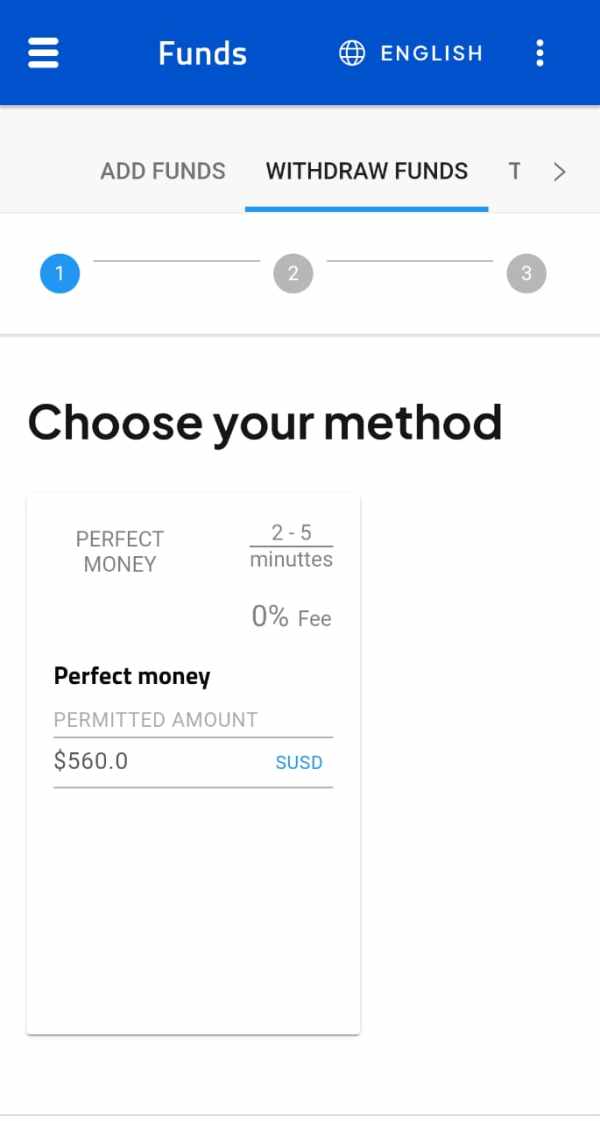

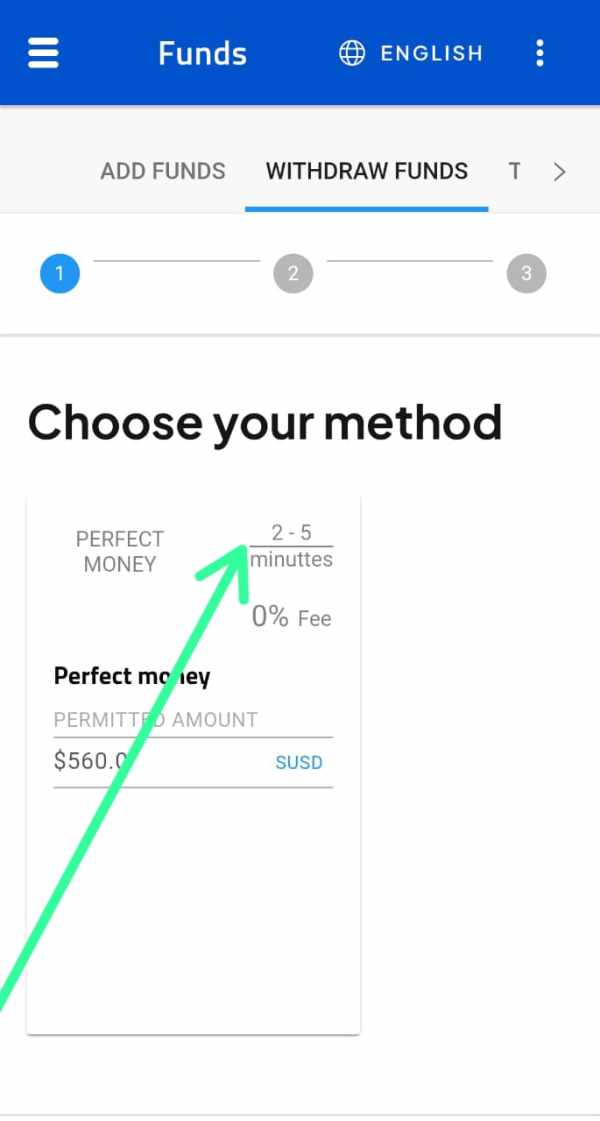

Deposit and Withdrawal

Trading212 supports traders to deposit and withdraw funds to their investment accounts via various payment methods such as VISA/MasterCard/Maestro credit/debit cards, PayPal, Skrill, wire transfers.

Deposits can be made via bank transfers for free, while deposits made via cards, Google Pay, Apple Pay and other methods are free for cumulative amounts up to €2000/$2000. For cumulative amounts above €2000/$2000, a 0.7% fee is charged. On the other hand, withdrawals are free of charge on the platform, providing clients with a hassle-free experience in accessing their funds. It is important to note that payment processing times may vary based on the payment method chosen and the individual's location.

Educational Resources

Trading 212 has a good variety of educational videos, with over 170 available on its YouTube channel. Detailed articles and advanced materials are limited to the help center, however, and there are no archived webinars.

Education at Trading 212 consists mostly of videos, many of which are embedded in its web and mobile platform. Besides some posts in its community forum and FAQs in its help section, Trading 212 does not offer educational articles.

Customer Support

To seek assistance or support, traders on Trading212 can choose from various channels, including phone, email, or filling out the web form available on the platform's website. Additionally, there is a live chat feature available for traders to connect with customer support representatives. While the hours of support were not explicitly mentioned, it can be assumed that regular business hours are in place. Regardless, the availability of multiple channels for customer support ensures that traders can seek help and receive timely assistance whenever needed.

Conclusion

Overall, Trading212 can be an ideal choice for beginners due to its regulated status, demo accounts, and accessible customer support. However, users should be aware of the platform's limitations, including the limited product range, restrictions on certain trading strategies, inactivity fees, and a somewhat restricted research selection.

FAQs

Q: What deposit methods are available on Trading212?

A: Trading212 offers several deposit methods, including bank transfers, cards, Google Pay, Apple Pay, and other options.

Q: What is the fee for card deposits on Trading212?

A: Card deposits are free for cumulative amounts up to €2000/$2000. For cumulative amounts above that, a 0.7% fee is charged.

Q: Are withdrawals free on Trading212?

A: Yes, withdrawals are free of charge on Trading212.

Q: What is the processing time for deposits and withdrawals on Trading212?

A: Payment processing times on Trading212 may vary based on the payment method chosen and the individual's location.

Q: Is Trading212 regulated?

A: Yes, Trading212 is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CYSEC).

Keywords

- 10-15 years

- Regulated in United Kingdom

- Regulated in Cyprus

- Market Making(MM)

- Global Business

- Vanuatu Retail Forex License Revoked

- High potential risk

News

News Investing Made Easy with Trading 212

Trading 212 simplifies automated investing with BlackRock-powered ETFs. Set goals, deposit funds, and let your portfolio grow effortlessly.

2024-09-05 16:32

News Trading 212 Acquires FXFlat Bank to Expand German Market Reach

Trading 212 acquires Germany's FXFlat Bank to expand its presence in the German market, offering zero-commission trading and enhanced services to investors.

2024-08-16 11:56

News Trading 212 Launches Multi-Currency Cards with Paynetics

Trading 212 teams up with Paynetics to offer multi-currency cards, enhancing customer financial management.

2024-05-13 17:57

Exposure WikiFX Broker Assessment Series | Something You Need to Know About Trading212

Have you ever heard about a broker named Trading212? WikiFX made a comprehension review on this broker to help you better understand the truth, we will analyze the reliability of this broker from specific information, regulation, exposure, etc. And you should never miss it.

2024-01-08 18:01

News Trading 212 UK Sees 74% Rise in 2021 Revenue, Netted £45M as Income

The broker has seen a massive jump in its financial performance in the past few years. It is now shifting its focus from CFDs to the stockbroking business.

2022-04-12 16:01

News Trading 212 introduces FX conversion fees, losing its commission-free status

A slim 0.15 per cent conversion fee will be added for equities and ETFs in other currencies.

2021-12-16 13:26

Review 11

Content you want to comment

Please enter...

Review 11

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

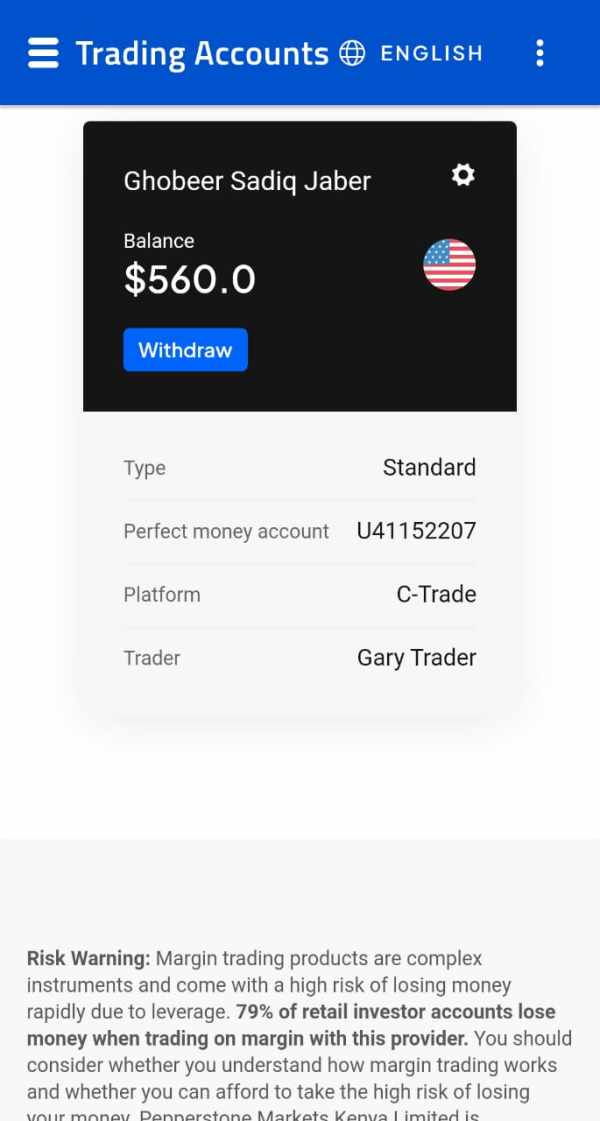

FX1348692970

Yemen

Unable to withdraw. Scammer. I was scammed by the broker.

Exposure

2024-03-10

Mick890

Czech Republic

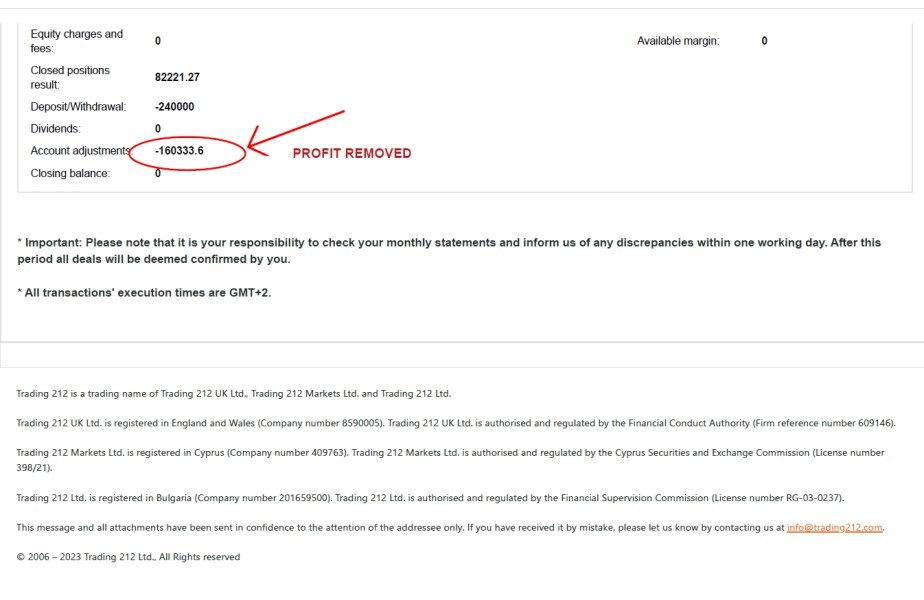

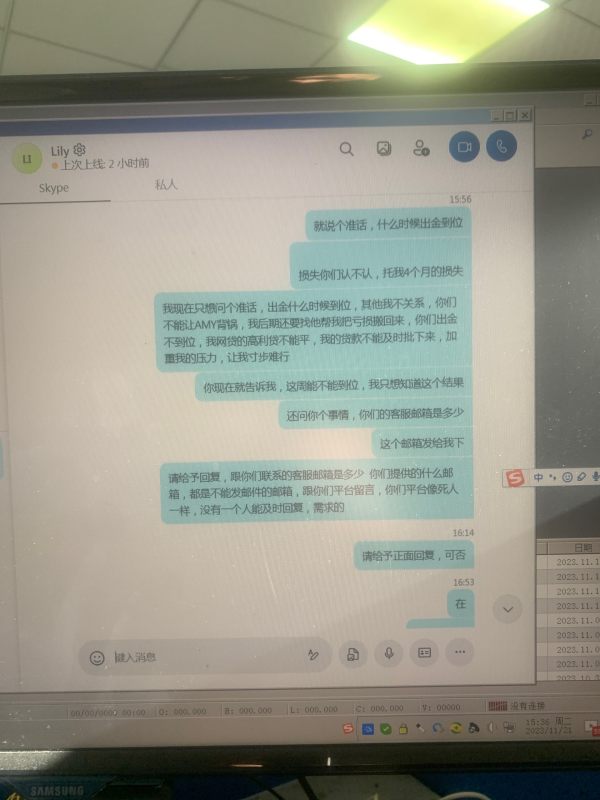

As a retail client, I opened a live account with broker Trading212 on August 4th, 2023.Trading 212 UK Ltd. is registered in England and Wales (Company number 8590005). Trading 212 UK Ltd. is authorised and regulated by the Financial Conduct Authority (Firm reference number 609146). Registered address: 107 Cheapside, London, EC2V 6DN, United Kingdom.After 4 months of live trading, on 27th November 2023, without any previous notice, I was informed by the broker that I "breached" their T&C with "a high volume of transactions that are opened and closed within an unusually short period of time as compared to the ‘average’ client, with a disproportionate number placed advantageously between the price of trade and the price of the underlying market instead of the 'random distribution' that would be expected when the Trading Platform is used "fairly"...And for this "reason", they unilaterally decided to close my live account. All 17 trades I made in 4 months were voided and all the profit I made (approx. 5000 GBP) was canceled.I feel I wasn't treated fairly by Trading212. 1. It's obvious and very easy to prove, that (according to my trading history) I didn't use any short, tick-scalping strategies. Almost all my trades lasted more than 3+ minutes and some trades even 20+ minutes, which can hardly be seen as something "unusual" and also can not be defined as a few seconds scalping...2. They accused me of "high volume of transactions"... checking my trading history, it's obvious I made only 17 trades in 4 months and I always traded max. 1 open position/trade at the time. 3. They accused me of "latency" or "price" manipulation. My trading is based purely on price action (and volatility) following major fundamental news or events, which is generally seen as a standard trading strategy. I don't know a single EU/UK broker that wouldn't allow this kind of trading. I trade exactly the same way with many other FCA/CySec/ASIC regulated and reputable brokers without any issues. Trading212 is the first broker having a "problem" with my trading style. As for "platform misuse", I can only work/trade with price quotes provided via broker's trading platform. I see unfair that the same broker accused me of "misusing" his own platform and price quotes. I, as a retail client, have no chance to "manipulate" what price quotes I receive on the broker's platform - nor I can be responsible for any discrepancy between prices Trading212 should've been providing, and the ones that were in fact being streamed. Providing accurate quotes is the broker's risk, not clients' risk and the client should not be penalized for broker's mispricing errors if they occur. If the broker isn't able to provide accurate and stable pricing of market instruments, they shouldn't offer them at all.Still, it's worth noting here that if we compare prices (my trades were executed at) with 3rd party quotes, we will see these prices were absolutely realistic and similar to my other brokers at the time of trades.4. I double-checked Trading212 T&C and I haven't found any information about specific trading strategies that would be prohibited. Also, I haven't found any specific information to comply with, e.g. minimum trading holding time, max orders open, max volume, etc. If this is so important for them and can lead to closing clients' accounts (or even voiding ALL the profits), why didn't they specify these parameters in T&C clearly? so I or anyone else could comply with them? In their T&C, I found only uncertain and vague clauses that leave the decision entirely up to broker's discretion.5. Finally, I wish to emphasize, that my trading history with Trading212 started in August 2023 and lasted more than 4 months, with no issues. Since August, there has been zero notice from broker's side that there is anything wrong with my trades or that they have problems with my orders. Then suddenly, after 4 months of trading, they unilaterally closed my account without any previous warning and voided all my trades and profits.Probably not trading itself, but my constantly growing profit was a "real" problem here for Trading212. I assume if I lost money with Trading212, no account closure would ever happen.It seems that some forex brokers (even regulated ones) operate in a very questionable way. Retail clients losing money are welcomed, while profitable accounts are simply closed and profits canceled. Flawless business for them. From my point of view, this practice is unfair.If the broker doesn't want me as a client anymore, I'm fine with that. But I strongly don't agree with removing all my profits for 4 months of trading. Regulated financial institutions should not work like that. I still hope I can find a reasonable solution with Trading212.

Exposure

2023-12-04

刘辉9345

Hong Kong

I started applying for withdrawal on August 17th, but it took 4 months. I asked the platform customer service. The platform customer service was like a robot, saying please wait.

Exposure

2023-11-21

FX1698946984

United Kingdom

Do yourself a favour and do not deal with scam company.They are not based in the UK despite their claims. They are a Scam company that traded from Cyprus and had their licensees Revoked in Cyprus (where they traded from) & also by the UK FCA.They set up another company claiming to operate from the UK which is a forwarding Address & not offices!No proof of ID or Tax details were request which is mandatory by Law in the UK prior to opening a trading account or allowing deposits.£45.000 was scammed

Exposure

2021-06-23

FX1698946984

United Kingdom

Trading 212 UK LTD claim to be “UK FCA Regulated” in fact they ARE a SCAM and DONT trade from the UK. Previously traded in UK from an offshore company under the name Gobaba FXLTD (previously AVUS CAPITAL- now Trading 212 UK) CySEC license REVOKED in 2018 & UK FCA license cancelled NOT to Trade in the UK! Not surprisingly it didn’t stop their scam.Registering Trading 212 UK using UK London address for their “offices”(Address not occupied just empty warehouse) They continue to scam! STAY AWAY !

Exposure

2021-06-22

虎背熊腰

Hong Kong

Leverage of 1:300 is extremely high! I cant believe that Trading212 is regulated by the FCA legally, British brokers have to limit their clients to 1:30..if i am not mistaken.. so suspicious!!

Neutral

2022-11-16

FX1524913740

Pakistan

I've been actively trading forex for about three years now and switched to Trading212 about 8 months ago. The difference is like day and night! Firstly, I was quite surprised by their zero commission policy - they live up to the bill. Saving on costs allowed me to invest more without having to worry about cutting a slice of my profits. Their trading platform? Snazzy, lightweight and very user-friendly. You don't have to be a statistical whizz to navigate their tools. In fact, they actually explain complex stuff like candlestick patterns and Bollinger bands in an easy-to-understand manner. I've used a couple of platforms before but their trading charts are impressively intuitive and accurate. Oh and the cherry on top? Their customer service is fantastic! There was this one time I faced an issue with my withdrawal. Raised a ticket and within 2 hours, got a response. The issue was sorted shortly. If you’ve traded forex, you know how crucial quick, efficient customer service can be!

Positive

2023-12-02

ㅤ84614

Malaysia

Spreads here are quite competitive which, coupled with their low commission structure, promises traders a more feasible profits margin. A standout trade that I'd like to share was on the EUR/USD pair. Based on this platform's reliable trading signals, I positioned a long order which, thanks to their responsive platform, was executed just at the right moment and I made a healthy profit. When it came to withdrawing my earnings, the process was mostly smooth, although the speed of the completion could be a tad quicker compared to some industry leaders.

Positive

2023-11-30

FX1222910301

Morocco

Excellent service provided. I recently started trading with Trading212, and I'm pleased with the service they offer. They have shown a high level of professionalism, which is more than enough for my trading ambitions.

Positive

2023-02-20

FX1209760213

India

Hello guys, Here I want to say, Trading212 is the best broker ever. During my five years’ trading here, I never met trading issues, like withdrawal problems, unstable trading platform, slippages, etc. My account managers are always patient and professional. I just love Trading212.

Positive

2023-02-16

Derya

Hong Kong

Easy to use and in Trading 212's app verison, you can use the tools from trading view which seems good. You can lose money easily because they use a leveraged order system...

Positive

2022-11-15