Score

GRIC FX

United States|2-5 years|

United States|2-5 years| https://greaticapital.com

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed GRIC FX also viewed..

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Website

greaticapital.com

Server Location

United States

Website Domain Name

greaticapital.com

Server IP

207.246.82.228

gicc-fx.com

Server Location

Singapore

Website Domain Name

gicc-fx.com

Server IP

95.111.193.140

Company Summary

| GRIC FX | Basic Information |

| Company Name | GRIC FX |

| Founded | 2019 |

| Headquarters | United States |

| Regulations | Not regulated |

| Tradable Assets | Forex, CFDs, Metals, Energies, Indices, Cryptos |

| Account Types | Standard Account, Cent Account, Pro Account |

| Minimum Deposit | From $0 |

| Maximum Leverage | 1:500 |

| Spreads | From 1.5 pips |

| Commission | From 0 pips |

| Deposit Methods | Bank transfer, Credit card, Skrill, Neteller, Perfect Money, Bitcoin |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, Mobile Trading App |

| Customer Support | Email support (service@gicc-fx.com) |

| Education Resources | Trading courses, video tutorials, articles, live webinars, forum, demo account |

| Bonus Offerings | None |

Overview of GRIC FX

GRIC FX, established in 2019 and headquartered in the United States, is a brokerage that offers traders access to a diverse range of financial instruments. While it provides a wide array of tradable assets, including Forex, CFDs, Metals, Energies, Indices, and Cryptocurrencies, it's important to note that GRIC FX is not regulated. While the brokerage holds a license with the United States National Futures Association (NFA), its regulatory status is currently abnormal, with an official designation as unauthorized. This regulatory situation should prompt traders and potential clients to exercise caution and conduct thorough due diligence before considering GRIC FX as a trading platform.

GRIC FX caters to traders of varying experience levels by providing three distinct account types: Standard Account, Cent Account, and Pro Account. Each account type comes with its own set of features, offering flexibility and choice to traders. Additionally, the brokerage offers leverage of up to 1:500, which can amplify both profits and losses. GRIC FX charges spreads and commissions, and the exact trading fees may vary depending on the trading instrument and account type. While the brokerage provides multiple deposit methods, it's worth noting that some non-trading fees, such as inactivity and withdrawal fees, may apply. In terms of educational resources, GRIC FX offers a range of materials, including trading courses, video tutorials, articles, live webinars, a forum, and a demo account, aiming to support traders in enhancing their skills and knowledge. However, the absence of specified bonus offerings may be a consideration for some traders.

Is GRIC FX Legit?

GRIC FX is not regulated. While it holds a license with the United States National Futures Association (NFA) under license number 0532585, it's essential to note that the regulatory status of GRIC FX is currently abnormal, and the official regulatory status is unauthorized. Traders and potential clients should exercise caution and be aware of the associated risks when considering GRIC FX as a trading platform. It's advisable to thoroughly research and consider the regulatory status and oversight of any brokerage before engaging in trading activities to ensure the safety and security of your investments.

Pros and Cons

GRIC FX offers traders a diverse range of tradable assets, including Forex, CFDs, metals, energies, indices, and cryptocurrencies. With multiple account types catering to both beginners and experienced traders, it provides flexibility. The generous leverage of up to 1:500 can amplify trading potential. Moreover, GRIC FX offers various educational resources, enhancing the learning experience. However, the absence of regulation and the associated risks should be a significant concern for traders. Additionally, non-trading fees, limited customer support options, and unclear bonus offerings are areas that could be improved for a better overall trading experience.

| Pros | Cons |

| Diverse Tradable Assets | Lack of Regulation |

| Multiple Account Types | Non-Trading Fees |

| Generous Leverage | Limited Customer Support |

| Educational Resources | Unclear Bonus Offerings |

Trading Instruments

GRIC FX offers a comprehensive range of trading instruments, including:

Forex: Trade major, minor, and exotic currency pairs.

CFDs: Engage in Contracts for Difference across various assets, including stocks, commodities, indices, and cryptocurrencies.

Metals: Trade precious metals such as gold, silver, platinum, and palladium.

Energies: Participate in the energy market with oil, natural gas, and other commodities.

Indices: Trade on numerous stock market indices like the S&P 500 and the Dow Jones Industrial Average.

Cryptocurrencies: Take positions in popular cryptocurrencies like Bitcoin and Ethereum.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| GRIC FX | Yes | Yes | Yes | Yes | Yes | No | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Pocket Option | Yes | Yes | Yes | Yes | Yes | Yes | No |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Account Types

GRIC FX offers 3 account types: Standard Account, Cent Account, and Pro Account.

Standard Account: This is the most basic account type and is suitable for beginners. It has no minimum deposit requirement and no trading fees.

Cent Account: This account is designed for traders who want to trade with smaller amounts of money. The minimum deposit is $1 and the spreads are slightly wider than the Standard Account.

Pro Account: This account is designed for experienced traders who need more flexibility and control. It has a lower minimum deposit requirement and tighter spreads.

Leverage

GRIC FX offers leverage up to 1:500, which means that you can control a large position with a small deposit. For example, if you have a $1000 deposit and you use leverage of 1:500, you can control a position worth $500,000.

Leverage can magnify your profits as well as your losses. This means that you can make more money with a smaller deposit, but you can also lose more money if the market moves against you.

It is important to use leverage carefully and to understand the risks involved. If you are not comfortable with the risks of using leverage, then you should not use it.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | GRIC FX | FxPro | IC Markets | RoboForex |

| Maximum Leverage | 1:500 | 1:200 | 1:500 | 1:2000 |

Spreads and Commissions (Trading Fees)

GRIC FX charges spreads and commissions on its trades. The spreads are the difference between the bid and ask prices, and the commissions are a flat fee charged per trade.

The spreads and commissions charged by GRIC FX vary depending on the trading instrument and the account type. For example, the spreads for the EUR/USD currency pair are 3.0 pips for the Standard Account, but go down to 2.0 pips with a Platinum account.

Here is a table summarizing the spreads and commissions charged by GRIC FX for some popular trading instruments:

| Trading Instrument | Standard Account | Cent Account | Pro Account |

| EUR/USD | 3.0 pips | 3.5 pips | 2.0 pips |

| GBP/USD | 3.5 pips | 4.0 pips | 2.5 pips |

| AUD/USD | 3.2 pips | 3.7 pips | 2.2 pips |

| XAU/USD | 1.8 pips | 1.9 pips | 1.5 pips |

| BTC/USD | 6.0 pips | 6.5 pips | 5.0 pips |

Non-Trading Fees

GRIC FX imposes non-trading fees that traders should be aware of. Firstly, there is an inactivity fee of $10 per month if your account balance falls below $200. This fee is relevant for traders who may not actively engage in trading activities and should encourage account activity to avoid incurring extra charges.

Additionally, GRIC FX applies swap fees on overnight positions. These fees are determined by the interest rate differentials between the two currencies involved in the trade. Swap fees are common in the forex market and can either be positive or negative, depending on the direction of the trade and the interest rate differentials. It's essential for traders to consider these non-trading fees as part of their overall cost analysis when using GRIC FX as their trading platform.

Deposit & Withdraw Methods

GRIC FX provides multiple options for depositing and withdrawing funds, making it convenient for traders to manage their accounts.

One of the primary methods is through bank transfers, which do not incur a deposit fee. However, it's important to note that there is a withdrawal fee of $25 associated with this method. Traders who prefer the ease of credit card transactions can use this option, but there is a 2% funding fee for credit card deposits. The withdrawal fee for credit card transactions is $10.

For those who prefer digital payment solutions, GRIC FX offers several choices. Skrill, Neteller, and Perfect Money are all available with no deposit or withdrawal fees. Additionally, Bitcoin is accepted as a method for both deposits and withdrawals without any associated fees. These options cater to the varying preferences of traders, ensuring they have flexibility when managing their accounts.

Trading Platforms

GRIC FX provides traders with a selection of trading platforms to suit their individual preferences and needs. One of the popular choices is MetaTrader 4, a widely-used platform known for its versatility and user-friendly interface. MetaTrader 4 offers an array of features, including advanced charting tools, technical analysis capabilities, and support for automated trading strategies.

For traders seeking more advanced functionalities, GRIC FX offers MetaTrader 5, the latest iteration of the MetaTrader series. MetaTrader 5 introduces new features like algorithmic trading and copy trading, making it an ideal choice for experienced traders looking to diversify their strategies.

Additionally, GRIC FX offers a web-based trading platform known as WebTrader, which enables traders to access the markets from any computer with an internet connection. This platform offers flexibility and convenience for those who prefer browser-based trading.

For traders on the go, GRIC FX provides a mobile trading app, allowing them to trade and monitor their accounts from their mobile devices. The choice of trading platform ultimately depends on an individual's level of experience and specific requirements, ensuring that traders have options tailored to their needs.

Customer Support

GRIC FX offers customer support through email communication. Traders and clients can reach out to the company's support team by sending emails to service@gicc-fx.com. While email support provides a channel for inquiries and assistance, it's important to note that additional customer support options, such as phone support or live chat, may enhance the accessibility and responsiveness of customer service. It's advisable for traders to check the company's website or contact them directly for more information on the availability of different support channels and their responsiveness to client queries and concerns.

Educational Resources

GRIC FX offers a range of educational resources for traders. These resources include trading courses, video tutorials, articles, and blog posts that cover various aspects of forex trading. Traders can access live webinars to stay updated on market trends and participate in a forum to discuss trading strategies with fellow traders. Additionally, GRIC FX provides a demo account for practice trading with virtual funds, making it suitable for traders of all experience levels to improve their forex trading knowledge and skills.

Conclusion

In conclusion, GRIC FX offers a wide array of tradable assets and diverse account types, making it accessible to traders with varying levels of experience. The high leverage potential can be enticing for those seeking amplified trading opportunities. However, the lack of regulatory oversight poses a significant risk, and the absence of clear bonus offerings and limited customer support options may deter some traders. Traders should approach GRIC FX with caution, conducting thorough research and risk assessment before considering it as a trading platform.

FAQs

Q: Is GRIC FX regulated?

A: GRIC FX is not regulated, and its regulatory status is currently abnormal.

Q: What are the account types offered by GRIC FX?

A: GRIC FX offers three account types: Standard Account, Cent Account, and Pro Account.

Q: What is the minimum deposit required to open an account with GRIC FX?

A: The minimum deposit varies depending on the account type but starts from $0.

Q: What is the maximum leverage offered by GRIC FX?

A: GRIC FX offers leverage of up to 1:500.

Q: What trading platforms are available at GRIC FX?

A: GRIC FX provides MetaTrader 4, MetaTrader 5, WebTrader, and a mobile trading app as trading platforms.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

News

Exposure WikiFX Review: Plz Watch Out For GRIC FX!!!

Stay away from brokerage firms like GRIC FX that was not licensed by national financial institutions.

2022-11-08 15:49

News Global markets are at your fingertips

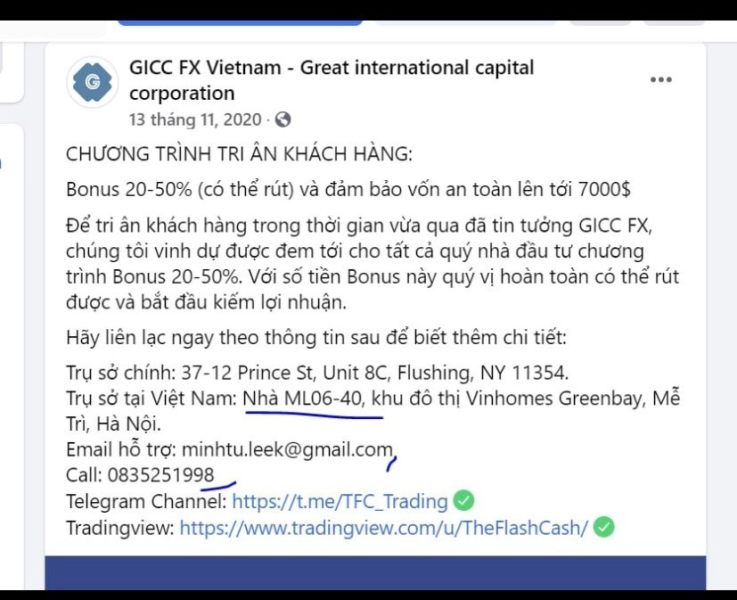

GICC FX USES the most advanced ECN quote technology in the industry to continuously optimize the spot spread while providing traders with the perfect one-stop global fx and CFD trading experience to meet the trading needs of different types of traders.

2021-12-16 18:39

Review 19

Content you want to comment

Please enter...

Review 19

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

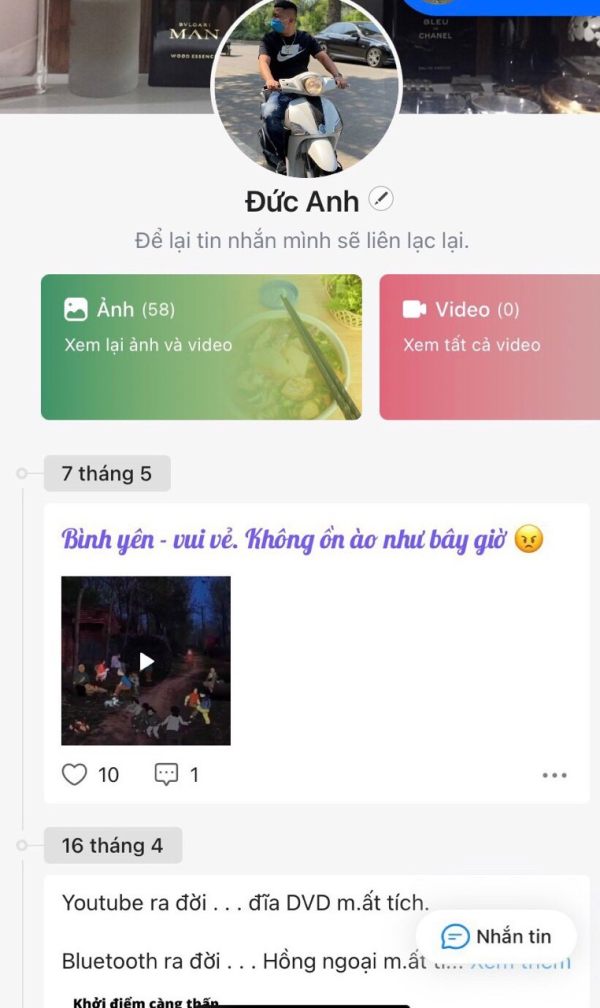

Ra091198

Vietnam

Can't withdraw money with a fee of 1.5 million dong

Exposure

2023-05-22

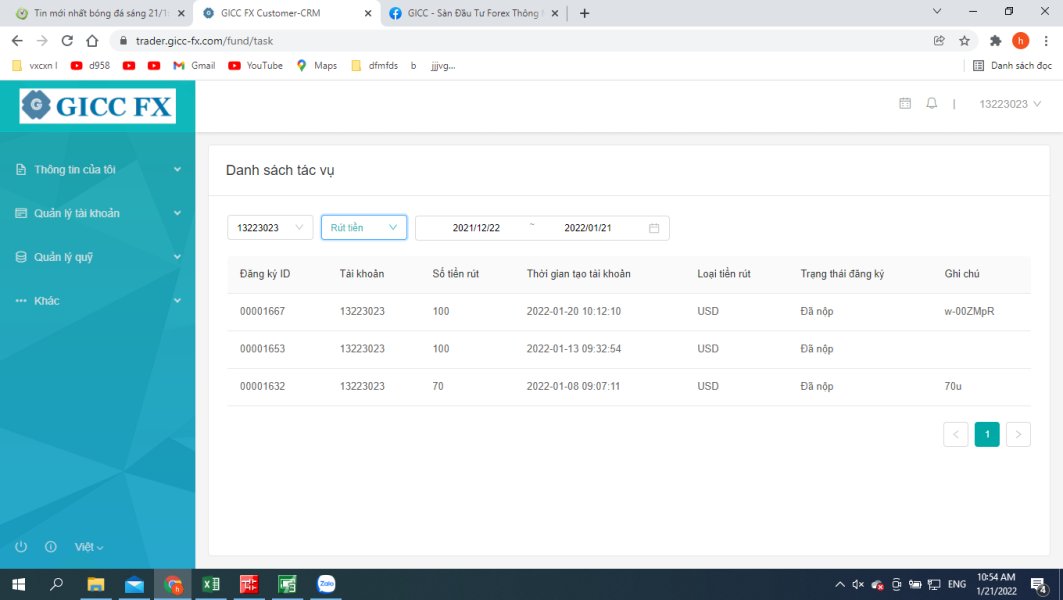

hautrinh1990

Vietnam

My name is Trinh Van Hau, a customer at GICC with MT5 number: 13223023. In January, I made 3 withdrawal orders with a total amount of 270 dollars. All 3 orders show the payment status but the money has not been transferred to my bank account. Please Admin support me! Thank you!

Exposure

2022-02-18

FX3132870528

Vietnam

I deposited $500 under the guidance of GICC-FX and joined a group of orders. There was only one correct order, while other four orders were wrong. My account suffered a loss of $281, which was acceptable for me. But I was unable to withdraw. The technical department refused the application and their phone call was unavailable. Then my account was deleted. Beware of this platform.

Exposure

2021-07-22

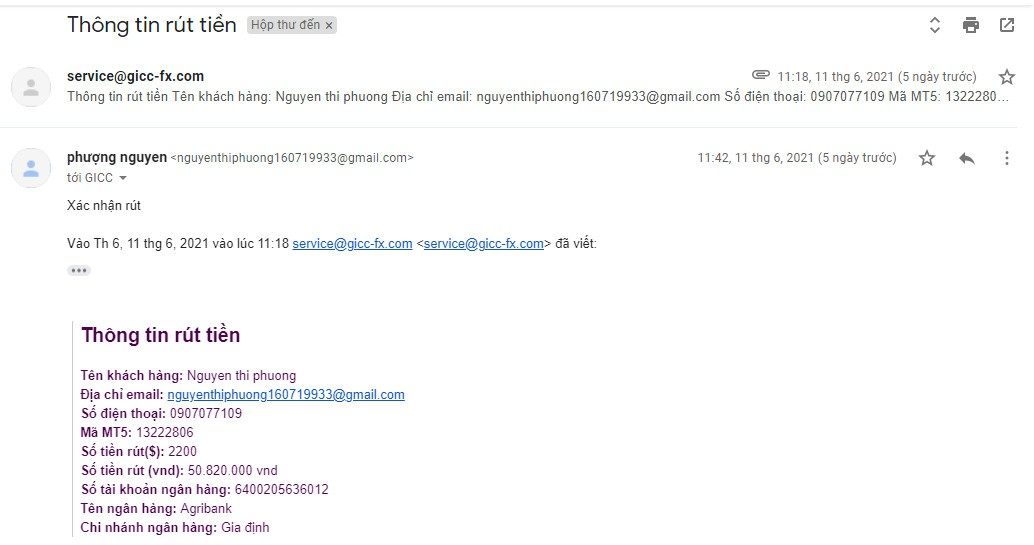

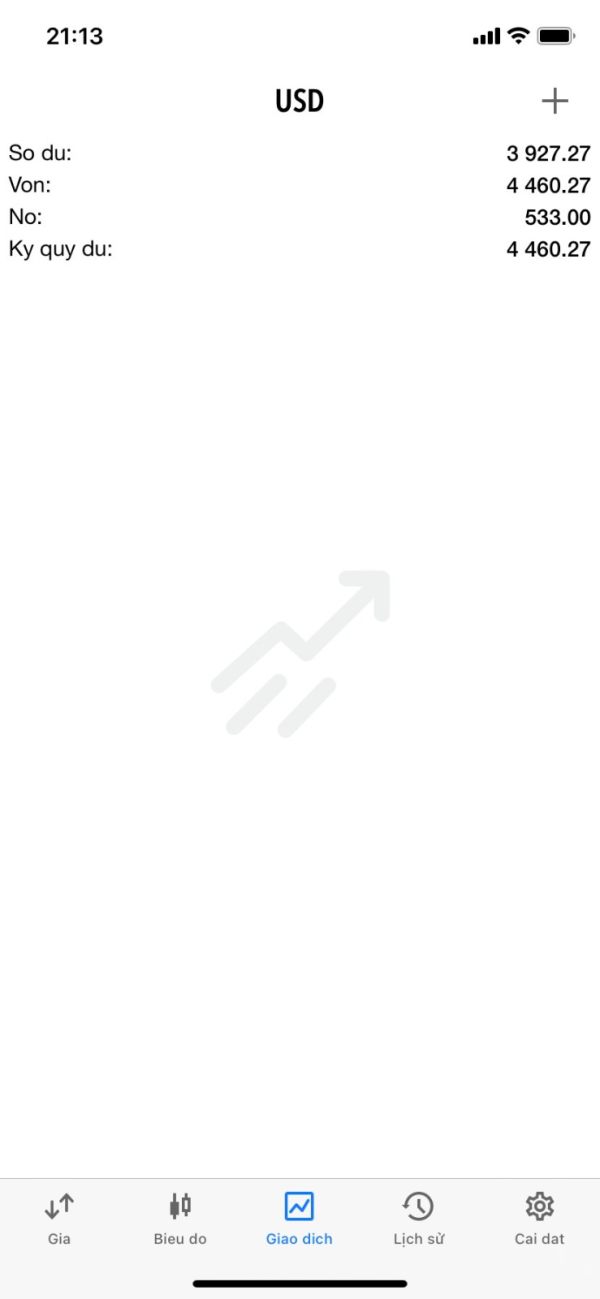

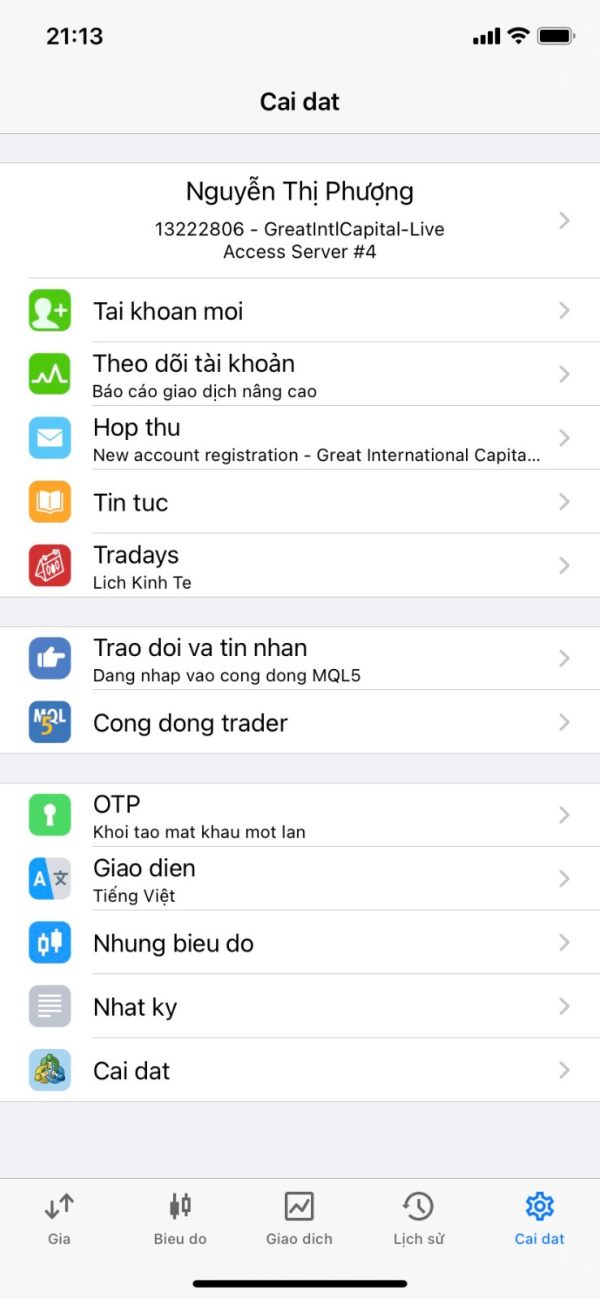

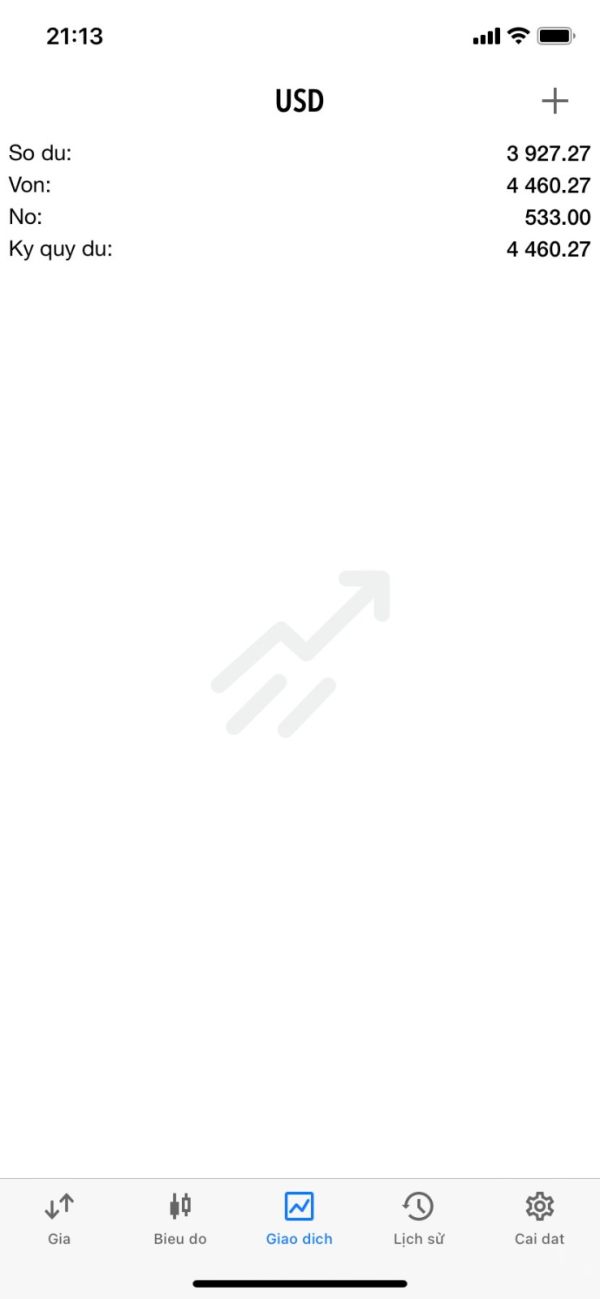

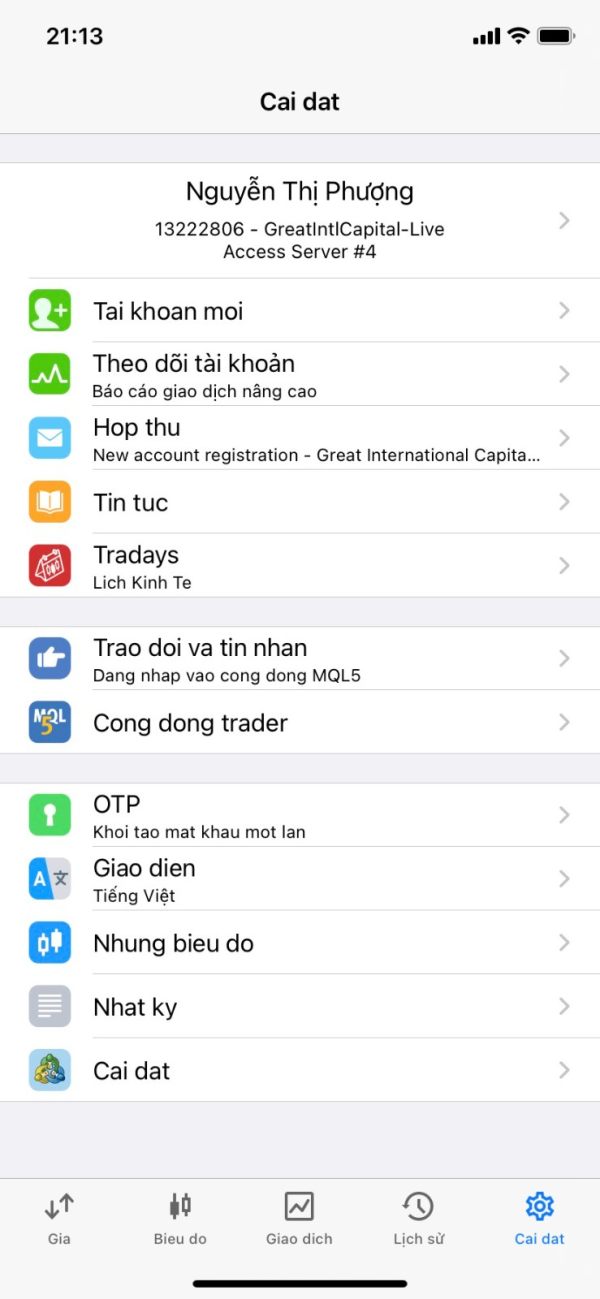

FX2613783092

Vietnam

My name is Nguyen Thi Phuong, and I have been trading on the exchange for a while. My MT5 number is 13222806. After confirmation last Friday (June 11, 2021), I placed the withdrawal order. Going back to the exchange, I just want to withdraw the capital part of $2,200 and keep the profit in the account based on the exchange’s opinion. But until now, I haven't seen money deducted from my MT5 account and the money has not been returned. I hope that the platform will completely solve the issue for me, because I need money to support my family.

Exposure

2021-06-16

FX2613783092

Vietnam

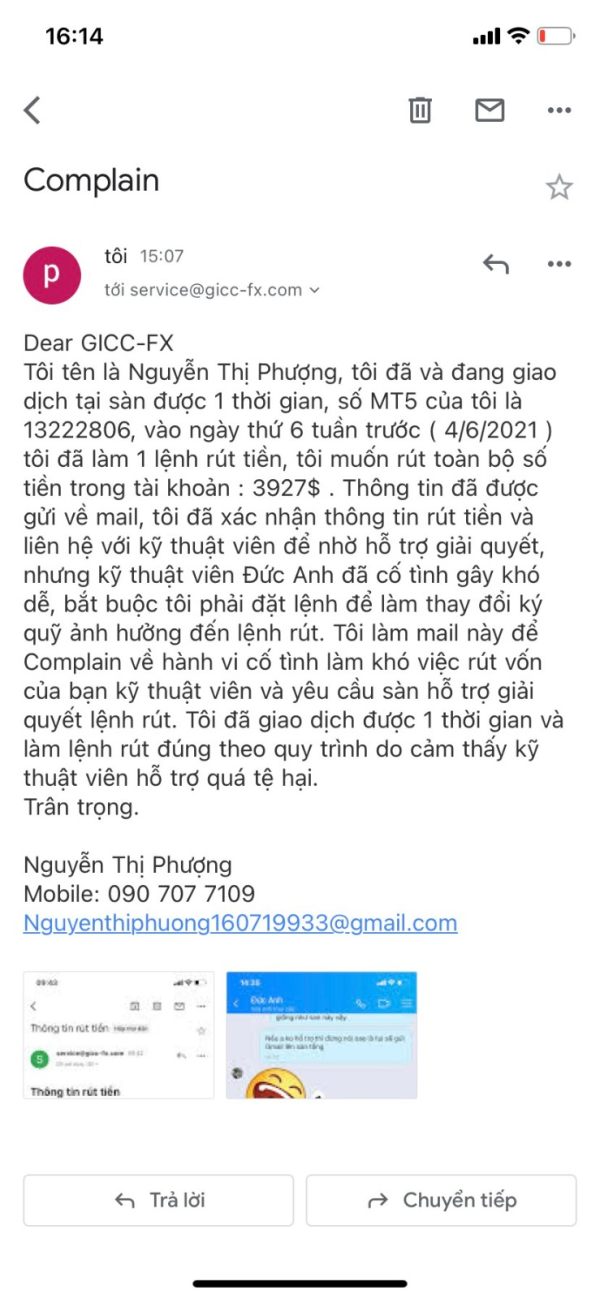

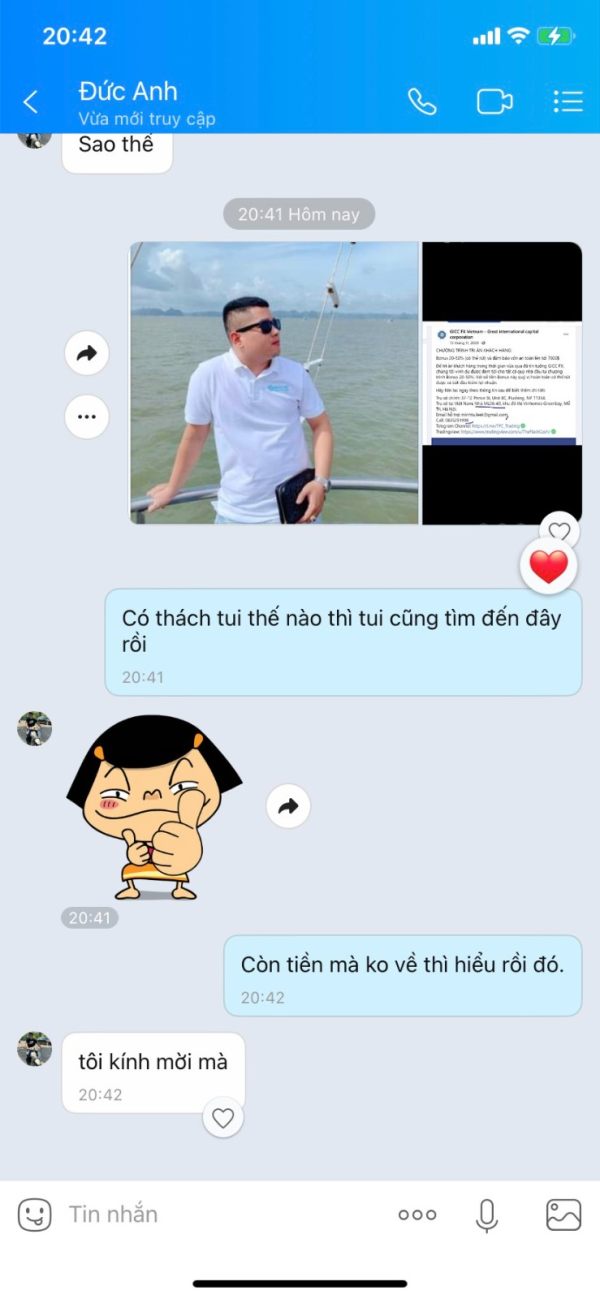

My name is Nguyen Thi Phuong. I traded once on the floor. My MT5 number is 13222806. Last Friday (June 4, 2021) I placed a withdrawal order. I want to withdraw the entire amount in my account: $ 3927. The information has been sent to the mailbox. I have confirmed the withdrawal information and contacted the technical staff for support. However, the Duc Anh technical staff deliberately caused difficulties and forced me to place an order and change the margin to affect the withdrawal order.

Exposure

2021-06-10

FX2613783092

Vietnam

My name is Nguyen Thi Phuong. I traded on the floor once. My MT5 number is 13222806. I made a withdrawal order last Friday (June 4, 2021). I want to withdraw the entire amount in my account: 3927 $. The information has been sent to the mailbox. I have confirmed the withdrawal information and contacted the technical staff for support. However, the Duc Anh technical staff deliberately caused difficulties and forced me to place an order and change the margin to affect the withdrawal order.

Exposure

2021-06-09

FX3241529399

Vietnam

After depositing $340 into the account. I traded by myself and made a little money. But when I asked for a withdrawal, they said that the total amount I had to deposit was $500 to support my withdrawal. Before, they did not mention that they must deposit $500 to withdraw funds. Ground GICC FX is a suspicious exchange.

Exposure

2021-05-14

FX1683684994

Vietnam

I’m Duong Huu Vinh. I invested nearly 100 million VND on this floor. It’s been six months now and I haven’t received any money.

Exposure

2021-05-05

Đức Tuấn

Vietnam

Dear GICC-FX exchange, my name is: Le Duc Tuan, code MT5: 13222425 Currently, I have an investment account on GICC-FX, the code is MT5: 13222225. However, for personal reasons, I need to withdraw funds from the investment account to handle this work. However, the evacuation was difficult, and the explanations of the two support staff were not satisfactory. The word does not match. For example: Technically, you told me to withdraw a sufficient amount of 1.5 pounds. When I reached a sufficient price, I still could not withdraw funds, and the market clerk said that I could withdraw at any time, and never said that I must achieve sufficient trading volume. I asked for proof of this, but so far, there has been no satisfactory answer. Therefore, we hope that your trading floor can consider and resolve it satisfactorily for me. Thank you, and look forward to hearing from you. Le Duc Tuan

Exposure

2021-04-22

FX3297274862

Vietnam

At first, I was asked to recharge $1,000

Exposure

2021-04-10

FX4565780092

Vietnam

GICC FX has no monitoring information on the system of the NFA but in the information to get NFA certification. Cheat!!! Cannot withdraw money.

Exposure

2021-03-26

FX1827031428

Vietnam

This is a scam broker wg=huch adjusts prices from time to time, making u lose money. Do not invest here.

Exposure

2021-02-09

FX1827031428

Vietnam

They said they would compensate me 50% of the 2 orders. But they manipulated the price to make customers lose money

Exposure

2021-02-05

FX1827031428

Vietnam

The quotations here are not right

Exposure

2021-02-04

FX1162655823

Vietnam

My order was frozen after I was subject to technology support's requirements. They asked for more money to help me unfreeze it.....

Exposure

2021-01-27

Rodriguez 06

Pakistan

Terrible experience! Opening an account was easy, but they wanted a million forms of ID. Kinda annoying.

Neutral

08-07

超人队长-超人社区®

New Zealand

GRIC FX's website is no longer open. It seems that there are always many companies in the foreign exchange industry that are short-lived and fail within two years of their establishment. What's worse is that I've seen many people have been scammed out of money by this company...it's quite infuriating.

Positive

2023-03-14

janan&janan

Pakistan

good

Positive

2022-11-08

Pisey

Cambodia

please helps me

Positive

2022-10-10