Score

Fifth Third Bank

United States|2-5 years|

United States|2-5 years| https://www.53.com/content/fifth-third/en.html

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Uganda 4.48

Uganda 4.48Contact

Licenses

Licenses

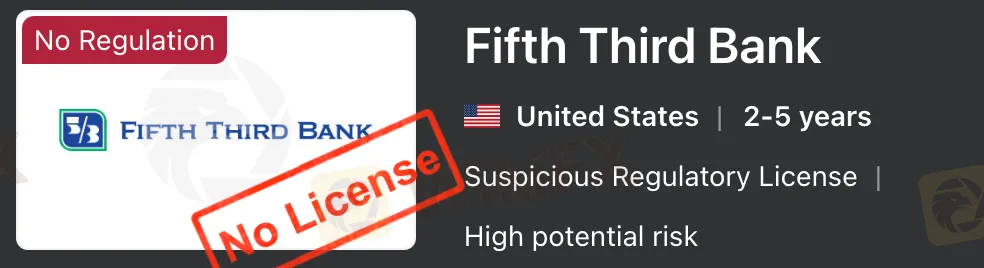

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United States

United StatesUsers who viewed Fifth Third Bank also viewed..

IronFX

- 15-20 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

53.com

Server Location

United States

Website Domain Name

53.com

Website

WHOIS.NETWORKSOLUTIONS.COM

Company

NETWORK SOLUTIONS, LLC.

Domain Effective Date

1995-11-17

Server IP

23.218.22.130

Company Summary

| Fifth Third Bank | Basic Information |

| Company Name | Fifth Third Bank |

| Founded | 1858 |

| Headquarters | United States |

| Regulations | Not regulated |

| Products and Services | Personal Banking, Business Banking, Commercial Banking, Wealth Management |

| Customer Support | 1-866-671-5353 (Customer Support line) |

| Education Resources | Personal Finance topics (Auto Loans, Investment Basics, etc.), Business & Industry topics (Global Banking, Business Management, etc.) |

Overview of Fifth Third Bank

Fifth Third Bank, with its origins dating back to 1858, has evolved into a prominent financial institution headquartered in the United States. Renowned for its longevity and commitment to financial services, the bank operates as a comprehensive provider catering to diverse needs. Offering an array of services encompassing Personal Banking, Business Banking, Commercial Banking, and Wealth Management, Fifth Third Bank positions itself as a multifaceted financial partner.

In the realm of Personal Banking, Fifth Third Bank stands out with a diverse range of offerings, including checking and savings accounts, personal loans, mortgages, and credit cards. The emphasis on digital banking solutions underscores its commitment to providing customers with convenient and modern financial tools. For businesses, the bank provides tailored solutions through Business Banking, catering to the needs of small and medium-sized enterprises. This includes business checking and savings accounts, loans, lines of credit, and essential services like merchant services and treasury management. Furthermore, the bank extends its reach to larger enterprises through Commercial Banking, offering comprehensive financial solutions such as treasury management and capital markets services. Complementing these, Fifth Third Bank's Wealth Management services focus on investment management, financial planning, and estate planning, serving the needs of individuals and families.

Despite its extensive offerings, it's important to note that Fifth Third Bank operates without regulation, a factor that may raise concerns about fund safety and regulatory compliance. This lack of oversight emphasizes the importance of careful consideration when engaging with the bank's services.

Is Fifth Third Bank Legit?

Fifth Third Bank is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Trading with an unregulated broker like Fifth Third Bank carries inherent risks. Without regulatory supervision, there may be limited avenues for dispute resolution, and traders may face challenges in seeking recourse in case of any issues or disputes. Additionally, unregulated brokers may not be subject to stringent financial and operational standards, potentially leading to inadequate client fund protection and unfair trading practices.

Pros and Cons

Fifth Third Bank offers a diverse range of financial services, catering to both individual and business needs. With a history dating back to 1858, the bank brings a sense of stability and experience to its customers. The emphasis on digital banking underscores its commitment to providing convenient and accessible financial solutions. However, the absence of regulation is a notable concern, as it leaves customers without the protection and oversight provided by recognized financial authorities. This lack of regulatory scrutiny raises questions about the safety of funds and the transparency of the bank's operations. Potential limitations in dispute resolution and the risk of unfair practices further highlight the inherent risks associated with banking with an unregulated entity. Prospective clients should weigh the convenience of the bank's services against the potential risks posed by its unregulated status.

| Pros | Cons |

|

|

|

|

|

|

|

|

Products and Services

Personal Banking:

Fifth Third Bank offers a diverse range of personal banking products and services tailored to meet individual financial needs. This includes various checking and savings account options, each designed to provide flexibility and convenience. The bank's personal loans, mortgages, and credit cards offer competitive terms and features. Fifth Third Bank also emphasizes digital banking solutions, allowing customers to manage their accounts, pay bills, and conduct transactions seamlessly through online and mobile platforms.

Business Banking:

For small and medium-sized businesses, Fifth Third Bank provides a suite of business banking solutions. This encompasses business checking and savings accounts, business loans, and lines of credit to support operational needs and expansion. The bank also offers merchant services, treasury management, and business credit cards, aiming to empower businesses with efficient financial tools.

Commercial Banking:

Fifth Third Bank extends comprehensive commercial banking services to larger enterprises. This includes customized financial solutions such as treasury management, capital markets services, and financing options for complex business needs. The bank collaborates with commercial clients to address working capital requirements, navigate cash flow challenges, and facilitate strategic initiatives.

Wealth Management:

Fifth Third Bank's wealth management services cater to individuals and families seeking to grow, manage, and protect their wealth. This encompasses investment management, financial planning, estate planning, and retirement solutions. The bank's team of wealth advisors works closely with clients to create personalized strategies aligned with their financial goals. Additionally, Fifth Third Bank provides access to investment products, private banking services, and trust and estate administration to enhance its wealth management offering.

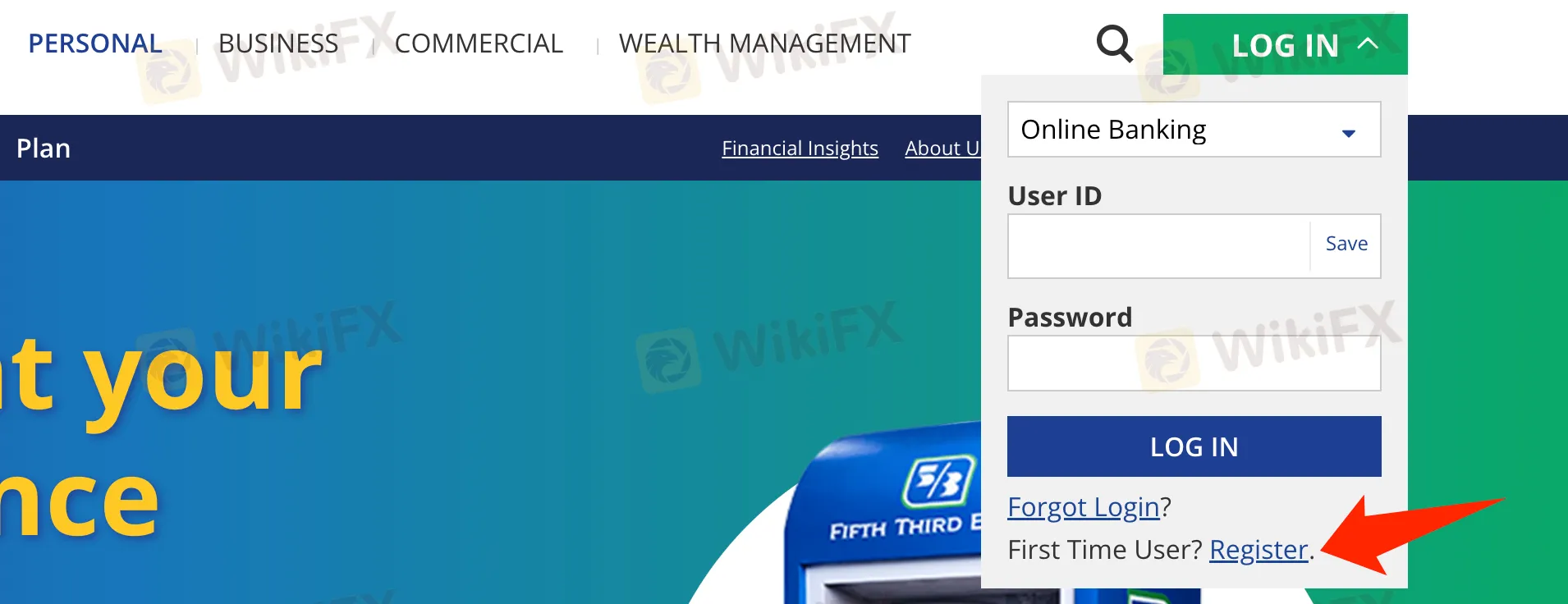

How to Open an Account?

To open an account with Fifth Third Bank, follow these steps.

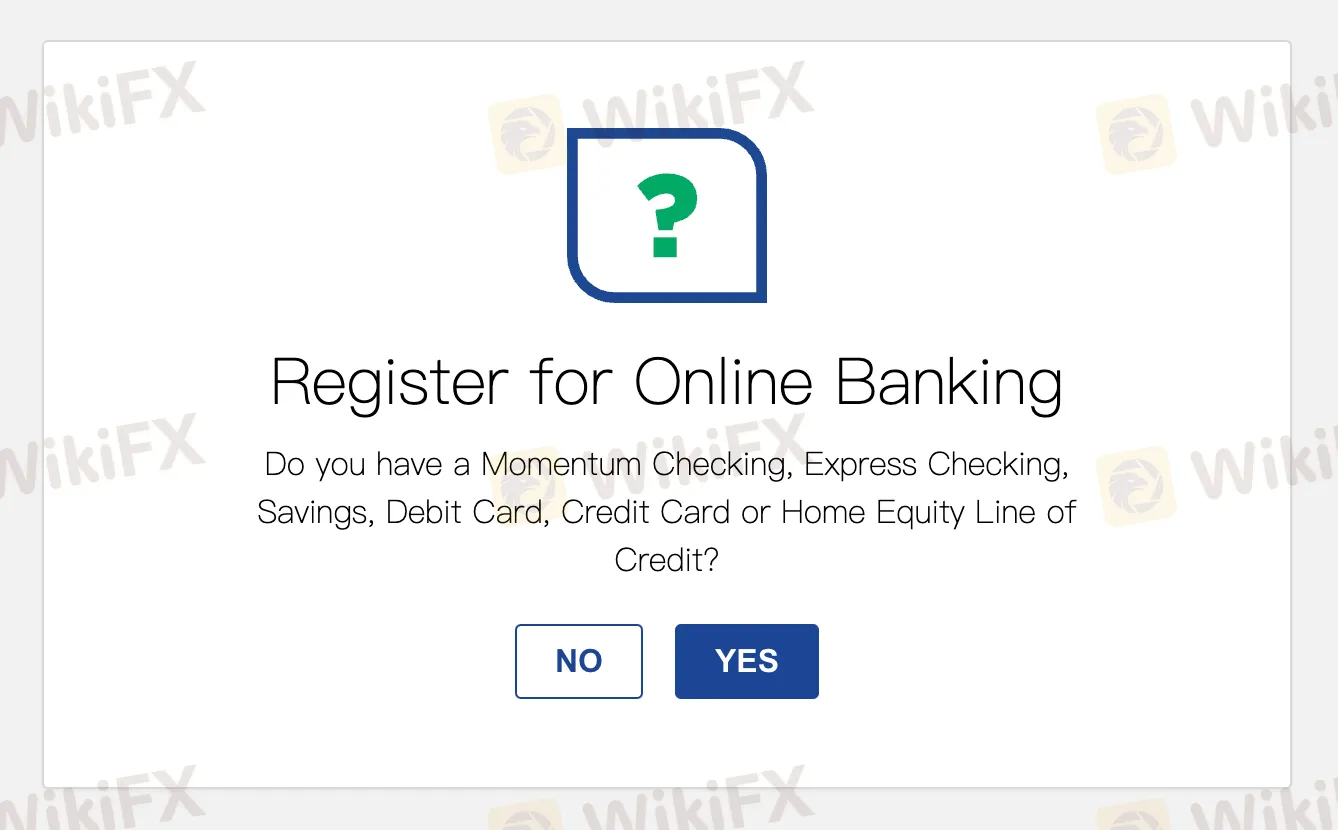

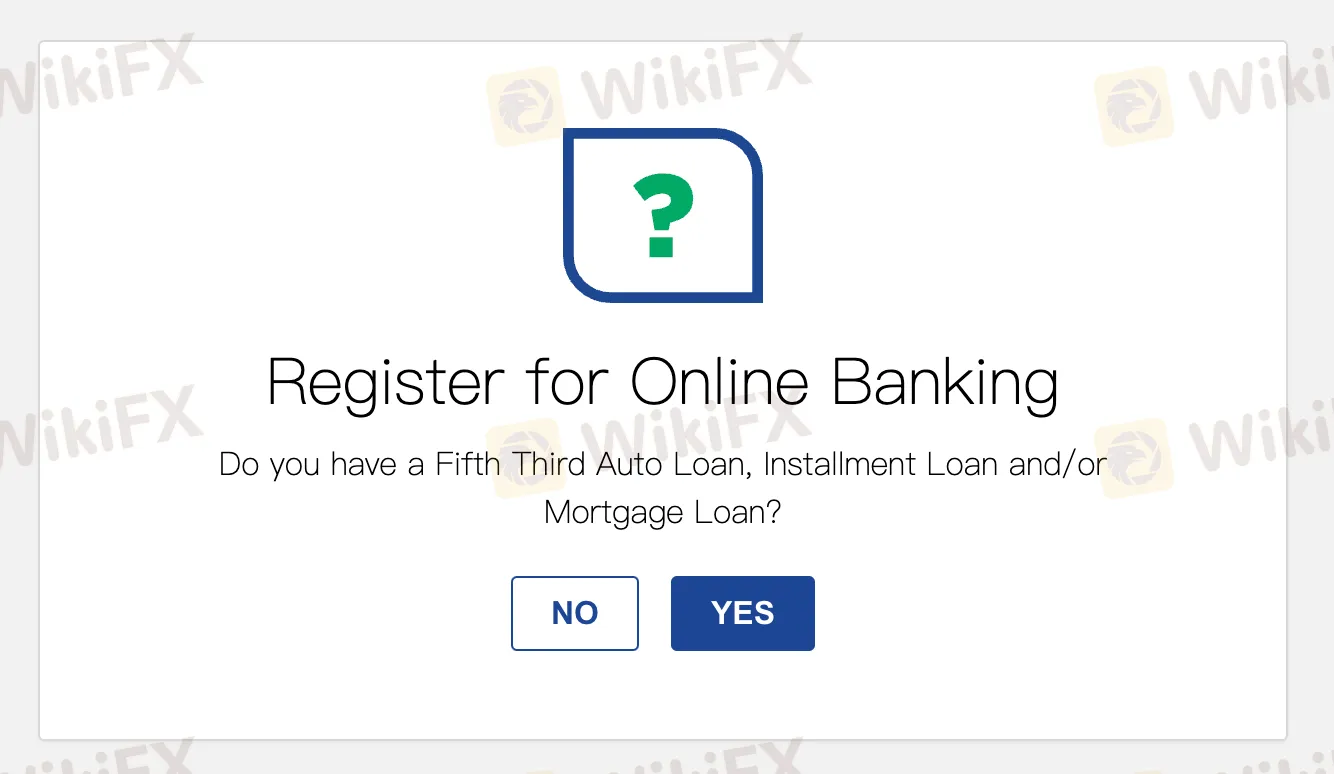

Visit the Fifth Third Bank website. Look for the “Register” button on the homepage and click on it.

2. Depending on the type of account desired (checking, savings, debit card, credit card, or home equity line of credit), complete the registration process.

3. If the user doesn't have specific Fifth Third Bank products, they are guided to proceed with online banking registration.

4. For those with specific loan products or needing further assistance, contact Fifth Third Bank's Customer Service at 1-800-972-3030.

Customer Support

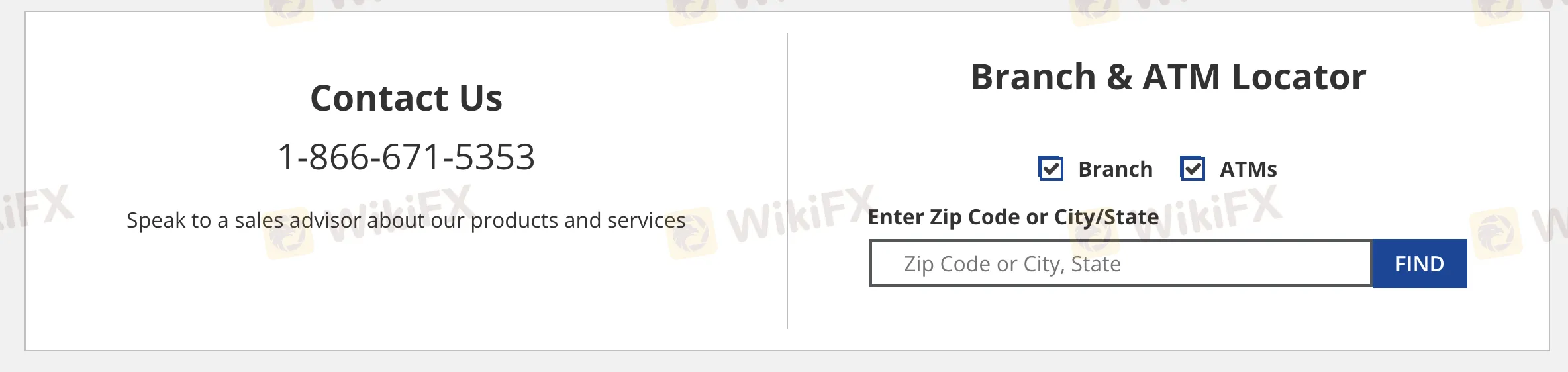

Fifth Third Bank offers comprehensive customer support to address inquiries and provide assistance. Customers can contact the bank through the dedicated Customer Support line at 1-866-671-5353. Whether you have questions about their products or services, a sales advisor is available to provide information and guidance.

Additionally, for those who prefer in-person assistance, Fifth Third Bank has a network of branches and ATMs. The Branch & ATM Locator on their website allows customers to find the nearest branch or ATM by entering their zip code or city/state information. This locator tool enhances accessibility for customers seeking face-to-face interactions or specific banking services available at physical locations. Fifth Third Bank is committed to ensuring that customers have convenient access to the support they need, both digitally and through local branches and ATMs.

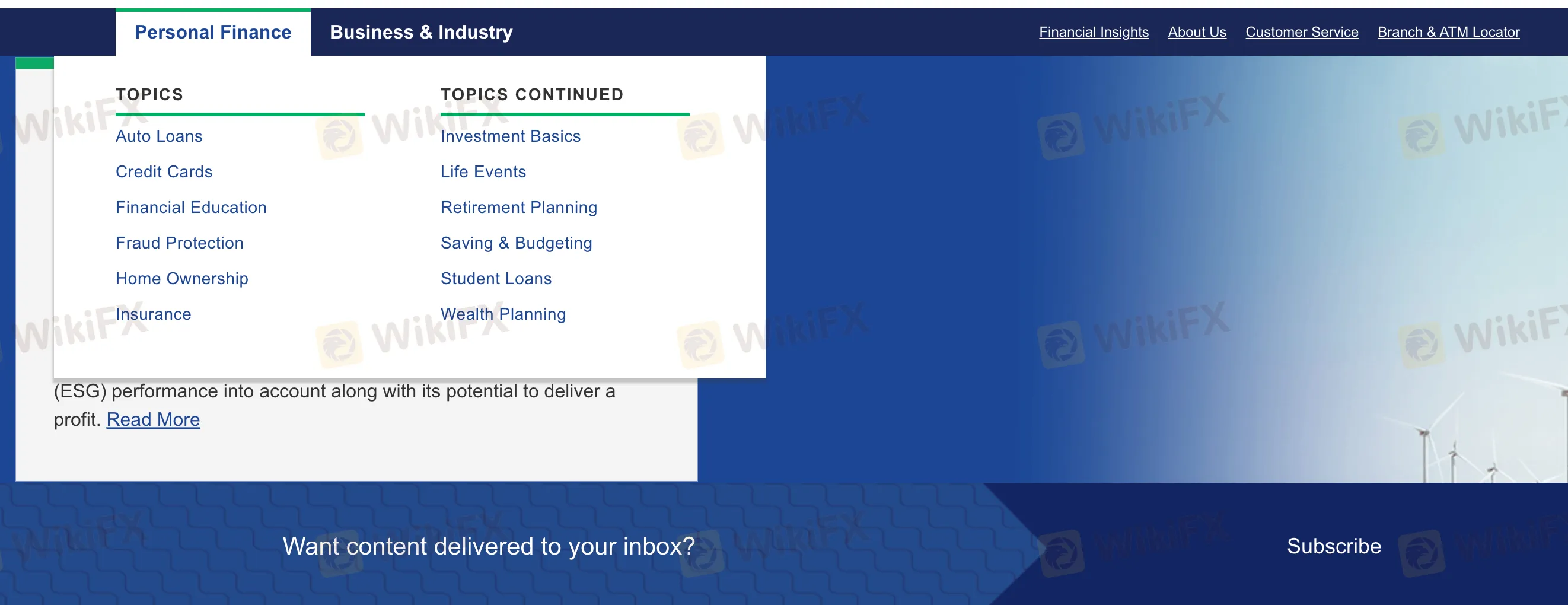

Educational Resources

Fifth Third Bank provides a diverse range of educational resources covering personal finance and business-related topics. In the realm of personal finance, the bank offers insights into crucial areas such as Auto Loans, Investment Basics, Credit Cards, Life Events, Financial Education, Retirement Planning, Fraud Protection, Saving & Budgeting, Home Ownership, Student Loans, Insurance, and Wealth Planning. These resources aim to empower individuals with knowledge and guidance to make informed financial decisions at every stage of life.

For businesses and industries, Fifth Third Bank's educational offerings cover financial, operational, and strategic aspects. Financial topics include Global Banking, Business Management, Insurance, Customer Service, Markets & The Economy, Fraud & Cybersecurity, Succession Planning, Human Resources, Taxes, Marketing, Treasury & Cash Flow, and Operations. Operational topics delve into areas like Grow Your Business, Leadership, Mergers & Acquisitions, Selling Your Business, and Starting a Business. The bank's strategic insights encompass guidance on shaping business strategies for long-term success. Overall, Fifth Third Bank's educational resources cater to both individual and business clients, aiming to enhance financial literacy and foster informed decision-making.

Conclusion

In conclusion, Fifth Third Bank, with its extensive history dating back to 1858, offers a diverse range of financial services, emphasizing convenience and digital banking solutions. The bank provides personal, business, commercial, and wealth management services, catering to a broad spectrum of clients. However, potential disadvantages include the lack of regulatory oversight, raising concerns about safety, transparency, and dispute resolution. While the bank has established itself as a key player in the financial industry, users should carefully consider the associated risks.

FAQs

Q: Is Fifth Third Bank regulated by financial authorities?

A: No, Fifth Third Bank operates without regulation from recognized financial authorities.

Q: What services does Fifth Third Bank offer?

A: Fifth Third Bank provides personal banking, business banking, commercial banking, and wealth management services.

Q: How can I open an account with Fifth Third Bank?

A: To open an account, visit the bank's website, find the “Register” button, and follow the registration process based on the desired account type.

Q: What are the main advantages of Fifth Third Bank?

A: Fifth Third Bank boasts a diverse range of financial services, a long-established history, and a commitment to digital banking for enhanced convenience.

Q: What are the potential disadvantages of banking with Fifth Third Bank?

A: Disadvantages include the lack of regulatory oversight, which may pose concerns regarding safety, transparency, and dispute resolution.

Keywords

- 2-5 years

- Suspicious Regulatory License

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now