Score

PU Markets Ltd

United Kingdom|1-2 years|

United Kingdom|1-2 years| https://www.pufxmarkets.com/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

PU Markets Ltd

PU Markets Ltd

United Kingdom

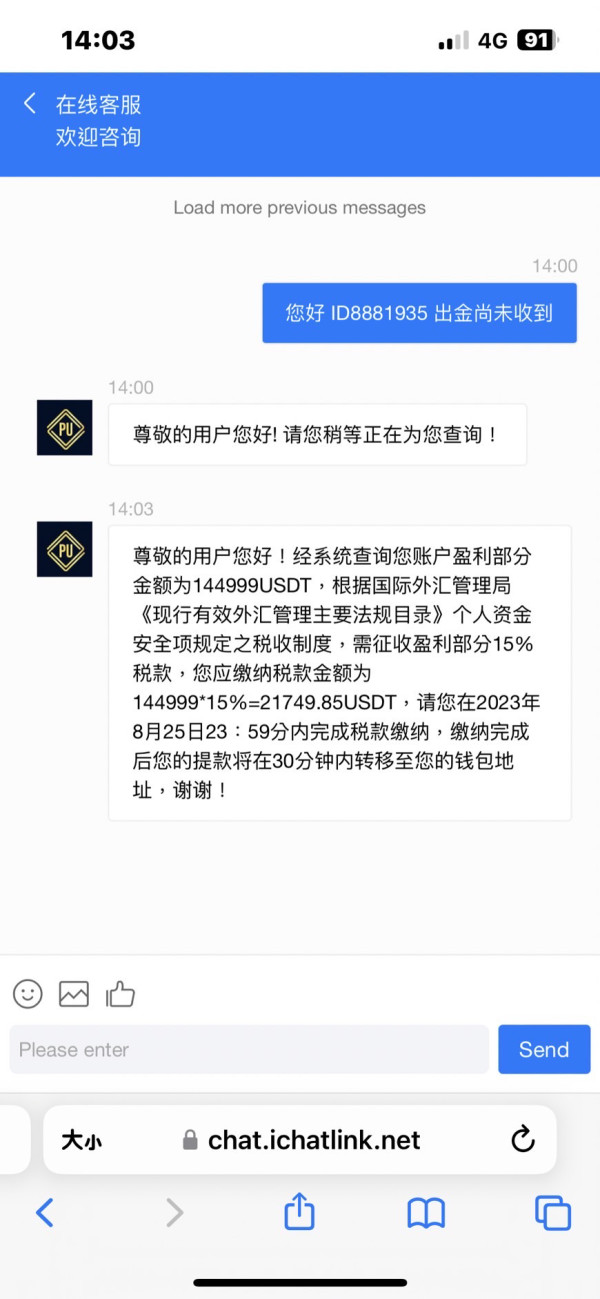

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The United KingdomFCA regulation (license number: 146311) claimed by this broker is suspected to be clone. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed PU Markets Ltd also viewed..

XM

FBS

STARTRADER

Neex

PU Markets Ltd · Company Summary

| Aspect | Information |

| Company Name | PU Markets Ltd |

| Registered Country | United Kingdom |

| Founded Year | 2022 |

| Regulation | Not regulated |

| Minimum Deposit | $20 |

| Maximum Leverage | Up to 1:100 |

| Spreads | Starting from 0.0 pips |

| Trading Platforms | PU Markets Ltd Trading Central |

| Tradable Assets | Stocks, futures, crude oil, gold, Bitcoin, currencies |

| Account Types | Comprehensive, Finance and Financial STP accounts. |

| Customer Support | Limited, email support at service@enjoypumarkets.com |

| Deposit & Withdrawal | Credit cards, debit cards, bank transfers, and e-wallets |

| Educational Resources | Limited educational resources including news& calendar |

Overview of PU Markets Ltd

PU Markets Ltd, founded in 2022 in the United Kingdom, operates without regulatory oversight, potentially posing risks due to the lack of investor protection. This unregulated platform offers a mix of pros, including a diverse range of tradable assets, competitive spreads, high leverage, and a comprehensive trading platform. However, it comes with cons, such as security concerns stemming from past breaches, limited customer support, and a lack of extensive educational resources. PU Markets Ltd enables trading in various instruments like stocks, futures, crude oil, gold, Bitcoin, and currencies, providing opportunities for diversification and exploration across multiple financial markets. Users should exercise caution and perform due diligence when considering this platform.

Is PU Markets Ltd legit or a scam?

PU Markets Ltd operates without any regulatory oversight. This lack of regulation poses potential risks for investors and traders. Regulatory authorities play a crucial role in ensuring transparency, financial stability, and the protection of client funds within the financial industry. In the absence of regulatory supervision, investors may face challenges related to accountability, dispute resolution, and the security of their investments. It's important for individuals considering PU Markets Ltd to be aware of these risks and exercise caution, conducting thorough due diligence before engaging with the platform to make informed investment decisions.

Pros and Cons

| Pros | Cons |

| Diverse Range of Assets | Unregulated |

| Competitive Spreads | Security Concerns |

| Leverage | Limited Customer Support |

| Comprehensive Trading Platform | Limited Educational Resources |

Pros:

Diverse Range of Assets: PU Markets Ltd provides a wide variety of assets, offering opportunities for diversification and exploration across multiple financial markets. Traders can access a comprehensive range of trading instruments, from stocks to cryptocurrencies.

Competitive Spreads: The platform offers competitive spreads starting from 0.0 pips, ensuring cost-effective trading conditions for users. Lower spreads can potentially reduce trading costs and enhance profitability.

Leverage: PU Markets Ltd provides leverage of up to 1:100, allowing traders to amplify their positions significantly.

Comprehensive Trading Platform: PU Markets Ltd Trading Central is a feature-rich platform offering over 50 technical indicators, intraday analysis tools, and a demo account for practice.

Cons:

Unregulated: PU Markets Ltd operates without regulatory oversight, raising concerns about the lack of investor protection and safeguards commonly provided by regulated brokers.

Security Concerns: The platform has experienced security breaches in the past, which can be a significant concern for traders. The history of security issues raises questions about the safety of users' funds and data.

Limited Customer Support: PU Markets Ltd offers limited customer support, lacking options like phone and live chat.

Limited Educational Resources: While the platform provides news and calendar features for staying updated on market events, it may lack more comprehensive educational materials like tutorials and webinars.

Market Instruments

PU Markets Ltd provides a diverse range of assets, allowing you to diversify your investment portfolio and explore multiple financial markets.

Stocks: Explore a wide array of stocks, granting access to numerous companies and sectors for your investments.

Futures: Engage in futures trading, offering opportunities to speculate on the future prices of commodities and financial instruments.

Crude Oil: Seize trading opportunities in the crude oil market, benefiting from the fluctuations in this critical commodity.

Gold: Trade gold, a popular and stable precious metal favored by many investors.

Bitcoin: Enter the world of cryptocurrency with Bitcoin, a pioneering digital asset with significant market potential.

Currencies: Participate in the forex market, with access to a diverse selection of currency pairs, enabling you to capitalize on global currency fluctuations.

Account Types

PU Markets Ltd offers a range of distinct account types to cater to the diverse needs of traders.

Comprehensive Account: The Comprehensive Account is well-rounded, offering a diverse range of trading assets, including CFDs and indices. With leverage of up to 1:100, it provides a competitive edge for traders. It boasts a starting spread of 0.0 pips, ensuring cost-effective trading. A commission of 0.10% applies, and a reasonable minimum deposit of $20 makes it accessible to traders of various levels. Additionally, a demo account is available for practice.Finance Account: Designed for those inclined towards Forex, commodities, and cryptocurrencies, the Finance Account offers leverage of up to 1:100, matching the Comprehensive Account. It maintains competitive pricing with spreads starting from 0.0 pips and a lower commission rate of 0.05%. A minimum deposit of $200 is required. As with the other account types, a demo account is provided for users to refine their trading skills.

Financial STP Account: The Financial STP Account is tailored for traders interested in Forex, commodities, and cryptocurrencies. It offers a competitive leverage of up to 1:100, similar to the other accounts. With spreads starting at 0.0 pips and the lowest commission rate at 0.02%, it ensures cost-effective trading. However, a higher minimum deposit of $2,000 is necessary. A demo account is also accessible for practicing and honing trading strategies.

| Aspects | Comprehensive | Finance | Financial STP |

| Trading assets | CFD, Indexs | Forex, commodities, cryptocurrencies | Forex, Commodities, Cryptocurrencies |

| Leverage | Up to 1:100 | Up to 1:100 | Up to 1:100 |

| Spread | Starts from 0.0 pips | Starts from 0.0 pips | Starts from 0.0 pips |

| Commission | 0.10% | 0.05% | 0.02% |

| Minimum Deposit | $20 | $200 | $2,000 |

| Demo Account | Yes | Yes | Yes |

How to Open an Account?

Opening a PU Markets Ltd Account in 6 Simple Steps:

Step 1: Access PU Markets Ltd

Visit the official PU Markets Ltd website through your preferred web browser. https://servicepull.com/

Step 2: Account Creation

On the website's homepage, locate and click on the “Create Account” or “Sign Up” button to initiate the account creation process.

Step 3: Choose Account Type

Select the account type that aligns with your trading preference. You can opt for a demo account for practice or a real money account for live trading.

Step 4: Personal Information

Fill out the registration form with accurate personal details, including your name, email address, phone number, and residential country.

Step 5: Deposit Funds

Fund your newly created PU Markets Ltd account. The platform supports various payment methods for your convenience.

Step 6: Start Trading

With your account funded, you can commence trading through the mobile app, desktop app, or web browser. Begin exploring the diverse trading assets and features offered by PU Markets Ltd. Trade responsibly and stay informed about market developments throughout your trading journey.

Leverage

PU Markets Ltd provides leverage of up to 1:100 for all forex and CFD trading pairs, allowing you to trade positions that are 100 times the size of your initial deposit. This leverage feature amplifies your trading capacity and potential returns.

Spreads & Commissions

PU Markets Ltd offers exceptionally competitive trading conditions. The spreads on all account types start from an impressive 0.0 pips, ensuring cost-effective trading. Commissions vary with each account type, ranging from 0.02% to 0.10%, providing flexibility in cost structures for traders.

| Aspects | Comprehensive | Finance | Financial STP |

| Spread | Starts from 0.0 pips | Starts from 0.0 pips | Starts from 0.0 pips |

| Commission | 0.10% | 0.05% | 0.02% |

Trading Platform

PU Markets Ltd utilizes its comprehensive trading platform, PU Markets Ltd Trading Central, which offers the following key features:

Extensive Technical Tools: The platform provides more than 50 technical indicators and intraday analysis tools, making it a robust choice for charting and in-depth analysis.

Demo Account: Users can access a demo account, enabling them to practice trading with virtual funds without limitations. This feature is particularly valuable for individuals looking to gain trading experience without financial risk.

Diverse Asset Offerings: The platform consolidates a wide range of assets, including forex, synthetic indices, stocks, stock indices, and cryptocurrencies. This provides traders with a single platform to access multiple asset classes.

24/7 Trading Access: PU Markets Ltd Trading Central offers continuous trading access, even on weekends. This feature enhances flexibility and accessibility, allowing users to trade at their convenience.

Deposit & Withdrawal

PU Markets Ltd offers flexibility when it comes to deposit and withdrawal methods. Users can choose from a variety of options, including credit cards, debit cards, bank transfers, and e-wallets. The minimum deposit requirements are as follows:

Comprehensive Account: $20

Finance Account: $200

Financial STP Account: $2,000

| Aspects | Comprehensive | Finance | Financial STP |

| Minimum Deposit | $20 | $200 | $2,000 |

Deposit and withdrawal processing times may vary depending on the selected method. Generally, credit and debit card deposits are processed promptly. Bank transfers may take longer due to standard banking procedures. E-wallets offer the advantage of faster processing times and the convenience of digital transactions.

Customer Support

PU Markets Ltd's customer support is limited in its scope, lacking phone and live chat support options. The sole channel for reaching out to the company is through email at service@enjoypumarkets.com. While email can be an effective mode of communication, the absence of more immediate support channels like phone or live chat may impact the responsiveness and availability of customer assistance.

Investors and traders should take into account these limitations in customer support when dealing with PU Markets Ltd, ensuring they are comfortable with the available means of communication for addressing inquiries or resolving issues on the platform.

Educational Resources

PU Markets Ltd's educational resources include news and calendar features. While these resources can be valuable for staying updated on market events and economic releases, they primarily focus on news and calendar functionalities.

However, it's important to note that PU Markets Ltd may lack more comprehensive educational materials like tutorials, webinars, or articles for in-depth learning. Traders seeking extensive educational support to enhance their trading knowledge might need to explore external sources to complement their education.

Conclusion

In conclusion, PU Markets Ltd presents an enticing array of trading assets and features, catering to traders seeking diversity and competitive conditions. However, its unregulated status and historical security concerns raise important questions about investor protection and overall platform safety. The absence of robust customer support options and limited educational resources further indicate areas where the platform falls short. While PU Markets Ltd offers opportunities, investors should be cautious, conduct thorough research, and carefully evaluate the associated risks before engaging with the platform. Making informed investment decisions is paramount in this unregulated environment.

FAQs

Q: Is PU Markets Ltd regulated by any financial authorities?

A: No, PU Markets Ltd operates without any regulatory oversight.

Q: What types of assets can I trade with PU Markets Ltd?

A: You can trade a diverse range of assets, including stocks, futures, crude oil, gold, Bitcoin, and various currencies.

Q: What is the leverage offered by PU Markets Ltd?

A: PU Markets Ltd provides leverage of up to 1:100 for all forex and CFD trading pairs.

Q: Does PU Markets Ltd have a demo account for practice?

A: Yes, PU Markets Ltd offers a demo account for users to practice trading with virtual funds.

Q: What is the minimum deposit required to open an account with PU Markets Ltd?

A: The minimum deposit varies based on the account type, starting from $20.

Q: How can I contact customer support at PU Markets Ltd?service@enjoypumarkets.com, as PU Markets Ltd does not offer phone or live chat support.

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now