Score

EDGE Finance

United Kingdom|1-2 years|

United Kingdom|1-2 years| https://edgefinance.ltd/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Disclosure

Danger

Contact number

Other ways of contact

Broker Information

More

EDGE Finance

EDGE Finance

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:50 |

| Minimum Deposit | 5000$ |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:35 |

| Minimum Deposit | 1000$ |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:20 |

| Minimum Deposit | 250$ |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed EDGE Finance also viewed..

XM

Decode Global

IC Markets Global

MultiBank Group

EDGE Finance · Company Summary

| Edge Finance Review Summary | |

| Registered Country/Region | China |

| Regulation | Unregulated |

| Market Instruments | Forex, stock, indices, commodities |

| Demo Account | Available |

| Leverage | 1:1 - 1:200 |

| EUR/USD Spread | 1.05 pips |

| Minimum Deposit | $250 |

| Trading Platforms | WebTrader |

| Customer Support | Enquiry form, email |

What is Edge Finance?

Edge Finance, based in China, offers a range of financial services to its clients. While it operates without regulatory oversight, it provides access to an array of market instruments, including forex, stocks, indices, and commodities. With the availability of a demo account, traders can hone their skills and strategies without risk, and competitive leverage of up to 1:200 is at their disposal. The EUR/USD spread starts at 1.05 pips, making it accessible to various traders, and the minimum deposit requirement of $250 caters to those looking to get started with different account options. The user-friendly WebTrader platform and diverse customer support channels, encompassing enquiry form, email, contribute to a comprehensive trading experience with Edge Finance.

Pros & Cons

| Pros | Cons |

| • Various trading instruments | • No regulations |

| • Instant execution | • Limited leverage compared to some competitors |

| • No commission for withdrawal and deposit | • Restricted access in certain countries |

Pros:

• Various trading instruments: This extensive range offers traders a diverse selection, aiding in portfolio diversification and alignment with individual trading strategies.

• Instant execution: Ensures immediate order fulfillment, particularly vital in fluctuating markets where prices can shift swiftly.

• No commission for withdrawal and deposit: A transparent pricing structure aids traders in precisely determining their potential costs and profits and investors do not have to pay commissions for withdrawal and deposit.

Cons:

• No regulations: Doubts surrounding a platform's regulatory status can be concerning. Proper regulation guarantees that the broker adheres to lawful and ethical standards, safeguarding traders from potential malpractices.

• Limited leverage compared to some competitors: While Edge Finance offers up to 1:200 leverage, for silver accounts, the leverage limit is only 1:20, which will not fulfill needs for risk-seeking investors.

• Restricted access in certain countries: Edge Finance caters to most international traders.Traders from Iran or USA will not be able to access or use the platform, limiting its global reach.

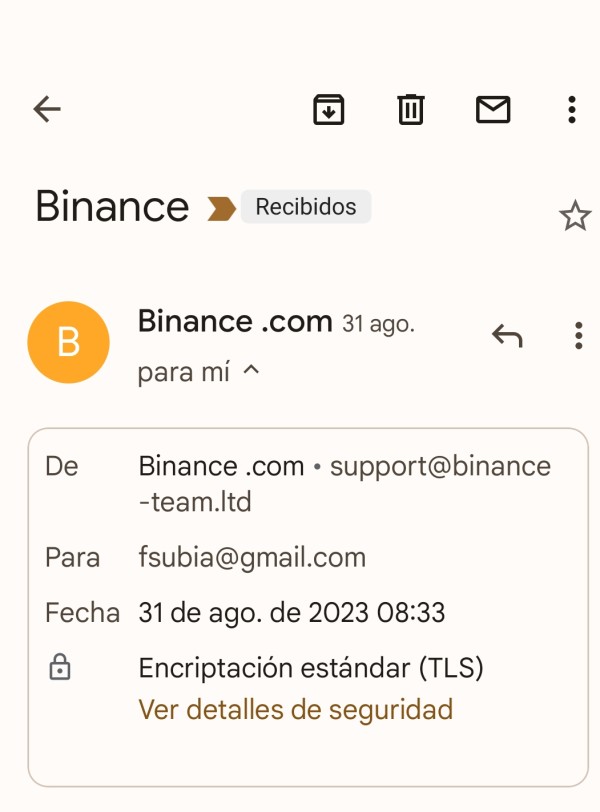

Is Edge Finance Safe or Scam?

When considering the safety of a brokerage like Edge Finance or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: It is not regulated by any major financial authorities,which means that there is no guarantee that it is a safe platform to trade with.

User feedback: 1 report of scam on WikiFX should be taken into consideration as potential red flags. It is recommended to conduct thorough research and due diligence before engaging with any financial institution or investment platform.

Security measures: Edge Finance has implemented policies such as negative balance protection to secure investors' money and protect privacy.

Ultimately, the decision of whether or not to trade with Edge Finance is a personal one. You should weigh the risks and benefits carefully before making a decision.

Market Instruments

Edge Finance boasts a comprehensive and diverse array of market instruments, catering to the varied needs of its global clientele. From traditional forex trading to CFDs, the platform provides multiple avenues for potential investment. Here are some examples of the instruments available:

Currency Pairs Trading

The Forex segment at Edge Finance features traditional instruments for this market, such as currency pairs. These pairs express the value of one currency in terms of another.

World Indices CFD Trading

Instruments in this category allow traders to engage with indices from leading stock exchanges. The pricing of these instruments is set in the local currency of each specific index.

Online Stock CFD Trading

This segment comprises CFDs on highly liquid stocks from companies listed on major global stock markets.

Commodities CFDs Trading

You can buy commodities directly, but you will need to pay commissions for storage of products, as well as resolve issues with supplies. Therefore, EDGE Finance invites you to act through CFDs. It is much more profitable and easier than trading the underlying asset.

Accounts & Leverage

Edge Finance offers 5 types of accounts with specific information illustrated in the tables below:

| Silver | Glod | Platinum | VIP | PRO | |

| Minimum Deposit | $250 | $1000 | $5000 | $10000 | $15000 |

| Leverage | 1:20 | 1:35 | 1:50 | 1:100 | 1:200 |

| Maximum Order | 10 lots | 15 lots | 20 lots | 25 lots | 30 lots |

| Minimum Order | 0.01 lots | ||||

| Negative balance protection | Yes | ||||

| Limited asset selection | Yes | ||||

| Support | Yes | ||||

| Tight spreads | Yes | ||||

Trading Platforms

Edge Finance's trading platform, WebTrader, is a valuable tool for traders seeking to enhance their investment experience. Packed with an array of features, it's designed to simplify and optimize your trading journey. With access to advanced indicators and charts, traders can make informed decisions with the latest analytical tools at their fingertips. What makes WebTrader even more convenient is its compatibility with all devices, ensuring that you can manage your investments from your computer, tablet, or smartphone seamlessly.

The platform facilitates instant order execution and offers a diverse selection of assets, allowing you to diversify your portfolio effectively. Should you require assistance or have inquiries, the 24/7 online support ensures that help is readily available, contributing to a smoother and more profitable trading experience. With these advantages, Edge Finance's WebTrader is a powerful resource on the path to successful trading.

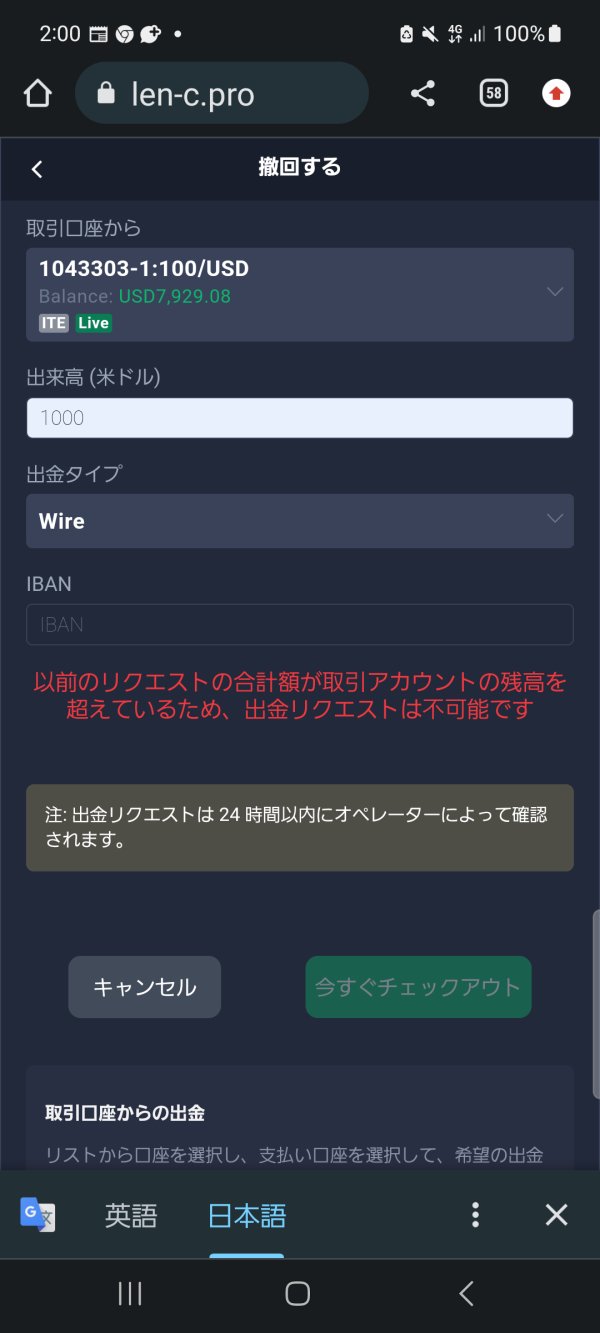

Deposits & Withdrawals

Edge Finance provides its users with a diverse array of deposit and withdrawal methods, catering to the varied preferences of its global clientele.

Edge Finance prides itself on providing a seamless and cost-effective deposit and withdrawal process for its clients. One of the standout features is the absence of commissions, ensuring that your funds are used for trading rather than unnecessary fees.

Clients can conveniently deposit and withdraw funds using popular methods, including Mastercard and Visa, which are widely recognized and trusted by traders worldwide. Additionally, Piastrix and wire transfer options offer flexibility to cater to individual preferences. This commitment to accessible and commission-free transactions underlines Edge Finance's dedication to delivering a user-friendly financial environment.

Users should note that while Edge Finance ensures flexibility in deposits, withdrawal of funds might be subject to commissions from the payment system. These commissions can change without prior notice as determined by the respective payment systems.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Working Hours: Mon - Fr: 10am - 7pm

Enquiry Form

Email: compliance@edgefinance.ltd

Conclusion

Edge Finance, headquartered in China, provides a wide range of financial services, including forex, stocks, indices, and commodities, making it accessible to a broad spectrum of traders. Despite its unregulated status, it offers a low minimum deposit of $250 and competitive leverage of up to 1:200, catering to traders of different experience levels. However, the lack of regulatory oversight is a potential concern for investors, and they should conduct thorough research before committing.

Edge Finance emphasizes transparency in pricing and offers demo accounts for risk-free practice. The platform provides multiple account types, each with specific minimum deposit requirements and leverage options, ensuring flexibility. Deposits and withdrawals are commission-free, further enhancing convenience. It's important to note that withdrawal fees may apply depending on the chosen payment method. Customer support is available via an enquiry form and email during specific working hours. While Edge Finance offers a comprehensive trading experience, traders should be aware of the lack of regulation and carefully consider their options and risk tolerance.

Frequently Asked Questions (FAQs)

| Q 1: | Is Edge Finance regulated? |

| A 1: | No, it is not. |

| Q 2: | What is the minimum deposit amount required by Edge Finance? |

| A 2: | Minimum allowed deposit amount depends on the trading account type. For the Silver account, the minimum deposit is $250. |

| Q 3: | Does Edge Finance offer demo accounts? |

| A 3: | No. |

| Q 4: | At Edge Finance, are there any regional restrictions for traders? |

| A 4: | Edge Finance does not accept clients from certain countries/regions, including the United States. Iran, and Israel. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now