Score

IPCAPITAL

Canada|2-5 years|

Canada|2-5 years| https://iprimecapital.com/full/en

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Ecuador 4.08

Ecuador 4.08Surpassed 14.10% brokers

Contact

Licenses

Single Core

1G

40G

Disclosure

Danger

Contact number

+6046158137

Other ways of contact

Broker Information

More

INTELLIGENCE PRIME CAPITAL LTD.

IPCAPITAL

Canada

- https://iprimecapital.com/full/en

- https://member.lprimecapital.com/Account/Login

- https://member.iprimekapital.com/Account/Login/

- https://iprimecapitalbot.com/about-us/

- https://iprimecapitalbot.com/

- https://iprime-capital.com/

- https://ipcteam.tech/ib188361f-en/

- https://intelligenceprimecapital.com/

- https://intelligenceprimecapital-bot.com/

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 320 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- AustraliaASIC (license number: 001294622) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed IPCAPITAL also viewed..

XM

FP Markets

IC Markets Global

ATFX

IPCAPITAL · Company Summary

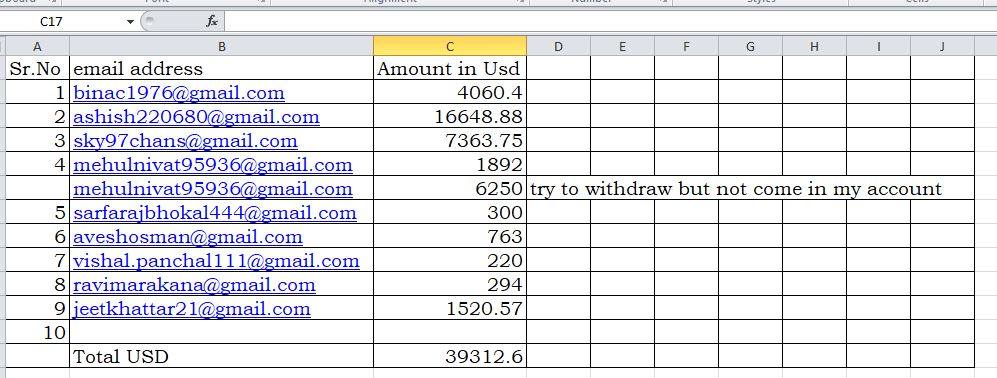

| Aspect | Information |

| Registered Country/Area | Canada |

| Founded Year | 1-2 years |

| Company Name | IPCAPITAL |

| Regulation | Regulated by the Australian Securities & Investment Commission (ASIC) |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 400:1 |

| Spreads | Not specified |

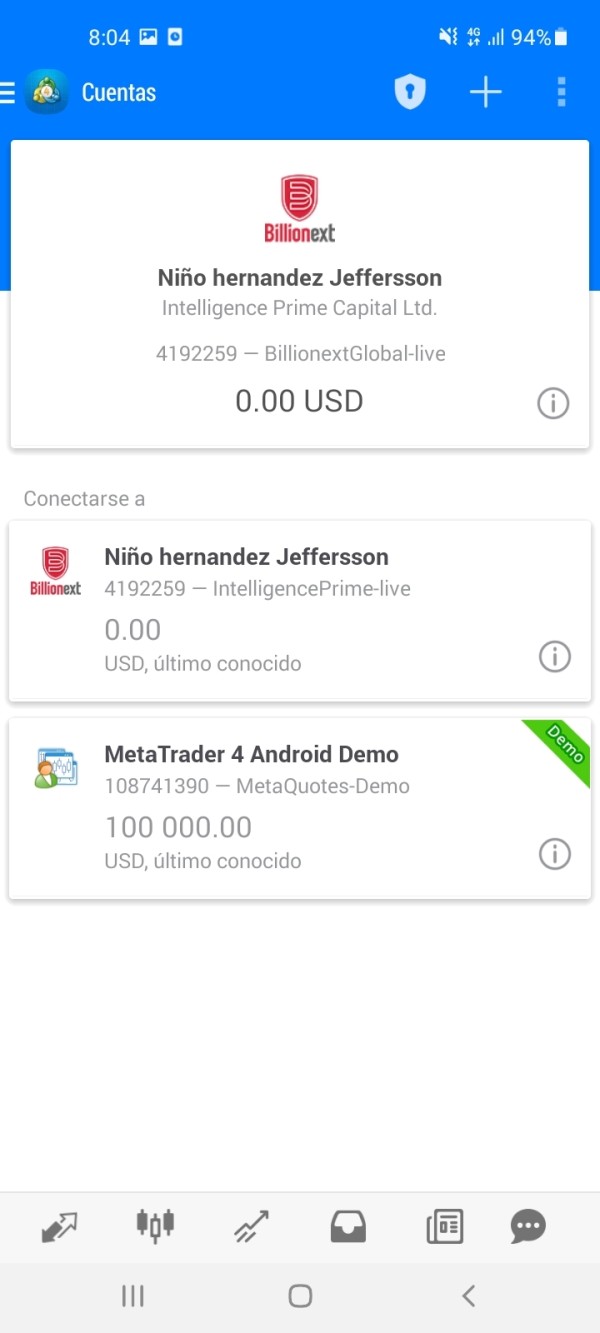

| Trading Platforms | MT4, WebTrader, IPCAPITALgO, IPCSocial App, ZuluTrade, DupliTrade |

| Tradable Assets | Forex currency pairs, cryptocurrencies, stocks, commodities, indices |

| Account Types | SMART BOT, BRILLIANT BOT, GENIUS BOT |

| Demo Account | Not specified |

| Customer Support | Online chat, email, social media, Chinese (Simplified) phone number |

| Payment Methods | Not specified |

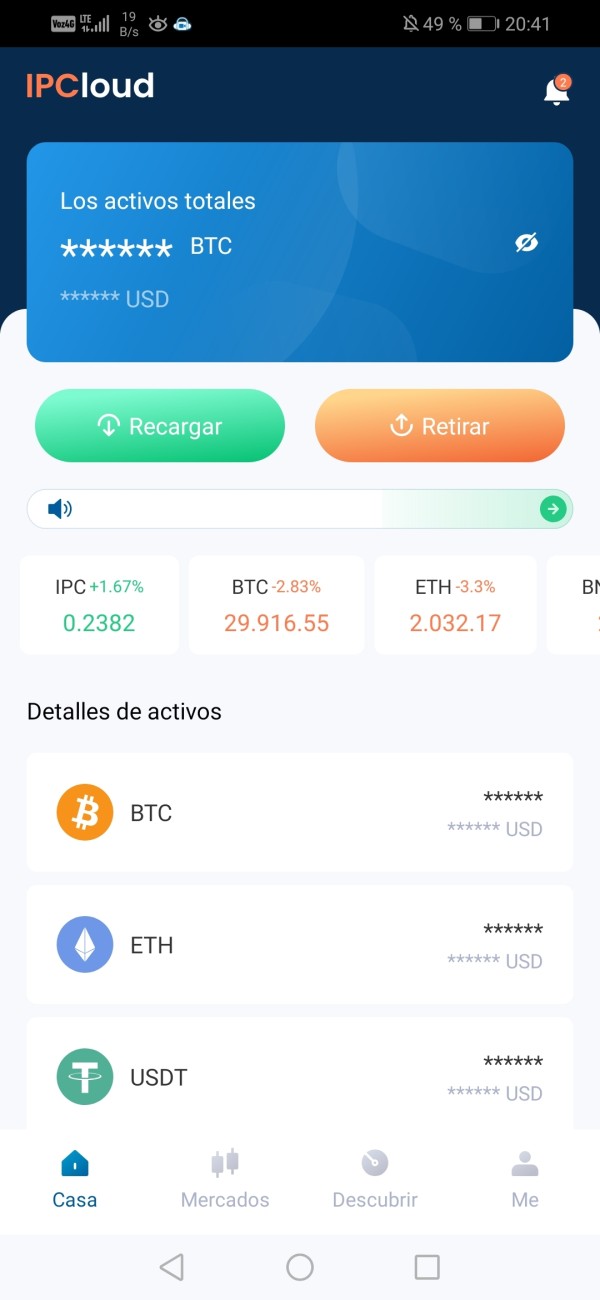

| Trading Tools | AIA BOT system, IPCCLOUD |

General Information

IPCAPITAL is a financial institution operating under the licensed institution INTELLIGENCE PRIME CAPITAL FINANCIAL ADVISORY PTY LTD. It is regulated by the Australian Securities & Investment Commission (ASIC) and holds an Appointed Representative (AR) license. However, IPCAPITAL has received a significant number of complaints according to WikiFX, a platform that tracks complaints and provides risk assessments for brokers. It is listed in their complaint blacklist, and caution is advised when dealing with them.

IPCAPITAL offers a range of market instruments, including forex currency pairs, cryptocurrencies, stocks, commodities, and indices. They provide different account types with varying features, such as the SMART BOT, BRILLIANT BOT, and GENIUS BOT subscriptions, which claim to offer different levels of returns on investment.

The broker offers leverage of up to 400:1 for forex and indices trading, allowing traders to control larger positions with a smaller amount of capital. However, the specific details of spreads and commissions are not mentioned.

There is no specific information about the minimum deposit requirement or supported payment methods for IPCAPITAL.

Traders can choose from various trading platforms, including MT4, WebTrader, IPCAPITALgO, IPCSocial App, ZuluTrade, and DupliTrade. These platforms cater to different trading preferences and offer features such as charting tools, real-time market data, and social trading options.

IPCAPITAL provides trading tools such as the AIA BOT system, which utilizes AI algorithms, and IPCCLOUD, a diversified asset management platform.

Customer support is available through online chat, email, and social media platforms. However, negative reviews suggest difficulties with fund withdrawals, lack of communication channels, and allegations of fraudulent activities.

Pros and Cons

IPCAPITAL has both pros and cons that should be considered before engaging with their services. On the positive side, they offer a diverse range of market instruments, including forex, cryptocurrencies, stocks, commodities, and indices. Their leverage of up to 400:1 provides traders with the opportunity to control larger positions with a smaller capital investment. IPCAPITAL also offers a variety of trading platforms, including popular options like MT4, WebTrader, and IPCSocial App. Additionally, their trading tools, such as the AIA BOT system and IPCCLOUD, aim to enhance trading decisions and provide asset management options.

However, there are some concerning aspects. IPCAPITAL has received a significant number of complaints, as listed on WikiFX's complaint blacklist, which raises doubts about their reliability. The lack of specific information regarding spreads, commissions, and minimum deposit requirements makes it challenging to assess the trading costs involved. Negative reviews suggest difficulties in fund withdrawals and a lack of communication channels, which may leave traders feeling frustrated and dissatisfied. It is crucial to carefully consider these pros and cons and conduct thorough research before making any investment decisions.

| Pros | Cons |

| Regulated by ASIC | Numerous complaints and negative reviews on fund withdrawals |

| Wide range of market instruments | Lack of communication channels for addressing concerns |

| Multiple trading platforms | Allegations of fraudulent activities |

| High leverage potential | Lack of specific information on Spreads & Commissions and Deposit & Withdraw |

| AIA BOT system and IPCCLOUD platform |

Is IPCAPITAL Legit?

Based on the information provided, it appears that IPCAPITAL, operating under the licensed institution INTELLIGENCE PRIME CAPITAL FINANCIAL ADVISORY PTY LTD, is regulated by the Australian Securities & Investment Commission (ASIC). They hold an Appointed Representative (AR) license and their license number is 001294622. The effective date of their license is December 20, 2021.

However, it is important to note that the information also indicates a warning from WikiFX, a platform that tracks complaints and provides risk assessments for brokers. According to WikiFX, IPCAPITAL has received a significant number of complaints (319 in the past 3 months) and is listed in their complaint blacklist. The warning suggests being cautious and aware of the potential risks and the possibility of it being a scam.

Market Instruments

IPCAPITAL provides traders with a wide range of market instruments to trade. Here is a breakdown of the market instruments available:

1. Forex Currency Pairs: Traders can trade major, minor, and exotic currency pairs. This includes pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/CAD, and many more.

2. Cryptocurrencies: IPCAPITAL offers trading in various cryptocurrencies, allowing traders to participate in the cryptocurrency market. This may include popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and others.

3. Stocks: IPCAPITAL provides access to a selection of stocks from different global markets. Traders can trade stocks of well-known companies listed on major stock exchanges. These may include stocks from companies like Apple, Google, Amazon, Microsoft, and more.

4. Commodities: Traders can also trade a range of commodities, including precious metals, energy products, agricultural products, and more. Examples of commodities available for trading may include gold, silver, crude oil, natural gas, wheat, corn, coffee, and others.

5. Indices: IPCAPITAL offers trading in various indices, representing baskets of stocks from specific markets or sectors. Popular indices such as the S&P 500, Dow Jones Industrial Average, NASDAQ, FTSE 100, DAX, and others may be available for trading.

| Pros | Cons |

| Wide range of market instruments available | Potential risk associated with trading volatile instruments |

| Opportunities to trade major, minor, and exotic currency pairs | Market fluctuations can impact investment performance |

| Access to cryptocurrencies, including popular ones like Bitcoin and Ethereum | Lack of specific information on trading conditions and fees |

| Availability of stocks from well-known global companies | Regulatory restrictions or limitations in certain markets |

| Opportunity to trade a variety of commodities | Market complexities may require in-depth research and analysis |

Account Types

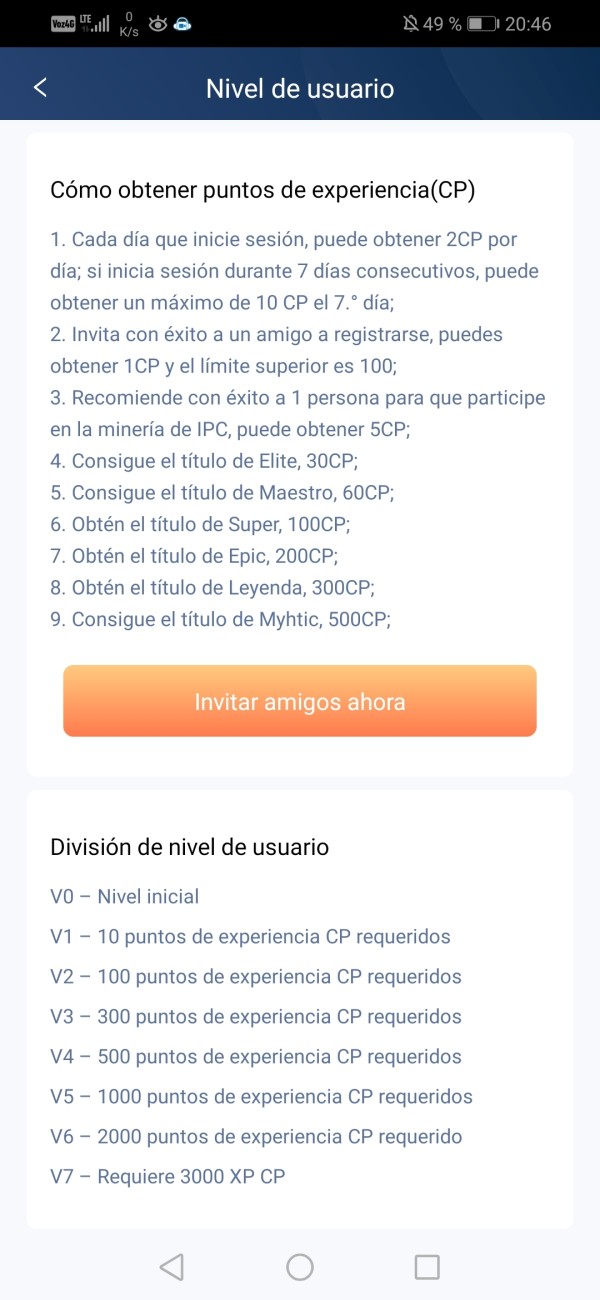

IPCAPITAL offers different types of AIA Bot subscriptions. Here is a breakdown of the account types and their associated features:

1. SMART BOT: This subscription costs $19.90 as a one-time fee. It claims to offer a return on investment (ROI) of up to 15% per month. The details of the subscription's features and trading strategy are not specified.

2. BRILLIANT BOT: The Brilliant Bot subscription is priced at $39.90 as a one-time fee. It promises a higher ROI of up to 30% per month. The specific trading approach or strategy employed by this bot is not mentioned.

3. GENIUS BOT: The Genius Bot subscription is the highest-tier option, priced at $99.90 as a one-time fee. It claims to provide a potential ROI of up to 45% per month. However, it's important to note that such high monthly returns are unrealistic and may raise suspicions.

It is crucial to exercise caution and skepticism when encountering claims of guaranteed or exceptionally high returns, as they may indicate a potential scam or unrealistic promises.

Furthermore, the information indicates that payments for these subscriptions must be made in cryptocurrencies such as Bitcoin or Tether. Additionally, IPCAPITAL imposes a 20% fee on generated returns, and withdrawals are apparently only allowed on weekends.

It's advisable to carefully assess the legitimacy and credibility of any investment service, especially when they make extraordinary claims or offer high returns with low risks. Conducting thorough research, seeking professional advice, and considering the risks involved are important steps before engaging with such offerings.

| Pros | Cons |

| Provides different account types with varying ROI potential | Lack of transparency in subscription features and strategies |

| Offers a range of price options for subscriptions | Unrealistic and potentially suspicious high ROI claims |

| Allows traders to choose a subscription based on their preferences | Potential risk of misleading investors |

Leverage

IPCAPITAL offers leverage to traders for forex and indices trading, with a maximum leverage of up to 400 times. Leverage allows traders to control a larger position in the market with a smaller amount of capital.

A leverage ratio of 400:1 means that for every dollar of the trader's capital, they can control a position worth up to 400 dollars. This can potentially amplify both profits and losses. While higher leverage can increase the potential for larger gains, it also exposes traders to higher risks.

Spreads & Commissions

According to the information provided, there is no specific mention of trading costs such as spreads and commissions on the IPCAPITAL website. The absence of this information makes it difficult to provide specific details regarding the spreads charged for trading instruments or any commissions associated with trading activities.

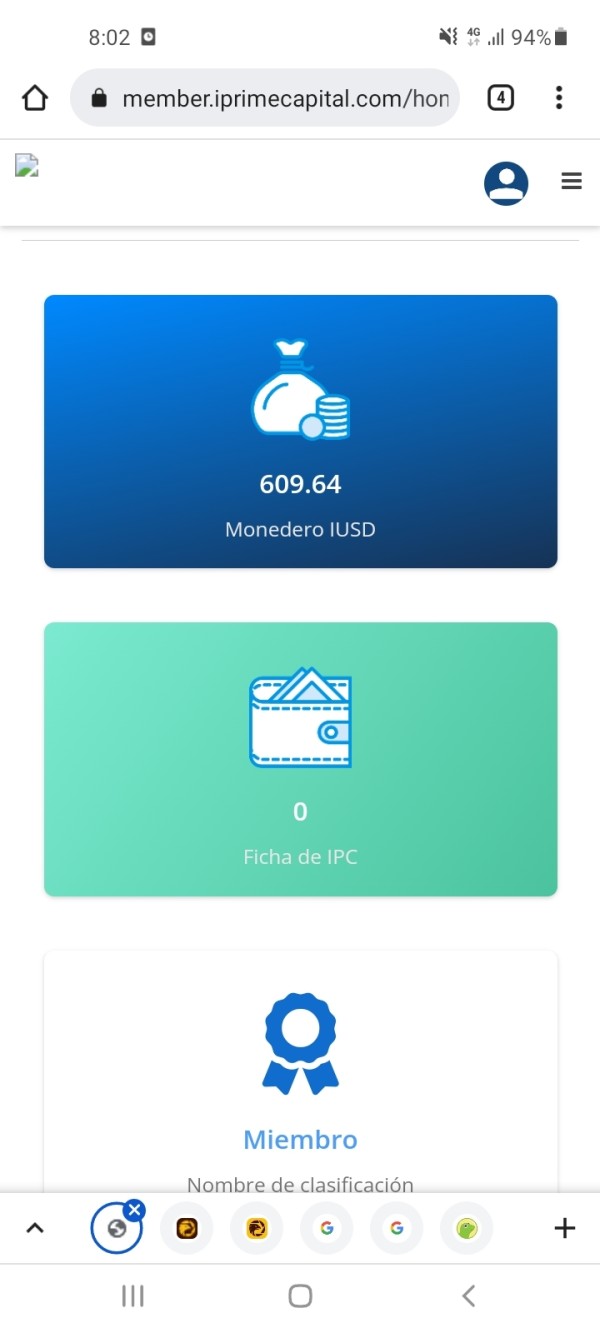

Deposit & Withdrawal

There is no specific mention of the minimum deposit requirement for IPCAPITAL. Therefore, it is unclear what the minimum amount is to fund an account with IPCAPITAL.

Additionally, the information does not specify the payment methods supported by IPCAPITAL for depositing funds into trading accounts. It's important to note that payment methods can vary among brokers and may include options such as bank transfers, credit/debit cards, e-wallets, or cryptocurrencies. To obtain accurate and up-to-date information on the available payment methods, it is recommended to contact IPCAPITAL directly or consult their official website.

Trading Platform Available

IPCAPITAL provides traders with a range of trading platforms to suit their preferences and trading styles. Here is a description of the trading platforms available:

1. MT4 (MetaTrader 4): MT4 is a popular and widely used manual trading platform in the industry. It offers a user-friendly interface, advanced charting tools, technical analysis indicators, and the ability to execute trades directly from the platform. Traders can access a wide range of financial instruments and employ various trading strategies. MT4 also supports automated trading through the use of expert advisors (EAs).

2. WebTrader: IPCAPITAL offers a web-based trading platform that allows traders to access their accounts and trade directly from their web browsers without needing to download or install any software. WebTrader provides similar functionality to MT4, including real-time market quotes, charting tools, and order execution capabilities.

3. IPCAPITALgO: IPCAPITALgO is a proprietary manual trading platform developed by IPCAPITAL. It is designed to provide a user-friendly trading experience and is optimized for mobile devices. Traders can access their accounts, view real-time market data, place trades, and manage their portfolios on the go.

4. IPCSocial App: IPCAPITAL offers an innovative trading platform called IPCSocial App. This platform incorporates social trading features, allowing traders to follow and copy the trades of successful traders. It combines social interaction with trading, enabling users to interact with other traders, share insights, and benefit from collective trading wisdom.

5. ZuluTrade and DupliTrade: IPCAPITAL supports third-party automated trading platforms such as ZuluTrade and DupliTrade. These platforms allow traders to automatically copy the trades of experienced traders, known as signal providers. By connecting their accounts to these platforms, traders can replicate the trades of signal providers and potentially benefit from their expertise.

| Pros | Cons |

| Variety of trading platforms to suit different preferences | Limited information on platform features and customization |

| MT4 offers advanced charting tools and automated trading options | Potential learning curve for new users |

| WebTrader allows trading directly from web browsers without downloads | Limited platform-specific educational resources |

| IPCAPITALgO provides a user-friendly mobile trading experience | Limited customization options for IPCAPITALgO |

| IPCSocial App incorporates social trading and collective wisdom | Reliance on signal providers' performance in ZuluTrade/DupliTrade |

Trading Tools

IPCAPITAL offers the following trading tools:

1. AIA BOT SYSTEM: AIA BOT is IPCAPITAL's proprietary AI (Artificial Intelligence) trading system. It utilizes advanced algorithms and machine learning to analyze large volumes of data from various sources. The system's robo-advisers process this data to identify potential trading opportunities and execute trades at what is deemed to be the optimal price. The aim is to leverage AI technology to enhance trading decisions and potentially improve trading outcomes.

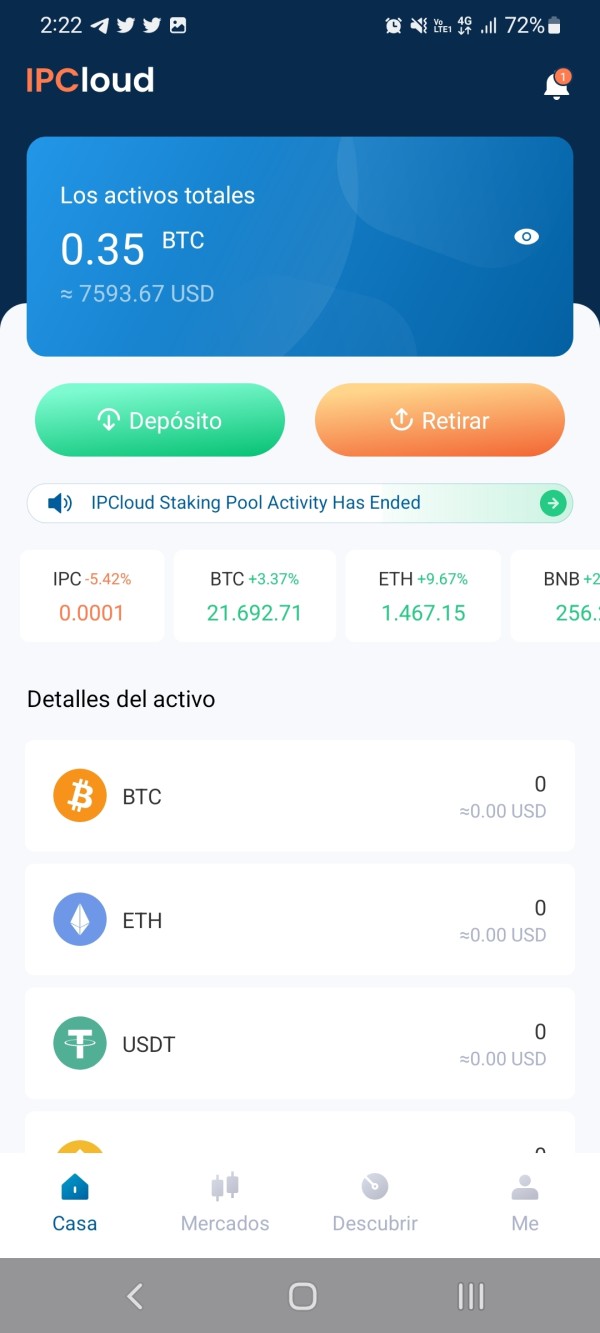

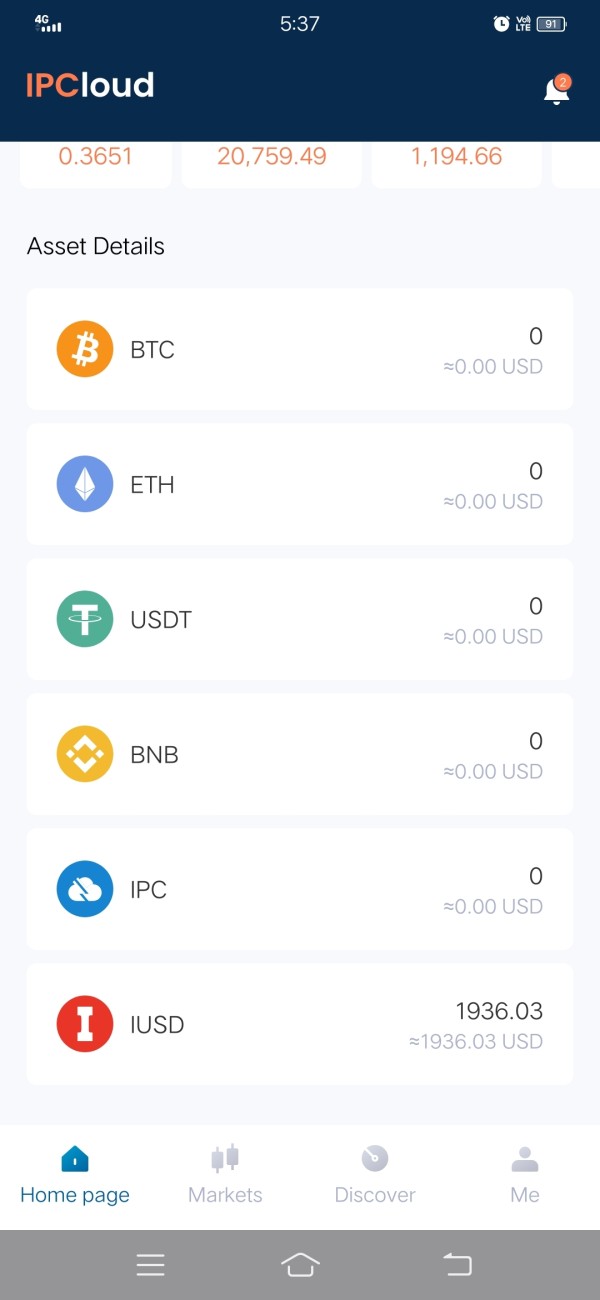

2. IPCCLOUD: IPCCLOUD is a diversified asset management platform provided by IPCAPITAL. The platform allows users to manage and monitor their investment portfolios, providing access to a range of financial instruments and strategies.

These trading tools, the AIA BOT system, and IPCCLOUD, are intended to support traders and investors in their decision-making and management of investment portfolios.

| Pros | Cons |

| AIA BOT SYSTEM utilizes advanced algorithms and machine learning to analyze data for potential trading opportunities and optimal execution | Limited transparency on the specifics of the AI algorithms used |

| Provides access to a range of financial instruments and strategies | Limited information on the platform's features and capabilities |

| The aim is to enhance trading decisions and potentially improve trading outcomes | Lack of independent verification or performance data |

| Limited user reviews or feedback on the effectiveness |

Customer Support

IPCAPITAL provides customer support services through various channels. Here is a description of the customer support options available:

1. Online Chat: Traders can access customer support through an online chat feature available on the IPCAPITAL official website. To initiate a chat, users are typically required to fill in their name and email address. This allows them to directly interact with a customer support representative in real-time, addressing any inquiries or concerns they may have.

2. Email: IPCAPITAL offers email support for customers. Traders can reach out to the support team by sending an email to support@iprimecapital.com. This allows for more detailed communication and the opportunity to provide attachments or documents, if needed.

3. Social Media Platforms: IPCAPITAL maintains a presence on various social media platforms, including Twitter and YouTube. Traders can follow their Twitter account, which can be found at https://twitter.com/IPCOfficial2?s=09, to stay updated on company announcements, news, and potentially reach out to them through direct messaging. Their YouTube channel, accessible at https://www.youtube.com/channel/UCfg8l66I86oHL2aUfJuVx6g, may contain educational resources, tutorials, or promotional content.

4. Chinese (Simplified) Phone Number: The information provided includes a phone number for Chinese (Simplified) support, which is listed as +6046158137. Traders who prefer phone communication may utilize this number to seek assistance from the IPCAPITAL support team.

Negative Reviews

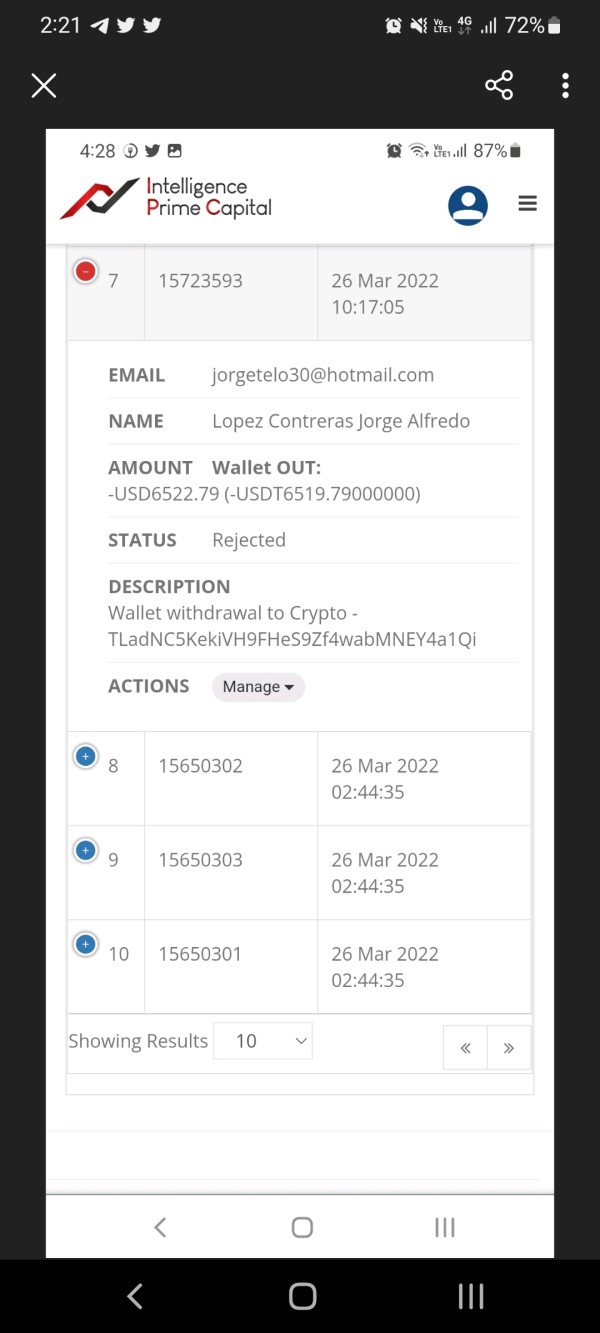

Based on the negative reviews on WikiFX, it appears that there are several complaints regarding the inability to withdraw funds from IPCAPITAL. Traders have reported experiencing difficulties in withdrawing their profits or investments, with some alleging that their funds were stolen or converted to a different currency without their consent. There are also allegations of fraudulent activities, including the promotion of a token and wallet.

Additionally, some reviews suggest that IPCAPITAL lacks communication channels and support, leaving investors without any means to address their concerns or retrieve their investments. The negative reviews indicate frustration and dissatisfaction with the broker's practices, with accusations of scams and pyramid schemes being raised.

It's important to note that these reviews represent the experiences and opinions of individual users, and it's always recommended to conduct thorough research and exercise caution when dealing with any financial service provider.

Conclusion

In conclusion, IPCAPITAL is a brokerage firm operating under the licensed institution INTELLIGENCE PRIME CAPITAL FINANCIAL ADVISORY PTY LTD, regulated by the Australian Securities & Investment Commission (ASIC). However, caution is advised as IPCAPITAL has received a significant number of complaints, as reported by WikiFX. These complaints raise concerns about difficulties in withdrawing funds, allegations of fraudulent activities, and poor communication and support. The broker offers a range of market instruments, leverage of up to 400:1, and multiple trading platforms, including MT4 and proprietary platforms. They also provide AI-based trading tools and customer support through online chat, email, and social media. However, the lack of transparency regarding trading costs, minimum deposit requirements, and payment methods is a drawback. Negative reviews and allegations of scams indicate potential risks and suggest the need for thorough research and caution before engaging with IPCAPITAL.

FAQs

Q: Is IPCAPITAL a legitimate investment company?

A: IPCAPITAL operates under the licensed institution INTELLIGENCE PRIME CAPITAL FINANCIAL ADVISORY PTY LTD and is regulated by the Australian Securities & Investment Commission (ASIC). However, it has received a significant number of complaints and is listed in the complaint blacklist by WikiFX, a platform that tracks complaints and provides risk assessments for brokers. Exercise caution and be aware of the potential risks.

Q: What market instruments can I trade with IPCAPITAL?

A: IPCAPITAL offers a variety of market instruments, including forex currency pairs, cryptocurrencies, stocks, commodities, and indices. You can trade major, minor, and exotic currency pairs, popular cryptocurrencies like Bitcoin and Ethereum, stocks of well-known companies, various commodities such as gold and crude oil, and indices like the S&P 500 and Dow Jones Industrial Average.

Q: What are the different account types offered by IPCAPITAL?

A: IPCAPITAL offers three AIA Bot subscriptions: SMART BOT, BRILLIANT BOT, and GENIUS BOT. These subscriptions come with different one-time fees and claim to offer varying returns on investment (ROI) per month. However, be cautious of claims of exceptionally high returns, as they may be unrealistic or indicate potential scams.

Q: What is the leverage offered by IPCAPITAL?

A: IPCAPITAL offers leverage for forex and indices trading, with a maximum leverage of up to 400 times. Leverage allows traders to control larger positions in the market with a smaller amount of capital, but it also amplifies both profits and losses.

Q: What trading platforms are available at IPCAPITAL?

A: IPCAPITAL offers multiple trading platforms, including MT4 (MetaTrader 4), WebTrader, IPCAPITALgO, IPCSocial App, and third-party platforms like ZuluTrade and DupliTrade. These platforms cater to different trading preferences, providing features such as real-time market quotes, charting tools, and order execution capabilities.

Q: What trading tools are provided by IPCAPITAL?

A: IPCAPITAL offers the AIA BOT system, which utilizes AI technology for trading decisions, and IPCCLOUD, a diversified asset management platform.

Q: How can I contact IPCAPITAL's customer support?

A: IPCAPITAL provides customer support through online chat on their website, email support at support@iprimecapital.com, and their presence on social media platforms such as Twitter and YouTube. They also offer a Chinese (Simplified) phone number for support inquiries.

News

Review 334

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now