Score

DBS

Singapore|Above 20 years|

Singapore|Above 20 years| https://www.dbs.com.cn/index/default.page

Website

Rating Index

Influence

Influence

AAA

Influence index NO.1

Taiwan 9.38

Taiwan 9.38Contact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

Basic Information

Singapore

SingaporeUsers who viewed DBS also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Hong Kong

Macao

Singapore

Myanmar

Indonesia

India

dbs.com.hk

Server Location

Singapore

Most visited countries/areas

United States

Website Domain Name

dbs.com.hk

Website

WHOIS.HKIRC.HK

Company

-

Server IP

103.7.8.138

dbs.com

Server Location

Singapore

Most visited countries/areas

United States

Website Domain Name

dbs.com

Website

WHOIS.CORPORATEDOMAINS.COM

Company

CSC CORPORATE DOMAINS, INC.

Domain Effective Date

1997-06-25

Server IP

103.7.8.138

dbs.com.tw

Server Location

Malaysia

Website Domain Name

dbs.com.tw

Website

WHOIS.TWNIC.NET.TW

Company

-

Domain Effective Date

2004-11-15

Server IP

110.4.47.190

Company Summary

| Broker Name | DBS |

| Regulatory Status | Regulated by the Labuan Financial Services Authority (LFSA) |

| UK FCA License | License number 204650 for Non-Forex activities |

| DBS Financial Services | - Offers a wide array of financial solutions |

| Services for Individual Clients | - Wealth Management |

| - Treasures Banking Privileges | |

| - DBS Lifestyle Privileges | |

| - Wealth Management Services | |

| - Wealth Preservation | |

| - Banking Services | |

| Services for Corporate Clients | - SME Banking (DBS IDEAL) |

| - Corporate Banking | |

| Sustainability Initiatives | - Commitment to achieving net-zero greenhouse gas emissions |

| - Investment in clean energy and supporting sustainability | |

| Customer Support | - Phone Support (Call BusinessCare) |

| - Online Enquiry (Enquiry Form) | |

| - Complaint Handling for Institutional Clients | |

| - BusinessCare Hotline | |

| - Email Support | |

| - Mailing Address |

Overview

DBS is a regulated bank under the Labuan Financial Services Authority (LFSA) and holds a UK FCA license for Non-Forex activities. They offer a range of financial solutions for both individual and corporate clients, along with a commitment to sustainability initiatives. However, caution is advised due to increased negative reviews, and thorough due diligence and credibility assessment are strongly recommended before engaging their services, particularly if the UK's FCA oversight is a priority for investors.

Interest Rates and Fees

The interest rate offered by DBS DBS Bank (Hong Kong) Limited in Hong Kong dollars is 5.25% per annum. Brokerage commission for securities trading in Hong Kong is 0.2% of the amount (minimum HK$100/RMB100), brokerage commission for transactions via automated telephone banking service, telephone banking service hotline, or express securities trading line is 0.35% of the transaction amount (minimum charge of HK$100/RMB100). SFC transaction levy is 0.0027% of the transaction amount, and stamp duty is 0.1% of the transaction amount. For more information on fees and charges, please refer to the official website of DBS Bank (Hong Kong) Limited.

Regulation

DBS is regulated by the Financial Conduct Authority (FCA) in the UK with an Institution Forex License (License No. 204650) and by the Labuan Financial Services Authority (LFSA) in Malaysia with a Market Making license. Both agencies oversee DBS's compliance with financial regulations in their respective regions.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

Services

DBS (formerly known as The Development Bank of Singapore) offers a wide range of financial services, catering to both individual clients and corporate clients. Below is a detailed description of the services provided by DBS:

For Individual Clients:

- Wealth Management: DBS offers wealth management services through its DBS Treasures program. This service is designed for individuals with a minimum deposit or investment threshold. It provides customers with access to qualified treasures who can assist in managing and growing their wealth. Additionally, DBS Treasures Privileges offer a range of customized services and exclusive benefits.

- Treasures Banking Privileges: This service is tailored to provide wealth management expertise and exclusive banking privileges across Asia. It includes various investment and financial products to help individuals achieve their financial goals.

- DBS Lifestyle Privileges: DBS values its customers and offers them curated indulgences and exclusive privileges, which can include discounts, special offers, and unique experiences.

- Wealth Management Services: DBS offers opportunities to expand investment portfolios by leveraging assets linked to equities, commodities, currencies, and credits, with access to global markets. This service is designed to help customers accumulate wealth.

- Wealth Preservation: DBS provides asset allocation plans tailored for individuals, including retirement plans, education foundations, and wealth transfer strategies. This helps clients protect and preserve their accumulated wealth.

- Banking Services: DBS offers various banking services, including the DBS digibank app, which allows clients to manage their accounts conveniently on mobile devices. Clients can also access information on major markets, currency exchange rates, structured investment products, and more.

For Corporate and SME Banking:

- SME Banking (DBS IDEAL): DBS IDEAL is a comprehensive platform designed to help small and medium-sized enterprises (SMEs) manage their working capital and transactions efficiently. It can be accessed through desktop, tablet, and mobile devices and offers features such as seamless security, easy maintenance, comprehensive services, and true mobility. SMEs can monitor funds, make payments, manage trade finance, and conduct mobile banking with ease.

- Corporate Banking: DBS addresses climate change by advocating for collective efforts and sustainable business practices. They have committed to achieving net-zero greenhouse gas emissions by 2050 and have set decarbonization targets for various sectors, including Power, Oil & Gas, Automotive, Aviation, Shipping, Steel, and Real Estate. DBS is actively investing in clean energy and supporting Asia's transition to a low-carbon economy.

DBS's services are designed to meet the financial needs of both individual and corporate clients, offering a wide range of solutions for wealth management, banking, and sustainability in today's evolving financial landscape.

Customer Support

DBS offers comprehensive customer support through its BusinessCare service to assist customers and address their inquiries and concerns. Here is a description of their customer support services:

- Phone Support (Call BusinessCare):

- Telephone Number: 400 821 8881

- Operating Hours: 9:00 AM to 6:00 PM, Monday to Friday (excluding Public Holidays)

- Customers can reach out to DBS BusinessCare via phone during the specified operating hours. Trained representatives are available to provide assistance and address queries related to DBS's financial products and services.

- Online Enquiry (Enquiry Form):

- DBS encourages customers to submit their inquiries online using the provided enquiry form. These inquiries will be directed to a BusinessCare representative who will respond as promptly as possible.

- Complaint Handling for Institutional Clients:

- DBS takes customer complaints seriously and has a dedicated process for handling them.

- Each branch of the bank has complaint handling officers responsible for accepting and addressing client complaints.

- The complaint handling process includes acknowledging the receipt of the complaint within 5 working days, providing a response to the client within 15 days, and ensuring complex cases receive attention within a maximum of 60 days.

- Unresolved complaints are escalated to the complaint management department at the bank's head office for further investigation and resolution.

- BusinessCare Hotline:

- Hotline Number: 400 821 8881

- Hotline Service Hours: Monday to Friday, 9:00 AM to 6:00 PM

- Customers can reach DBS BusinessCare via the hotline during the specified service hours for immediate assistance with their banking-related inquiries and issues.

- Email Support:

- Customers can also contact BusinessCare via email at the provided email address: businesscarecn@dbs.com. They can send their queries and receive responses through this channel.

- Mailing Address:

- For postal inquiries, DBS provides a mailing address for customers to send their correspondence:

DBS Businesscare

29/F, China Resources Building

5001 Shennan Dong Road

Shenzhen, PR China

DBS is committed to serving its customers efficiently and strives to provide timely and comprehensive support through multiple communication channels, ensuring that clients' needs are met and their concerns addressed effectively.

Keywords

- Above 20 years

- Regulated in United Kingdom

- Regulated in Malaysia

- Institution Forex License

- Market Making(MM)

- Global Business

- High potential risk

Review 9

Content you want to comment

Please enter...

Review 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX1122662787

Hong Kong

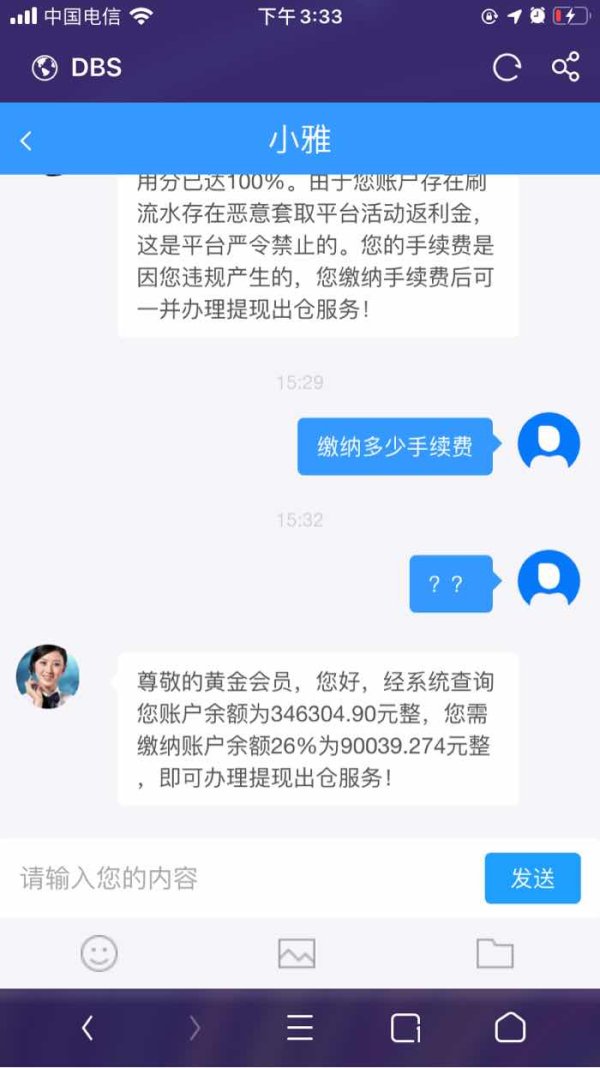

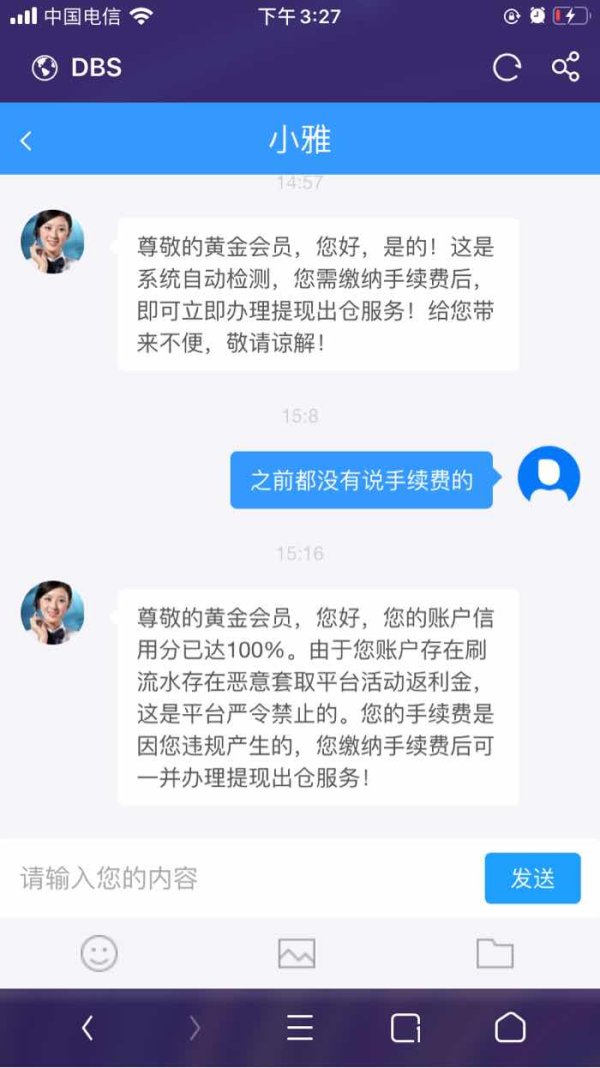

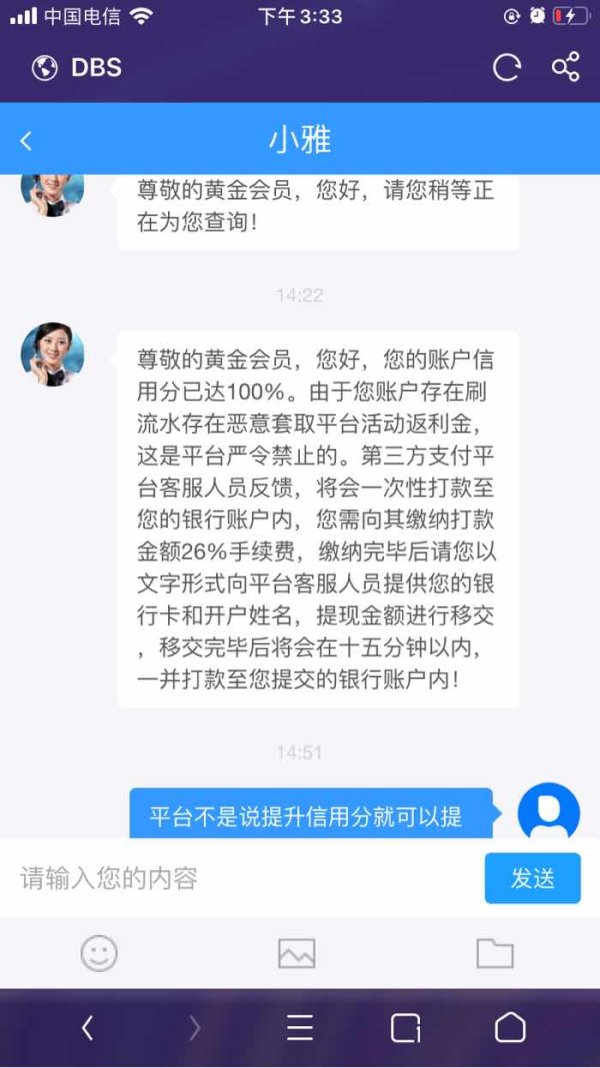

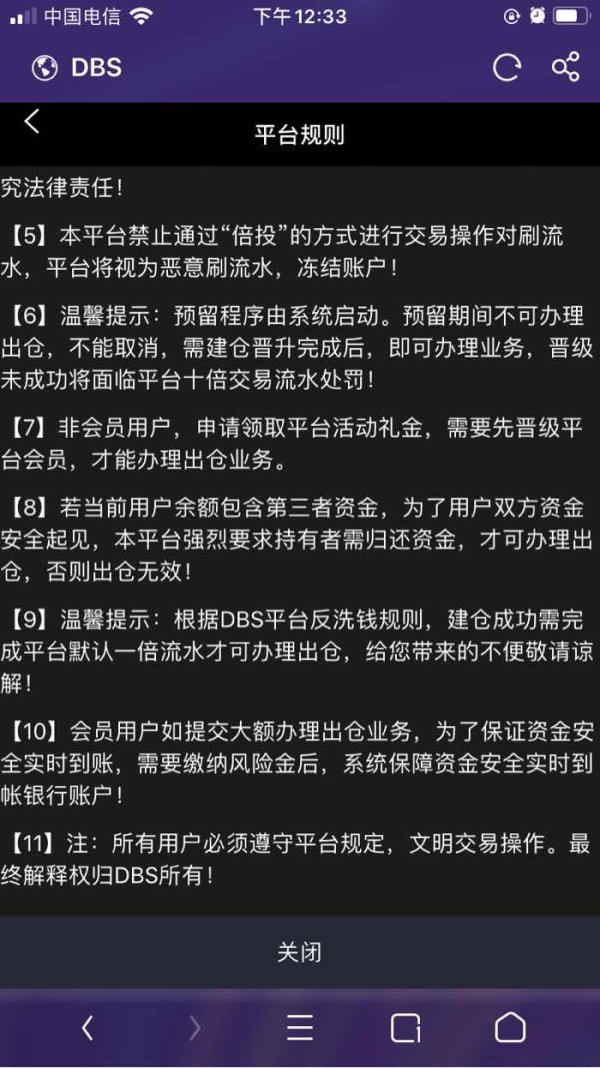

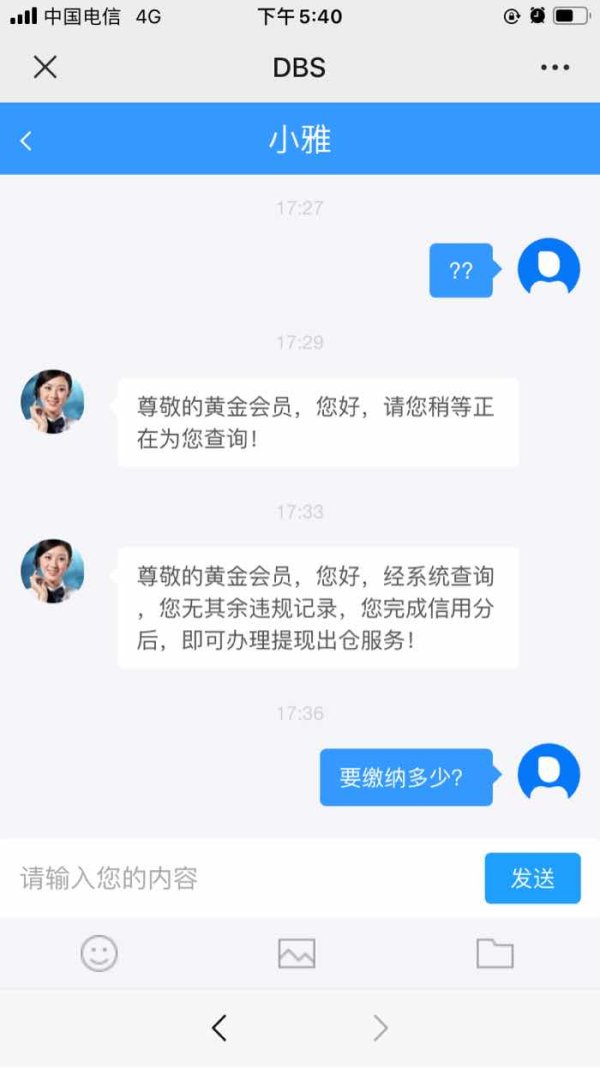

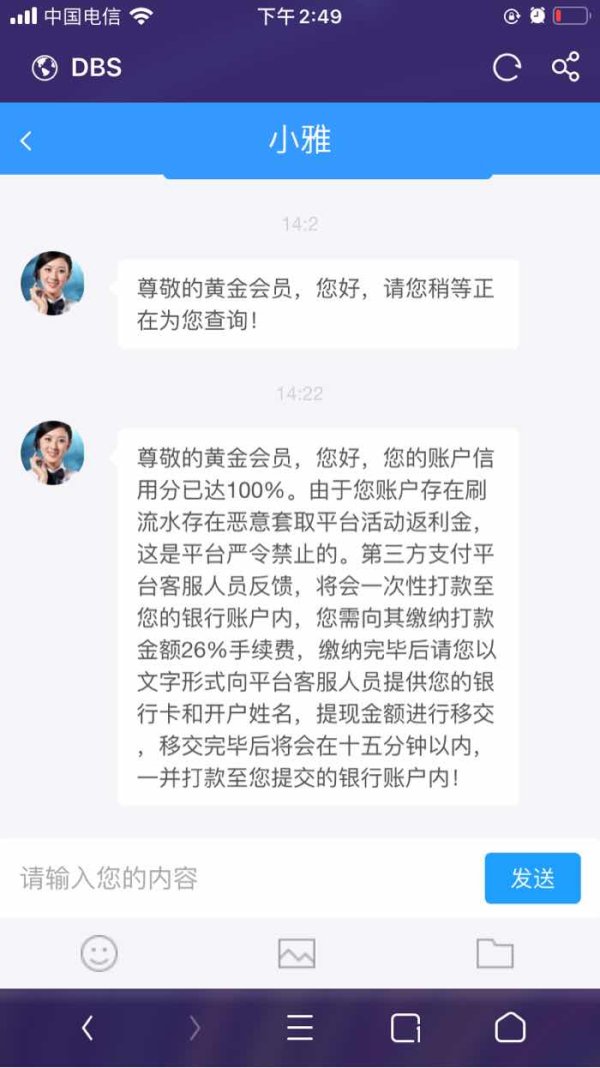

Unable to withdraw. I contact the customer service and asked them to inquire, yet they said the system was so busy that they can’t inquire about it. Now my account of 800,000 was frozen and I’m unable to withdraw. Besides, I need to pay to unfreeze my account. Garbage. A fraud platform, please stay away from it.

Exposure

2020-09-07

FX1122662787

Hong Kong

DBS is a fraud platform. Unable to withdraw. Programmers, agents, customer service, are all a gang. The website is unexpectedly maintaining.

Exposure

2020-08-30

FX1122662787

Hong Kong

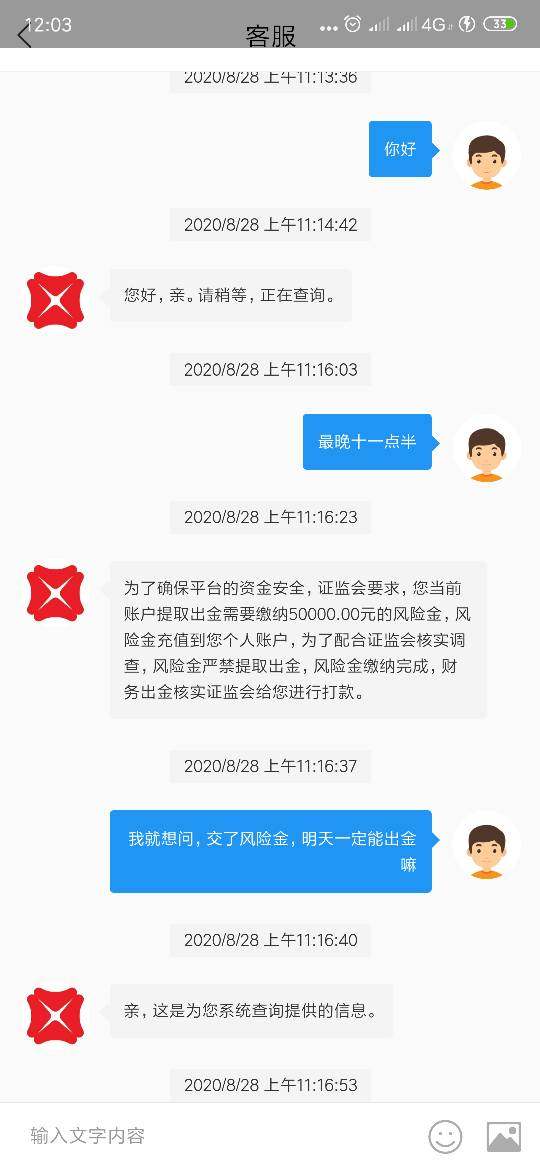

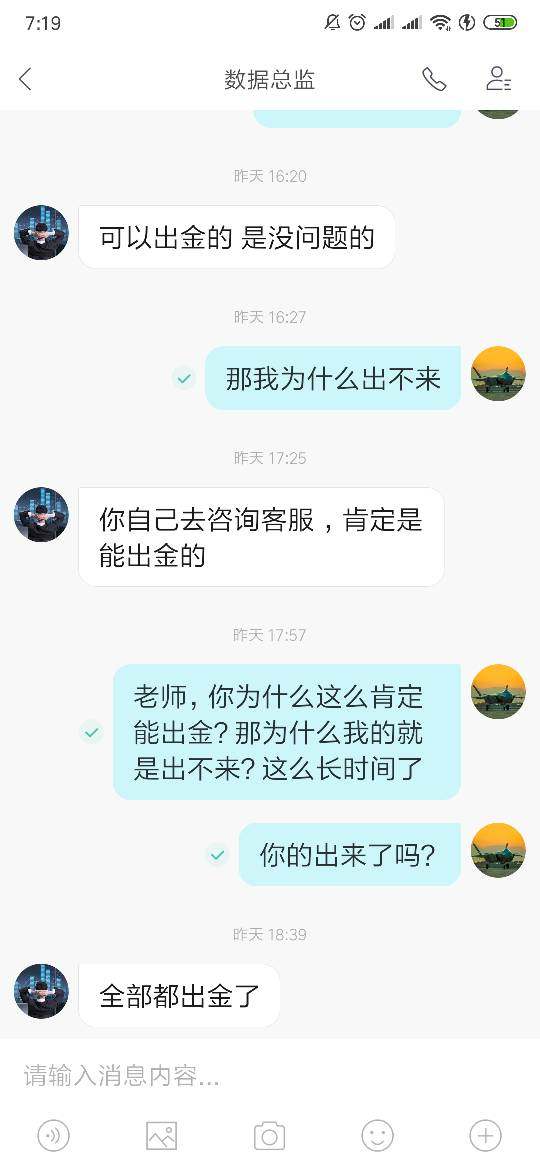

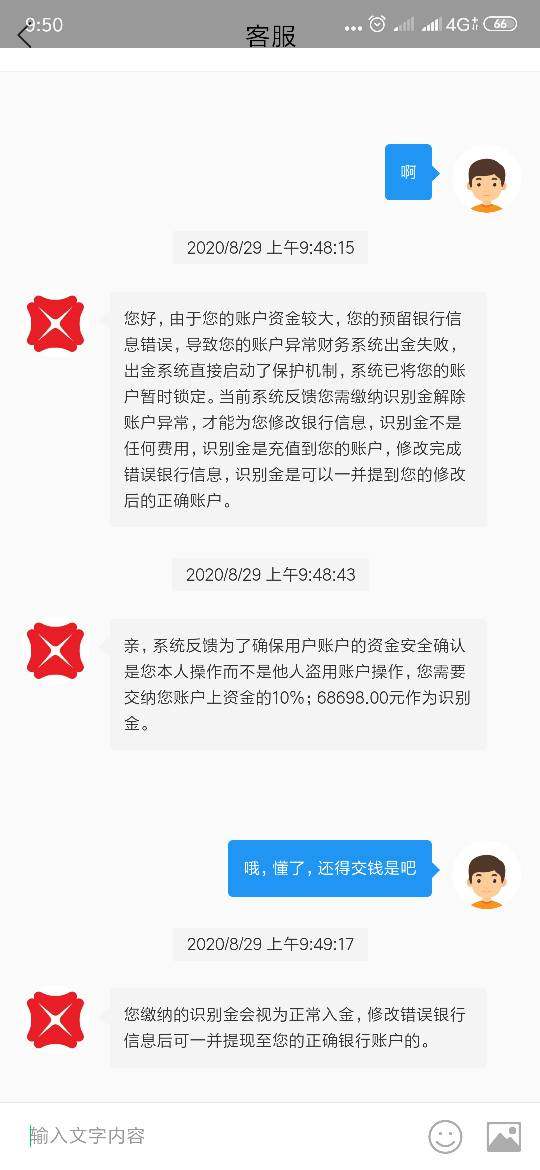

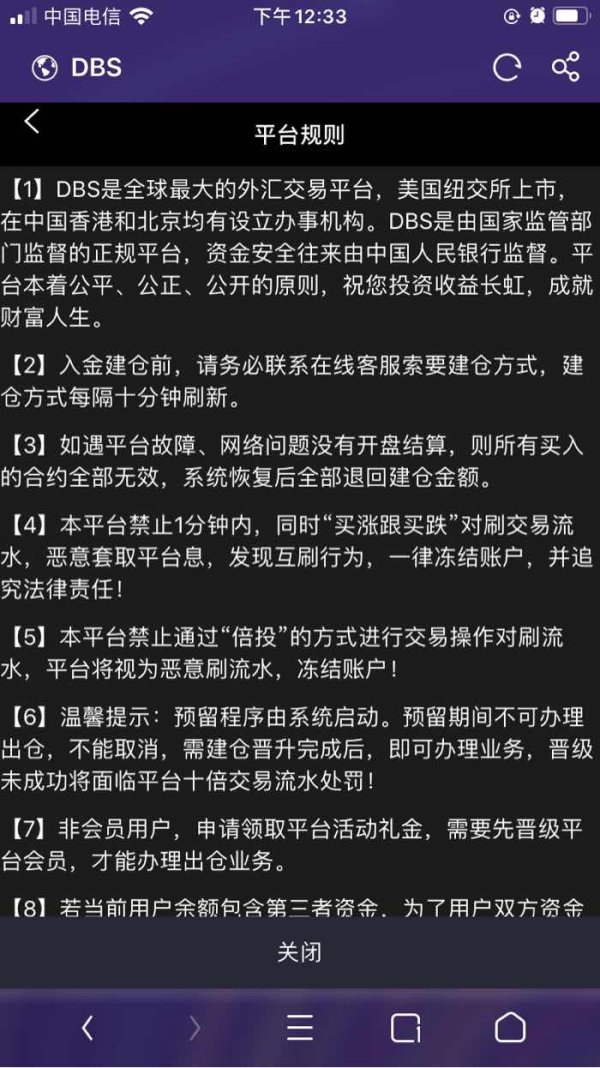

Every day they share their moments about who makes money and will give you irregular preferential activities. Let you want to invest. Then, let you scan the QR code, register, fill in the QR code, deposit, and make an appointment with a programmer for you. Programmers lead you to order and you’ll make money. Then the programmer doesn’t let you withdraw and ask you to log off. Test followed. He says there is a need for risk control so you have to deposit 50,000. Your request of withdrawal is under audit after you deposit 50,000. When your request is approaching 24 hours, the withdrawal is rejected. The customer service will tell you that the information of withdrawal is abnormal. Then you’ll find that the number of your ID card or bank card is wrong. You ask the customer service to modify account information, and they’ll tell you that the money is huge so you have to pay another 10% of your account to withdraw. If you meet such situation, call the police. This is from my own personal experience.

Exposure

2020-08-30

FX1122662787

Hong Kong

When I withdrew, I was told that my account was abnormal and I need to pay 50,000 as the risk fund. After that, they modified the number of my bank card and ask me to pay money for recognition. I called the police.

Exposure

2020-08-29

〔新时代窗饰〕小陈

Hong Kong

Setting position/Deposit/Fixed rebate/Rollover/Individual income tax/Frozen account/Unfreezing fee/Credit-raising fee/Third-party handling fee

Exposure

2020-08-16

Antonio Rossi Y

Italy

The DBS mobile app is fantastic! I really appreciate the intuitive interface and fast transaction speeds. However, I recently faced an issue with fund transfers where the transaction was pending for an unusually long time. It would be great if you could improve the notification system for such cases.

Neutral

2024-08-07

FX1575982441

Pakistan

Deposits are straightforward, but rebates are rigid and overnight rebates are minimal. Tax obligations are clear, but account freezes for rule violations can be frustrating. Thawing accounts requires additional fees. Improving credit score comes at a cost, and third-party transfer fees add up.

Neutral

2023-12-22

Ya Narak

Singapore

It's really strange, as far as I know, DBS Bank is a very famous bank in Singapore, but some people say it is a scam company... It scares me.

Positive

2023-03-02

胡阳

Hong Kong

A year ago, I transferred the money to my brother in Singapore at DBS Bank, the fee was very low, and the service deserved 5 stars. At that time, the staff who helped me apply for the most favorable fee. I am very satisfied with the service of this bank.

Positive

2022-12-13