Score

TransferWise

Australia|5-10 years|

Australia|5-10 years| https://transferwise.com/hk/

Website

Rating Index

Influence

Influence

AA

Influence index NO.1

Germany 8.12

Germany 8.12Contact

Licenses

Licenses

Licensed Institution:TransferWise Ltd

License No.:456295

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Australia

AustraliaAustralian broker TransferWise not found

A field survey according to the address where it claims to be located did not find TransferWise’s physical presence. The broker claims to hold a full license from the Australian ASIC (456295),which had been canceled.

Australia

AustraliaAustralian broker TransferWise not found

A field survey according to the address where it claims to be located did not find TransferWise’s physical presence. The broker claims to hold a full license from the Australian ASIC (456295),which had been canceled.

Australia

AustraliaUsers who viewed TransferWise also viewed..

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

United Kingdom

Switzerland

Japan

transferwise.com

Server Location

United States

Most visited countries/areas

China

Website Domain Name

transferwise.com

Website

WHOIS.101DOMAIN.COM

Company

101DOMAIN GRS LIMITED

Domain Effective Date

2010-11-26

Server IP

104.16.41.16

Company Summary

| Aspect | Information |

| Company Name | Wise (formerly known as TransferWise) |

| Registered Country/Area | UK |

| Founded Year | 2011 |

| Regulation | Regulated by the ASIC( Revoked) |

| Tradable Assets | International money transfers(over 450 currencies) |

| Account Types | Personal and Business account |

| Customer Support | 24/7 customer support via email, live chat, and phone. |

| Deposit & Withdrawal | Bank Transfer, PayID,POLi, Debit Card andCredit Card |

| Educational Resources | Web navigation guide,FAQ |

Overview of TransferWise

Wise, formerly known as TransferWise, is a London-based international money transfer provider founded in 2011. With a global presence, it offers rapid money transfers in over 450 currencies, provides bank details for payments across 30 different countries, facilitates multi-currency direct debits, and more.

In February 2021, the company rebranded as Wise to signify its commitment to broadening its service offerings beyond traditional money transfers. Wise operates under the regulatory oversight of the Australian Securities and Investments Commission (ASIC) and holds a comprehensive license under its authorization, governed by Regulation No. 456295.

Is TransferWise legit or a scam?

As of the latest available information, TransferWise has had its license revoked by the Australia Securities & Investment Commission (ASIC). The license, which falls under the category of Market Making (MM), is no longer in effect. TransferWise Ltd, the licensed institution, had previously been authorized to operate within Australia under license number 456295.

Regulatory Agencies: Australia Securities & Investment Commission

Current Status: Revoked

License Type: Market Making(MM)

Regulated By:Australia

License No.: 456295

Licensed Institution: TRANSFERWISE LTD

Pros and Cons

| Pros | Cons |

| Efficient Global Money Transfers | Limited Market Instruments |

| Transparent Fee Structure | Limited Financial Offerings |

| Variety of Payment Methods | Limited Investment Education |

| Personal and Business Accounts | |

| Regulated |

Pros:

Efficient Global Money Transfers: Wise excels in providing efficient and cost-effective global money transfer services. Users can send funds internationally with competitive exchange rates and low fees, making it a preferred choice for many.

Transparent Fee Structure: Wise offers a transparent fee structure, ensuring users have a clear understanding of the costs associated with their transactions.

Variety of Payment Methods: Wise supports a wide range of payment methods, including bank transfers, debit/credit card payments, and more, catering to diverse user preferences.

Personal and Business Accounts: Wise accommodates both personal and business accounts, making it versatile for individual users and businesses alike.

Regulated: Wise operates under regulatory oversight in various jurisdictions, enhancing trust and security for its users.

Cons:

Limited Market Instruments: Wise primarily focuses on international money transfers and does not offer a range of market instruments such as stocks, bonds, or commodities. Users seeking investment opportunities beyond money transfers may find the platform lacking in this regard.

Limited Financial Offerings: Wise does not provide a broader spectrum of financial products like savings accounts, loans, or investment options, which some users may require for comprehensive financial management.

Limited Investment Education: Investors seeking in-depth financial education or market analysis may need to seek supplementary sources to fulfill their learning needs.

Market Instruments

Wise does not offer any market instruments, such as stocks, indices, or commodities. The company only offers international money transfers.

Wise provids rapid money transfers that cover a wide range of over 450 currencies, including major ones like AUD, EUR, GBP, and CAD, as well as others such as BGN, BRL*, CNY*, CHF, CZK, DKK, and HUF. This extensive currency coverage allows users to send and receive funds in various denominations.

Account Types

Wise offers two types of accounts: personal and business.

The personal Wise account is for individuals who need to send, spend, or receive money internationally. It's a great option for people who live, work, or travel abroad, or who have friends or family in other countries.

The personal Wise account has a number of features, including:

Over 40 currencies to choose from

Mid-market exchange rates

A Wise debit card that can be used to spend money in over 150 countries

Low fees

No monthly fees

The Wise business account is for businesses that need to send or receive money internationally. It's a great option for businesses that sell goods or services online, or that have employees or contractors in other countries.

The business Wise account has a number of features, including:

Over 40 currencies to choose from

Mid-market exchange rates

A Wise business debit card that can be used to spend money in over 150 countries

Low fees

No monthly fees

Additional features such as team accounts, mass payments, and Xero and QuickBooks integration

Sure, here's the information presented in a table format for easy reference:

| Account Type | Personal Wise Account | Business Wise Account |

| Target Audience | Individuals for international use | Businesses for international use |

| Currencies | Over 40 currencies to choose from | Over 40 currencies to choose from |

| Exchange rates | Mid-market exchange rates | Mid-market exchange rates |

| Payment method | Wise debit card for spending | Wise business debit card for spending |

| Fee | No monthly fees | No monthly fees |

| Additional features | Team accountsMass paymentsXero and QuickBooks integration |

How to Open an Account?

Opening an account with Wise (formerly known as TransferWise) is a straightforward process. Here are the concrete steps broken down into six points:

Step 1: Visit the Wise Website

Start by visiting the official Wise website. You can access the website using your web browser on a computer or a mobile device.

Step 2: Sign Up

On the Wise homepage, you'll find an option to “Sign up” or “Register.” Click on this option to begin the registration process.

Step 3: Provide Personal Information

Fill out the registration form with your personal information. This typically includes your full name, email address, and a password that you'll use to log in to your Wise account.

Step 4: Verification

Wise will require you to verify your identity. This may involve uploading a copy of a government-issued ID, such as a passport or driver's license, and providing additional information for identity verification.

Step 5: Add a Payment Method

Once your identity is verified, you'll need to link a payment method to your Wise account. You can add your bank account details or use a debit/credit card for funding your Wise account.

Step 6: Start Transacting

With your account set up and payment method added, you can now start using Wise for international money transfers, currency exchange, and other financial services.

Spreads & Commissions

Wise charges a flat fee for international money transfers. The fee varies depending on the currency pair and the amount of money being transferred.

Money Transfering Platform

Wise is a financial platform that specializes in facilitating efficient global money transfers. One of its key strengths is its ability to process rapid money transfers, spanning a wide spectrum of over 450 currencies. This extensive currency coverage ensures that users can seamlessly send and receive funds in various denominations, enhancing its versatility for international financial transactions.

Furthermore, Wise simplifies cross-border payments by providing bank details recognized in 30 different countries. This feature streamlines the process of conducting transactions across multiple regions, eliminating the need for numerous banking arrangements or intermediaries. Users can make payments conveniently and receive funds efficiently in various parts of the world.

In addition to these services, Wise also offers the convenience of managing multi-currency direct debits. This feature empowers users to handle recurring payments or subscriptions in different currencies, streamlining financial operations.

Transfer Fees

Wise offers multiple payment methods, each with its own associated fee structure. Regardless of the transaction amount, the percentage fee tends to remain consistent for each payment method. The following payment methods are available:

Bank Transfer: Typically, this method incurs a $0 fixed fee, with a percentage fee determined by the currency being converted.

PayID: Similar to bank transfers, PayID transactions typically come with a $0 fixed fee and a percentage fee based on the currency conversion.

POLi: For POLi transactions, a fixed fee of $1.73 is applied, in addition to the percentage fee based on the currency.

Debit Card: When using a debit card, a fixed fee of $3.59 is charged, along with the relevant percentage fee based on the currency conversion.

Credit Card: Transactions made with a credit card typically incur a fixed fee of $9.80, plus the applicable percentage fee tied to the currency conversion.

| Payment Method | Fixed Fee | Percentage Fee (Varies by Currency) |

| Bank Transfer | $0.00 | Varies by Currency |

| PayID | $0.00 | Varies by Currency |

| POLi | $1.73 | Varies by Currency |

| Debit Card | $3.59 | Varies by Currency |

| Credit Card | $9.80 | Varies by Currency |

Each currency and destination comes with its own unique attributes, which can impact the duration of your transfer. Typically, transfers may take up to 2 business days, contingent upon how swiftly the recipient's bank processes the funds.

For users looking to send money using pounds sterling, Wise provides various transfer options, including low-cost and expedited transfers. The speed of fund transfer is influenced by the specific transfer type selected by the user, offering flexibility to match individual preferences and priorities.

Customer Support

Wise offers excellent customer support 24/7 via email, live chat, and phone. The company's customer support team is known for being responsive, helpful, and knowledgeable. Wise also has a comprehensive help center with articles and FAQs on a wide range of topics.

Educational Resources

TransferWise offers some educational resources to assist individuals and businesses in navigating the complexities of international finance. These resources cover a broad spectrum of topics, ensuring that users have access to comprehensive information to make informed decisions.

Sending Money: Users can learn how to set up, pay for, edit, and even cancel transfers. This section provides insights into secure and efficient international money transfers.

Managing Your Account: Guidance is available for setting up a TransferWise account and successfully completing the verification process, ensuring that users can fully utilize their accounts.

Holding Money: This section delves into the nuances of holding balances within TransferWise accounts, including setting up Direct Debits and exploring options like Interest & Stocks.

Wise Card: Users can explore the functionality of the Wise card, from the process of ordering and activation to using it for seamless spending. Troubleshooting guidelines are also provided to address any potential issues.

Receiving Money: Users can learn how to efficiently receive funds from anywhere in the world by leveraging their TransferWise account details.

Wise Business: Business users can benefit from resources related to multi-user access, accounting practices, and guidance on utilizing the TransferWise API for streamlined financial operations.

Conclusion

In summary, TransferWise, now known as Wise, is a globally recognized financial institution offering a wide array of services for individuals and businesses seeking efficient and transparent international money management solutions. With a global presence, it offers rapid money transfers in over 450 currencies, provides bank details for payments across 30 different countries, facilitates multi-currency direct debits, and more. The platform offers educational resources that cover essential topics, including sending money, managing accounts, maintaining balances, using the Wise card, receiving funds, and addressing the requirements of businesses through Wise Business solutions.

FAQs

Q: How are Wise's exchange rates calculated?

A: Wise uses the mid-market exchange rate to calculate its transfer fees. This means you will get the same exchange rate as you would get at a bank or other money transfer company.

Q: How much are Wise's transfer fees?

A: Wise's transfer fees vary depending on the amount and currency of the transfer. In general, Wise's fees are lower than banks or other money transfer companies.

Q: How fast are Wise's transfers?

A: Wise's transfer speeds vary depending on the amount and currency of the transfer. In general, Wise's transfers are faster than banks or other money transfer companies.

Q: How secure is Wise?

A: Wise is a regulated company and its security measures meet industry standards. Wise uses SSL encryption to protect your personal and financial information.

Q:What payment methods does Wise support?

A:Wise supports various payment methods, including bank transfers, PayID, POLi, debit cards, and credit cards.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Global Business

- Australia Market Making(MM) Revoked

- High potential risk

Review 6

Content you want to comment

Please enter...

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX3832616320

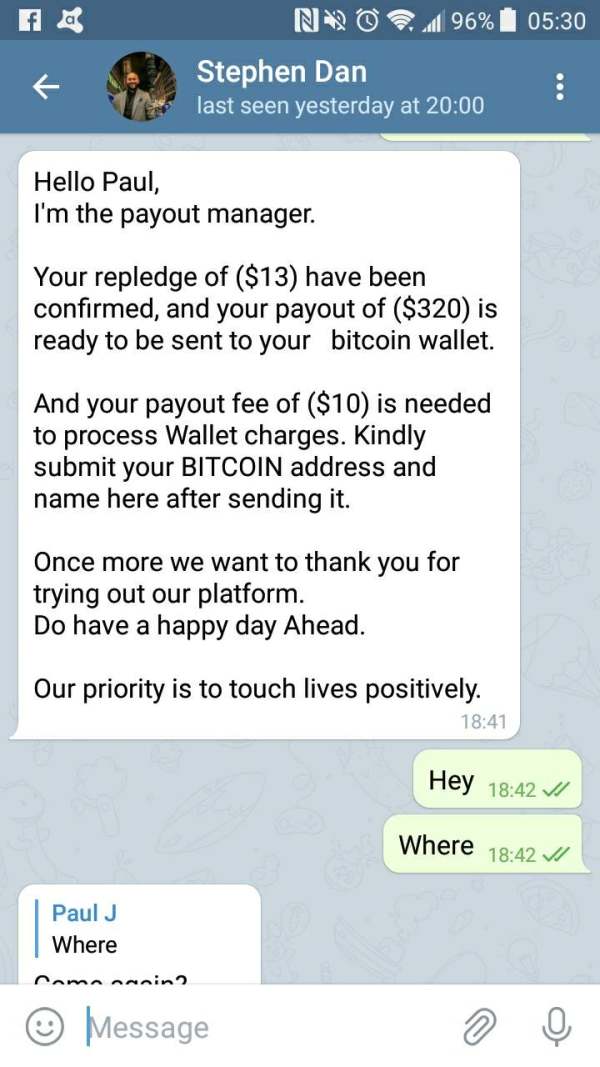

South Africa

iq trading ...Stephen Dan...his fake...guy posed as him wants money and money

Exposure

2020-11-01

FX2999591368

South Africa

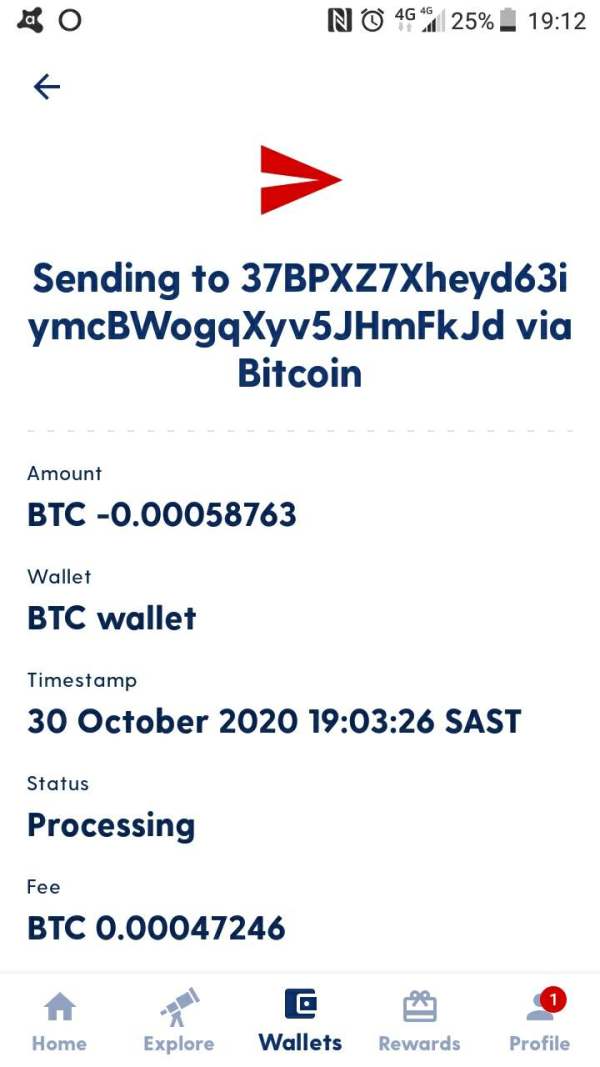

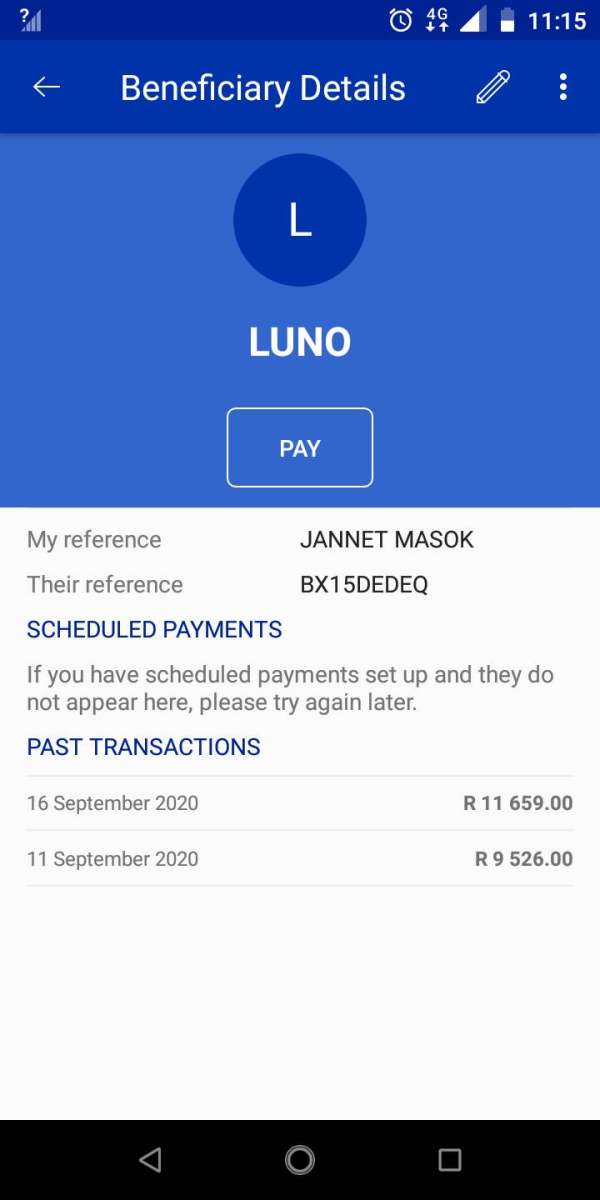

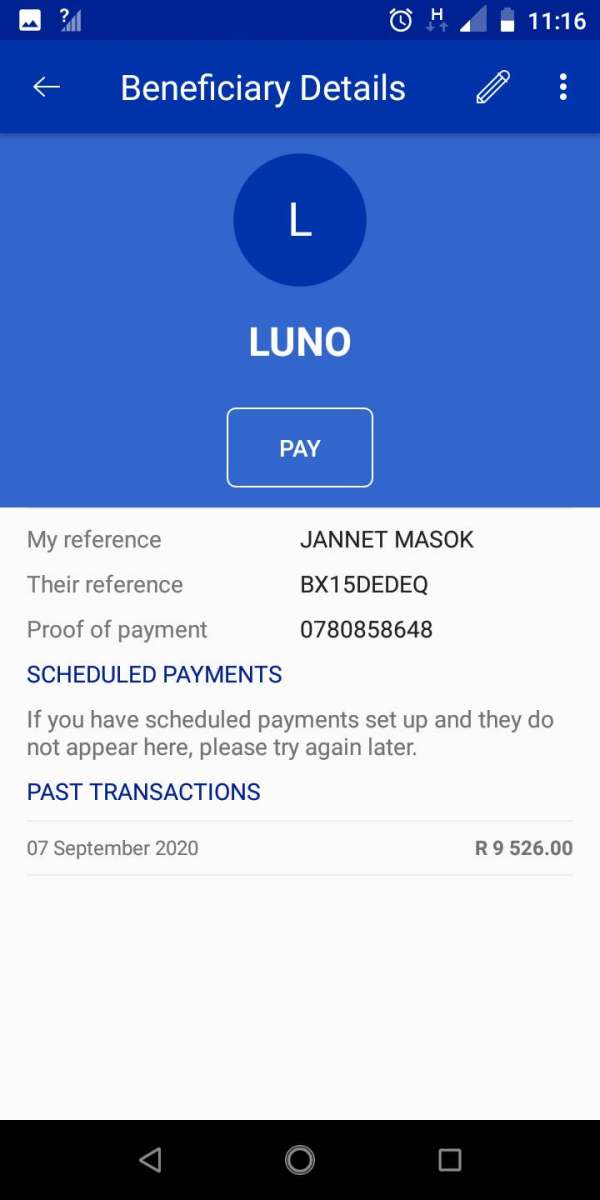

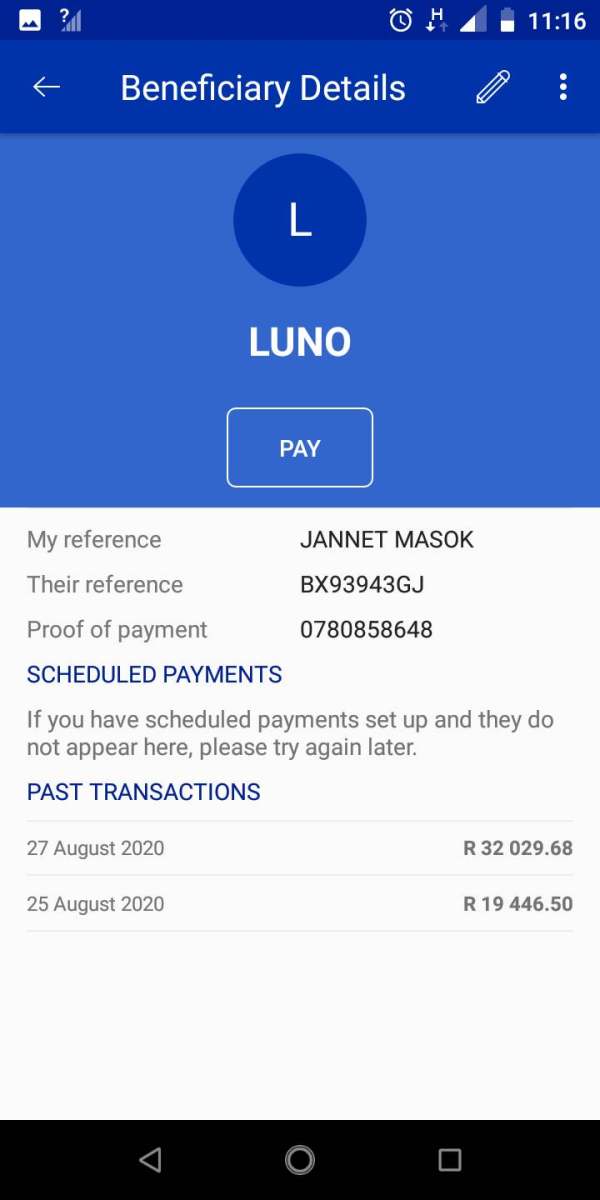

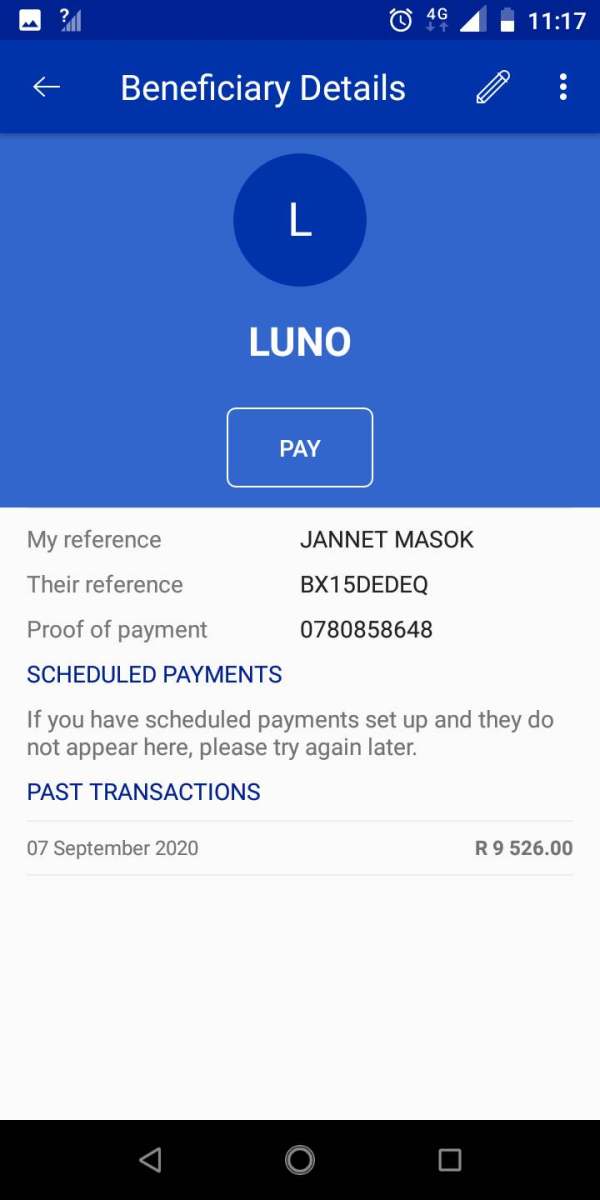

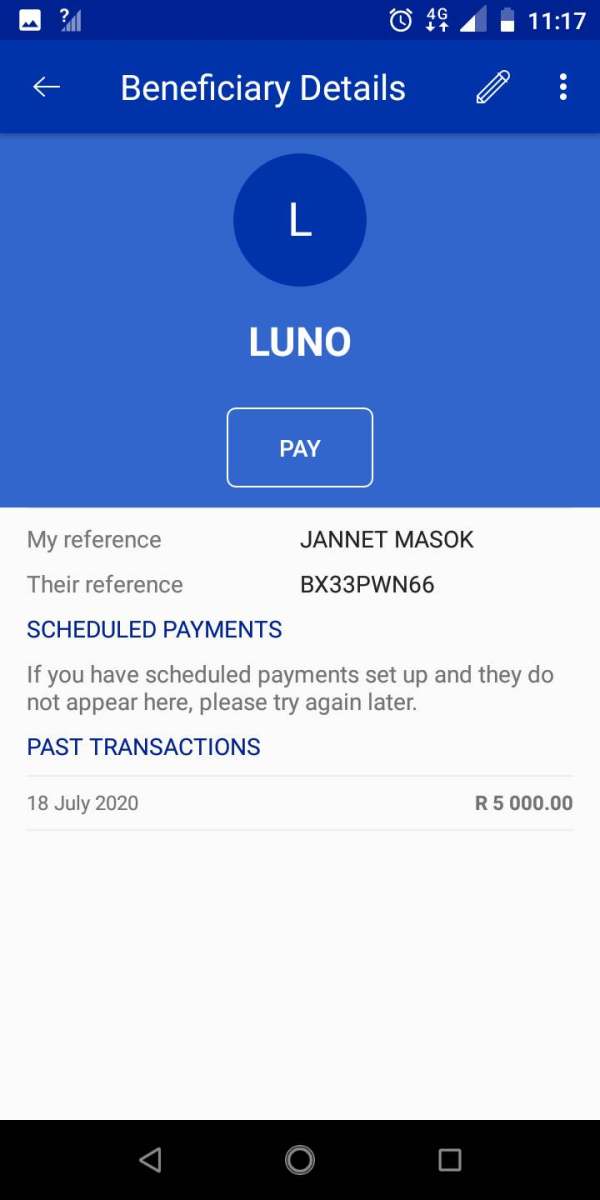

I was scammed of my profit by the Algotradingoption,they ask me to pay for trading cost,tax and domiciliary charges which I did and after they stopped contact me,I emailed them several times and when they responded they said they are still doing investigation when I ask for what,they didn't respond,here is proof

Exposure

2020-10-30

德善@WJ

New Zealand

I've seen this company many times but there has never been anybody able to tell me if it's a scam or not. I think if I can find a reliable international remittance platform, I can save a lot of fees!

Neutral

2023-02-23

FX1202464292

Venezuela

I know that when transferring money overseas, they often have to pay a high fee to banks. I don't want her either. But I'm not more into recklessly using an online channel to save this money and getting scammed...it's not worth it.

Neutral

2023-02-14

陈升号·小鲤鱼

Taiwan

I think if you have ever made an international remittance, you must feel that the bank's remittance fee is very high...at least tens or even a hundred dollars. So when I first saw this company, I was attracted by the low fees it claimed. But after careful research, I decided to use the bank to transfer money, because this company does not have any regulatory license.

Neutral

2022-12-14

Mohsin 7130

Pakistan

ok

Positive

2022-10-01