Score

ACTIVO TRADE

Spain|5-10 years|

Spain|5-10 years| https://www.activotrade.com/es/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Spain 4.42

Spain 4.42Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Spain

SpainUsers who viewed ACTIVO TRADE also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IronFX

- 15-20 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Website

activotrade.com

Server Location

Ireland

Website Domain Name

activotrade.com

Server IP

54.77.50.151

Company Summary

General information and regulation

ActivoTrade is a Forex and CFD broker based in Spain. The official Activotrade website does not display any valid regulatory information. Unregulated brokers are not always good options for traders as they cannot guarantee the safety of funds.

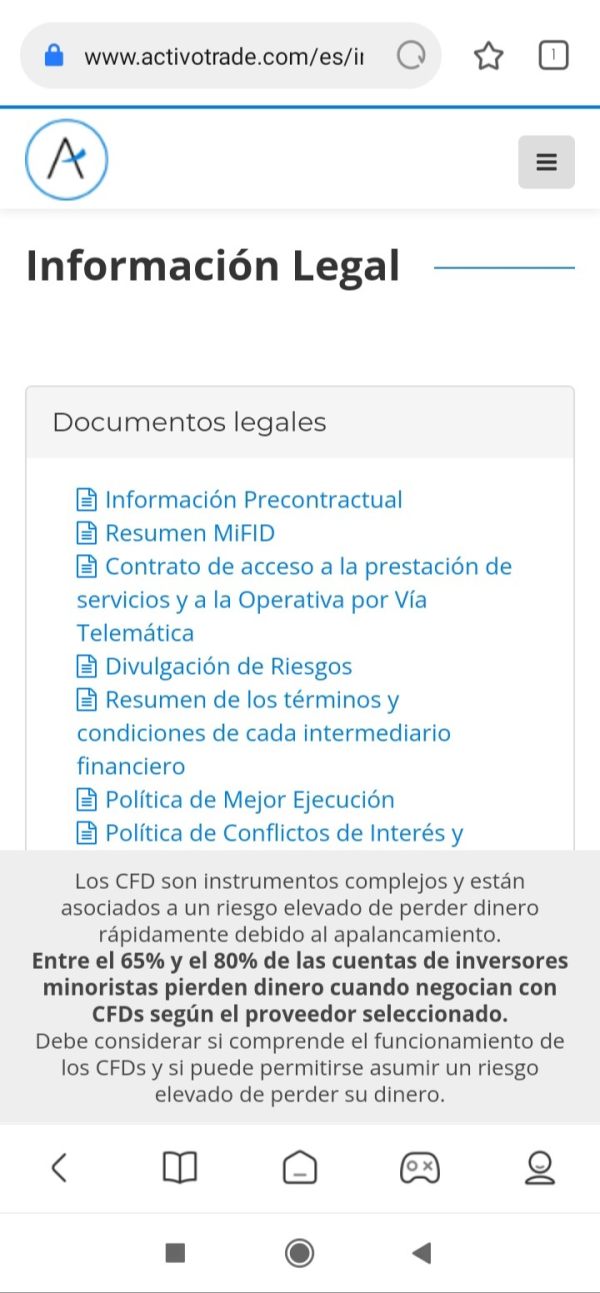

This company is one of the most chosen in Spain to make investments in the online stock market. As announced on its home page, it has more than 10 years of experience in this business, which gives it unique prestige. Throughout its journey, the company has achieved numerous milestones. Licenses are the most determining factor: license from the Spanish CNMV, certification from Fogain (Investment Guarantee Fund); Activotrade complies with the MIFID Financial Market Regulations.

market instruments

ActivoTrade offers investors access to popular tradable financial instruments, primarily currency pairs, stocks, indices, futures, and Forex CFDs.

Among the assets available at the broker are traditional stocks, as well as indices and other classic items such as commodities and metals.

Among the most popular assets are stocks, which are the starting tool for most investors with no prior experience. The next step is usually the indices, which present more complexities and allow markets to be explored in the long term.

But the alternatives do not stop there. There are also investment possibilities in metals, energy and raw materials. This requires a good study of the market, since it is not easy to invest in products such as gold, gas, oil or grains. In fact, this area carries great responsibility.

Even more: on the platform you can invest in futures, bonds and even EFTs. The latter corresponds to exchange-traded funds, that is, listed investment funds. They are an alternative that combines the flexibility of shares with the long-term vision of indices.

minimum deposit

The company does not provide information about a standard initial deposit quote. Typically, most brokers ask for an initial amount of $100 or an equivalent amount to start trading for real.

ActiveTrade Leverage

there is no mention of trading leverage information on the website of ACTIVO TRADE . brokers set their fees, which in some cases can be as high as 1:100 or even 1:1000. Forex leverage is primarily expressed as a ratio. 1:100 leverage means that with a fund of $1 you will be able to open positions of up to $100.

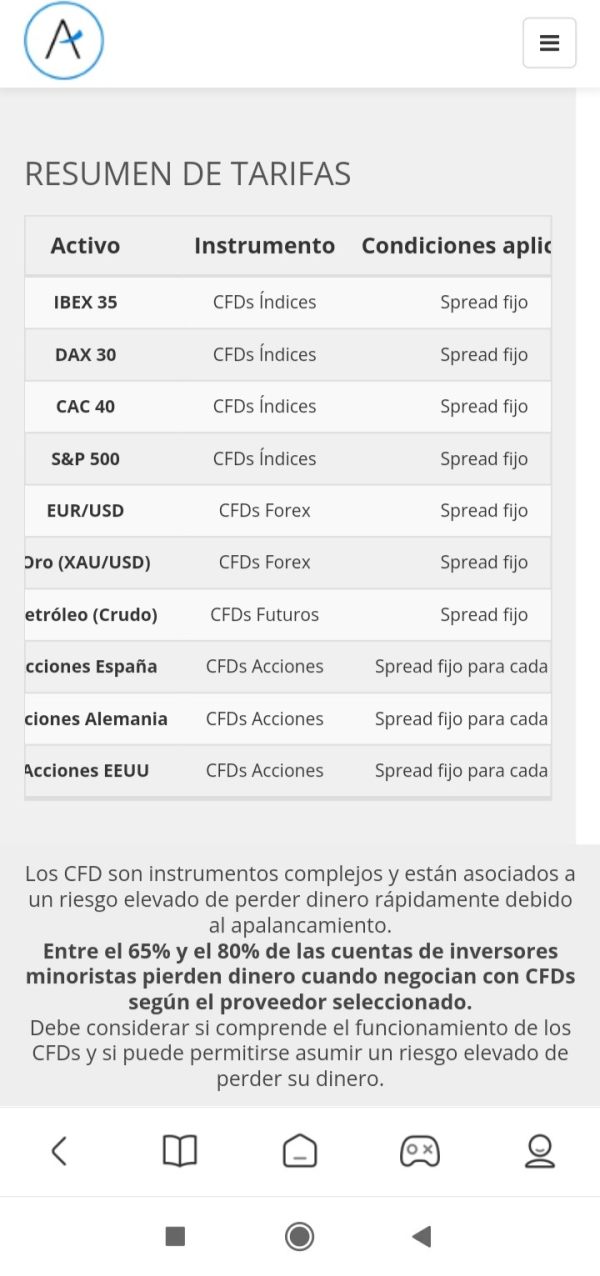

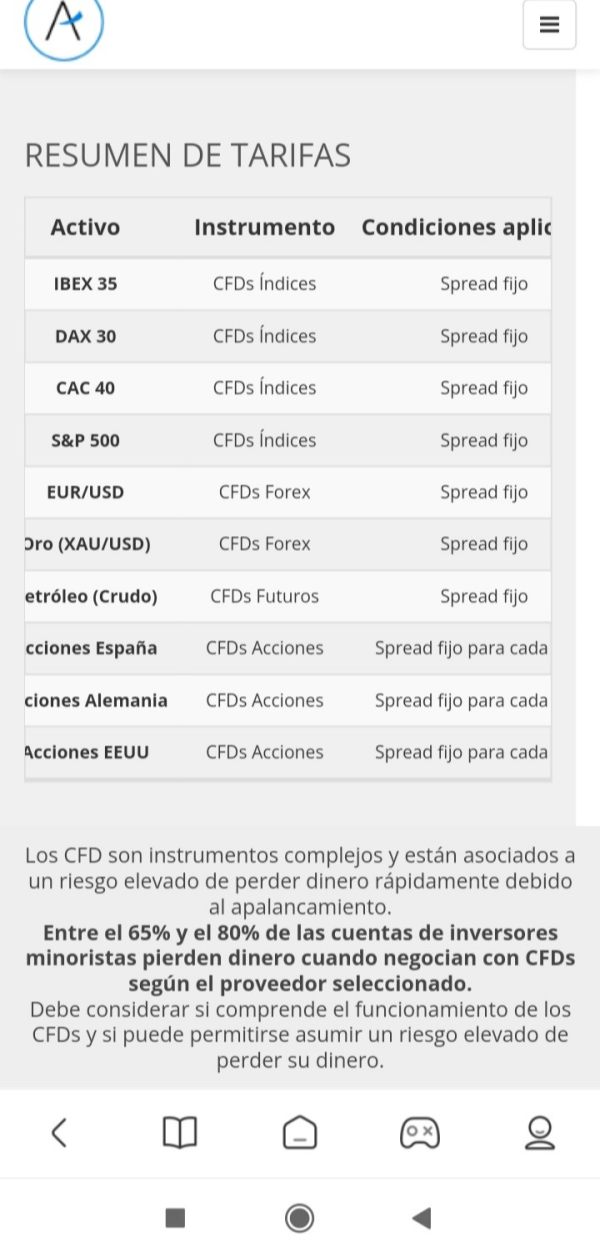

Spreads and commissions

ActivoTrade says that it offers fixed spreads, but does not provide specific details. The commission for operating with Spanish and German shares is 0.07% of the value of the operation. For US stocks, it is $0.015 per share. For DAX30, it is 0.0065% of trade volume. For Dax futures, it is EUR 3.51 per contract. For S&P 500 CFDs, it is 0.016% of the trade value, and for EURUSD, the minimum spread is 0.6 pips. The gold dollar spread is 0.8 pips.

Trading accounts available

The user will have the possibility to create several types of accounts with each one having different characteristics.

ActiveTrade Mini -> Opening with #3500.

Activotrade Plus -> Opening with $7000.

Activotrade pro -> Opening with $10,000.

Each of the accounts have different commissions. The account with the lowest commissions is the last one, but the initial income is somewhat high, therefore we believe that it is an option for only certain types of users.

trading platforms

ActivoTrade offers traders the Active Trade platform, an expertly developed trading platform that is simple, easy to use and powerful. Traders can improve their decision-making process by locating which instruments are the most volatile and which are moving the most up or down with the most advanced tools and features, trader trends, brokerage calendar, etc. More than 2,100 financial instruments can be traded on the Active Trade platform, with free risk management tools. The platform is also available for mobile phones and tablets, iPhone and Android. If the merchant is using an iPhone, the platform must be downloaded from the Apple Store; if the merchant is using an Android, the platform must be downloaded from Google Play.

The company has four different financial platforms: ACTIVO TRADE , active plus, active pro and active mini. each of them are used to manage different types of portfolios

account opening

Opening an account with ActivoTrade is simple.

We have to fill out the electronic form with our data and later send copies of our identification documents and proof of residence, such as an electricity or water bill, for example.

The minimum deposit to open an account with this broker is €2,500 for INFX, €3,500 for mini, €7,000 for plus and €10,000 for pro.

Deposits can be made by credit or debit card or by transfer, at least in the smallest accounts. In the majors, the transfer method will have to be used.

Deposit and Withdrawal

Trade.com's financing methods include credit cards, bank transfers, WebMoney, and other online payment programs. The minimum amount to open a Trade.com account is $100 and there is no deposit fee. Withdrawals can be made using the same methods.

Broker News:

As for his reputation in the field, it is outstanding. Reviews abound in which its own users give an account of their experience on the platform, and, based on these observations, the operator gives results. Many of his clients have achieved ideal profitability thanks to the system's tools.

The opinions seem to indicate that it has all the hallmarks of a reliable operator. It enjoys both the satisfaction of its users and the respect of like-minded companies in the same industry.

Customer Support:

| Company | Activotrade Securities Securities Agency SA |

| Address | C/ Av. Diagonal 309, 6th floor, Barcelona 08013 |

| Registration number | 239 CNMV |

| License number | 239 CNMV |

| telephone | (+34) 932 205 440 |

| contacto@activotrade.com | |

| Live Chat | No |

| call back | No |

Activotrade payment methods

Activotrade proposes transactions through:

1) credit or debit card;

2) bank transfers;

3) Trustly (money management app).

All three methods work quickly and efficiently.

In all cases, data encryption systems govern that make it impossible for personal information to circulate on the web. In the case of Trustly, it allows you to operate with ING Direct, BBVA, Santander, CaixaBank, Sabedell, Bankia, Bankinter or also in Germany with Deutsche Handelsbank. As for the commissions, Activotrade does not charge them, but they are in the hands of the banks.

| Payment methods | Bank transfers, debit and credit cards, Trustly |

| minimum deposit | € 5 |

| commissions | According to the method |

| accepted currencies | USD, EUR |

| withdrawal options | Bank transfers, debit and credit cards, Trustly |

The Activotrade broker has varied and reliable alternatives to deposit and withdraw money. We see that there is a real commitment to make the flow of money dynamic and without obstacles, without extra commissions.

Conclusion

After having analyzed different comments and opinions, Activotrade seems to be a reliable operator with a lot of potential. We are aware that its users have achieved real profitability through its systems, and that the platforms operate in accordance with financial laws. What we highlight the most is the presence of rigorous certifications. The most important of these is that of the CNMV. It is advantageous that the company is covered by Fogain. This guarantee fund covers the debts of any of the parties, in case it is declared insolvent. Thus, the money of the users is supported.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX6283185592

Argentina

Do not send them money. They want to get as much money as possible with lies. The operations are not real and the money does not enter the market. They only show it and tell you that you have lost in the end, and they keep it. They ask you for more deposit to pay taxes, fees, legalizations, etc. DO NOT do it! It is a clear sign that they want to steal your money and they will not return anything even if you pay.

Exposure

2021-12-17

FX2664828147

Colombia

Do not invest your money here. In my case, my money as you see, the operations have been manipulated causing everything to be lost. Also the page seems to be hacked and I see my legal information in danger

Exposure

2021-12-16

强哥 13862181028

United States

The company's website is only available in Spanish, but that's not the most important thing. The most important thing is that it's a scammer! I hope everyone stay vigilant and don't entrust your money to scammers easily.

Neutral

2023-02-23

砾石

Mexico

Activo trade is a forex broker registered in Spain but not regulated. When choosing a forex broker on your forex journey, security should be the primary factor. Effective and onshore regulation is the minimum requirement.

Positive

2023-02-14