Score

Funda Markets

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://fundamarkets.com/web/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Disclosure

Danger

Contact number

Other ways of contact

Broker Information

More

Funda Markets Limited

Funda Markets

Saint Vincent and the Grenadines

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed Funda Markets also viewed..

XM

Neex

FXCM

FBS

Funda Markets · Company Summary

| Information | Details |

| Company Name | Funda Markets |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Founded in | Within 1 year |

| Tradable Instruments | 60 trading instruments including Forex pairs, Gold, Crude Oil, Indices, Stocks, and Cryptocurrency |

| Trading Platforms | cTrader |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Account Types | Standard, Standard Islamic, Premium, Platinum, Platinum Islamic, and Diamond |

| Deposit Methods | Bank wire, credit/debit cards, PayU, DirectPlay, and even cryptocurrencies |

| Customer Support | 24/5 live chat, phone, email, social media |

| Additional Features | Demo account |

| FAQs | Yes |

Overview of Funda Markets

Funda Markets is a financial company registered in Saint Vincent and the Grenadines. Established within the last year, it offers a wide range of trading opportunities in various financial markets. It provides a diverse selection of 60 tradable instruments, including Forex pairs, Gold, Crude Oil, Indices, Stocks, and Cryptocurrency through the cTrader platform. The company offers multiple account types, such as Standard, Standard Islamic, Premium, Platinum, Platinum Islamic, and Diamond, catering to individual preferences and requirements. Furthermore, it offers a maximum leverage of 1:500, allowing traders to amplify their positions and potentially increase their profits. Deposits can be made through various methods, including bank wire, credit/debit cards, PayU, DirectPlay, and even cryptocurrencies, providing flexibility and convenience for clients. Traders can reach the company's support team 24/5 via live chat, phone, email, and social media platforms. In addition to its services, Funda Markets offers a demo account for those who wish to practice their trading strategies and familiarize themselves with the platform before committing real funds.

Pros and Cons

Funda Markets offers a wide range of market instruments and account types to cater to different trading preferences and strategies. Traders can choose from various deposit and withdrawal methods, making it convenient to manage their funds. One notable advantage of Funda Markets is its generous leverage of up to 1:500, allowing traders to amplify their trading positions and potentially increase their profits. The platform also provides a demo account and a bonus program. To assist traders, Funda Markets provides 24/5 live help and frequently asked questions (FAQs) section, ensuring that traders can receive prompt support and find answers to their queries.

However, there are a few drawbacks to consider. Funda Markets does not offer the popular MT4/MT5 trading platforms, which may be a disadvantage for traders who are accustomed to these widely used platforms. Traders should also be aware of swap charges, overnight interest fees, and withdrawal fees, which can impact the overall cost of trading.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Market Instruments

Funda Markets offers a wide range of trading instruments across various asset classes, including Stocks, Indices, Metals, Energies, Cryptocurrencies, Forex, and Commodities.

| Currency | Stocks | Indices | Crypto | Commodities | |

| Funda Markets | √ | √ | √ | √ | √ |

| FXTM | √ | √ | √ | √ | √ |

| FP Markets | √ | √ | √ | √ | √ |

| XM | √ | √ | √ | √ | √ |

Account Types

Funda Markets offers a range of account types, including Standard, Standard Islamic, Premium, Platinum, Platinum Islamic, and Diamond.

The positive aspect is that the Standard account has a reasonable minimum deposit of $100, which falls within the industry standard range of up to $200. However, it's important to be cautious when considering the higher-tier accounts. For example, the Platinum account requires a minimum deposit of $2000, while the Diamond account demands a substantial $5000.

It's worth noting that these high deposit requirements may not be justified, particularly when dealing with an offshore broker that lacks an established reputation or credible forex license. As a prudent trader, it is crucial to exercise vigilance and conduct thorough research on any broker before committing your funds.

How to Open an Account?

Follow these simple steps:

1. Visit the Funda Markets website: Go to the official website of Funda Markets using your web browser. In this case, the URL you provided is https://fundamarkets.com/.

2. Locate the account opening section: Look for a “Open an Account” button on the website. Click on it.

3. Choose the account type: Funda Markets might offer different types of accounts, such as Standard, Standard Islamic, Premium, Platinum, Platinum Islamic, and Diamond Account. Select the account type that suits your needs and click on it.

4. Fill out the application form: You will be presented with an application form that needs to be filled out. Provide the requested information, which may include your name, contact details, date of birth, address, employment information, and financial details.

5. Provide identification documents: Online platforms typically require you to submit identification documents for verification purposes. This may include a copy of your passport, driver's license, or other government-issued identification.

6. Submit your application: Review the information you have entered and ensure everything is accurate. Submit your application by clicking the appropriate button.

7. Account approval: Once your application and verification process are complete, Funda Markets will review your information. If everything is in order, your account will be approved, and you will receive further instructions on how to access and manage your account.

Spread & Commission

Funda Markets presents a range of highly competitive spreads on its trading platform. Notably, our calculations reveal impressively tight spreads of 0.1 pips on EURUSD, 0.4 pips on GBPUSD, and 0.4 pips on USDJPY.

While these narrow spreads may capture the attention of traders, it is vital to consider other pivotal factors to safeguard your trading experience. One of the foremost aspects is the regulation and security of your funds.

To prioritize the safety of your investments, it is strongly advised to select a broker that is regulated by a reputable financial authority. By doing so, you can ensure a higher level of security and peace of mind while pursuing your trading activities.

Leverage

Funda Markets provides a range of account types, each offering generous leverage options of up to 1:500. It's worth noting, however, that certain jurisdictions have implemented leverage restrictions to safeguard the interests of clients. Even seasoned traders should exercise caution when dealing with high leverage, underscoring the significance of selecting a reputable broker and gaining a comprehensive understanding of leverage mechanics.

Overnight Interest Fees (Non-trading Fees)

According to the international banks practices, overnight fee is calculated for 7 days in a week. Foreign Exchange, Gold, and Crudebil transactions are settled after 2 trading days (Wednesday) (T +2).On Monday, Tuesday, Thursday, and Friday, 1 day of overnight fee is charged. On Wednesday, the overnight fee for trading position carry forward is being charge 3 days of interest to cover on weekend charge.

For indices, Monday to Thursday overnight fee is 1 day of interest daily, and 3 days of overnight fee to be charged on Friday. Cryptocurrency is subjected to 3 days of overnight fee on Thursday.

Trading Platform

Funda Markets provides traders with both a WebTrader and the popular desktop cTrader platform. However, it's essential to prioritize the safety of your funds. Unlike regulated brokers, offshore brokers like Funda Markets cannot offer the same level of protection.

When it comes to trading, it's always wiser to prioritize safety and select a reputable broker with top-of-the-line software. That's why we recommend opting for industry-standard platforms such as MetaTrader4 and 5 or cTrader. Instead of settling for less, why not enjoy the best of both worlds: superior trading software and a secure trading environment?

If you're skeptical about the hype surrounding MT4 and MT5, allow us to highlight some of their remarkable features. These platforms offer advanced charting tools, customizable indicators, automated trading options, and a user-friendly interface. With such comprehensive features, they truly provide everything you need for successful trading.

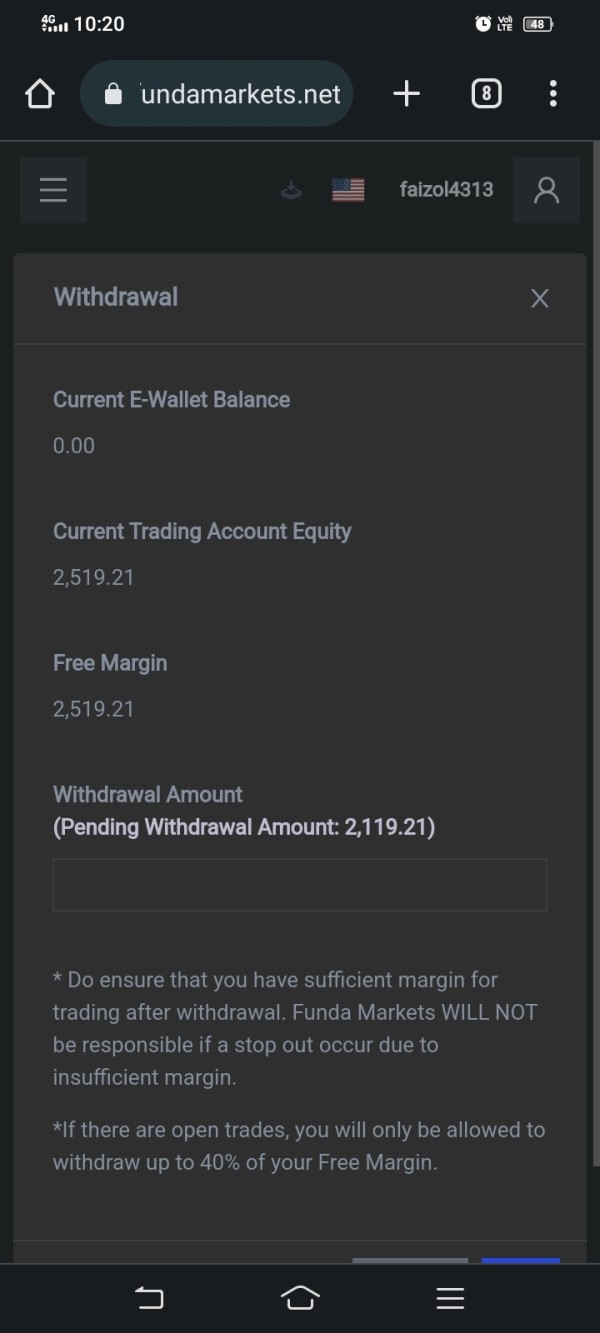

Deposit & Withdrawal

When it comes to funding your trading account, Funda Markets offers a wide range of payment options for your convenience. You have the flexibility to choose from various methods such as bank wire, credit/debit cards, PayU, DirectPlay, and even cryptocurrencies. However, it is essential to exercise caution due to concerns regarding the company's reputation. It is strongly advised that investors refrain from making deposits with Funda Markets. There is a possibility that any deposits made may not be credited to your trading account, resulting in potential complications.

Funda Markets claims that it does not charge withdrawal fees from clients (you may refer to our Deposit & Withdrawal Fee Schedule Here), except the following circumstances:

(1) A processing fee of 6% will be charged when 50% of deposited funds have not been used for trading(accumulate) or made

withdrawal request without performing any trading after the last deposited funds.

(2) This company does not support funds from 3rd-party account/credit card holder, and the funds will be returned with a rate of 7% of processing fee.

Deposits that are made with online banking or mobile bank transfer, generally funds will be transferred into your trading account within 10 minutes.

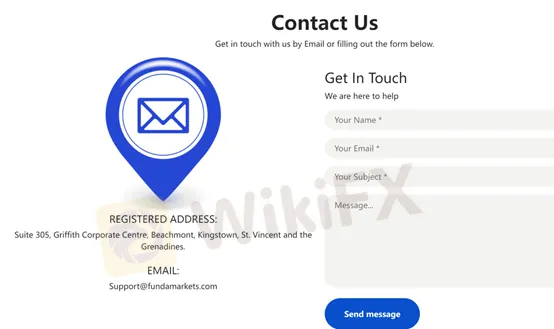

Customer Support

Funda Markets provides the address and email address on its website and claims that users can contact their customer support team via email, phone, and social media including Facebook and Instagram.

Conclusion

In conclusion, Funda Markets offers a wide range of market instruments, diverse account types, and convenient deposit/withdrawal methods. It provides generous leverage and helpful customer support features.

FAQs

Q: Can I log in to Demo Account on App?

A: Yes, you may switch between Real Account and Demo Account in the APP.

Q: Is there any Demo Account for trading?

A: (1) There is Demo Account for you to experience trading operation, markets data of Demo account and Real account are completely consistent.

(2) You may register as a Demo account with 10,000 USD when you sign up for a Traders Room Account. You can always switch between Demo account and Real account in the cTrader APP.

Q: What is the age limit to open a trading account?

A: There are age limit for opening a trading account and document verification which is between 18-60 years old, otherwise verification will not be verified.

Q: What are the requirements for activating accounts?

A: Standard trading account requires only minimum of 100 USD for account activation.

Q: What is the minimum trading volume per trade?

A: Minimum trading volume is 0.01 lot for Standard account and VIP account.

Q:What type of instruments I can trade?

A: After activating your real trading account, you are allowed to trade over 60ing instruments including Forex pairs, Gold, Crude Oil, Indices, Stocks, and Cryptocurrency, you may always visit our website or log into your trading account to check on the available list of trading instrument.

Q: Can I perform trade operation after request for withdrawal?

A: After you have submitted your withdrawal request, it will be recorded into system as a pending withdrawal amount, and will not affect the normal transaction of your funds.

Q: Can I request for withdrawal while having opened position?

A: Funds are allowed to withdraw if free margin is sufficient and will be processed promptly. The withdrawal amount cannot be more than 40% of the free margin from the trading account.

News

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now