Score

Ally

United States|5-10 years|

United States|5-10 years| https://www.ally.com/invest/

Website

Rating Index

Influence

Influence

AAA

Influence index NO.1

United States 9.88

United States 9.88Surpassed 15.40% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

+1 855-880-2559

Other ways of contact

Broker Information

More

Ally Financial Inc

Ally

United States

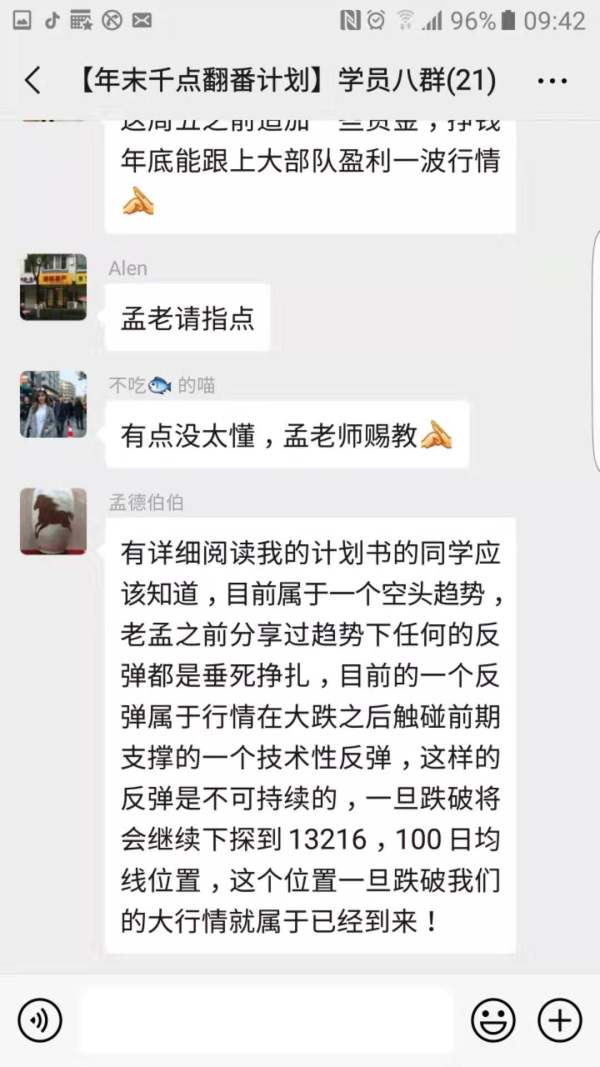

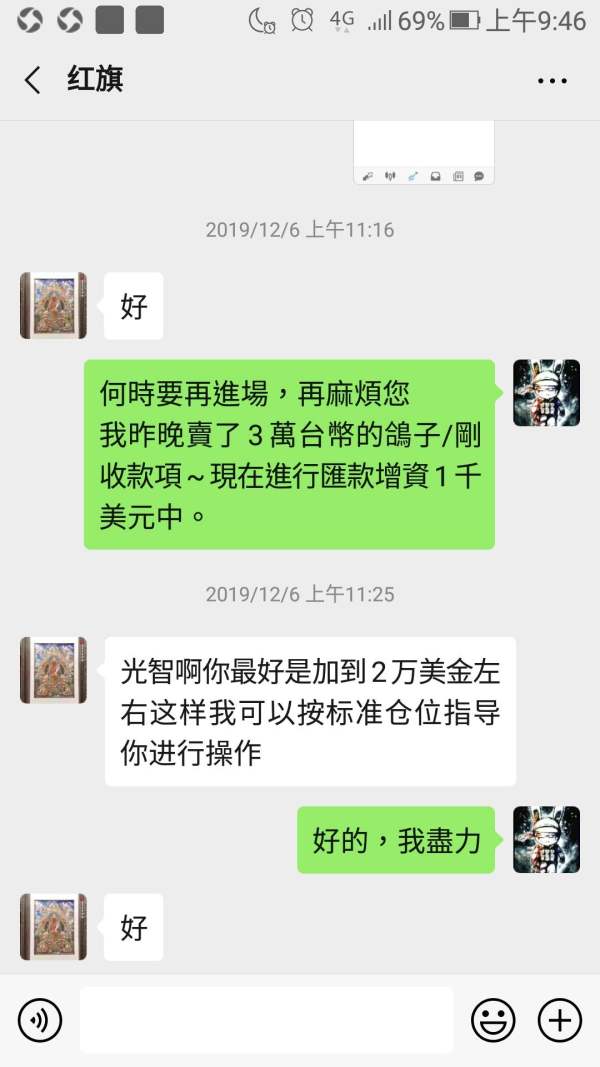

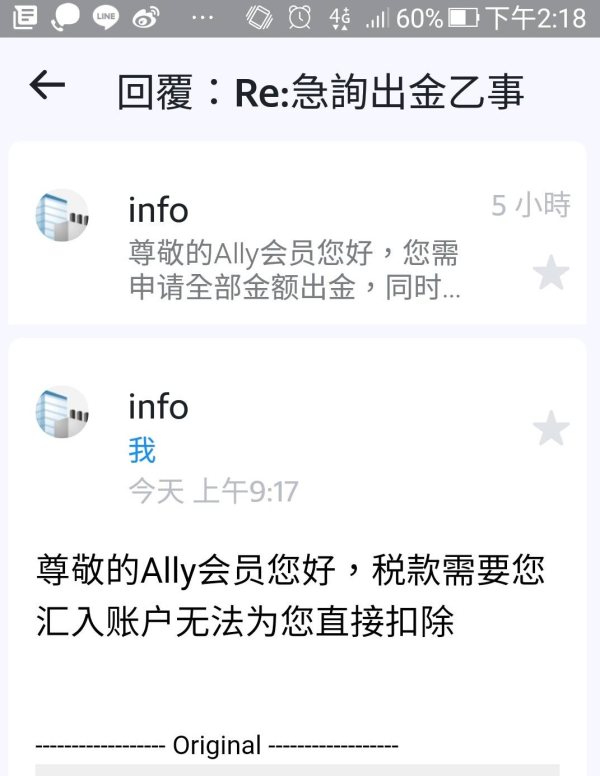

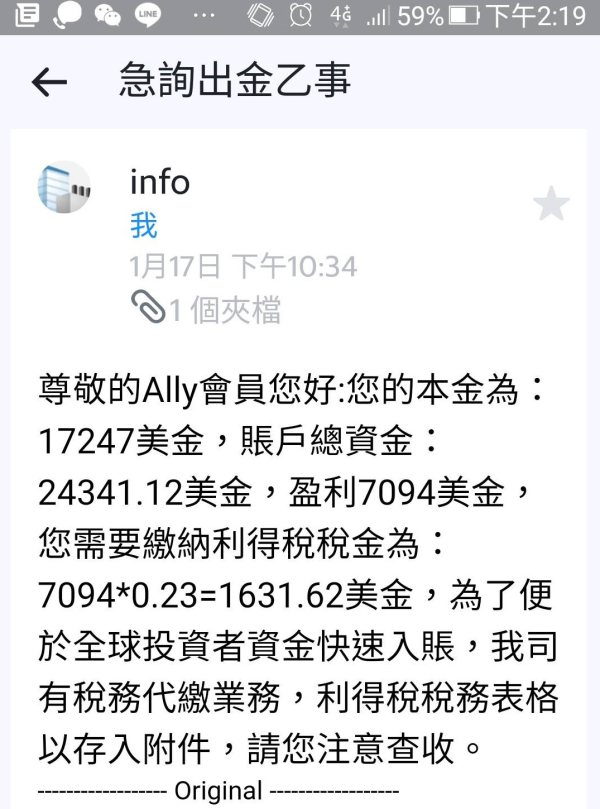

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The United StatesNFA regulation (license number: 0408077) claimed by this broker is suspected to be clone. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed Ally also viewed..

XM

GO MARKETS

FP Markets

ATFX

Sources

Language

Mkt. Analysis

Creatives

Ally · Company Summary

| Aspect | Information |

| Registered Country/Area | United States |

| Founded Year | 2-5 years |

| Company Name | Ally Financial Inc |

| Regulation | Suspicious Regulatory License |

| Minimum Deposit | Not specified |

| Trading Platforms | No trading software available at present |

| Tradable Assets | Stocks, ETFs, Commission-free ETFs, Options, Bonds, Mutual Funds, Crypto Trusts, Bitcoin Futures, Crypto Stocks |

| Account Types | Not specified |

| Customer Support | Phone: +1 855-880-2559 |

| Credit Cards | Ally Platinum Mastercard, Grey Ally Everyday Cash Back Mastercard, Black Ally Unlimited Cash Back Mastercard |

| Services | Banking products (mortgage lending, deposits, savings accounts, CDs, checking accounts, money market accounts, IRAs, credit cards), online brokerage services, Forex services, mortgages, trading platforms, customer support |

Overview of Ally

Ally is a financial institution based in the United States that offers a range of banking, investment, and credit card services. The broker lacks valid regulation and is suspected of having a cloned United States NFA license, raising concerns about its legitimacy. Additionally, Ally currently does not possess any trading software.

Despite these risks, Ally provides market instruments for investment, including stocks and ETFs, commission-free ETFs, options, bonds, mutual funds, and cryptocurrencies. They offer rates and services tailored for low-priced securities. In the banking sector, Ally offers various products and services such as mortgages, CDs, money market accounts, checking accounts, and digital wealth management. Their credit card options include the Ally Platinum Mastercard, Grey Ally Everyday Cash Back Mastercard, and Black Ally Unlimited Cash Back Mastercard. However, it's important to note that Ally Forex, affiliated with Ally Financial, lacks protection from the Securities Investor Protection Corp. and the Federal Deposit Insurance Corp.

Ally's trading platform is web-based and supports mobile applications for access. It provides features like charts, watchlists, research capabilities, and options for ETF and options trading. The platform also offers comprehensive research and market data, including an ETF screener and option chains. Ally provides customer support through various channels, including social media platforms and contact information for different services.

Considering the potential risks, lack of valid regulation, and absence of necessary trading software, caution is advised when dealing with Ally.

Pros and Cons

Ally is a financial institution that offers a range of banking products, investment services, credit cards, mortgages, and forex trading options. However, there are several concerns associated with Ally. Firstly, the broker lacks valid regulation, which poses potential risks for customers. There are suspicions regarding the authenticity of their claimed United States NFA regulation. Additionally, Ally does not possess any trading software at present, which raises concerns about their ability to provide a robust trading platform. Despite offering a variety of market instruments for investment, such as stocks, ETFs, options, bonds, and mutual funds, customers should exercise caution due to the risks and the absence of necessary regulatory measures. It is important to consider these factors before engaging with Ally.

| Pros | Cons |

| Offers a range of market instruments for trading | Lack of valid regulation |

| Provides a variety of banking products and services | Suspicions regarding NFA regulation |

| Simplified and expedited mortgage application process | No trading software available |

| Credit cards with cash back rewards and benefits | Potential risks for customers |

| Web-based trading platform with comprehensive features | Lack of necessary regulatory measures |

| Customer support services through various channels |

Is Ally Legit?

Ally does not have valid regulation. This lack of regulation poses potential risks for customers. Additionally, the claimed United States NFA regulation with license number 0408077 is suspected to be a clone, further raising concerns about the broker's legitimacy. Furthermore, it has been observed that Ally does not possess any trading software at present. It is important to exercise caution when dealing with this broker due to the aforementioned risks and absence of necessary regulatory measures.

Market Instruments for Investment

Ally offers a range of market instruments for trading, including Stocks and ETFs, Commission-free ETFs, Options, Bonds, and Mutual Funds.

Stocks and ETFs:

For Stocks and ETFs, Ally provides commission-free trading with no account minimums, allowing customers to invest in a variety of stocks and exchange-traded funds.

Commission-free ETFs

Commission-free ETFs are also available, enabling customers to trade ETFs without incurring any commission fees.

Options

Options trading is another offering by Ally, with a commission fee of $0 and an additional 50 cents per contract fee. Customers can explore various options trading opportunities through Ally's platform.

Bonds

When it comes to Bonds, Ally follows standard pricing and select pricing, charging $1 per bond with a minimum of $10. This enables customers to invest in bonds based on their financial goals and preferences.

Mutual Funds

Ally also offers the opportunity to buy and sell no-load Mutual Funds with no fees per trade. Customers can explore a wide range of mutual funds to diversify their investment portfolios.

Additionally, Ally provides information and services specifically tailored for Low Priced Securities, which are stocks priced less than $2.00. Trading these securities incurs a fee of $4.95 plus 1 cent per share.

Cryptos

In addition to the above market instruments, Ally provides options for investing in Crypto Trusts, which are private trusts that invest in and track the price of specific cryptocurrencies, allowing indirect trading similar to stocks.

Bitcoin Futures are also available through Ally, which are exchange-traded funds (ETFs) that invest in the purchase of bitcoin futures contracts. This provides exposure to Bitcoin's future price without directly owning the cryptocurrency.

Furthermore, Ally offers the opportunity to invest in Crypto Stocks, which are publicly traded companies that individually buy and hold cryptocurrencies. Buying shares of these stocks provides indirect exposure to cryptocurrencies.

| Pros | Cons |

| Commission-free trading for Stocks and ETFs | Fee for trading Low Priced Securities |

| Commission-free ETFs | Limited options for Cryptos |

| Zero commission fee for Options trading | Standard pricing for Bonds |

| No fees per trade for Mutual Funds | |

| Option to invest in Crypto Stocks for indirect exposure |

Products & Services

Ally Financial offers a range of banking products and services to its customers. These include mortgage lending, deposits, online savings accounts, certificate of deposits (CDs), checking accounts, money market accounts, individual retirement accounts (IRAs), debit and credit cards, digital wealth management, and online brokerage services. The company caters to various types of clients, including retail customers, businesses, automotive dealers, and corporate clients. They serve their customers through branch offices, direct sales force, and online portals.

One of the banking services provided by Ally is their CD offerings, which include options such as High Yield CDs, Raise Your Rate CDs, and No Penalty CDs. The No Penalty CD allows customers to withdraw their full balance and interest without incurring any penalties after the initial 6 days of funding the CD. Ally offers rates and provides a Loyalty Reward when customers renew their CD.

Customers can use any Allpoint® ATM in the U.S. for free, with unlimited ATM withdrawals. Ally reimburses up to $10 per statement cycle for fees charged at other ATMs nationwide. The Money Market Account offers a rate of interest that is compounded daily, allowing customers to earn more on their savings. Deposits made into Ally accounts are insured by the FDIC up to the maximum allowed by law.

For customers seeking checking account services, Ally provides features like Ally eCheck Deposit℠, which allows users to remotely deposit checks using their smartphones. The checking accounts have no monthly maintenance fees or overdraft fees, and customers can access a network of no-fee Allpoint® ATMs. Ally also offers spending buckets to help customers manage their expenses.

In addition to banking services, Ally provides self-directed trading, robo portfolios, wealth management services, and options for forex trading. They offer retirement account solutions, including IRAs and Rollover IRAs, to help individuals plan for their future.

| Pros | Cons |

| Daily compounded interest on Money Market Account | Limited physical branch presence |

| No monthly maintenance fees or overdraft fees on checking accounts | Limited face-to-face customer support |

| No Penalty CD option for easy withdrawals | Limited availability of specialized banking services |

| Retirement account solutions (IRAs and Rollover IRAs) | Limited international banking capabilities |

| Free access to Allpoint® ATMs in the U.S. | Limited availability of physical ATMs in certain areas |

Forex Business

Ally Financial operates Ally Forex, which offers Forex services. While Ally Forex and Ally Invest are affiliated companies, they are separate entities. It's worth noting that Forex accounts provided by Ally cater to self-directed investors and lack protection from the Securities Investor Protection Corp. (SIPC) and the Federal Deposit Insurance Corp. (FDIC). Acting as an introducing broker, Ally Forex partners with GAIN Capital Group, LLC. The responsibility of holding and managing clients' Forex accounts lies with GAIN Capital, serving as the clearing agent and counterparty for trades. GAIN Capital is duly registered with the Commodity Futures Trading Commission (CFTC) and holds membership in the National Futures Association (NFA) under ID number 0339826. Similarly, Ally Forex is also a member of the National Futures Association, identified by ID number 0408077.

Credit Cards

Ally offers three credit card options: the Ally Platinum Mastercard, the Grey Ally Everyday Cash Back Mastercard, and the Black Ally Unlimited Cash Back Mastercard.

The Ally Platinum Mastercard is designed to assist users in achieving their credit goals. It features automatic credit line increase reviews and offers benefits such asno annual fee, free online FICO® score, and no surprise fees. Additionally, it provides peace of mind with zero fraud liability and around-the-clock fraud monitoring.

The Grey Ally Everyday Cash Back Mastercard is ideal for maximizing cash back on everyday purchases. Cardholders earn 3% cash back at gas stations, grocery stores, and drugstores, along with 1% cash back on all other purchases. Similar to the other Ally cards, it comes with benefits like no annual fee, zero fraud liability, and 24/7 customer care.

The Black Ally Unlimited Cash Back Mastercard is a go-to card for consistent cash back rewards. It offers 2% cash back on all purchases, with no exceptions or expirations. Additionally, an exclusive version is available for nurses and teachers. The card includes benefits such as no annual fees, zero fraud liability, and tap-to-pay technology.

All Ally credit cards provide benefits like no late-payment rate hikes, no surprise fees, and free online FICO® scores. They also offer around-the-clock fraud monitoring, personal support, and easy account management through the Ally app.

| Pros | Cons |

| No annual fee | Limited credit card options |

| Automatic credit line increase reviews | Potentially higher interest rates |

| Free online FICO® score | Possible foreign transaction fees |

| Easy account management through Ally app | Limited travel benefits or rewards |

| Around-the-clock fraud monitoring | Lack of specialized cardholder perks |

| Cash back rewards |

Mortgages

Ally offers home mortgages with a simplified and expedited application process, allowing applicants to complete their applications in as little as 15 minutes, without incurring any lender fees. Ally aims to provide a faster closing process, typically up to 10 days faster than the industry average.

Ally provides various loan options, including fixed-rate mortgages and adjustable-rate mortgages (ARMs). The fixed-rate mortgage options offer interest rates and terms tailored to individual needs, with options ranging from 15-year to 30-year terms. The adjustable-rate mortgage options, such as the 7/6 ARM and 10/6 ARM.

Ally displays the current rates for each loan type, categorized by fixed-rate and adjustable-rate mortgages, and provides additional information on interest rates, points or credits, and monthly payment amounts. The rates are based on a $350,000 home loan for a single-family home with a 20% down payment in Florida.

Overall, Ally's home mortgage offerings emphasize simplicity, speed, and the absence of lender fees, making them a viable option for those seeking a streamlined mortgage application process and loan options.

Trading Platforms & Tools

Ally Financial provides a web-based trading platform that operates on a streaming HTML 5 interface. This platform allows traders to access their accounts through mobile and tablet applications compatible with iPhone and Android devices.

The platform offers a comprehensive range of features, including charts, watchlists, research capabilities, and support for ETFs and options trading. Traders can access streaming charts with various chart types, such as candlestick, bar, mountain, and line charts. These charts are equipped with 117 chart studies and 36 drawing tools, enabling users to analyze the performance of stocks, ETFs, and indices. Customizable settings and interactive charts facilitate in-depth price and study analysis.

CHARTS:

Within the platform, traders can access a variety of chart types, including candlestick, bar, mountain, and line charts. These charts offer comprehensive insights into the performance of stocks, ETFs, and indices. With 117 chart studies and 36 drawing tools, users can perform detailed analysis and customize settings according to their preferences.

WATCHLISTS:

With the watchlist feature, traders can create personalized watchlists to keep track of groups of securities and easily access market data related to them

RESEARCH:

Ally Financial's trading platform provides extensive research and market data, offering market statistics, news updates, and detailed metrics on companies of interest. Traders can access company quotes, charts, high/low prices, dividend dates, news articles, peer performance comparisons, and more, empowering them with valuable information for making informed trading decisions.

ETFs

For traders interested in ETFs, the platform includes an ETF screener. This tool enables users to research, analyze, and compare performance and price data for thousands of ETFs. Traders can search using symbols, fund family or company names, utilize predefined ETF categories, or filter options based on specific criteria such as price range or Morningstar Analyst Ratings™.

OPTIONS:

The platform also supports options trading, offering a display of option chains. This feature makes it easy for traders to view available options and execute trades accordingly.

MOBILE:

In addition to the web-based platform, Ally offers mobile applications for both iPhone and Android users. These mobile apps provide traders with the option to manage their accounts and execute trades on the go.

Overall, Ally's trading platforms, including the web-based platform and mobile apps, offer a comprehensive suite of tools and features to support traders in their investment activities.

Pros and Cons

| Pros | Cons |

| Comprehensive charting options, including various chart types and customizable settings | Limited discussion on pricing and fees |

| Ability to create personalized watchlists for easy tracking of securities | No mention of advanced order types or trading algorithms |

| Extensive research and market data, including company quotes, news articles, and performance metrics | Lack of information on educational resources or trading tutorials |

| ETF screener for researching and comparing ETF performance and price data | No mention of advanced technical analysis tools |

| Option chains display for easy viewing and execution of options trades | No specific mention of customer support availability |

| Mobile applications for account management and trading on the go | No information on the availability of international markets or trading instruments |

Customer Support

The Forex support team is available 24/5, from Sunday at 10 am ET to Friday at 5 pm ET. Customers can contact Ally Financial through social media platforms such as Facebook, Twitter, YouTube, Instagram, and LinkedIn. Additionally, the company offers different department-specific contact information based on specific business needs. Contact details, including phone numbers, chat options, and mailing addresses, can be found on their website. The bank's customer support is available 24/7, while other departments have specific operating hours. Ally also provides support for credit cards, home loans, investments, lending, and dealer services, with contact information for each category. They have fraud hotlines and options to report suspected fraud or abuse. Customers can manage privacy preferences and control the sharing of personal information through online settings or by contacting the designated phone number.

Conclusion

In conclusion, Ally presents several disadvantages and potential risks that should be considered. The broker lacks valid regulation, which poses potential risks for customers, and there are suspicions regarding its claimed United States NFA regulation. Additionally, Ally currently does not possess any trading software, further raising concerns about its legitimacy. It is crucial to exercise caution when dealing with this broker due to these risks and the absence of necessary regulatory measures. On the positive side, Ally offers a variety of market instruments for investment, including stocks, ETFs, options, bonds, and mutual funds. The company also provides a range of banking products and services, such as mortgages, deposits, checking accounts, credit cards, and wealth management. However, given the aforementioned disadvantages and potential risks, it is advisable to thoroughly evaluate the risks involved and consider alternative options before engaging with Ally.

FAQs

Q: Is Ally a legitimate broker?

A: Based on the latest detection, Ally lacks valid regulation, raising concerns about its legitimacy and posing potential risks for customers.

Q: What market instruments does Ally offer for investment?

A: Ally offers Stocks, ETFs, Commission-free ETFs, Options, Bonds, and Mutual Funds for trading.

Q: Does Ally provide Forex services?

A: Yes, Ally operates Ally Forex for Forex services, but accounts lack protection from SIPC and FDIC.

Q: What credit card options does Ally offer?

A: Ally offers the Ally Platinum Mastercard, Grey Ally Everyday Cash Back Mastercard, and Black Ally Unlimited Cash Back Mastercard, each with its own benefits.

Q: What types of mortgages does Ally offer?

A: Ally offers fixed-rate mortgages and adjustable-rate mortgages (ARMs) with a simplified and expedited application process.

Q: What trading platforms and tools does Ally provide?

A: Ally offers a web-based platform, mobile apps, comprehensive charts, watchlists, research capabilities, and support for ETFs and options trading.

Q: How can I contact Ally for customer support?

A: Ally provides customer support through phone, chat, social media, and department-specific contact information, with 24/7 support for banking services and designated operating hours for other departments.

News

NewsThe Easiest Ways to Become Rich in the Stock Market

Investing in the stock market is one of the finest methods to build money around the globe. One of the stock market's key advantages is that there are several methods to benefit from it.

WikiFX

WikiFX

NewsApril 2022: Top Options Trading Brokers and Platforms

While the majority of the brokers on our list of the best brokers for stock trading are also excellent options brokers, this list concentrates on brokers that excel in areas that are crucial to options traders. Many of the brokers on this list are also on our list of the best online trading platforms for day trading.

WikiFX

WikiFX

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now