Score

NovaTech

Saint Vincent and the Grenadines|5-10 years|

Saint Vincent and the Grenadines|5-10 years| https://www.novatechfx.com/

Website

Rating Index

Influence

Influence

A

Influence index NO.1

United States 8.63

United States 8.63Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesUsers who viewed NovaTech also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

novatechfx.com

Server Location

United States

Website Domain Name

novatechfx.com

Server IP

23.236.62.147

Company Summary

| Registered in | St. Vincent and the Grenadines |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | forex pairs, commodities, indices and stocks |

| Minimum Initial Deposit | $99 |

| Maximum Leverage | 1:100 |

| Minimum spread | Information not available |

| Trading platform | MT5 |

| Deposit and withdrawal method | cryptocurrency |

| Customer Service | Email, phone number, address |

| Fraud Complaints Exposure | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of NovaTech

Pros:

Low minimum deposit requirement of $99

Availability of demo account

Offers trading on multiple financial instruments including forex pairs, commodities, indices, and stocks

MT5 trading platform available

No deposit fees charged

24/5 customer support via email, phone, and address

Cons:

Not regulated by any reputable financial authority

Limited information on spreads and commissions

Only supports deposits and withdrawals through cryptocurrency

No educational resources available on the platform

High risk of fraud and scams associated with unregulated brokers

Maximum leverage of 1:100 may be considered high and risky for some traders.

What type of broker is NovaTech?

| Advantages | Disadvantages |

| NovaTech offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, NovaTech has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

NovaTech is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, NovaTech acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that NovaTech has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with NovaTech or any other MM broker.

General information and regulation of NovaTech

NovaTech is an unregulated forex broker registered in St. Vincent and the Grenadines. The company offers trading in forex pairs, commodities, indices, and stocks, using the MT5 trading platform. NovaTech requires a minimum deposit of $99 and offers a maximum leverage of 1:100. The broker also provides customer support via email, phone, and address. However, the broker has no educational resources and accepts only cryptocurrency deposits and withdrawals.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Market instruments

| Advantages | Disadvantages |

| Wide range of tradable financial instruments | No information available on minimum spreads |

| Opportunity to diversify trading portfolio | Limited selection of stocks compared to other brokers |

| Ability to take advantage of market fluctuations in various markets | Limited information available on specific commodities and indices |

| Potential for higher returns with leverage | No information available on margin requirements |

NovaTech offers a diverse range of financial instruments for trading on its platform, including forex pairs, commodities, indices and stocks. This variety allows traders to diversify their portfolio and take advantage of market opportunities across multiple asset classes. Additionally, with the use of leverage, traders have the potential to increase their profits. However, there is no information available on minimum spreads or margin requirements, which may be a disadvantage for some traders. Furthermore, while the selection of stocks is available, it is relatively limited compared to other brokers. Additionally, there is limited information available on specific commodities and indices.

Spreads and commissions for trading with NovaTech

| Advantages | Disadvantages |

| No information on the specific amount of spreads and commissions | Lack of transparency regarding the costs of trading |

| Low spreads declared by the broker | Potentially higher costs compared to other brokers with transparent fee structures |

| No commission fees mentioned | Difficulty in accurately calculating potential profits or losses |

NovaTech does not provide specific information on spreads, commissions and other costs associated with trading on their platform. While the broker declares to offer low spreads, the lack of transparency regarding the costs of trading can be a cause for concern. The absence of commission fees may seem appealing, but the potential for higher costs compared to other brokers with transparent fee structures cannot be ruled out. Additionally, the difficulty in accurately calculating potential profits or losses due to the lack of clear information on fees can be a hindrance for traders.

Trading accounts available in NovaTech

| Advantages | Disadvantages |

| Low minimum deposit requirement of $99 | No information on account types and features available |

| Demo account available for traders to practice and test strategies | No information on account types and features available |

| Easy and fast account opening process | No information on account types and features available |

NovaTech offers both demo and live accounts to its traders, with a minimum deposit requirement of $99, which is not too high. The account opening process is also easy and fast. However, the broker does not provide any specific information on the types of accounts available or their features, which may be a disadvantage for traders who want to know more about the account types and the services offered with them. Nonetheless, the availability of a demo account is a plus, as it provides traders with an opportunity to practice and test their trading strategies without risking real money.

Trading platform(s) that NovaTech offers

| Advantages | Disadvantages |

| Advanced Charting | Limited to MT5 platform only |

| Automated Trading | Steep learning curve for new users |

| Multiple Timeframes | Limited customization options |

| Supports multiple OS | Limited availability of third-party plugins |

NovaTech offers the MetaTrader 5 (MT5) platform, a popular trading platform known for its advanced charting tools and support for automated trading. MT5 also offers multiple timeframes and is available on various operating systems. However, the platform has a limited availability of third-party plugins and customization options, and it can have a steep learning curve for new users. Additionally, MT5 is the only trading platform offered by NovaTech, which limits the flexibility for traders who prefer different trading platforms.

Maximum leverage of NovaTech

| Advantages | Disadvantages |

| Allows traders to control a larger position with a smaller amount of capital | Higher leverage can lead to larger losses if not managed properly |

| Can potentially increase profits | High leverage can increase the risks of margin calls and stop outs |

| Offers traders more flexibility in their trading strategies | Over-reliance on leverage can lead to reckless trading behavior and increased risk of blowing up the account |

| Can be useful for experienced traders who know how to manage their risk | Novice traders may not understand the risks associated with high leverage and could potentially lose all of their invested capital. |

NovaTech offers a maximum leverage of up to 1:100, which is a relatively standard amount offered by many forex brokers. While leverage can be a useful tool for experienced traders to increase their potential profits, it can also increase the risks of losses if not managed properly. Novice traders should be cautious and educate themselves on the risks associated with high leverage before engaging in trading with leverage. Additionally, traders should carefully consider their risk tolerance and trading strategies before selecting a leverage amount.

Deposit and Withdrawal: methods and fees

| Advantages | Disadvantages |

| No deposit fees charged | Limited payment options available |

| Fast and easy transactions | Risk of volatile cryptocurrency markets |

| Secure and anonymous deposits and withdrawals | Lack of traditional payment methods such as bank transfer or credit card |

| No need for third-party payment processors | Inconvenience for traders not familiar with cryptocurrencies |

NovaTech offers a deposit and withdrawal method only through cryptocurrencies such as BTC, LTC, and ETH. While the broker claims there are no deposit fees charged, it is essential to understand the risks involved in funding through a crypto wallet, which can be volatile. Additionally, this payment method may be inconvenient for traders not familiar with cryptocurrencies, and the limited payment options available may be a disadvantage for those who prefer traditional payment methods such as bank transfer or credit card. However, the use of cryptocurrencies offers fast and easy transactions, secure and anonymous deposits and withdrawals, and eliminates the need for third-party payment processors.

Educational resources in NovaTech

| Advantages | Disadvantages |

| None Available | May hinder traders progress |

NovaTech does not offer any educational resources to its clients. This may discourage beginners who want to learn more about the financial market before trading or hinder the progress of traders who want to advance their knowledge. Not having access to educational resources may limit traders' understanding of the market and make them vulnerable to losses. This lack of educational resources is a disadvantage for NovaTech, as it puts them at a disadvantage compared to other brokers who offer a variety of educational resources to help traders improve their knowledge and skills.

Customer service of NovaTech

| Advantages | Disadvantages |

| Multiple ways to contact support (phone, email, address) | Limited customer support hours |

| Physical office address provided | No live chat support |

| Clear contact information provided | No multilingual support available |

NovaTech offers a few options for contacting customer support, including phone, email, and a physical address for their office. However, the customer support hours are limited, and there is no live chat option available. Additionally, there is no multilingual support, which may be a disadvantage for some non-English speakers. Overall, while NovaTech provides some ways to contact customer support, the limited hours and lack of live chat support may be a drawback for some traders.

Conclusion

In conclusion, NovaTech is a relatively new and unregulated forex broker that offers traders access to a variety of financial instruments through the MT5 platform. The broker requires a minimum deposit of $99 and offers high leverage of up to 1:100, which can be a risk for traders. While the lack of transparency on spreads and commissions is a significant drawback, the absence of deposit fees and availability of cryptocurrency deposits may appeal to some traders. However, the absence of educational resources, limited customer support, and the high exposure to fraud complaints could be concerning for potential clients. Therefore, it is essential to consider the pros and cons before deciding to trade with NovaTech.

Frequently asked questions about NovaTech

Q 1: Is NovaTech regulated?

A 1: No. It has been verified that NovaTech currently has no valid regulation.

Q 2: Does NovaTech offer demo accounts?

A 2: Yes.

Q 3: Does NovaTech offer the industry-standard MT4 & MT5?

A 3: Yes. NovaTech supports MT5.

Q 4: What is the minimum deposit for NovaTech?

A 4: The minimum initial deposit with NovaTech is $99.

Q 5: Is NovaTech a good broker for beginners?

A 5: No. NovaTech is not a good choice for beginners. Though it offers demo MT5 accounts, never forget that it is unregulated.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Global Business

- High potential risk

News

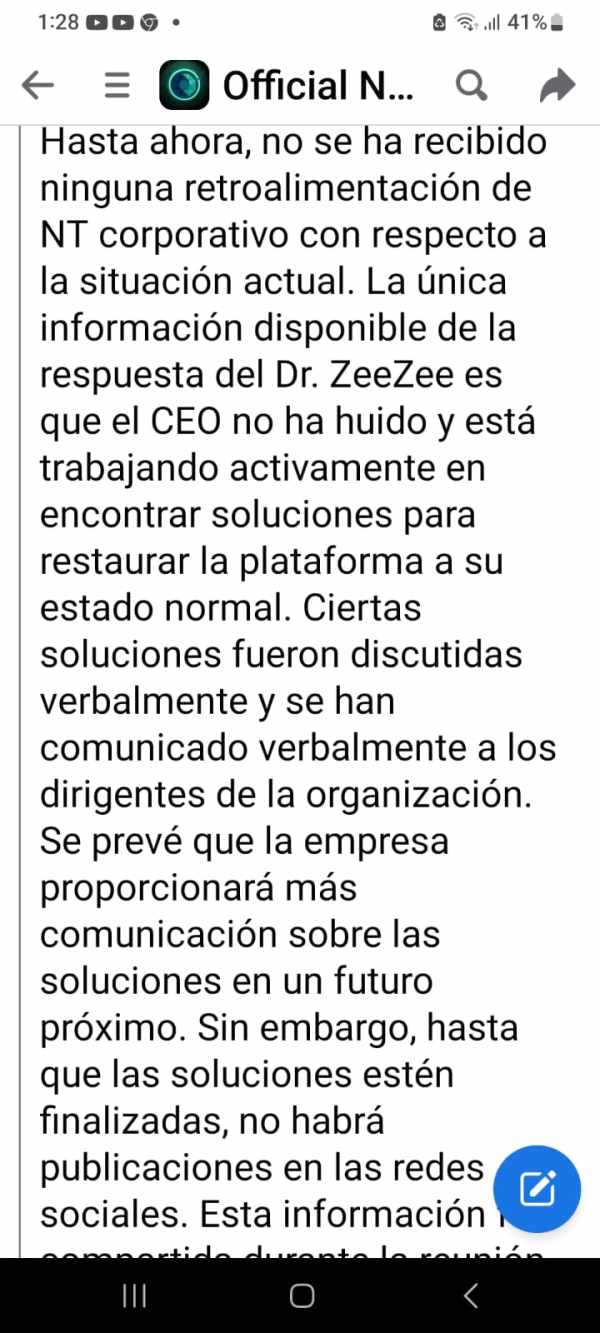

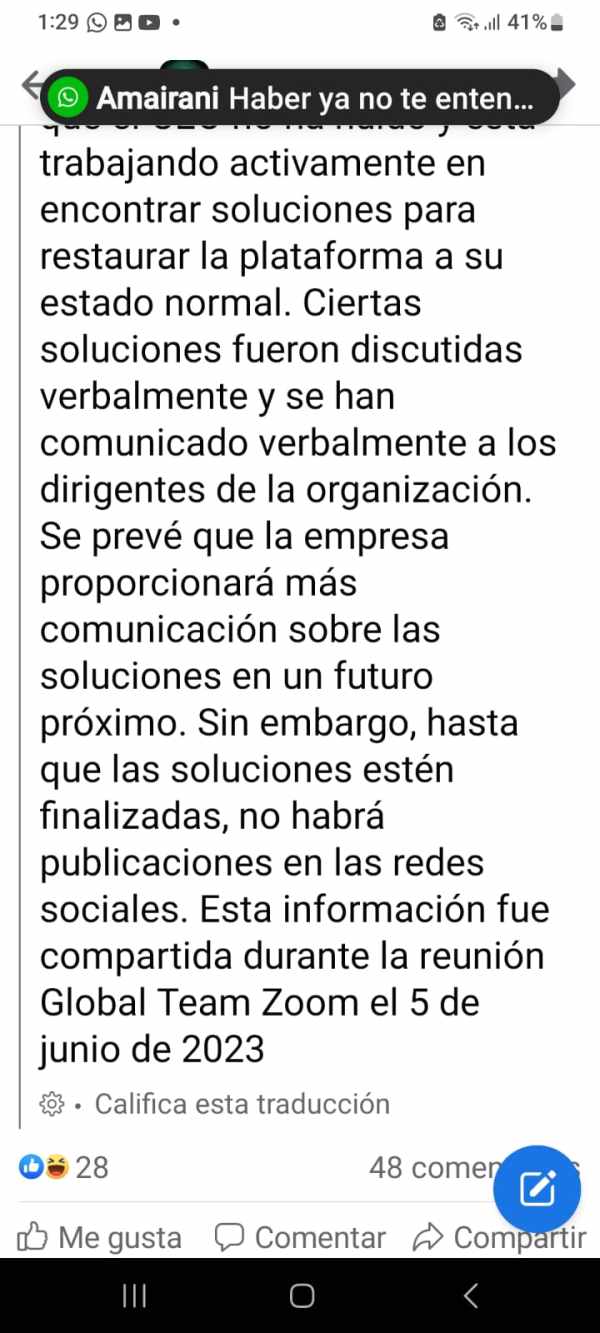

Exposure New York Sues NovaTech for $1B Crypto Pyramid Scheme

NY Attorney General Letitia James sues NovaTechFx founders for defrauding investors, targeting minority communities, and operating an illegal pyramid scheme.

2024-06-10 13:27

Exposure Ontario Securities Commission warns you that NovaTech FX & CEO Cynthia Petion

On 24 August 2023, the Ontario Securities Commission released a statement of allegations in the matter of NovaTech FX and Cynthia Petion. NovaTech FX & CEO Cynthia Petion did not attend the regulatory hearing on September 28. The Capital Markets Tribunal has scheduled another hearing on this matter for 27 November 2023 at 9:00 a.m.

2023-11-08 16:13

Exposure NOVATECH FX DODGES SECOND OSC TRIBUNAL HEARING

NovaTech FX misses a second OSC Tribunal hearing in Canada amid allegations of running a Ponzi scheme. The Ontario Securities Commission is taking steps to hold the company accountable.

2023-10-04 11:32

News Unregistered Trading Platform Nova Tech Ltd Highlighted by Canadian Securities Regulators

The public has been cautioned by the Canadian Securities Administrators (CSA) about Nova Tech Ltd (NovaTech), who claim that the business is not listed with any Canadian securities authority. As a consequence, NovaTech is not permitted to propose to deal in stocks or futures to anyone who resides in Canada

2023-03-21 15:52

News WIKIFX REPORT: NovaTechFX Co-Authors a New Article

The high-tech financial platform collaborated on an essay exploring the different styles of asset trading

2022-08-12 14:49

News WikiFX report: Novatech Compensation Plan & 7 Ways to Get Paid with Residual Bonuses Profit

NovaTech is a registered MetaTrader broker operating its own trading platform with one of the deepest liquidity pools in the industry. What we OFFER Cryptocurrency & Forex MT5 Trading Platform PAMM or MT5 Accounts Cryptocurrency Payment Gateway Exclusive Affiliate Program

2022-05-18 15:28

Review 25

Content you want to comment

Please enter...

Review 25

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

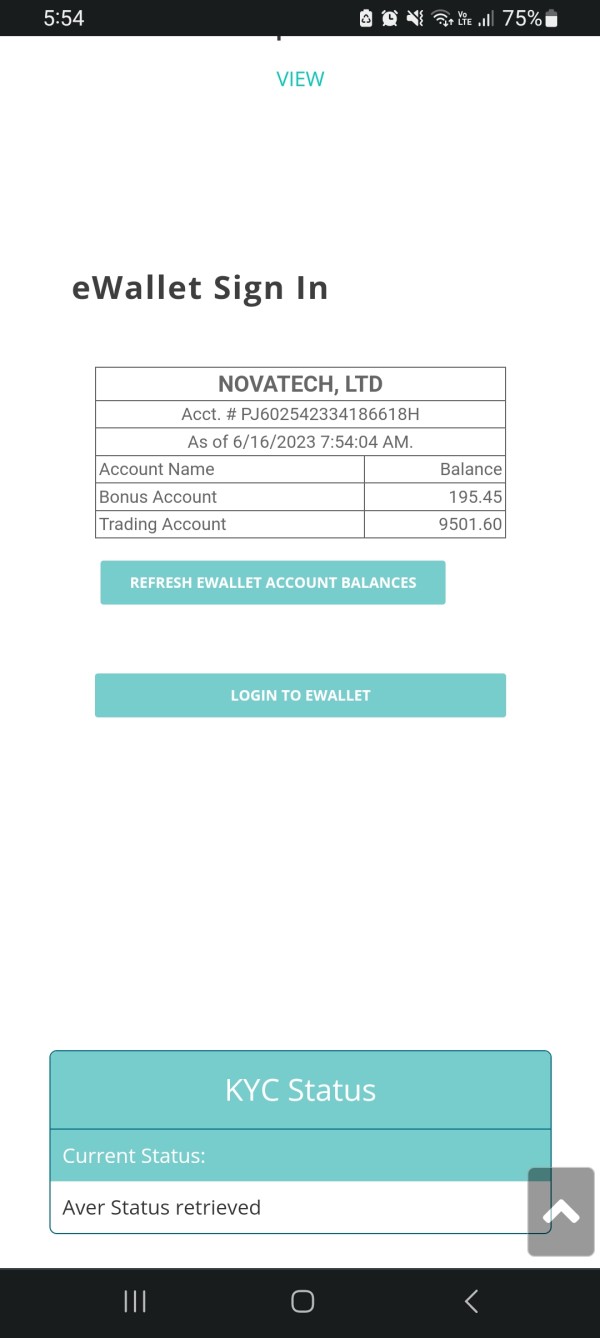

JBATISTA

Mexico

NovaTech has not paid pending withdrawals since May 2023 and the capital associated with the trading account is kept frozen in the company's accounts.

Exposure

2023-08-12

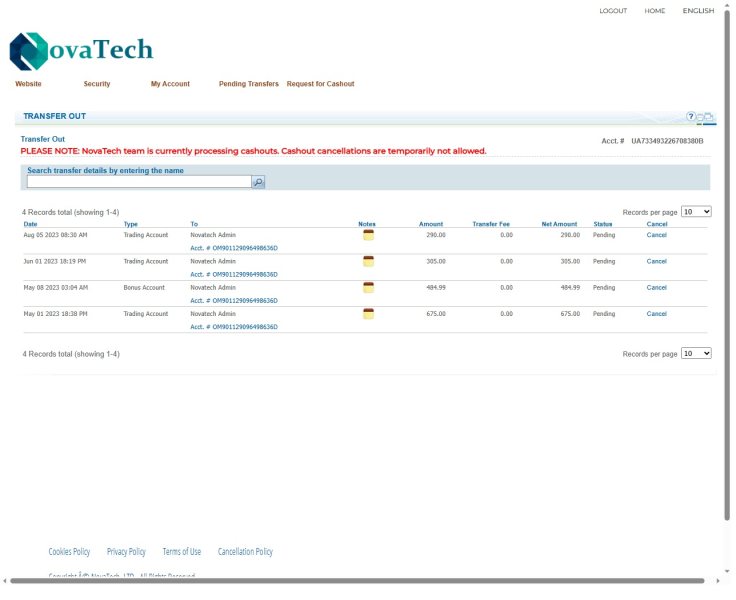

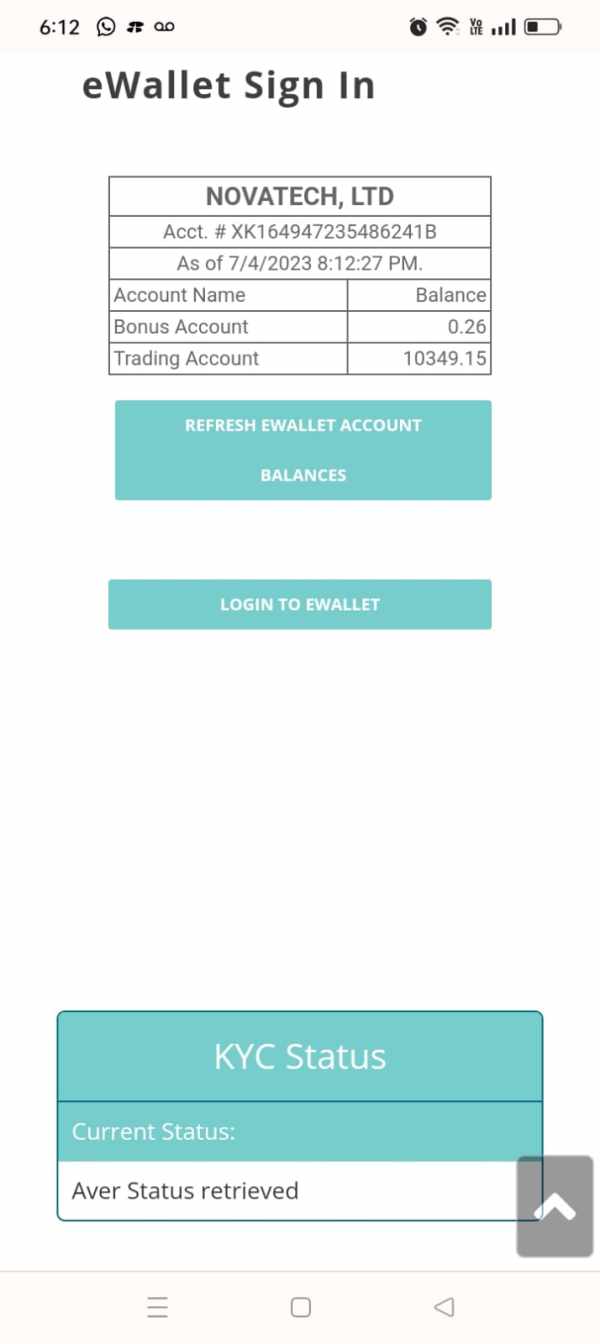

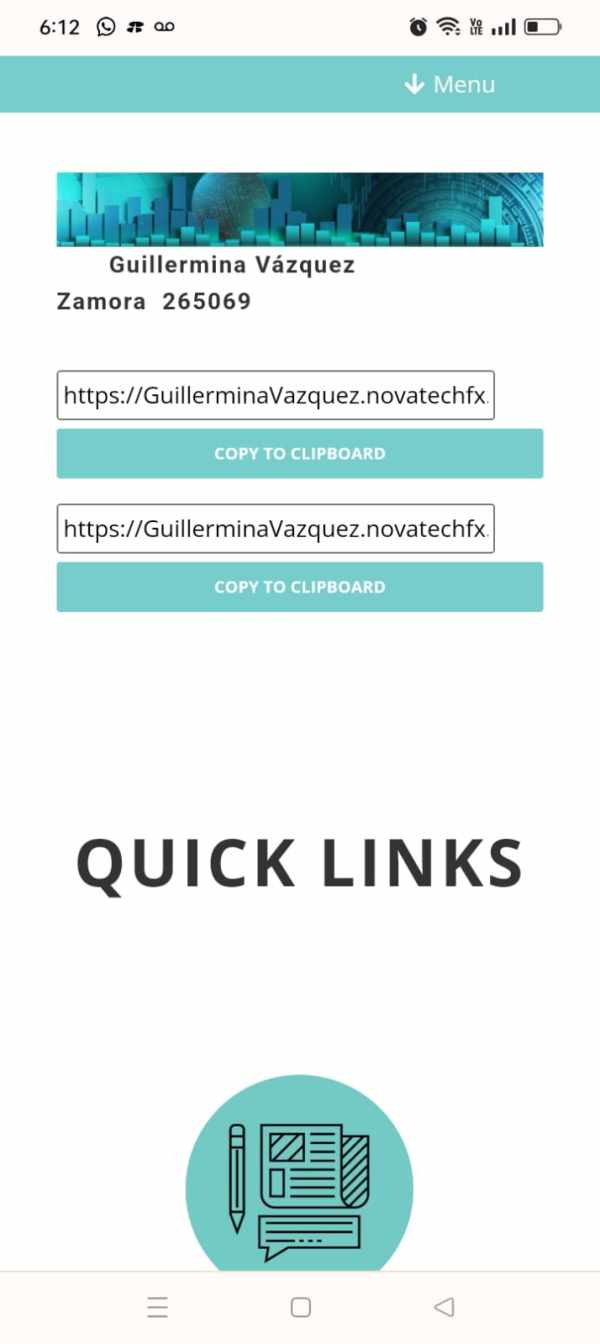

vazquez4824

Mexico

NovaTech has withheld my money for two months now, in May they told us that we could withdraw only 15 percent, the withdrawal was made but it has not arrived. In my account I have more than 10,000 dollars plus 1,500 that I put to withdraw and I can't get anything out. No withdrawals have arrived and nothing can be done on account. I need my full money back. Since I invested a lot of money and it is not possible that they want to keep our money, and they don't respond anymore, nobody says anything and the last message from more than three weeks ago was that we should wait and so far nobody says anything and there is no response.

Exposure

2023-07-05

Natalye

United States

It does not allow me to withdraw my investment. It's a fraud. I need help and guidance on what I should do to get my money back.

Exposure

2023-07-04

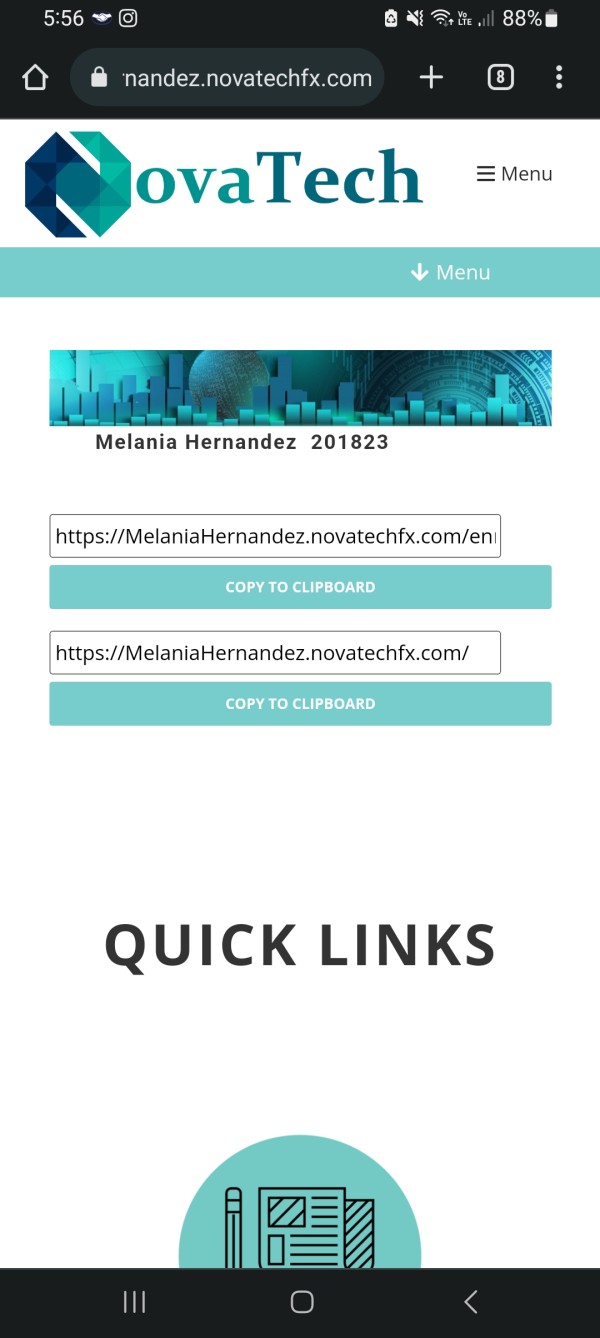

Melania

Mexico

I stop paying the bonds, you can't withdraw your capital and they no longer answer messages. in december, overnight, they only said that you could withdraw 250 dls weekly if you combined them from the payment of your earnings, otherwise wait for them to come together so that you can withdraw them and the withdrawal of capital would be the first 5 days of every month, since when i joined this "company" one of the initiatives was that you could withdraw your capital whenever you wanted. saúl rodríguez, representing the company for the latin american area, always said that this change was not forever but until the payment gateway was expanded and now he complains that messages are sent to him to ask when there will be a response from the company and her friend ceo cinthia petition. totally a fraud NovaTech he left many of us trapped with the promise of payment of up to 3% weekly.

Exposure

2023-06-18

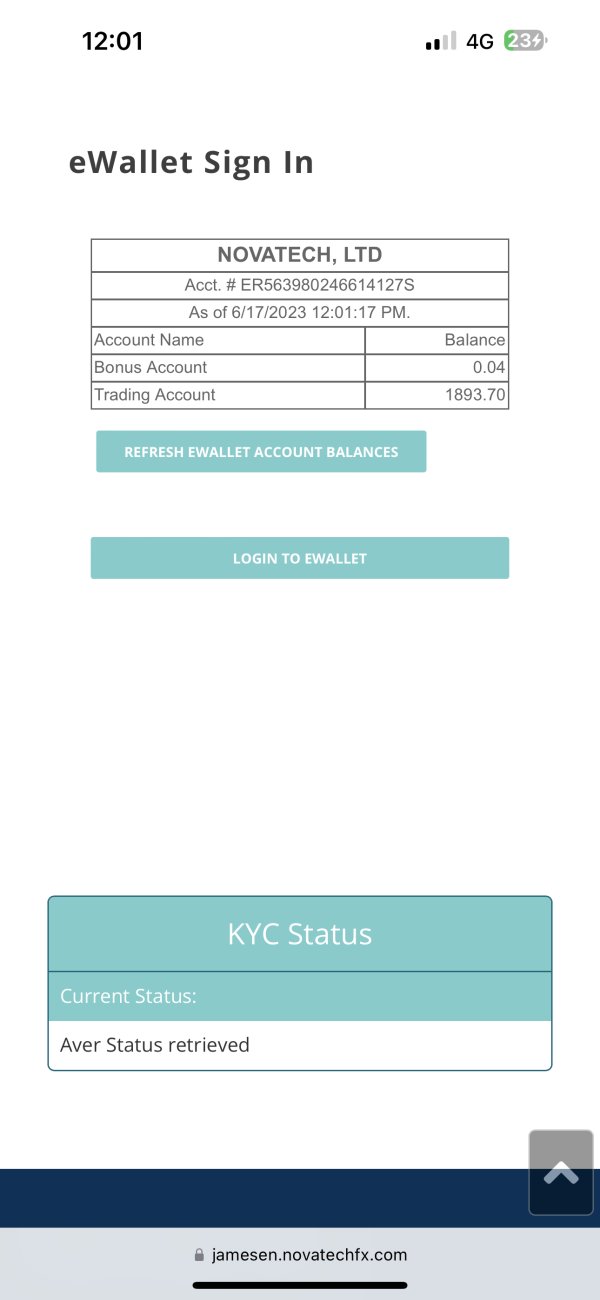

Jymmy

Chile

Hi, I have an account at Novatech but it won't let me withdraw my money. Please, if you can help me, I would be very grateful. Those people are stealing my savings that I have earned with great effort.

Exposure

2023-06-18

Juan 6649

Colombia

I opened an account # HM70758489789625R in Novatech in 2022. The user is InovalleGroup. My name is Juan Carlos Calderón. I live in Cali Columbia and become a family member. I can't make any withdrawals. I have 580 dollars in that account. I want to withdraw it. Thank you for your help!

Exposure

2023-06-16

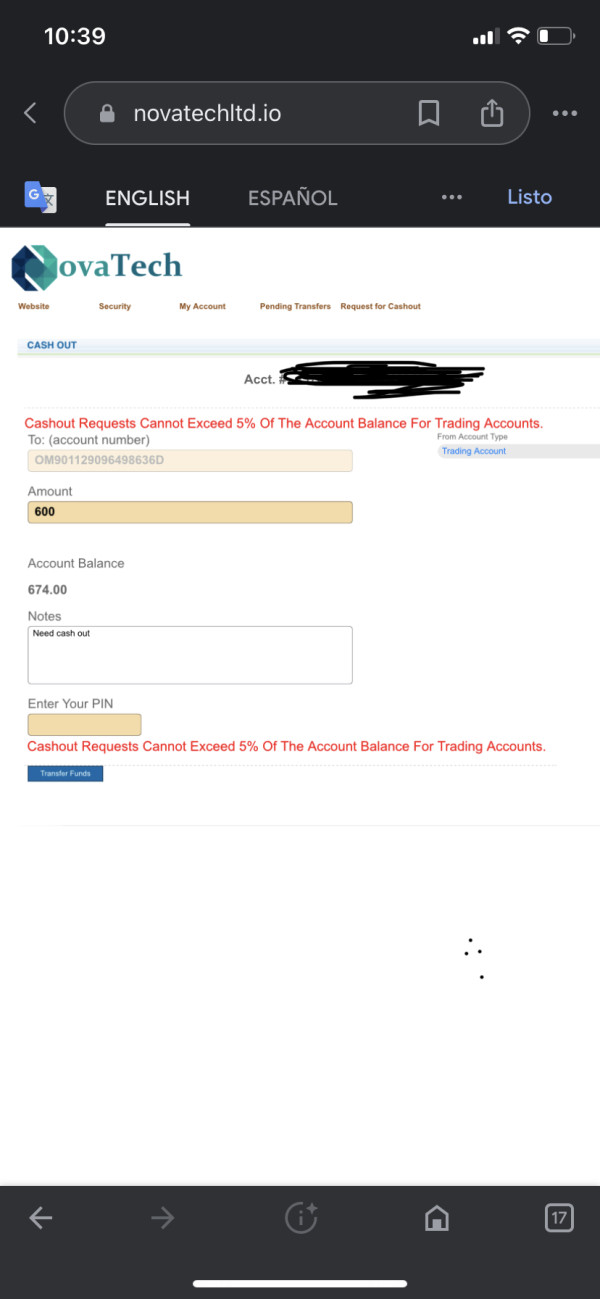

bolo445

United States

I can't make my withdrawal back. It's blocked. It says less than $250 you can't withdraw from it and when you put more than that amount, it tells me that the only thing I can withdraw is 5% of all my capital in the account..So in practice neither one nor the other can be withdrawn.

Exposure

2023-06-06

Angela9934

Ecuador

They scammed us, and they haven't paid us since January. They added the withdrawal to the capital and at the same time they paid us.

Exposure

2023-06-06

Andrea572

Mexico

Novatech did not allow the withdrawal of commissions and it was already blocked from withdrawing the fund. Novatech scammed me, and it did not allow me to withdraw any of my money.

Exposure

2023-06-06

Juanca2821

Colombia

At the time of withdrawal it says that you can only withdraw 5% of the trading account, and the minimum withdrawal is 250 dollars, and I only have 250 dollars in the trading account. Previouly, there was the possibility of withdrawing all the capital of the trading account, now you can not.

Exposure

2023-06-06

luis156

United States

It does not allow you to withdraw anything even if you have a balance in the trading account.

Exposure

2023-06-06

SILVA 647

Portugal

I have pending bonus and equity withdrawals.

Exposure

2023-06-05

Chefy

Colombia

I got to know this platform through a family member who had joined and told me about the business, I made my first investment, and I managed to double it in 6 months, from there I started to withdraw my money, but I could only make three withdrawals and now I have not been able to withdraw the bonuses or any of my capital, as I have not been able to do. There are other members of my family and friends in the same condition. I hope you can please help me. Today, June 1, we went to withdraw 15% of the capital because according to them, from June 1 to 5, we could withdraw the capital, and it turns out that they have already lowered it to 5% and that the minimum amount must be 250 dollars.

Exposure

2023-06-02

rik151293

Peru

I have been wanting to withdraw the funds I invested at the end of January until today.

Exposure

2023-06-01

Edwin 87

Colombia

On January 30, 2023 I invested $1,000 dollars and to date it is impossible for me to withdraw all or part of my money.

Exposure

2023-05-24

Eddy Goncalves

Venezuela

Good morning, since April 10, 2023 I no longer receive transfers from Novatech, it is impossible to make a transfer to your Binance account and Novatech is not available.

Exposure

2023-05-23

FX3130982632

Mexico

I had made a contract with them where they said I could withdraw my capital at any time I liked, suddenly they completely change the rules in breach of the contract. Now it is necessary to withdraw a minimum of 250 dollars miamos that I will not be able to gather but after more than a year being that I have as capital 621 dollars if the yield they give, is 12 percent if well we do well then it is to not pay it is clear to me , that's why I decide to put the complaint here . Thank you in advance.

Exposure

2023-05-15

FX2641708531

Mexico

Novatech has not deposited my withdrawals from my bonus account for a month now and I have no access to my trading capital.

Exposure

2023-05-15

GABO1971

Mexico

Many people are involved in this. They made no response to their promised payments. My withdrawal was held since last April 3 and so far I have not yet received!

Exposure

2023-05-04

Fx4679443

United Kingdom

Good evening, I want to ask if NovaTech is authorized, as we are currently living in Europe & trading on its platform, they’re delaying our withdrawals just to be stealing our profits, they ignoring our emails when we remind them, they should be blocked from all banks.

Exposure

2023-03-06