简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

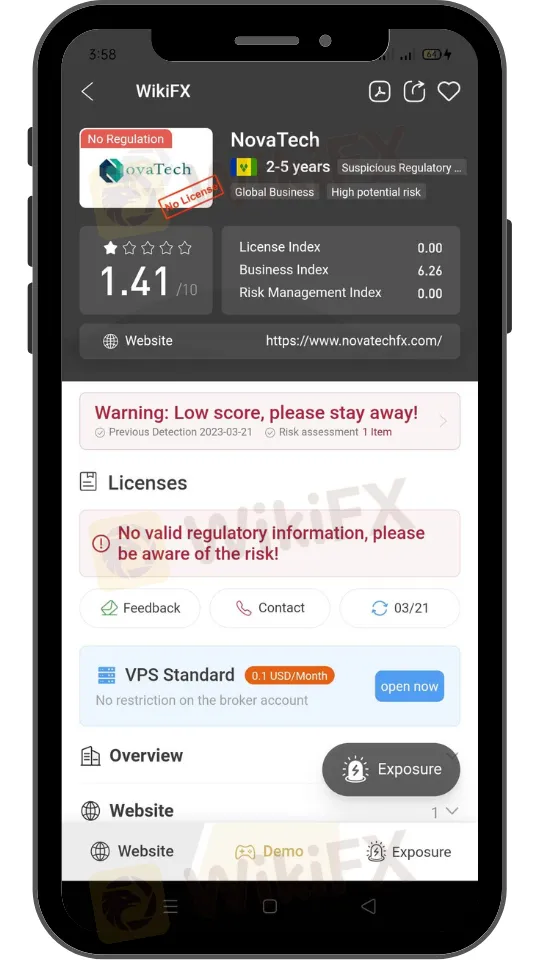

Unregistered Trading Platform Nova Tech Ltd Highlighted by Canadian Securities Regulators

Abstract:The public has been cautioned by the Canadian Securities Administrators (CSA) about Nova Tech Ltd (NovaTech), who claim that the business is not listed with any Canadian securities authority. As a consequence, NovaTech is not permitted to propose to deal in stocks or futures to anyone who resides in Canada

NovaTech may be in violation of provincial and territorial securities and derivatives law, including provisions related to unregulated trading and the illegal distribution of securities. The company appears to offer investment products and trading services through its website.

NovaTech announced a temporary freeze in trading account withdrawals for a period of 60 days on February 5, 2023. The reason for this freeze is unknown.

The Capital Markets Tribunal (Ontario) extended a cease trade order issued by the Ontario Securities Commission on March 2, 2023. The order requires NovaTech to temporarily cease all trading in any securities.

All individuals and businesses trading securities or derivatives, or providing investment advice in relation to securities and derivatives in Canada, including platforms facilitating trading of forex and crypto assets, must comply with applicable securities or derivatives legislation.

Investors should always check the registration of any person or business trying to sell them an investment or provide investment advice. This will help to ensure that they are dealing with legitimate, authorized individuals or businesses.

Canadian Securities Administrators' Role (CSA)

The Canadian Securities Administrators (CSA) is a group of financial officials from each of Canada's 13 provinces and regions. Its main responsibility is to supervise and control Canadian financial markets, ensuring that they are equitable, effective, and open.

The CSA works to safeguard clients by developing and implementing laws that support the securities industry's honesty, openness, and security. It also offers instruction and tools to assist clients in making educated choices.

The CSA's primary responsibility is to create and implement rules and laws for public businesses and stock agents. These laws cover financial filing obligations, transparency standards, and rules regulating market players' behavior. The CSA also checks conformance with these rules and, when appropriate, initiates disciplinary action.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

PayPal Expands PYUSD Transfers to Ethereum and Solana

PayPal's PYUSD stablecoin can now transfer across Ethereum and Solana, enhancing flexibility for users through a LayerZero cross-chain integration.

Broker Review: Is Exnova Legit?

A forex broker named Exnova has recently come to our attention. This broker is registered in Saint Vincent and the Grenadines and started its business in 2021. In this article, we will dig into this broker deeply and provide some information if you are interested.

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

The scammer behind a $73 million pig butchering scheme has pleaded guilty to defrauding victims through fake cryptocurrency investments.

Influencer-Led $232M Crypto Scam Exposed in South Korea

South Korean authorities recently dismantled a large-scale cryptocurrency scam, allegedly orchestrated by a popular YouTuber referred to as Mr. A, which misled over 15,000 investors and amassed nearly 325.6 billion Korean won (approximately $232.7 million USD).

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Currency Calculator