简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FX Analysis – Falling Yields Pressure USD, the Key Levels to Watch

Abstract:Recent US figures have seen a rout in treasury yields with the flagship 10-year now yielding 4.435% after starting November at 16-year highs north of 5% and in a seemingly unstoppable uptrend. A cooler CPI and PPI showing inflation is decelerating at a faster pace than the market anticipated, along with weaker employment and industrial production figures have traders re-adjusting for a less hawkish Fed and bringing their timing forward for the pricing in of rate cuts.

Recent US figures have seen a rout in treasury yields with the flagship 10-year now yielding 4.435% after starting November at 16-year highs north of 5% and in a seemingly unstoppable uptrend. A cooler CPI and PPI showing inflation is decelerating at a faster pace than the market anticipated, along with weaker employment and industrial production figures have traders re-adjusting for a less hawkish Fed and bringing their timing forward for the pricing in of rate cuts.

Why this is important to serious FX traders is because rates and FX have a high correlation, even more in the post pandemic period of cuts, hikes and peak rates and maybe cuts again, big FX traders look for yield and that can be used as important information for smaller players to position themselves to take advantage of that. An example of this relationship can be seen on the weekly chart of the US Dollar index below.

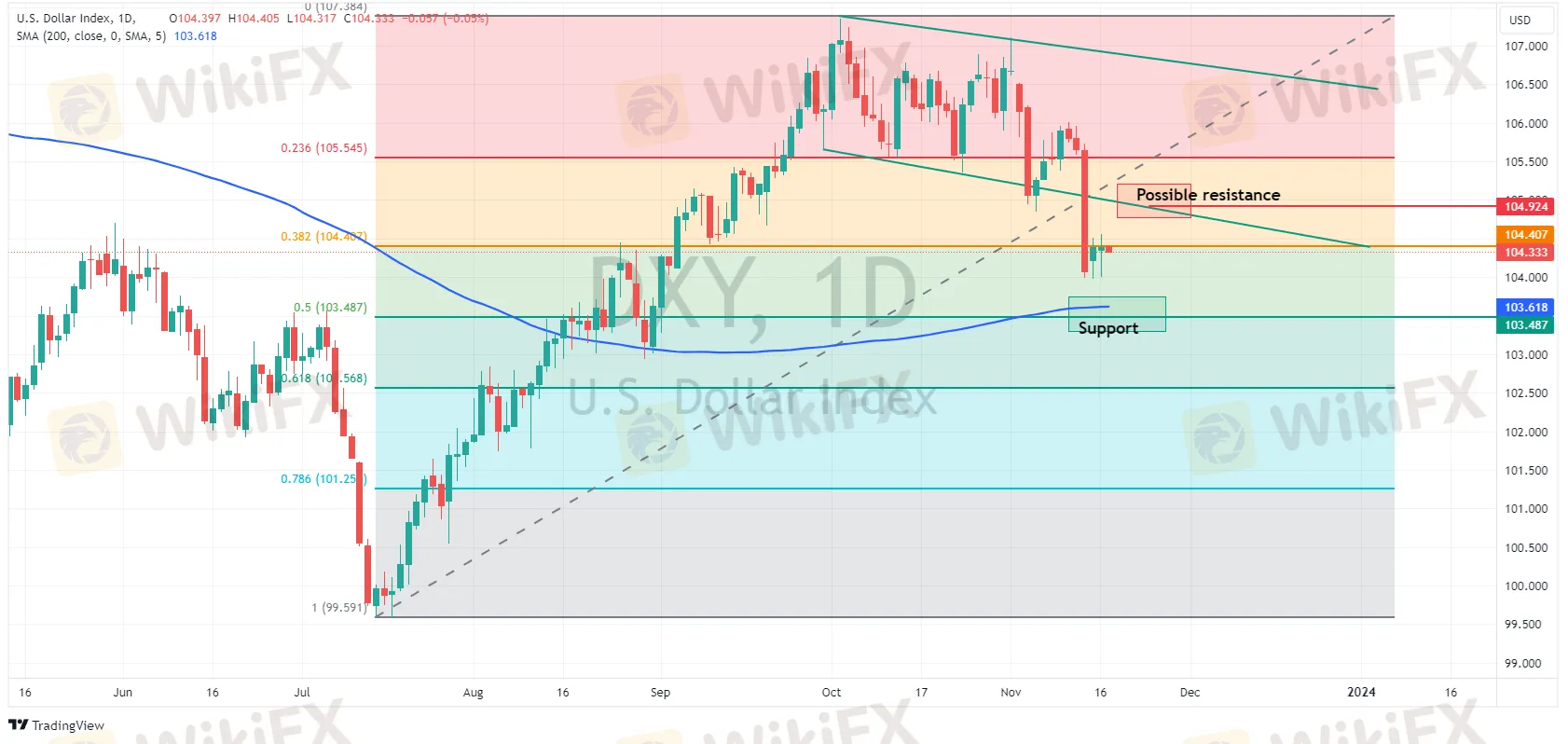

The US dollar Index has fallen 2.5% so far in November, a move first started with the big miss in NFP which saw support at the 23.6 Fib level broken, then accelerating this week on a Cooler CPI which saw it take out the 38.2 Fib level support which the price is currently hovering around at 104.41.

This along with the situation in yields will be the level to watch in the short term, if yield and dollar bulls take charge a break and support hold could see USDollar first test the lower trend line resistance, with the next stop from a technical point of view being the 23.6 Fib level resistance at 105.545. To the downside if yields continue their fall the next technical support will be the 50% fib level, paired with the 200-day moving average.

Next week there are a few important data points with FOMC minutes, consumer sentiment and manufacturing figures all scheduled. For FX traders they will be worth watching for any further clues as to yields and where traders think they will go as they work to front run the Fed.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Review: Is IQ Option trustworthy?

IQ Option is catching our eye as it seems to be a trending topic. For those who want to know whether IQ Option is a reliable broker, WikiFX made this article to help you better understand this broker.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator