Score

INFINOX

United Kingdom|15-20 years| Benchmark AA|

United Kingdom|15-20 years| Benchmark AA|https://infinox.co.uk/en

Website

Rating Index

Benchmark

Benchmark

AA

Average transaction speed (ms)

MT4/5

Full License

InfinoxCapitalLimited-Live04

United Kingdom

United KingdomInfluence

A

Influence index NO.1

Thailand 6.68

Thailand 6.68Benchmark

Speed:AAA

Slippage:A

Cost:AA

Disconnected:A

Rollover:A

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomInfluence

Influence

A

Influence index NO.1

Thailand 6.68

Thailand 6.68Surpassed 63.10% brokers

Contact

Licenses

Single Core

1G

40G

Disclosure

More

Warning

Danger

Danger

Contact number

+66 (0) 2 026 6996

+44 0-800-060-8744

+84 028 9998 8669

+66 1 800 012 244

Other ways of contact

Broker Information

More

Infinox Limited

INFINOX

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of the complaints received by WikiFX have reached 10 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- The Bahamas SCB regulation with license number: SIA F-188 is an offshore regulation. Please be aware of the risk!

- The United KingdomFCA (Regulatory number: 501057) Institution Forex License (MM) held by belongs to the scope of institutional business, excluding retail business. It cannot open accounts for individual investors. Be aware of the risks!

- Global regulators have disclosed 4 pieces of information about this broker, please be aware of the risks!

WikiFX Verification

| Benchmark | AA |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | 50 USD |

| Minimum Spread | 0.9 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | AA |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | 50 USD |

| Minimum Spread | 0.2 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | £5/€5.5/7.5 USD |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed INFINOX also viewed..

XM

Neex

GO MARKETS

IronFX

Total Margin Trend

- VPS Region

- User

- Products

- Closing time

Seoul

Seoul- 770***

- EURUSD

- 11-14 03:35:09

Tokyo

Tokyo- 120***

- EURUSD

- 11-13 18:19:31

Singapore

Singapore- 892***

- EURUSD

- 11-13 17:46:37

Stop Out

0.76%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

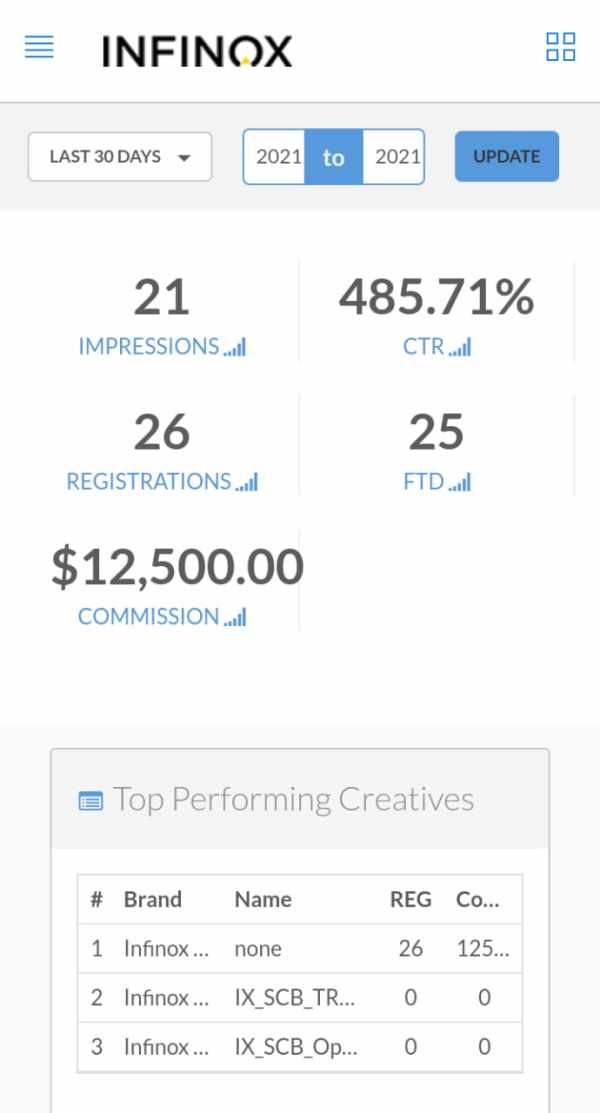

Creatives

INFINOX · Company Summary

Company Summary

Company profile

| Registered in | United Kingdom |

| Regulation status | FCA. SCB |

| Year(s) of incorporation | 10-15 years |

| market instruments | Currency pairs, stocks, raw materials, precious metals, energies, indices… |

| minimum initial deposit | £50 |

| maximum leverage | 1:30 (1:400 leverage is only available to professional clients.) |

| minimum spread | From 0.2 pips |

| trading platform | MetaTrader5, MetaTrader4 |

| Deposit and Withdrawal Methods | debit or credit cards, digital wallets and bank transfers |

| Customer Service | Email/phone number/address/ live chat/ social media |

| Fraud complaints | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date this review was generated may also be an important factor to consider, as the information may have changed since then. Therefore, readers are advised to always check the updated information directly with the company before making any decision or action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should take precedence. However, we recommend that you open the official website for further consultation.

Pros and cons of INFINOX

Pros:

Wide variety of financial instruments, including currency pairs, stocks, commodities, indices, and futures.

Industry leading trading platforms, MetaTrader4 and MetaTrader5.

Various account options to meet the needs of different types of traders.

Extensive and useful educational resources for traders of all levels.

Customer service available by phone, email and social media.

Flexible and diverse deposit and withdrawal options.

Regulated by the UK FCA and adhered to the Financial Services Compensation Scheme.

Cons:

The EURUSD spread is high compared to other brokers.

The minimum deposit required is not disclosed.

ECN accounts have trading fees, which can be expensive for some traders.

What kind of broker is INFINOX?

| Dimension | Advantages | Disadvantages |

| broker model | INFINOX offers tight spreads and fast execution due to its Market Making model. | As a counterparty in its clients' operations, INFINOX has a potential conflict of interest that may lead to decisions that are not in the best interest of clients. |

INFINOX is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly with the market, INFINOX acts as an intermediary and assumes the opposite position to that of its clients. As such, it can offer faster order execution speeds, tighter spreads, and greater flexibility in terms of leverage offering. However, this also means that INFINOX has a certain conflict of interest with its clients, since their profits come from the difference between the purchase and sale price of the assets, which could lead them to make decisions that are not necessarily the better for your customers. It is important that traders are aware of this dynamic when trading with INFINOX or any other MM broker.

General Information and INFINOX Regulation

INFINOX is an online broker founded in 2009 in London, UK. The company offers a variety of financial instruments, including currency pairs, stocks, commodities, indices, and futures. INFINOX also offers two types of accounts, STP and ECN, and a number of educational resources to help its clients improve their trading skills. The company is regulated by the UK Financial Conduct Authority (FCA) and has a 24/5 customer support team.

In the following article, we will analyze the characteristics of this broker in all its dimensions, offering easy and well-organized information. If you're interested, read on.

Market instruments

| Advantages | Disadvantages |

| It offers a wide range of instruments, including currency pairs, stocks, commodities, indices, and futures. | The selection of instruments can be overwhelming for novice traders. |

| Traders have access to a variety of global markets. | The high number of instruments can lead to a dispersion of the trader's attention. |

| Traders can diversify their investment portfolio. | Volatility in certain markets can lead to significant losses. |

INFINOX offers its clients a wide variety of financial instruments to trade, including currency pairs, stocks, commodities, indices and futures. This allows traders to have access to a wide variety of markets and trading opportunities. With the ability to diversify their portfolios and reduce risk, clients can take advantage of the wide range of instruments offered by the broker. Furthermore, traders can access global markets and take advantage of opportunities in different markets. However, the availability of some instruments may be restricted depending on the geographic location of the client and the quality of prices and liquidity of the different instruments may affect the execution of orders.

Spreads and commissions to trade with INFINOX

| Advantages | Disadvantages |

| EURUSD spread is higher compared to other brokers | |

| No commissions for deposit or withdrawal | Inactivity fee charged |

| Possibility of trading with microlots | Swap overnight can be higher than other brokers |

INFINOX is proud to offer one of the most competitive spreads on the market. However, the specific spreads for each instrument vary, and some of them may be higher compared to other brokers. INFINOX does not charge fees for deposits or withdrawals, which can be beneficial for traders who trade frequently. In addition, clients have the option to trade micro lots, allowing them greater control over their risk exposure. Although it is important to note that INFINOX charges an inactivity fee if the account remains without operations for more than 180 days. It is also important to note that overnight swaps can be higher than other brokers, which can affect those traders who hold positions open for long periods of time.

Trading accounts available at INFINOX

| Advantages | Disadvantages |

| STP account without commissions | Higher spreads than ECN account |

| ECN account offers lower spreads | Commissions applicable on the ECN account |

| Minimum lot size of 0.01 | Minimum deposit not disclosed |

| Options of different base currencies |

INFINOX offers its clients two account types, STP and ECN, which differ in spreads and commissions. The STP account is commission free, but has higher spreads that start at 0.9 pips. On the other hand, the ECN account has lower spreads, which start at 0.2 pips, but commissions start at $3.00. Both accounts have a minimum lot size of 0.01 and options of different base currencies. However, the minimum deposit required to open an account is not disclosed.

Trading platform(s) offered by INFINOX

| Advantages | Disadvantages |

| MetaTrader4 is a widely used platform that is well known to most of the traders. | MetaTrader4 is an older platform than MetaTrader5 and lacks some of the advanced features of MetaTrader5. |

| MetaTrader5 is a more advanced platform that offers more tools and features than MetaTrader4. | MetaTrader5 can be more difficult to use for beginners due to its complexity. |

| The MetaTrader4 and MetaTrader5 platforms offer a wide range of technical analysis tools. | MetaTrader5 has not yet reached the same popularity as MetaTrader4, which means that there are fewer resources available online to learn how to use it. |

| INFINOX offers support for both platforms, allowing traders to choose the platform that best suits their needs. |

INFINOX offers its clients the ability to trade on the MetaTrader4 and MetaTrader5 trading platforms. MetaTrader4 is a widely used trading platform that is well known to most of the traders, while MetaTrader5 is a more advanced platform that offers more tools and features than MetaTrader4. Both platforms offer a wide range of technical analysis tools and allow traders to customize their trading experience. INFINOX offers support for both platforms, allowing traders to choose the platform that best suits their needs. However, it is important to note that MetaTrader5 has not yet reached the same popularity as MetaTrader4, which means that there are fewer resources available online to learn how to use it. Overall, INFINOX offers its clients a good selection of high-quality trading platforms to choose from.

Here is a MetaTrader 4 video tutorial on its official YouTube channel.

A maximum leverage of INFINOX

| Advantages | Disadvantages |

| Allows you to trade larger positions with less capital | Limit profit potential |

| It can help you get higher profits | Increases the risk of major losses |

| Allows you to diversify your investment portfolio | Requires good risk management and capital management |

| Increases flexibility in trading strategy | May be limited compared to other brokers |

| Offers the possibility of opening positions in different markets | May not be suitable for beginning investors |

INFINOX offers a maximum leverage of 1:30, which means that traders can trade larger positions with less capital. This feature is advantageous for experienced traders who are looking to maximize their profits and have good risk management and capital management.

However, leverage can also increase the risk of further losses if it is not used properly. Also, the maximum leverage offered by INFINOX may be limited compared to other brokers. Therefore, it is important that beginning investors carefully consider their investment objectives and risk tolerance before using leverage.

It is worth mentioning that the 1:400 leverage is only available for professional clients.

Deposit and Withdrawal: methods and fees

| Advantages | Disadvantages |

| Offers a wide variety of deposit and withdrawal options | Does not accept cash or checks as deposit methods |

| The minimum deposit is reasonably low | Does not accept American Express or Diners cards |

| Supports different base currencies for the account | There may be charges from the payment provider |

| Process deposits and withdrawals quickly | Information on specific processing times is not provided |

INFINOX offers several options for deposits and withdrawals, which is beneficial for its clients. Deposits can be made with debit or credit cards, digital wallets and bank transfers. The minimum deposit required is 50 GBP or its equivalent in the base currency of the account, which is reasonably low compared to other brokers. In addition, the processing of deposits and withdrawals is fast, allowing clients to quickly access their funds. However, INFINOX does not accept cash or checks as deposit methods, nor does it accept American Express or Diners cards, which could be a disadvantage for some customers. In addition, there may be additional charges from the payment provider, although this is not the direct responsibility of INFINOX.

Education at INFINOX

| Advantages | Disadvantages |

| Lots of educational resources available | The quality and relevance of educational materials may vary |

| Includes research, courses, economic calendar, press, webinars, among others | Some resources may be too advanced for beginning traders |

| Educational resources are available free of charge to INFINOX customers | It can be overwhelming for some traders to navigate and select the right resources. |

INFINOX offers a wide variety of educational resources for its clients, including research, courses, economic calendar, press and webinars, among others. The availability of a large number of resources can be an advantage for traders who want to learn and improve their trading skills. However, some resources may be too advanced for beginning traders and the quality and relevance of the educational materials may vary. Also, it can be overwhelming for some traders to navigate and select the right resources. In general, INFINOX offers a good number of free educational resources for its customers.

INFINOX customer service

| Advantages | Disadvantages |

| Availability of the support team 24/5. | There is no live support 24 hours a day. |

| Multiple communication channels, including email, phone, and social media. | Multi-language support is not provided. |

| A Frequently Asked Questions (FAQs) page for quick answers. | There is no maximum response time specified for queries. |

INFINOX offers good customer service through various communication channels, including email, telephone and social networks. Their support team is available 24/5 and they also have an FAQ section for quick answers to common queries. However, they do not offer multi-language support and there is no 24/7 live support. Also, there is no specified maximum response time for queries, which could be a disadvantage for customers who need immediate assistance. In general, INFINOX offers satisfactory customer service with a good level of availability and various communication channels.

Conclusion

In conclusion, INFINOX is a Forex and CFD broker that offers its clients a wide variety of trading instruments, popular trading platforms, educational resources, and accessible customer service. Its pricing model varies depending on the type of account chosen, and its offer of competitive spreads and no commission on STP accounts may be attractive to some traders. However, it is important to note that the spreads can be higher compared to other brokers and the impact on trading costs must be taken into account. Also, the lack of transparency in some aspects, such as minimum deposit and margin requirements, can be a drawback for some clients. Overall, INFINOX seems to be a solid choice for those looking for a broker with a wide range of instruments and educational resources, but further research is recommended before making a decision.

Frecuently asked questions about INFINOX

Question: What is the minimum deposit required to open an account at INFINOX?

Answer: The minimum deposit is 50 GBP or the equivalent in the base currency of the account.

Question: What account types are available at INFINOX?

Answer: There are two account types available: STP and ECN. The STP account is commission free, but the spreads start at 0.9 pips. The ECN account has lower spreads, starting at 0.2 pips, but has commissions starting at $3.00.

Question: What deposit and withdrawal methods are accepted at INFINOX?

Answer: Deposits are accepted by debit or credit card, digital wallets and bank transfers. Withdrawals can be made by the same methods.

Question: What is the maximum leverage offered by INFINOX?

Answer: The maximum leverage offered is 1:30.

Question: What trading platforms are available at INFINOX?

Answer: Both MetaTrader4 and MetaTrader5 platforms are offered.

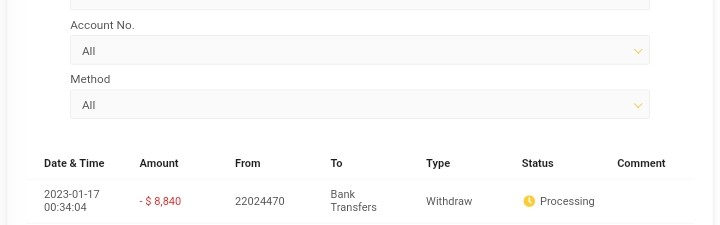

Question: How long does it take to process withdrawals at INFINOX?

Answer: Withdrawals are usually processed within 24 business hours.

Question: What is the email address and phone number for INFINOX customer service?

Answer: The email is support@infinox.co.uk and the phone number is +44 (0) 208 158 6060.

| Company Name | INFINOX |

| Registered | United Kingdom |

| Regulation Status | FCA, SCB |

| Year(s) of Incorporation | 10-15 years |

| Market Instruments | Currency pairs, stocks, raw materials, precious metals, energies, indices… |

| Minimum Deposit | £50 |

| Maximum Leverage | 1:30 (1:400 leverage is only available to professional clients.) |

| Minimum Spread | From 0.2 pips |

| Trading Platform | MetaTrader5, MetaTrader4 |

| Deposit and Withdrawal Methods | Debit or credit cards, digital wallets and bank transfers |

| Customer Service | Email/phone number/address/ live chat/ social media |

| Fraud Complaints | Yes |

INFINOX Information

INFINOX is an online broker founded in 2009 in London, UK. The company offers a variety of financial instruments, including currency pairs, stocks, commodities, indices, and futures. INFINOX also offers two types of accounts, STP and ECN, and a number of educational resources to help its clients improve their trading skills. The company is regulated by the UK Financial Conduct Authority (FCA) and has a 24/5 customer support team.

Regulatory Status

INFINOX is regulated by two major authorities. When choosing brokers to trade with, a broker with restrict regulatory licences is necessary to consider:

- Financial Conduct Authority (FCA) United Kingdom:

- Status: Regulated

- Type: Institution Forex License

- License Number: 501057

INFINOX holds an Institutional Forex License from the FCA, one of the most respected financial regulatory bodies globally, which oversees the integrity and reliability of its operations within the UK.

Securities Commission of The Bahamas (SCB):

- Status: Offshore Regulatory

- Type: Bahamas Retail Forex License

- License Number: SIA F-188

- Additionally, INFINOX is regulated by the SCB, providing it with an offshore regulatory framework for retail forex trading. This allows INFINOX to offer services under the regulatory standards set by the Bahamas.

Pros and Cons of INFINOX

| Pros | Cons |

| Diverse financial instruments across multiple asset classes | Higher EURUSD spread compared to other brokers |

| Access to MetaTrader 4 and MetaTrader 5 platforms | Undisclosed minimum deposit requirement |

| Multiple account types tailored for various traders | ECN accounts incur trading fees |

| Comprehensive educational resources | |

| Responsive customer support via multiple channels | |

| Flexible funding options | |

| Regulated by the FCS and SCB(offshore regulated) |

Market Instruments

INFINOX provides traders with access to a diverse array of over 900 financial instruments, enabling trading across multiple asset classes including forex, indices, commodities, bonds, futures (CFD), and cryptocurrencies (CFD). This extensive selection allows traders to explore a wide range of markets and capitalize on various trading opportunities each trading day.

The platform's broad offering enables clients to diversify their investment portfolios, potentially reducing risk by spreading exposure across different types of assets. Additionally, INFINOX facilitates global market access, allowing traders to seize opportunities in various international markets.

Spreads and Commissions to trade with INFINOX

INFINOX claims that they provide competitive spreads on the market. INFINOX does not charge fees for deposits or withdrawals, which can be beneficial for traders who trade frequently. In addition, clients have the option to trade micro lots, allowing them greater control over their risk exposure. Although it is important to note that INFINOX charges an inactivity fee if the account remains without operations for more than 180 days. Overnight swaps can be higher than other brokers, which can affect those traders who hold positions open for long periods of time.

Trading Accounts Review

INFINOX offers its clients two account types, STP and ECN, which differ in spreads and commissions. The STP account is commission free, but has higher spreads that start at 0.9 pips. On the other hand, the ECN account has lower spreads, which start at 0.2 pips, but commissions start at $3.00. Both accounts have a minimum lot size of 0.01 and options of different base currencies. However, the minimum deposit required to open an account is not disclosed.

Trading Platform

INFINOX offers its clients the ability to trade on the MetaTrader4 and MetaTrader5 trading platforms. MetaTrader4 is a widely used trading platform that is well known to most of the traders, while MetaTrader5 is a more advanced platform that offers more tools and features than MetaTrader4. Both platforms offer a wide range of technical analysis tools and allow traders to customize their trading experience. INFINOX offers support for both platforms, allowing traders to choose the platform that best suits their needs.

However, MetaTrader5 has not yet reached the same popularity as MetaTrader4, which means that there are fewer resources available online to learn how to use it.

Maximum Leverage

INFINOX provides leverage options that enhance the potential and impact of your trades across various financial instruments. Leverage allows traders to control a larger position than their initial capital by using a fraction of the trade's full value as a margin deposit. This can significantly amplify both gains and losses, making it a powerful but risky tool.

Here are the leverage ratios offered by INFINOX for different instruments, with the maximum leverage up to 1:1000:

- Forex: 1:1000

- Indices: 1:1000

- Commodities: 1:20

- Futures: 1:1000

- Crypto: 1:50

- Bonds: 1:100

Trading Platforms and Tools

INFINOX offers a robust Virtual Private Server (VPS) service in partnership with 4XSolutions, designed to optimize connectivity and performance for clients and their Expert Advisors (EAs). This VPS infrastructure ensures low latency and cross-connectivity by being directly connected to INFINOX's trading servers. Additionally, it provides world-class security and protection, backed by 24-hour support to address any issues promptly.

Moreover, INFINOX enhances trading capabilities through its MT4 and MT5 platforms, which are not just powerful trading platforms but also hubs for a variety of trading tools and functions. Users can access trading signals, indicators, and communities directly from the platform or via the MetaQuotes websites. These platforms also support custom modifications, allowing traders to tailor their trading environment to their specific needs. This combination of reliable VPS service and versatile trading platforms makes INFINOX a comprehensive choice for serious traders looking for effective trading solutions.

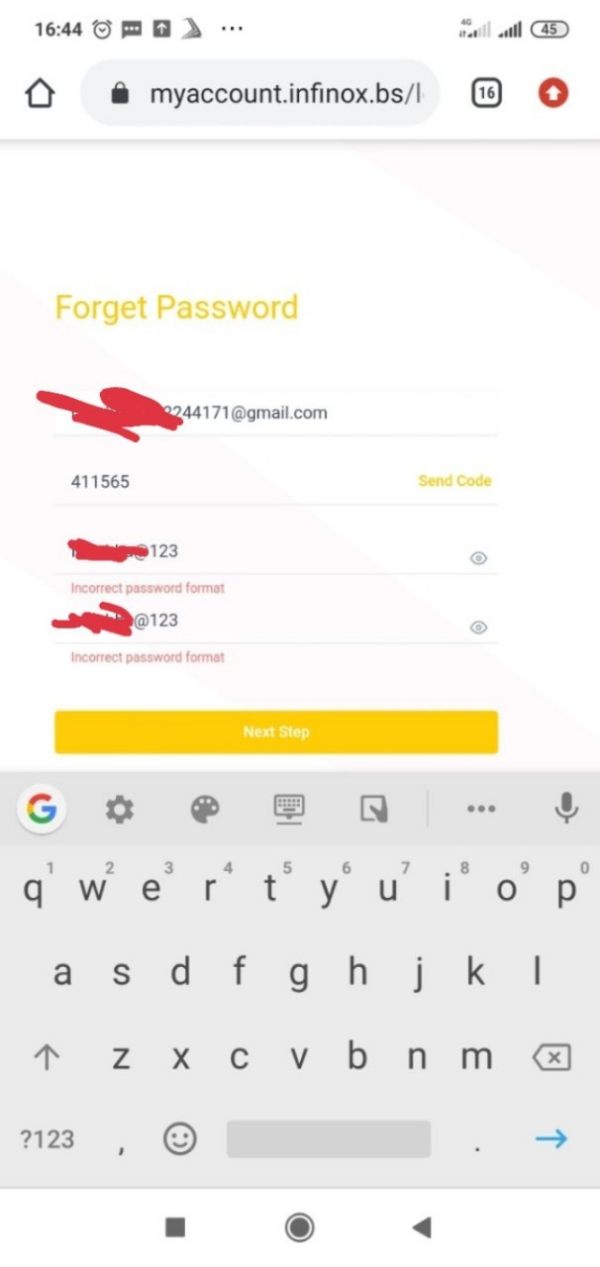

Deposit and Withdrawal

INFINOX offers a range of deposit and withdrawal methods including debit or credit cards, digital wallets, and bank transfers, while excluding cash, cheques, American Express, or Diners cards. The platform requires a minimum deposit of 50 GBP or its equivalent in other currencies. There is no upper limit on the amount you can deposit for verified accounts, though unverified accounts have a cap of 2,000 USD or equivalent.

For withdrawals, funds must be returned via the same method used for deposits up to the deposited amount; profits can be withdrawn using any preferred method.

However, withdrawals are contingent on successful verification of the trader's identity and address. This system ensures that financial transactions are secure and comply with regulatory standards, facilitating efficient

INFINOX Customer Service

INFINOX offers good customer service through various communication channels, including email, telephone and social networks. Their support team is available 24/5 and they also have an FAQ section for quick answers to common queries. However, they do not offer multi-language support and there is no 24/7 live support. Also, there is no specified maximum response time for queries, which could be a disadvantage for customers who need immediate assistance. In general, INFINOX offers satisfactory customer service with a good level of availability and various communication channels.

Conclusion

In conclusion, INFINOX is a Forex and CFD broker that offers its clients a wide variety of trading instruments, popular trading platforms, educational resources, and accessible customer service. Its pricing model varies depending on the type of account chosen, and its offer of competitive spreads and no commission on STP accounts may be attractive to some traders.

However, the spreads can be higher compared to other brokers and the impact on trading costs must be taken into account. Also, the lack of transparency in some aspects, such as minimum deposit and margin requirements, can be a drawback for some clients.

FAQs about INFINOX

- What is the minimum deposit required to open an account at INFINOX?

- The minimum deposit is 50 GBP or the equivalent in the base currency of the account.

- What account types are available at INFINOX?

- There are two account types available: STP and ECN. The STP account is commission free, but the spreads start at 0.9 pips. The ECN account has lower spreads, starting at 0.2 pips, but has commissions starting at $3.00.

- What deposit and withdrawal methods are accepted at INFINOX?

- Deposits are accepted by debit or credit card, digital wallets and bank transfers. Withdrawals can be made by the same methods.

- What is the maximum leverage offered by INFINOX?

- The maximum leverage offered is 1:30.

- What is the email address and phone number for INFINOX customer service?

- The email is support@infinox.co.uk and the phone number is +44 (0) 208 158 6060.

News

NewsINFINOX Celebrates 15 Years as a Global CFD and FX Leader

INFINOX celebrates 15 years of success as a global leader in CFD and Forex trading, expanding its reach and empowering traders through innovative multi-asset platforms.

WikiFX

WikiFX

NewsINFINOX Leads the Financial Sector with Green Initiatives

Global trading platform INFINOX goes paperless and collaborates on a tree-planting initiative to promote sustainability.

WikiFX

WikiFX

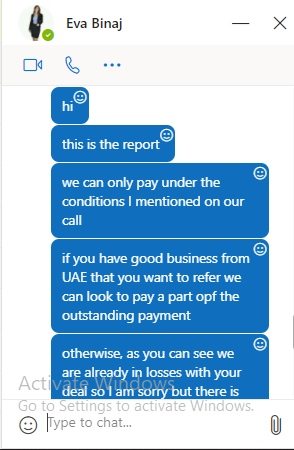

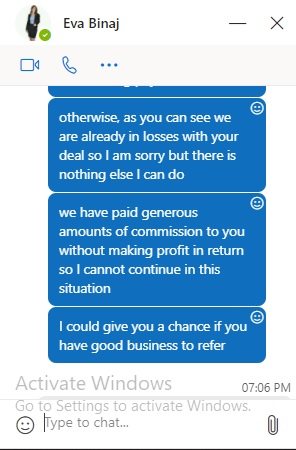

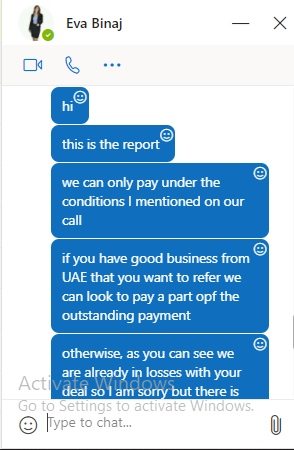

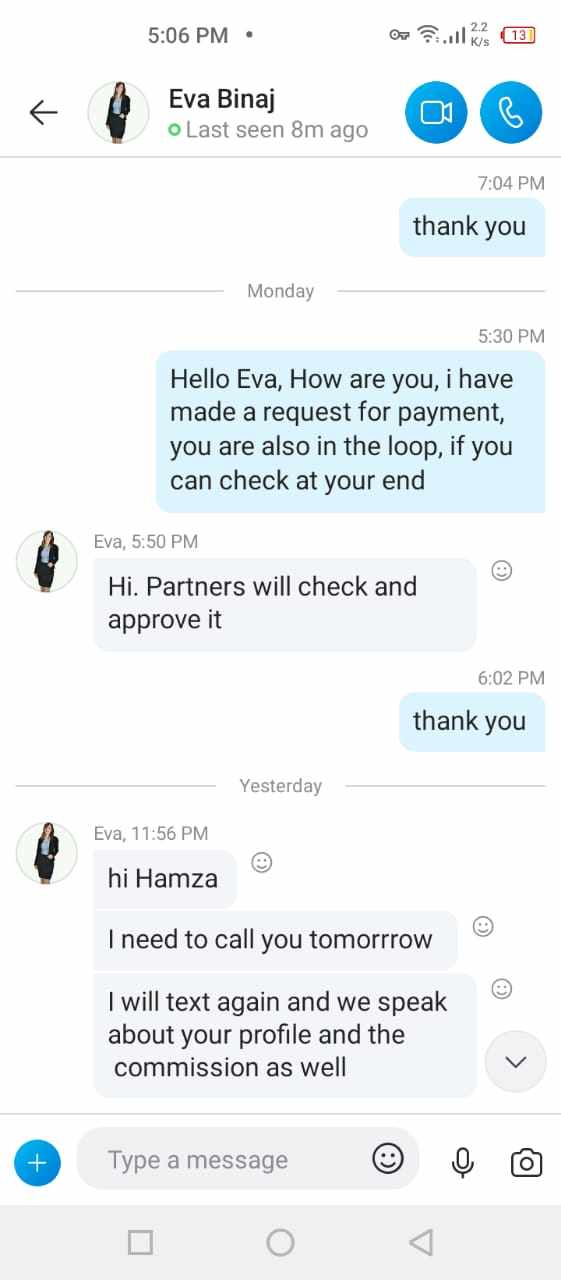

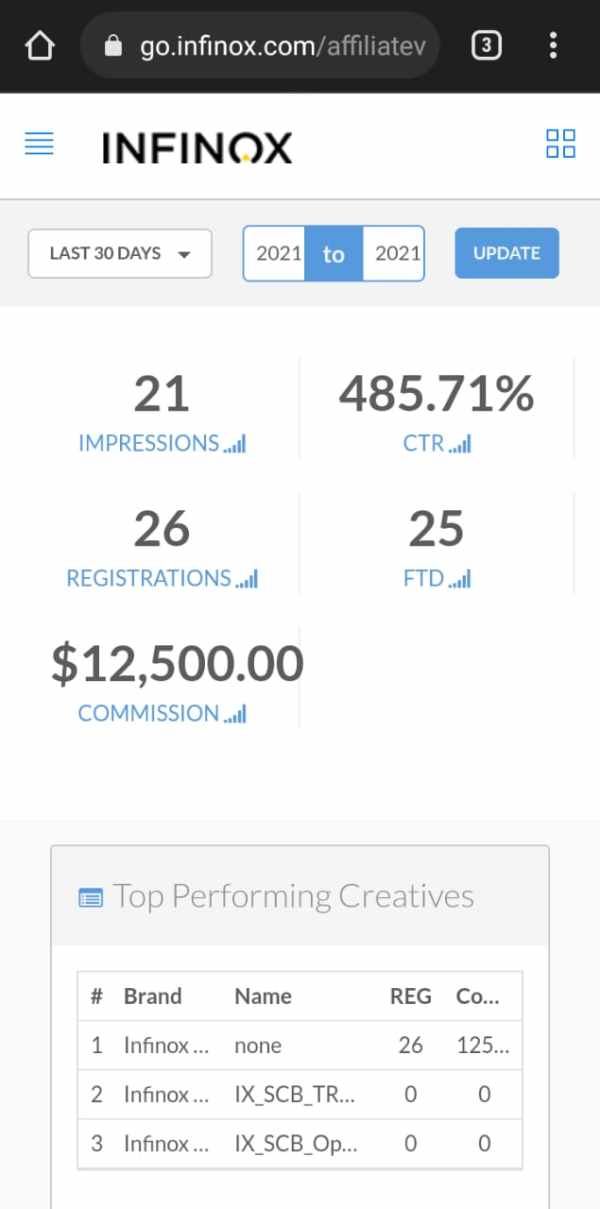

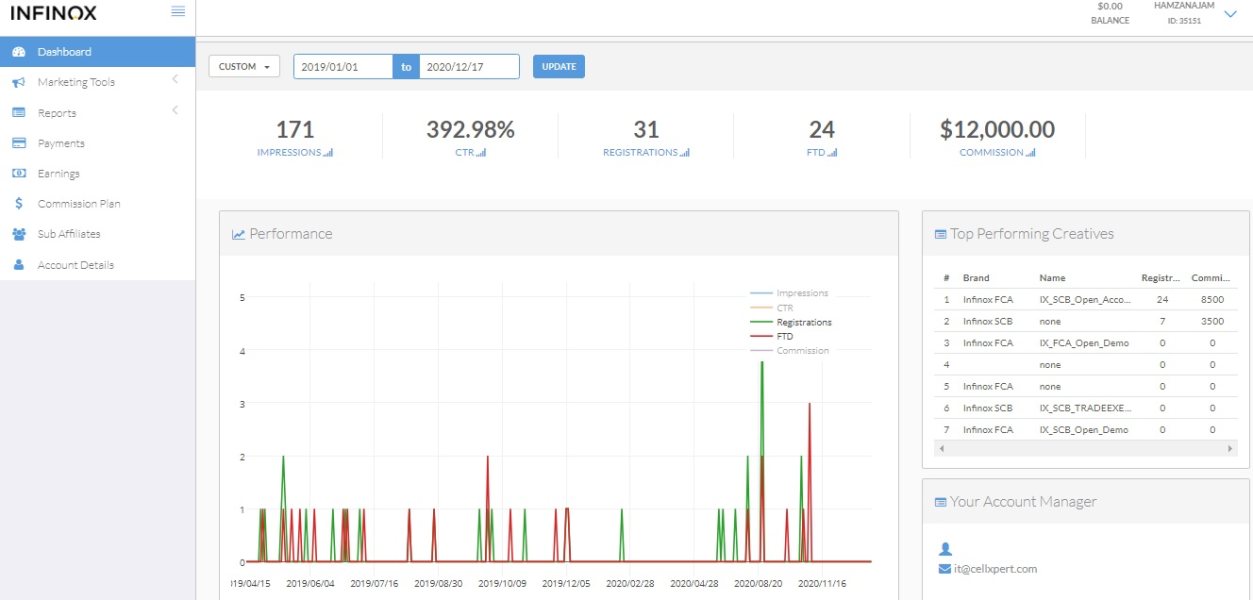

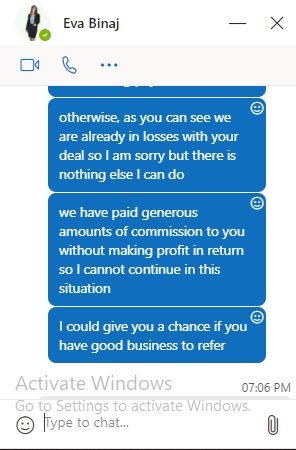

ExposureAlert: Infinox Reported Complaints Have Risen

Infinox, a global trading platform, faces a spike in user complaints questioning its reliability and user investment safety. Cases highlight issues like payment withholdings and poor business practices, despite its regulatory oversight by the FCA and SCB.

WikiFX

WikiFX

ExposureWikiFX Review: Something you need to know about INFINOX

INFINOX has been a globally recognized forex broker since 2009. Is this broker trustworthy? In this article, we will talk about INFINOX based on its specific data, regulation, exposures, etc.

WikiFX

WikiFX

Review 20

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now