简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

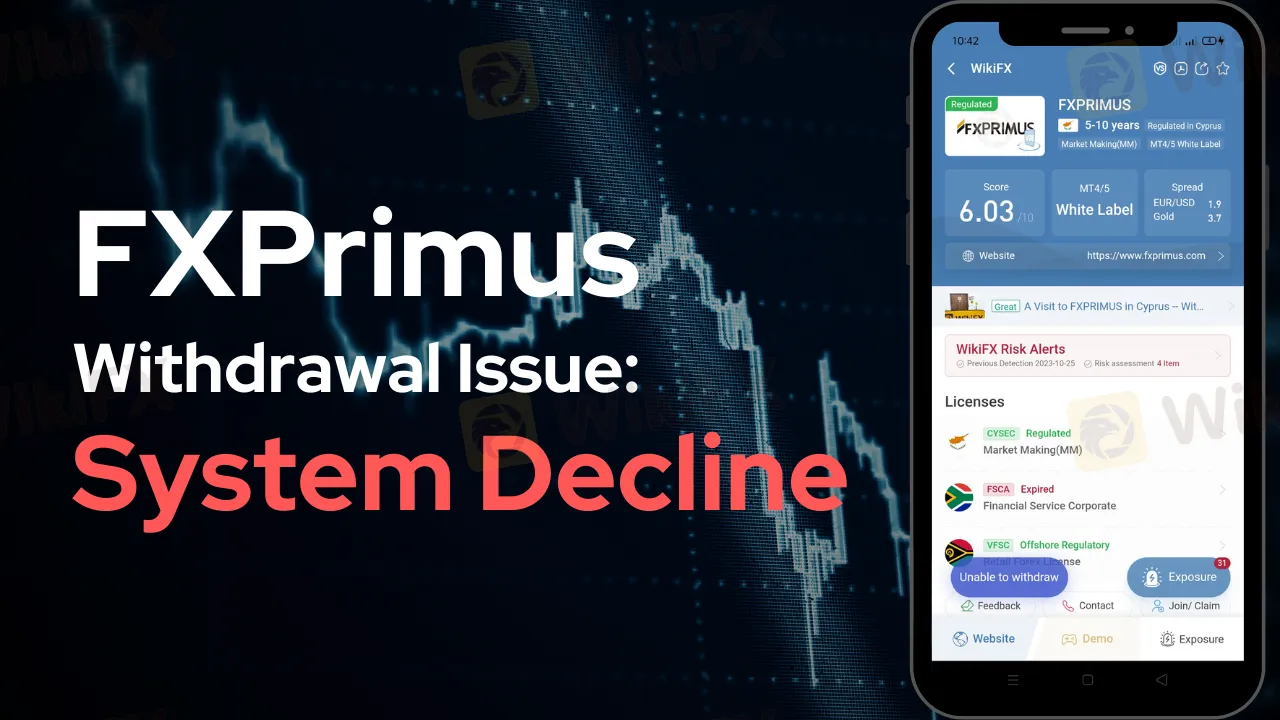

FXPrimus Withdrawal Issue: System Decline

Abstract:An anonymous trader alleges FXPrimus is withholding a profit of $8870, citing issues with the customer panel. This raises concerns about the broker's reliability despite its regulatory status and market reputation. Such incidents can impact trust within the trading community. Prompt resolution is crucial for both the trader's rightful earnings and FXPrimus's market standing.

In the intricate world of online forex trading, numerous concerns often arise among traders, both experienced and new. At the heart of these is the necessity for reliable brokers that uphold the trust and confidence of their users. FXPrimus is one such name in the industry that has built a reputation for itself. However, even the most esteemed entities can sometimes face issues that can potentially tarnish their image. One such concern has recently come to light.

The Concern

An anonymous trader has reached out, drawing attention to an unsettling experience with FXPrimus. They claim that the broker is holding back a considerable amount - 8870 USD to be precise. This amount was profited from an investment the trader made on their account with the login number 4614490. The trader expected a smooth withdrawal process, given FXPrimus's regulatory status and positive reputation in the market. However, contrary to expectations, they encountered a hurdle when they were informed of a problem with the customer panel, making it impossible for them to access and withdraw their funds.

“[...] FXPrimus company does not pay the 8870 USD profit I earned after the investment I made to my account with login number 4614490. I would be glad if you could help me withdraw my money by saying there is a problem with the customer panel.” - Anonymous Trader

What Does This Mean for FXPrimus?

Given their status in the market, this issue has the potential to dent FXPrimus's reputation. Trust and reliability are paramount in the trading world, especially when significant amounts of money are involved. FXPrimus, being a regulated broker, is bound by several regulatory guidelines and has an obligation to its customers.

Traders put their hard-earned money into these platforms, anticipating not just profit but also seamless service, which includes hassle-free withdrawals. Anomalies, like the one stated, can lead to skepticism among potential and current users.

What's Next?

It is essential for both parties involved - the trader and FXPrimus - to address this situation promptly. For the trader, it's about retrieving their rightfully earned profit. For FXPrimus, it's a matter of upholding their trust and standing in the market.

We really hope that the concerned trader and FXPrimus can reach an agreement. Brokers must understand that each event, no matter how isolated, has repercussions for the worldwide trading community. At the same time, we encourage traders to maintain detailed records of their transactions and interactions to ensure they have the appropriate proof in the event of a dispute.

Note: We encourage traders to do their own research, stay informed, and never hesitate to bring such issues to light. It not only helps them but also contributes to a transparent and reliable trading ecosystem.

You may access all the complaints sent by FXPrimus traders.

Link: https://www.wikifx.com/en/dealer/4051155469.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Justice Served: Illegal Investment Scheme Ends in RM28 Million Repayment

The Kuala Lumpur High Court has ruled that a Singaporean businessman, Chan Cheh Shin, must return RM28 million to 122 Malaysian investors after the court determined that his investment operations were conducted illegally.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Four men in Tokyo were arrested for running an unregistered FX trading operation, collecting over ¥1.6 billion from 1,500 investors.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

WikiFX Broker

Latest News

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Rupee gains against Euro

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator