Score

Orbin Markets

Saint Vincent and the Grenadines|1-2 years|

Saint Vincent and the Grenadines|1-2 years| https://orbinmarkets.com/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Eltoro PVT LTD

Orbin Markets

Saint Vincent and the Grenadines

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $350 |

| Minimum Spread | from 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $10,000 |

| Minimum Spread | from 0.1 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $1,000 |

| Minimum Spread | from 0.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Orbin Markets also viewed..

XM

GTCFX

FP Markets

IronFX

Orbin Markets · Company Summary

| Orbin Markets | Basic Information |

| Company Name | Orbin Markets |

| Founded | 2010 |

| Headquarters | Saint Vincent and the Grenadines |

| Regulations | Unregulated |

| Tradable Assets | CFDs, Forex, Cryptocurrencies, Energies, Stocks, Indices, Metals, Binary |

| Account Types | Standard, Pro, VIP, Islamic |

| Minimum Deposit | $100 - $2,500 |

| Maximum Leverage | 1:1500 |

| Spreads | 0.1 - 1.5 pips |

| Commission | From 0 pips |

| Deposit Methods | Credit Card Payments, Swifticard |

| Trading Platforms | Orbin Web Platform |

| Customer Support | Email, Live Chat |

| Trading Tools | Economic Calendar, Live Rates |

| Bonus Offerings | Tiered bonuses tied to specific investment amounts |

Overview of Orbin Markets

Orbin Markets, established in 2010 and headquartered in Saint Vincent and the Grenadines, positions itself as a comprehensive trading platform offering a diverse range of financial instruments. The broker boasts an extensive array of trading options, including Contracts for Difference (CFDs), forex, cryptocurrencies, energies, stocks, indices, metals, and binary options. While the platform claims to provide extremely low spreads and commission-free trading with advanced features, it is noteworthy that Orbin Markets operates without regulation from recognized financial authorities, raising concerns about transparency and fund security.

One notable feature of Orbin Markets is its tiered account structure catering to various trader preferences. The Standard, Pro, VIP, and Islamic accounts offer different minimum deposits, spreads, and additional services such as dedicated account managers. The broker's proprietary Orbin Web Platform serves as the trading interface, incorporating tools like ECN integration, a No Dealing Desk (NDD) framework, and the ability to trade directly with global banks. However, potential users should exercise caution due to the lack of regulatory oversight and carefully weigh the advantages and disadvantages before engaging with Orbin Markets.

Is Orbin Markets Legit?

Orbin Markets is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Trading with an unregulated broker like Orbin Markets carries inherent risks. Without regulatory supervision, there may be limited avenues for dispute resolution, and traders may face challenges in seeking recourse in case of any issues or disputes. Additionally, unregulated brokers may not be subject to stringent financial and operational standards, potentially leading to inadequate client fund protection and unfair trading practices.

Pros and Cons

Orbin Markets presents traders with a variety of pros and cons to consider. While the broker offers a diverse range of trading instruments and account types, including an Islamic account, its unregulated status may pose risks. The Orbin Web Platform provides advanced features, but the absence of specified regulatory information raises concerns about oversight. Traders can benefit from enticing bonuses tied to specific investment amounts, adding a unique touch to the trading experience. However, the lack of regulatory scrutiny may impact the broker's overall transparency and accountability.

| Pros | Cons |

|

|

|

|

|

|

|

Trading Instruments

Orbin Markets presents a diverse range of trading instruments, catering to a broad spectrum of traders. The platform offers Contracts for Difference (CFDs), allowing traders to speculate on the price movements of various assets without owning them. This category encompasses an extensive array of financial instruments, providing flexibility for diverse trading strategies.

Forex trading takes center stage at Orbin Markets, offering a comprehensive selection of currency pairs, including major, minor, and exotic pairs. The Forex market provides traders with liquidity and volatility, essential elements for dynamic and successful trading.

Cryptocurrencies have become increasingly popular, and Orbin Markets reflects this trend by providing a wide range of digital assets for trading. Traders can engage in speculating on the price movements of popular cryptocurrencies like Bitcoin and Ethereum.

For those interested in energy markets, Orbin Markets facilitates trading in Energies, including commodities such as oil and natural gas. These markets are influenced by geopolitical events, supply and demand dynamics, and global economic conditions.

Equity enthusiasts can explore a diverse selection of Stocks available on the Orbin Markets platform. Traders gain access to stocks from renowned companies, enabling them to participate in global markets and diversify their portfolios.

Indices, representing the performance of a group of stocks, form another integral part of Orbin Markets' trading instruments. Traders can choose from a variety of global indices, allowing them to capitalize on broader market trends and movements.

Metals, including precious metals like gold and silver, offer a haven for traders seeking alternative assets. Orbin Markets facilitates trading in metals, providing opportunities to navigate the often-influenced precious metal markets.

Binary options, known for their simplicity and fixed risk-reward structure, are also part of Orbin Markets' offering. Traders can speculate on the direction of asset prices within a predetermined time frame, with fixed payouts for correct predictions.

With this comprehensive array of trading instruments, Orbin Markets empowers traders to tailor their portfolios and strategies to their individual preferences and market insights.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Orbin Markets | RoboForex | FxPro | IC Markets | Exness |

| Forex | Yes | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | Yes | No |

| Options | No | No | Yes | No | No |

Account Types

Orbin Markets provides a range of account types tailored to accommodate the diverse needs and preferences of its traders. Each account type comes with distinct features, catering to different trading styles and experience levels.

Standard Account:

With a minimum deposit requirement of $100, the Standard Account on Orbin Markets offers an affordable entry point for traders. This account type comes with a spread of 1.5 pips, providing a balance between cost-effectiveness and accessibility. While it doesn't include an account manager, traders in the Standard Account category have access to standard customer support and the full array of trading instruments available on the platform.

Pro Account:

Tailored for traders with more experience, the Pro Account necessitates a minimum deposit of $500. It boasts a narrower spread of 0.5 pips, enabling pricing that is more favorable. Those who choose the Pro Account receive aid from an assigned account manager, elevating the degree of individualized support. Moreover, Pro Account holders are granted priority customer support and are provided access to all trading instruments available on the Orbin Markets platform.

VIP Account:

The VIP Account is designed for individuals with high net worth or institutional traders, requiring a minimum deposit of $2,500. With an ultra-low spread of 0.1 pips, VIP Account holders experience pricing considered among the most favorable on the platform. This account category involves the assistance of a dedicated account manager, ensuring a heightened level of support. VIP Account traders additionally receive priority customer support and are granted access to the complete range of trading instruments available on Orbin Markets.

Islamic Account:

Orbin Markets recognizes the unique requirements of Islamic traders and offers an Islamic Account with features aligned with Sharia principles. With a minimum deposit of $100, this account type includes a spread of 1.5 pips. While it doesn't come with an account manager, Islamic Account holders benefit from standard customer support and have access to all trading instruments.

Traders can select the Orbin Markets account type that best suits their trading goals, experience level, and financial capacity, ensuring a customized and rewarding trading experience.

How to Open an Account?

To open an account with Orbin Markets, follow these steps.

Visit the Orbin Markets website. Look for the “Sign up” button on the homepage and click on it.

2. Sign up on websites registration page.

3. Receive your personal account login from an automated email

4. Log in

5. Proceed to deposit funds to your account

6. Download the platform and start trading

Leverage

Orbin Markets provides a maximum leverage of 1:1500 across all its account types, including Standard, Pro, VIP, and Islamic accounts. Leverage is a key factor in trading, allowing traders to control larger positions with a smaller amount of capital. The Standard Account, with a minimum deposit of $100, offers the highest leverage of 1:1500, catering to a broad range of traders. The Pro Account, designed for more experienced traders with a minimum deposit of $500, also maintains the maximum leverage of 1:1500 but comes with a tighter spread starting from 0.5 pips. The VIP Account, tailored for high-net-worth individuals or institutions with a minimum deposit of $2,500, features the same maximum leverage of 1:1500 and offers an ultra-low spread starting from 0.1 pips.

It's important for traders to carefully consider their risk tolerance and trading preferences when choosing an account type and leverage level. While higher leverage can amplify potential profits, it also increases the risk of significant losses. Orbin Markets' tiered account structure provides options for traders with varying experience levels and capital sizes, allowing them to tailor their trading experience accordingly.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Orbin Markets | FxPro | VantageFX | RoboForex |

| Maximum Leverage | 1:1500 | 1:200 | 1:500 | 1:2000 |

Spreads and Commissions (Trading Fees)

Orbin Markets offers multiple account types with varying spreads to cater to different trading preferences.

Standard Account:

The Standard account on Orbin Markets features spreads starting from 1.5 pips. This account type provides traders with a standard level of service, covering all trading instruments available on the platform. The focus is on accessibility, making it suitable for traders looking for a straightforward trading experience.

Pro Account:

For traders seeking tighter spreads, the Pro account offers spreads starting from 0.5 pips. This account type aims to establish a pricing structure perceived as more cost-effective compared to the Standard account.

VIP Account:

Orbin Markets' VIP account boasts the tightest spreads among the account types, starting from 0.1 pips. Designed for high-volume traders, this account type offers optimal pricing for VIP clients who prioritize minimal spreads to enhance their trading profitability.

Islamic Account:

The Islamic account on Orbin Markets offers spreads starting from 1.5 pips. Tailored to accommodate traders who adhere to Islamic finance principles, this account type provides access to all trading instruments without interest-based charges. The focus is on providing a trading environment that aligns with Islamic financial practices.

Traders can choose the account type that best suits their trading preferences, with the option to select varying spreads based on their individual needs. The tiered account structure allows for flexibility in finding a suitable balance between trading costs and desired features.

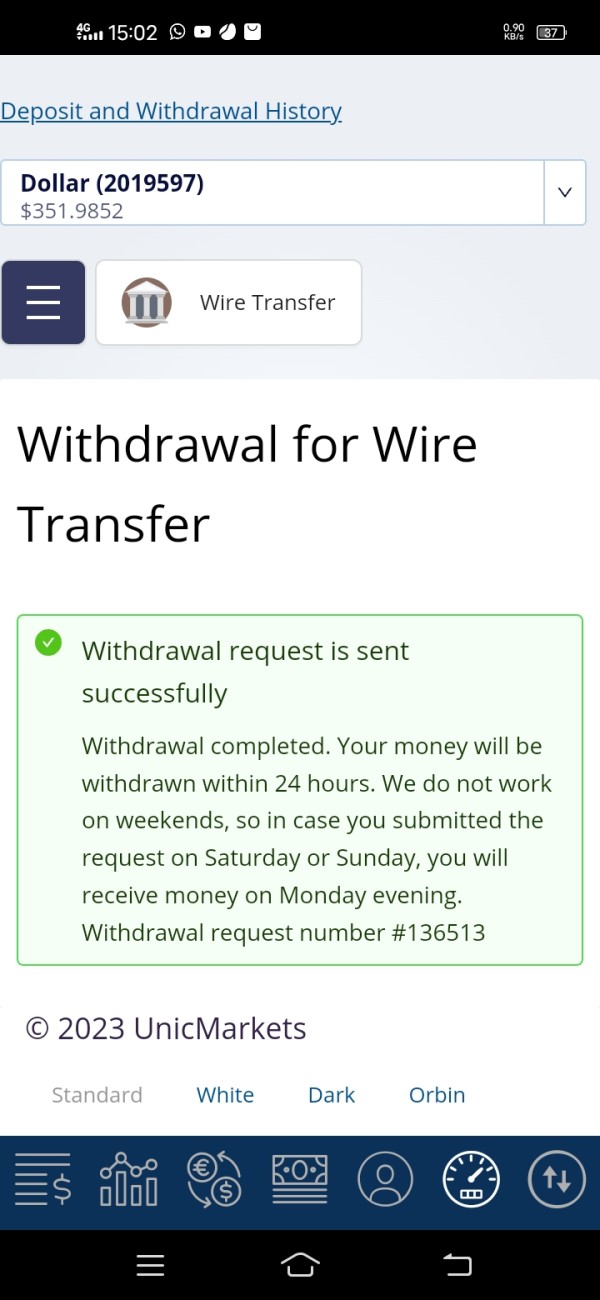

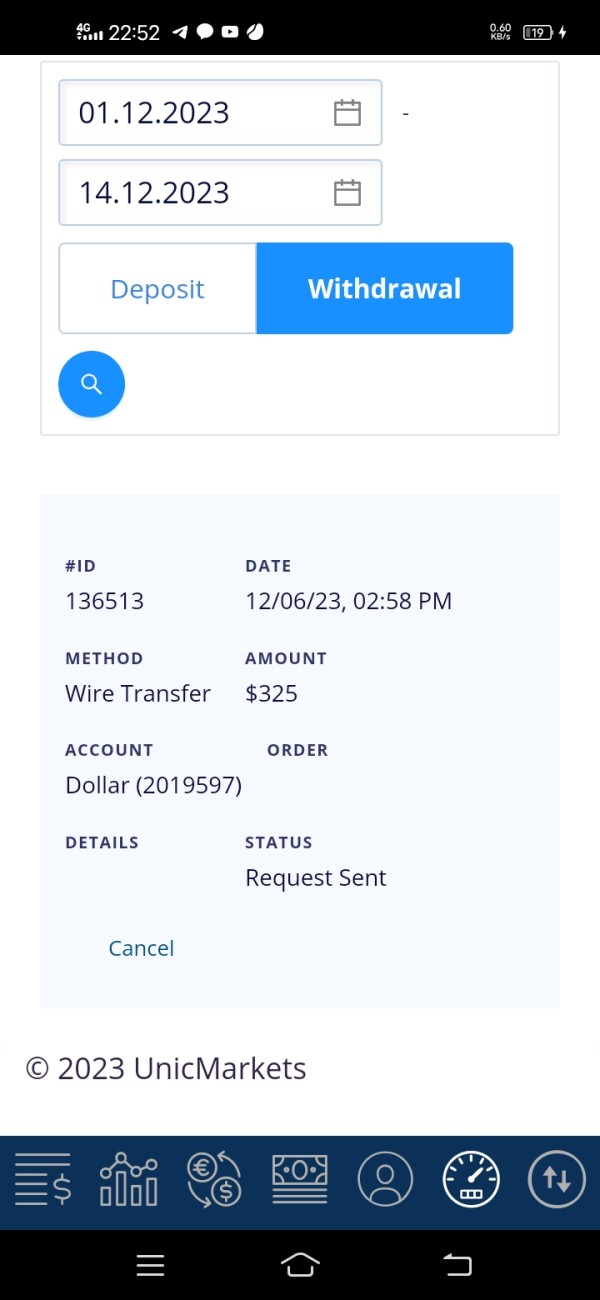

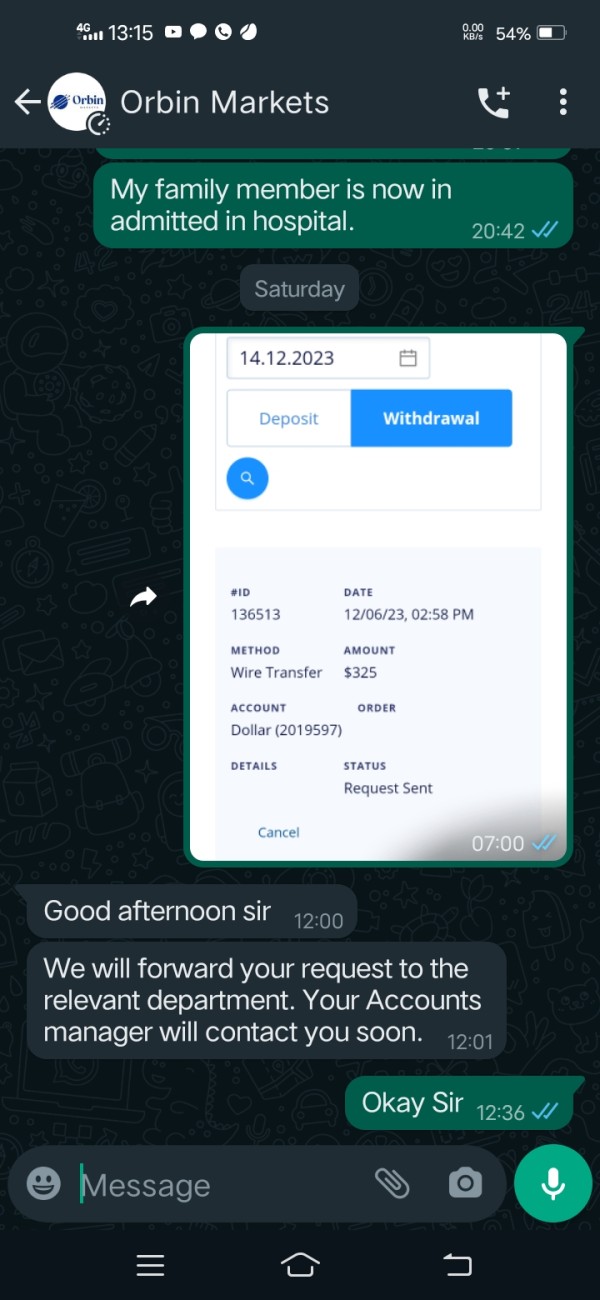

Deposit & Withdraw Methods

Orbin Markets offers a streamlined approach to deposit and withdrawal methods, providing traders with convenient options.

Credit Card Payments:

Traders can fund their Orbin Markets accounts using credit card payments, adding a layer of flexibility to the deposit process. This method allows for swift and secure transactions, enabling traders to access their funds promptly and engage in trading activities without unnecessary delays. Credit card payments are a widely accepted and accessible method, catering to a broad range of traders.

Swifticard:

Orbin Markets supports Swifticard as one of its deposit and withdrawal methods. Swifticard is likely a proprietary card or a financial tool integrated into the platform. Traders can use Swifticard to facilitate seamless and efficient transactions, both for funding their accounts and withdrawing profits. This method aligns with Orbin Markets' commitment to providing diverse and user-friendly financial solutions to meet the needs of its trading community.

Trading Platforms

Orbin Markets offers an advanced trading platform known as the Orbin Web Platform, designed for both new and experienced traders. With extremely low spreads and access to a diverse range of markets, the platform provides commission-free trading without broker interference. Key features include ECN integration, a No Dealing Desk (NDD) framework, and the ability to trade directly with global banks for deep liquidity.

The platform supports various operating systems and devices, ensuring flexibility for traders. It includes tools for efficient trade execution, such as Trailing Stop on the server side and the option to trade directly from charts. With over 70 indicators and comprehensive technical analysis tools, traders can make informed decisions.

Unique features like a trader's rating system, multilingual support, and a customizable watch list enhance the overall trading experience. Customer feedback is valued for continuous platform improvements. The platform also allows for multiple account trading and provides a detailed trading history for transparency.

Customer Support

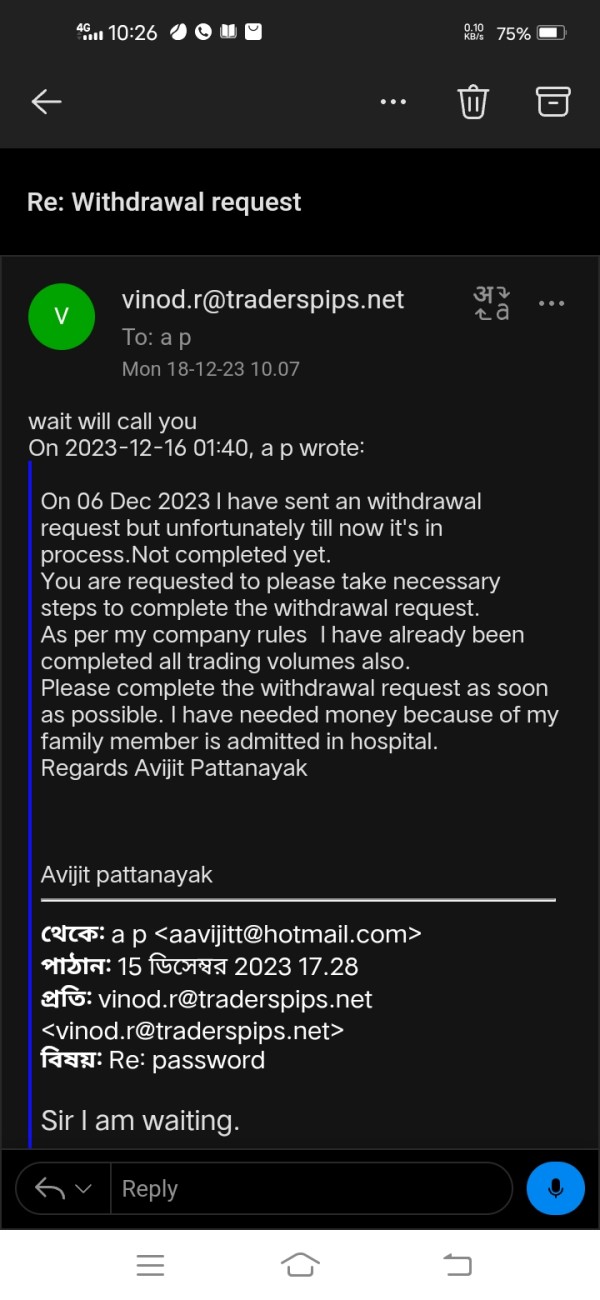

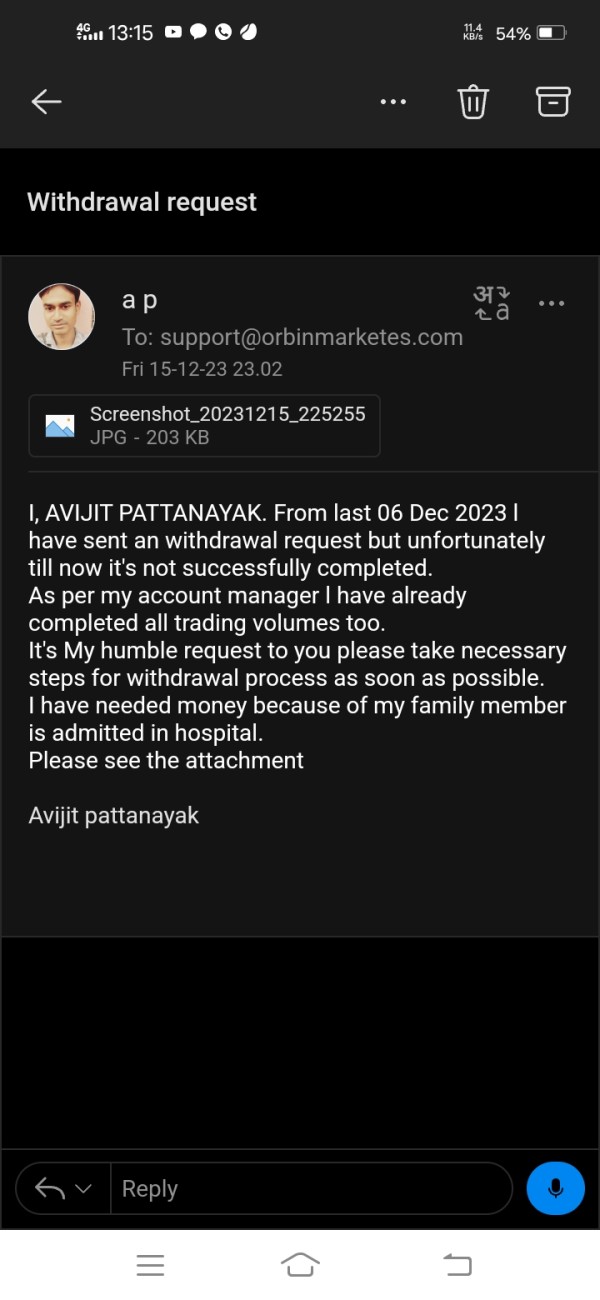

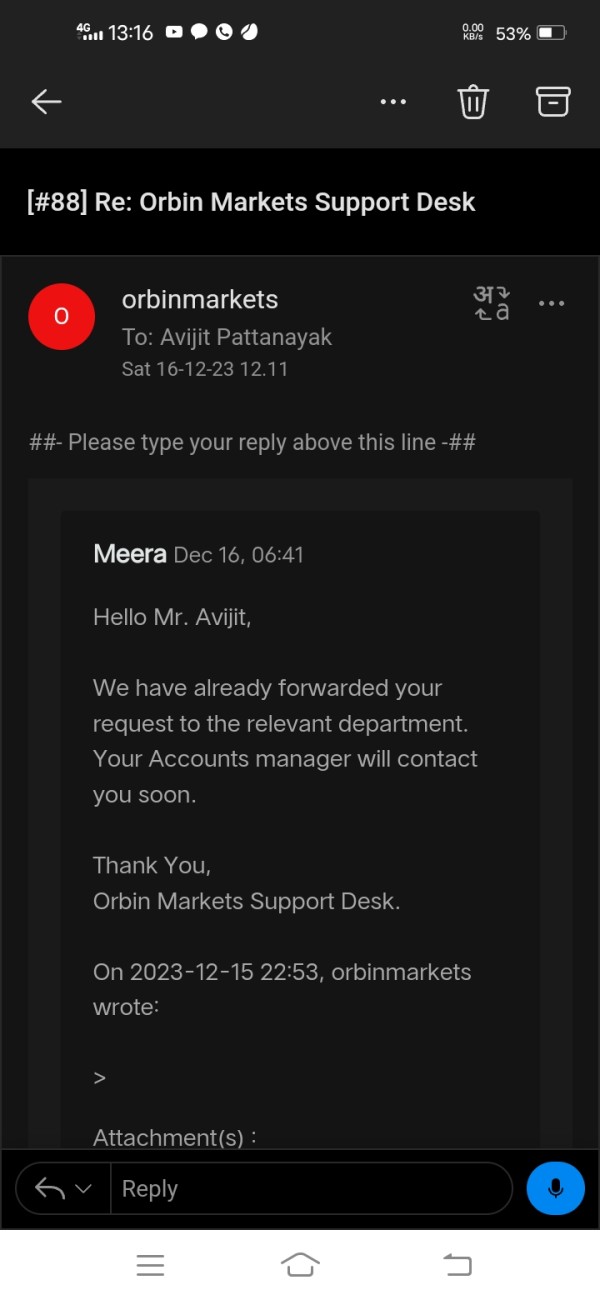

Orbin Markets prioritizes customer support through various channels, offering users the convenience of reaching out via email or live chat. For email inquiries or complaints, traders can contact the support team at support@orbinmarkets.com or complaints@orbinmarkets.com, respectively. This provides a written record and allows users to articulate specific details regarding their concerns or inquiries.

For more immediate assistance, Orbin Markets also offers a live chat option. Traders can initiate a chat session for quick and real-time support, enabling them to seek assistance, clarify queries, or resolve issues efficiently. The live chat feature serves as a direct communication channel, ensuring that users can connect with the support team promptly during trading hours. Orbin Markets aims to deliver accessible and responsive customer support to enhance the overall user experience on the platform.

Trading Tools

Orbin Markets equips traders with essential tools to navigate the dynamic financial markets effectively. The platform features an Economic Calendar, a fundamental tool providing a schedule of upcoming economic events, announcements, and reports that may influence market conditions. Traders can stay informed about key indicators, such as interest rate decisions, employment figures, and GDP releases, enabling them to anticipate potential market volatility and adjust their strategies accordingly.

In addition to the Economic Calendar, Orbin Markets offers Live Rates, a real-time streaming feature that provides up-to-the-minute pricing information for various trading instruments. This tool allows traders to monitor live market rates, enabling quick decision-making based on the latest price movements. Live Rates play a crucial role in helping traders stay connected to the market, facilitating timely and informed trading decisions.

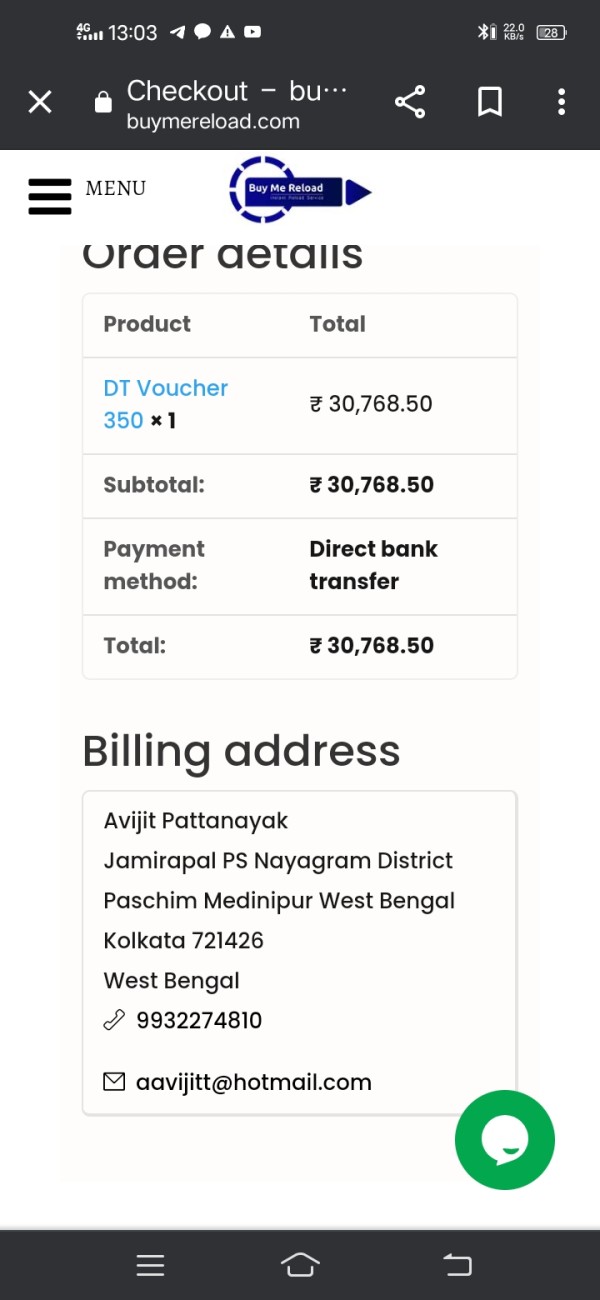

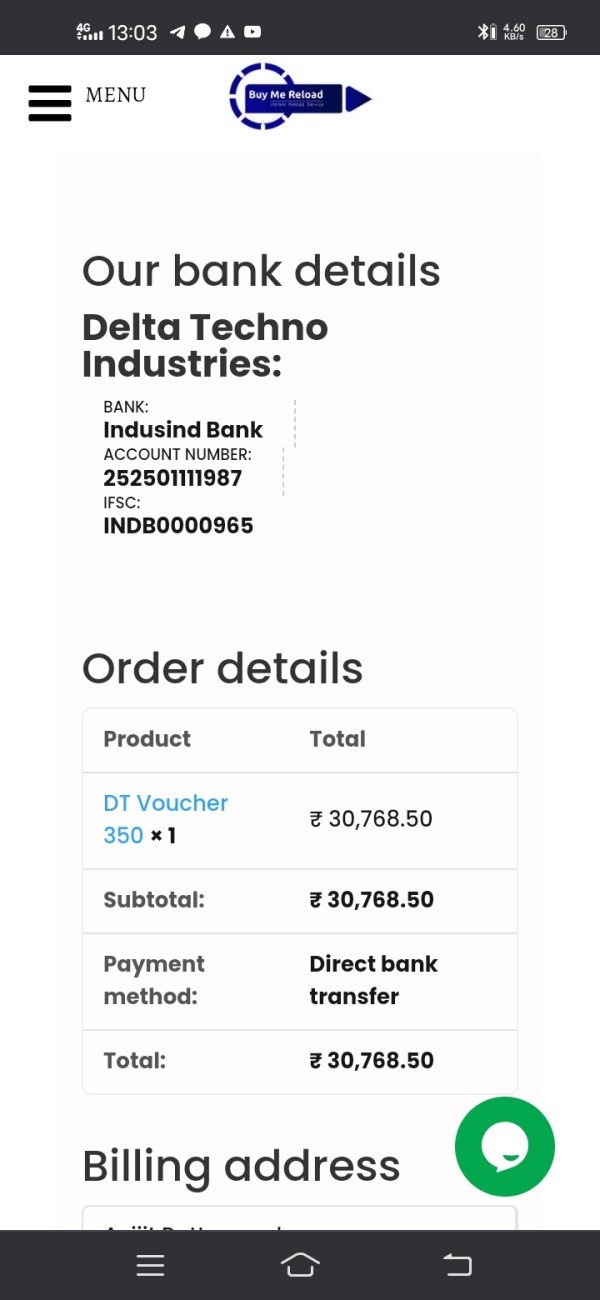

Bonus

Orbin Markets offers enticing bonuses to enhance the trading experience for its investors. By investing specified amounts, traders can unlock attractive bonuses, providing additional value to their trading journey. The bonuses are structured in tiers, with different levels of investment offering various rewards.

For example, investing $399 entitles traders to a complimentary one-night stay at Hotel Snow Line in Manali, using a designated coupon code. This promotion showcases the platform's commitment to providing unique and diverse benefits to its investors.

Similarly, higher investment tiers, such as $599 and $999, offer additional rewards, including free nights at renowned hotels like Fogg Hills Cottages Hotel and The Manali Cottages in Manali. Each tier comes with its own coupon code, allowing traders to redeem these exclusive offers.

These bonuses present a distinctive approach by Orbin Markets, aiming to provide investors with not only financial incentives but also memorable experiences. It adds an unconventional yet personalized touch to the trading journey, aligning with the platform's commitment to offering a comprehensive and rewarding trading environment.

Conclusion

In conclusion, Orbin Markets offers traders a diverse range of financial instruments through its proprietary Orbin Web Platform, featuring extremely low spreads and commission-free trading. The tiered account structure caters to various trader preferences. However, potential users should exercise caution due to the absence of regulatory oversight, raising concerns about the platform's credibility and fund security. While emphasizing advantages such as a wide array of trading tools and bonuses, the platform's unregulated nature poses inherent risks that traders must carefully consider before engaging.

FAQs

Q: Is Orbin Markets a regulated broker?

A: No, Orbin Markets is not regulated by any recognized financial regulatory authority, which raises concerns about the oversight and security of funds.

Q: How does Orbin Markets differentiate its account types?

A: Orbin Markets provides diverse account types, including Standard, Pro, VIP, and Islamic, each tailored to meet the specific needs and preferences of traders.

Q: What is the minimum deposit required to open an account with Orbin Markets?

A: Orbin Markets offers various account types with different minimum deposit requirements, starting from $100 for the Standard account.

Q: Can traders access the Orbin Web Platform on different devices?

A: Yes, the Orbin Web Platform is designed to support various operating systems and devices, providing flexibility for traders.

Q: How can traders contact customer support on Orbin Markets?

A: Traders can reach Orbin Markets' customer support through email at support@orbinmarkets.com or live chat for immediate assistance.

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now