简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

OctaFX in Malaysia | Revealing the Truth!

Abstract:In this comprehensive article, WikiFX delves into an in-depth exploration of OctaFX, thoroughly examining its features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. By the end of this review, you'll have all the essential information to make an informed decision on whether to choose this platform. Continue reading to uncover the details!

OctaFX, a renowned and award-winning online Forex broker established in 2011, has gained recognition for its global presence, with registrations in St. Vincent and the Grenadines under license number 19776 IBC 2011 and regulation by CySEC (372/18). The company has physical offices in Spain, Cyprus, and Malaysia, further solidifying its reputation in the industry.

As a comprehensive trading platform, OctaFX offers access to an extensive range of trading instruments, including 35 currency pairs, gold, silver, 3 energy assets, 10 global indices, 30 cryptocurrencies, and 150 stocks. Clients can choose between MT4 and MT5 accounts, both of which are well-respected platforms in the trading world.

OctaFX distinguishes itself with its attractive features, such as low spreads, commission-free accounts, fast and free deposit and withdrawal methods, up to 50% margin increase, an exclusive replicated trading platform, and a highly rewarding IB program for referrals.

Notably, the company goes beyond its financial endeavors by actively supporting charitable and humanitarian initiatives, striving to enhance educational infrastructure and uplift local communities in Malaysia and beyond. Recently, OctaFX joined hands with Ideas Academy, a Malaysian educational organization, to spearhead the digitalization of multiple learning centers, benefiting refugees and underprivileged students.

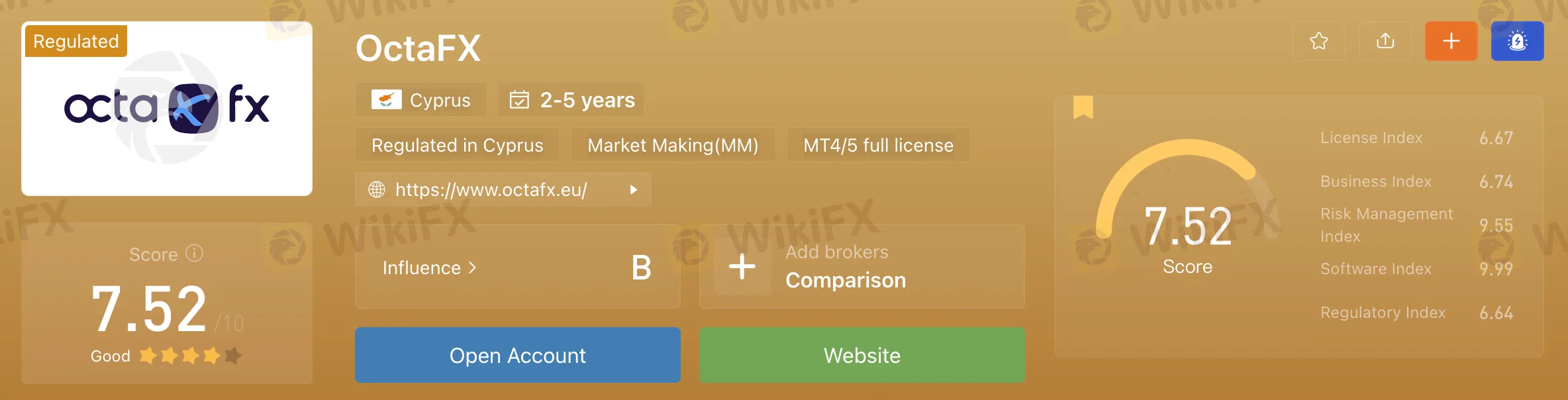

Our WikiFX database states that OctaFX has a fairly high WikiScore of 7.52, meaning it is a reliable broker. Simultaneously, we also verified the license which OctaFX claims to possess.

Accounts offered:

Traders can opt for three types of accounts, namely the MT4 account, which is commission-free and suitable for convenient and swift account setup, providing spreads starting at 0.6. The MT4 account allows trading in 35 currency pairs, gold, silver, 3 energy assets, 4 indices, and 30 cryptocurrencies (stocks are excluded).

On the other hand, the MT5 account caters to innovative traders who prefer intelligent technical analysis. Similar to the MT4 account, the MT5 account is commission-free and grants access to 35 currency pairs, gold, silver, 3 energy assets, 10 indices, 30 cryptocurrencies, and 150 stocks.

OctaFX also accommodates traders requiring an Islamic account that adheres to Sharia principles, eliminating interest while retaining all the key features of regular accounts.

Deposits and withdrawals:

Regarding deposit and withdrawal methods, OctaFX accepts various options, including credit cards, bank wire transfers, e-wallets (e.g., Skrill and Neteller), and digital currencies, ensuring seamless transfers without any commissions or handling fees. However, the availability of deposit and withdrawal methods may vary based on the client's location, necessitating consultation with customer service before opening an account. It's important to note that users from certain countries can use their local banks for payments, though this option is not available for users from Taiwan.

OctaFX prioritizes swift withdrawal processes, returning funds using the same method as the initial deposit, with withdrawal requests processed and approved within 1-3 hours.

Trading platforms:

Regarding trading platforms, OctaFX offers two highly regarded options: MT4 and MT5. Additionally, clients who face difficulties with downloading or using the MetaTrader mobile application can utilize OctaFX's official mobile application (OctaTrader), which directly connects to a MetaTrader trading account.

Customer service:

The OctaFX customer support team is highly accessible, offering 24-hour service from Monday to Friday. Traders can reach them through various channels, including live chat, phone, WhatsApp, Telegram, email, and traditional mail. Additionally, the platform features a helpful FAQ section for those who prefer finding answers on their own.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

IG Group Enters Direct Investment Market with £160 Million Freetrade Buyout

IG Group, a prominent global financial trading and investment company, has announced its acquisition of Freetrade, a commission-free investment platform, for £160 million. The deal, funded through IG’s existing capital resources, marks a strategic move to expand its footprint in the United Kingdom.

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

Cinkciarz.pl, one of Central Europe’s largest currency exchange platforms, has made headlines after accusing major Polish banks of conspiring to undermine its operations. The company has threatened legal action amounting to 6.76 billion zlotys ($1.6 billion) in damages. However, the platform is now under intense scrutiny following allegations of fraud and the mismanagement of customer funds.

BSP and JICA Renew Partnership to Expand Credit Risk Database for SMEs in the Philippines

On December 11, 2024, a significant milestone was reached in the Philippines' financial sector as the Bangko Sentral ng Pilipinas (BSP) and the Japan International Cooperation Agency (JICA) officially signed the ‘Records of Discussion’ for the second phase of the Credit Risk Database (CRD) project. The ceremony at the BSP headquarters in Manila marked a pivotal moment in widening access to financing for small and medium enterprises (SMEs) across the country.

Why Copy Trading is Perfect for New Investors

Learn why copy trading is ideal for new investors. Follow expert traders, minimize risks, and start earning confidently—no prior expertise is required.

WikiFX Broker

Latest News

How Long Can the Dollar Remain Strong?

Forex Price Trend Prediction! | Come be a New Year Price Winner!

HFM NY Special Offer!

How a Promised RM1.4 Million Return Turned into a Costly Scam

First Unfair Trading Case Reported Under South Korea’s Virtual Asset User Protection Act

Cinkciarz.pl Under Fire: Frozen Accounts, Missing Funds

“Predict and Win” Big Rewards! Join the Contest Now

South Korean President Yoon Suk Yeol's Arrest Shakes Markets

Titanium Capital LLC Ponzi Scheme: Henry Abdo Admits Fraud, Impacting Over 200 Investors

South Korea's Crypto Regulation Updates for 2025

Currency Calculator