简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is GO Markets Worth a Go?

Abstract:GO Markets is one of OG forex brokers founded in Australia. Today, WikiFX will do a thorough review on this broker to verify its credibility. Keep reading for more.

GO Markets is a company that offers online CFD trading (business number: 170969). Founded in 2006 in Australia, the company's office is located in the Republic of Maurice Garcia, while its head office is located in Melbourne. GO Markets is a licensed financial company that has been operating under the supervision of higher authorities for many years.

GO Markets is considered a pioneer in the Forex industry because it was one of the first companies to offer MetaTrader4 services to its clients. After the launch of MTQ's upgraded version of MT5, GO Markets has continued to provide MT5 software services to retail clients since 2018.

GO Markets was founded in Australia and holds a regulatory license (254963) issued by the Australian Securities Commission ASIC to protect the rights of Australian clients. Client funds are held separately in trust accounts with the National Australia Bank (NAB) and the Commonwealth Bank of Australia. Clients outside Australia are regulated by the Financial Services Commission of Mauritius (FSC) (GB 19024896).

GO Markets offers two types of accounts:

1. The GO Plus + account is a commission-free account with no handling fees, spreads starting at 0 pips, and unilateral commissions of A$3 per lot. The minimum initial deposit is A$200.

2. The Standard account is commission-free, spreads start at 0 pips, and the minimum initial deposit is A$200.

Deposits & Withdrawals:

GO Markets accepts credit cards, bank wire transfers, online payment gateway Fasapay, and e-wallets (Skrill & Neteller) for deposits and withdrawals.

Credit card deposits and withdrawals are made promptly, while bank wire transfers take 1-3 business days, and the customer is responsible for the wire transfer fees.

Trading Platforms Offered by GO Markets:

GO Markets currently offers two trading platforms, MT4 and MT5. GO Markets supports desktop (Windows), mobile (iOS, Android) and web versions, respectively, so investors are free to choose.

In addition, GO Markets also offers free trading assistance for clients with live accounts, including Autochartist (intelligent charting tool), MetaTrader Genesis plugin, Trading Central (analytical software), a-Quant (signal builder) and VPS (Virtual Private Server).

GO Markets provides professional customer service 24/5 and in multiple languages. The customer service will use a translator to reply to customers, although the grammar was not accurate, but all questions were answered.

WikiFXs verdict:

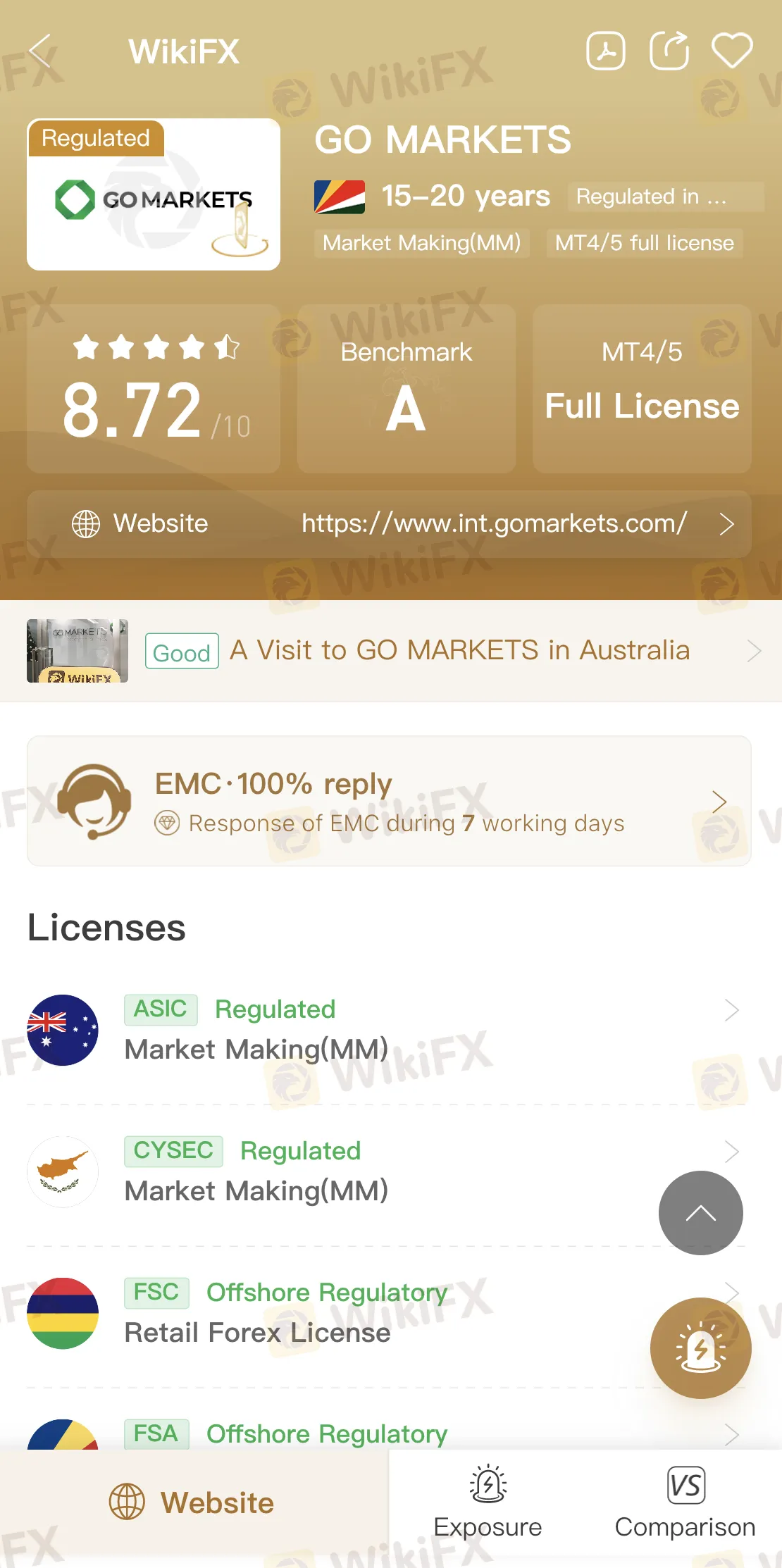

WikiFX is a platform that contains verified information of over 41,000 online brokers in collaboration with more than 30 national regulators. To verify the legitimacy of forex brokers, we at WikiFX, investigate, evaluate, and rate them based on a variety of factors. GO Markets is given as 8.72 out of 10 WikiScore, indicating it is a reliable broker.

WikiFX verified the legitimacy of GO Markets licenses which were issued by ASIC and FSC.

WikiFX also sent our field survey team to GO Markets physical office in Melbourne (Australia) to verify its address. This is the extra mile that WikiFX takes in order to provide more accurate information to help our users.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Justice Served: Illegal Investment Scheme Ends in RM28 Million Repayment

The Kuala Lumpur High Court has ruled that a Singaporean businessman, Chan Cheh Shin, must return RM28 million to 122 Malaysian investors after the court determined that his investment operations were conducted illegally.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Four men in Tokyo were arrested for running an unregistered FX trading operation, collecting over ¥1.6 billion from 1,500 investors.

Doo Group Expands Its Operations with CySEC License

Doo Financial, part of Doo Group, receives a CySEC license, allowing FX/CFD services in Europe. This strengthens its global presence and regulatory standards.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator