简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Something you need to know about Capital 19

Abstract: Registered in Australia, Capital 19 is an online forex broker offering a series of financial instruments to its clients. In today’s article, we made a comprehensive review of this broker so that you can have a better understanding of Capital 19.

About Capital 19

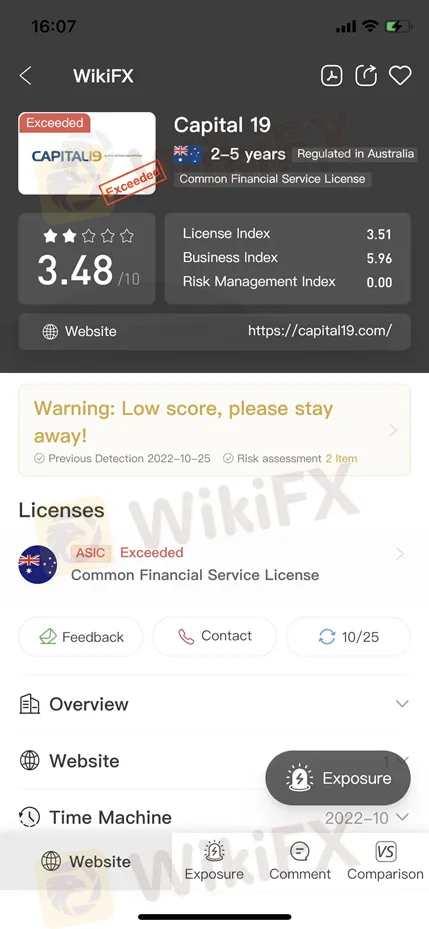

Capital 19 is an Australian trading brokerage committed to exploring global markets and to identify investment opportunities that achieve the highest returns possible for our clients. WikiFX has given this broker a low rating of 3.48/10.

Research Subscription Fees

With Capital 19, You have the option of subscribing to research from institutions such as Zacks and Morningstar through the TraderWorkstation (TWS). Each institution charges a fee for their research which is disclosed before subscribing.

The Algorithmic Model

Capital 19 provides The Algorithmic Model which uses a computer to monitor the markets based on a defined set of rules, removing the emotion from investing.

Trader Workstation

TWS gives investors the tools professional traders use to gain an edge. It optimizes trading speed and offers specialized tools for both novice and advanced traders.

Trade Size

The minimum trade size Capital 19 offers for all three account types is 0.01 lots, otherwise known as micro-lots. The largest trade size tips the scales at 150 lots. Margin call: 50%, Stop Loss: 50% are also the same for all three account types.

Deposit & Withdrawal

Capital 19 accepts payments from bank transfers, VISA and MasterCard. There is no known information on the site if e-wallets such as Neteller, Skrill, and PayPal and cryptocurrencies can be used to make payments.

Customer Support

You can contact Capital 19 by calling the manager via this number 1300 735 320 to inquire about services or to forward your complaint. You can as well contact Capital 19 by writing a mail to them at info@capital19.com. The physical address of this broker is Suite 303, 35 Lime Street, Sydney NSW 2000., and their Postal Address: iCapital 19, P.O. Box H69, Australia Square NSW. The LiveChat option isn't available but a response has been promised if contact is made through any of the above means.

Business in the US

Although this broker is based in Australia, it is running the business in the United States market.

Regulation: Is Capital 19 legit?

Capital 19 exceeds the business scope regulated by Australia ASIC (license number: 441891) National Futures Licence Non-Forex License. Therefore, we cannot consider this broker a regulated broker.

Conclusion:

Although we didn‘t receive complaints against this broker yet, it does not mean Capital 19 is an absolutely safe broker. Protecting investors’ interests is always WikiFXs primary. We advise you to do more research about this broker before making a final decision.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Capital.com transitions to a regional leadership model as Kypros Zoumidou steps down, promoting Christoforos Soutzis as CEO of its Cyprus operations.

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Online trading platform eToro has recently unveiled its latest investment offering—the Global-Edge Smart Portfolio. This new addition to eToro’s extensive portfolio options provides investors with a balanced approach to investing by combining global stocks and bonds, tailored for those looking for growth and stability.

Something You Need to Know About SogoTrade

Have you ever heard of a broker named SogoTrade? In this article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information.

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

Webull has announced the launch of a new 24/5 Overnight Trading feature for U.S. users, developed in partnership with Blue Ocean ATS. This feature allows Webull’s clients to trade stocks and ETFs outside traditional market hours, from 8:00 pm to 4:00 am ET, Sunday through Thursday.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Currency Calculator