Score

SBG SECURITIES

Kenya|5-10 years|

Kenya|5-10 years| https://www.sbgsecurities.co.ke/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Netherlands 2.89

Netherlands 2.89Contact

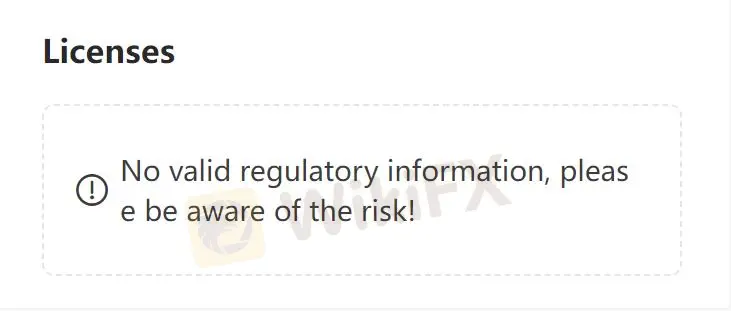

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Kenya

KenyaUsers who viewed SBG SECURITIES also viewed..

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

sbgsecurities.co.ke

Server Location

South Africa

Website Domain Name

sbgsecurities.co.ke

Server IP

196.8.136.150

Company Summary

| SBG SECURITIESReview Summary | |

| Founded | 2010-08-11 |

| Registered Country/Region | Kenya |

| Regulation | Unregulated |

| Products and Services | Vision and mission/Agents network/CDSC Services/What is M-shares/Downloadable files/Other outputs from Re/search |

| Demo Account | ✅ |

| Trading Platform | iTrader |

| Customer Support | Phone:+254 20 363 8080+254 20 363 8942+254 20 363 8900+254 73 944 1441+254 70 444 1441 |

| Email:sbgs@stanbic.comchiefexec-sbgs@stanbic.comcustomercare-sbgsecurities@stanbic.com | |

SBG SECURITIES Information

Registered in Kenya, SBG SECURITIES provides various services reflected in its Vision and mission, Agents network, CDSC Services, What is M-shares, Downloadable files, and Other outputs from Research. The company is still risky due to its unregulated status. Details are as follows: https://youtu.be/3F6zX0N6Ubc.

Is SBG SECURITIES Legit?

SBG SECURITIES is not regulated, making it less safe than regulated brokers.

What products and services does SBG SECURITIES provide?

SBG SECURITIES offers various products and services, including Vision and mission, Agents network, CDSC Services, What is M-shares, Downloadable files, and Other outputs from Research.

CDSC Services: Services including Account opening, Settlement of shares bought and sold, Immobilization of shares held in certificate form, Pledge of shares in favor of banks and financial institutions, Release of pledged shares, Private transfer of shares (subject to approval by NSE, CMA, and CDSC), Transmission of shares in case of death/succession. Services provided by SBG Securities as a CDA are chargeable services.

Equity trading: Guides how to work orders in the market which relate to large transactions and illiquid counters for local and foreign asset managers, hedge funds, and insurance companies as well as high net worth and retail clients.

Fixed income: Providing advisory services on primary issuance of Treasury bonds using informed insights into interest rate movements and money market sentiment.

Other outputs from our Research: provide company-specific notes on the counters listed on the regional stock exchanges.

There is no minimum investment requirement. However, the minimum number of shares that can be sold or purchased is 100.

Trading Platform

On November 24, 2010, SBG SECURITIES developed the iTrader platform and had a stock trading account. Trade on https://www.csfs.co.ke/activelite/. Central Depository and Settlement Corporation (CDSC) is an account where investors securities are stored electronically.

| Trading Platform | Supported |

| iTrader | ✔ |

Customer Support Options

Traders contact SBG SECURITIES via phone and email.

| Contact Options | Details |

| Phone | +254 20 363 8080+254 20 363 8942+254 20 363 8900+254 73 944 1441+254 70 444 1441 |

| sbgs@stanbic.comchiefexec-sbgs@stanbic.comcustomercare-sbgsecurities@stanbic.com | |

| Supported Language | English |

| Website Language | English |

| Physical Address | Stanbic Bank Centre 2nd floor, Westlands Road |

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now