简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Breaking News! FSCA issued a statement against Veracity Markets asking for a complete shutdown.

Abstract:Previously, WikiFX reported that a South Africa-rooted forex broker, Veracity Markets, has been accused of withdrawal refusal. Many traders lost control of their funds after investing in Veracity Markets. Then FSCA, the South Africa-based regulator decided to suspend Veracity Markets but didn’t launch official announcement yet. On July 13, 2022, FSCA finally made a statement about the case of Veracity Markets.

Previously, WikiFX reported that a South Africa-rooted forex broker, Veracity Markets, has been accused of withdrawal refusal. Many traders lost control of their funds after investing in Veracity Markets. Then FSCA, the South Africa-based regulator decided to suspend Veracity Markets but did not launch an official announcement yet. On July 13, 2022, FSCA finally made a statement about the case of Veracity Markets.

About FSCA

The Financial Sector Conduct Authority (FSCA) is a South Africa-based regulator. It was established by the South African government to ensure that financial institutions and financial service providers adhere to strict rules of conduct. Its goal is to protect investors' legitimate rights and interests from scammers. FSCA can shut down financial institutions that violate its rules of conduct, so that traders can conduct business in a safe and healthy financial environment. Due to the recent situation of Veracity Markets, it is legal for FSCA to ask Veracity Markets for a complete shutdown.

(Source: FSCA)

About Veracity Markets

Founded in 2020, Veracity Markets is an online forex broker based in South Africa. It has two physical addresses: 155 West Street, Sandown, Sandton, 2031, and 80 Strand Street, Cape Town, 8000. According to WikiFX, Veracity Markets is not regulated. The FSPR with license number: 40983 and FSCA with license number: 4701 claimed by this broker are suspicious clones. Thus, WikiFX has given this broker a very low rating of 1.34/10.

The reason why Veracity Markets has been forced to shut down

Recently, Veracity Markets has been accused of withdrawal refusal. Many traders lost control of their funds after investing in Veracity Markets. In addition, some investors expose that this broker has caused severe slippage. Veracity Markets filed for liquidation and bankruptcy last year. This broker is suspected to encourage money to come into its account while limiting money to return back to clients. Thus, due to the notorious reputation of Veracity Markets in recent months, FSCA decided to suspend Veracity Markets.

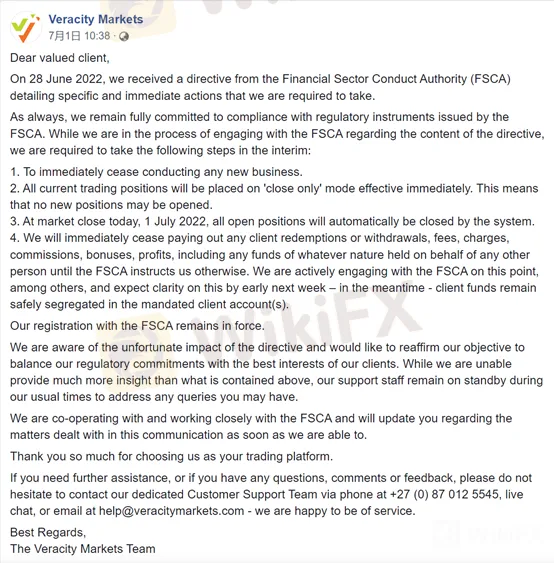

Statement from Veracity Markets on July 1, 2022

On July 1, Veracity Markets issued a statement on this matter on Facebook. In the statement, Veracity Markets maintained its commitment to complying with FSCA. It claimed to cease conducting any new business immediately. For more information about the background, please check our relevant article by clicking this link https://www.wikifx.com/en/newsdetail/202207055594924207.html

Exposure related to this broker on WikiFX

As of July 15, 2022, WikiFX has received seven complaints against this broker within three months. Some traders from South Africa claimed that they were experiencing serious slippage problems when investing in Veracity Markets. Besides, other traders told WikiFX that they cannot withdraw money from this broker. And they didn't get any meaningful response from Veracity Markets.

The Statement from FSCA on July 13,2022

On July 13, 2022, FSCA officially releases a new statement about its new action on Veracity Markets. In this statement, FSCA requires Veracity Markets to shut down its business immediately. In addition, FSCA asks Veracity Markets to refund all clients within 7 days. Below is the statement. We want to show you.

According to this statement from FSCA, FSCA asks Veracity Markets to shut down this business and “pay out to clients all funds owing to them upon request, within seven working days from the date of the request”.

In this statement, FSCA points out that Veracity Markets is an appointed juristic representative of Nirvesh Financial Services.

FSCA informs the public of a directive issued against Nirvesh Financial service Ltd and its juristic representative, Veracity Markets Ltd. FSCA is investigating Nirvesh Financial Services (Pty) Ltd and Veracity Markets (Pty) Ltd, for conducting unauthorised over-the-counter (OTC) derivative business, and possible breaches of other financial sector laws.

FSCA again reminds traders to invest in a broker that has a legitimate license

Conclusion

According to report, Veracity Markets filed for liquidation and bankruptcy last year. We believe that Veracity Markets is not trustworthy at all. Fortunately, FSCA has compelled this broker to refund all clients within 7 days. We are expecting that investors' legitimate rights can eventually be protected.

All traders should be vigilant when investing in a broker. WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

PayPal Expands PYUSD Transfers to Ethereum and Solana

PayPal's PYUSD stablecoin can now transfer across Ethereum and Solana, enhancing flexibility for users through a LayerZero cross-chain integration.

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Capital.com transitions to a regional leadership model as Kypros Zoumidou steps down, promoting Christoforos Soutzis as CEO of its Cyprus operations.

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Online trading platform eToro has recently unveiled its latest investment offering—the Global-Edge Smart Portfolio. This new addition to eToro’s extensive portfolio options provides investors with a balanced approach to investing by combining global stocks and bonds, tailored for those looking for growth and stability.

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

Webull has announced the launch of a new 24/5 Overnight Trading feature for U.S. users, developed in partnership with Blue Ocean ATS. This feature allows Webull’s clients to trade stocks and ETFs outside traditional market hours, from 8:00 pm to 4:00 am ET, Sunday through Thursday.

WikiFX Broker

Latest News

JUST Finance and UBX Launch Multi-Currency Stablecoin Exchange

XM Revamps Website with Sleek Design and App Focus

Global Shift in Cryptocurrency Taxation: Italy and Denmark Chart New Paths

Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

TradingView & Mexico’s Uni. Partnership, to Enhance Financial Education

Something You Need to Know About SogoTrade

eToro Launches Global-Edge Smart Portfolio: A Balanced Approach to Growth and Stability

Darwinex advises traders to update MT4 & 5

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Currency Calculator