Score

Optimus Futures

United States|5-10 years|

United States|5-10 years| https://optimusfutures.com/index.php

Website

Rating Index

Influence

Influence

A

Influence index NO.1

United States 7.74

United States 7.74Contact

Licenses

Licenses

Licensed Institution:Optimus Futures,LLC

License No.:0481133

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United States

United StatesUsers who viewed Optimus Futures also viewed..

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

India

United States

optimusfutures.com

Server Location

United States

Most visited countries/areas

United States

Website Domain Name

optimusfutures.com

Server IP

45.33.11.152

Company Summary

| Optimus Futures | Basic Information |

| Registered Country/Area | United States |

| Regulation | NFA Suspicious Clone |

| Minimum Deposit | $500 |

| Spreads | $0.25 per side on micros, $0.75 per side on standard contracts |

| Trading Platforms | Rithmic, CQG, Firetip, TradeStation and more |

| Tradable Assets | Futures contracts |

| Account Types | Individual, Joint, IRA, Corporate, LLC, Partnership, Trust |

| Demo Account | Available |

| Customer Support | Phone, Email, Live Chat |

| Payment Methods | Wire transfer, ACH transfer, checks |

| Educational Tools | Available |

Overview of Optimus Futures

Optimus Futures is a brokerage firm that caters to traders with its wide range of account types, including individual, joint, retirement, company, LLC, partnership, and trust accounts. Traders can choose the account type that suits their needs and preferences. The company offers competitive pricing, ensuring that traders can access favorable trading conditions. With multiple trading platforms available, including popular options like Rithmic, CQG, Firetip, and TradeStation, traders have the flexibility to choose the platform that best aligns with their trading strategies.

One notable advantage of Optimus Futures is its extensive educational resources,traders can benefit from various educational materials. Additionally, the company provides multiple customer support channels, such as phone, email, and live chat, ensuring efficient assistance for traders whenever they need it.

While Optimus Futures has positives, there are a few considerations to keep in mind. The uncertainty surrounding their trading license raises concerns about trust and security for some traders. Additionally, commissions are required for trading, which adds to the overall trading costs. Furthermore, the company has a higher minimum deposit requirement, which may pose challenges for beginners or traders with limited funds.

Is Optimus Futures legit or a scam?

Optimus Futures claims to be regulated by the National Futures Association (NFA) in the United States, with a regulatory license number of 0481133. However, it is important to note that there are concerns regarding the authenticity of this license. Some sources suggest that the license number may be a clone or a duplicate of another license.

Regulation is a crucial aspect to consider when choosing a broker, as it provides a level of oversight and protection for traders. It ensures that the broker operates in accordance with industry standards and follows specific rules and regulations to safeguard clients' funds and maintain fair trading practices.

In light of the uncertainty surrounding the regulatory status of Optimus Futures, it is advisable for potential traders to exercise caution and conduct thorough research before engaging in any trading activities with this broker. It is essential to verify the legitimacy of regulatory claims and seek out reputable and transparent brokers that are properly regulated by recognized authorities.

Pros and Cons

Optimus Futures offers several advantages and disadvantages as a brokerage firm. On the positive side, they provide diverse account types, allowing traders to choose the most suitable option for their needs. They also offer competitive pricing, ensuring that traders can access favorable trading conditions. Additionally, the availability of a variety of trading platforms caters to different trading preferences. Optimus Futures stands out with its extensive educational resources, supporting traders in enhancing their knowledge and skills. Furthermore, they provide multiple customer support channels for efficient assistance and a wide range of trading tools for comprehensive market analysis.

However, there are some drawbacks to consider. The uncertainty surrounding Optimus Futures' trading license raises concerns for some traders, as it may impact the level of trust and security. Additionally, traders are required to pay commissions, which can increase overall trading costs. Another potential disadvantage is the higher minimum deposit requirement, which may pose challenges for beginners or traders with limited funds.

| Pros | Cons |

| Diverse Account Types | Uncertainty Regarding Trading License |

| Competitive Pricing | Commissions Required |

| Variety of Trading Platforms | Higher Minimum Deposit Requirement |

| Extensive Educational Resources | |

| Multiple Customer Support Channels (phone, email, live chat) | |

| Wide Range of Trading Tools |

Market Instruments

Optimus Futures offers a range of trading products, including Micro Futures, that cover various market sectors such as equity indices, Bitcoin, energy, treasuries, currencies, and Ethereum. These Micro Futures contracts are designed to provide individual traders with access to these markets at a fraction of the cost, making futures trading more accessible and affordable.

In addition to the innovative Micro Futures, their platform introduces a range of unique opportunities to explore and capitalize on market movements. One fascinating offering is the event-based contracts, which provide traders with smaller-sized, daily expiring products. These contracts allow traders to express their views on the price direction of key futures markets by the end of each trading session. For those seeking the freedom of self-directed online trading, Optimus Futures provides a platform that allows traders to trade futures online at discounted rates.

Optimus Futures also caters to the needs of traders planning for their retirement by offering Individual Retirement Account (IRA) services. With an IRA, traders can enjoy the tax benefits while trading the futures markets, ensuring that their financial future is secured while actively participating in the dynamic world of trading. To further enhance their offerings, Optimus Futures facilitates participation in the CME Membership Programs. This enables high-volume futures traders to take advantage of reduced exchange fees, offering cost efficiencies and lower fees for approved members trading specific products.

For those seeking automation and efficiency, Optimus Futures provides access to automated trading systems. These sophisticated computer programs are designed by expert developers to follow specific market algorithms, analyzing data, identifying trends, and generating real-time buy and sell signals. By utilizing automated systems, traders can overcome time constraints and benefit from the precision and speed of algorithmic trading.

Additionally, Optimus Futures acknowledges the potential of managed futures, where professional money managers known as commodity trading advisors (CTAs) manage client assets. These CTAs diversify across global futures markets, enabling simultaneous profit potential from various sectors such as stock indices, currencies, treasuries, bonds, and commodities. By offering access to a network of trading advisors, Optimus Futures allows investors to explore diverse trading approaches and benefit from the expertise of seasoned professionals.

Account Types

At Optimus Futures, you have the option to open the following types of accounts:

Individual Account: Designed for individual traders, allowing for individual management and control of the account.

Joint Account: Suitable for multiple individuals to jointly manage and control the account.

Individual Retirement Account (IRA): Specifically for individual retirement accounts, offering tax advantages for retirement savings.

Superannuation Account: Designed for the Australian superannuation plan.

Corporate Account: Suitable for companies or corporate entities to establish a trading account.

Limited Liability Company (LLC) Account: Intended for trading accounts of limited liability companies.

Partnership Account: Designed for partnership businesses to set up a trading account.

Trust Account: Applicable for trust funds or trustee accounts.

Each type of account has its own features and eligibility criteria. You can choose the most suitable account type based on your needs and circumstances to open a trading account with Optimus Futures.

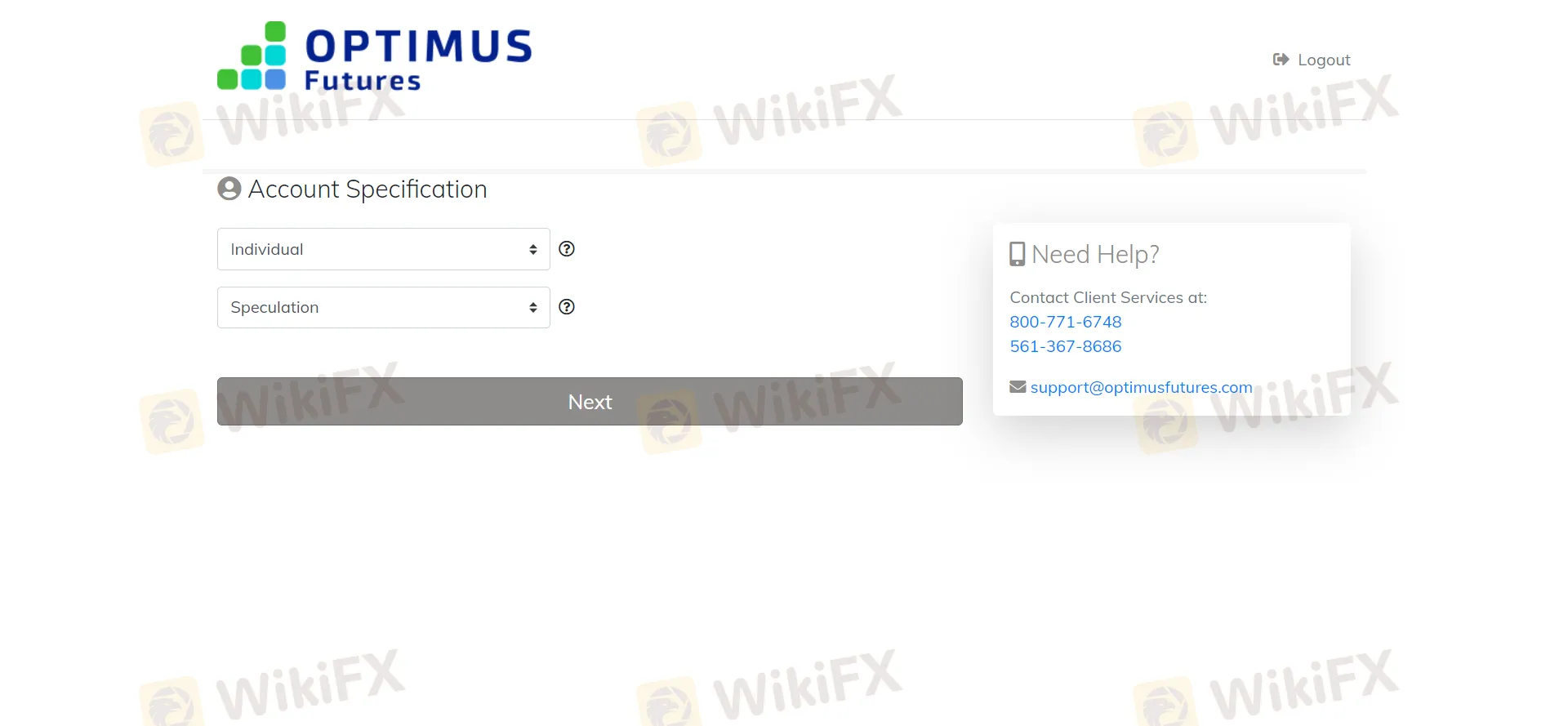

How to open an account?

Here are the steps to open an account with Optimus Futures:

Visit the Optimus Futures website: Open your web browser and enter the official website address of Optimus Futures to access their site.

Click on “Open Live Account” or “ Open Demo Account ” button.

Follow the instructions and complete the account opening application form. You will need to provide your email address and then set a password.

The next step, you will need to choose the type of account you wish to open. Select the account type that best suits your needs and goals, whether it's an individual, joint, IRA, corporate, LLC, partnership, or trust account.

Next, you will need to provide your personal identification information, including your full name, address, date of birth, and contact number. Additionally, you will be required to submit supporting documents as proof of your identity and residential address, such as identification cards and residency permits.

After your application has been successfully reviewed and approved, you will be required to make the minimum deposit to activate your trading account.

Spreads & Commissions (Trading Fees)

Optimus Futures offers competitive pricing for all day traders, with spreads and commissions that vary depending on the trading accounts. For micro contracts, the spread is as low as $0.25 per side. This makes micro futures an attractive option for traders looking to minimize costs while still accessing the futures market. On the other hand, for standard contracts, the spread is as low as $0.75 per side, providing traders with favorable pricing for their trading activities.

Optimus Futures offers a flexible commission structure that caters to traders of varying trading volumes. The commissions vary depending on the trading accounts, allowing clients to benefit from even lower commission rates as they trade more.

Clients who meet the specified daily trading volume levels can enjoy significant savings with commissions starting as low as $0.05 per side. To ensure eligibility for these reduced commission rates, clients are required to open an account and then contact Optimus Futures at (800) 771-6748 or support@optimusfutures.com.

This table illustrates the commission rates for Micros contracts and standard futures contracts based on the average daily contract volume. As the daily contract volume increases, the commission rates decrease. Traders can choose the appropriate contract type and corresponding commission rate based on their trading activity and needs to optimize their trading costs and profitability.

| Average Daily Contracts | Micros Commissions Per Side | Futures Commissions Per Side |

| 0 - 20 Contracts | $0.25 | $0.75 |

| 21 - 100 Contracts | $0.20 | $0.50 |

| 101 - 500 Contracts | $0.15 | $0.25 |

| 501 - 1000 Contracts | $0.10 | $0.20 |

| Over 1000 Contracts | $0.05 | $0.10 |

Non-Trading Fees

When it comes to other fees associated with trading at Optimus Futures, it's important to note that these costs are pass-through fees and are applicable to all traders. Optimus Futures does not mark up any of the fees outlined below.

Technology Fees: Technology fees are associated with order routing, which involves routing orders between exchanges and your trading platform. These fees, also known as execution costs, are charged by the datafeed provider on a per transaction basis. Here are the technology fees for different platforms:

| Platform | Fee Per Side |

| Optimus Futures | FREE |

| Rithmic | $0.10 |

| CQG | $0.10 |

| Firetip | FREE |

| GAIN Futures (Stone X) | FREE |

| TradeStation | FREE |

| TT | $0.50 |

| CTS | Varies |

Exchange Execution & NFA Fees: Exchange fees are applicable to all traders, regardless of their broker, platform, or technology. These fees are charged on a per transaction basis and vary based on the market and product being traded. The fees are charged directly by the exchange to your brokerage account in exchange for providing market access. Members of exchanges may benefit from discounted fees.

Exchange Data Fees: Exchange data fees are flat fees charged by the exchanges for providing real-time market data to traders.

| Exchange Group | Description | Monthly Fee | |

| Level 1TOP OF BOOK | Level 2MARKET DEPTH | ||

| CME Market Data* | Bundle - All CME Markets | $9 | $39.00 |

| CME | FREE | $15.00 | |

| CBOT | $3 | $15.00 | |

| COMEX | $3 | $15.00 | |

| NYMEX | $3 | $15.00 | |

| ICE Market Data | ICE - US Exchange - TF, DX | $117 | |

| ICE - UK Exchange - Energies | $117 | ||

| ICE-LIFFE Exchange - FTSE, Gilt, Short Sterling | $117 | ||

| CFE/CBOE Data | CBOE Volatility Index (VIX) | $13 | |

| Foreign Exchange (Non-US) | EUREX| non-pro | 18.00 EUR | |

| Osaka - Japan (JPX) | 29.00 USD | ||

| Singapore (SGX) | 80.00 USD | ||

| Sydney Futures Exchange (SFE) | 67.00 USD | ||

| Cash Index Data | $DOW, ^TICK, ^TRIN, ^ADV, ^DECL, NYSE Internals, Dow Jones Indexes | 39.00 USD | |

| NASDAQ Indexes | 8.00 USD | ||

| Misc | Additional User| Multiple users/logins | 10.00 USD | |

| Rithmic Monthly Connection Fee | 25.00 USD | ||

| CQG Monthly Connection Fee | 10.00 USD | ||

Account Fees: Optimus Futures offers several account-related services without any additional charges, including broker consultation, technical support, and Incoming Deposits: Wires, Checks and ACH. Here are the fees associated with specific transactions:

| Broker Consultation | Free |

| Technical Support | Free |

| Incoming Deposits: Wires, Checks, ACH | Free |

| Withdrawals | |

| ACH (Next Day - 4pm CST Delivery - Domestic only) | Free |

| Check (Domestic Only) | $0 - $15 |

| Wire Transfers (Domestic) | $20 - $40 |

| Wire Transfers (International) | $25 - $60 |

| Currency Conversions | Free* (Bank Rates May Apply) |

| Electronic Daily & Monthly Statements | Free |

| Emergency Trade Desk | Free |

| Margin Call | $50 |

| *ACH Withdrawal is not available at all Clearing Firms. Wire transfers out and check withdrawal fees vary by clearing firm. | |

Trading Platform

Optimus Futures offers a diverse selection of trading platforms for users to choose from. In addition to their proprietary platforms, Optimus Flow and Optimus Trader, users can also explore a variety of third-party platforms, including Firetip, TT® Platform, MT5 Platform, TradingView, TradeStation (Desktop, Web & Mobile), MultiCharts, MultiCharts.NET, Sierra Chart, R | Trader Pro, ATAS, GAIN Trader, and many others. Each platform boasts unique features and capabilities, allowing traders to personalize their trading experience based on their preferences and strategies.

These platforms feature distinct commission structures, ranging from free options to monthly subscriptions at different price points. For detailed information, users can visit the official website to explore the commission details.

Deposit & Withdrawal

To initiate your trading journey with Optimus Futures, a minimum deposit is required. The minimum amount to open an account is $500. However, it's important to note that different minimum account balances are needed to place trades based on the specific contract sizes:

Nanos: To trade Nanos contracts, a minimum account balance of $100 is required.

Micros: For Micros contracts, a minimum account balance of $500 is needed.

E-Minis: Trading E-Minis contracts requires a minimum account balance of $2000.

These minimum account balances ensure that you have sufficient funds in your account to support trading activities. It's worth noting that the minimums vary based on the contract size, reflecting the different levels of investment and risk associated with each type of contract.

As long as there are no open positions, clients are free to withdraw 100% of their funds at any time. This means that the funds in your Optimus Futures account are fully available, and you have the freedom to withdraw them as needed.

Customer Support

Optimus Futures provides diverse customer support to assist traders at every stage of their journey. Whether you have general questions, need guidance on opening an account, require assistance with trading activities, or seek platform guides, you can fine related information on the official website.

In addition to traditional support channels, Optimus Futures offers various avenues for engaging with their team and community. Traders have the opportunity to connect and discuss trading-related topics with the Optimus technical team, fellow customers, and partners on the vibrant Optimus Community forum. Social media enthusiasts can also reach out to Optimus Futures via Twitter, where they can follow and interact with @optimusfutures.

For more hands-on assistance, Optimus Futures provides remote desktop support. By downloading the remote support application, traders can grant technicians access to their PC, enabling them to troubleshoot and address any issues efficiently.

To reach out to Optimus Futures, traders have multiple contact options available. They can call the toll-free number at (800) 771-6748 or the local number at (561) 367-8686. Alternatively, they can seek support through email or utilize the live chat feature, conveniently located at the bottom right of the website.

Educational Resources

Optimus Futures offers a wealth of educational resources to empower traders with the knowledge and skills needed to navigate the futures markets effectively. Their comprehensive list of educational guides covers a wide range of topics, catering to traders of all levels of experience.

For beginners looking to venture into futures trading, Optimus Futures provides a detailed guide on “How to Start Trading Futures.” This guide serves as a valuable resource, offering step-by-step instructions, essential terminology, and practical tips to help newcomers get started on their trading journey.

In addition to the basics, Optimus Futures recognizes the importance of establishing solid trading principles. They offer a guide titled “Golden Rules for Futures Traders,” which outlines key principles and strategies to foster disciplined and successful trading. Traders can learn valuable insights and best practices to enhance their decision-making process and risk management.

Optimus Futures also provides educational material on specialized areas of trading, such as “An Introduction to Managed Futures.” This guide explores the concept of managed futures and introduces traders to the world of professional money managers known as commodity trading advisors (CTAs). Traders can gain insights into the benefits and strategies employed in managed futures, expanding their understanding of alternative investment opportunities.

These are just a few examples of the educational resources available at Optimus Futures. Traders can access a variety of guides covering topics such as technical analysis, trading psychology, risk management, and more. The educational resources provided by Optimus Futures aim to empower traders with the knowledge and skills necessary to make informed trading decisions and achieve their financial goals.

Conclusion

In conclusion, Optimus Futures offers traders a wide range of choices and advantages. With diverse account types, competitive pricing, a variety of trading platforms, and extensive educational resources, it provides flexibility and convenience to traders. Additionally, the multiple customer support channels and wide range of trading tools ensure timely assistance and enhance the trading experience. However, it's important to acknowledge the challenges that Optimus Futures faces, including the uncertainty regarding trading license, the requirement of commissions, and the higher minimum deposit requirement. Therefore, traders should carefully consider these factors and make informed decisions based on their own needs and preferences. By evaluating the pros and cons comprehensively, traders can determine if Optimus Futures is the right platform for them to achieve their trading goals and ensure success in the financial markets.

Q: What types of trading accounts does Optimus Futures offer?

A: Optimus Futures provides a range of trading account options, including individual, joint, retirement (IRA), company, LLC, partnership, and trust accounts.

Q: Are there any fees associated with trading on Optimus Futures?

A: Yes, traders are required to pay commissions for their trades.

Q: Does Optimus Futures provide educational resources for traders?

A: Yes, Optimus Futures offers extensive educational resources to support traders' learning and development.

Q: How can I get customer support from Optimus Futures?

A: Optimus Futures provides multiple customer support channels, including phone, email, and live chat.

Q: What is the minimum deposit requirement to open an account with Optimus Futures?

A: There is a minimum deposit of $500 to open an account.

Q: Is there a demo account available for practice trading?

A: Yes, Optimus Futures offers demo accounts for traders to practice their trading strategies without risking real money.

Q: Can I withdraw funds from my Optimus Futures account at any time?

A: Yes, as long as there are no open positions, traders are generally free to withdraw 100% of their funds from their Optimus Futures account at any time.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Regional Brokers

- Suspicious Overrun

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now