Score

CDG

Saint Vincent and the Grenadines|5-10 years|

Saint Vincent and the Grenadines|5-10 years| http://www.cdgglobalfx.com/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Indonesia 2.51

Indonesia 2.51Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesCDG's Australia Office Has Moved Out

It has been proved by the on-the-site investigation of the staff that the actual address of the Australia licensed broker CDG is inconsistent with that declared by the supervision agency. Although the broker holds a STP license (332/17) and an Investment Advisory License (224485) issued by CySEC and ASIC respectively, its Australia office has moved out and the new address remains unclear.

Australia

AustraliaCDG's Australia Office Has Moved Out

It has been proved by the on-the-site investigation of the staff that the actual address of the Australia licensed broker CDG is inconsistent with that declared by the supervision agency. Although the broker holds a STP license (332/17) and an Investment Advisory License (224485) issued by CySEC and ASIC respectively, its Australia office has moved out and the new address remains unclear.

Australia

AustraliaAccount Information

Users who viewed CDG also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

cdgglobal.eu

Server Location

United States

Website Domain Name

cdgglobal.eu

Website

WHOIS.EU

Company

EURID

Server IP

47.254.131.196

cdgglobalfx.com

Server Location

Germany

Website Domain Name

cdgglobalfx.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2019-09-02

Server IP

49.51.153.190

Company Summary

| Aspect | Information |

| Registered Country/Area | Malaysia (Labuan Financial Services Authority jurisdiction) |

| Company Name | CDG Global (Labuan) Limited |

| Regulation | Unregulated |

| Minimum Deposit | $500 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Competitive; vary by account type |

| Trading Platforms | MetaTrader 4 (MT4) and MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Metals, Commodities, Indices, Energy, Cryptocurrencies, Stocks |

| Account Types | ECN Diamond, Islamic Account, Standard Account, ECN Platinum, ECN Gold |

| Demo Account | Available |

| Islamic Account | Available |

| Customer Support | Email, Phone |

| Payment Methods | AliPay, Bank Wire, Cards, Crypto, Fasapay, Skrill, and more |

| Educational Tools | Limited; Market Insights, Economic Calendar, Events |

General Information

CDG Global EU is a broker that has been around a while – since 2003. CDG is licensed with the Cyprus Securities and Exchanges Commission (CySEC), with Regulatory License No.332/17. Besides, this broker is also regulated by Labuanan Financial Service Authority (LFSA), with license number LL16154.

Regulation

CDG Global (Labuan) Limited is a unregulated by any regulatory authorities.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

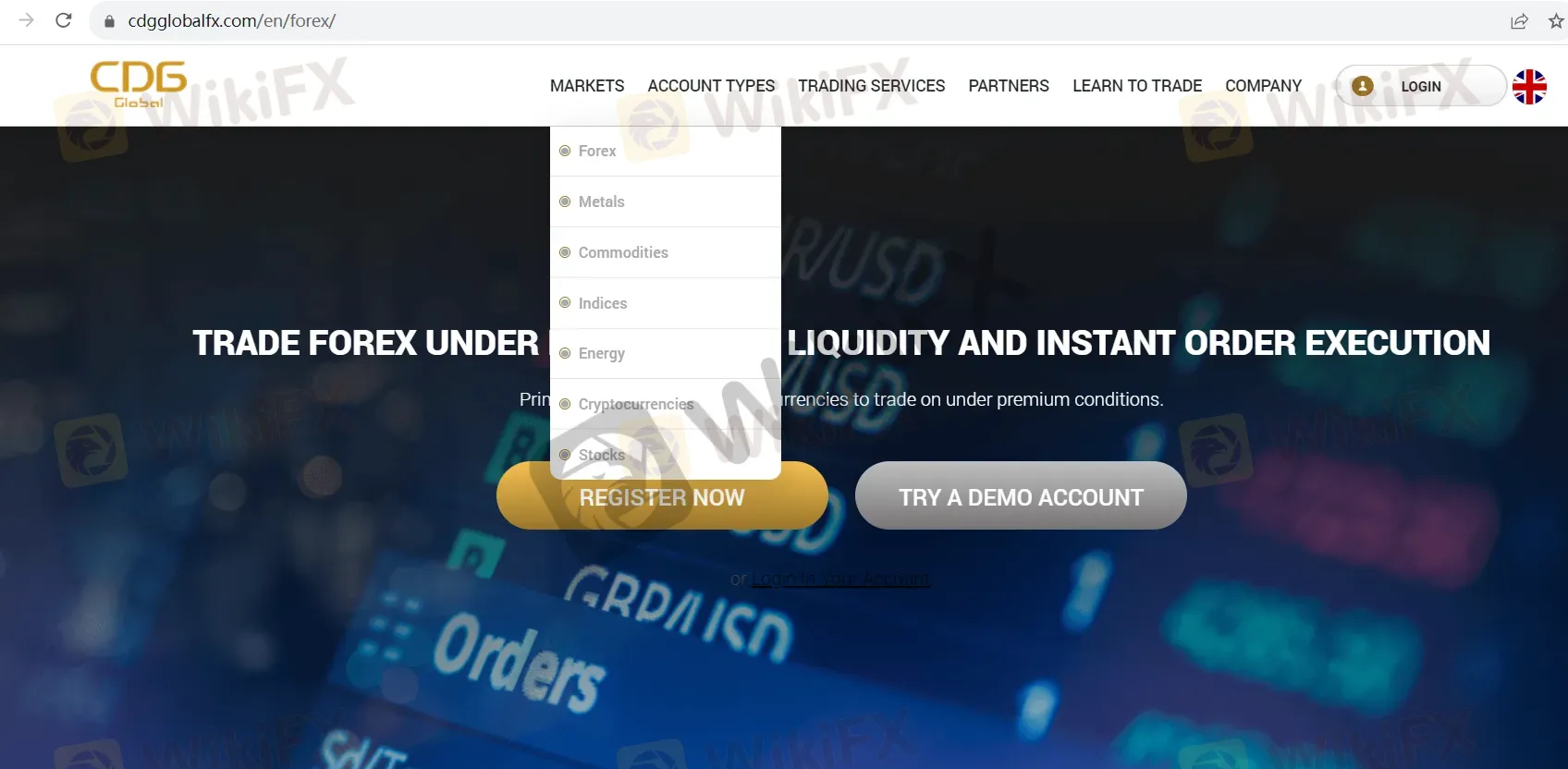

Markets Instruments

Tradable financial instruments available on the CDG platform include forex, metals commodities, indices, energy, crypto currency and stocks.

- Forex (Foreign Exchange): CDG provides access to the forex market, allowing traders to trade currency pairs. This includes major, minor, and exotic currency pairs, providing opportunities for speculation on the value of one currency relative to another.

- Metals: Traders can trade precious metals such as gold and silver. These commodities are often seen as safe-haven assets and are commonly traded for hedging and investment purposes.

- Commodities: CDG offers a range of commodity trading opportunities, which may include agricultural products (e.g., wheat, corn), energy commodities (e.g., oil, natural gas), and industrial metals (e.g., copper, aluminum). Commodity trading can be used for both speculation and risk management.

- Indices: The platform provides access to stock market indices from various regions around the world. Traders can speculate on the performance of these indices without directly trading individual stocks.

- Energy: Energy commodities such as crude oil and natural gas are available for trading. These are essential components of the global economy and offer opportunities for speculation based on supply and demand dynamics.

- Cryptocurrencies: CDG allows traders to access the cryptocurrency market. This includes popular digital currencies like Bitcoin (BTC), Ethereum (ETH), and other altcoins. Cryptocurrencies are known for their volatility and can be traded 24/7.

- Stocks: CDG offers access to equity mCDG, enabling traders to buy and sell shares of publicly listed companies. This allows for participation in the ownership and potential profits of these companies.

Minimum Deposit

A total of five trading accounts available with CDG brokerage platform: Standard, ECN Gold, ECN Platinum, ECN Diamond and Islamic accounts. Standard account is more suitable for novice traders, with starting deposit as low as $50, while ECN accounts are designed for scalpers and professional traders who pursue deep liquidity and trade at large volume. Three ECN account requires initial deposit of $500, $20,000 and $50,000, respectively. Islamic accounts are also available with this brokerage platform, which exclusively are designed for Muslim traders or who follow Muslim laws.

Here's a table summarizing the key features of each account type:

| Account Type | Starting Deposit | Tradable Instruments | Overnight Swap Fees | EAs Supported | Minimum Lot Size | Margin Call / Stop Out | Max Leverage | Managed Accounts | Commission |

| ECN DIAMOND | $50,000 | FX, Metals, Commodities, Indices, Energy, Cryptocurrencies, Stocks | Yes | Yes | 0.01 lots FX | 100% / 60% | Up to 1:200 | Yes | $4 per Lot |

| ISLAMIC ACCOUNT | $50 | FX, Metals, Commodities, Indices, Energy, Cryptocurrencies, Stocks | No | Yes | 0.01 lots FX | 100% / 60% | Up to 1:1000 | Yes | No |

| STANDARD ACCOUNT | $50 | FX, Metals, Commodities, Indices, Energy, Cryptocurrencies, Stocks | Yes | Yes | 0.01 lots FX | 100% / 30% | Up to 1:1000 | Yes | No |

| ECN PLATINUM | $20,000 | FX, Metals, Commodities, Indices, Energy, Cryptocurrencies, Stocks | Yes | Yes | 0.01 lots FX | 100% / 60% | Up to 1:500 | Yes | $7 per Lot |

| ECN GOLD | $500 | FX, Metals, Commodities, Indices, Energy, Cryptocurrencies, Stocks | Yes | Yes | 0.01 lots FX | 100% / 60% | Up to 1:500 | Yes | $10 per Lot |

Leverage

As a Cryprus based forex broker under the jurisdiction of the CySEC, there is a maximum leverage cap of 1:30 for retail traders to protect their fund safety. This was put in place because trading with higher leverages can incur higher losses too.

Spreads & Commissions

Spreads and commissions are determined by trading accounts you are holding. Standard accounts offer a zero-commission trading environment, accompanied by wider spreads. While ECN accounts offers extremely spreads as low as 0.0 pips, plus with a low commission of $10 per lot for ECN Gold, $7 per lot for ECN Platinum and $4 per lot for ECN Diamond, respectively.

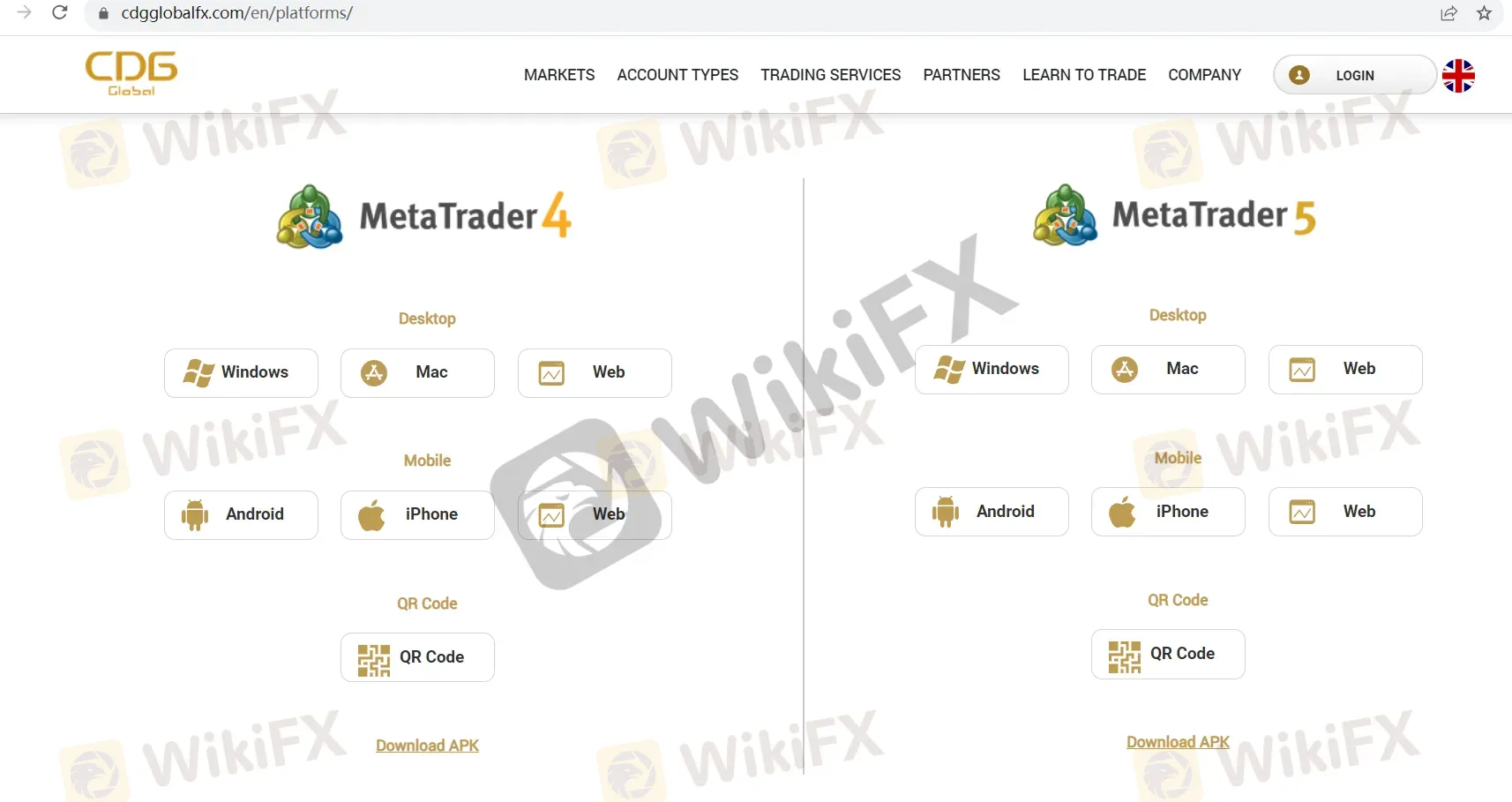

Trading Platform Available

CDG offers the popular MetaTrader trading platforms, including both MT4 (MetaTrader 4) and MT5 (MetaTrader 5). Here's a refined description:

CDG provides traders with access to the MetaTrader suite of trading platforms, encompassing both MT4 (MetaTrader 4) and MT5 (MetaTrader 5). These platforms are renowned in the industry for their robust features and user-friendly interfaces, making them preferred choices among traders worldwide. MT4 offers a comprehensive trading experience with advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors (EAs). On the other hand, MT5 builds upon MT4's foundation, enhancing it with additional timeframes, more technical indicators, economic calendar integration, and support for a wider range of asset classes. Traders can choose between MT4 and MT5 based on their specific trading preferences and strategies, ensuring a powerful and customizable trading experience tailored to their needs.

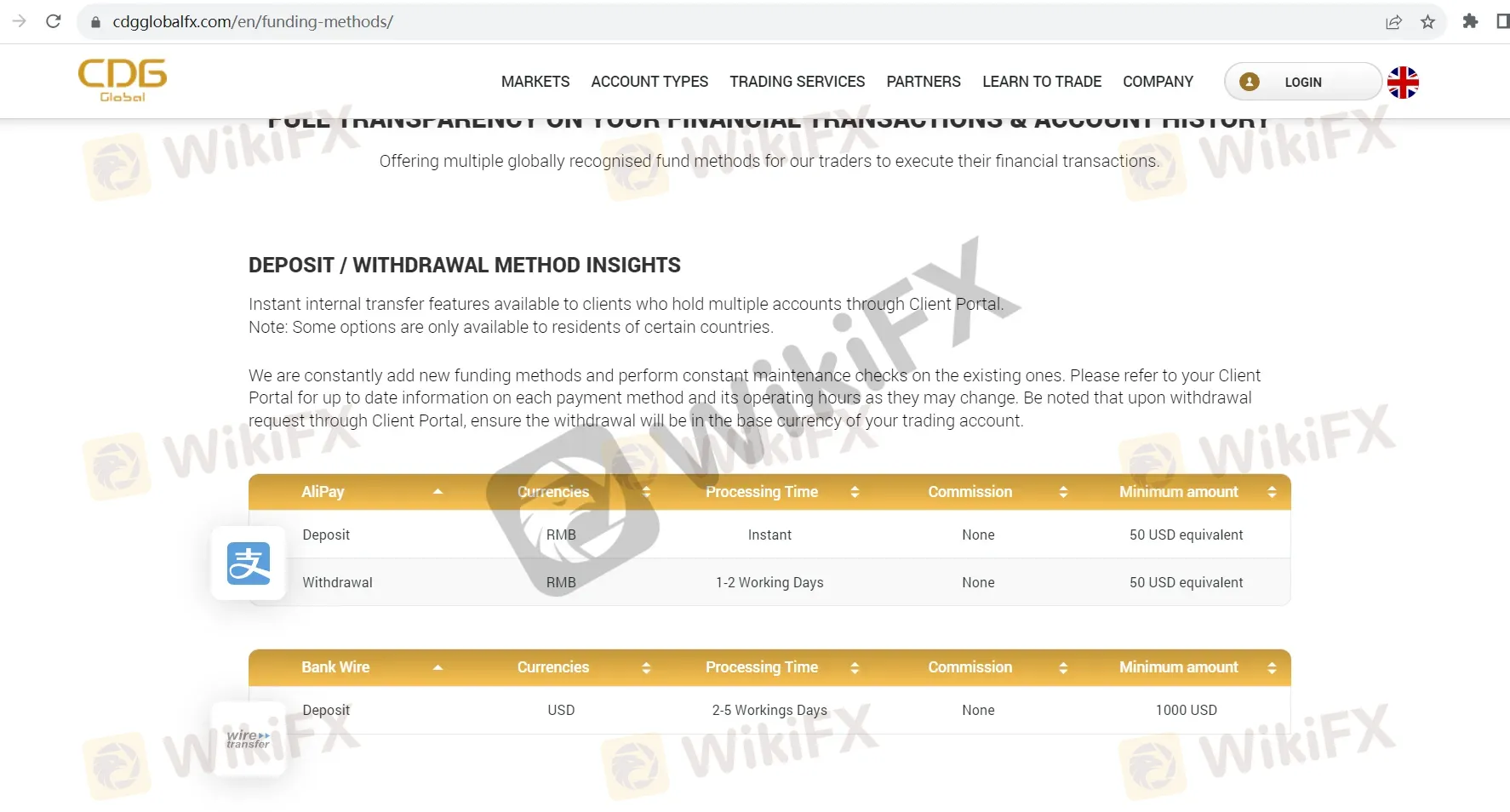

Deposit& Withdrawal

CDG Global EU accepts payments via credit cards, the Skrill E-wallet and wire transfer.

Deposit Methods:

- AliPay:

- Currencies: RMB

- Processing Time: Instant

- Commission: None

- Minimum Amount: 50 USD equivalent

- Notes: Alipay deposits are processed instantly in RMB.

- Bank Wire:

- Currencies: USD

- Processing Time: 2-5 Working Days

- Commission: None

- Minimum Amount: 1000 USD

- Notes: Bank wire transfers allow larger deposits but take longer to process.

- Cards:

- Currencies: USD

- Processing Time: Instant

- Commission: 3%

- Minimum Amount: 50 USD equivalent

- Notes: Card deposits are processed instantly with a 3% commission.

- Crypto:

- Currencies: BTC, USDT, VNDC

- Processing Time: 1-2 Working Days

- Commission: None

- Minimum Amount: 50 USD equivalent

- Notes: Crypto deposits are processed within 1-2 working days.

- Fasapay:

- Currencies: USD, IDR

- Processing Time: Instant

- Commission: None

- Minimum Amount: 50 USD equivalent

- Notes: Fasapay allows instant deposits in USD and IDR.

Withdrawal Methods:

- Bank Wire:

- Currencies: USD

- Processing Time: 2-5 Working Days

- Commission: None

- Minimum Amount: 1000 USD

- Notes: Bank wire withdrawals typically take 2-5 working days to process.

- Cards:

- Currencies: USD

- Processing Time: 1-2 Working Days

- Commission: None

- Minimum Amount: 50 USD equivalent

- Notes: Card withdrawals are processed within 1-2 working days.

- Crypto:

- Currencies: BTC, USDT, VNDC

- Processing Time: 1-2 Working Days

- Commission: None

- Minimum Amount: 50 USD equivalent

- Notes: Crypto withdrawals are processed within 1-2 working days.

- Fasapay:

- Currencies: USD, IDR

- Processing Time: 1-2 Working Days

- Commission: None

- Minimum Amount: 50 USD equivalent

- Notes: Fasapay allows withdrawals in USD and IDR.

- Skrill:

- Currencies: USD

- Processing Time: 1-2 Working Days

- Commission: 1%

- Minimum Amount: 50 USD equivalent

- Notes: Skrill withdrawals are processed within 1-2 working days with a 1% commission.

- Other Methods: CDG offers additional withdrawal methods, such as AliPay, Help2pay, Neteller, Nganluong, Paytrust88, ThunderXPay, and ZotaPay, each with its own processing times, commissions, and minimum amounts.

Please note that the processing times, minimum amounts, and commissions can vary between payment service providers, and it's essential to refer to your Client Portal for up-to-date information on each payment method and its operating hours, as these details may change. Additionally, CDG may charge withdrawal fees if there is no trading activity in the account or for excessive withdrawal requests beyond the first three each month.

Customer Support

CDG provides a top-notch customer service crew that gets the job done in a jiffy. Customers can reach customer care by phone, live chat, call back service, or email with any trading-related issues.

Email: cs@cdgglobalfx.com

There is also a web form for you to fill out your queries and then waiting to be connected.

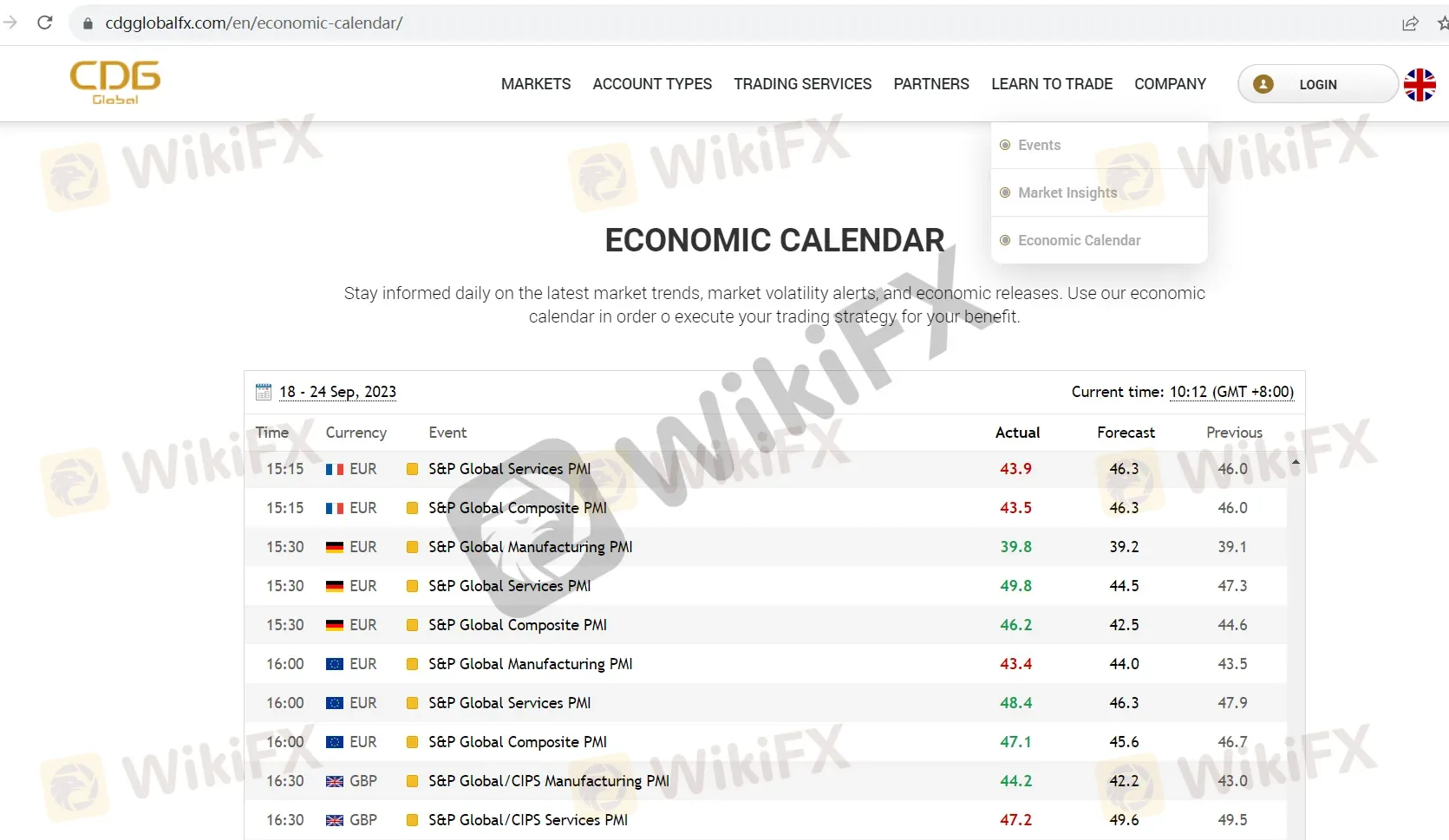

Educational Resources

CDG offers a “Learn to Trade” section, which provides traders with limited educational resources. These include:

Events: This section likely features occasional events, such as webinars or seminars, offering traders insights into market trends and trading strategies.

Market Insights: CDG offers concise market insights, providing brief summaries of market trends and news. However, these insights may be limited in depth and scope.

Economic Calendar: The economic calendar helps traders track upcoming economic events and announcements that can impact financial markets.

While these resources serve as a starting point, traders are encouraged to seek more comprehensive education from diverse sources, such as online courses, trading literature, and webinars, to build a robust foundation for successful trading.

Summary

CDG Global offers a comprehensive trading experience with a range of account types tailored to different trader preferences, from the high-capital ECN Diamond account to the accessible Islamic account. The broker is regulated by the Labuan Financial Services Authority in Malaysia, ensuring a level of oversight. CDG provides access to various financial instruments, including forex, metals, commodities, indices, energy, cryptocurrencies, and stocks, giving traders diverse opportunities. The broker offers the popular MetaTrader platforms, MT4 and MT5, known for their versatility and features.

FAQs

Q1: Is CDG Global regulated?

A1: Yes, CDG Global (Labuan) Limited is a regulated financial institution operating under the oversight of the Labuan Financial Services Authority (Labuan FSA) in Malaysia.

Q2: What is the maximum leverage offered by CDG?

A2: CDG offers a maximum trading leverage of up to 1:1000, allowing traders to control positions up to 1000 times their invested capital.

Q3: What account types does CDG provide?

A3: CDG offers various account types, including ECN Diamond, Islamic Account, Standard Account, ECN Platinum, and ECN Gold, each designed to cater to different trading preferences and budgets.

Q4: What trading platforms are available with CDG?

A4: CDG provides access to the MetaTrader trading platforms, including both MT4 and MT5, known for their powerful features and user-friendly interfaces.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 68

Content you want to comment

Please enter...

Review 68

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

小铃铛65300

Hong Kong

I can't log in to cdg. The "login" on the official website direct to "contact us". No reply from emails. I can't withdraw money.

Exposure

2023-06-14

Trang4059

Vietnam

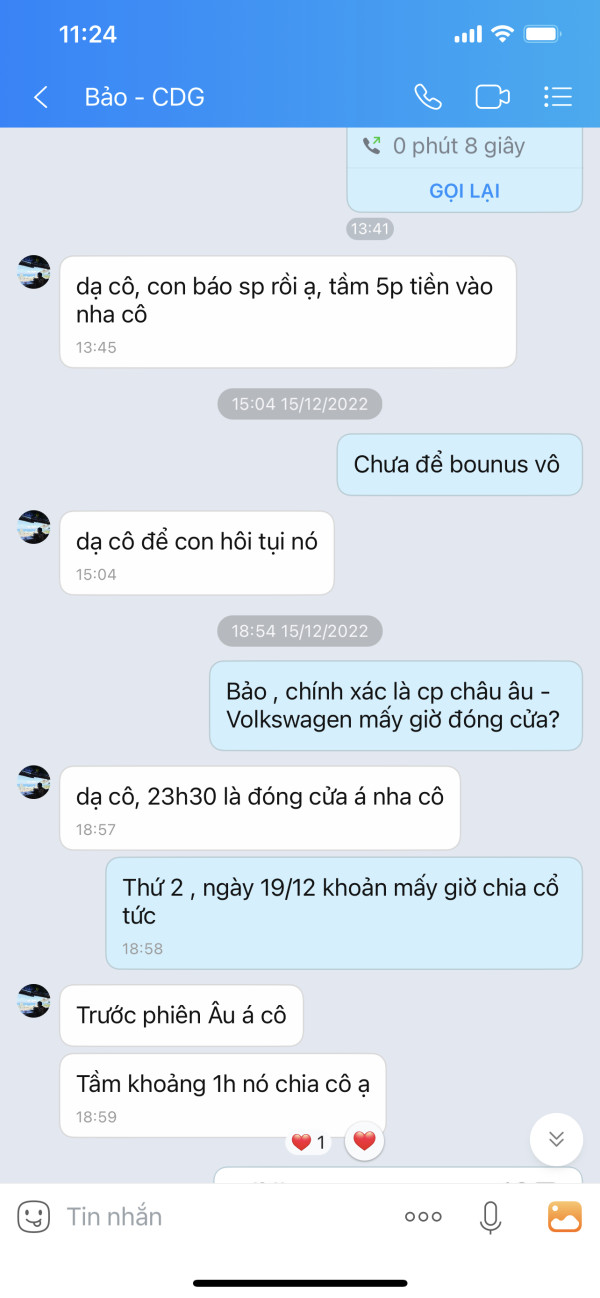

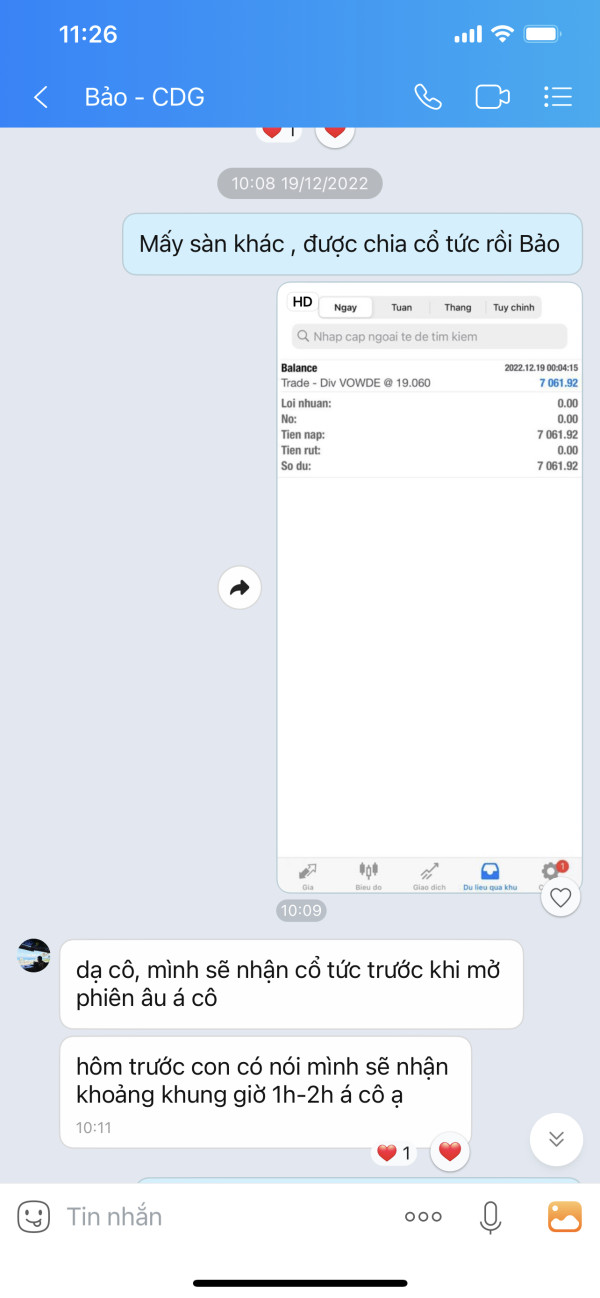

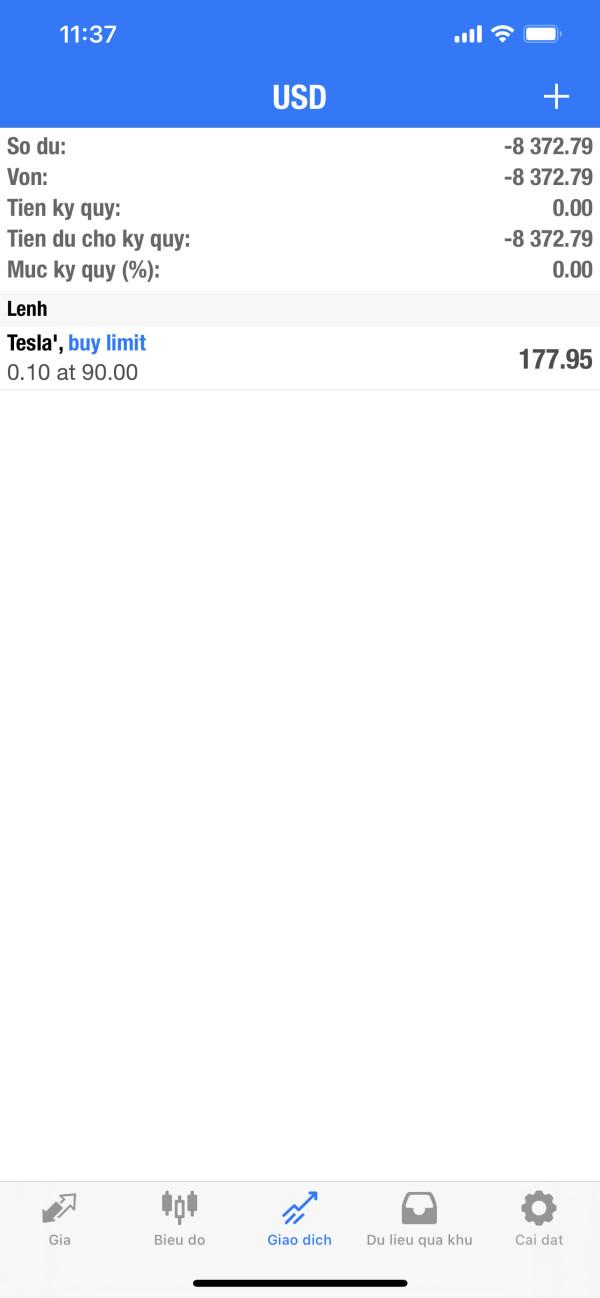

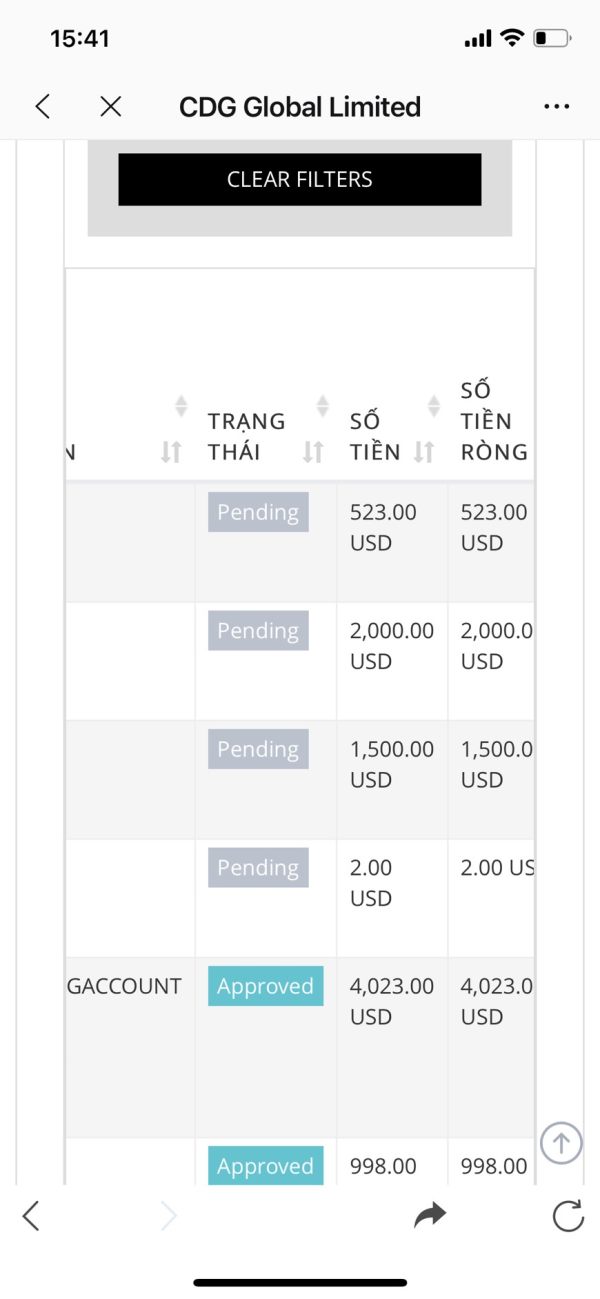

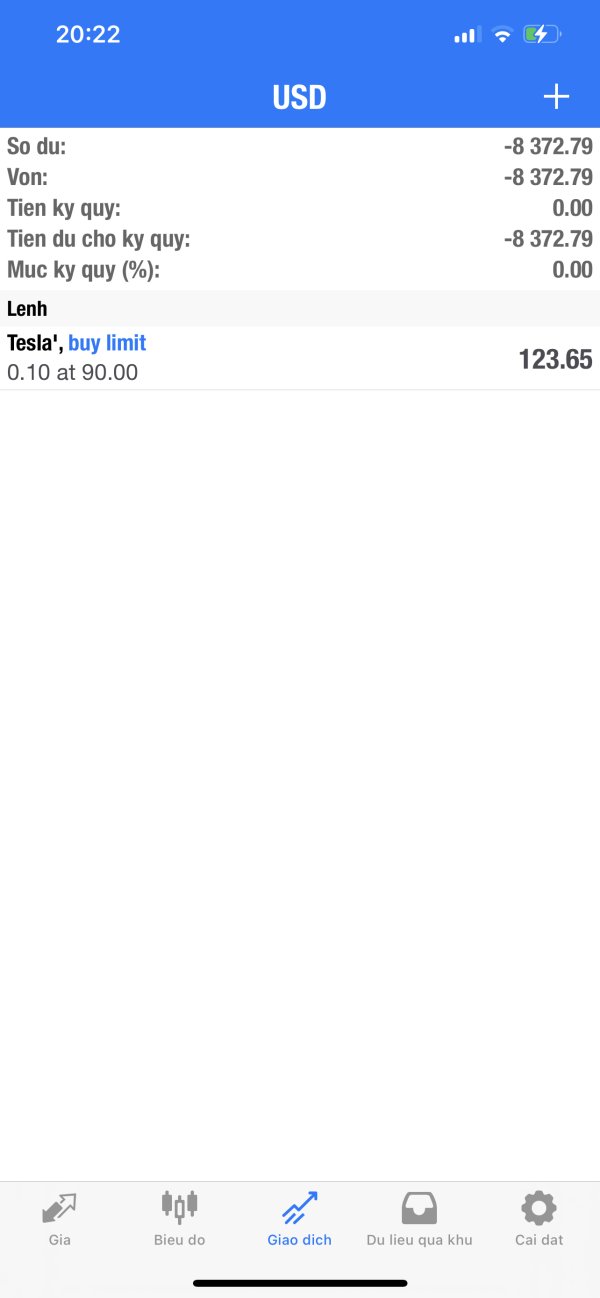

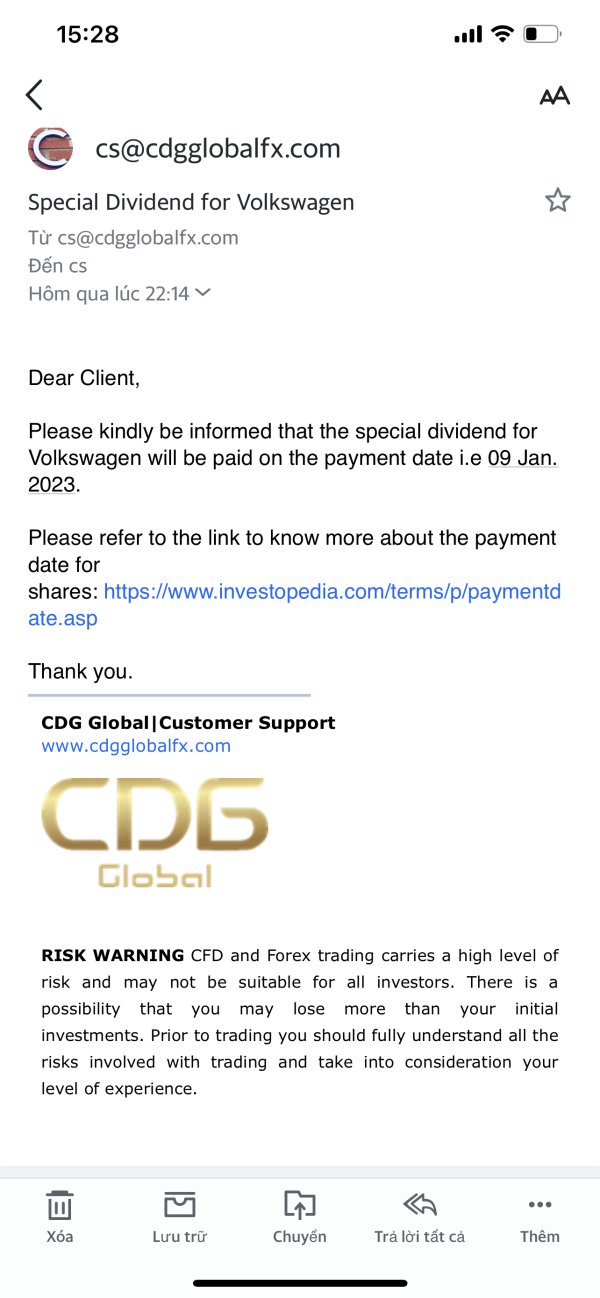

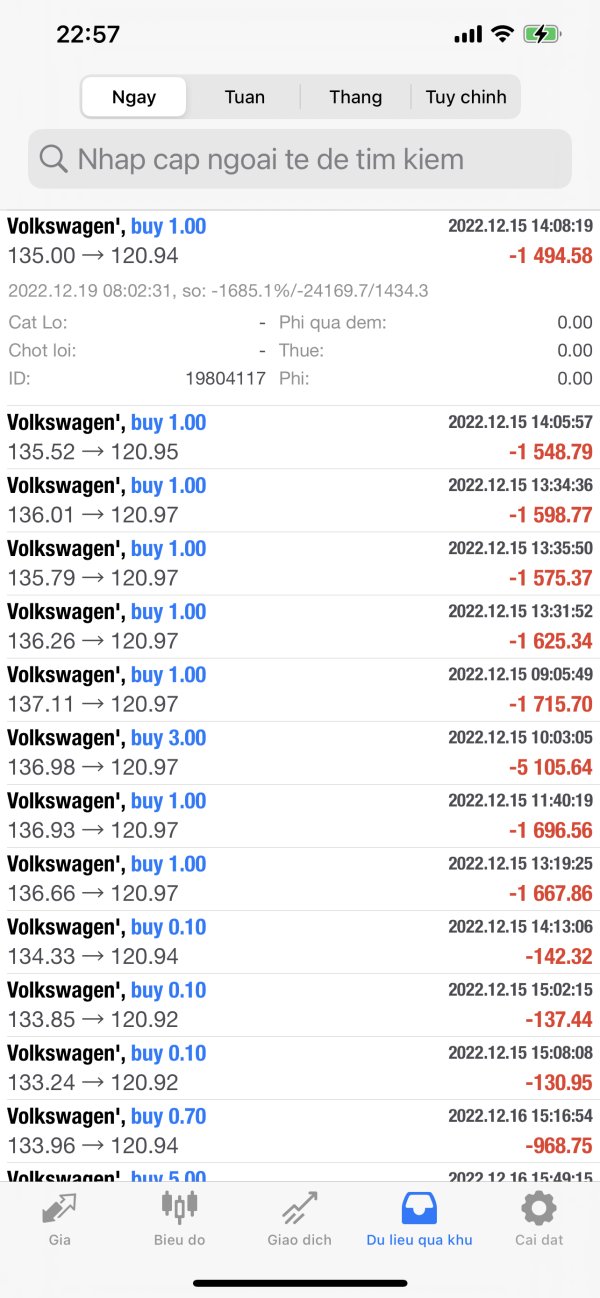

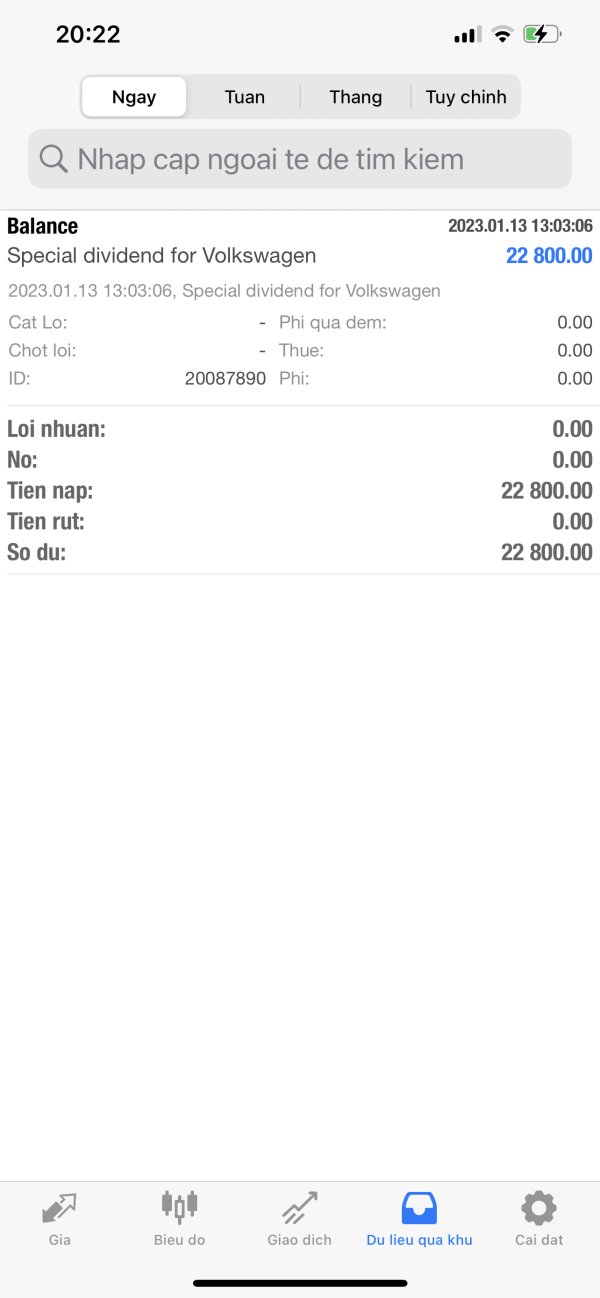

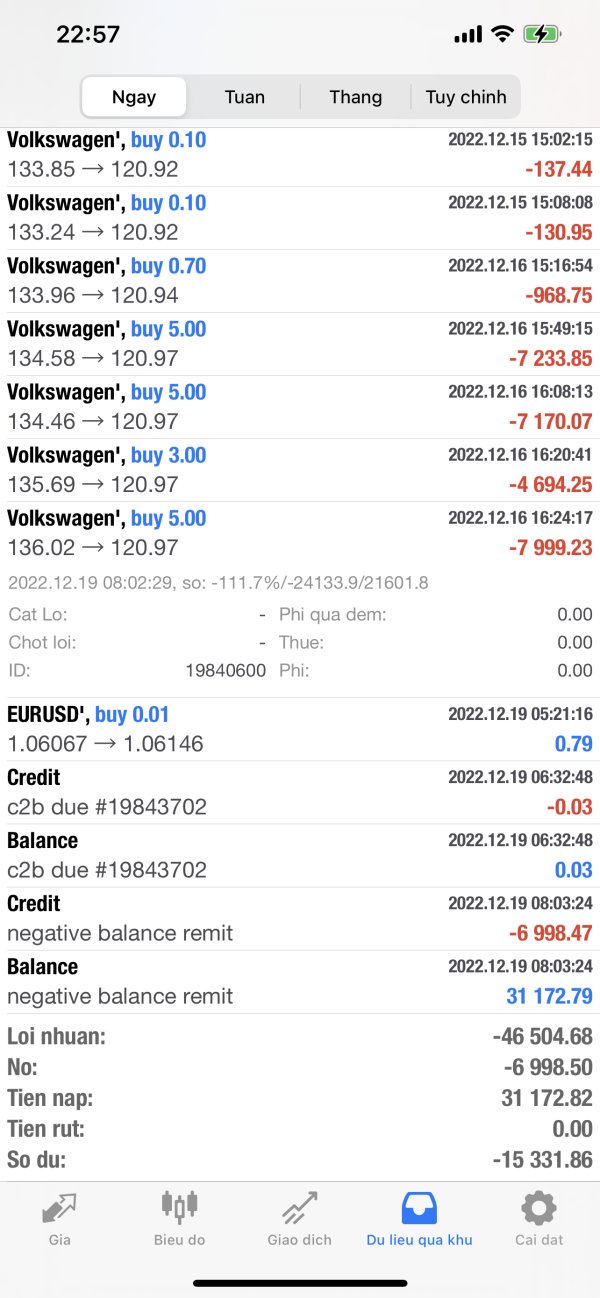

I put money in CDG from december 9, 2022 with a total amount of 342.700.000 vnd (nearly 15,000 usd), mt4 number is 862384, on december 15, 2022 i bought 3,000 volkswagen shares to receive dividends on december 19, 2022 (dividend is 19.06 euros per share, buy 3,000 shares my dividend is $61,000) , but as of 19/12/2022 CDG did not pay me dividends (while all exchanges in the world paid volkswagen dividends on the morning of december 19, 2022) then at 15:00 hrs the volkswagen stock price fell dramatically, making my account my account was burned (account after burning balance automatically adjusted to 0) then 22g CDG email me and tell me the dividend will be paid on 9/1/2023 . then to january 13, 2022 CDG withdraw from my account -31,172$ and add to 22,800$, now my account is -8,372$ so my capital and profit are lost i send an email to CDG asked me to pay volkswagen dividends many times but they did not respond, i have been trading in this market for almost 10 years, first time seeing such a broker. if CDG if you don't pay me dividends and transaction money, i will report it to the police, tell the person to knock down the website of the exchange, i will go to the company at: b01-b8, boutique offces 1, menara 2, kl eco city, no3, jalan bangsar, 59200 kuala lumpur malaixia , to find you CDG ! because this amount is huge for me . i am very angry and sad , CDG locked my money for more than 2 months now.

Exposure

2023-02-11

Trần Tuấn Anh

Vietnam

she request withdraw money from CDG at least 4 months ago and CDG still not approve.I contacted to CDG's staff for many times and told them she really need this money, it affect to her life but they seem don't want to solve it.

Exposure

2023-02-08

Trang4059

Vietnam

Me: Nguyen Thi Xuan Lan, customer number CU33135, MT4: 862384, email: nguyenthixuanlantv@yahoo.com. I have deposited money into my MT4 account since September 12, 2022 with a total amount of $14,100. On December 15, 2022, I bought 3,000 shares of Volkswagen AG VZO O.N to receive dividends on December 19, 2022, but on that day, CDG did not pay me Volkswagen dividends (while all exchanges did not pay me dividends). All over the world pay Volkswagen dividends on the morning of December 19, 2022. At 15:00 on December 19, 2022, the European session opened, and Volkswagen shares dropped dramatically, causing my account liquated with a balance of $31,172. Then at 10:00 pm on December 19, 2022, CDG emailed me and informed me that Volkswagen would pay dividends on January 9, 2023. I look forward every day to receive dividend, but on 13/1/2023 CDG only pay me $22,800 (while my dividend is $61,000) for Volkswagen dividend, far not enough to cover the negative balance, now my account is negative $8.372. So I ask CDG to double check and pay in full (about $61,000) of Volkswagen dividends to me, so that I can continue to invest and earn profits. CDG has held my dividend from December 19, 2022 to now for more than 1 month. I am very worried and miserable. Thanks ! I emailed CDG many times, but no reply ! The support person in Vietnam is Tran Chi Bao. I called Bao and he didn't answer the phone and texted and didn't reply. Vietnam, January 26, 2023

Exposure

2023-01-26

Forex Minor

Indonesia

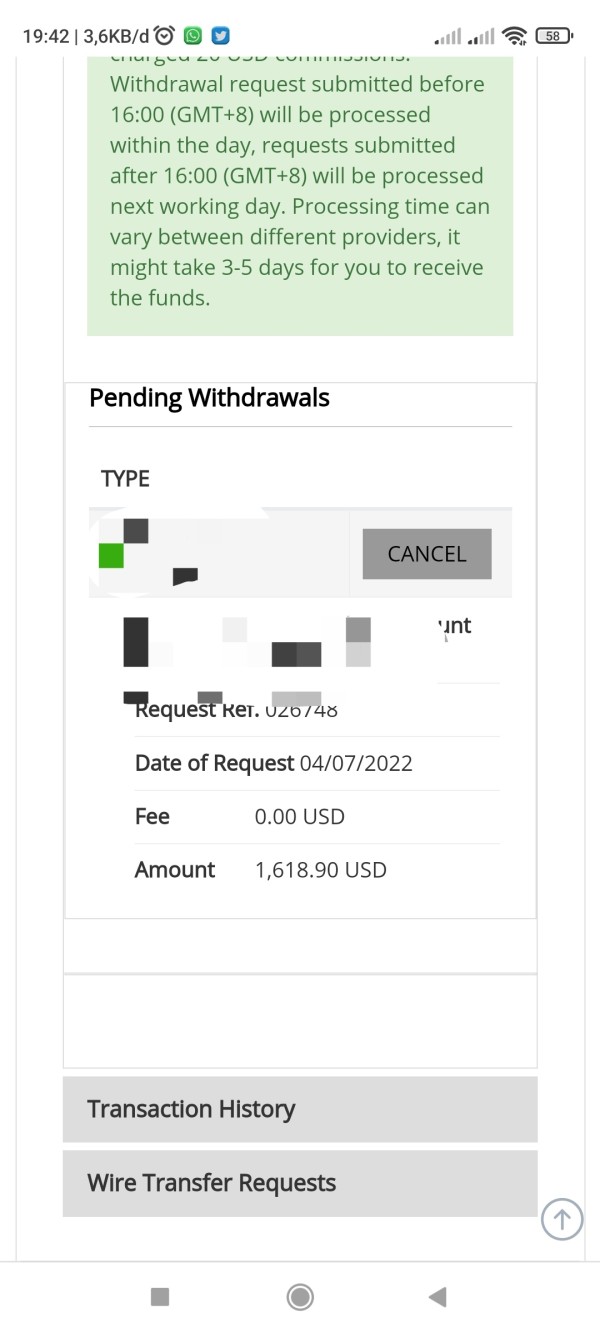

I have submitted a withdrawal since July 4, and it has been more than a month since the application has not been approved. I have sent a message to support but no response. Previously I had cut my rebate to $2,000. untrusted broker

Exposure

2022-08-12

小旋风19123

Hong Kong

They do not withdraw the commission since I share same IP with my customer. I hope everyone stays away from this platform.

Exposure

2022-06-20

Bōmëoκ

Hong Kong

Withdrawal was not processed for a week. No reply for email. The customer service do not respond.

Exposure

2022-06-10

〇〇7

Hong Kong

I am a very experienced trader. I opened an account in CDG and started trading very smoothly. Later, a wave of gold prices came up and the list was reversed. The list was carried, and the list was locked. With hard work and luck, the lock was also unlocked, and there were some small profits. The platform said that I locked the order for illegal transactions, and the locked order was not accepted by the seller and was rejected, so my profit could not be withdrawn. If I lose money like this, will your platform return it to me? ? ? Excuse me, what is the matter between you and the last family? I am an investor. I recognize that I lose money on a single order, and it is a good platform to make money for me. Now it is good, this platform can only lose money, not make money. Platform rules and regulations, such a business, you are the richest man in the world

Exposure

2022-03-22

Yekhizel

Indonesia

The spread suddenly widened on February 24, 2022 and reached 3214 pips and was really detrimental to trade!!! Junk Brokers!

Exposure

2022-03-02

RealHopeFX

South Korea

I'm their IB and trader. After the last incident, LOSS also requested the withdrawal of the remaining funds on February 10th, and informed them of this to CHAT support, but only the answer was to contact a personal manager.This is not a fake picture. I'll fix it as solved when it's solved.

Exposure

2022-02-28

FX3515488951

Vietnam

CDG has arbitrarily cut my orders with the price that the market does not have

Exposure

2022-02-24

RealHopeFX

South Korea

I was their IB and trader. As a special contract for the HFT strategy, there were more than six months of locked funds, and they said that this would guarantee the withdrawal of profits. And I understood their methods and explanations as much as I could. However, on January 21st, they opened an 15lots order on my side and put the manipulated price to me to make a margin call on my account. And I asked them for the receipt of these orders and the Pricebook provided by the correct LP, but I have never provided them until now. also the remaining funds are not withdrawn. l loss 45k more from 15lot order and manipulated price. A month has passed since this happened, but there has been no action. I'm very angry.That's why I can't trust them anymore. They're just saying that LP was like that without providing me with clear data.https://t.me/realclub2 << this is my group. u can see my history and posts.

Exposure

2022-02-21

FX4255247862

France

CDG didn't proceed with my withdraw for more than 2 weeks!!! Treating customers to withdraw their comments or they don't pay. Ridiculous

Exposure

2021-10-10

FX5944873722

Malaysia

I traded gold and other transactions on , and they placed a plug-in on my account. When I entered the market, it took more than 1 second to open and close the operation. In any case, plug-ins that manipulate the market should be illegal!!!!, I made a withdrawal 1 month ago, but the money did not enter my account through cryptocurrency, and the customer service department insisted that I would receive it! ! But I didn't receive the money! ! ! At that time, the customer service had already ignored me! keep away...

Exposure

2021-09-28

Mr. Rolex

Portugal

I have traded on CDG scalping on Gold until they have placed a plugin on my account that when i enter on the market takes more than 1 second to open operations and close. Plugins to manipulate the market should be illegal under any circumstances!!!!I have placed a withdraw 1 month ago the money is not in my account via crypto and support keeps saying that i will receive it soon!!! For me the broker i would give 0 starts since nothing is working properly!!!Better brokers on market, stay away...

Exposure

2021-09-28

Trần Tuấn Anh

Vietnam

I placed a withdrawal request but during 2 weeks, the cdg could not process it for me. They give many reasons to explain this even my money is not big It make me fear about a scam They not improve their withdrawal since i started trade on CDG DON’T CHOOSE CDG!!!!!!

Exposure

2021-06-29

SHRIMP2t

Vietnam

No support. advise people to be vigilant

Exposure

2021-05-03

FX9179599943

Hong Kong

The customer service doesn't reply to me. They still cheats people by bonus

Exposure

2021-03-30

FX9179599943

Japan

Unable to withdraw in CDG. Cheat people via bonuses

Exposure

2021-03-24

FX6290201932

Vietnam

My name is Chi. I registed in CDG on March 10, 2021. I ask for the withdrawal but the withdrawal has not been to my bank acc. My customer manager is Nguyen Minh Tam who prevent me from withdrawing funds.

Exposure

2021-03-13