Score

GLX

Cambodia|5-10 years|

Cambodia|5-10 years| https://www.glexchange.com/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomContact

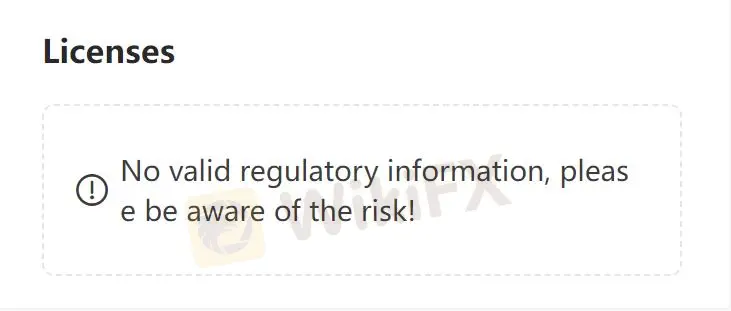

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Cambodia

CambodiaAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed GLX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

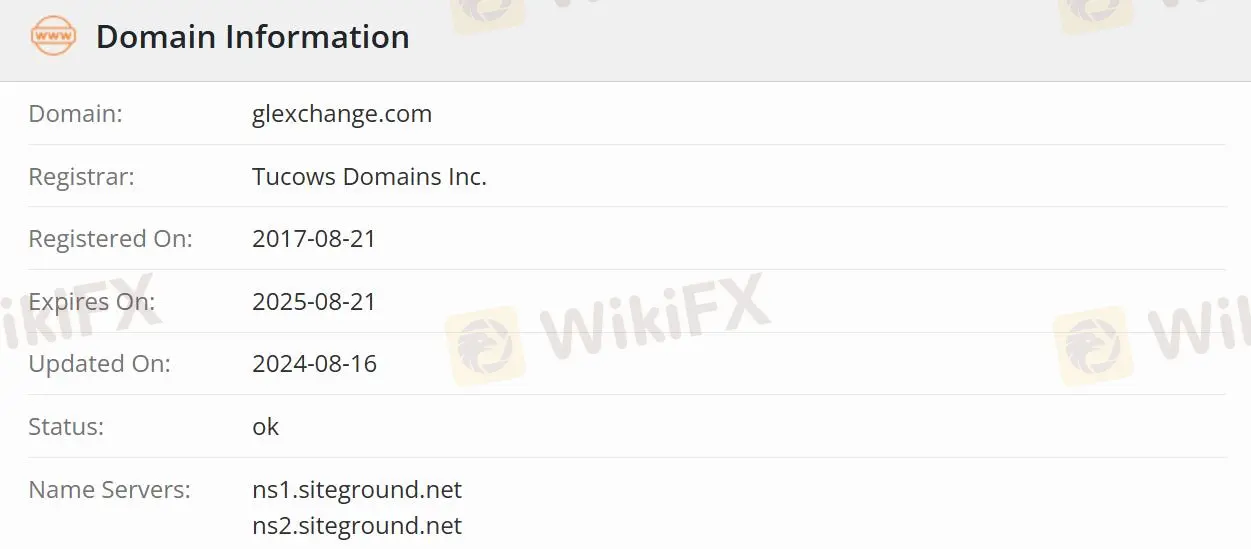

Website

glexchange.com.kh

Server Location

Cambodia

Website Domain Name

glexchange.com.kh

Server IP

103.166.94.79

glexchange.com

Server Location

Australia

Website Domain Name

glexchange.com

Server IP

109.73.228.157

Company Summary

| GLX Review Summary | |

| Founded | 2017-08-21 |

| Registered Country/Region | Cambodia |

| Regulation | Unregulated |

| Market Instruments | CDFs on forex, indices, futures, commodities, cryptocurrencies, and stocks |

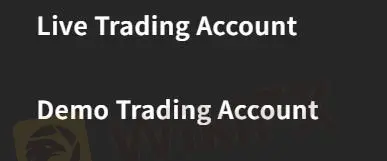

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | EUR/USD spread averaging 0.1 pips |

| Trading Platform | MT5(Web/Mobile)/MT4 |

| Min Deposit | $200 |

| Customer Support | Phone: +852 936 132 67 |

| Email: info@glexchange.com | |

GLX Information

GLX is a comprehensive forex financial services provider providing trading solutions and trading experiences for clients engaged in CDF investments with a maximum leverage of 1:1000. The broker also provides standard and Raw Spread accounts. The minimum spread is from 0.0 pips and the deposit is as little as $200. GLX is still risky due to its unregulated status and high leverage.

Pros and Cons

| Pros | Cons |

| Leverage up to 1:1000 | Unregulated |

| Spread as low as 0.0 | No 24/7 customer support |

| MT4/MT5 available | |

| CDFs on various assets |

Is GLX Legit?

GLX is not regulated, even though it claims to be regulated by the Securities Exchange Regulator of Cambodia (SERC). However, an unregulated broker is not as safe as a regulated one.

What Can I Trade on GLX?

Traders can choose different investment directions because the broker provides CDFs on forex including 61 currency pairs, 25 indices, futures from the ICE Dollar Index and CBOE VlX Index, commodities that trade energy, agriculture, and metals, cryptocurrencies, and stocks.

| Tradable Instruments | Supported |

| Forex CDFs | ✔ |

| Commodities CDFs | ✔ |

| Stocks CDFs | ✔ |

| Cryptocurrencies CDFs | ✔ |

| Futures CDFs | ✔ |

| Indices CDFs | ✔ |

Account Type

GLX offers two live account types, Standard account and our market-leading, Raw Spread account. Raw Spread Account with a commission charge of $7 per standard lot round turn shows the Raw inter-bank spread received from our liquidity providers. Standard Account commission is free but instead, markup is applied to the spread of 1 pip above the raw Inter-bank rate received from Liquidity providers. In addition, the demo accounts are predominantly used for familiarizing traders with the trading platform and for educational purposes only.

GLX Fees

The minimum spread is from 0.0. GLX offers Forex traders EUR/USD spread averaging 0.1 pips, some of the tightest spreads out of all Forex exchange brokers globally. GLX does not charge a commission on Standard Accounts, but on GLXs Raw Spread Account, GLX charges a commission of $3.5 per standard lot round turn.

Leverage

GLX offers flexible leverage options ranging from 1:1 to 1:1000. GLX allows trading the spot price for metals including Gold or Silver against the US Dollar or Euro and the metals Platinum or Palladium against the US Dollar as a currency pair on 1:1000 leverage.

Trading Platform

GLX cooperates with the authoritative MT4, as well as MT5 available in Web and Mobile to trade. MT5 not only provides various trading strategies but also implements EA systems.

| Trading Platform | Supported | Available Devices |

| MT5 | ✔ | Web/Mobile |

| MT4 | ✔ | - |

Deposit and Withdrawal

GLX allows clients to open an account with as little as $200 or currency equivalent. GLX does not charge any additional fees for deposits or withdrawals. GLX does not accept payments from third parties. If the trading account holder is one of the parties on the Bank Account / Credit Card, payments from Joint Bank Accounts / Credit Cards are accepted. Traders can deposit and withdraw by VISA, MasterCard, Neteller, Bank transfer, Skrill, and UnionPay as well. Wire transfers normally take one to two business days. For international bank transfers, please allow up to three to five working days.

Keywords

- 5-10 years

- Suspicious Regulatory License

- MT5 Full License

- White label MT4

- Regional Brokers

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now