Score

Royal Capital

Hong Kong|5-10 years|

Hong Kong|5-10 years| https://www.llg9999.com/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

China

ChinaContact

Licenses

Single Core

1G

40G

Contact number

+852 3753 7940

Other ways of contact

Broker Information

More

ROYAL CAPITAL

Royal Capital

Hong Kong

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of the complaints received by WikiFX have reached 8 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- This broker exceeds the business scope regulated by New Zealand FSPR(license number: 489386)Financial Service Providers Register Non-Forex License. Please be aware of the risk!

WikiFX Verification

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Royal Capital also viewed..

XM

STARTRADER

FP Markets

MultiBank Group

Royal Capital · Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| Royal Capital Review Summary in 10 Points | |

| Founded | 2012 |

| Registered Country/Region | Hong Kong |

| Regulation | CGSE |

| Market Instruments | London Gold, London Silver |

| Demo Account | N/A |

| Margin | $3,000 per lot (London Gold), $1,800 per lot (Golden Silver) |

| EUR/USD Spread | 2 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $50/$300 |

| Customer Support | Telephone, Fax |

What is Royal Capital?

Royal Capital is a regulated financial brokerage firm,headquartered in Hong Kong, China, with offices in New York, London, and Paris, offering trading services in various markets, including gold and silver, commodities, forex, indices, and equities CFDs through the MT4 trading platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

Royal Capital has several advantages that make it potentially attractive to traders. Firstly, it is regulated by the Chinese Gold & Silver Exchange Society (CGSE), providing a level of oversight and security for clients. With more than 10 years of industry experience, Royal Capital brings a level of expertise to the table.

However, there are certain drawbacks to consider. Reports of scams associated with the broker raise concerns about its credibility and trustworthiness.

| Pros | Cons |

| • Regulated by CGSE | • Reports of scams |

| • Wide range of market instruments available for trading | • Wide spreads |

| • Experienced in the industry for over 10 years | • Limited deposit and withdrawal options |

| • Multiple account types to suit different trading preferences | • Limited educational resources and tools |

| • Commission-free | |

| • Offers the popular MT4 trading platform |

Ultimately, prospective traders should carefully evaluate the pros and cons of Royal Capital and consider their individual needs and risk tolerance before deciding to engage with the broker.

Royal Capital Alternative Brokers

Rakuten Securities - for traders looking for a reliable and well-established brokerage with a wide range of financial instruments and competitive trading conditions.

SBI FXTRADE - for traders seeking a reputable and regulated broker with a strong presence in the Japanese market and a comprehensive suite of trading tools and educational resources.

LIGHT FX - for traders who prefer a user-friendly and intuitive trading platform, competitive spreads, and access to a diverse range of financial instruments, including forex, commodities, and indices.

There are many alternative brokers to Royal Capital depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Royal Capital Safe or Scam?

Regulation by the Chinese Gold & Silver Exchange Society (CGSE, License No. 076) and the implementation of segregated client accounts are positive factors indicating a level of regulatory oversight and protection for clients' funds. However, it's important to note that the safety and reliability of a broker cannot be solely determined by regulation and segregated accounts.

Other factors, such as the broker's reputation, client feedback, and transparency, also play crucial roles. Considering Royal Capital's more than 10 years of experience in the industry, it suggests a certain level of stability. However, it is recommended to conduct thorough research, read client reviews, and assess the broker's overall reputation and reliability before making any investment decisions.

Market Instruments

Royal Capital offers a diverse range of market instruments for trading, including Gold & Silver, Commodities, Forex, Indices, and Equities CFDs. With Gold & Silver, traders have the opportunity to participate in the precious metals market, taking advantage of price fluctuations and hedging strategies. The Commodities category allows traders to access a variety of popular commodities, such as oil, natural gas, and agricultural products, providing exposure to global commodity markets.

In the Forex market, Royal Capital offers a wide selection of currency pairs, allowing traders to engage in currency trading and capitalize on currency exchange rate movements. The Indices category enables traders to speculate on the performance of major stock market indices, offering exposure to global equity markets. Lastly, the Equities CFDs provide an opportunity to trade Contracts for Difference on individual stocks, allowing traders to participate in the performance of specific companies.

Accounts

Royal Capital provides a range of four account types designed to cater to the needs of different traders. The Mini account is an entry-level option with a minimum deposit requirement of $300, making it accessible to traders who are starting with a smaller capital. The Standard account requires a minimum deposit of $1,000 and offers enhanced features and trading conditions compared to the Mini account.

The Superior account, with a minimum deposit of $3,000, provides even more benefits, including lower spreads and additional trading tools. For experienced and high-volume traders, the Supreme account offers the most comprehensive set of features and advantages, requiring a minimum deposit of $20,000. With each account type, traders gain access to a variety of financial instruments and can take advantage of Royal Capital's trading platforms and services.

Margin

Royal Capital offers competitive margin requirements for trading London Gold and London Silver. For London Gold, the initial margin is set at $3,000 per lot, which represents the minimum amount required to open a position. The market margin, on the other hand, is set at $6,000 per lot, indicating the amount needed to maintain the position. Similarly, for London Silver, the initial margin is $1,800 per lot, while the market margin is $3,600 per lot.

Margin requirements play a crucial role in leveraged trading, as they determine the amount of funds needed to control a specific position. With its margin requirements, Royal Capital aims to provide traders with sufficient flexibility and risk management options, allowing them to participate in the London Gold and London Silver markets while maintaining appropriate risk levels.

Spreads & Commissions

Royal Capital offers a transparent fee structure with no commissions charged on trades. Instead, the company applies spreads on various trading instruments. The spread is the difference between the bid and ask price, and it represents the cost of executing a trade.

For example, the spread for Local London Gold is 0.5 pips, while for Local London Silver and Crude oil, it is 0.04 pips. For the popular EURUSD currency pair, the spread is 2.0 pips. Additionally, the spread for Natural Gas is 0.01 pips. The specific spreads for other instruments can be found in the provided table or through the platform's screenshots.

| Trading Instrument | Spread | |

| Metals | Local London Gold | 0.5 pips |

| Local London Silver | 0.04 pips | |

| Forex | EURUSD | 2.0 pips |

| GBPUSD | 2.6 pips | |

| USDJPY | 2.0 pips | |

| AUDUSD | 2.3 pips | |

| EURJPY | 2.6 pips | |

| EURGBP | 2.4 pips | |

| USDCNH | 25.0 pips | |

| NZDUSD | 2.4 pips | |

| USDCAD | 2.4 pips | |

| USDCHF | 2.6 pips | |

| CFDs on Commodities | Crude oil | 0.04 pips |

| Natural Gas | 0.01 pips | |

| CFDs on Indices | SPX500 | 0.5 index points |

| DRAGON300 | 3.0 index points | |

| A50 | 20.0 index points | |

| FTSE100 | 4.0 index points | |

| NK225 | 12.0 index points | |

| DAX30 | 5.0 index points | |

Royal Capital aims to provide competitive and transparent pricing to its clients, enabling them to make informed trading decisions while keeping their trading costs in check.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| Royal Capital | 2.0 | Free |

| Rakuten Securities | 0.5 | Free |

| SBI FXTRADE | 0.2 | Free |

| LIGHT FX | 1.5 | Free |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Trading Platforms

Royal Capital offers its clients the popular and widely recognized MetaTrader4 (MT4) trading platform. MT4 is renowned for its user-friendly interface, advanced charting capabilities, and extensive range of trading tools and features. Traders can enjoy a seamless trading experience with zero slippage, ensuring that their orders are executed at the desired price levels. With direct access to the market, users can trade with transparency and efficiency. The platform is available for PC, allowing traders to access their accounts and monitor the markets from their desktops.

Additionally, Royal Capital provides a mobile terminal version of MT4, compatible with both Apple iOS and Android devices. This enables traders to stay connected and execute trades on-the-go, providing flexibility and convenience. With a focus on safety and stability, Royal Capital ensures that its clients can rely on the MT4 platform to execute their trading strategies efficiently and securely.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Royal Capital | MT4 |

| Rakuten Securities | Rakuten FX |

| SBI FXTRADE | SBI FXTRADE FX |

| LIGHT FX | LIGHT FX Trading Platform |

Deposits & Withdrawals

Royal Capital accepts traders to fund their account through payment methods including Alipay and online banking transfers, ensuring ease and flexibility in managing their funds.

The minimum deposit requirement of $50 allows for accessibility, accommodating both beginner and experienced traders. Opening an account with Royal Capital requires a minimum initial deposit of $300, which provides traders with the opportunity to start trading and accessing the markets promptly.

Royal Capital minimum deposit vs other brokers

| Royal Capital | Most other | |

| Minimum Deposit | $50/$300 | $100 |

Customer Service

Royal Capital prioritizes customer service and offers multiple channels for clients to reach out and seek assistance. Traders can easily connect with Royal Capital's customer support team through telephone and fax, providing direct and efficient communication. Additionally, the broker's commitment to transparency is evident in the open disclosure of their office addresses, which adds credibility and trustworthiness to their operations.

Overall, Royal Capital's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

| Pros | Cons |

| • Telephone and fax support | • Lack of 24/7 customer support |

| • Clear disclosure of office addresses | • No live chat support |

| • No presence of social media | |

| • No FAQ section |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Royal Capital's customer service.

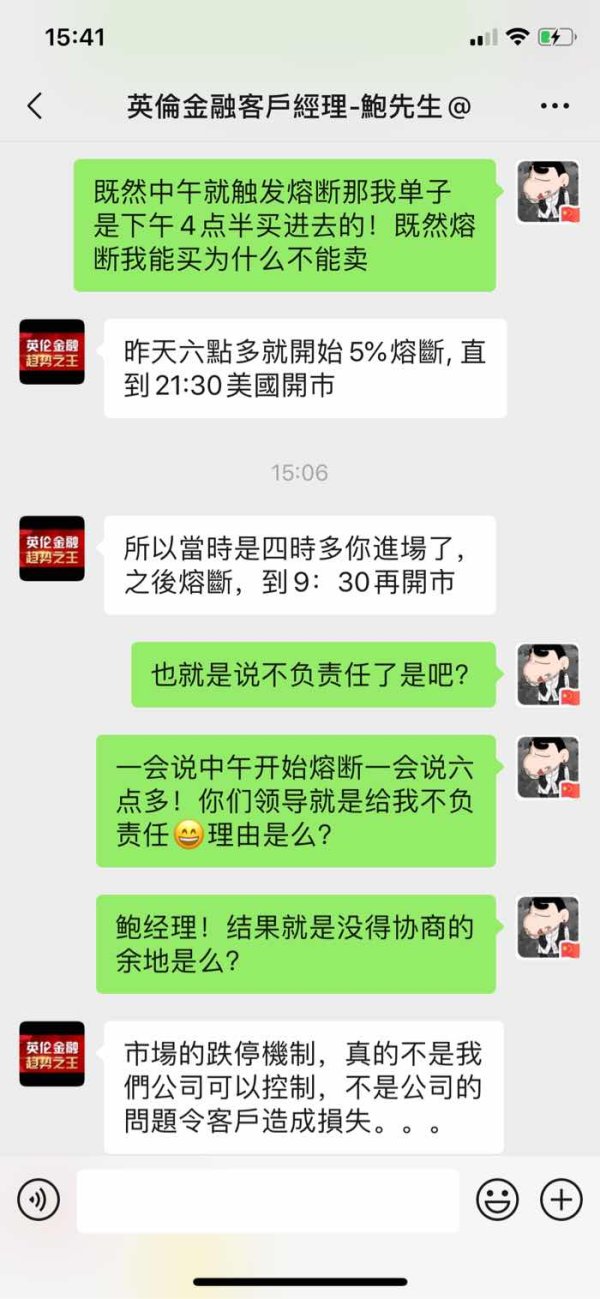

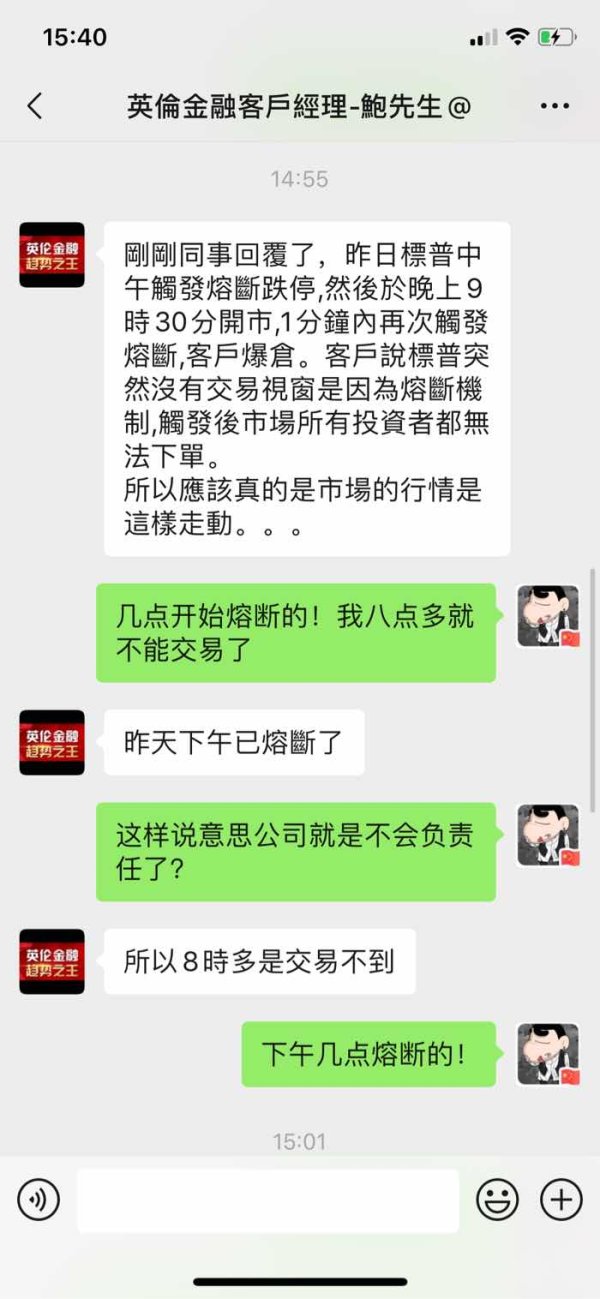

User Exposure on WikiFX

On our website, you can see that reports of scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

In conclusion, Royal Capital presents a mixed picture with both positive and negative aspects. On the positive side, Royal Capital is a regulated broker with over 10 years of experience in the industry. The company offers a variety of market instruments, including Gold & Silver, Commodities, Forex, Indices, and Equities CFDs through the popular MT4 trading platform. They provide different account types to cater to the needs of various traders, with varying minimum deposit requirements.

However, it's important to note that there have been reports of scams associated with Royal Capital, which raises concerns about their trustworthiness. Prospective traders are advised to exercise caution and conduct thorough research before engaging with Royal Capital.

Frequently Asked Questions (FAQs)

| Q 1: | Is Royal Capital regulated? |

| A 1: | Yes. It is regulated by the Chinese Gold & Silver Exchange Society (CGSE, License No. 076). |

| Q 2: | Does Royal Capital offer the industry leading MT4 & MT5? |

| A 2: | Yes. It supports MT4. |

| Q 3: | What is the minimum deposit for Royal Capital? |

| A 3: | The minimum deposit is $50, while opening an account requires at least $300. |

| Q 4: | Is Royal Capital a good broker for beginners? |

| A 4: | Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. |

Review 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now