Score

EasyTrade

Australia|2-5 years|

Australia|2-5 years| https://www.etfxi.com

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Australia

AustraliaAccount Information

Users who viewed EasyTrade also viewed..

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IronFX

- 15-20 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

etfxi.com

Server Location

United States

Website Domain Name

etfxi.com

Server IP

104.21.2.253

Company Summary

Note: EasyTrades official site - https://www.etfxi.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| EasyTrade Review Summary in 10 Points | |

| Founded | N/A |

| Registered Country/Region | Australia |

| Regulation | No license |

| Market Instruments | Currency pairs, Commodities and Indices |

| Demo Account | no |

| Leverage | 500:1 |

| EUR/USD Spread | From 1.0 pips (Standard) |

| Trading Platforms | MT4 |

| Minimum deposit | $250 |

| Customer Support | Phone, email |

What is EasyTrade?

EasyTrade is a brand owned by Easy Trade Markets Ltd, allegedly based in Australia. It implies the company needs an ASIC regulation for legal providing financial services. Once we have checked the Australian authority body registers, we found no EasyTrade broker.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Commission-free Standard accounts | • No license |

| • MT4 supported | • Unavailable website |

| • Reports of severe slippage and unable to withdraw | |

| • US traders are not accepted | |

| • Limited trading instruments | |

| • No demo accounts or Islamic/swap-free accounts | |

| • High commission for Standard accounts | |

| High minimum deposit ($250) |

EasyTrade Alternative Brokers

AETOS - a regulated broker with a wide range of trading instruments and competitive spreads, making it a potentially good choice for traders seeking a reliable trading experience.

LegacyFX - a regulated broker that offers a user-friendly trading platform, diverse asset selection, and educational resources, making it suitable for both novice and experienced traders.

TigerWit - a regulated broker known for its innovative social trading platform and competitive trading conditions, making it a recommended choice for traders interested in copy trading and a seamless trading experience.

There are many alternative brokers to EasyTrade depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is EasyTrade Safe or Scam?

Based on the information provided, where EasyTrade does not hold any valid regulatory licenses and their website is currently unavailable, it raises significant concerns about the legitimacy and safety of the platform. Without proper regulation, there is a higher risk of potential scams or fraudulent activities. It is advisable to exercise caution and consider alternative regulated brokers with a transparent track record and proper licensing when engaging in financial trading.

Market Instruments

It seems that EasyTrade decided to focus on several assets instead of being all over the place. Clients can access only 3 markets, including Currency pairs, Commodities (Metals & Energies), and Indices. However, considering the lack of regulatory licenses and the unavailability of EasyTrade's website, it is crucial to approach the platform with caution and thoroughly research alternative regulated brokers that provide a wider range of market instruments.

Accounts

EasyTrade offers two types of trading accounts for investors: Standard and Raw. Both account types have a minimum deposit requirement of $250, allowing traders with different capital sizes to participate in the market.

However, EasyTrade does not provide a demo account option for traders to practice and familiarize themselves with the platform and trading conditions before committing real funds. Additionally, EasyTrade does not offer an Islamic/swap-free account for clients who follow Shariah principles.

Leverage

EasyTrade offers high leverage of up to 1:500, which allows traders to potentially amplify their profits. However, it is important to note that EasyTrade is an unregulated broker and the lack of regulation raises concerns about the safety and reliability of the offered leverage.

High leverage can significantly increase the risks involved in trading, and traders should exercise caution and fully understand the potential consequences before engaging in high-leverage trading. It is advisable to choose regulated brokers that adhere to strict financial standards and offer responsible leverage options to ensure the safety of funds and mitigate unnecessary risks.

Spreads & Commissions

EasyTrade offers competitive spreads for its clients. For the Standard account, the spread starts from 1.0 pips, which is relatively favorable for traders seeking a more cost-effective trading environment. On the other hand, the Raw account provides even tighter spreads starting from 0.0 pips, which can be beneficial for those who require a more precise pricing structure. As for commissions, Standard account has no commissions, the Raw account incurs a commission fee of $50 per lot traded.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (Standard) | Commission (Standard) |

| EasyTrade | 1.0 pips | $0 |

| AETOS | 0.8 pips | $0 |

| LegacyFX | 1.6 pips | $0 |

| TigerWit | 0.6 pips | $0 |

Please note that spreads and commissions may vary and it's always recommended to check with the brokers directly for the most up-to-date information.

Trading Platforms

Like most FX brokers, EasyTrade supports the industry standard, MetaTrader4. With MT4, traders can enjoy a user-friendly and feature-rich trading experience. The platform offers a comprehensive range of tools and resources to analyze the markets, execute trades, and manage positions effectively. MT4 is known for its advanced charting capabilities, customizable indicators, and a wide range of technical analysis tools.

Moreover, EasyTrade offers mobile versions of MT4 for both iOS and Android devices, allowing traders to access their accounts and trade on the go. This flexibility ensures that traders can stay connected to the markets and seize trading opportunities at any time and from anywhere.

Overall, EasyTrade's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platform |

| EasyTrade | MetaTrader 4 (MT4) |

| AETOS | MetaTrader 4 (MT4), MetaTrader 5 (MT5), AETOS WebTrader |

| LegacyFX | MetaTrader 5 (MT5) |

| TigerWit | TigerWit Trading App, TigerWit WebTrader |

Please note that this table is based on general information and it's advisable to visit the respective broker's websites for the most up-to-date and accurate information on their trading platforms.

Customer Service

EasyTrade provides customer service through various channels, including phone and email support. Clients can reach out to the company's support team by calling +61 3 8373 4800 or sending an email to support@etfxi.com. These contact options allow traders to seek assistance, ask questions, or address any concerns they may have regarding their trading experience.

Additionally, the company has a physical address located at Level 6, 360 Collins Street Melbourne, VIC 3000, Australia. This provides a sense of transparency and accessibility for clients who may prefer to communicate through traditional means.

| Pros | Cons |

| • Availability of phone and email support | • No 24/7 support |

| • Lack of live chat support |

Note: These pros and cons are subjective and may vary depending on the individual's experience with EasyTrade's customer service.

User Exposure on WikiFX

The number of the complaints received by WikiFX has reached 19 for this broker in the past 3 months. To sum up, traders listed EasyTrade login issues as one of the biggest problems they are facing. After they submit a withdrawal request, it happens that they can no longer access their trading accounts. Another big issue is that clients never see their deposits. In the end, we found EasyTrade is connected to one of the most famous Bulgarian boiler rooms, E&G Bulgaria. This same company operates several other scam brands, including Option888, XMarkets, and more. Please be aware of the risk and stay away!

Conclusion

Overall, the absence of valid regulatory licenses and the unavailability of their website raise concerns about its legitimacy and safety. It is crucial to exercise caution and conduct thorough research before engaging with EasyTrade or any similar platform. Consider exploring alternative regulated and reputable brokers that provide transparent information and offer a secure trading environment. Consulting with financial professionals is also advisable to make informed investment decisions.

Frequently Asked Questions (FAQs)

| Q 1: | Is EasyTrade regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | At EasyTrade, are there any regional restrictions for traders? |

| A 2: | Yes. US traders are not accepted. |

| Q 3: | Does EasyTrade offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT4. |

| Q 4: | Is EasyTrade a good broker for beginners? |

| A 4: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 22

Content you want to comment

Please enter...

Review 22

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Charlie 1844

Colombia

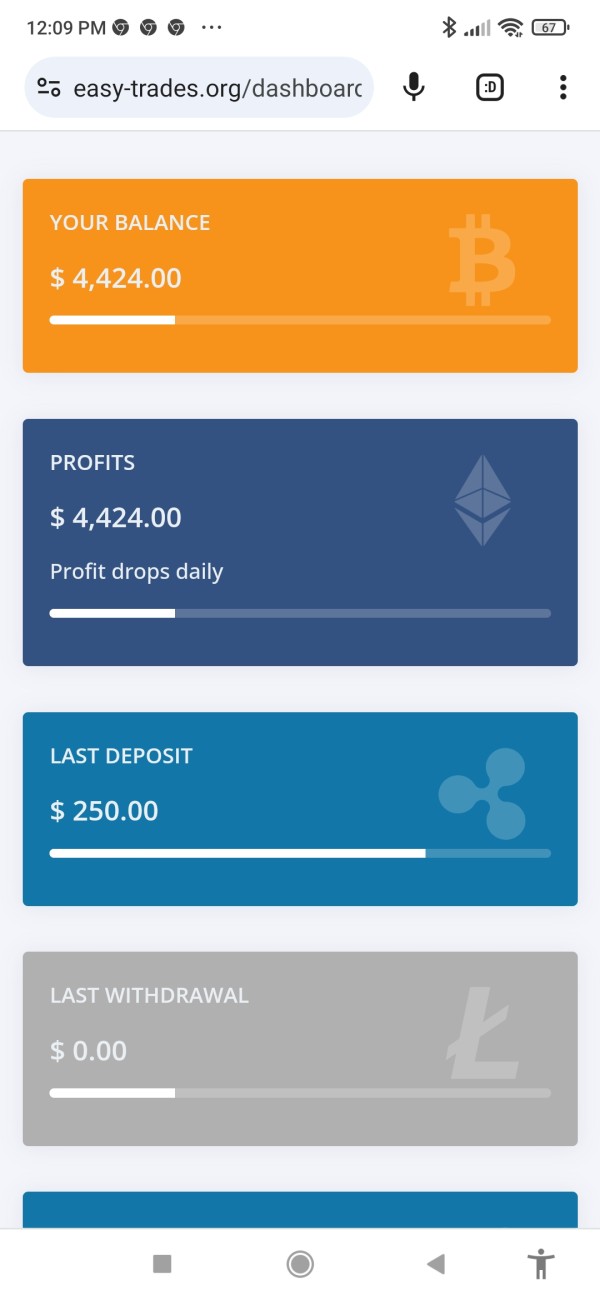

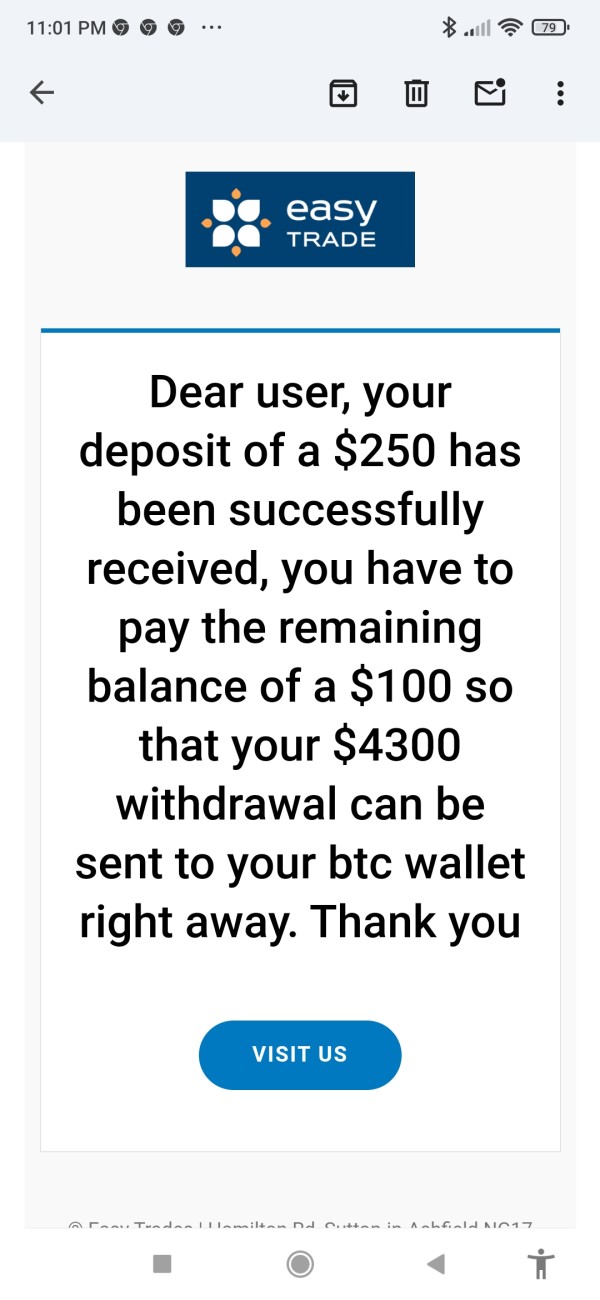

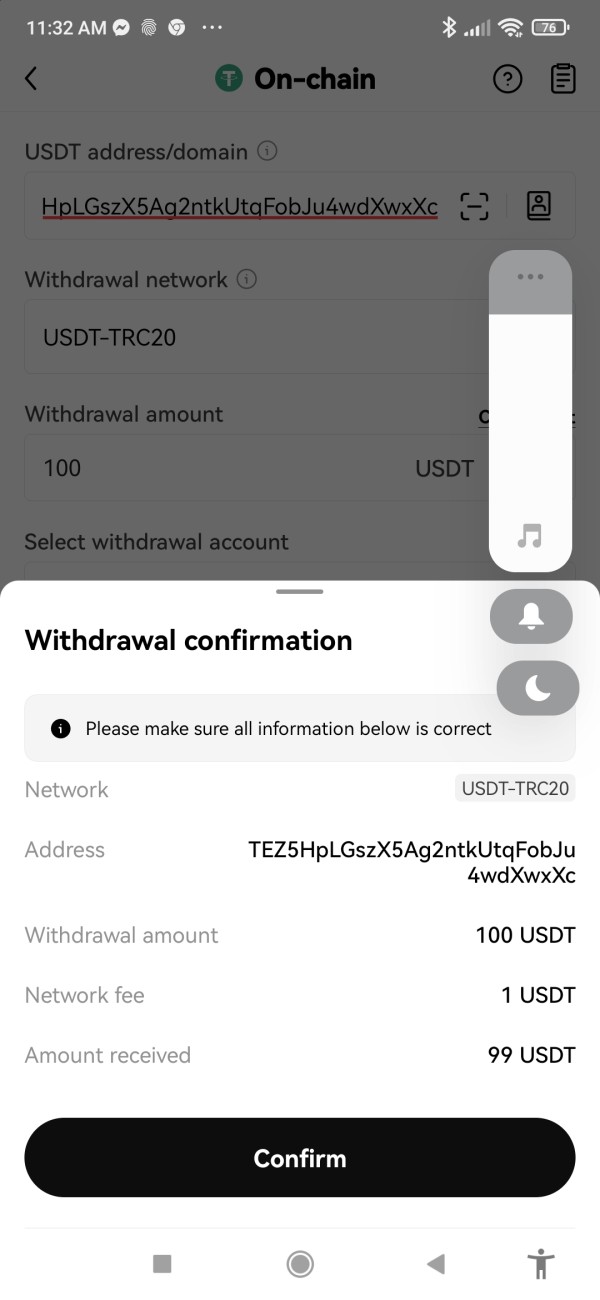

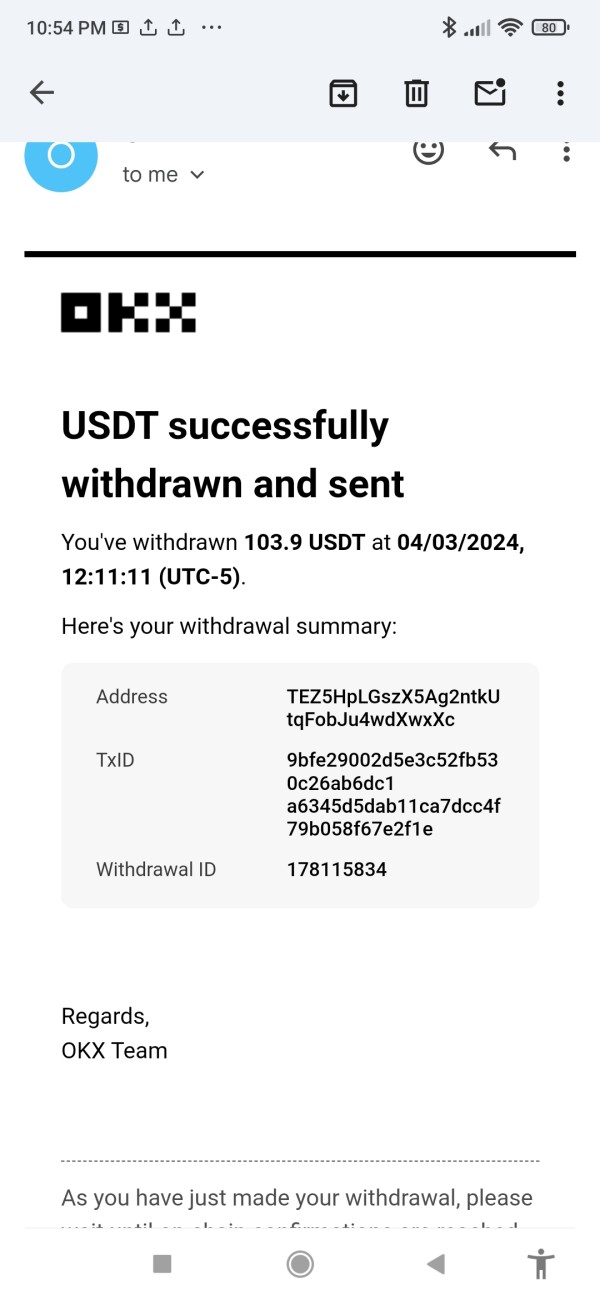

We started with TradeTech and continued with Easy Trades and they asked for a deposit of $350 which was paid first $250 and then $100 one after the other on the same day within minutes of each other. Below is a letter from Easy Trades after making the deposits. They are saying that they did not get the $100 deposit and want me to redeposit another $100. It's all a SCAM!!

Exposure

2024-04-15

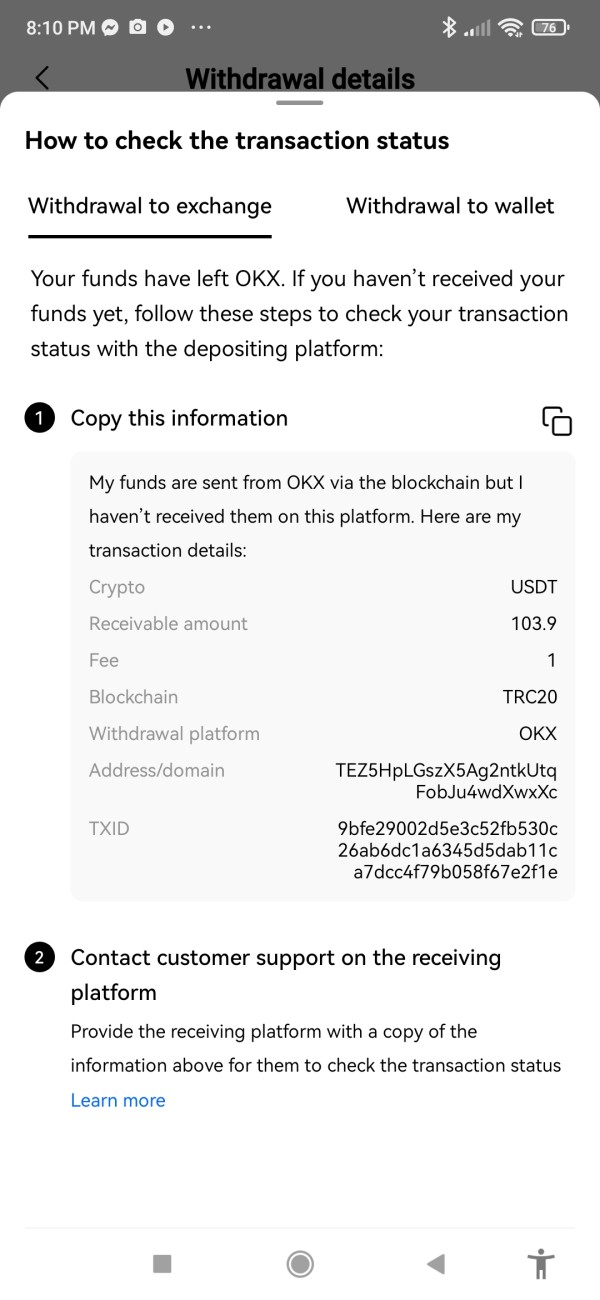

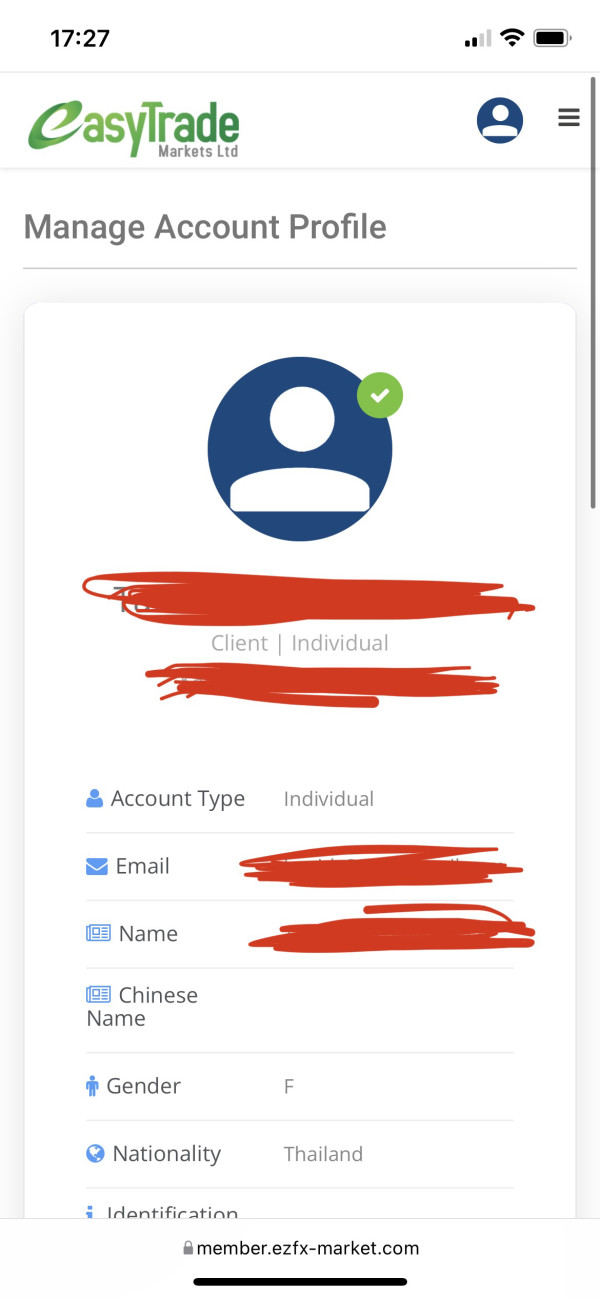

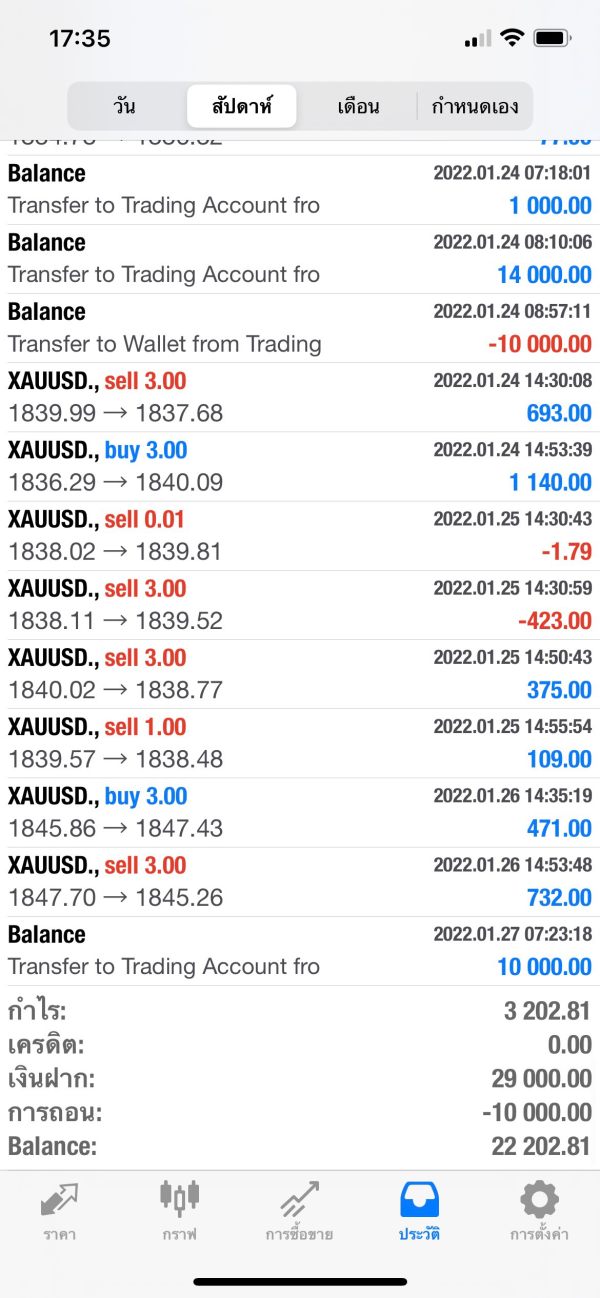

FX2140794094

Thailand

Do not trade forex by unknown person as mine. Easytrade or Leom is fake broker. You will lose your money at all. I was approached by unknown girl name Angela at whatsapp last December 2021. Actually She pretended to be businesswoman who interest to invest in Hotel and not talking about Forex trading for the initial of conversation. After 2 weeks past, she gradually informed me for Forex trading that she would like me to learn and try to trade with her. She boast her portfolio over us.d 10.- million and gain every day. 2 days later, she persuade me again to make a trial transfer to easytrade through Thai name for us.d 100.-, she committed to return me if I did not get it to my port. Then I made a tranfer to Thai name account which be got it by easytrade platform. After that, I had been recommended by Angela to trade and gain some profit every day. She also introduce me to made a trial withdrawal us.d 100.- to convince me that I could withdraw my money any time. Then I made a trial as her suggestion, i could withdraw my money too. After I trade and gain us.d 30,000.- , I can't withdraw my money.Now easytrade changed their name to Leom market and start to decieve, defraud again. Do not waste time to communicate with fake broker before you would lost your money as mine.

Exposure

2022-04-13

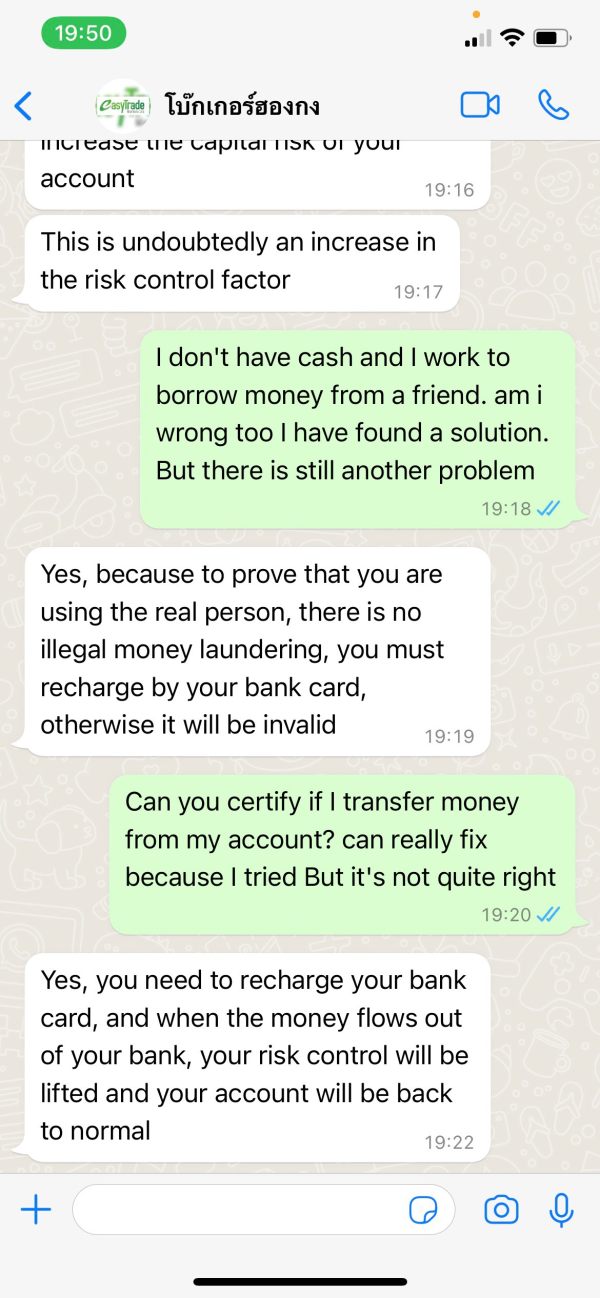

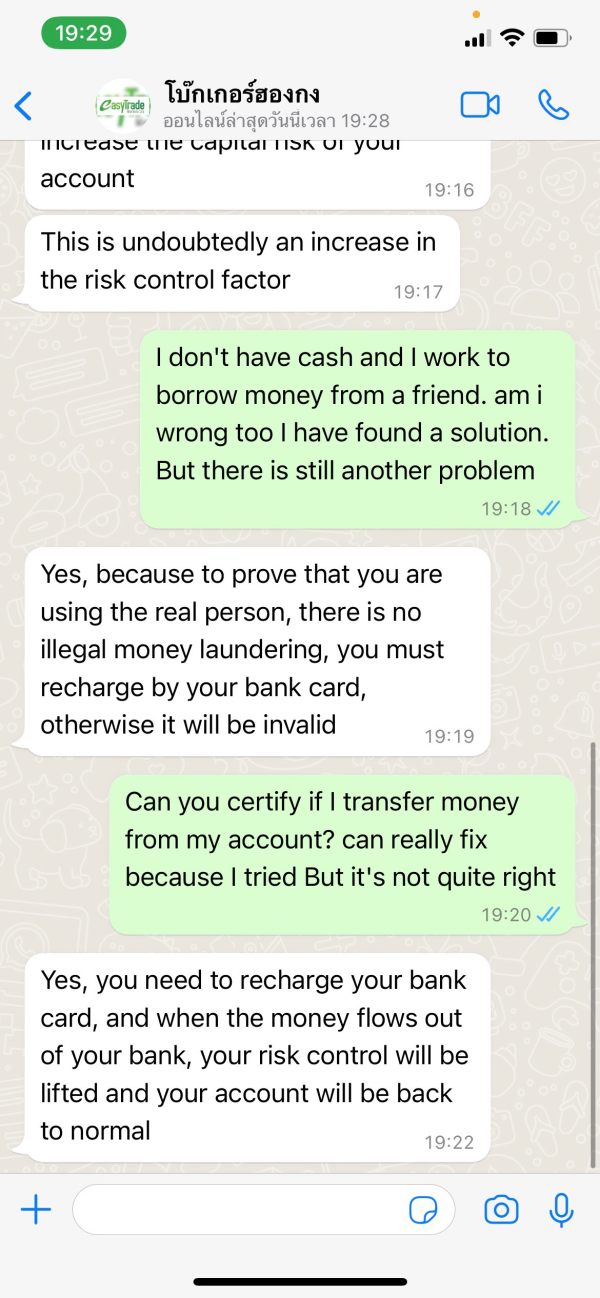

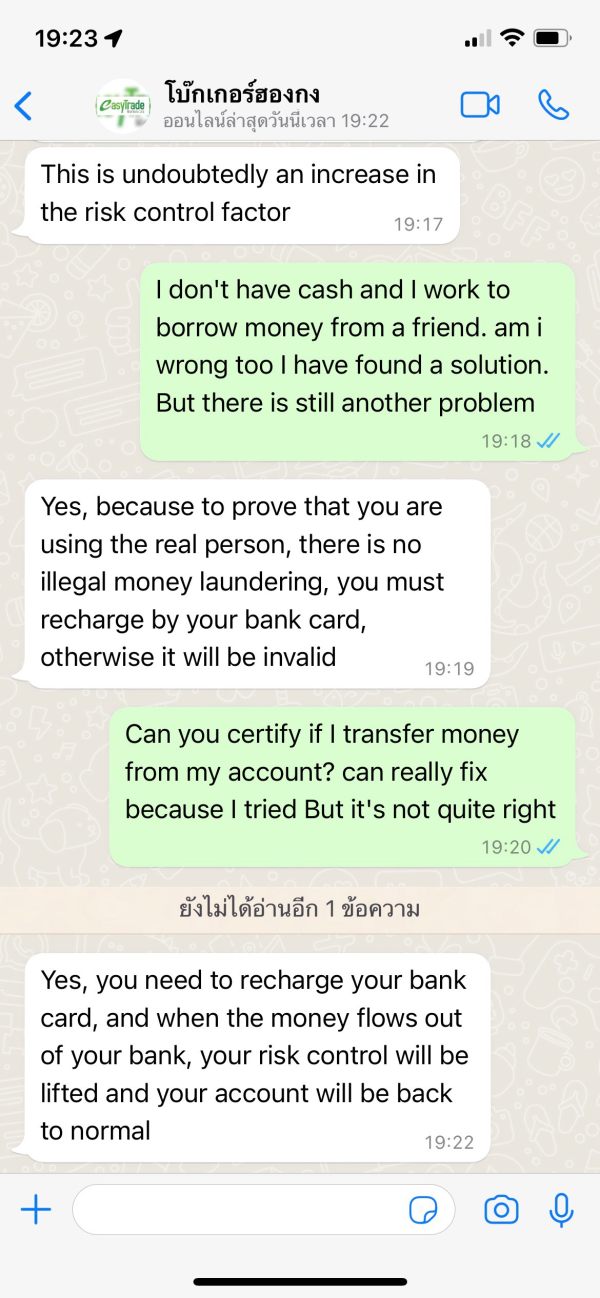

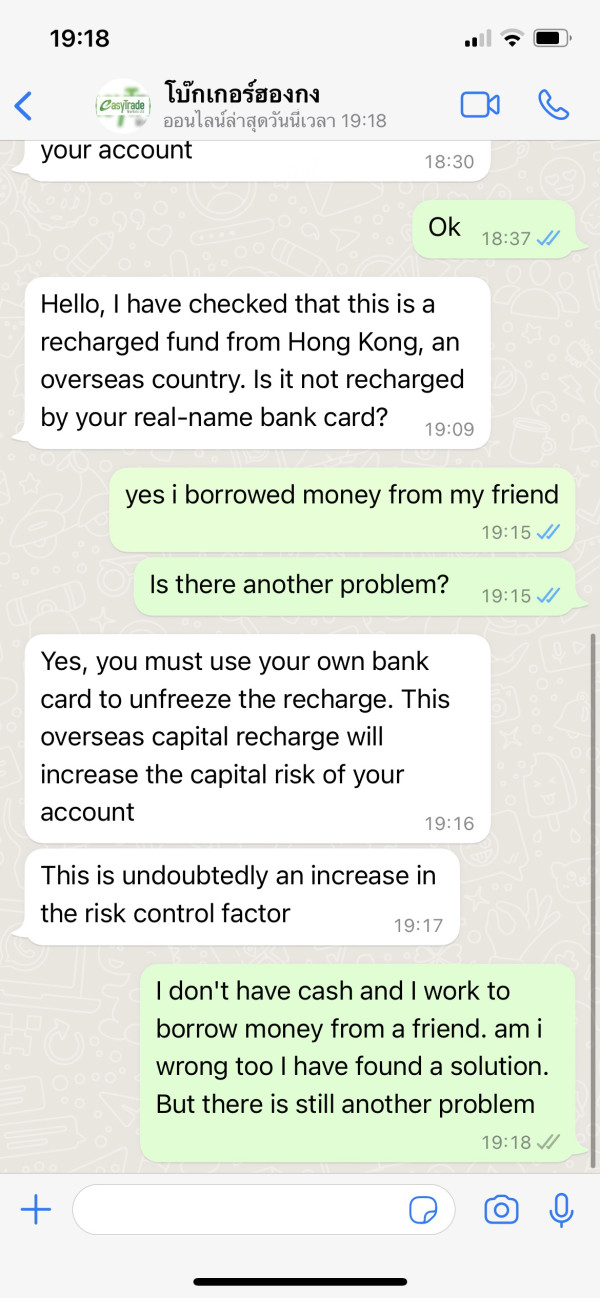

หวาน ใจ

Thailand

Being deceived and joined into trading and unable to withdraw money. Come to claim that we laundered money and will allow more money to be transferred to correct that it is not money laundering. If you don't transfer more, it will be blocked.

Exposure

2022-01-31

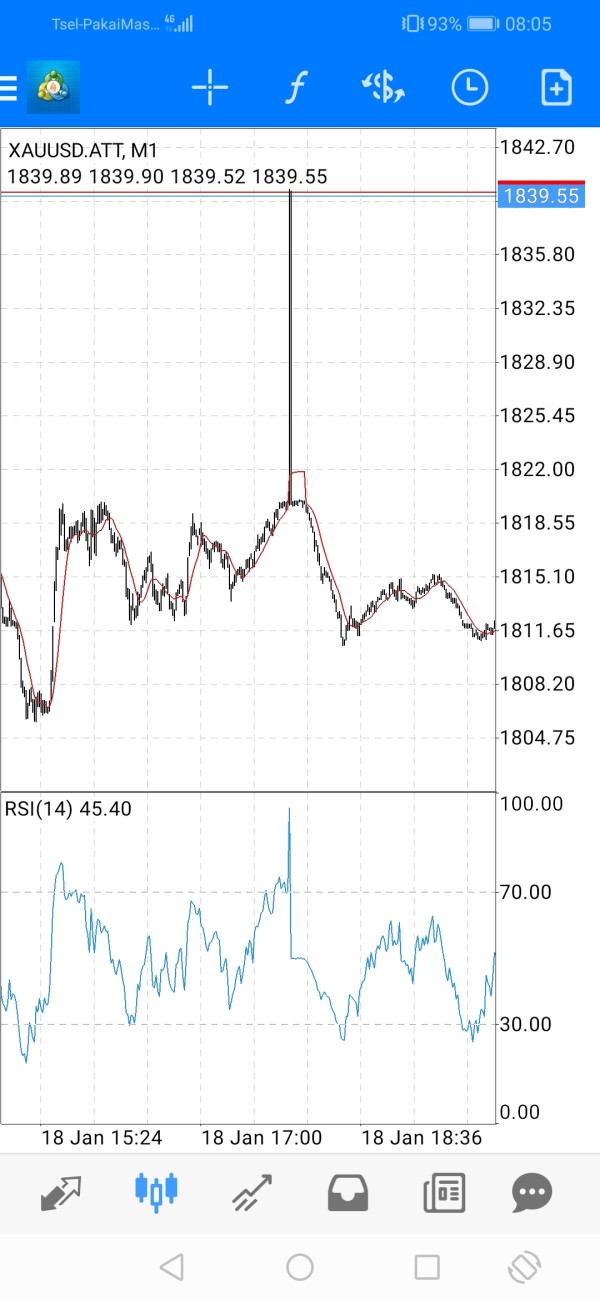

Uri

Indonesia

candle is unnaturally long

Exposure

2022-01-22

fauzan nasution

Indonesia

Problem with this brokers, never use this server

Exposure

2022-01-22

FX2176415390Watt

Thailand

I will share 50% if anyone can help me.

Exposure

2022-01-15

Uri

Indonesia

Candlestick suddenly surged for a short while

Exposure

2022-01-10

FX2176415390Watt

Thailand

Fraud, scam, can't withdraw $189000 Scam group uses phone number from Hong Kong

Exposure

2021-12-29

FX2176415390Watt

Thailand

Unable to withdraw $50,000. Cheating the whole graph

Exposure

2021-12-25

FX5495322372

Thailand

I cannot withdraw money from this broker.

Exposure

2021-12-24

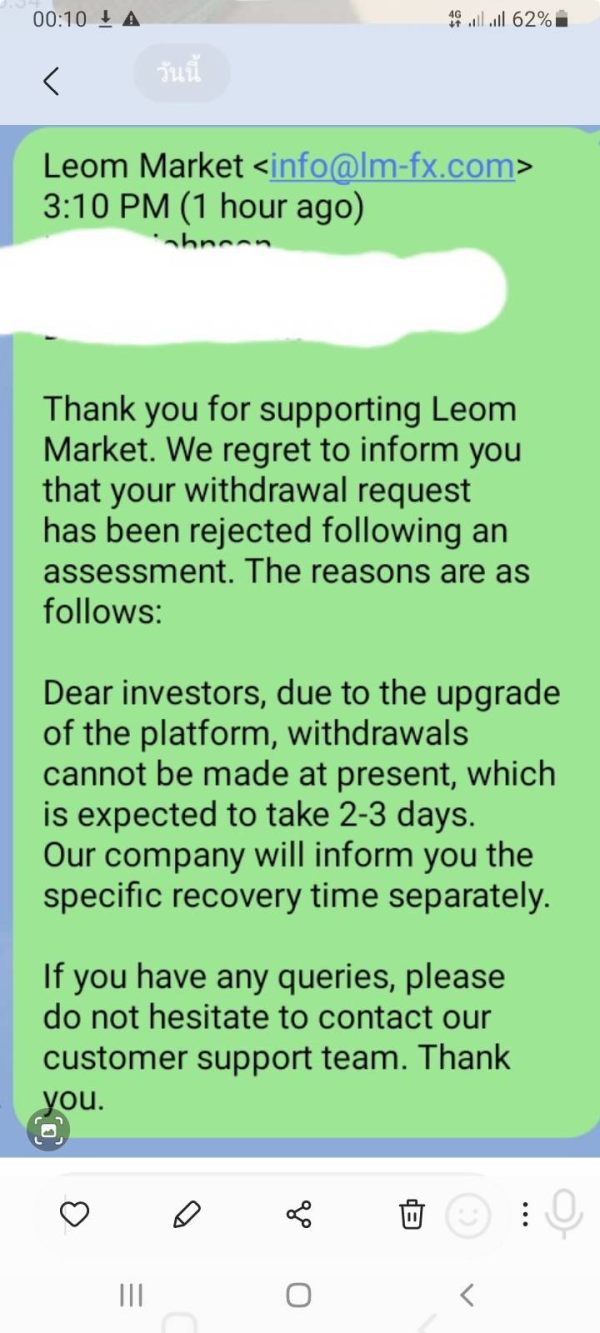

xx56xxth7u

Thailand

This Fraud website reject my first withdraw because of they excuse about transaction maintenance so i think my 10000 $ already disappear so becareful and if any body can help me please make suggestion Becareful don't trust the scam website

Exposure

2021-12-23

Cicciolin0

United States

I'm convinced EasyTrade Markets Ltd is an unregulated platform as they wouldnt allow withdrawals even after paying tax. They'll keep convincing you to make deposit to increase your margin. After about 6 weeks of them not responding to my complaints I'm in talks with traceasset.org to force out my withdrawal . Its rather strange that EasyTrade Markets appears to be legitimate but in the real sense, they are not. Everyone should deal careful

Exposure

2021-11-27

MM60625

Thailand

If someone convince you via WhatsApp and Line application to trade absolutely forbidden transfer money to personal account!!, While trading, someone will lead you via chat and they can be customized of market chart to make you belive that you have made a big profit to convince you to deposit more.The first 2 times you only withdraw a small amount after that you will not be able to withdraw it anymore So I lost a lot of money with this broker, Please becareful and belive me!!

Exposure

2021-11-26

Sittichai Sangdech

Thailand

My name is Sittichai Sangdech.Due to I was cheating from Forex trading on Meta trade 4. Broker name is Easytrade Market Co,Ltd that use mobile phone number in Hongkong. Sequence 1) In August, I discussion with Ms. Chenyuyan by Whatapp and Line application by she used phone no. to contact with me. 2) 3-Sep-2021, I started to register the account number for trading to broker Easytrade Market and trading on Meta trader 4 application .3) 6- Sep-2021. start trading Before trading ,we have transfer money from my Account of Kasikorn bank 1782601071 to Thai people 4 accounts for passing to broker.4) But on 13-Oct-2021 , I want to withdraw money back 18,400 US. but unsuccess after over due date 5 days of working day.5) 20-Oct-21, I have already to notify to Police at Pluakdang police station , Pluakdang ,Rayong

Exposure

2021-10-29

FX1798375772

Vietnam

The first you can't withdraw money then they will delete your account even though the table has money in it.they also created many other scam company careful with pich

Exposure

2021-10-22

FX2694535387

Vietnam

Do not invest this platform. It was a scam. At first, they pretended to make profits with the $100000 of profits per order. I could withdraw the money and trust it. So I deposited more on it and withdrew it when I need. But the broker said the system went wrong and they were repairing it. I had to wait for the withdrawal. Although there was money in my account, it was under pending. The consultant told me to wait because it took a long time to communicate. But I waited for 1 month and still could not withdraw my money in mt4, while in other countries the withdrawal was normal. I applied for transferring the money to another account. But they did not approve it due to many reasons. Do not be cheated again. I lost more than $13000 on it. I never regret it.

Exposure

2021-10-20

FX2131304072

Thailand

Status keep pending approval cannot withdrawal

Exposure

2021-10-18

FX2931443797

Malaysia

Their information was fake and stolen from eightcap.

Exposure

2021-08-19

FX2931443797

Malaysia

It was a group of scammers. They asked for a large amount of margins.

Exposure

2021-08-04

FX2931443797

Malaysia

Customer service and contact numbers are all embezzled. Fraud platform.

Exposure

2021-07-31