Score

BOQ

Australia|Above 20 years|

Australia|Above 20 years| https://www.boq.com.au/

Website

Rating Index

Influence

Influence

AA

Influence index NO.1

Australia 9.32

Australia 9.32Surpassed 82.20% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

+61 1300557272

+61 7 3336 2420

Other ways of contact

Broker Information

More

Bank of Queensland Limited

BOQ

Australia

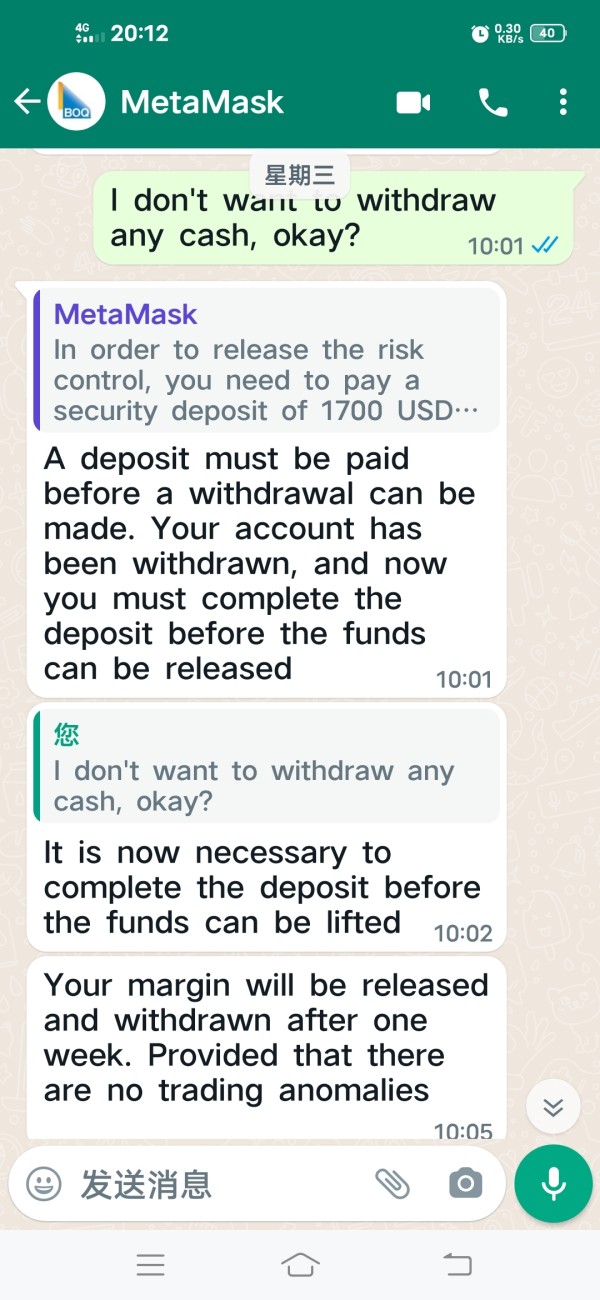

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed BOQ also viewed..

XM

GTCFX

IronFX

CPT Markets

BOQ · Company Summary

| Bank of Queensland Limited (BOQ) | Basic Information |

| Company Name | Bank of Queensland Limited (BOQ) |

| Founded | 1874 |

| Headquarters | Australia |

| Regulations | Regulated |

| Financial Services | Loans, Credit cards, International and Domestic Trade Finance services, and more |

| Account Types | Personal and Business account |

| Payment Methods | Online International Payments, In-Branch International Payments, Receiving International Payments |

| Trading Tools | Calculators |

| Customer Support | Email (customerassistanceteam@boq.com.au)Phone (1300 55 72 72) |

Overview of Bank of Queensland Limited (BOQ)

BOQ, previously named Bank of Queensland Limited, has a rich history dating back to its inception in 1874. Based in Australia, BOQ functions as a regulated financial entity. It provides a wide spectrum of financial solutions, encompassing loans, credit cards, as well as International and Domestic Trade Finance services. Serving the needs of both individuals and businesses, BOQ offers a varied selection of account types customized to meet the unique requirements of its clientele.

Is Bank of Queensland Limited (BOQ) Legit?

Bank of Queensland Limited (BOQ) is regulated, operating within a regulated framework overseen by the Australian Securities and Investments Commission (ASIC). Holding a full license issued by ASIC under regulatory number 244616, BOQ adheres to stringent regulatory standards. Regulation by ASIC ensures that BOQ conducts its operations in compliance with established laws and regulations, offering investors essential protections. Regulatory oversight helps mitigate the risk of fraudulent activities, fostering a safer trading environment. However, it's important for traders to recognize that while regulation provides oversight and accountability, it doesn't eliminate all risks associated with online trading. Therefore, maintaining vigilance and exercising caution remain imperative for traders engaging in financial markets.

Pros and Cons

Bank of Queensland Limited (BOQ) presents a compelling proposition for customers with its diverse range of account types, catering to different financial needs and preferences. However, one drawback is the limited payment methods available, which may inconvenience some users. Nevertheless, BOQ operates under the regulatory oversight of the Australian Securities and Investments Commission (ASIC), ensuring adherence to stringent standards and providing a sense of security for customers. On the downside, there is a lack of clarity regarding spreads and commissions, potentially causing uncertainty for traders. Despite this, BOQ offers various customer support channels, enhancing accessibility and responsiveness for resolving inquiries and issues efficiently.

| Pros | Cons |

|

|

|

|

|

Financial Services

Bank of Queensland Limited (BOQ) provides a diverse range of financial services tailored for both individuals and businesses.

For individuals, BOQ offers banking and saving solutions, home loans, credit cards, personal loans, car loans, and various insurance options including Home and Contents Insurance, Landlord Insurance, and car insurance.

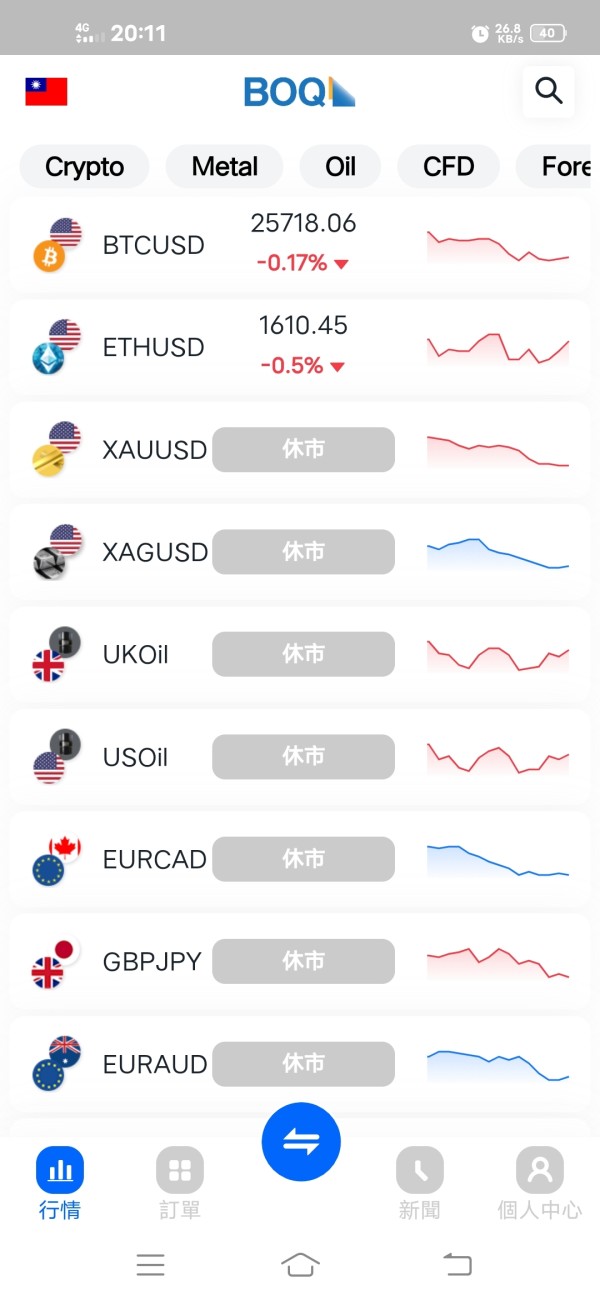

For businesses, BOQ provides business loans, bank accounts, Foreign Exchange Risk Management solutions, Currency Accounts and Deposits, as well as International and Domestic Trade Finance services. Additionally, BOQ SmartFX offers trading in 12 currencies including AUD, USD, CAD, EUR, CHF, JPY, NZD, GBP, HKD, SGD, THB, and ZAR.

Account Types

BOQ offers a range of account types to meet the diverse personal and business banking needs of its customers.

Personal Accounts:

Everyday Account: Designed for everyday use, this account enables customers to make payments and transactions in real-time. It provides easy management of finances and allows users to set spending budgets for specific categories such as groceries and bills.

Savings Accounts: BOQ offers various savings accounts tailored to different age groups and financial goals:

Future Saver Account: Geared towards individuals aged 14 to 35, this high-interest savings account encourages young savers to build their savings for the future.

Smart Saver Account: Specifically designed for customers aged 36 years and older, this account offers competitive interest rates to help grow savings effectively.

Kids Savings Account: Introduces children under 14 to the concept of saving and money management, fostering financial literacy from a young age.

Term Deposit Account: BOQ's Term Deposit account is ideal for customers looking to earn higher interest rates on their savings over a fixed term. It rewards customers with attractive interest rates on balances over $5,000, providing a secure avenue for growing savings.

Business Accounts:

Everyday Business Account:

Offers free branch, ATM, and cheque deposits.

Provides free Direct Debits and Direct Credits.

Enables easy account access through ATM/EFTPOS, Internet, and Mobile Banking.

Business WebSavings Account:

No monthly account maintenance fee.

Interest is calculated daily and paid monthly.

Offers unlimited free online BPAY payments.

Minimum opening deposit: $1.

Superannuation Savings Account:

No monthly account maintenance fee.

Interest is calculated daily and paid monthly.

Provides unlimited free online BPAY payments.

Minimum opening deposit: $1.

Term Deposit:

No account keeping or transaction fees.

Offers competitive term deposit interest rates.

Customers can choose how and when to receive interest payments.

Minimum opening deposit: $1,000.

Business Performance Saver:

Enables business customers to earn an ongoing, competitive interest rate on their savings.

Rewards customers for using their linked Everyday Business Account.

In addition to these accounts, BOQ offers foreign currency accounts for business customers dealing regularly in foreign currencies. These accounts assist in managing cash flows and reducing costs associated with intermediary bank fees and unnecessary conversions.

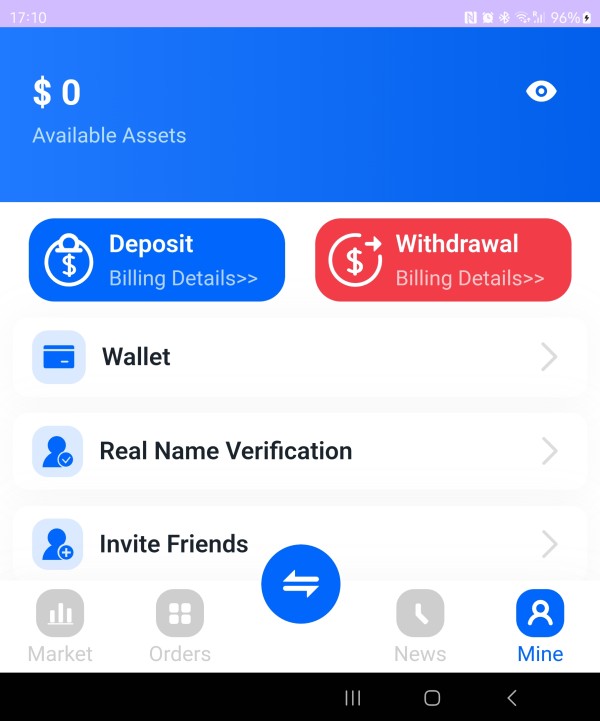

Deposit & Withdraw Methods

BOQ offers multiple payment methods to facilitate both domestic and international transactions:

Online International Payments: Customers can conveniently initiate international transfers through BOQ's internet banking platform.

In-Branch International Payments: For those preferring face-to-face interactions or needing assistance with international payments, BOQ branches provide the option to process international transactions with the help of bank staff.

Receiving International Payments: When receiving funds from an overseas bank account into a BOQ account, customers need to provide the SWIFT or BIC code to the sender. BOQ's unique SWIFT/BIC code is QBANAU4B.

Trading Tools

BOQ offers a suite of trading tools to cater to diverse financial needs. These include Home Loan Tools and Calculators, Personal Loan Calculators, Savings and Investment Calculators, and Travel Money Rates and Calculator.

Customer Support

BOQ offers comprehensive and accessible customer support through various channels:

General Enquiries:

Phone: 1300 55 72 72

Hours: 8am – 8pm Monday – Friday AEDT; 9am – 5pm Saturday AEDT

Calling Internationally:

Phone: +61 7 3336 2420

myBOQ Mobile App Support:

Phone: 1300 737 766

Hours: 8am – 8pm Monday – Friday AEDT; 9am – 5pm Saturday AEDT (excluding public holidays)

BOQ Finance Enquiries:

Phone: 1800 245 614

Hours: Monday - Friday 8am - 5pm AEST excluding National Public Holidays

BOQ Specialist Enquiries:

Phone: 1300 160 160

Hours: Monday - Friday 8am - 8pm & Saturday 9am - 5pm AEDT excluding Public Holidays

Financial Difficulty Assistance and Natural Disaster Support:

Phone: 1800 079 866

Email: customerassistanceteam@boq.com.au

Hours: 8.30am - 5pm, Monday to Friday (AEDT)

Feedback and Complaints:

Phone: 1300 55 72 72

Conclusion

In conclusion, Bank of Queensland Limited (BOQ) offers a compelling array of account types, accommodating diverse financial needs and preferences. The limited payment methods, however, may pose inconvenience to some users. Yet, BOQ operates under the regulatory oversight of the Australian Securities and Investments Commission (ASIC), ensuring adherence to rigorous standards and fostering customer trust. Nevertheless, the lack of clarity surrounding spreads and commissions may introduce uncertainty for traders. Despite these challenges, BOQ provides multiple customer support channels, enhancing accessibility and responsiveness in addressing inquiries and concerns promptly. Traders should approach BOQ with caution, conducting thorough research to mitigate potential risks and ensure a secure trading experience.

FAQs

Q: Is Bank of Queensland Limited (BOQ) regulated?

A: Yes, Bank of Queensland Limited (BOQ) operates within a regulated framework overseen by the Australian Securities and Investments Commission (ASIC). Holding a full license issued by ASIC under regulatory number 244616, BOQ adheres to stringent regulatory standards.

Q: What financial services are available at Bank of Queensland Limited (BOQ)?

A: Bank of Queensland Limited (BOQ) offers a diverse range of financial services for individuals and businesses, including banking and saving solutions, home loans, credit cards, personal loans, car loans, insurance options, business loans, bank accounts, Foreign Exchange Risk Management solutions, Currency Accounts and Deposits, International and Domestic Trade Finance services, and trading in 12 currencies through BOQ SmartFX.

Q: What account types does Bank of Queensland Limited (BOQ) offer?

A: Bank of Queensland Limited (BOQ) provides various personal and business account types to meet different banking needs.

Q: How can I contact Bank of Queensland Limited (BOQ)'s customer support?

A: You can reach Bank of Queensland Limited (BOQ)'s customer support primarily through phone at 1300 55 72 72 during the hours of 8am – 8pm Monday – Friday AEDT and 9am – 5pm Saturday AEDT. For international inquiries, you can call +61 7 3336 2420.

Review 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now