Score

GFS

Hong Kong|5-10 years|

Hong Kong|5-10 years| https://gfs-markets.com/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

Japan

JapanContact

Licenses

Licenses

Licensed Institution:GLOBAL FEMIC SERVICES PTY LTD

License No.:001305989

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 15 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

Hong Kong

Hong KongAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed GFS also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IronFX

- 15-20 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

gfs-markets.co

Server Location

United States

Website Domain Name

gfs-markets.co

Server IP

104.21.9.225

gfsmarkets.co

Server Location

United States

Website Domain Name

gfsmarkets.co

Server IP

104.21.65.53

gfsmarkets.com

Server Location

United States

Website Domain Name

gfsmarkets.com

Server IP

172.67.136.68

Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| GFS Review Summary in 10 Points | |

| Founded | 2013 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Market Instruments | Forex, CFDs, stocks, cryptocurrencies, indices |

| Demo Account | N/A |

| Leverage | 1:500 |

| EUR/USD Spread | From 0.8 points |

| Trading Platform | MT5, Webtrader |

| Minimum Deposit | N/A |

| Customer Support | 24/5 online messaging, phone, email |

What is GFS?

GFS is an ASIC - regulated online forex broker that was established in 2013, offering trading on a wide range of trading instruments, including forex, CFDs, stocks, cryptocurrencies, and indices through the MetaTrader5 platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Regulated by ASIC | • Regional restrictions |

| • Wide range of trading instruments offered | • No info on accounts and commissions |

| • Spreads as low as 0.8 points on more than 60 currency pairs | • Limited info on deposit/withdrawal |

| • MT5 supported | |

| • 24/5 multi-channel support |

GFS Alternative Brokers

There are many alternative brokers to GFS depending on the specific needs and preferences of the trader. Some popular options include:

Swissquote: a reliable and established broker with a wide range of trading instruments and tight spreads.

Exness: a broker with a wide range of account types and leverage options.

LiteForex: a broker with a user-friendly platform and low fees.

Here is a more detailed comparison of the three brokers:

| Feature | GFS | Swissquote | Exness | LiteForex |

| Regulation | ASIC | FCA, MFSA, FINMA, DFSA | CySEC, FCA, FSCA | CySEC |

| Trading instruments | Forex, CFDs, stocks, cryptocurrencies, indices | Forex, CFDs, stocks, ETFs, bonds, indices | Forex, CFDs, stocks, cryptocurrencies, indices | |

| EUR/USD Spread | From 0.8 points | Average 0.2 pips | Average 0.1 pips | Average 0.3 pips |

| Leverage | 1:500 | 1:30 for retail | 1:888 for professional | 1:30 for retail |

| Account types | N/A | Standard, Pro, VIP | Standard, Raw Spread, Zero Spread, Pro, Expert | Standard, ECN, Zero, Cent |

| Fees | N/A | Deposit fees of 1% for credit/debit cards, 0% for bank transfers | No deposit fees | |

| Platforms | MetaTrader5, Webtrader | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | |

| Customer support | 24/5 online messaging, phone, and email | 24/5live chat, phone, and email | ||

Ultimately, the best broker for you will depend on your individual needs and preferences. It is important to do your own research and compare different brokers before making a decision.

Is GFS Safe or Scam?

GFS is a forex broker that is regulated by the Australian Securities & Investments Commission (ASIC, No. 001299400). ASIC is a reputable financial authority that sets high standards for its regulated brokers. This means that GFS is required to comply with a number of regulations designed to protect its customers, such as:

Keeping client funds segregated from company funds

Providing fair and transparent trading conditions

Having adequate financial resources to meet its obligations to its customers

However, being regulated by ASIC does not guarantee that GFS is a safe broker. There have been cases of ASIC-regulated brokers engaging in fraudulent or unethical practices. It is important to do your own research before opening an account with any broker, regardless of its regulation.

If you are concerned about the safety of GFS, you can contact the ASIC to ask questions or file a complaint. You can also contact other regulatory authorities, such as the Financial Conduct Authority (FCA) in the United Kingdom or the Commodity Futures Trading Commission (CFTC) in the United States.

Ultimately, the decision of whether or not to open an account with GFS is up to you. If you are comfortable with the risks involved and you think the broker's features and offerings are a good fit for your trading needs, then you may want to consider opening an account. However, if you are not sure, it is always best to do more research and compare GFS to other brokers before making a decision.

Market Instruments

GFS offers a wide range of trading instruments, including:

Forex: GFS offers over 100 currency pairs to trade, including major, minor, and exotic pairs.

Stocks: GFS offers trading in stocks from over 20 stock exchanges around the world, including the New York Stock Exchange (NYSE), the London Stock Exchange (LSE), and the Tokyo Stock Exchange (TSE).

Cryptocurrencies: GFS offers trading in over 20 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Indices: GFS offers trading in indices from over 10 different countries, including the S&P 500, the Dow Jones Industrial Average, and the Nikkei 225.

Commodities: GFS offers trading in commodities, such as gold, silver, oil, and natural gas.

Leverage

Leverage is a financial tool that allows traders to control a larger position than they would be able to with their own capital. This is done by borrowing money from the broker to fund the trade.

GFS offers a maximum leverage of 1:500. This means that for every $1 you deposit, you can control a position worth $500. For example, if you deposit $100 and trade EUR/USD with a leverage of 1:500, you will be able to control a position worth $50,000.

Leverage can magnify your profits, but it can also magnify your losses. If the market moves against you, you could lose more money than you deposited. It is important to use leverage carefully and to understand the risks involved before using it.

Spreads & Commissions

GFS offers spreads as low as 0.8 points on more than 60 currency pairs. This means that for every $100 you trade, you will pay a spread of $0.8. For example, if you trade EUR/USD with a spread of 0.8 points, you will pay $0.8 when you open the trade and $0.8 when you close the trade. However, GFS does not reveal any info on commissions.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| GFS | 0.8 pips | N/A |

| Swissquote | 0.2 pips | 0.1% |

| Exness | 0.1 pips | $2 per lot |

| LiteForex | 0.3 pips | $6 per lot |

It is important to note that these spreads are subject to change. You should always check the broker's website for the most up-to-date information.

Trading Platforms

GFS offers MetaTrader 5 (MT5) as its trading platform. MT5 is a popular platform that is used by millions of traders around the world. It offers a wide range of features and tools, including:

Real-time market data: MT5 provides real-time market data for all of the major trading instruments.

Charting tools: MT5 offers a wide range of charting tools, including technical indicators, drawing tools, and backtesting capabilities.

Order execution: MT5 offers a variety of order execution methods, including market orders, limit orders, and stop-loss orders.

Risk management tools: MT5 offers a variety of risk management tools, such as stop-losses and trailing stops.

Automated trading: MT5 allows traders to automate their trading strategies using Expert Advisors (EAs).

See the trading platform comparison table below:

| Broker | Trading Platform |

| GFS | MetaTrader5, Webtrader |

| Swissquote | MetaTrader4, MetaTrader5, cTrader |

| Exness | MetaTrader4, MetaTrader5 |

| LiteForex | MetaTrader4, MetaTrader5 |

As you can see, all four brokers offer MetaTrader4 and MetaTrader5 as their trading platforms. MetaTrader4 and MetaTrader5 are the most popular trading platforms in the world, and they offer a wide range of features and tools for traders.

Swissquote also offers cTrader, which is a newer trading platform that offers some unique features, such as a built-in charting tool and a market maker-free execution model.

GFS and LiteForex only offer MetaTrader4 and MetaTrader5, but they both offer web-based trading platforms that can be accessed from any computer with an internet connection.

Ultimately, the best trading platform for you will depend on your individual needs and preferences. If you are familiar with MetaTrader4 or MetaTrader5, then any of the four brokers would be a good option. If you are looking for a newer trading platform with unique features, then Swissquote may be a better choice.

Trading Tools

GFS provides a range of trading tools to assist its customers in making informed investment decisions. One of the notable tools offered by GFS is an Economic Calendar. This calendar compiles and displays key economic events, such as central bank meetings, economic data releases, and other significant financial indicators. The Economic Calendar helps traders stay updated on important events that can impact the financial markets, allowing them to anticipate potential market movements and adjust their trading strategies accordingly. By providing this tool, GFS empowers its customers with valuable information to make well-informed trading decisions based on the latest economic developments.

Deposits & Withdrawals

GFS does not specify deposit and withdrawal, but from the logos at the foot of the home page, we found that GFS appears to accept a variety of deposit and withdrawal methods, including:

Credit/debit cards: GFS accepts MasterCard and Visa.

E-wallets: GFS accepts Skrill, Neteller, and UnionPay.

Bank transfer: GFS accepts bank transfers in a variety of currencies.

GFS minimum deposit vs other brokers

| GFS | Most other | |

| Minimum Deposit | N/A | $100 |

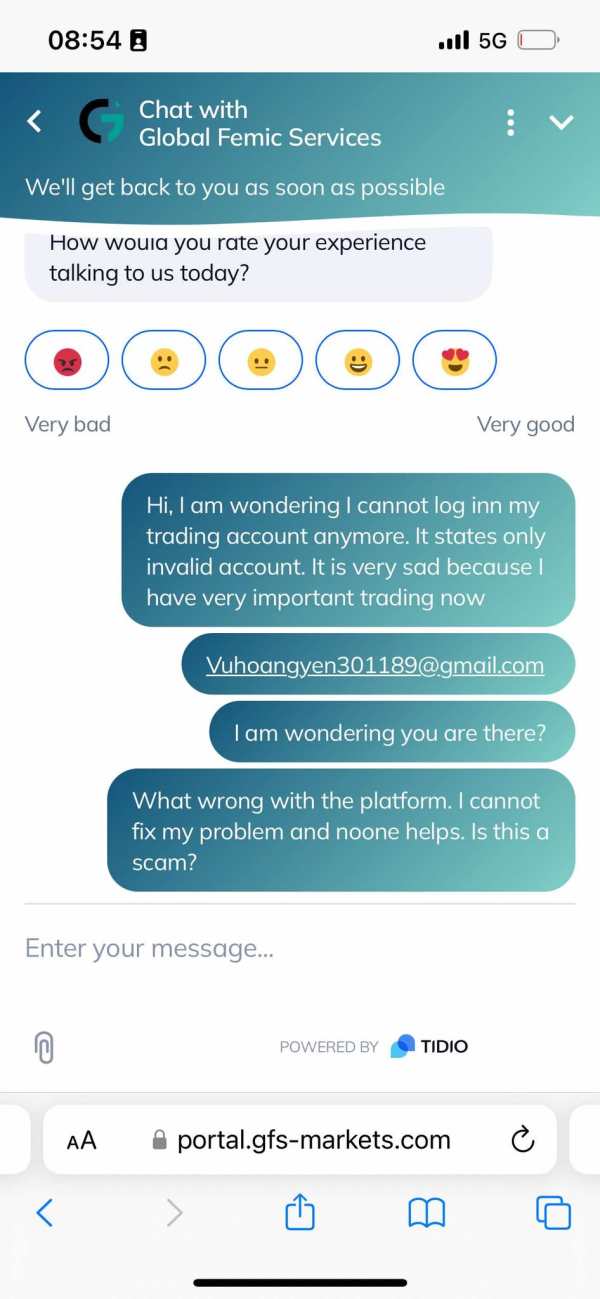

Customer Service

The customer service of GFS is designed to provide convenient and accessible support to its customers. With a 24/5 availability, customers can reach out to GFS for assistance through various channels. They can engage in online messaging, where they can communicate with a representative in real-time, ensuring quick and efficient responses to their queries or concerns. Additionally, customers can contact GFS through the provided phone number, +41 77 226 63 93, allowing for direct and personalized assistance. For those who prefer written communication, GFS offers an email address, cs@gfsmarkets.co, where customers can send their inquiries or feedback.

To further assist customers, GFS also provides an FAQ section, which likely contains answers to commonly asked questions, enabling users to find information independently. Overall, GFS customer service aims to provide reliable and responsive support, catering to the needs of its clients.

| Pros | Cons |

| • 24/5 availability | • No 24/7 support |

| • Multiple contact ways | • No live chat support |

| • FAQ section offered | • No social media presence |

Note: These pros and cons are subjective and may vary depending on the individual's experience with GFS's customer service.

Conclusion

GFS is a regulated broker that offers a wide range of trading instruments through the leading MT5 platform. However, it's always a good idea to conduct your own research, read customer reviews, and consider multiple sources of information before making any decisions or forming opinions about a financial service provider.

Frequently Asked Questions (FAQs)

| Q 1: | Is GFS regulated? |

| A 1: | Yes. It is regulated by Australia Securities & Investment Commission (ASIC, No. 001299400). |

| Q 2: | At GFS, are there any regional restrictions for traders? |

| A 2: | Yes. The information on this site is not directed at residents of the United States, Belgium, North Korea or any particular country outside the Hong Kong and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. |

| Q 3: | Does GFS offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT5 for Windows, Android, MacOS, iOS andWeb Trader. |

| Q 4: | Is GFS a good broker for beginners? |

| A 4: | No. It is not a good choice for beginners. Though it is regulated well and offers the leading MT5 trading platform, it lacks transparency in trading conditions. |

Keywords

- 5-10 years

- Regulated in Australia

- Appointed Representative(AR)

- MT5 Full License

- Regional Brokers

- High potential risk

News

Review Quick Hits from Today's Markets

In yesterdays session, GOLD saw a promising recovery, closing above the critical level of 2643.644. This movement signals a likely continuation of the bullish trend, bolstered by exaggerated RSI l

2025-01-08 12:41

Review Today's Top News

Rate Cuts on the Horizon: A Comprehensive Market Update Asian stock markets and the U.S. dollar paused on Wednesday as investors awaited pivotal U.S. inflation data and a potential rate c

2024-12-11 13:20

Review Market Pulse: Today's Top Headlines

Market Overview U.S. economic data released yesterday signaled continued resilience in the labor market. The JOLTS job openings report showed a robust 7.74 million openings, exceeding exp

2024-12-04 12:30

Review Today's Market Movers

Market Overview Australian wage growth holds steady at 0.8%, falling short of the forecasted uptick. Attention now turns to tonights inflation report from the FED, which could shift expec

2024-11-13 11:23

Review Today's Must-Know Market Updates

Whats at Stake for Traders this Election Day Election day is here, and traders are on edge about what a “Trump Trade” could mean. Many expect a Trump victory, feeling it would bring a mor

2024-11-06 11:06

Review Key Economic Indicators: What to Watch Today

Market Analysis:GOLD: After weeks of stability, GOLD has broken out of its range, driven by reduced expectations for a 50-point Fed rate cut. Investors now anticipate a 25-basis-point cut, reflecting

2024-10-09 12:07

Review 31

Content you want to comment

Please enter...

Review 31

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX3342677107

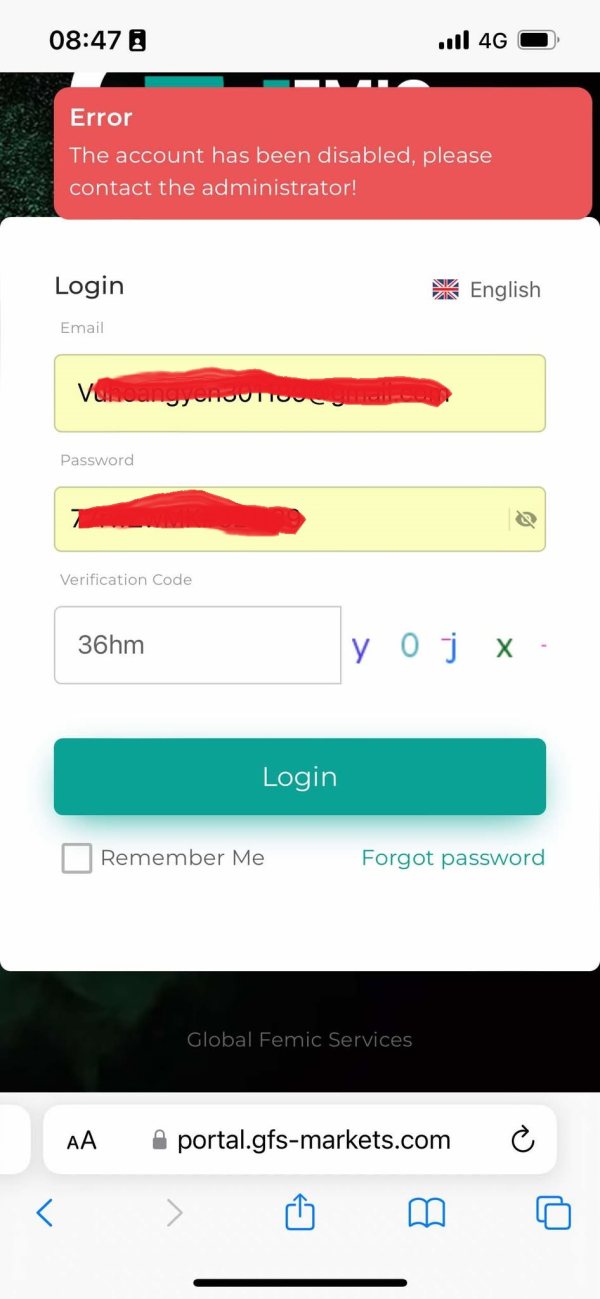

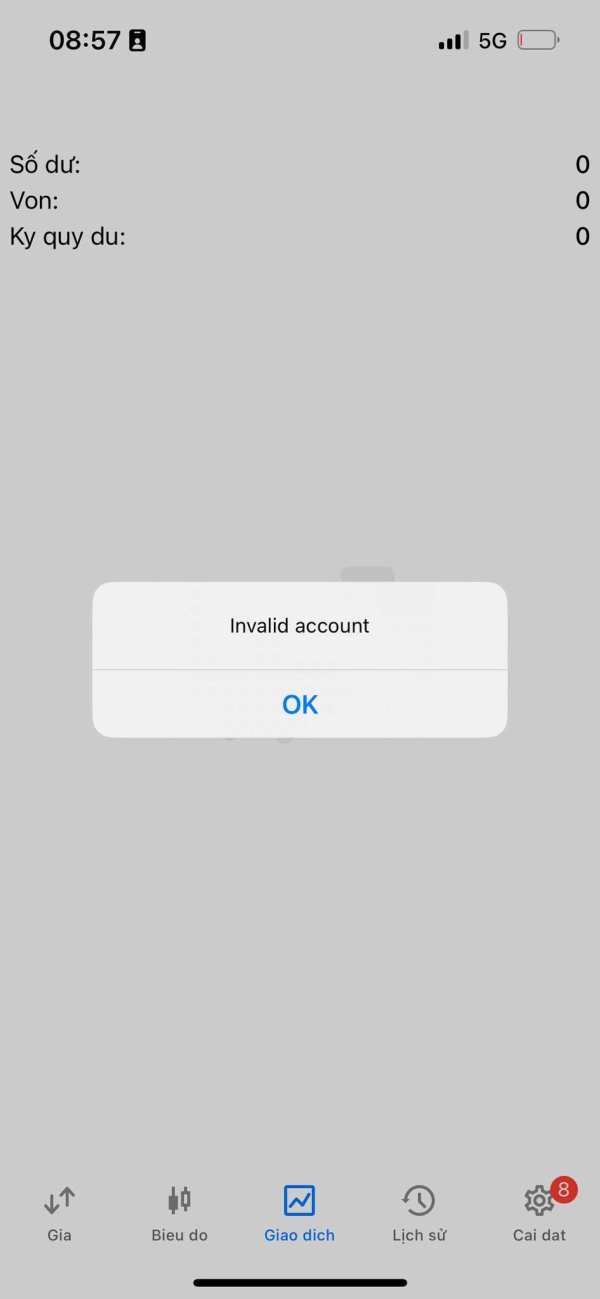

Norway

They deleted and deactived my account after I tried to connect again to Metatrader 5 and contact them. I tried to ask the customer service and they did not answer. Then, I sendt the messenger angrily and them if the platform was a scam, and the day after they locked and deactived my account without any message and comfirmation. I have lost all money invested in such a stupid, , greedy and dirty platform. Please never ever invest your money in this shit.

Exposure

In a week

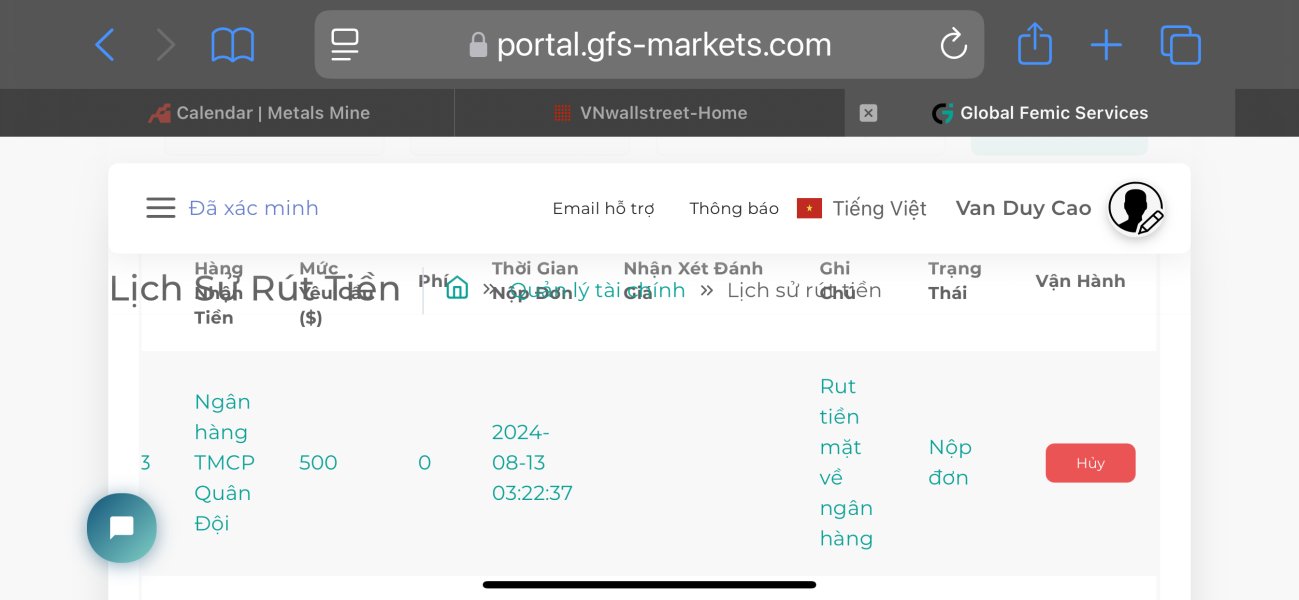

FX4260779925

Vietnam

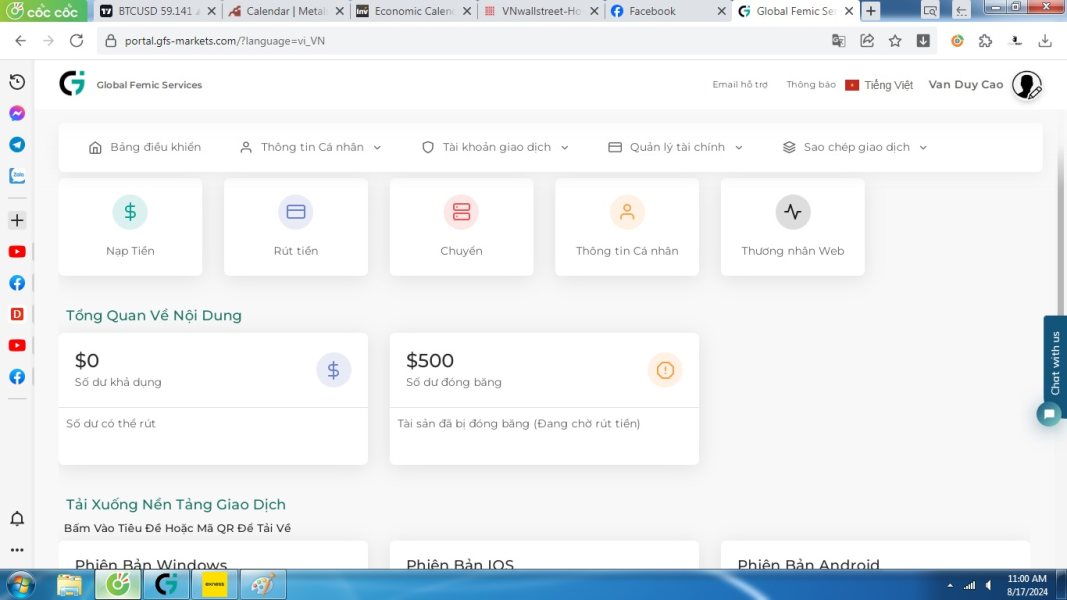

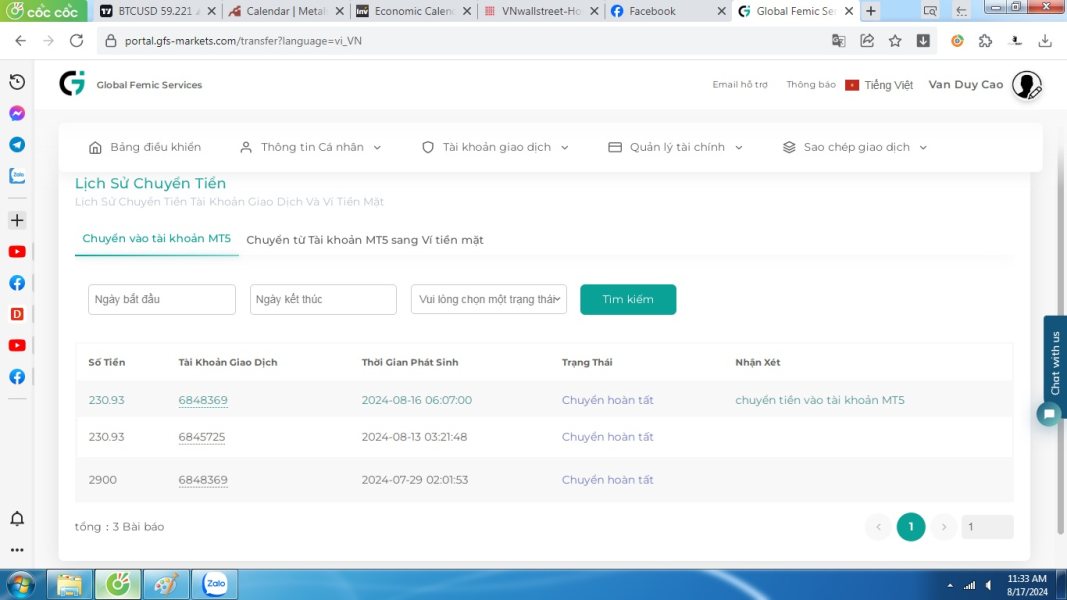

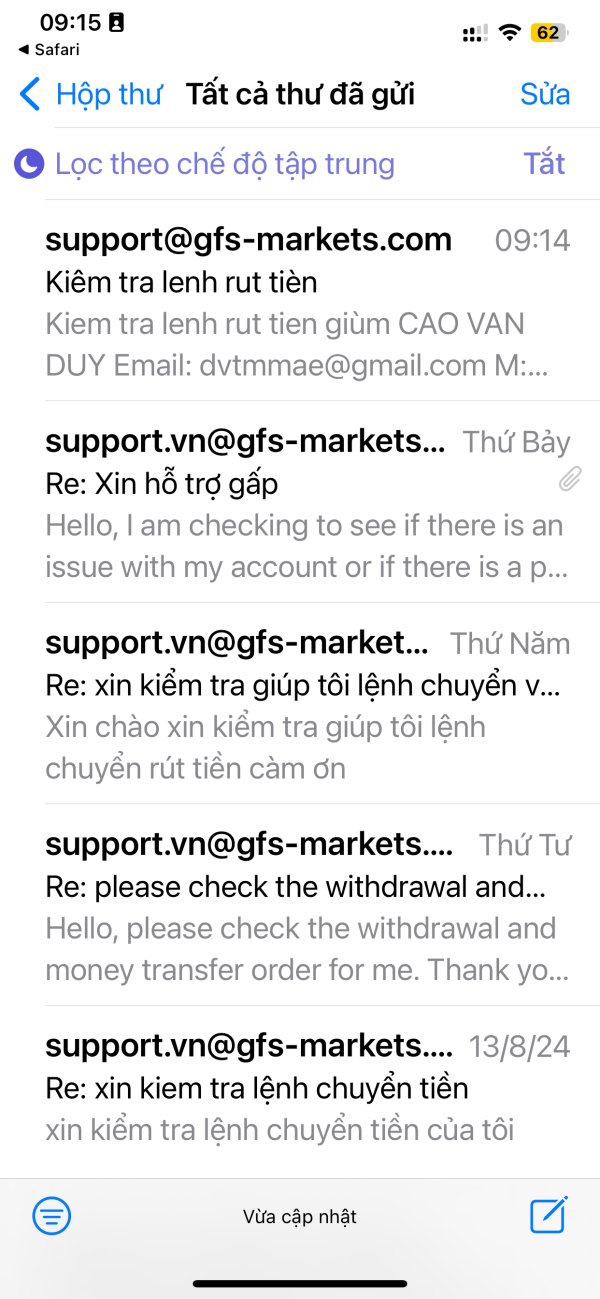

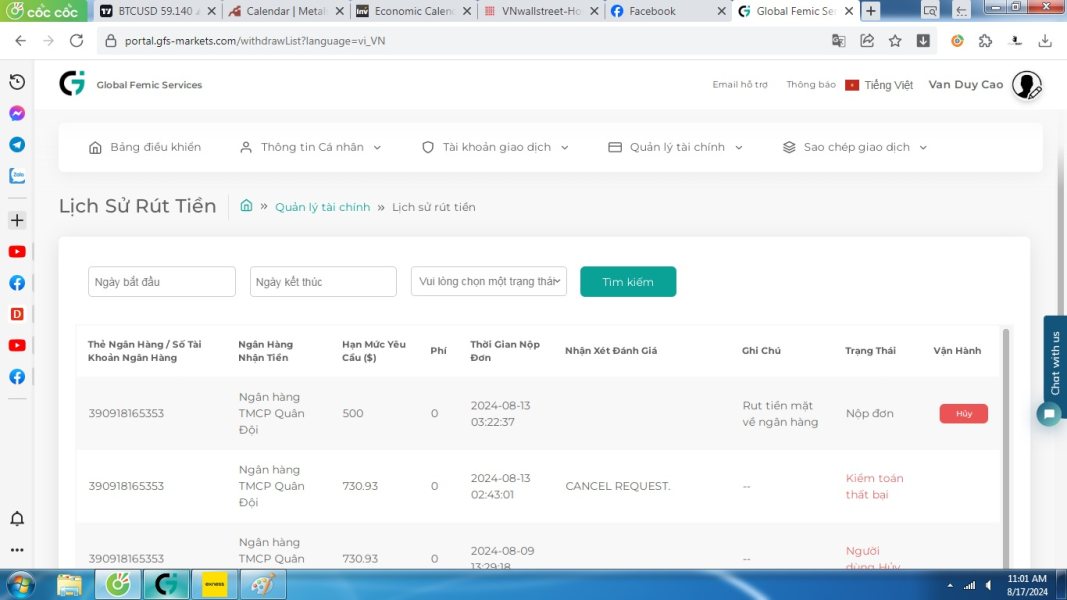

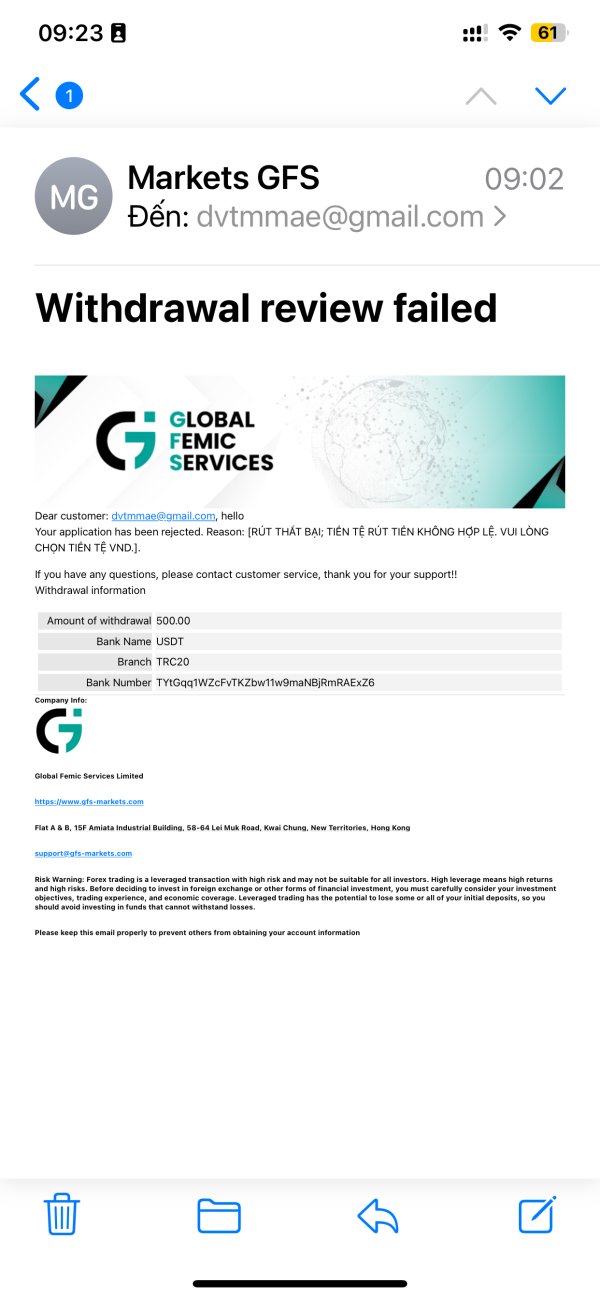

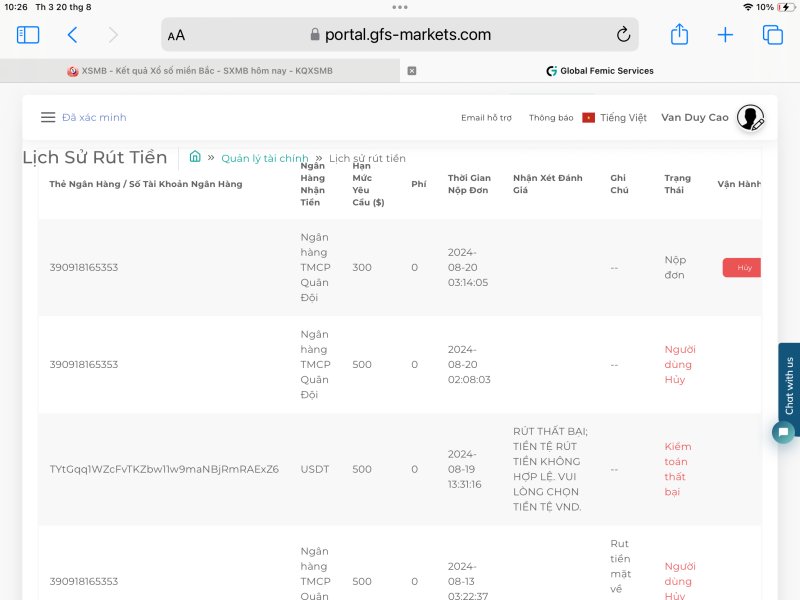

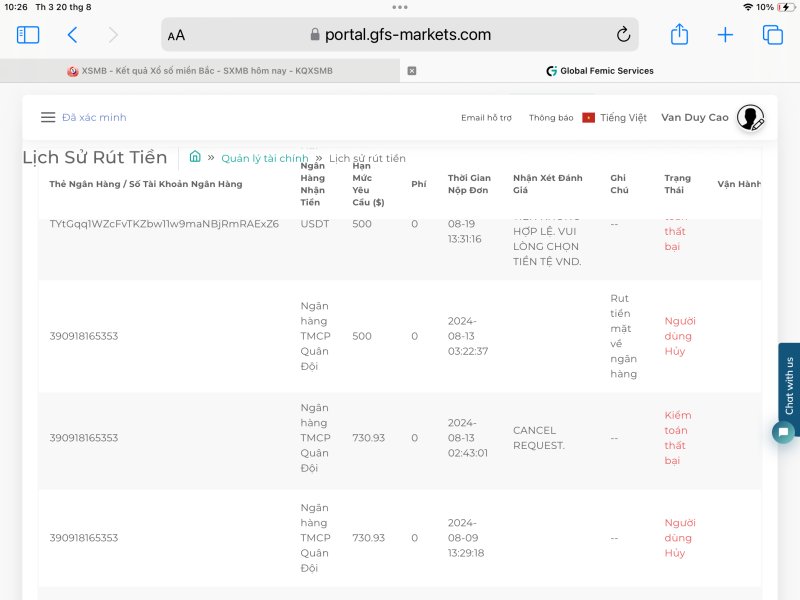

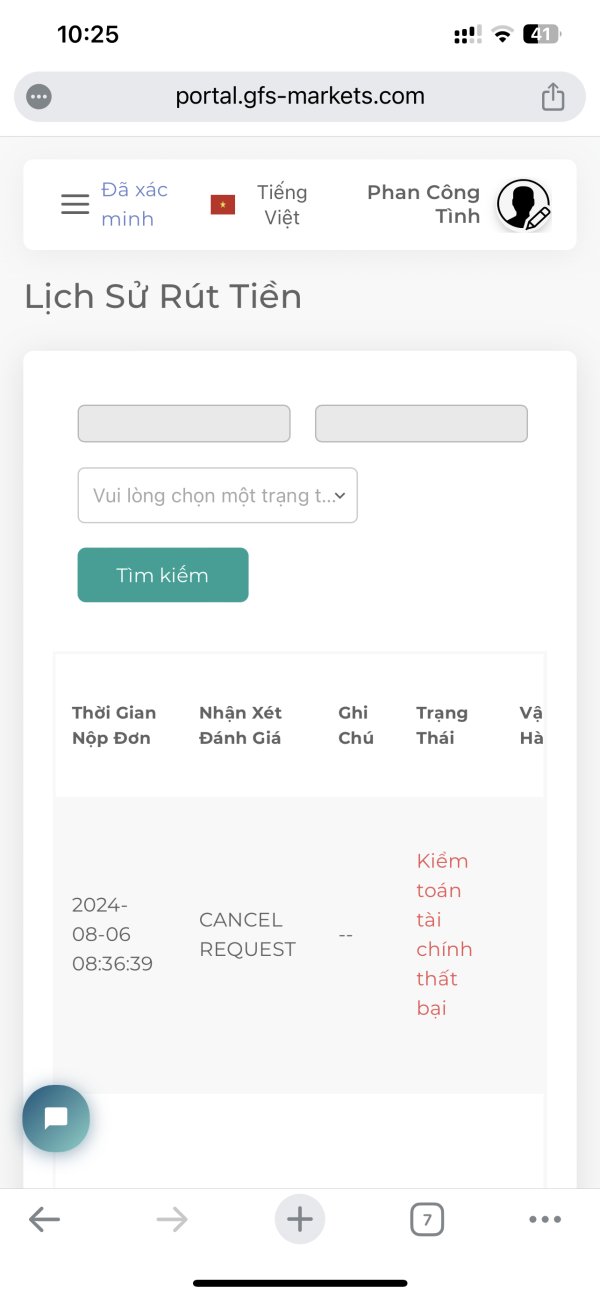

I cannot withdraw money to my bank account

Exposure

2024-08-30

FX7213252192

Vietnam

Confirmation information: Money can be withdrawn within 24 hours, but withdrawal orders made 7 days ago have not been processed yet.

Exposure

2024-08-20

你娃叼哟

Hong Kong

The scam company attracts people through stocks, hold competitions, launch foreign exchange to let people open accounts and deposit funds in order to charge high fees.

Exposure

2024-08-11

FX3363011055

Vietnam

Withdrawals are not allowed

Exposure

2024-08-11

FX7213252192

Vietnam

Scam exchange does not allow withdrawal, closes customers' accounts

Exposure

2024-07-31

小溪1339

Hong Kong

They have cooperation with GFS, in order to earn cash back, they pretend to be the champion of the election, and let fans vote for themselves. In the end, it's not really for the championship, but to lure everyone into foreign exchange. People who have no experience are also attracted by the impressive profits. However, the spread of this foreign exchange platform is unusually high, with a spread of up to 7 pips for GBP/USD, plus a commission of $50 per lot. Just think about it, it's disgusting! Isn't this sucking the blood of fans? I realized it too late, sigh! It's hard to guard against these things nowadays!

Exposure

2024-07-24

补

Hong Kong

I joined a group through their gang members. They organized a CITIC competition and held training classes, directing us to buy and sell in the group solely to earn high commission fees and slippage. The commission fee per lot was as high as fifty US dollars, with spreads of sixty to seventy points. They called for trades every day, resulting in daily stop-losses, and within less than two weeks, I had lost a significant amount of money. Just from commission fees alone, I paid $5,700, not including the spread, which means each lot I bought was already at a 12-point loss from the start. I suspect GFS is in collusion with them. Many people in the group suffered heavy losses or even had their accounts liquidated. I even doubt that my trades were actually placed in the market; it seems they set us up to lose money. From an initial 100,000 RMB, I'm left with only 10,000 RMB after following their trading calls, which mostly resulted in us being stopped out.

Exposure

2024-05-31

补

Hong Kong

I was deceived into opening an account with GFS after joining a group; I had never dealt with forex before. The group leaders Qingyun, Jingcheng, Jianghe, and GFS collaborated in the scam, extracting high commission fees and large spreads from transactions.

Exposure

2024-05-31

thanhduong

Vietnam

I can't withdraw money from the exchange. Please check for me. I sent email many times but the response was always to wait.

Exposure

2024-05-24

PATZIR419

Bolivia

Ah I had homework and that platform https://skillsyncr.top/ bad fraud tax payment was Financial Department. My bank does not want to return and said it's frozen.

Exposure

2024-04-02

jibbong

South Korea

Test results were normal for all exchanges with official licenses, but GFS did not move and there were no servers connected.

Exposure

2024-03-29

Bùi Thị Đào

Vietnam

I lost all orders closed on February 28 and February 29. I lost all the money in the account and cannot be withdrawn.

Exposure

2024-02-29

韩小姐

Hong Kong

Agents of GFS induce and defraud investors by holding training classes through competitions and other methods. They call for orders multiple times in the group to get us to buy and sell heavy positions. For example, with a principal of 10,000 US dollars, we are asked to buy ten lots at a time. The purpose is to charge a high handling fee when we liquidate the position. A handling fee of fifty US dollars per lot, a spread of 0.07 basis points (basis point = 1.2600/1.26070), a total of 12 basis points, and even a high exchange rate, such as the exchange rate of 7.21 for today's withdrawal, but the 7.07 settlement instead. Most investors suffered heavy losses. I lost a total of more than 60,000 US dollars in spreads and handling fees. I reported the matter to the GFS headquarters and hoped that it would be dealt with, but he replied to me that they complied with the regulatory requirements of the Australian Securities Regulatory Commission. The handling fee of 50 US dollars and the slippage of 0.07 are both legal. They cover up their agents and work with the agents to harm the interests of investors. They also disregard the company's reputation and disrupt the entire foreign exchange trading market. Currently, many friends in the group have suffered heavy losses and are still being deceived. They are exposing this company, claiming it is not a formal company at all. It is a company that purely deceives investors in the foreign exchange market and does not adhere to integrity and moral bottom lines. Investors around the world must see clearly the true face of this company and keep from being deceived by this company and its agents. Because every investor who opens an account with this company will eventually be liquidated or suffer serious losses, all due to handling fees.

Exposure

2024-02-12

Le tuấn anh4627

Vietnam

If you request to withdraw profits for more than a week and have not received enough lots to withdraw, you must pay a fine

Exposure

2024-02-08

前程似锦602

Hong Kong

GFS did not allow to withdraw profits, let alone principal. I suspect that the GFS platform is a group of fraud groups in northern Myanmar conducting online fraud in China. And I would like to remind you to stay away from the GFS platform.

Exposure

2023-12-15

前程似锦602

Hong Kong

GFS foreign exchange platform is an extremely bad online fraud group. GFS allows customers to deposit money but will not allow customers to withdraw money. I hope everyone will stay away from this GFS platform and don’t be deceived. I am a victim. My principal was defrauded, and now the trading account has been frozen, and the fund backend has also been frozen, and the principal will not be given. The GFS platform is an online fraud group.

Exposure

2023-12-14

前程似锦602

Hong Kong

GFSthe foreign exchange platform is an extremely vicious online fraud group. this GFS foreign exchange platforms refer to vile fraudulent companies that allow customers to deposit money but will not allow them to withdraw money. i hope everyone will see this. GFS stay away from the platform and don’t be deceived. i am a victim and i was defrauded of my principal. now my trading account has been frozen and my capital background has also been frozen. i can’t withdraw my profit of more than 7,000 us dollars, and i won’t let go of my principal. GFS the platform is an out-and-out online fraud group.

Exposure

2023-12-13

前程似锦602

Hong Kong

The GFS platform is an online fraud group that specializes in defrauding customers' funds, not giving away profits, let alone principal, and freezing trading accounts at will.

Exposure

2023-12-12

前程似锦602

Hong Kong

I made a profit of US$7,000 from trading on the GFS platform last month. Now my trading account was suddenly frozen without notifying me. I still have orders in my trading account. The account is frozen and I am unable to close my position. The fund backend has also been frozen, and now even the principal is not allowed to be withdrawn. This platform is hereby exposed as a fraud group. Everyone, be careful not to be defrauded of our hard-earned money by GFS in the name of foreign exchange transactions. The GFS platform only allows customers to lose money. It is a platform that does not allow withdrawals and even takes away the principal. Please stay away from this fraudulent platform.

Exposure

2023-12-11