Score

Oinvest

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.oinvest.com/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Singapore 2.39

Singapore 2.39Surpassed 15.30% brokers

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+44 2035196460

+66 23284742

+7 4950494260

Other ways of contact

Broker Information

More

Aronex Corporation LTD.

Oinvest

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

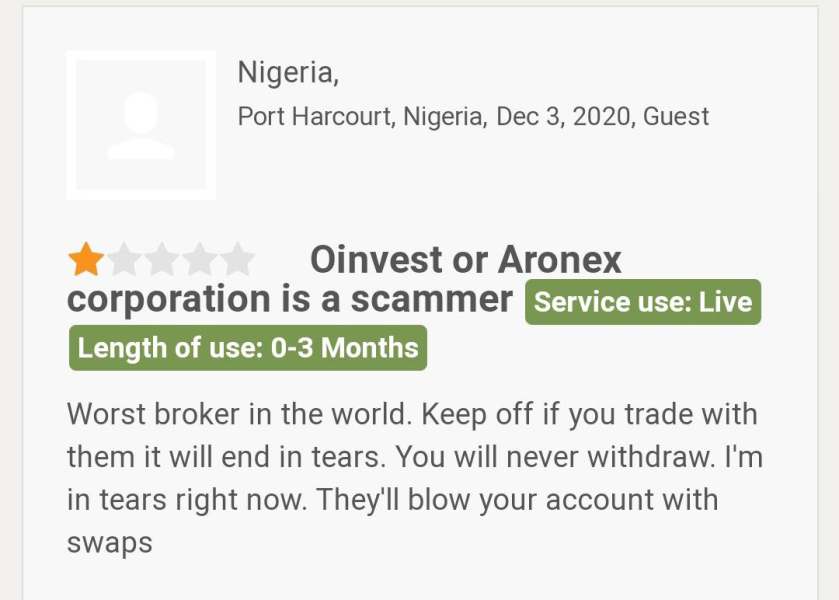

- The number of the complaints received by WikiFX have reached 7 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | FX 1:200;Gold & Silver (Metals) 1:50;Indices 1:50;Commodities 1:50;Stocks / Equities 1:20 |

| Minimum Deposit | -- |

| Minimum Spread | EUR/USD 2.2;GBP/USD 2.8;USD/JPY 2.3;AUD/USD 2.8;USD/CHF 2.6;USD/CAD 2.9;NZD/USD 3.1;EUR/GBP 2.6;Gold 0.59;Crude Oil 0.07;Dax 2 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | FX 1:400;Gold & Silver (Metals) 1:100;Indices 1:100;Commodities 1:100;Stocks / Equities 1:40 |

| Minimum Deposit | -- |

| Minimum Spread | EUR/USD 1.3;GBP/USD 2;USD/JPY 1.5;AUD/USD 1.8;USD/CHF 1.6;USD/CAD 1.9;NZD/USD 2.1;EUR/GBP 1.6;Gold 0.48; Crude Oil 0.05;Dax 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | FX 1:400;Gold & Silver (Metals) 1:125;Indices 1:125;Commodities 1:125;Stocks / Equities 1:50 |

| Minimum Deposit | -- |

| Minimum Spread | EUR/USD 0.7;GBP/USD 1.3;USD/JPY 0.8;AUD/USD 1.1;USD/CHF 0.9;USD/CAD 1.2;NZD/USD 1.4;EUR/GBP 0.9;Gold 0.37;Crude Oil 0.03;Dax 1 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Oinvest also viewed..

XM

GTCFX

FBS

ATFX

Sources

Language

Mkt. Analysis

Creatives

Oinvest · Company Summary

Note: Regrettably, the official website of Oinvest, namely https://www.oinvest.com/, is currently experiencing functionality issues.

| Oinvest Review Summary | |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Currency pairs, indices, commodities, precious metals, stocks and shares |

| Leverage | 1:400 (FX) |

| EUR/ USD Spread | 0.7 pips (EUR/USD) |

| Trading Platforms | MT4 |

| Minimum Deposit | $250 |

| Customer Support | Phone and email |

What is Oinvest?

Oinvest, an online trading platform based in the United Kingdom, operates in an unregulated environment. Offering a range of market instruments including currency pairs, indices, commodities, precious metals, and stocks, Oinvest provides traders with leverage up to 1:400 for FX trading. Oinvest employs the widely utilized MetaTrader 4 (MT4) as its trading platform. Despite its unregulated status, the platform requires a minimum deposit of $250 to open an account. Customer support is available via phone and email.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros of OInvest:

- Variety of market instruments: OInvest offers a range of market instruments, providing traders with diverse options for investment.

- Support for MT4: OInvest supports the widely used MetaTrader 4 (MT4) platform, which is popular among traders for its user-friendly interface and extensive features.

Cons of OInvest:

- Lack of legitimate forex license: OInvest operates without a legitimate forex license, raising concerns about the platform's regulatory compliance and oversight.

- Inaccessible website: Some users have experienced accessibility problems with the OInvest website, which may hinder the trading experience and raise questions about the platform's technical stability and reliability.

- Reports of scam and withdrawal issues: There are reports from users about encountering scam-related issues and difficulties with withdrawals, indicating potential reliability and trustworthiness issues.

Is Oinvest Safe or Scam?

Oinvest currently has no valid regulation, which means that there is no government or financial authority oversighting their operations. It makes investing with them risky. As there is no regulation, the people running the platform can pocket your money while bearing no responsibility for their criminal actions. They can disappear any time without notice.

Moreover, the fact that their official website is inaccessible raises concerns about the reliability of their trading platform. These factors contribute to a higher level of risk associated with investing in Oinvest.

Market Instruments

Oinvest provides a range of trading instruments, including currency pairs, indices, commodities, precious metals, stocks and shares.

- Currency pairs: Trading currency pairs involves speculating on the exchange rate between two currencies. This market is known as the forex (foreign exchange) market, which is the largest financial market in the world.

- Commodities: Commodities include physical goods such as oil, gold, silver, agricultural products, etc. Trading commodities allows investors to speculate on the price movements of these essential raw materials.

- Precious Metals: Precious metals like gold, silver, platinum, and palladium are often considered safe-haven assets. They can serve as a hedge against inflation and economic uncertainty.

- Indices: Indices represent a basket of stocks or other assets, measuring the performance of a specific market or sector. Trading indices allows investors to gain exposure to broader market movements without needing to invest in individual stocks.

- Stocks and Shares: Trading stocks and shares involves buying and selling ownership stakes in publicly listed companies. Stock trading can offer opportunities for capital appreciation through stock price movements and dividend income.

- Cryptocurrency: Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of a central authority. Popular cryptocurrencies include Bitcoin, Ethereum, Ripple, etc.

Account Types

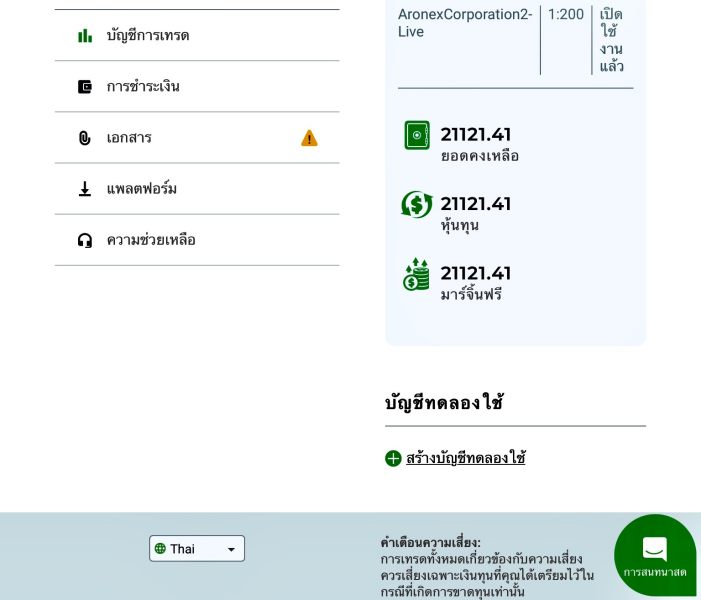

Oinvest offers three live account types: Silver, Gold, and Platinum. To open an account, the minimum deposits is $250.

- Silver Account:

This is the basic account type offered by Oinvest.

Provides access to the Oinvest trading platform and various financial instruments such as forex, commodities, indices, and cryptocurrencies.

Offers basic customer support services.

- Gold Account:

The Gold account is designed for traders who want more advanced features and benefits.

Provides priority customer support services.

- Platinum Account:

The Platinum account is the highest-tier account type offered by Oinvest, catering to experienced traders or those with larger trading capital.

Offers the most comprehensive range of features and benefits, including personalized support from account managers, exclusive market analysis, and tailor-made trading strategies.

Leverage

Oinvest offers varying levels of leverage across different types of accounts to accommodate the diverse needs and risk appetites of traders.

In the standard account, traders have access to leverage of up to 1:200 for FX trading, 1:50 for Gold & Silver (Metals), Indices, and Commodities, and 1:20 for Stocks/Equities.

For those seeking even higher leverage, the Gold Account provides increased leverage of up to 1:400 for FX trading, 1:100 for Gold & Silver (Metals), Indices, and Commodities, and 1:40 for Stocks/Equities. This heightened leverage amplifies the potential returns further, but it also escalates the risks associated with trading.

The Platinum Account offers the highest level of leverage among Oinvest's offerings, with leverage of up to 1:400 for FX trading, 1:125 for Gold & Silver (Metals), Indices, and Commodities, and 1:50 for Stocks/Equities. This level of leverage provides traders with even greater potential returns but demands careful risk management due to the heightened exposure to market volatility.

| Account Type | FX Leverage | Gold & Silver Leverage | Indices Leverage | Commodities Leverage | Stocks/Equities Leverage |

| Standard | 1:200 | 1:50 | 1:50 | 1:50 | 1:20 |

| Gold | 1:400 | 1:100 | 1:100 | 1:100 | 1:40 |

| Platinum | 1:400 | 1:125 | 1:125 | 1:125 | 1:50 |

Spreads & Commissions

Oinvest sets its spreads differently across these accounts.

In the SILVER account, for instance, Oinvest offers spreads such as 2.2 pips for EUR/USD, 2.8 pips for GBP/USD, and so forth for different currency pairs and commodities like gold and crude oil.

Moving up to the GOLD account, Oinvest tightens the spreads compared to the SILVER account, potentially offering traders more favorable conditions. For instance, the spread for EUR/USD decreases to 1.3 pips, which could result in lower transaction costs for traders operating within this account tier.

At the highest tier, the PLATINUM account, Oinvest further reduces spreads, providing traders with the tightest pricing available on the platform. With spreads as low as 0.7 pips for EUR/USD, traders operating within the PLATINUM account can potentially enjoy the most competitive trading conditions Oinvest has to offer. This tiered approach to spreads reflects Oinvest's commitment to providing varying levels of service tailored to different trading needs and preferences.

| Account Type | EUR/USD | GBP/USD | USD/JPY | AUD/USD | USD/CHF | USD/CAD | NZD/USD | EUR/GBP | Gold | Crude Oil | Dax |

| SILVER | 2.2 | 2.8 | 2.3 | 2.8 | 2.6 | 2.9 | 3.1 | 2.6 | 0.59 | 0.07 | 2 |

| GOLD | 1.3 | 2 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 | 1.6 | 0.48 | 0.05 | 1.5 |

| PLATINUM | 0.7 | 1.3 | 0.8 | 1.1 | 0.9 | 1.2 | 1.4 | 0.9 | 0.37 | 0.03 | 1 |

Regarding commissions, the specific details are not accessible due to the unavailability of the website. Despite the lack of specific information here, traders considering Oinvest should inquire about commission structures and any associated fees to make informed decisions about their trading activities.

Trading Platforms

Oinvest provides its clients with the popular MetaTrader 4 (MT4) trading platform, renowned for its user-friendly interface and comprehensive set of features. MT4 offers traders a versatile and customizable trading experience, catering to both novice and experienced traders alike.

One of the key advantages of the MT4 platform is its extensive charting capabilities, allowing traders to analyze markets using a wide range of technical indicators and charting tools. This empowers traders to make informed decisions based on market trends, patterns, and signals.

Additionally, MT4 supports automated trading through its Expert Advisors (EAs) functionality, enabling traders to automate their trading strategies and execute trades automatically based on predefined criteria. This feature is particularly beneficial for traders who wish to capitalize on market opportunities without the need for constant manual intervention.

User Exposure on WikiFX

Please make sure to review the reports available on our website concerning instances of withdrawal issues and fraudulent activities. Traders should carefully consider the information provided and acknowledge the potential risks linked with trading on an unregulated platform. Prior to engaging in any trading activities, we recommend visiting our platform to access the relevant information. Should you encounter unscrupulous brokers or become a victim of their practices, we kindly ask that you notify us via the Exposure section. Your cooperation is highly valued, and our team of professionals will endeavor to aid you in addressing the matter.

Customer Service

Customers can get in touch with customer service line using the information provided below:

Telephone: +44 2035196460/ +66 23284742/ +7 4950494260

Email: Support@oinvest.com, Docs@oinvest.com, support@oinvest.com

Conclusion

Oinvest presents itself as an online trading platform with a variety of market instruments and attractive trading conditions, such as flexible leverage, using the popular MT4 platform. However, its lack of a legitimate forex license and reports of scam and withdrawal issues raise significant concerns about its reliability and trustworthiness. Accessibility problems with the website further add to these concerns.

Frequently Asked Questions (FAQs)

| Q 1: | Is Oinvest regulated by any financial authority? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at Oinvest? |

| A 2: | You can contact via telephone: +44 2035196460/ +66 23284742/ +7 4950494260 and email: Support@oinvest.com / Docs@oinvest.com / support@oinvest.com. |

| Q 3: | What platform does Oinvest offer? |

| A 3: | It offers MT4. |

| Q 4: | What is the minimum deposit for Oinvest? |

| A 4: | The minimum initial deposit to open an account is $250. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

News

NewsTribunal can’t order FSCA to refund Oinvest investor his R346 000

An investor who lost R346 000 while trading on Oinvest has failed in his attempt to have the Financial Services Tribunal order the FSCA to reimburse his loss. He said the FSCA was liable, because it had not warned investors timeously of Oinvest’s contraventions of the FAIS Act.

WikiFX

WikiFX

NewsOInvest Review 2021: Is This Recent Broker a Scam?

Read our in-depth OInvest Review 2021 covering licenses, forex spreads, trading leverage, deposit & withdrawal and user reviews.

WikiFX

WikiFX

Review 10

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now