Score

BTIG

United States|5-10 years|

United States|5-10 years| https://www.btig.com/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

United States 5.04

United States 5.04Surpassed 56.60% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

BTIG LLC

BTIG

United States

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- This broker exceeds the business scope regulated by Australia ASIC(license number: 320961)Investment Advisory Licence Non-Forex License. Please be aware of the risk!

- This broker exceeds the business scope regulated by China Hong Kong SFC(license number: AQO116)SFC-Dealing in securities Non-Forex License. Please be aware of the risk!

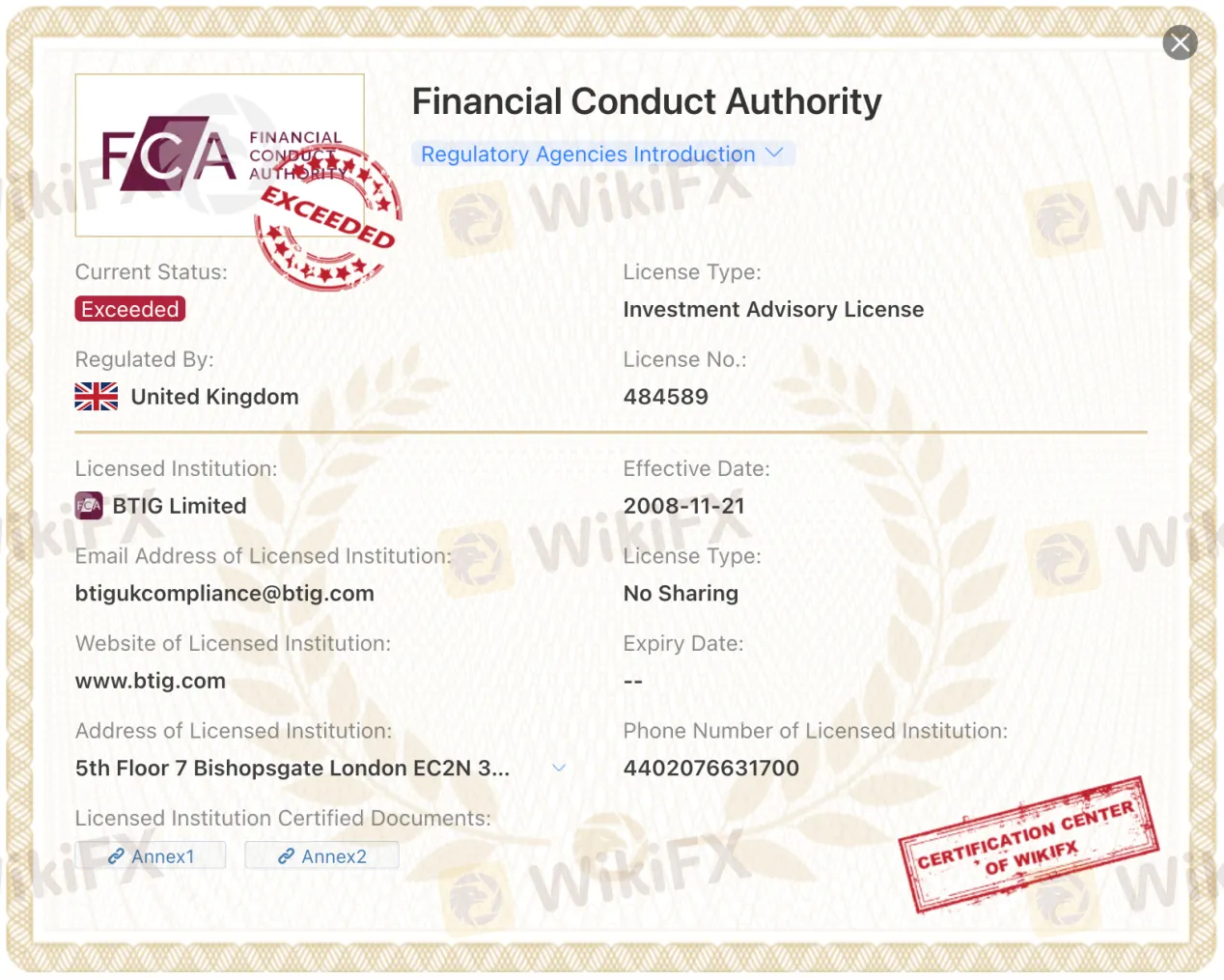

- This broker exceeds the business scope regulated by United Kingdom FCA(license number: 484589)Investment Advisory Licence Non-Forex License. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed BTIG also viewed..

XM

IronFX

ATFX

FXCM

Sources

Language

Mkt. Analysis

Creatives

BTIG · Company Summary

| BTIG | Basic Information |

| Company Name | BTIG |

| Founded | 2002 |

| Headquarters | United States |

| Regulations | SFC (Exceeded), ASIC (Exceeded), FCA (Exceeded) |

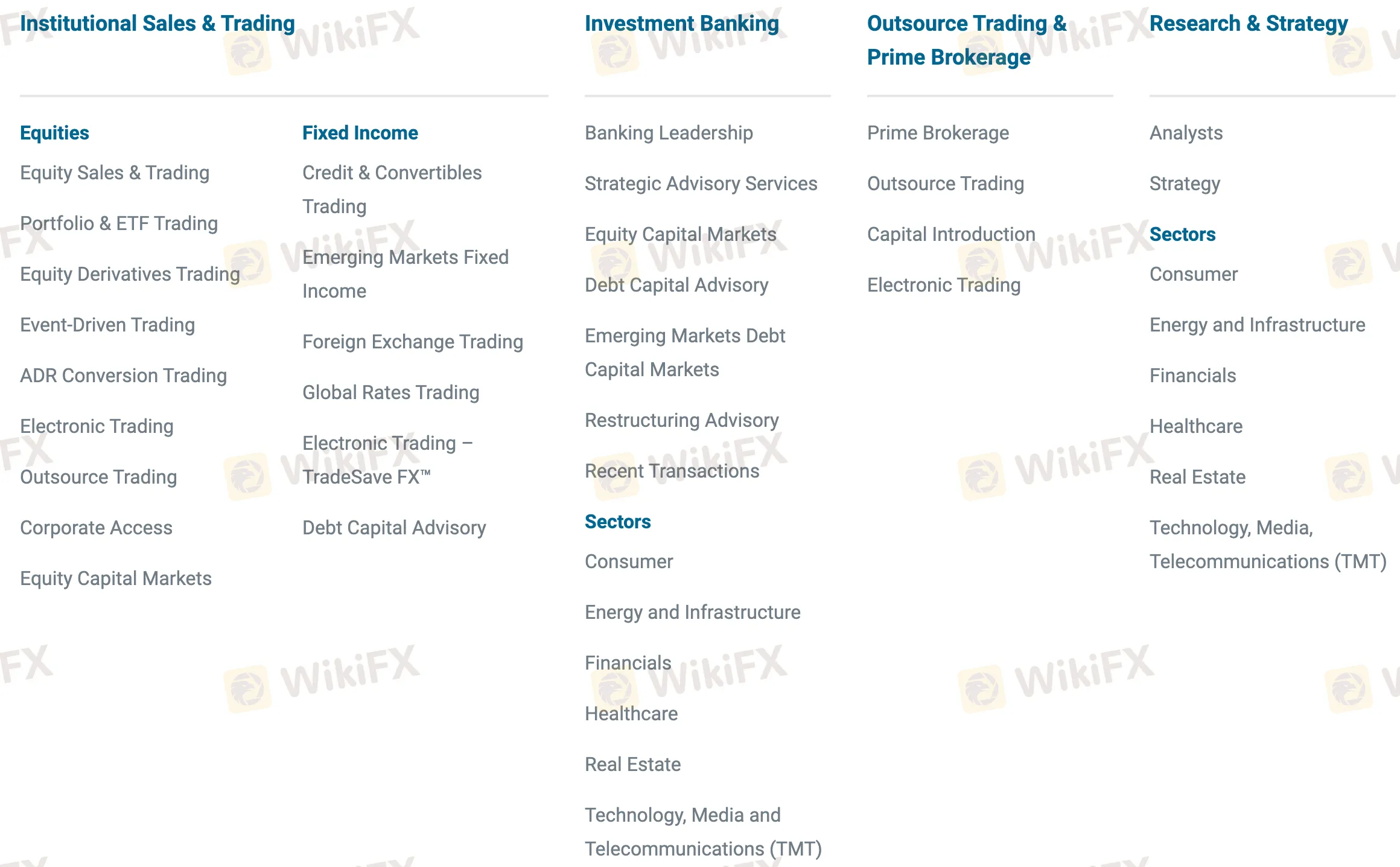

| Tradable Assets | Equity trading, fixed income, futures trading, equity derivatives, prime brokerage, foreign exchange trading, direct market access, capital markets introduction, equity research, corporate access as well as international trading, commission management services, portfolio analysis, and market intelligence |

| Account Types | Not specified |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Commission | Not specified |

| Deposit Methods | Not specified |

| Trading Platforms | Not specified |

| Customer Support | Available 24/7 |

| Education Resources | Research reports, insights, industry observations, sector-specific strategies |

| Bonus Offerings | None |

Overview of BTIG

BTIG is a financial services firm founded in 2002 that specializes in institutional brokerage, investment banking, research, and related services. Headquartered in New York, USA, BTIG has a global presence with offices in Europe, Asia, and Australia. The company offers a wide range of products and services, including equity trading, fixed income, futures trading, prime brokerage, foreign exchange trading, capital markets introduction, equity research, corporate access, and international trading.

BTIG is regulated by multiple authorities, including the Securities and Futures Commission of Hong Kong, the Australia Securities & Investment Commission, and the Financial Conduct Authority in the United Kingdom. However, BTIG's regulatory status is listed as “Exceeded,” it indicates that the company has met the regulatory requirements set by the respective authorities.

While BTIG offers a diverse range of services and global customer support, there are areas for improvement. The official website lacks readily available regulatory information, limiting transparency for potential clients. Additionally, BTIG primarily caters to institutional clients, potentially limiting accessibility for individual retail traders. There is also limited information provided regarding minimum deposits, maximum leverage, spreads, commissions, and bonus offerings.

Overall, BTIG aims to serve institutional clients by providing comprehensive solutions and expertise across various asset classes and sectors. Clients should conduct their own due diligence and consider their specific needs before engaging with the company.

Is BTIG Legit?

BTIG is regulated by multiple authorities, and its current regulatory status is “Exceeded” with the respective regulatory bodies. It is regulated by the Securities and Futures Commission of Hong Kong (License No.: AQO116) with a current status of “Exceeded”, indicating that BTIG has fulfilled the regulatory requirements set by the commission. Similarly, it is regulated by the Australia Securities & Investment Commission (License No.: 320961), and its current status is also “Exceeded”, indicating compliance with the regulatory standards in Australia. Lastly, BTIG is regulated by the Financial Conduct Authority (License No.: 484589) in the United Kingdom, and its current status is “Exceeded”, demonstrating adherence to the regulatory obligations set by the authority. Please be aware of the risk and the potential scam!

Pros and Cons

BTIG offers a diverse range of services, global presence, and regulatory compliance. However, there are some areas where improvement is needed, such as providing more transparent regulatory information and addressing the limitations for individual retail traders. It's important for individuals to conduct their own due diligence and consider their specific needs and preferences before engaging with the company.

| Pros | Cons |

| Wide range of products and services | Lack of readily available regulatory information on the official website. |

| Global presence with offices in different regions | Primarily caters to institutional clients, potentially limiting accessibility for individual retail traders. |

| Regulation by multiple authorities | Limited information on minimum deposit, maximum leverage, spreads, commission, and bonus offerings. |

| Extensive research and analysis capabilities | |

| Global customer service available 24/7. |

Products & Services

BTIG offers a wide range of products and services to cater to the needs of institutional clients. In the Institutional Sales & Trading area, BTIG provides equity sales and trading services, including portfolio and ETF trading, equity derivatives trading, event-driven trading, ADR conversion trading, electronic trading, and outsource trading. They also offer corporate access services to facilitate communication between companies and investors. In the Equity Capital Markets division, BTIG assists clients with equity capital raising and advisory services.

In the Fixed Income sector, BTIG specializes in credit and convertibles trading, emerging markets fixed income, foreign exchange trading, global rates trading, and electronic trading through their TradeSave FX™ platform. They also provide debt capital advisory services to help clients navigate the debt capital markets.

BTIG's Investment Banking division offers banking leadership, strategic advisory services, equity capital markets solutions, debt capital advisory, emerging markets debt capital markets expertise, and restructuring advisory.

The Sectors area of BTIG focuses on providing in-depth research and analysis in various sectors, including consumer, energy and infrastructure, financials, healthcare, real estate, and technology, media, and telecommunications (TMT).

BTIG's Outsource Trading & Prime Brokerage services include prime brokerage, outsource trading, capital introduction, electronic trading, and access to research and strategy.

Under Research & Strategy, BTIG employs experienced analysts who provide insightful research reports and analysis. They also offer sector-specific strategies for clients in consumer, energy and infrastructure, financials, healthcare, real estate, and technology, media, and telecommunications (TMT) sectors.

Overall, BTIG aims to serve institutional clients by providing comprehensive solutions and expertise across various asset classes and sectors, supporting their investment and trading strategies.

| Broker | Forex | Metals | Crypto | CFD | Indices | Stock | ETF | Options |

| BTIG | Yes | Yes | No | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | Yes | Yes | Yes | No | Yes |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Pocket Option | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

How to Open an Account?

To open an account with BTIG, follow these steps:

Start by visiting the BTIG website. Once you're on the homepage, look for the “CLIENT LOGIN” button and click on it. This button is typically located at the top right or left corner of the page.

2. On the login page, you will find a “NEW USER” button. Click on this button to initiate the account registration process.

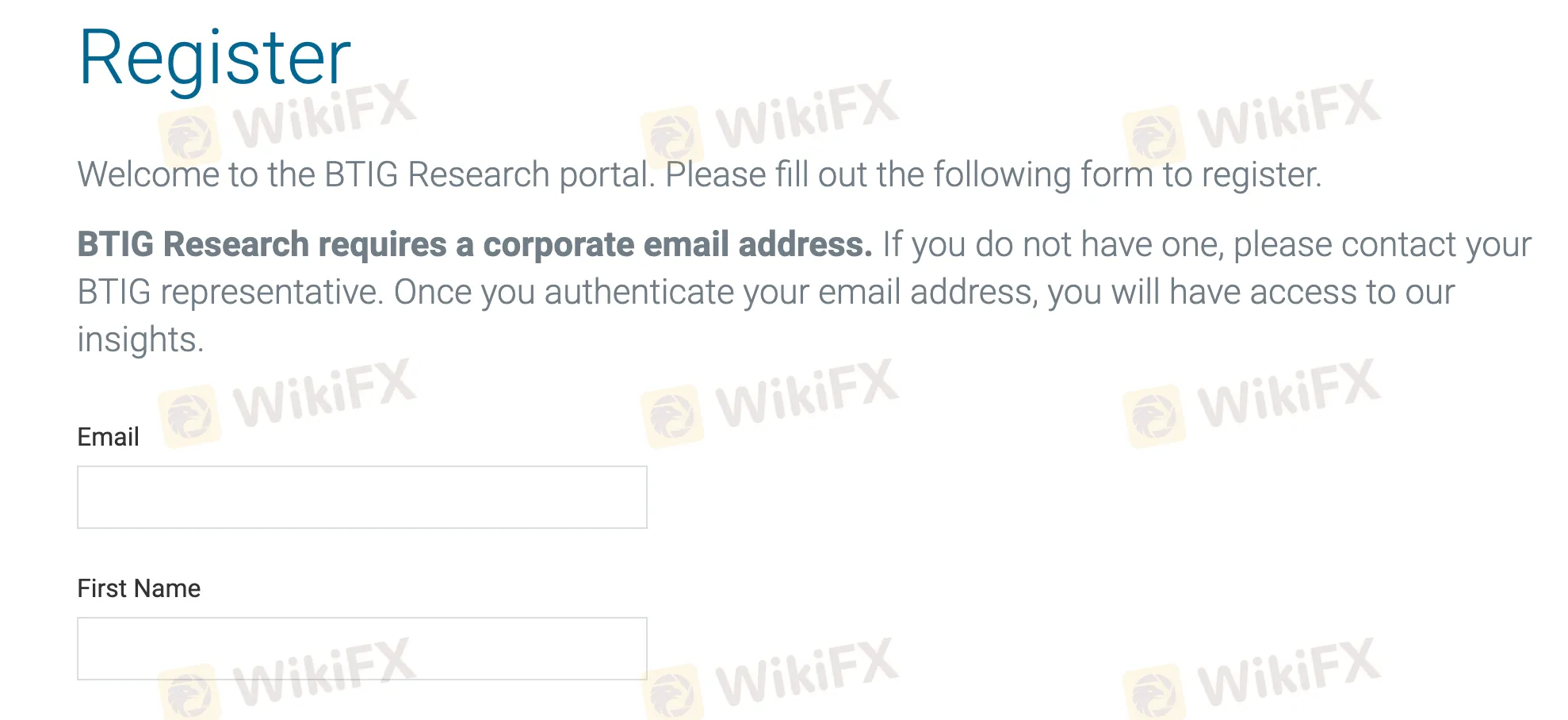

3. You will be directed to the website's registration page. Here, you will need to provide the required information to create your account. This information usually includes your name, contact details, and any other necessary personal or professional details. Follow the instructions and fill out the registration form accurately.

4. After you have successfully completed the registration process, BTIG will send you an automated email. This email will contain your personal account login details, including your username and password. Make sure to keep this information safe and secure.

5. Once you have received the email with your login details, return to the BTIG website. Click on the “CLIENT LOGIN” button again, and this time, enter your username and password in the respective fields. Click the “Log in” button to access your newly created BTIG account.

Remember to review any terms and conditions associated with opening an account with BTIG, as well as any additional steps or requirements that may be specific to your region or jurisdiction.

Customer Service

BTIG offers customer service through its global network of offices in the United States, Europe, Asia, and Australia. They are available 24 hours a day to assist clients during their operational hours. To contact BTIG's customer service, you can fill out a form on their website with your personal information, including your name, phone number, company, and email. You can then select the reason for contacting BTIG from a provided list and compose a message explaining your query or concern. It's important to note that BTIG has separate entities in different jurisdictions, and clients are advised to contact the appropriate entity in their home jurisdiction for transaction-related services. BTIG aims to provide prompt and tailored customer service to meet clients' needs effectively.

Educational Resources and Community Support

BTIG provides educational resources and community support to its clients through its research and strategy division. Their team of equity research analysts and strategy professionals analyze data from public and private companies, offering insights and research reports across various sectors, including consumer, energy and infrastructure, financials, healthcare, real estate, technology, and more. Their coverage often includes small and mid-cap industry disruptors that have the potential to become prominent brands. Clients rely on BTIG to identify trends, forecast performance, and provide accurate and thoughtful analysis.

BTIG's educational resources aim to help clients connect the dots and focus on the big picture. They offer contextualized critical data points and actionable insights that assist clients in making informed investment decisions. Through their research, they provide deep industry relationships, proprietary analysis, and a breadth of industry contacts to examine consumer tendencies, energy markets, financial data, healthcare trends, real estate markets, and technology advancements.

BTIG also supports its community by participating in media coverage and industry events. Their analysts and professionals are often quoted in news outlets and invited to share their expertise on various platforms. They host virtual conferences and events where industry participants, corporate management teams, and key opinion leaders come together to discuss relevant topics and share insights.

In addition to educational resources, BTIG offers a range of products and services, including institutional sales and trading, investment banking, and outsource trading and prime brokerage. These services complement their research offerings, providing clients with comprehensive support for their tactical and transactional needs.

Overall, BTIG strives to provide clients with valuable educational resources, thoughtful analysis, and a strong community support system to help them navigate the markets and make informed investment decisions.

Conclusion

BTIG is a financial services firm that offers a wide range of products and services to institutional clients. With its global presence and regulatory compliance, BTIG provides equity trading, fixed income, futures trading, prime brokerage, foreign exchange trading, and capital markets introduction, among other services. However, there are a few disadvantages to consider. The official website lacks readily available regulatory information, potentially affecting transparency for potential clients. Moreover, BTIG primarily caters to institutional clients, which may limit accessibility for individual retail traders. Additionally, detailed information on minimum deposits, maximum leverage, spreads, commissions, and bonus offerings is limited. It is important for individuals to conduct thorough due diligence and consider their specific needs before engaging with the company.

FAQs

Q: Is BTIG a legitimate company?

A: Yes, BTIG is a legitimate company. It is regulated by multiple authorities, including the Securities and Futures Commission of Hong Kong, the Australia Securities & Investment Commission, and the Financial Conduct Authority in the United Kingdom. However, BTIG's regulatory status is listed as “Exceeded”. Please be aware of the risk!

Q: What products and services does BTIG offer?

A: BTIG offers equity trading, fixed income, futures trading, prime brokerage, foreign exchange trading, direct market access, capital markets introduction, equity research, corporate access, international trading, commission management services, portfolio analysis, and market intelligence.

Q: How can I open an account with BTIG?

A: To open an account with BTIG, visit their website and click on the “CLIENT LOGIN” button to access the registration process. Fill out the required information accurately and follow the instructions provided. After successful registration, you will receive an email with your account login details.

Q: Does BTIG provide educational resources?

A: Yes, BTIG provides educational resources through its research and strategy division. They offer in-depth research reports and analysis across various sectors, helping clients make informed investment decisions. Additionally, BTIG participates in media coverage and industry events, sharing insights and expertise with the community.

Q: Does BTIG cater to individual retail traders or primarily institutional clients?

A: BTIG primarily caters to institutional clients, such as hedge funds, asset managers, and other institutional investors. While they offer a diverse range of products and services, their focus is on serving the needs of institutional investors. Individual retail traders may find limited accessibility to certain services or face specific requirements when engaging with BTIG.

News

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now