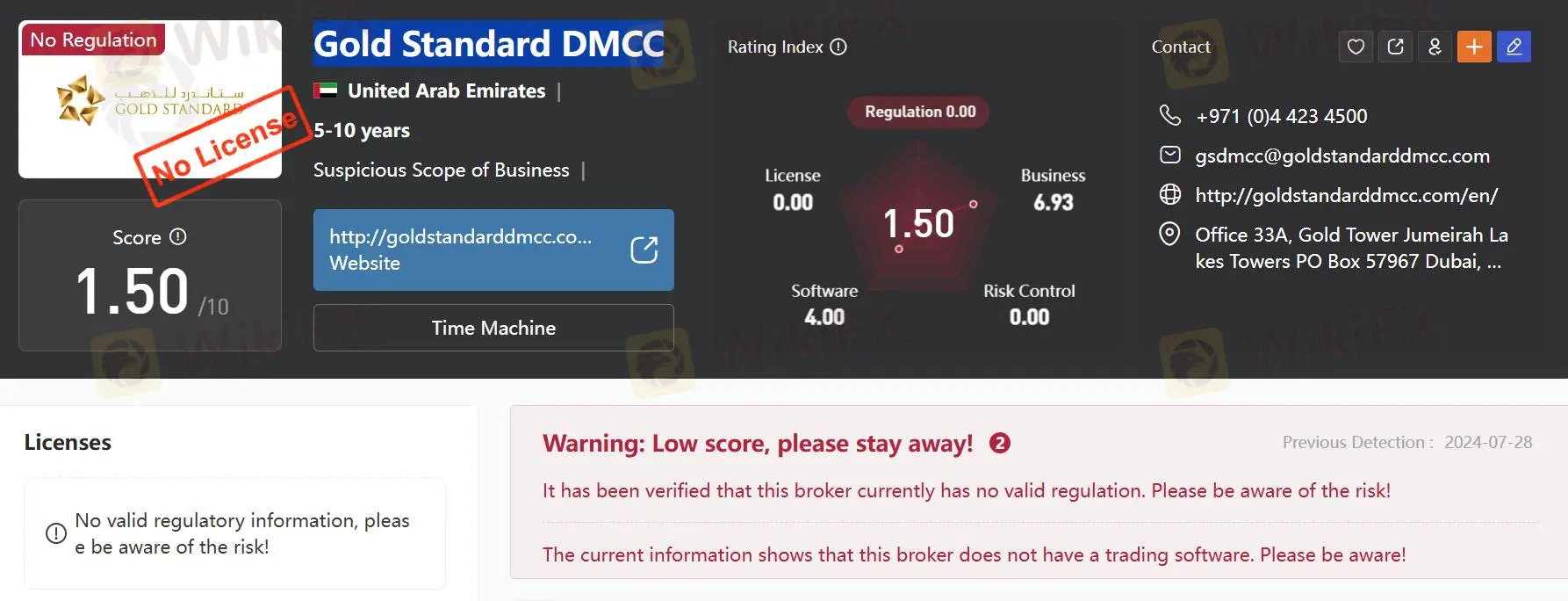

Score

Gold Standard DMCC

United Arab Emirates|5-10 years|

United Arab Emirates|5-10 years| http://goldstandarddmcc.com/en/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Arab Emirates

United Arab EmiratesUsers who viewed Gold Standard DMCC also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

goldstandarddmcc.com

Server Location

United States

Website Domain Name

goldstandarddmcc.com

Server IP

50.116.92.45

Company Summary

Overview of Gold Standard DMCC

Founded in 2007, Gold Standard DMCC is a Dubai-based company specializing in precious metals trading and investment. This firm trumpets a full suite of precious metal services. However, limited information available on their website about tading fees and platforms require further clarification for potential clients.

Pros and Cons

| Pros | Cons |

| Specialization in physical gold and precious metals trading | No valid regulatory certificates |

| Various customer support options | Limited information available about trading fees |

| Lack of detailed information about trading platforms |

Is Gold Standard DMCC Legit?

Gold Standard DMCC, incorporated in the United Arab Emirates, operates without regulation from any recognized financial authority. Opening an online brokerage account can be an easy way to start investing and there are always risks in investing. But we can choose to stay away from certain risks.

What Can I Trade on Gold Standard DMCC?

Gold Standard DMCC specializes in precious metals trading, with a primary focus on gold. Physical gold is also available in various forms, including gold bars and coins.

| Tradable Instruments | Supported |

| Precious Metals(Gold, Silver, Platinum, and palladium) | ✔ |

| Forex | ❌ |

| Stock | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Crypto | ❌ |

Services

Gold Standard DMCC boasts of its wide selection of solutions to clients across the institutional, corporate, industrial, fabrication, wholesale jewelry, production, and refining.

Protected deliveries worldwide is one of them. They promise secure transportation, handling, and shipment of precious metals using globally recognized international contract carriers.

Additionally, the firm provides precious metals trading and risk management solutions. Gold Standard DMCC does not declare its investment experts, you could contact them for detailed information.

Furthermore, the firm also facilitates the purchase or sale of physical bullion, including bulk metals, smaller investment bars, and scrap and dore.

Account Types

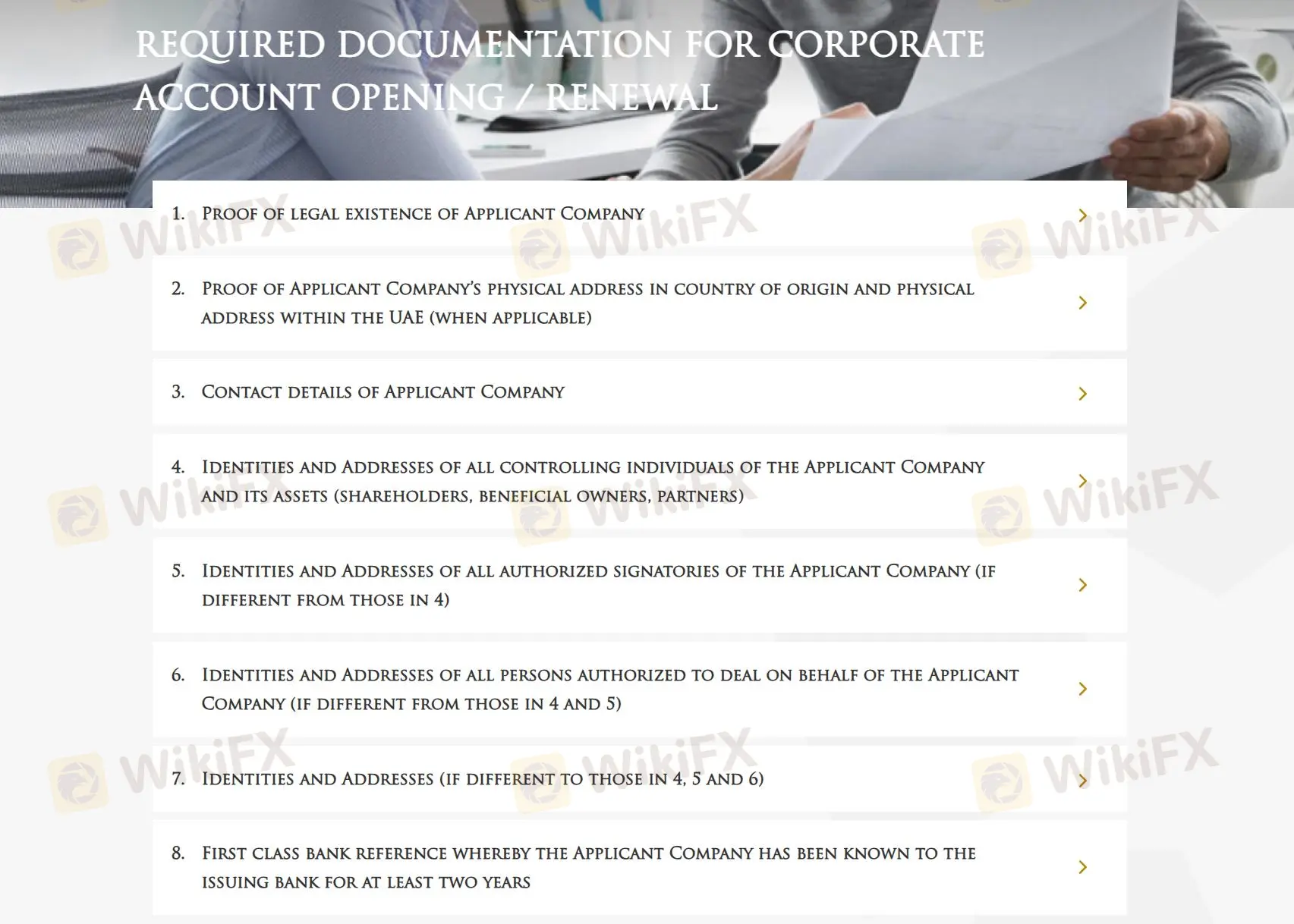

Account types and account opening process with Gold Standard DMCC are not explicitly detailed on their website. However, it is likely to involve standard procedures for financial services companies. Some kind of regulatory requirements for account opening may be needed in Dubai.

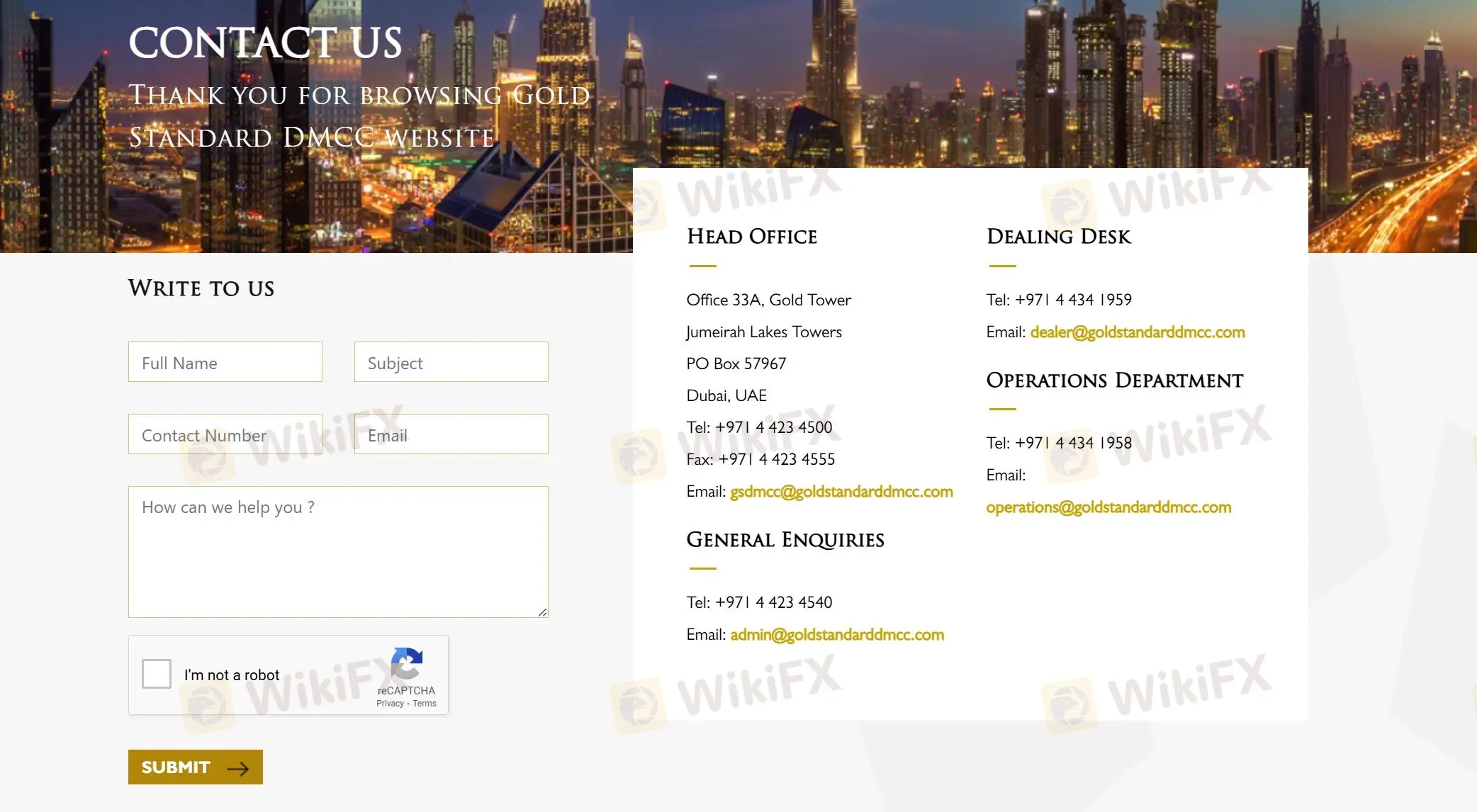

Customer Support Options

For any question you might have, help is available by phone(+971 4 423 4540) or email (admin@goldstandarddmcc.com). You can also dig into their social media channels (Facebook, Youtube, and Twitter) or hit a button on an online message box.

| Contact Options | Details |

| Phone | +971 4 423 4540 |

| admin@goldstandarddmcc.com | |

| Support Ticket System | N/A |

| Online Chat | No |

| Social Media | Facebook, Linkedin, and Twitter |

| Supported Language | N/A |

| Website Language | English |

| Physical Address | Office 33A, Gold TowerJumeirah Lakes TowersPO Box 57967Dubai, UAE |

The Bottom Line

Gold Standard DMCC offers specialized services in physical gold trading and investment. But the regulatory status and the lack of transparency about trading fees and platform are barriers investors have to confront. Potential clients would need to contact Gold Standard DMCC directly for more detailed information. There are lots of other regulated brokers and one of them might be worth looking into. When comparing brokerages, pay attention to the range of investments and costs involved.

FAQs

Is Gold Standard DMCC safe?

Gold Standard DMCC is not regulated by any reputable financial authority. Before choosing a brokerage, remember to consider the risk involved.

Is Gold Standard DMCC good for beginners?

No, this firm does not provide detailed information about trading fees and account types, which is not suitable for novice traders.

How does Gold Standard DMCC ensure the quality of its gold products?

As a company operating under the DMCC framework, Gold Standard DMCC is subject to strict quality control measures. but potential clients should inquire directly about their specific quality assurance processes.

Risk Warning

Online trading involves considerable risk, so it may not be suitable for every client. Please make sure that you totally understand the risks involved and notice that the information above provided in this review may be subject to alteration owing to the constant updating of the company's services and policies.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now