Score

Basel Markets

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://baselmarketscapital.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Users who viewed Basel Markets also viewed..

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

baselmarketscapital.com

Server Location

United States

Website Domain Name

baselmarketscapital.com

Server IP

104.21.18.158

baselmarkets.com

Server Location

United States

Website Domain Name

baselmarkets.com

Server IP

104.21.37.199

Company Summary

| Basel Markets Review Summary | |

| Founded | 2021 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | NFA-unauthorized |

| Market Instruments | Currency pairs, precious metals, indicies, energy |

| Demo Account | Available |

| Leverage | Up to 1:500 |

| EUR/USD Spreads | 2.3 pips |

| Minimum Deposit | $500 |

| Trading Platforms | MT5 |

| Customer Support | Phone, email, social media |

What is Basel Markets?

Basel Markets is a trading platform founded in 2021 and is headquartered in Saint Vincent and the Grenadines. Despite its recent inception, it offers a diverse range of market instruments for traders, including currency pairs, precious metals, indices, and energy.

Unfortunately, it currently operates without any formal regulatory oversight. Potential traders can familiarize themselves with the platform using its available demo account. With leverage going up to an impressive 1:500 and competitive EUR/USD spreads of 2.3 pips, Basel Markets tries to ensure flexibility in trading. The required minimum deposit stands at $100, and the platform primarily uses the widely recognized MT5 trading platform. For any queries or assistance, users can approach their customer support through phone and email channels.

Pros & Cons

| Pros | Cons |

| • Wide range of trading instruments | • Unauthorized regulation by NFA |

| • Unparalleled trading conditions | • Restricted access in certain countries |

| • Protection of funds | • Limited platfrom options |

| • Committed to financial education |

Pros:

Wide Range of Trading Instruments: Basel Markets offers a comprehensive portfolio of trading options, including currency pairs, precious metals, indices, and energy. This diversity allows traders to spread risk and explore multiple markets.

Unparalleled Trading Conditions: With attractive features like leverage of up to 1:500 and competitive EUR/USD spreads of 2.3 pips, Basel Markets ensures that its traders have an edge in the market.

Protection of Funds: Basel Markets emphasizes the security of its users' capital, employing strategies and mechanisms to ensure that funds are kept safely.

Committed to Financial Education: Recognizing the importance of informed trading, Basel Markets is committed to providing resources and educational tools, enabling traders to make knowledgeable decisions.

Cons:

Unauthorized regulation by NFA: Being flagged or viewed suspiciously by the National Futures Association (NFA) can raise red flags for potential investors, as it brings up concerns about the platform's credibility and trustworthiness.

Restricted Access in Certain Countries: Traders from specific regions might find themselves unable to access Basel Markets, limiting its global reach and potential user base.

Limited Platform Options: Being primarily centered around the MT5 platform limits traders who are familiar with or prefer other trading software options.

Is Basel Markets Safe or Scam?

Basel Markets operates under the National Futures Association (NFA) but it is labelled as unauthorized, a fact that potential users should approach with caution. The absence of regulation means that Basel Markets isn't bound by the standard protocols, guidelines, or safeguards that are enforced by regulatory bodies to protect consumers. Such a status can entail higher risks related to security, transparency, and the overall reliability of the platform, as there is no external body monitoring or ensuring its adherence to typical industry standards.

Market Instruments

Basel Markets boasts a comprehensive and diverse array of market instruments, catering to the varied needs of its global clientele. From traditional forex trading to Equities, the platform provides multiple avenues for potential investment. Here are some examples of the instruments available:

Foreign Exchange (Forex): At its core, Basel Markets offers a robust foreign exchange trading platform. Here, traders can speculate, hedge, or invest in various currency pairs, capitalizing on the fluctuations and dynamics of the global forex market.

Commodities: Commodity trading is yet another highlight of Basel Markets. Traders can delve into the world of tangible assets, including precious metals like gold and silver. Additionally, energy commodities, such as oil and natural gas, are available for those keen on trading based on global energy demand and geopolitics.

Indices: Basel Markets provides its users with the opportunity to trade on major global indices. This allows traders to take positions based on the performance of top companies in particular regions or sectors, reflecting broader market movements.

US Equities: For those interested in the American market, Basel Markets offers access to US equities. This provides a chance to invest in some of the largest and most influential companies based in the United States.

EU Equities: In addition to the US market, traders can also venture into European stocks. The EU equities segment opens doors to the European corporate landscape, offering a diverse range of investment opportunities.

Cryptocurrencies: Recognizing the growing importance and popularity of digital currencies, Basel Markets has incorporated cryptocurrency trading. With this, traders can participate in one of the most volatile and potentially rewarding markets, dealing in popular digital coins and tokens.

Account Types (Minimum Deposit, Leverage, Spreads)

Standard STP Account:

The Standard STP account is an entry point for traders looking to venture into global markets. With a modest minimum deposit, traders gain access to global equities, currencies, and more. This account is tailor-made for those beginning their global investment journey with a focused mindset.

Minimum Deposit: $500

Minimum Spread: 2.0

Maximum Leverage: 1:500

Minimum Trade Size: 0.01 lots

ECN Trading Account:

The ECN Trading account offers a more direct approach, where orders are routed straight to the liquidity provider. This ensures competitive pricing, making it a suitable choice for the professional investor. Notably, this account operates with no commission.

Minimum Deposit: $5,000

Minimum Spread: 1.0

Maximum Leverage: 1:500

Minimum Trade Size: 0.01 lots

Institutional Managers Account:

Designed specifically for Fund and Portfolio Managers, the Institutional Managers account boasts the lowest spreads. Trades are linked with Tier 1 financial institutions, ensuring optimal execution. This premium account offers trading costs that can go as low as 0.0 pip.

Minimum Deposit: $10,000

Minimum Spread: 0.0

Maximum Leverage: 1:500

Minimum Trade Size: 0.01 lots

Each account is structured to offer traders a specific set of advantages, from beginner-friendly settings in the Standard STP account to the razor-thin spreads in the Institutional Managers account. This allows traders of all levels to find a suitable platform for their trading needs at Basel Markets.

Trading Platform

Basel Markets exclusively offers the MetaTrader 5 (MT5) platform, heralded as an advanced successor to MT4. MT5 enhances traders' capabilities with expanded timeframes, an extensive array of technical indicators, and broader asset class support, making it a versatile tool for navigating financial markets. With an enriched library of technical tools, traders can conduct more comprehensive technical analysis, while the platform's support for various time intervals caters to a wide range of trading strategies.

Additionally, they have an innovative social trading system, where traders from around the globe can connect with one another, discuss trading strategies, and benefit from patented CopyTrader technology. With this technology, users have the opportunity to replicate the trading portfolios and performance of experienced traders who have a proven track record. With just a few clicks, they can follow, learn from, and mimic the moves of these top traders, allowing them to access their insights and expertise while harnessing their success to enhance their own trading journey. Traders can join the community today and unlock a new dimension of trading possibilities, where collaboration and cutting-edge technology converge for their financial advantage.

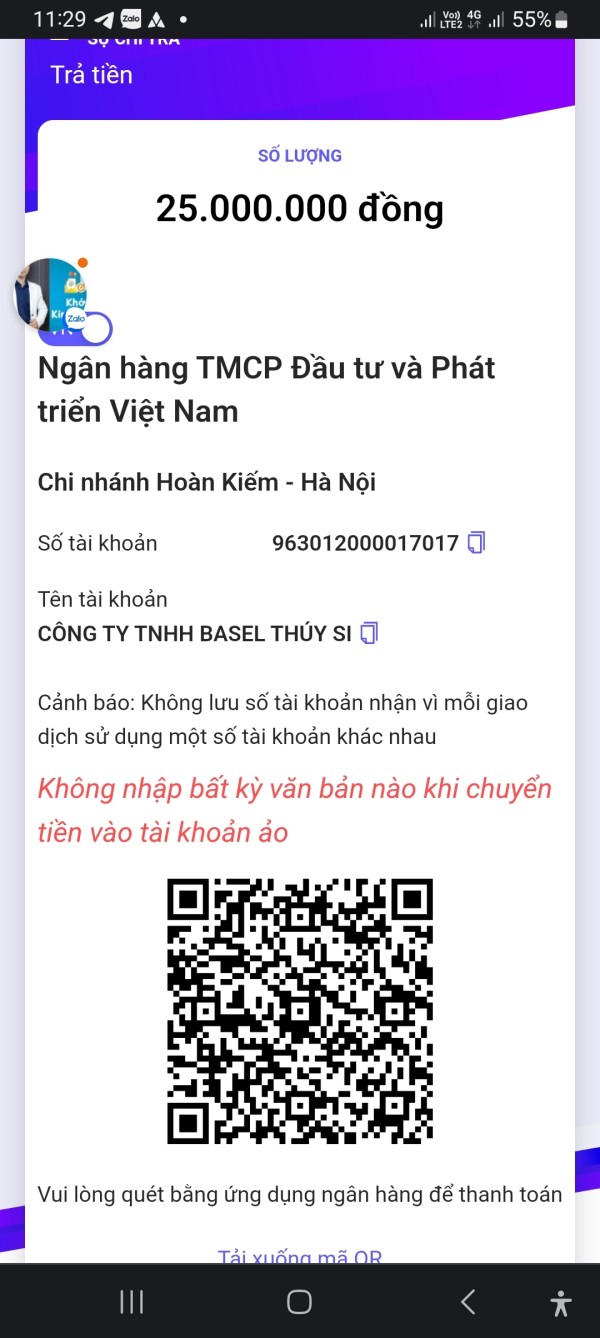

Deposits & Withdrawals

It is quick and easy to deposit funds into your Basel Markets trading account. Funds can be deposited using a wide range of payment methods including credit card, debit card, payment wallets including Neteller and Skrill, online banking and bank wire transfer:

Credit & Debit Card:

Accepted Currencies: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD

Deposit Time: Instant funding on MT5

Deposit Fees: None

Bank Transfer:

Accepted Currencies: All currencies

Deposit Time: 1 business day from when the funds are received

Deposit Fees: No deposit fees charged by Basel Markets. Notably, for deposits greater than 10,000 USD, Basel Markets will cover international fees up to 50 USD.

Other Instant Funding Options (Dragonpay, Fasapay, Zotapay):

Accepted Currencies: Various, including AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD, INR, MYR, IDR, THB, VND, among others.

Deposit Time: Instant funding on MT5

Deposit Fees: None

Users should note that while Basel Markets ensures flexibility in deposits, withdrawal of funds might be subject to commissions from the payment system. These commissions can change without prior notice as determined by the respective payment systems.

Trading Hours

The operational hours for CFD and Forex markets primarily revolve around the trading hours of global financial exchanges such as the London Stock Exchange, New York Stock Exchange, Hong Kong Stock Exchange, Tokyo Stock Exchange, and others. Given the dispersed locations and time zones of these markets, monitoring trading hours for various financial instruments can be complex. However, when it comes to currency pairs, their trading availability extends throughout the week, except for weekends. For instance, forex trading hours are 00:02-23:59 and USDRUB is 10:00-23:50.

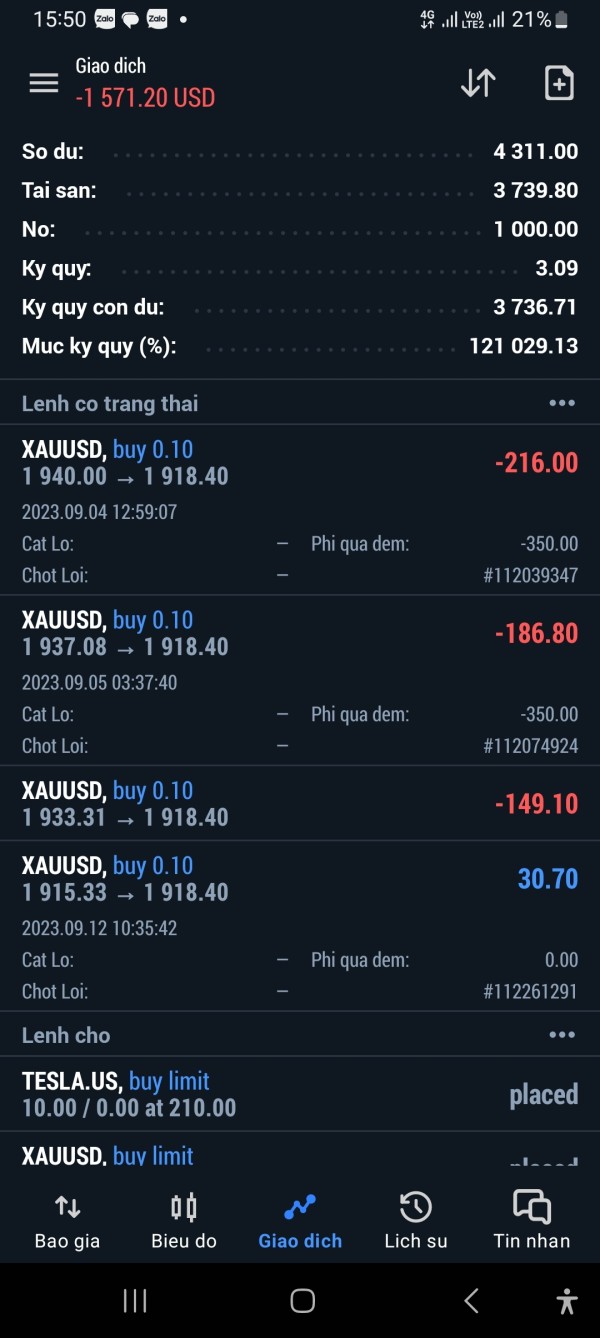

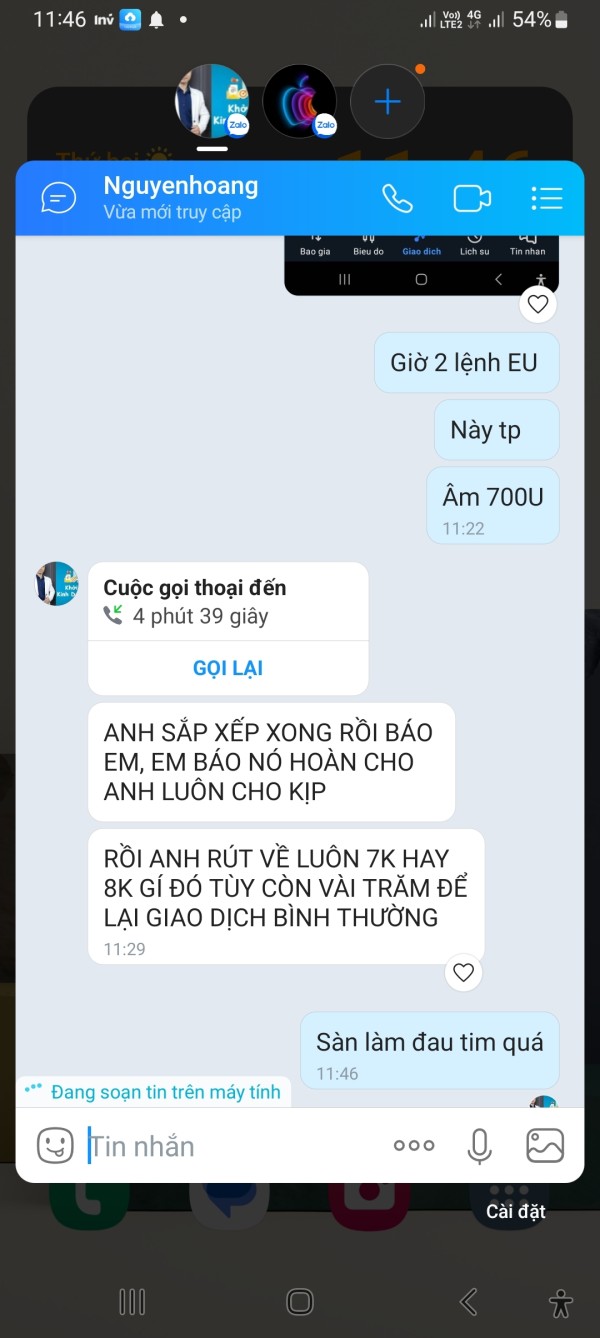

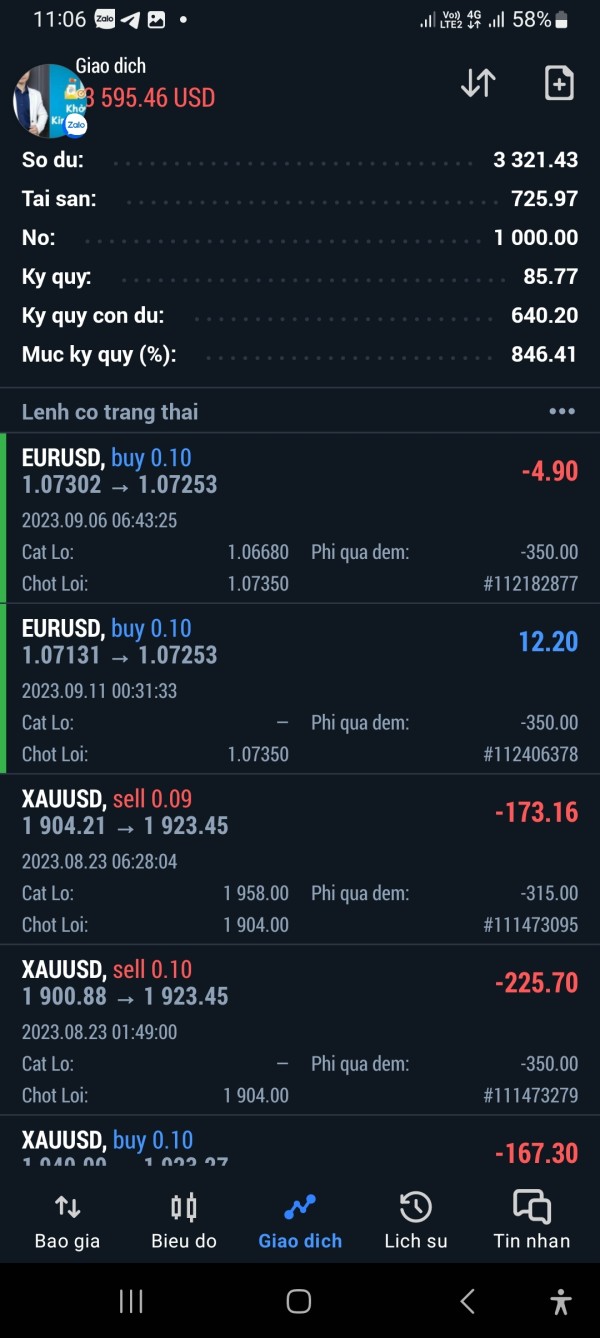

User Exposure on WikiFX

On our website, you can see reports of scams and unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section. We would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: (+1) 2624 09 2115

Email: services@baselmarkets.com

Address: Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, Saint Vincent and the Grenadines

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Linkedin and YouTube.

Conclusion

In conclusion, Basel Markets presents itself as a comprehensive and user-centric trading platform. With its diverse market instruments, ranging from forex to commodities and equities, it caters to a wide array of trading interests. Additionally, its structured account types, from Standard STP to Institutional Managers, ensure that both novice and expert traders find an environment tailored to their needs. The array of funding options, emphasizing instant funding and zero deposit fees, further accentuates its commitment to client convenience. Despite certain regulatory concerns, Basel Markets' offerings underscore its intent to be a competitive player in the global trading arena, prioritizing flexibility, transparency, and user experience.

Frequently Asked Questions (FAQs)

| Q 1: | Is Basel Markets regulated? |

| A 1: | Yes, but it is unauthorized by NFA. |

| Q 2: | What is the minimum deposit amount required by Basel Markets? |

| A 2: | Minimum allowed deposit amount depends on the trading account. It is $500 for standard STP. |

| Q 3: | Does Basel Markets offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Can I have an account in any currency? |

| A 4: | You can open accounts in US Dollar, Euro and Japanese Yen in MetaTrader 5. |

| Q 5: | At Basel Markets, are there any regional restrictions for traders? |

| A 5: | Basel Markets does not accept clients from certain countries/regions, including the United States and Hong Kong. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Disclosure

Review 14

Content you want to comment

Please enter...

Review 14

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

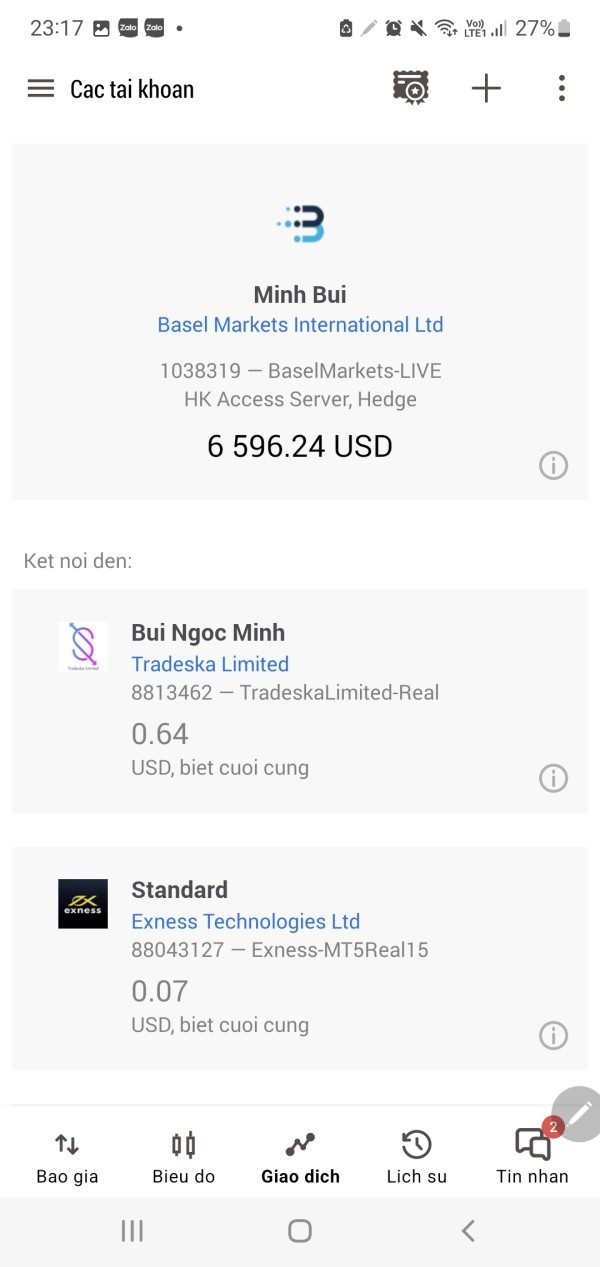

dao4129

Vietnam

The exchange locks transactions, adjusts swap fees, removes profit taking, cuts losses on customer orders, and requires withdrawal fees

Exposure

2023-09-15

dao4129

Vietnam

The fraudulent exchange adjusted the overnight fee even though it was still the same day as the transaction, disabling the account from further trading.

Exposure

2023-09-11

buiminh

Vietnam

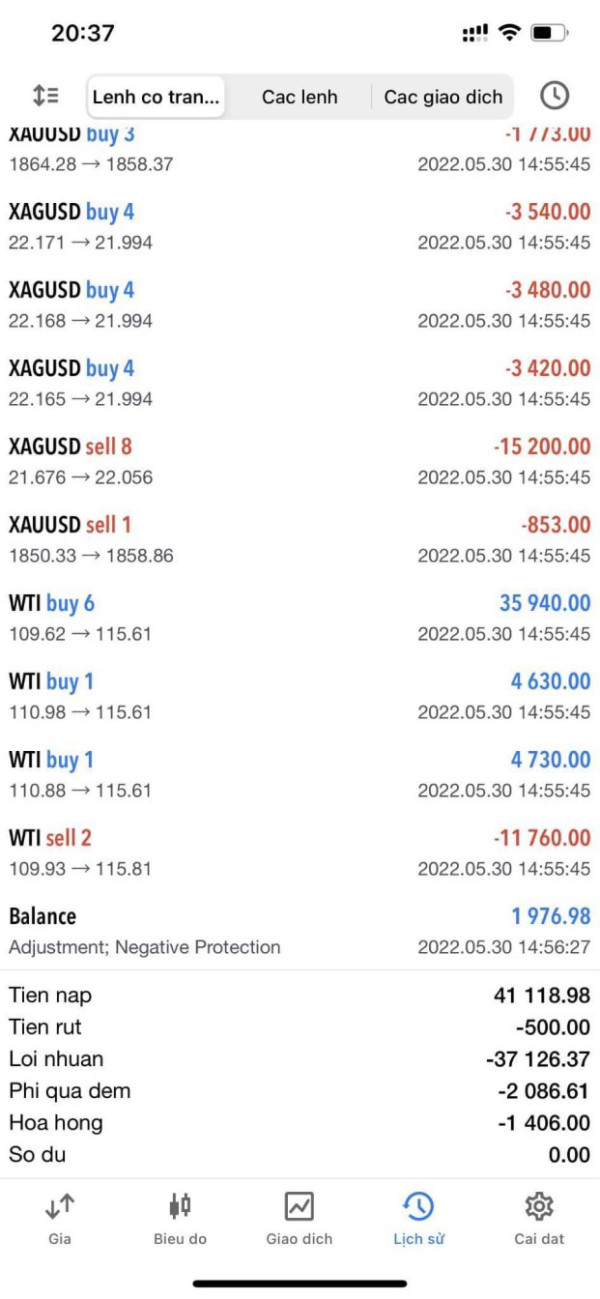

The floor automatically entered orders with unknown codes and entered at the same time when buying and selling burned investors' accounts.

Exposure

2023-07-21

Chien5432

Vietnam

I still keep sending mail for 2 months, but the platform does not respond. Looking up the hotline number to contact the platform, there is no: why does the government let such a platform cost? In the process of playing this platform, I used to have all kinds of tricks used by the exchange 1. Sudden increase in overnight fees 2. Spread expansion 40-100 times 3. Failure to pay ccor on time 4. High difference between deposit and withdrawal ( 24.5-23.3) at the same time 5. some friends reported that they couldn't withdraw their money 6. the brokers find every reason to ask you to deposit more money into your account

Exposure

2023-01-11

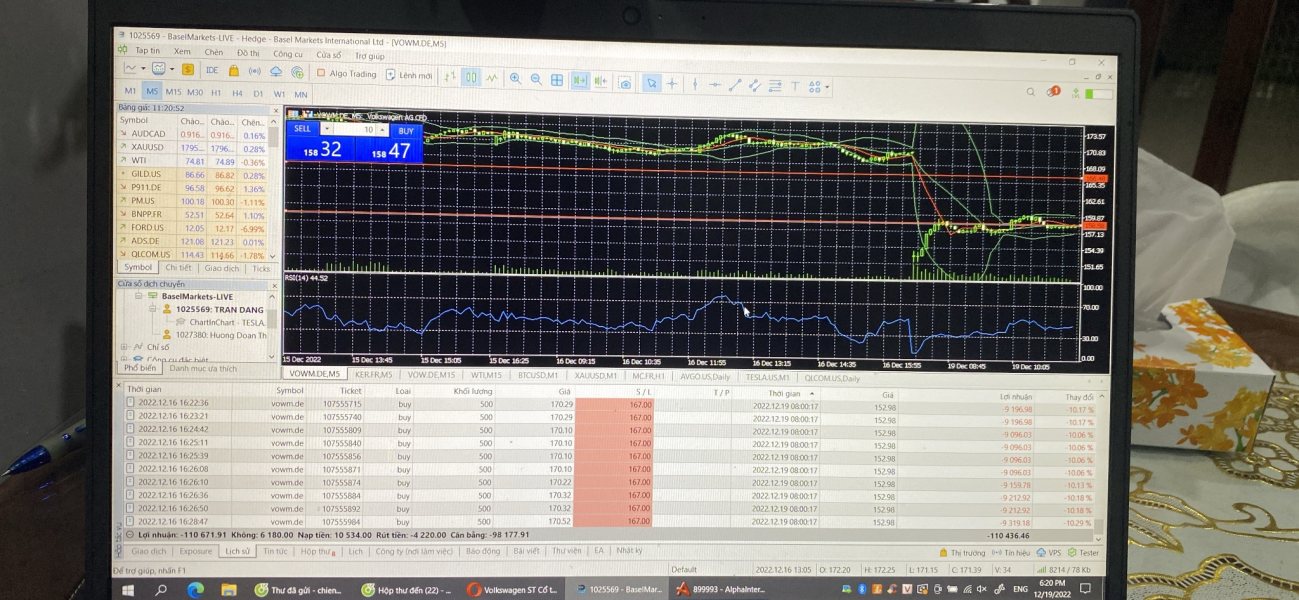

Chien5432

Vietnam

I have invested in Basel Market since December 2, 2022 with an initial capital of 6k$. If mt5 transaction is 1027380, after half a month, I can see that the deposit and withdrawal are ok in the morning. Seems reputable until 12/14 pm to add another 20k to buy VOW stock because it pays a high dividend of 19.6eu. But on the date of dividend payment on December 19, I still couldn't see the dividend, so I contacted the exchange via Mail, did not reply through a few IB banjs, and said it was late even though other exchanges paid dividends. When I opened the session because of the orders I placed, the orders were closed because of the price gap. During that session, I always asked about dividends, the exchange took the reason that I had not received the dividend, so I cut it so I didn't pay anymore. In the following days, I sent Mail on the floor many times with no reply. So far (December 21) I have not received a reply from the floor regarding the dividend issue. I write these words hoping the online community will help me get my dividends back?

Exposure

2022-12-21

Vu phuong nam

Taiwan

I have made a withdrawal from the platform since August 26, 2022, and still have not been able to withdraw to my account. Sent email to the platform, but no response

Exposure

2022-12-12

FX2313572012

Vietnam

My name is NVT. I opened a trading account on the exchange with a capital of 1500usd. I have been trading for 2 weeks, so my profit increased to 4061usd. In the trading session on April 25, 2022, I have Sell 41 shares total and have 1 order to place Profit 12. Tesla shares in the session because the day before Tesla announced revenue and tended to decrease sharply, the way my orders were both generating good profits. at 10:5pm I found it profitable, so I wanted to cut the order and go to the army, but I couldn't execute the order and lost the (x) button. I looked at the email and saw the updated information on the platform but did not notify the customer in advance. I am afraid the exchange will Touch tk and want to be sure of the order, so wait for the update to finish to cut the order for peace of mind. Until 12 o'clock at night, the order in platform jumped continuously, but the candle line did not change. while the market price is down, the whole order increases very quickly, continuously jumps more than 100 prices, and increases until the account is burned. I have taken pictures as proof. The next day, I had a petition to go to the floor and was informed by the support staff to wait 1 week to have a deposit. Next week, the floor has solved it for me, but I got back 1000u of capital and 1000u of bonus at the price. The floor just wanted to appease customers, I also know how difficult it is to get the credit back, so I have to accept that offer. So I call it beneficial or harmful to trade 1500u and have made a profit on capital up to more than 4000u in previous trading profits. So please stay away from this floor, don't lose money like me. I provide below screenshots of my trading account that day, the price list I captured that day of trading for proof. But what I have mentioned above is absolutely true.

Exposure

2022-04-29

Hieu Vo

Vietnam

Do not allow customers to withdraw when the transaction is profitable

Exposure

2022-02-19

Tam Hành

Vietnam

The broker changed the overnight fee from 0.075 to $30 per share and multiplied by 3 on Wednesday and burned the account. I sent e-mail for inquiry, but the complaint was not replied. For example, the stock I bought with the code MRCK.U from November 26 to December 2 which is 6 days, but the value difference of the overnight fee is exceeded $300 after changes. After the adjustment causes a burn, the platform is adjusted back to the original level. However, the negative value caused by overnight cannot be changed back

Exposure

2021-12-02

FX2109167019

Vietnam

I created a MT5 account on September 29, 2021 and deposited on October 1, 2021 with the amount of $1000. On July 10, 2021, I bought 20cp abt.us at 118. On October 12, 2021, I bought 30cp clx.us for 163. On October 13, 2021, I bought 30cp clx.us at 162 and 40cp clx.us for 161 On October 14, 2021 clx.us, The platform adjusted the spread increased from 11 to 1618 by 147 times and made my bid price from 163.26 to 147.08. At the same time abt.us, the broker adjusted the spread from 63 to 1581 by 25 times and caused my buy price with abt.us to drop from 117.20 to 102.19. My orders at that time were profitable. The broker adjusted the spread and burned my account. I have contacted many times but no resolution.

Exposure

2021-11-27

FX3786200864

Vietnam

A player was cheating. The leverage was constantly changing in two days since 1:20-tube 1 after we bought a stock with speed jpm 3. They change the levers, so I cut myself due to the high levers. It leads to the loss of all bonus. It should be an ordinary case. I want to warn the public.

Exposure

2021-07-19

FX3864389404

Vietnam

Place an order to cancel an order, so that the account is burned, and there is no price area within the cut-off price range

Exposure

2021-06-22

dtoan

Vietnam

reputable website

Neutral

2022-11-07

Hieu Vo

Vietnam

please solve it soon

Positive

2022-11-11