Score

SwissFS

Kuwait|5-10 years|

Kuwait|5-10 years| https://www.swissfs.com/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Jordan 2.63

Jordan 2.63Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Kuwait

KuwaitUsers who viewed SwissFS also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IronFX

- 15-20 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

swissfs.com

Server Location

United States

Website Domain Name

swissfs.com

Server IP

104.18.10.177

Company Summary

| SwissFS Review Summary | |

| Founded | 2004 |

| Registered Country/Region | Kuwait |

| Regulation | No regulation |

| Market Instruments | Forex, indices, equities, ETFs, commodities |

| Account Type | Live Account, Demo Account |

| Demo Account | ✔ |

| Leverage | Up to 1:200 |

| Trading Platform | MT4 |

| Customer Support | Phone: +965-22020490 |

| Email: admin@swissfs.com | |

| Physical Address: City Tower ( Al Madina Tower) Floor 16 Khalid Ibn Al Waleed Street Sharq Kuwait P.O.BOX 26635, SAFAT 13127 | |

SwissFS Information

SwissFS, founded in 2004, is a brokerage registered in Kuwait. The trading instruments it provides cover Forex, indices, equities, ETFs, commodities. It is unregulated.

Pros and Cons

| Pros | Cons |

| Wide range of trading instruments | Unregulated |

| Generous leverage up to 1:200 | No clear information about accounts |

| MT4 supported | Limited account types offered |

| Demo account available | No commission information |

| No Islamic account | |

| No payment methods information offered |

Is SwissFS Legit?

It is clear that SwissFS is currently unregulated.

What Can I Trade on SwissFS?

SwissFS offers traders forex, indices, equities, ETFs, commodities to trade.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Equities | ✔ |

| ETFs | ✔ |

| Indices | ✔ |

| Metals | ❌ |

| Futures | ❌ |

| Options | ❌ |

Account Types

SwissFS offers 2 different types of accounts to traders - Live Account, Demo Account. But there is no more account information on its official website.

Trading Platform

SwissFS's trading platform is MT4, which supports traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices |

| MT4 Margin WebTrader | ✔ | Web, Mobile |

| MT5 | ❌ |

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 10

Content you want to comment

Please enter...

Review 10

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Talal Baig68948

Pakistan

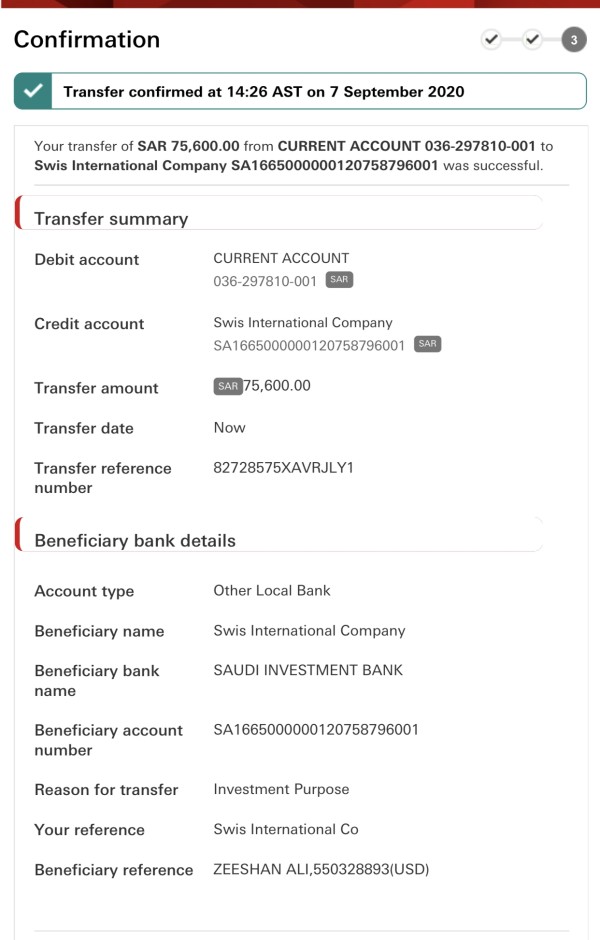

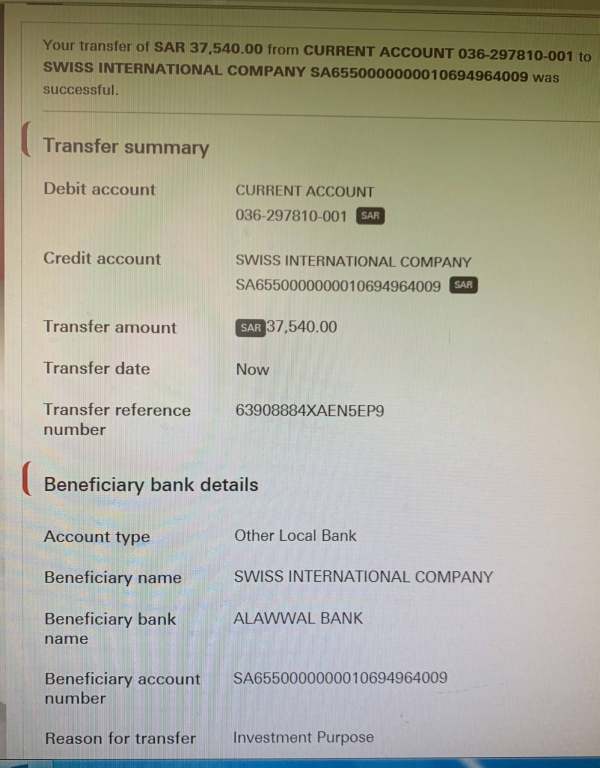

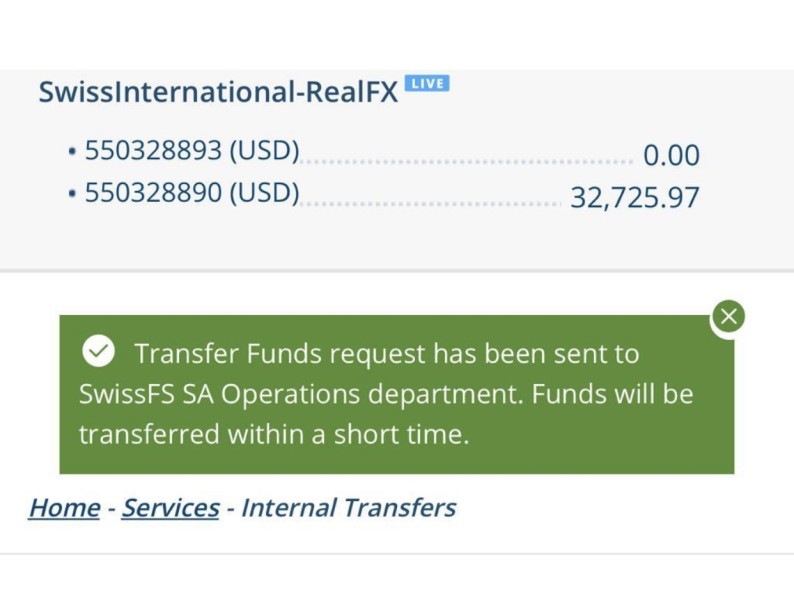

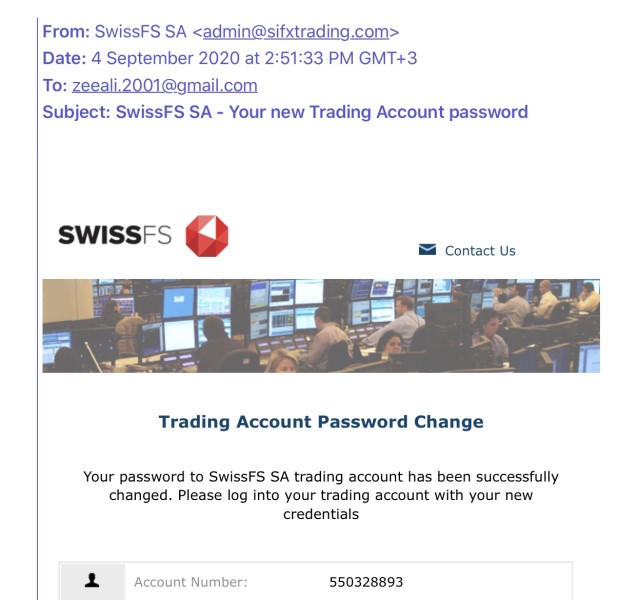

I Open the Real Trading account with SwissFS in August 2020, with USD 10,000 and tranfer fund via bank detail as provided on their portal . Kindly note my account detail @ portal “my.sifx.sa.com” Account No: 1000192767 MT4 Trading Account No : 550328893 and 550328890 Kindly note the bank tranfer detail of USD 10,000 which was transfered to "Swiss International Company" in in AWAL Bank “SA65500000010694964009” on 26 Aug 2020.

Exposure

2021-10-01

Mayaz Ahmad

Bangladesh

A client of SwissFS had his account blocked when he tried to withdraw from his account. He communicated this issue to the officials of SwissFS through mail but got no response since then.

Exposure

2021-06-19

FX1849652333

Saudi Arabia

i trade over Swissfs company and i get profits over 100K but they deny to send the money and delete every this even disable my account. i have all the evident and i will charge them

Exposure

2020-07-22

Eulalia Blackwood

Portugal

SwissFS opened up the financial world for me with a variety of trading instruments and a user-friendly account setup. The 1:200 leverage and MT4 platform make trading flexible, and the customer support is responsive. Overall, a decent experience.

Neutral

2023-12-06

Thaddeus Montgomery

Ecuador

SwissFS falls short on crucial aspects – no regulatory authorization, undisclosed spreads and commissions, and high leverage. The lack of transparency and accountability is a red flag. Caution is advised for potential traders.

Neutral

2023-12-05

Aseelnh

Kuwait

the best and biggest company in the Kuwait

Positive

2023-10-25

FX2382802730

Egypt

The Swiss company has an Arab license with the Kuwaiti Ministry of Commerce and Industry since 2002. I believe that the license protects the Arab trader, and it has local withdrawal and deposit methods in most Arab countries, which increases its credibility and honesty. I have been dealing with it for 3 years, and there is one flaw, which is that withdrawals are made from Through the bank in a maximum of two working days, but without any commissions, it deserves 5 stars

Positive

2023-10-25

bobader

Kuwait

The Swiss company is an excellent company after researching trading companies in Kuwait, but everyone must work outside the company’s headquarters in Kuwait because there are many fraudulent people claiming that they work for the company.

Positive

2023-10-24

bobader

Kuwait

swissfs الشركة السويسرية للوساطه المالية I can say that they're very professional and honest broker. They're commission-free with low spreads and default mini-lots for retail traders (10,000 units per lot) which is great for beginners and you can multiply it as you wish (for professional traders, although they've more advanced platforms and services for professional and institutional traders). They're compatible with islamic rules, which makes them appropriate for everyone, muslim or not. The platform is simple, but very reliable and contains all the features you may think of (although I'm still a Meta-Trader fan). Orders are filled immediately, with slippage of 2-3 pips in volatile conditions (which is nothing compared to other brokers and platforms) I didn't have to call the dealing room, but I met the customer support (it's an advantage to have a broker where you live). They were very honest and professional. I was day trader at first with repeated losses, so they adviced me to become a swing trader (which is less profitable for any broker -because of less deals per day- but not when they're clean and transparent) and taught me a sterategy, which gave me repeated good profits. I didn't try their ECN & Currenex service they provide, but I may think about it in my plan, although I'm very comfortable and satisfied with their default retail platform and service. I highly recommend them for any trader to give this broker a try.

Positive

2023-10-24

Lsy、

Vietnam

It deserves five stars anyway. The demo account is great, the MT4 trading platform is perfect, and the customer service is fast and warm. Thanks for all your help so far, SwissFS.

Positive

2023-02-17