Score

Sky Alliance Markets

Australia|5-10 years|

Australia|5-10 years| https://skyamarkets.com/

Website

Rating Index

Contact

- The claimed AustraliaASIC regulation (license number: 000292464) is verified as a clone firm. Please pay attention to the risk!

Basic Information

Australia

AustraliaAccount Information

Users who viewed Sky Alliance Markets also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

skyalliancemarket.com

Server Location

United Kingdom

Website Domain Name

skyalliancemarket.com

Server IP

35.177.52.3

skyamarkets.com

Server Location

Hong Kong

Website Domain Name

skyamarkets.com

Server IP

13.70.24.189

skyallmarkets.com

Server Location

Australia

Website Domain Name

skyallmarkets.com

Server IP

43.250.140.35

Company Summary

| Sky Alliance Markets Review Summary in 10 Points | |

| Founded | 2005 |

| Registered Country | Australia |

| Regulation | ASIC(Clone and revoked) |

| Market Instruments | Forex, commodities, indices, cryptocurrencies, futures |

| Demo Account | Available |

| Leverage | 1:400 |

| EUR/USD Spread | From 1.0 pips (Standard account) |

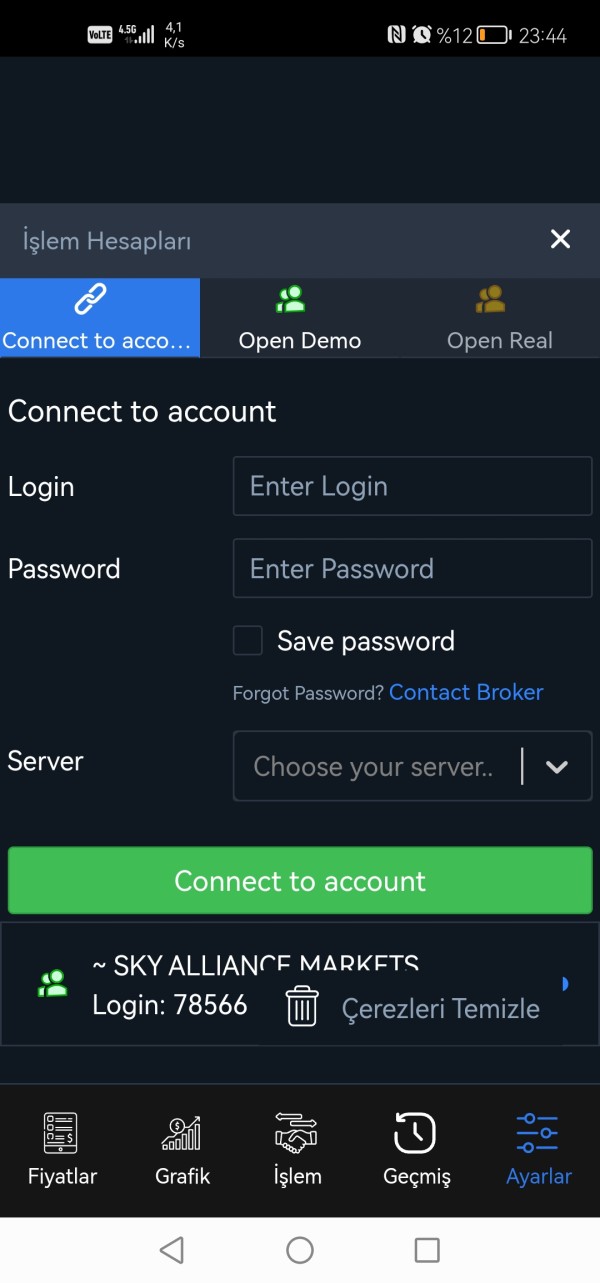

| Trading Platform | MT4 |

| Minimum Deposit | $100 |

| Customer Support | Email: client@skyallmarkets.com |

What is Sky Alliance Markets?

Sky Alliance Markets is an online trading broker owned by Sky Alliance Markets Pty Ltd, headquartered in Sydney, Australia. It provides traders with access to a wide range of financial instruments, including forex, commodities, indices, cryptocurrencies, and futures through the MetaTrader 4 (MT4) platform.

Pros & Cons

| Pros | Cons |

| • Popular payment methods accepted | • Reports of unable to withdraw and scams |

| • Wide range of financial instruments available | • Residents of United States of America (U.S), Australia, Afghanistan, North Korea, Iran, Iraq, Yemen, Ontario Province (Canada) are excluded |

| • Multiple account types | • Limited info on deposit/withdrawal |

| • Demo accounts available | • Limited trading tools and educational resources |

| • Tight spreads | • Only email support |

| • Commission-free accounts offered | • Clone and revoked licenses |

| • MetaTrader 4 (MT4) platform support |

Sky Alliance Markets Alternative Brokers

- FX Broadnet - offers competitive spreads, reliable customer support, and a user-friendly trading experience, making it a recommended choice for traders.

- Tasman FX - provides a diverse range of trading instruments, competitive spreads, and robust trading technology, making it a recommended option for traders seeking a comprehensive trading experience.

- TeraFX - offers a user-friendly trading platform, competitive trading conditions, and a wide range of financial instruments, making it a recommended choice for traders looking for a reliable and accessible trading environment.

There are many alternative brokers to Sky Alliance Markets depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Sky Alliance Markets Legit?

Sky Alliance Markets has three licenses, including 2 ASIC Revoked license and 1 ASIC Clone license. Traders should aware the risks and be cautious.

Market Instruments

Sky Alliance Markets offers 5 classes of tradable instruments to its clients, includes Forex, commodities. Indices, cryptocurrencies, futures. However, this broker does not provide trading on shares, ETFs and options.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Futures | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Options | ❌ |

Account Types

| Account Type | Minimum Deposit |

| Standard/Swap-free Standard | $100 |

| ECN/Swap-free ECN | $1,000 |

Sky Alliance Markets offers traders a variety of account types to choose from. The Standard account is designed for traders who prefer traditional trading conditions. It has a minimum deposit requirement of $100 and allows traders to access the full range of trading instruments offered by the broker.

For traders looking for tighter spreads and faster execution, the ECN (Electronic Communication Network) account is available. With a minimum deposit requirement of 1,000, the ECN account offers direct access to liquidity providers and allows traders to benefit from competitive pricing and lower trading costs. The ECN account is well-suited for experienced traders who value transparency and direct market access.

Sky Alliance Markets also provides Swap-free accounts, suitable for traders adhering to Islamic finance principles. The Swap-free Standard and Swap-free ECN accounts operate without any overnight swap charges, making them compliant with Islamic finance rules. Traders interested in these accounts can enjoy the same trading conditions as the Standard and ECN accounts while adhering to their religious beliefs.

The minimum lot size for all account types is 0.01 lot, providing flexibility in trade sizes. Regarding base currencies, Sky Alliance Markets supports multiple options, including USD, GBP, EUR, AUD, and NZD. This allows traders to select a base currency that aligns with their preferences and trading requirements.

Furthermore, Sky Alliance Markets offers demo accounts, allowing traders to practice their strategies and familiarize themselves with the trading platforms without risking real money. Demo accounts simulate live market conditions and provide a risk-free environment for traders to gain experience and test their trading skills.

Leverage

Sky Alliance Markets provides traders with varying levels of leverage depending on the trading instrument. For forex pairs, the broker offers leverage up to 1:400. Leverage allows traders to control larger positions in the market with a smaller amount of capital. A leverage of 1:400 means that for every $1 of available capital, traders can open a position worth up to $400.

When it comes to commodities trading, Sky Alliance Markets offers leverage up to 1:200. This enables traders to amplify their exposure to commodity markets such as gold, silver, crude oil, and natural gas. With a leverage of 1:200, traders can control positions that are up to 200 times the size of their account balance.

For US Oil and Brent Oil, as well as indices and futures, Sky Alliance Markets provides leverage up to 1:100. These leverage levels allow traders to participate in the price movements of these assets with increased buying power.

In the case of cryptocurrency CFDs, Sky Alliance Markets offers leverage up to 1:5. Cryptocurrencies are known for their volatility, and the lower leverage of 1:5 helps manage the risk associated with these assets.

| Asset Class | Maximum Leverage |

| Forex pairs | 1:400 |

| Commodities | 1:200 |

| US Oil & Brent Oil, indices, futures | 1:100 |

| Cryptocurrency CFDs | 1:5 |

It's important to note that while leverage can magnify potential profits, it also increases the risk of losses. Traders should exercise caution and carefully manage their risk when utilizing leverage. It is advisable to have a thorough understanding of leverage and its implications before trading with high leverage ratios.

Spreads & Commissions

Sky Alliance Markets offers competitive spreads and commissions to its traders. For the Standard and Swap-free Standard accounts, the spread starts from 1.0 pips. The spread refers to the difference between the buying and selling price of a trading instrument, and a starting spread of 1.0 pips indicates a relatively tight and competitive pricing environment.

On the other hand, the ECN and Swap-free ECN accounts at Sky Alliance Markets boast even tighter spreads, starting from 0.0 pips. ECN accounts utilize direct market access, allowing traders to access liquidity from multiple providers, resulting in potentially lower spreads and better pricing conditions.

| Account Type | EUR/USD Spread | Commission |

| Standard/Swap-free Standard | from 1.0 pips | $0 |

| ECN/Swap-free ECN | from 0.0 pips | $3.5 ($7 per round turn) |

In terms of commissions, there is no commission charged for trades executed on the Standard and Swap-free Standard accounts. This means that traders can enjoy trading without incurring additional costs in the form of commissions for their transactions.

For the ECN and Swap-free ECN accounts, there is a commission of $3.5 per lot traded, or $7 per round turn. This commission-based pricing structure is commonly found in ECN accounts, where traders benefit from the transparency of direct market access and pay a fixed commission per trade instead of wider spreads.

It is important to consider both the spread and commission structure when evaluating the cost of trading with a broker. While a tighter spread can be favorable for traders looking to enter and exit positions at more favorable prices, commissions can add an additional cost to each trade. Traders should assess their trading strategy, frequency of trading, and overall trading volume to determine which account type and pricing structure align best with their trading needs.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| Sky Alliance Markets | 1.0 (Standard account) | $0 (Standard account) |

| FX Broadnet | 0.6 | $7 |

| Tasman FX | 0.8 | $5 |

| TeraFX | 1.2 | $6 |

Please note that spreads and commissions may vary depending on market conditions, account types, and trading platforms. It's always recommended to check the latest information directly from the brokers' websites or contact their customer support for the most accurate and up-to-date details.

Trading Platform

Sky Alliance Markets provides traders with the popular MetaTrader 4 (MT4) trading platform, available for Windows, iOS, and Android devices. MT4 is widely recognized and appreciated for its robust features, user-friendly interface, and advanced trading tools.

With the MT4 platform, traders can access a comprehensive range of trading instruments offered by Sky Alliance Markets, including forex, commodities, indices, and cryptocurrencies. The platform allows for real-time price quotes, interactive charts, and a wide selection of technical indicators to aid in market analysis.

Traders can execute trades directly from the platform using various order types, including market orders, limit orders, and stop orders. The platform also supports automated trading through the use of Expert Advisors (EAs), which are customizable trading algorithms that can execute trades based on predefined conditions.

MT4 offers a range of charting capabilities, allowing traders to analyze price movements and apply various technical analysis tools. Traders can customize chart layouts, timeframes, and indicators to suit their preferred trading strategies.

Additionally, the MT4 platform provides access to historical data, allowing traders to backtest their trading strategies and evaluate their performance over time. This feature can be valuable for traders looking to refine their approaches and make data-driven decisions.

Furthermore, the mobile versions of MT4 for iOS and Android devices enable traders to stay connected to the markets and manage their trades on the go. Traders can monitor their positions, receive real-time market updates, and execute trades from their mobile devices, providing flexibility and convenience.

Overall, Sky Alliance Markets' offering of the MT4 platform for Windows, iOS, and Android provides traders with a reliable and feature-rich trading environment. The platform's comprehensive tools, customization options, and accessibility empower traders to make informed trading decisions and execute trades seamlessly across various devices.

See the trading platform comparison table below:

| Broker | Trading Platform |

| Sky Alliance Markets | MT4 |

| FX Broadnet | MT4 |

| Tasman FX | MT4 |

| TeraFX | MT4 |

Trading Tools

Sky Alliance Markets provides traders with a range of trading tools to enhance their trading experience. One of the notable tools offered is the MAM/PAMM (Multi-Account Manager/Percentage Allocation Management Module) system. This tool is designed for professional traders and money managers who manage multiple trading accounts on behalf of their clients. With the MAM/PAMM system, traders can allocate trades and manage multiple accounts simultaneously, making it efficient and convenient to execute trades across various clients' accounts.

Another valuable trading tool offered by Sky Alliance Markets is copy trading. This feature allows traders to follow and copy the trades of experienced and successful traders. By connecting their trading account to the platform's copy trading system, traders can automatically replicate the trades of the selected traders in their own accounts. This tool is particularly beneficial for those who are new to trading or wish to diversify their trading strategies by leveraging the expertise of proven traders.

Deposits & Withdrawals

Sky Alliance Markets offers traders a convenient and straightforward process for depositing and withdrawing funds. The broker accepts payments through various methods, including wire transfer, Skrill, Neteller, and NganLuong.vn.

Sky Alliance Markets supports multiple base currencies, including USD, GBP, EUR, AUD, and NZD. This allows traders to choose their preferred base currency for their trading accounts, which can be advantageous for managing their trading activities and reducing currency conversion costs.

Sky Alliance Markets minimum deposit vs other brokers

| Sky Alliance Markets | Most other | |

| Minimum Deposit | $100 | $100 |

The minimum deposit requirement is $100, allowing traders with different capital levels to start trading. Importantly, Sky Alliance Markets does not charge any deposit fees, providing an advantage for traders looking to maximize their trading capital.

Customer Service

Sky Alliance Markets only offers customer support through email: client@skyallmarkets.com. The absence of more direct contact options, such as telephone support or live chat, may limit the immediate accessibility for urgent matters.

In addition to email support, Sky Alliance Markets maintains a presence on various social media platforms, including Twitter, Facebook, and Instagram. By following the broker on these networks, traders can stay updated with the latest news, announcements, and market insights that may be shared by the company. Social media can also serve as a platform for traders to engage with the broker and potentially connect with other traders in the community.

| Pros | Cons |

| • Availability of social media channels | • No 24/7 customer support |

| • Lack of direct contact options (phone, live chat) | |

| • Only email support | |

| • No FAQ section |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Sky Alliance Markets' customer service.

User Exposure at WikiFX

On our website, you can see that reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Education

Sky Alliance Markets places a strong emphasis on educating its clients, providing valuable market insights and analytical articles that cater to both novice and experienced traders. These educational resources are designed to enhance understanding of market dynamics and improve trading skills. The content covers a broad spectrum of topics, from basic trading concepts to advanced strategies and market analysis, ensuring that all traders have access to the information they need to make informed decisions.

Conclusion

In conclusion, Sky Alliance Markets is a broker that provides appealing trading circumstances. Beginning to trade with this broker is easy because it allows for small budgets in trading, and experienced traders and scalpers would see its adjustable leverage as a benefit. Spreads, or trading charges, aren't very low in comparison to other brokers, though.

Frequently Asked Questions (FAQs)

At Sky Alliance Markets, are there any regional restrictions for traders?

Yes. Sky Alliance Markets do not offer our services to residents of certain jurisdictions where such distribution or use would be contrary to local law or regulation, United States of America (U.S), Australia, Afghanistan, North Korea, Iran, Iraq, Yemen, Ontario Province (Canada).

Does Sky Alliance Markets offer demo accounts?

Yes. Demo accounts are on offer.

Is Sky Alliance Markets a good broker for beginners?

Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions on the leading MT4 platform. Also, it offers demo accounts that allow traders to practice trading without risking any real money.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Clone Firm Australia

- Australia Appointed Representative(AR) Revoked

- High potential risk

Review 32

Content you want to comment

Please enter...

Review 32

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX9816750502

Turkey

Everything is fine until you open an account and start trading. They play screen games in the trades. In other words, they have control over whether you make or lose money from the trades you open. I opened an account with this company. We started trading. My account became 55,000 dollars. However, I couldn't withdraw my money. I definitely do not recommend it.

Exposure

2024-12-12

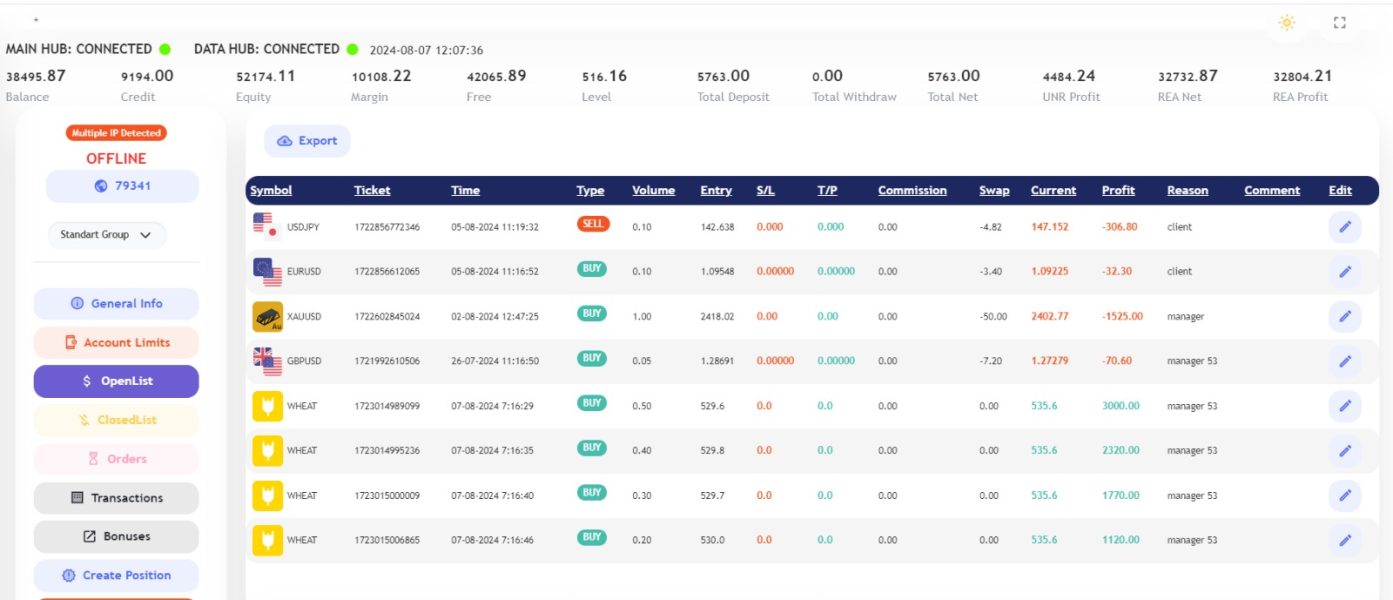

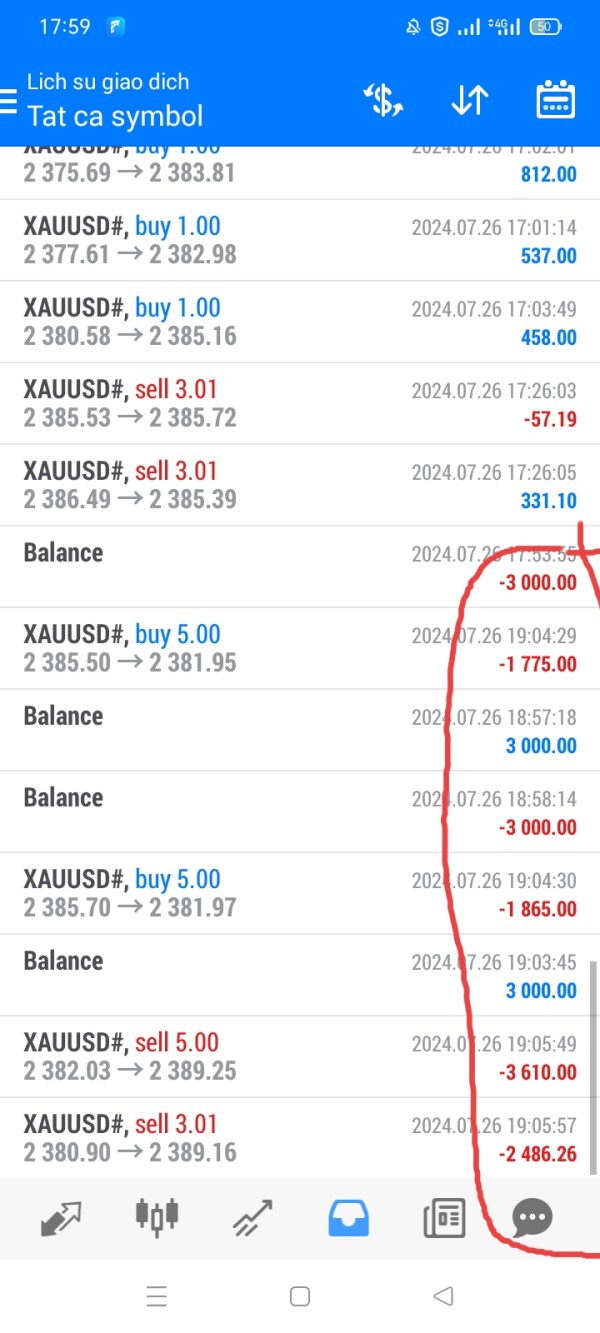

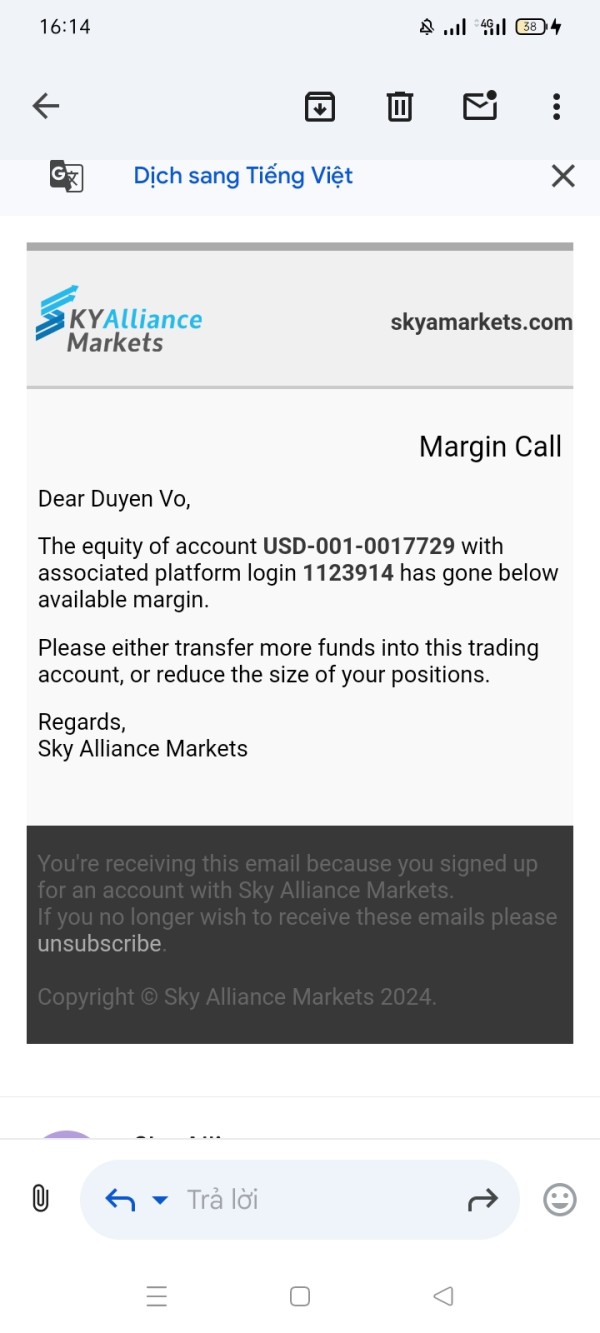

duyenvo

Vietnam

On July 26, 2024, why did my account automatically enter a running order and borrow money?

Exposure

2024-07-28

dragon9535

Turkey

I cannot withdraw money. I want to contact the relevant company.

Exposure

2024-07-05

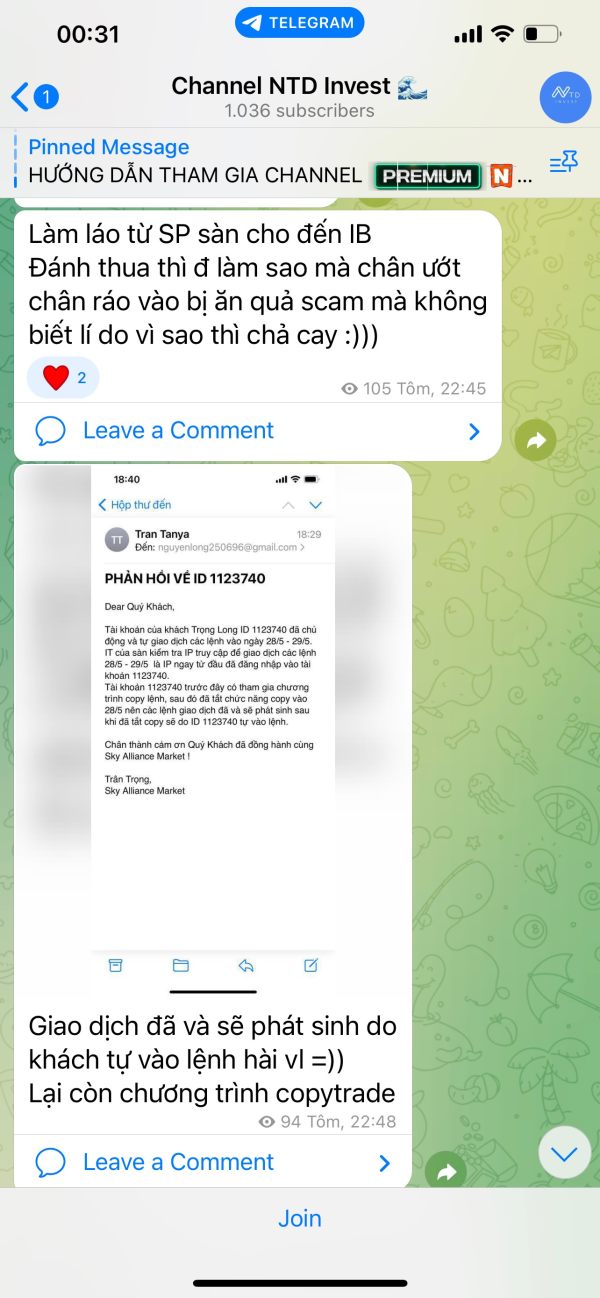

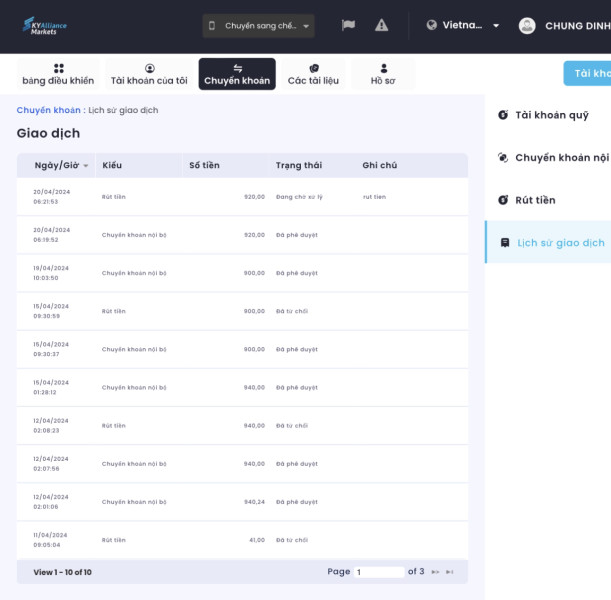

Nguyễn Trường Long

Vietnam

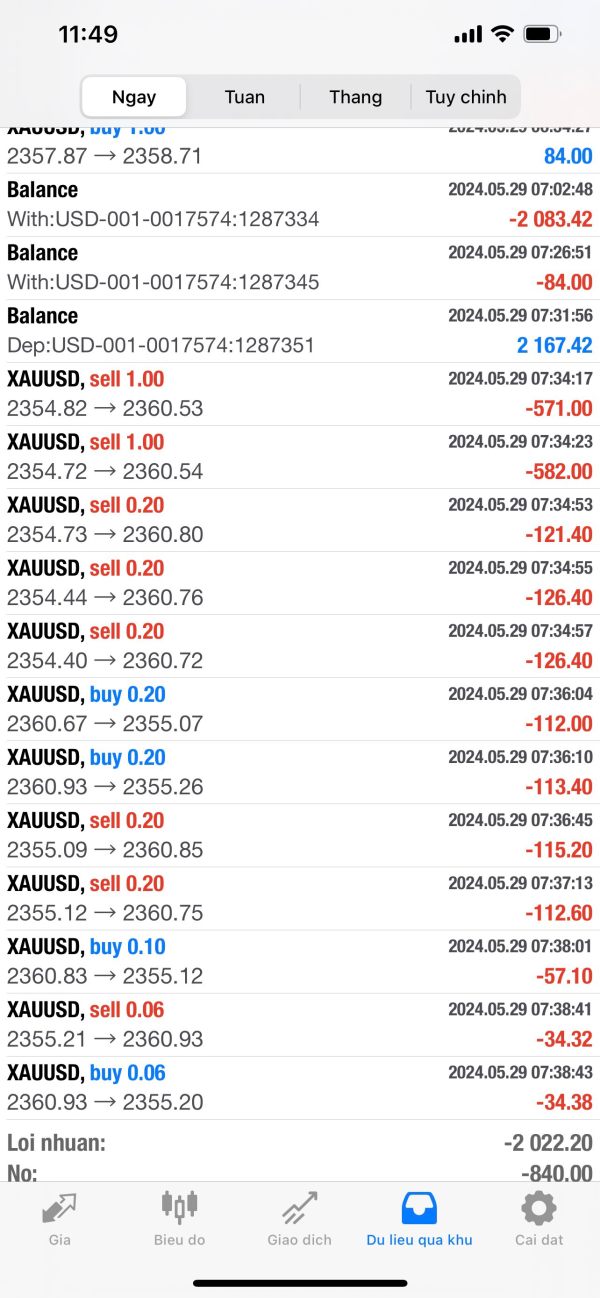

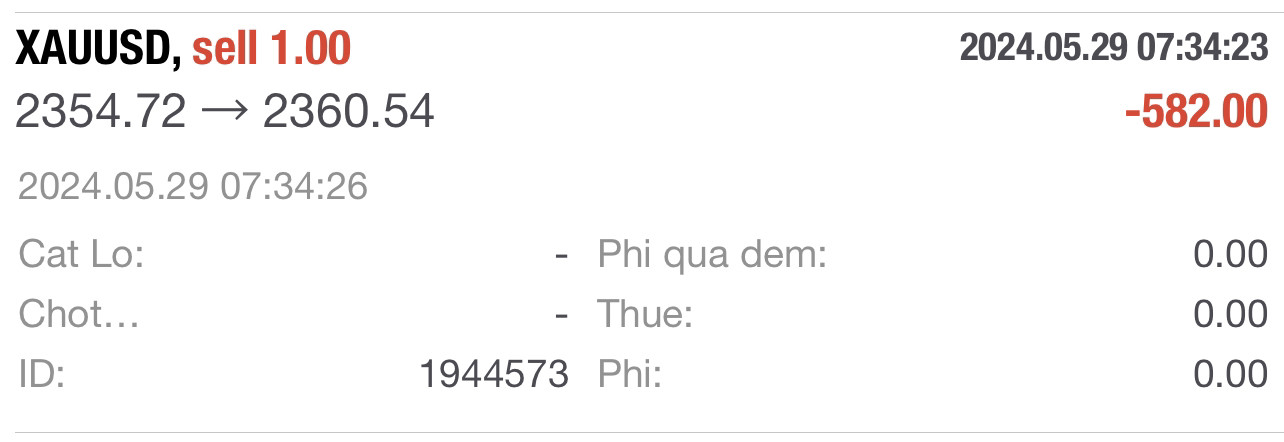

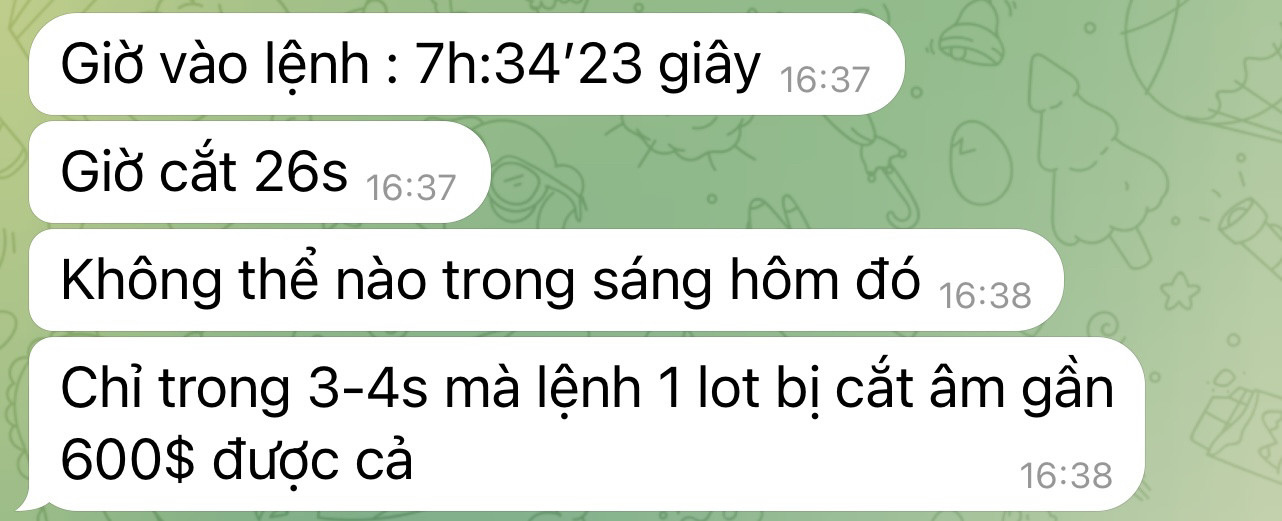

On May 29, I withdrew money from my account to bank twice but were rejected. Then it was automatically refunded to my trading account in MT4 and then placed 12 sell orders. Buying consecutively and cutting losses on these 12 orders continuously led to my account being liquidated. Then the price error of these 12 orders cannot be due to my mobile IP or any individual, but the floor's error. I hope support will check and process ID 1123740 properly and refund me. The following are images from my account and IP proving that this error was not caused by me which placed the order on May 29 on my device. And these orders had price errors due to an error from the exchange system.

Exposure

2024-06-20

vnchung

Vietnam

April 12, 2024 I entered a withdrawal order but the exchange refused and did not explain the reason. It has now been 10 days and I have been denied 4 withdrawals. I hope the exchange will consider and resolve the matter for the school. my case

Exposure

2024-04-22

Quang528

Vietnam

I need to withdraw money from my personal account, my problem has not been resolved.

Exposure

2024-04-17

Quang528

Vietnam

The floor is fake, does not approve withdrawal orders.

Exposure

2024-04-16

hoangthanh

Vietnam

Message to: skyAlliance markets support team: I am Hoang Van Thanh : My account is: ID 1121213 : at 7am to 8am on Thursday, April 5, 2024, I placed an order at the price 2290 - 2288- 2287 - 2284 At that time, the price went down to 2083 and I saw negative 20,000 USD. I set a sell stop at 2082 but I didn't touch my sell stop and cut off all my negative buy orders while the price had not yet gone down. That price: My account at that time was 57,288 USD. At that time, it was negative 20,000 USD. My current balance at that time was more than 30,000 USD, but my account was cut off and all orders were burned: I saw an anomaly here and request sky floor to review my transaction history and reimburse me for damages. We have confidence in the floor and have faith in the floor. My initial investment amount deposited into the floor to trade is 45,500 USD: I have saved this amount and borrowed money from the bank to trade. earned extra income and was unjustly lost in 1 hour: I do not accept the explanation of technical errors or any unjustified reasons: I attach herewith my Tk transaction history. Your order will be cut at the price that has not yet been reached, leading to the account being burned: best regardsimage0.png

Exposure

2024-04-13

Ly Do

Vietnam

I am Do Nguyen Ly, I opened a forex trading account at Sky Alliance. My account has ID: 1123110. My account has copy trade under Mr. Scott with Account ID 1123072. During the time of copying under him, I have made a profit. 5880usd and I noticed that Mr. Scott entered orders very slowly and he never entered 4-5 orders at the same price at the same time. In the early morning at 2:00 a.m. to 3:00 a.m. on March 28, 20524, I saw the transaction on my trading account. I discovered that TK entered many orders with very large volumes at almost the same price. I discovered something unusual so I called Skyalliance Support but didn't answer the phone. When I cut the orders and kept the previous 2 sell orders, my account was negative about 1,800 USD (my account at that time was 11,000 USD). After cutting off all the large sell orders at similar prices, I went to sleep with peace of mind. At 6:00 a.m. I woke up and saw that my account was burned with large sell orders at nearly the same price. Photos of unusual transaction orders that morning. I sent an email asking Sky Alliance for an explanation, but they replied that there was nothing unusual with my account. I am a trader who has been trading forex for 6 years now. I do not agree with this unreasonable answer. I also asked the Floor to send me a passport view of Mr. Scott's account so I could review his transaction history, but Sky did not agree.

Exposure

2024-04-04

Ly Do

Vietnam

MARCH 27: AFTER CUTTING ALL THE ORDERS, I TRANSFER THE AMOUNT OF 4,761usd TO THE INTERNAL ACCOUNT. AFTER WITHDRAWING THE MONEY FROM THE REMAINING ACCOUNT OF 2U AND THE FLOOR'S BONUS 500USD, I CONTINUE TO TRADE AND SIGN TO THE SECONDARY ACCOUNT FOR THE NEXT 280USD. I HAVE MADE A WITHDRAWAL ORDER AND REPORTED SUPPORT TO STOP COPYTRADE. AT 2:00 AM ON MARCH 28, I WAKE UP TO LOOK AT MY ACCOUNT AND FIND OUT THE MONEY HAS BEEN TRANSFERRED BACK TO THE TRADING ACCOUNT AND THERE ARE 6 SELL ORDERS AT ALMOST THE SAME PRICE. I SEE AN ABNORMALITY HERE AND CUT ALL THE ORDERS AT TIME. THAT CUT MY ACCOUNT ORDER AT 5161USD. I HAVE DEPOSIT THIS AMOUNT OF 5161USD TO AN INTERNAL ACCOUNT AND RECEIVED A CONFIRMATION EMAIL FROM THE EXCHANGE. THEN I GO TO BED. WHEN I WAKE UP IN THE MORNING I CHECKED THAT THE TK WAS ON FIRE. I HAVE ALL THE EVIDENCE HERE AND RECOMMEND THE FLOOR RESOLVE THE ABOVE ISSUE.

Exposure

2024-03-29

Sơn Nguyễn1916

Vietnam

I sent a withdrawal order from January 17, 2024, and today, January 23, 2024, it was rejected. I sent a message to the broker inbox but they said they didn't know and told me to send the email to them. I sent mail to client@skyalliancemarket.com but got no response. A/C can help me handle it. Thank you.

Exposure

2024-01-24

Sơn Nguyễn1916

Vietnam

A/C: the exchange did not process my withdrawal request. Previously, I withdrew $700 and was rejected by the exchange. I continued to redo the withdrawal order of $400 and $300, but the floor did not process my withdrawal order. When I contacted the floor inbox, they said they didn't know, and told me to send an email to the floor to see. I hope A/C can help me handle this! Thank you!

Exposure

2024-01-20

chien6247

Vietnam

A/C No: 1119410 I opened an account through an IB named Thien. At first, if the IB supported me, I could withdraw money. Then this IB said that if I didn't support it, I couldn't withdraw money. I emailed client@skyallmarkets .com has not received a response, currently IB Thien's number is blocked, cannot be contacted, please help or switch to personal account for transactions not through IB Thien TKS!

Exposure

2023-12-08

云上11995

Hong Kong

I made a withdrawal two weeks ago and it hasn't arrived yet. They haven't replied to the email I sent. I don't see the contact details here in China. The salesperson who opened the account for me before has also resigned. I don't know what to do.

Exposure

2023-09-21

云上11995

Hong Kong

I contacted the account opening salesperson, and the salesperson said he resigned last year. I wanted to withdraw some money first. I applied for withdrawal last week and it showed that the transfer was in progress. I sent an email to the company, but there was no response.

Exposure

2023-09-19

STEPHEN3224

Australia

On their website, it indicated fund withdrawal is to be processed within 3 - 5 business days. I submitted fund withdrwal (USDT) on 25 Nov 2022 and 28 Nov 2022, during these days, i have been sending email to them, got no respond at all. !!!!!!

Exposure

2022-12-06

yuan8410

Hong Kong

Unable to withdraw. It has been a month. Are they about to abscond?

Exposure

2022-11-10

yuan8410

Hong Kong

It has been a week for withdrawal and it has been delayed day after day.

Exposure

2022-11-10

MIR张

Hong Kong

I have been trading in sky Alliance Markets for a year. Before, the deposits and withdrawals were normal. The withdrawal from the last two months was particularly slow. Now, it has been almost a month for my account to withdraw 1878 US dollars and I still haven't received it.

Exposure

2022-11-09

泄露电话告你侵犯隐S

Hong Kong

Does the platform abscond? Why the official website and back-end website cannot be opened? How can I withdraw if I cannot log in?

Exposure

2021-11-19