Score

Rating Index

Contact

Licenses

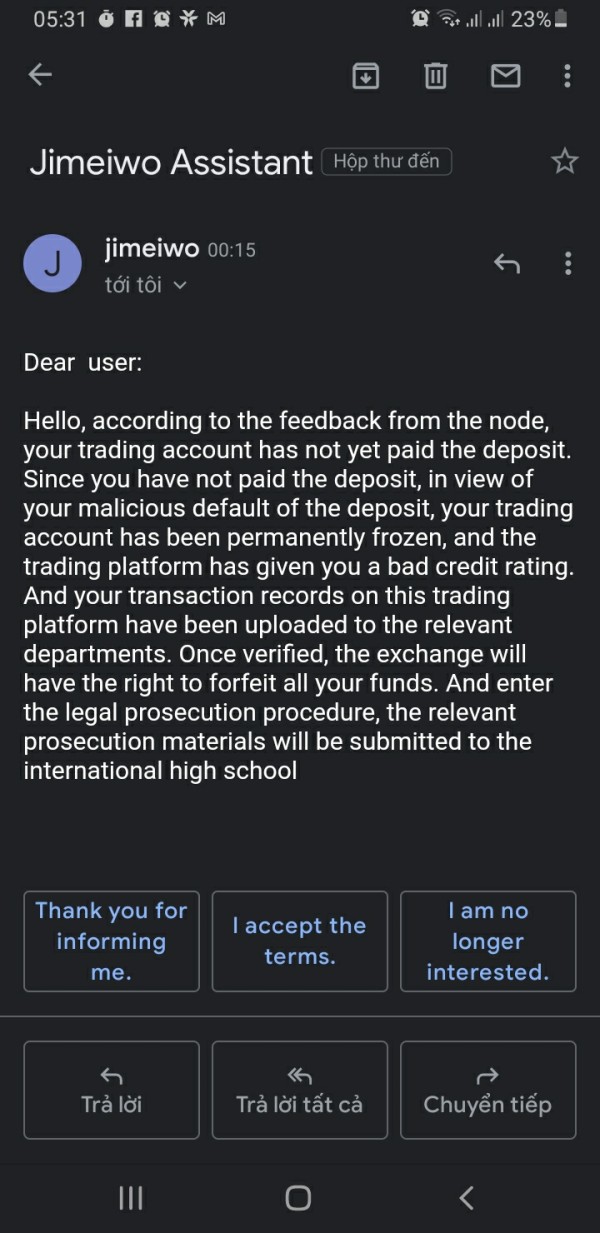

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

jimeiwo

jimeiwo

Canada

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed jimeiwo also viewed..

XM

GTCFX

GO MARKETS

VT Markets

jimeiwo · Company Summary

| Key Information | Details |

| Company Name | Jimeiwo |

| Years of Establishment | Within 1 year |

| Headquarters | Canada |

| Office Locations | N/A |

| Regulation | Unregulated |

| Tradable Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Account Types | Standard, ECN, VIP |

| Minimum Deposit | $100 |

| Leverage | Up to 1:100 |

| Spread | As low as 0.0 pips |

| Deposit/Withdrawal | Bank transfer, Wire transfer, Credit card/Debit card, PayPal |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

Overview of Jimeiwo

Jimeiwo is an unregulated company headquartered in Canada, operating for less than a year. They offer trading services primarily through the MetaTrader 4 and MetaTrader 5 platforms, facilitating transactions across various asset classes, including forex, stocks, indices, commodities, and cryptocurrencies. The company provides three types of accounts: Standard, ECN, and VIP, each with varying spreads and commission structures.

Clients can access leverage ratios of up to 1:100 for forex trading, while other asset classes offer lower leverage. Jimeiwo charges withdrawal fees of $20 for bank transfers and $5 for wire transfers and offers multiple deposit/withdrawal methods, including bank transfers, wire transfers, credit cards/debit cards, and PayPal. It should be noted, that Jimeiwo is without customer support, making for a high risk factor brokerage.

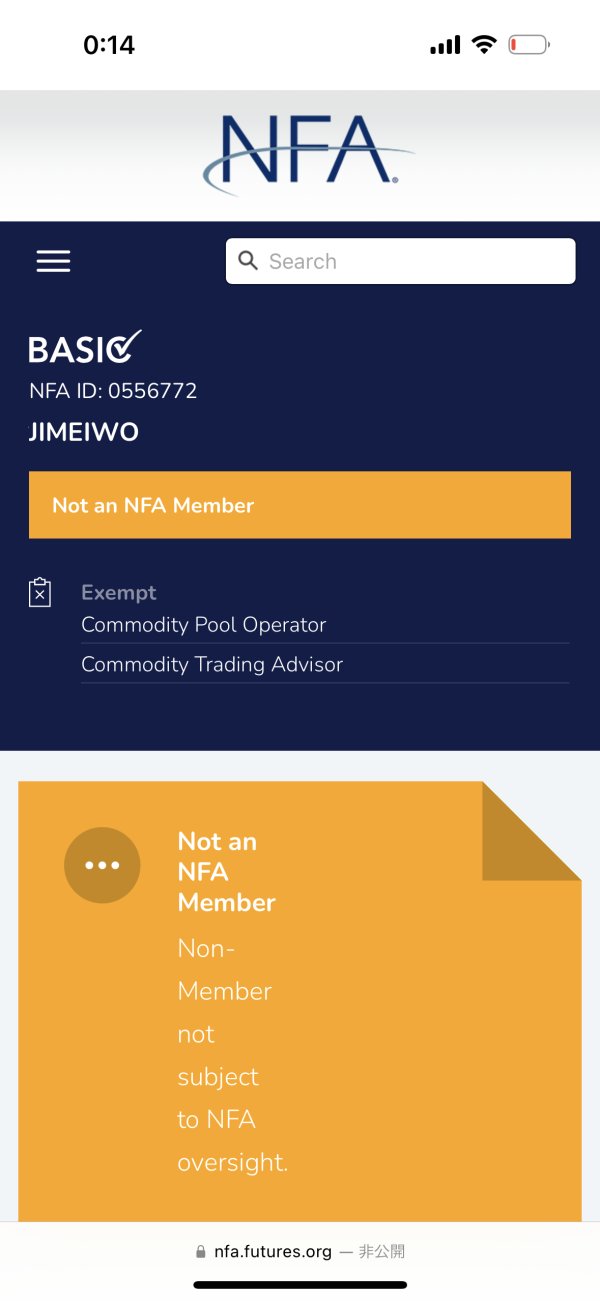

Regulation

The National Futures Association has classified Jimeiwo with License No. 0556772 as a “Suspicious Clone.” This designation implies that the company is under suspicion of potentially engaging in fraudulent or scam-related activities. The license status is unclear, but the suspicion of cloning raises significant concerns regarding the legitimacy of the company's operations.

A “Suspicious Clone” in regulatory terms refers to a company that is suspected of mimicking or imitating the identity of a legitimate and authorized financial entity, often for deceptive purposes. This type of regulation aims to safeguard investors and traders from fraudulent schemes and unethical practices. The risks associated with dealing with a “Suspicious Clone” include potential financial losses, identity theft, and the absence of regulatory protections, as these entities often operate without the necessary oversight and authorization.

Pros and Cons

| Pros | Cons |

| Competitive Spreads | Unregulated Status |

| Choice of Platforms | Limited Customer Support |

| Multiple Tradable Assets | Minimum Deposit Required |

Pros:

Competitive Spreads: Jimeiwo offers competitive spreads, starting at 0.0 pips for its ECN and VIP account types, making it attractive to traders seeking cost-effective trading conditions.

Choice of Trading Platforms: Clients have the flexibility to choose between MetaTrader 4 and MetaTrader 5, both renowned platforms with robust features for comprehensive trading.

Multiple Tradable Assets: The company provides access to a wide range of tradable assets, including forex, stocks, indices, commodities, and cryptocurrencies, allowing traders to diversify their portfolios.

Cons:

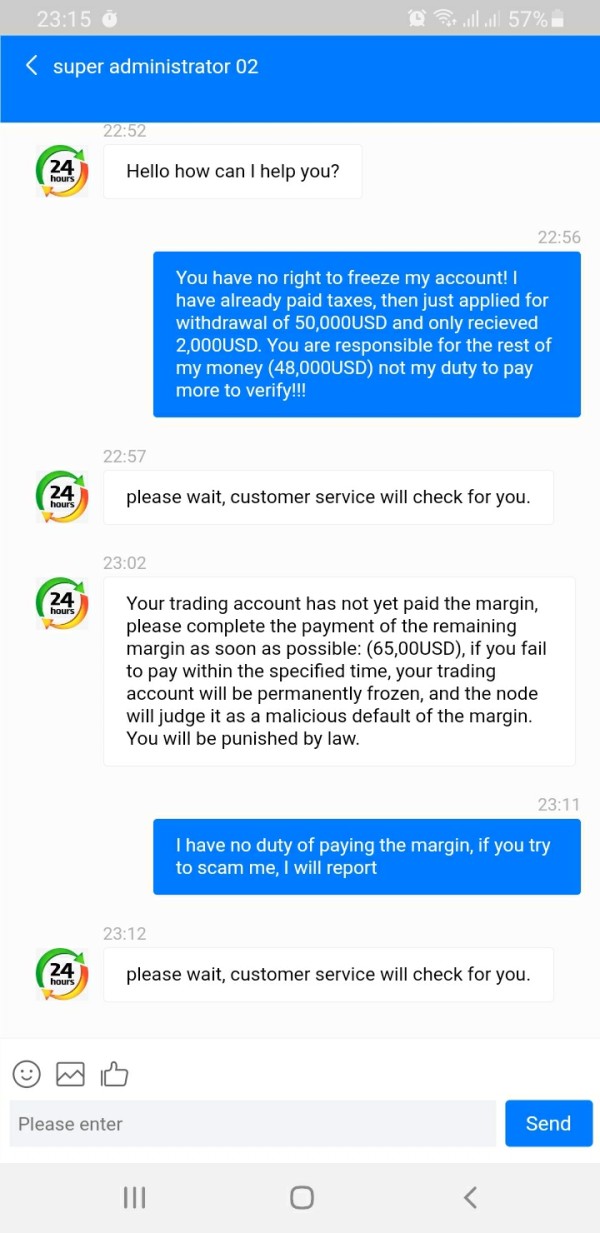

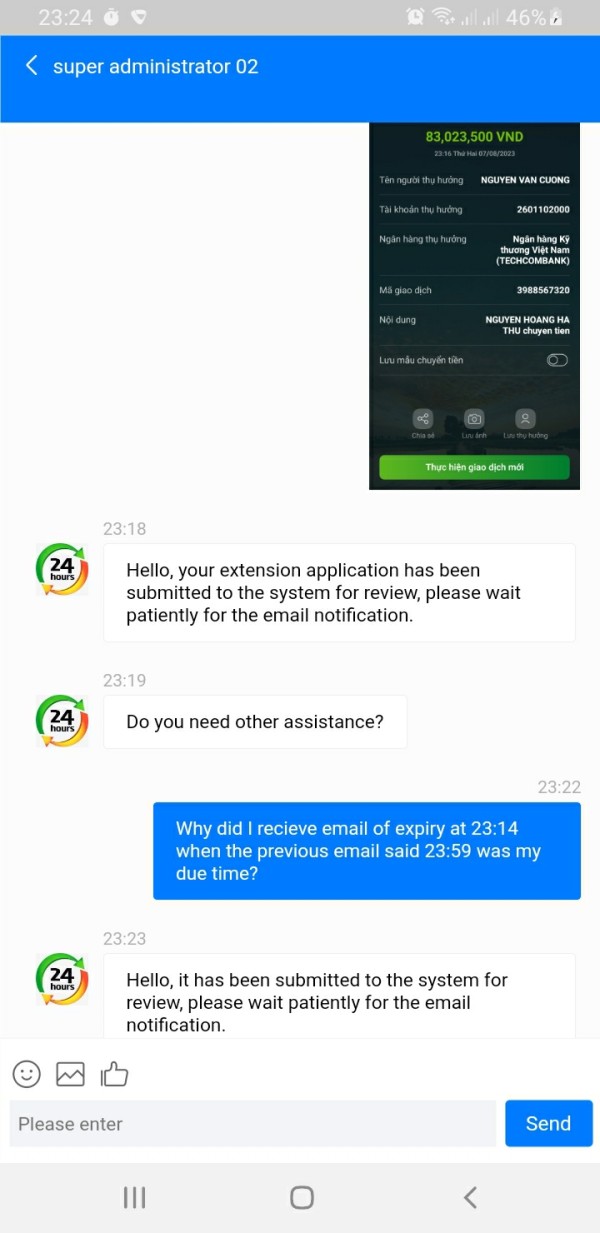

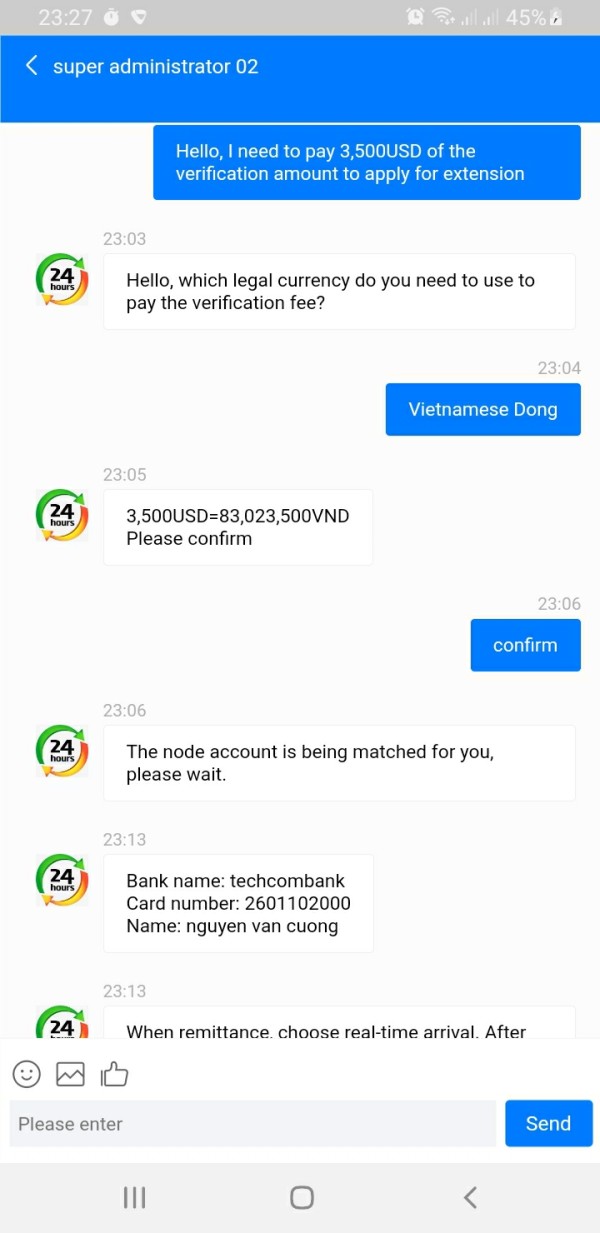

Unregulated Status: Jimeiwo operates without regulatory oversight, which can raise concerns about investor protection and the lack of regulatory authority to address disputes.

Limited Customer Support: The absence of readily available customer service options on the official website may hinder clients in need of immediate assistance, potentially leading to delays in issue resolution.

Minimum Deposit Required: While not exorbitant, the minimum deposit requirement of $100 may be a barrier for traders with limited capital looking to start trading.

Market Instruments

Jimeiwo offers a comprehensive range of market instruments, including forex, stocks, indices, commodities, and cryptocurrencies, which is in line with the offerings of its competitors. Specifics are as follows:

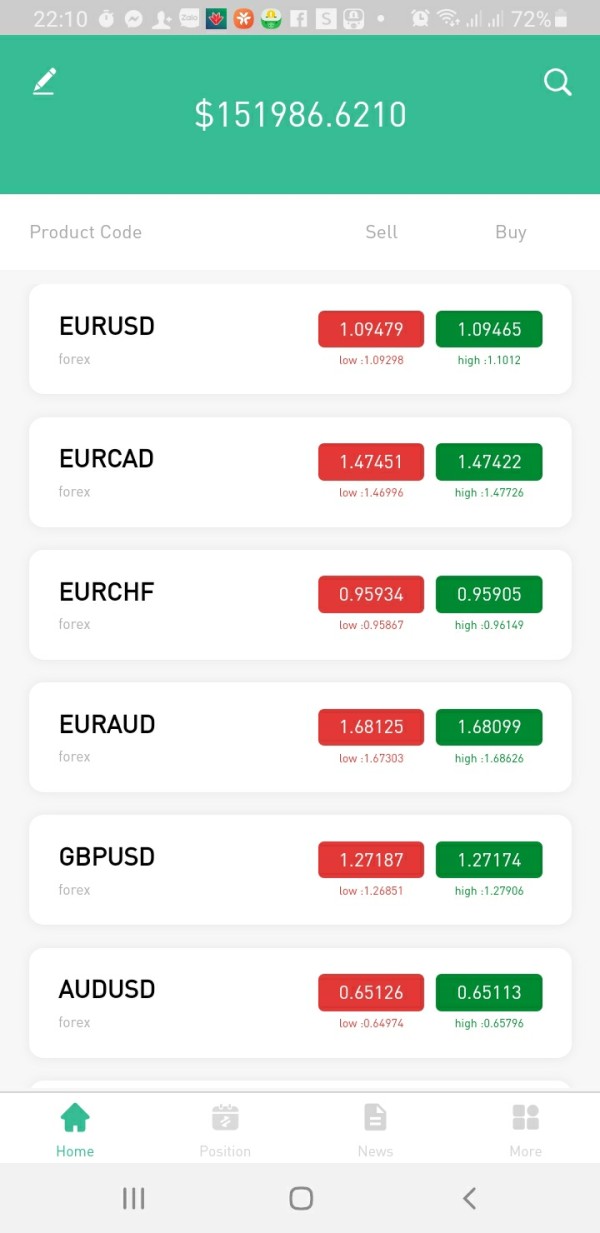

Forex: Jimeiwo offers a range of over 100 currency pairs for trading, allowing investors to speculate on the exchange rate fluctuations between various global currencies. Popular pairs like EUR/USD, GBP/JPY, and USD/JPY are available for trading.

Stock: Jimeiwo provides access to a vast selection of over 10,000 stocks from more than 100 exchanges worldwide. Traders can invest in stocks from companies across various industries and regions, such as Apple Inc. (AAPL), Amazon.com Inc. (AMZN), and Alibaba Group Holding Ltd. (BABA).

Indices: Jimeiwo offers over 20 stock indices for trading, enabling investors to track the performance of major global stock markets. Indices like the S&P 500, NASDAQ 100, and FTSE 100 are available for speculation.

Commodities: Jimeiwo allows traders to engage in the commodities market with access to over 20 different commodities, including precious metals like gold and silver, energy commodities like crude oil, and agricultural commodities such as wheat and soybeans.

Cryptocurrency: Jimeiwo provides access to more than 10 cryptocurrencies, allowing traders to buy and sell digital assets like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

The following is a table that compares Jimeiwo to competing brokerages:

| Broker | Market Instruments |

| Jimeiwo | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| FXPro | Forex, Stocks, Indices, Commodities, Cryptocurrencies, Futures, Options, Shares |

| IC Markets | Forex, Stocks, Indices, Commodities, Cryptocurrencies, Bonds, Futures, Options |

| FBS | Forex, Stocks, Indices, Commodities, Cryptocurrencies, Metals, Energies, Cryptocurrency CFDs |

| Exness | Forex, Stocks, Indices, Commodities, Cryptocurrencies, Cryptocurrency Indices, Cryptocurrency Pairs |

Account Types

Jimeiwo offers three distinct account types—Standard, ECN, and VIP. Specifics are as follows:

Standard Account: Jimeiwo offers a basic account type known as the Standard Account. This account comes with spreads starting at 1.8 pips, offering traders a straightforward option for participating in the financial markets.

ECN Account: Jimeiwo provides an ECN Account designed for traders seeking tighter spreads and direct market access. With spreads starting at 0.0 pips, this account includes a commission fee of $7 per round trip, making it suitable for more experienced traders looking for competitive pricing.

VIP Account: The VIP Account at Jimeiwo caters to traders looking for premium features. It offers spreads starting at 0.0 pips, with a lower commission of $5 per round trip compared to the ECN Account. This account type is suitable for traders who require enhanced trading conditions and are willing to meet the associated requirements.

Here's a table summarizing the features of each account type:

| Account Type | Spreads | Commission |

| Standard | Starting at 1.8 pips | N/A |

| ECN | Starting at 0.0 pips | $7 |

| VIP | Starting at 0.0 pips | $5 |

How to open an account?

The first step would be navigate to the “Register” button that is located at the top right side of the official webpage.

After this step, the user will be forwarded to the register page. From this point, the user will be prompted to input their account email and password of choice.

Once this information is input, the user will be prompted to input personal information like country of residences and name. Finally, the account creation will be completed, which will open the user to the ability to edit their account type and brgin trading.

Minimum Deposit

Jimeiwo requires a minimum deposit of $100 to open an account with the company. This amount serves as the initial capital that traders need to fund their accounts before they can start participating in the financial markets through Jimeiwo's trading platforms. It's important to note that this minimum deposit is an essential factor for individuals considering trading with the company, as it sets the entry point for engaging in various asset classes, including forex, stocks, indices, commodities, and cryptocurrencies.

Leverage

Jimeiwo offers varying leverage ratios based on the market instruments. For the forex market, traders can access leverage ratios of up to 1:100, which allows them to control larger positions with a relatively smaller amount of capital. However, for other asset classes such as stocks, indices, commodities, and cryptocurrencies, the leverage ratios tend to be lower, with most brokers offering ratios of up to 1:50 for stocks and 1:20 for indices. Leverage on commodities is typically offered at up to 1:10, and for cryptocurrencies, it is up to 1:5. The specific leverage ratios provide traders with the potential to amplify their trading positions but also come with increased risk, as both profits and losses are magnified.

Here's a table comparing the maximum leverage ratios for the mentioned market instruments of Jimeiwo with those of other brokerages:

| Broker | Forex | Stocks | Indices | Commodities | Cryptocurrencies |

| Jimeiwo | Up to 1:100 | Up to 1:50 | Up to 1:20 | Up to 1:10 | Up to 1:5 |

| FXPro | Varies | Up to 1:20 | Up to 1:20 | Up to 1:10 | Up to 1:2 |

| IC Markets | Up to 1:500 | Up to 1:20 | Up to 1:20 | Up to 1:10 | Up to 1:5 |

| FBS | Up to 1:3000 | Up to 1:20 | Up to 1:20 | Up to 1:10 | Up to 1:3 |

| Exness | Up to 1:2000 | Up to 1:5 | Up to 1:5 | Up to 1:2 | Up to 1:2 |

Spread

Jimeiwo offers competitive spreads across its different account types. For the Standard Account, the spreads start at 1.8 pips, providing a baseline for traders who prefer fixed spreads. On the other hand, the ECN Account offers spreads starting at 0.0 pips, which can be particularly attractive to traders seeking tighter spreads and direct market access, although it comes with a commission fee of $7 per round trip. The VIP Account also offers spreads starting at 0.0 pips but with a reduced commission of $5 per round trip. The varying spreads allow traders to choose an account type that aligns with their trading preferences and strategies, whether they prioritize fixed spreads or are willing to pay a commission for more competitive pricing.

Deposit & Withdrawal

Jimeiwo offers a selection of deposit and withdrawal methods to facilitate transactions for its clients. These methods include bank transfers, wire transfers, credit cards/debit cards, and PayPal.

Bank Transfer: Jimeiwo facilitates transactions through traditional bank transfers. This method is commonly used for depositing and withdrawing funds from trading accounts, offering a secure and reliable way to transfer money.

Wire Transfer: For those looking to transfer larger sums securely, Jimeiwo provides the option of wire transfers. This method is suitable for traders who require a more substantial financial transaction.

Credit Card/Debit Card: Jimeiwo accepts credit cards and debit cards as a convenient and quick means of depositing funds. It allows for straightforward and instant transactions, enhancing accessibility for traders.

PayPal: Jimeiwo also offers PayPal as an online payment option. This digital payment method provides flexibility for traders who prefer the convenience and security of online payment solutions.

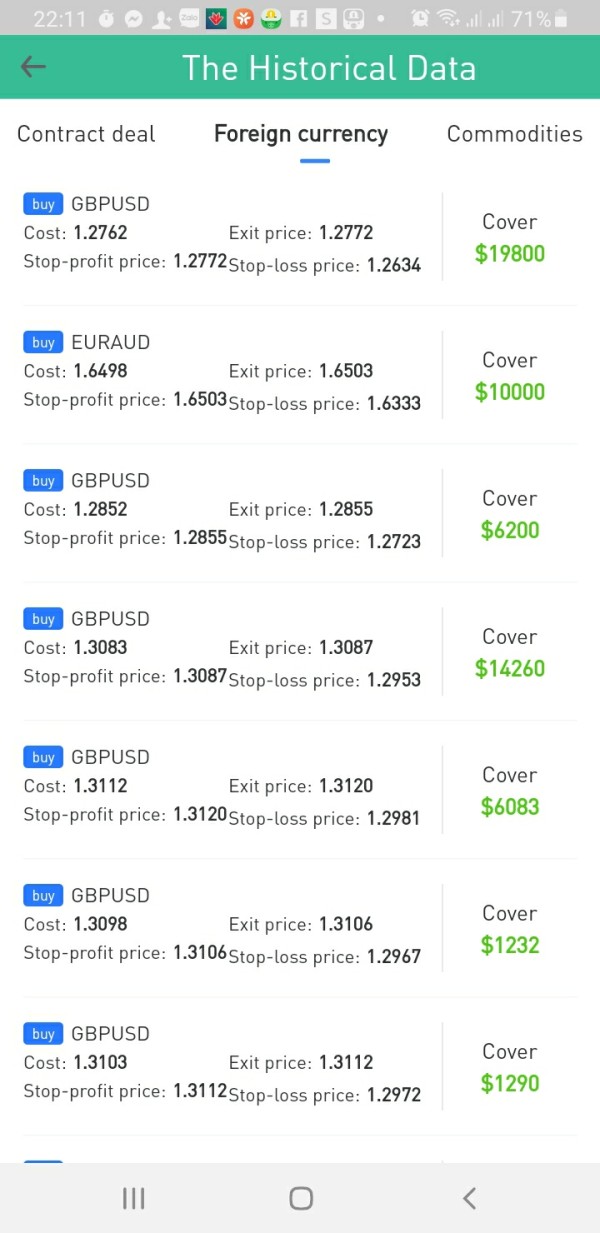

Trading Platforms

Jimeiwo offers traders the choice of two widely used and popular trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are known for their user-friendly interfaces and comprehensive features, making them suitable for traders of varying experience levels.

| Broker | Trading Platforms |

| Jimeiwo | MetaTrader 4 and MetaTrader 5 |

| FXTM | MetaTrader 4, MetaTrader 5, FXTM WebTrader, FXTM Mobile |

| Exness | MetaTrader 4, MetaTrader 5, Exness WebTerminal |

| Pepperstone | MetaTrader 4, MetaTrader 5, cTrader, Pepperstone WebTrader |

| FP Markets | MetaTrader 4, MetaTrader 5, IRESS, FP Markets Mobile |

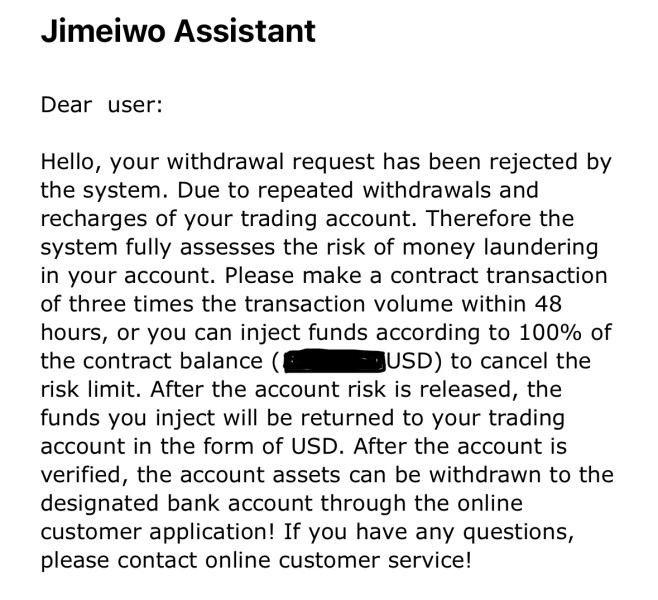

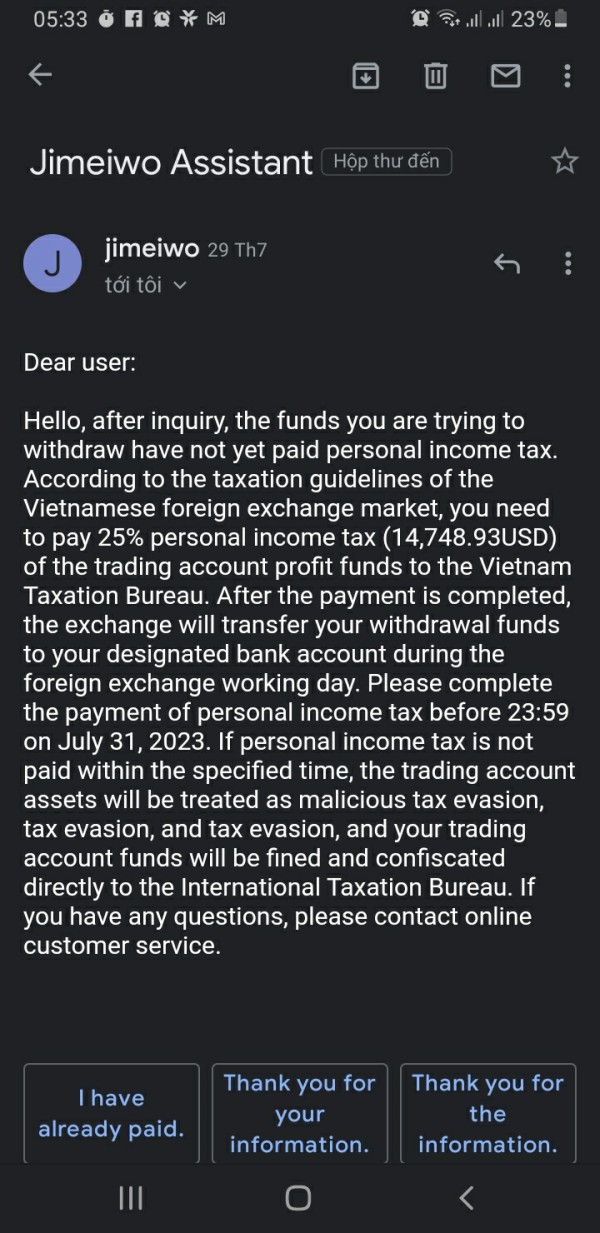

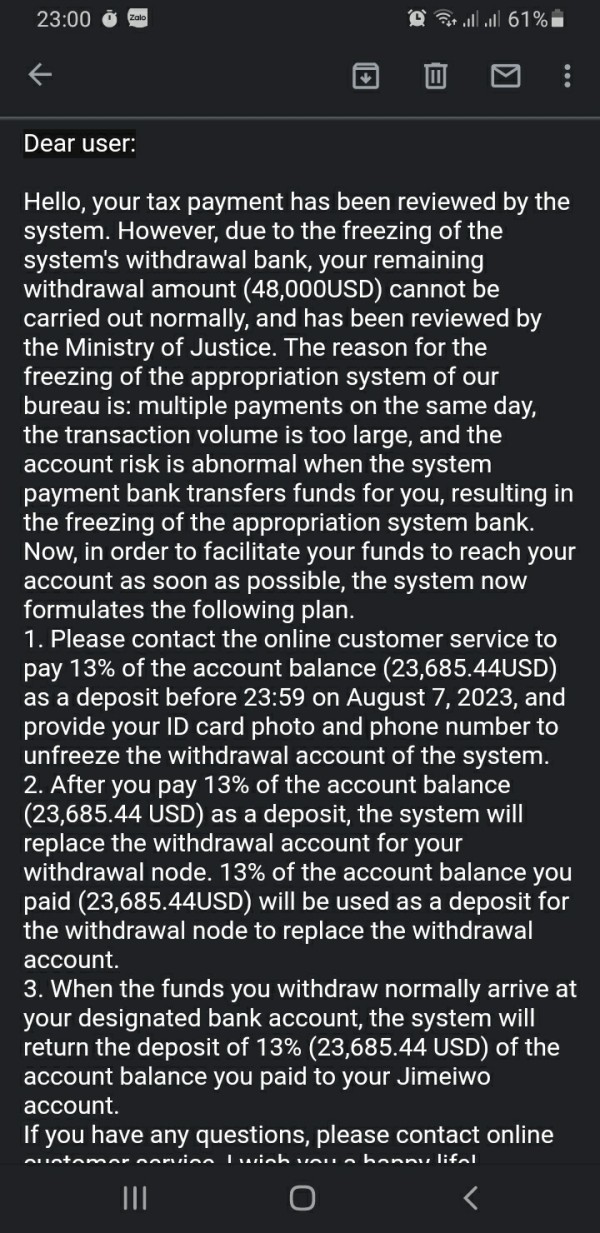

Customer Support

Jimeiwo notably lacks any customer service options available on its official website. This absence of direct customer support channels, such as live chat, phone numbers, or email contacts, can be a significant drawback for clients seeking immediate assistance or inquiries. It implies that traders may face challenges in obtaining prompt and direct support from the company, potentially leading to frustrations and delays in resolving issues or queries. This lack of accessible customer service options may deter potential clients who prioritize efficient and responsive support when choosing a brokerage.

Educational Resources

Jimeiwo provides a valuable advantage to its clients by offering a newsletter focused on market insights and updates. This newsletter serves as a valuable resource for traders, delivering timely information on market trends, news, and analysis directly to their inbox. Subscribing to such a newsletter allows traders to stay informed about critical developments that can impact their trading decisions. It enables clients to make more informed and timely trading choices, potentially enhancing their trading strategies and overall performance. This proactive approach to disseminating market information can be a valuable tool for traders seeking to stay ahead in the financial markets.

Conclusion

In conclusion, Jimeiwo is an unreuglated brokerage firm that, while relatively new to the market, offers a range of trading opportunities across various asset classes, including forex, stocks, indices, commodities, and cryptocurrencies. Despite its unregulated status, the company caters to traders with diverse account types, each tailored to specific trading needs. Traders can access these accounts with a minimum deposit of $100, which provides flexibility for those looking to start trading.

Jimeiwo's trading environment is primarily facilitated through the widely recognized MetaTrader 4 and MetaTrader 5 platforms, providing traders with robust tools and resources for their strategies. However, it's worth noting that the absence of readily available customer service options on the official website may pose challenges for clients seeking immediate assistance.

FAQs

Q: What is the minimum deposit required to open an account with Jimeiwo?

A: Traders need to deposit at least $100 to begin trading with Jimeiwo.

Q: What trading platforms does Jimeiwo offer for its clients?

A: Jimeiwo provides access to the MetaTrader 4 and MetaTrader 5 platforms.

Q: Are there multiple account types available at Jimeiwo?

A: Yes, Jimeiwo offers a range of account types, including Standard, ECN, and VIP.

Q: How does Jimeiwo handle customer inquiries and support on its website?

A: Jimeiwo does not provide customer service options on its official website.

Q: What is the maximum leverage ratio offered for forex trading at Jimeiwo?

A: Jimeiwo offers leverage ratios of up to 1:100 for forex trading.

Q: Is Jimeiwo regulated by any financial authorities?

A: No, Jimeiwo operates as an unregulated brokerage.

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now