Score

JFD Bank

Cyprus|5-10 years|

Cyprus|5-10 years| https://www.jfdbank.com/en

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Germany 2.72

Germany 2.72Contact

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Cyprus

CyprusUsers who viewed JFD Bank also viewed..

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IronFX

- 15-20 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

jfdbank.com

Server Location

United States

Website Domain Name

jfdbank.com

Server IP

107.154.139.109

Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| JFD Bank Review Summary in 10 Points | |

| Founded | 2011 |

| Registered Country/Region | Cyprus |

| Regulation | VFSC (offshore regulatory), BaFin (exceeded), CYSEC (suspicious clone) |

| Market Instruments | 60+ currency pairs & CFDs on commodities, precious metals, 15 indices, bonds, ETFs, and stocks |

| Demo Account | Available |

| Leverage | 1:30/1:400 |

| EUR/USD Spread | 0.4 pips |

| Trading Platforms | MT4/5 |

| Minimum Deposit | $500 |

| Customer Support | 24/5 multilingual phone, email, online messaging |

What is JFD Bank?

JFD Group is a financial services company that provides online trading and investment solutions to retail and institutional clients. It offers access to various financial instruments, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies through the MT4/5 platforms.

JFD Group Ltd (ex. JFD Brokers Ltd), a company with registration number HE 282265, authorized and regulated by the Cyprus Securities and Exchange Commission - CySEC (Suspicious Clone, Licence No. 150/11),

JFD Overseas Ltd which is authorized and regulated by the Vanuatu Financial Services Commission - VFSC (Offshore Regulatory, License No.17933) and

JFD Bank AG which is authorized and regulated by the Federal Financial Supervisory Authority - BaFin (Exceeded, License No. 120056).

“JFD Bank” is a brand name and registered trademark owned and used by the JFD group of companies, which includes:

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

JFD Bank offers a wide range of financial instruments, including forex and CFDs on various assets. The bank provides advanced trading platforms, competitive spreads, and multiple funding options to support traders' needs.

However, it does not hold any valid regulation currently. It has a limited selection of account types and a higher minimum deposit requirement, which may not be suitable for all traders.

| Pros | Cons |

| • Wide Range of Instruments | • No valid regulation |

| • Demo accounts available | • Limited info on website |

| • Competitive Spreads | • Reports of unable to withdraw and scams |

| • MT4/5 supported | • Single account type |

| • Multiple funding options | • High minimum deposit |

| • 24/5 multilingual customer support |

JFD Bank Alternative Brokers

City Index - a well-established broker with a user-friendly platform, making it a solid choice for traders seeking a wide range of markets and competitive pricing.

Trading 212 - a popular commission-free trading platform that offers a user-friendly interface, a broad selection of financial instruments, and an innovative “Invest” feature for long-term investing.

XGLOBAL Markets - a reliable broker known for its competitive spreads, comprehensive trading tools, and robust customer support, making it suitable for traders looking for a reputable and feature-rich trading experience.

There are many alternative brokers to JFD Bank depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is JFD Bank Safe or Scam?

Bank does not have valid regulatory licenses. The Vanuatu Financial Services Commission - VFSC (License No. 17933) is offshore regulatory, the Federal Financial Supervisory Authority - BaFin (License No. 120056) is exceeded, and the Cyprus Securities and Exchange Commission - CYSEC (License No. 150/11) is a suspicious clone. This raises concerns about the legitimacy and safety of the broker.

Regulatory licenses play a crucial role in ensuring the transparency, security, and adherence to financial regulations by brokers. Without valid and recognized licenses, there may be a higher risk of potential scams or fraudulent activities.

It is important for traders to carefully consider the regulatory status of a broker before engaging in any financial transactions. Unregulated brokers may lack the necessary oversight and investor protection measures that regulated brokers are required to have.

It is advisable for traders to conduct thorough research, consider the risks involved, and explore regulated alternatives when choosing a brokerage.

Market Instruments

JFD Bank provides investors with a diverse range of financial instruments to trade. One of the key offerings is access to over 60 currency pairs, including major, minor, and exotic pairs. This allows traders to participate in the global foreign exchange market and take advantage of currency price movements.

In addition to forex, JFD Bank offers CFDs (Contracts for Difference) on commodities. This includes popular commodities such as gold, silver, oil, and natural gas. Trading commodity CFDs allows investors to speculate on the price movements of these physical assets without actually owning them.

Furthermore, JFD Bank provides CFDs on 15 indices, which represent baskets of stocks from various markets. This allows traders to gain exposure to the performance of specific markets or sectors without having to buy individual stocks. Indices such as the S&P 500, Dow Jones, and FTSE 100 are commonly offered for trading.

JFD Bank also offers CFDs on bonds, providing access to fixed income securities. This allows traders to speculate on the price movements of government bonds and potentially benefit from changes in interest rates.

Moreover, JFD Bank provides CFDs on Exchange-Traded Funds (ETFs), which are investment funds traded on stock exchanges. Trading ETFs allows investors to gain exposure to a diversified portfolio of assets, such as stocks, bonds, or commodities, in a single trade.

Lastly, JFD Bank offers CFDs on individual stocks, allowing traders to invest in shares of various companies listed on global stock exchanges. This provides opportunities to trade on the price movements of specific stocks, both long and short.

Accounts

JFD Bank offers investors a Standard account type, which is their primary account option. To open a Standard account, traders are required to make a minimum initial deposit of $500, which is considered relatively higher compared to some other brokers in the market.

Additionally, JFD Bank offers demo accounts, allowing traders to practice and familiarize themselves with the platform and its features before committing real funds. Demo accounts provide a risk-free environment where traders can test their strategies and assess the broker's trading conditions.

Leverage

JFD Bank implements different leverage limits based on the trader's jurisdiction and the financial instruments being traded. For European resident traders, the maximum leverage offered is 1:30. This is in accordance with the regulations imposed by the European Securities and Markets Authority (ESMA) to ensure the protection of retail clients. The lower leverage limit aims to mitigate the potential risks associated with high leverage trading.

On the other hand, traders operating through JFD Bank's overseas entities may have access to higher leverage levels, specifically up to 1:400 on Forex instruments. It's important to note that the availability of higher leverage is subject to the regulations and requirements of the specific jurisdiction in which the trader operates.

Traders should consider their risk tolerance, trading strategies, and regulatory restrictions when deciding on the appropriate leverage level. It's crucial to understand the potential implications of leverage on trading positions, as higher leverage amplifies both profits and losses. Therefore, traders should exercise caution and ensure they fully comprehend the risks involved before utilizing leverage in their trading activities.

Spreads & Commissions

JFD Bank offers competitive spreads and transparent commission structures to its clients. Based on the testing of demo accounts, it is observed that the spread on the popular EUR/USD currency pair is extremely low, only 0.4 pips. This indicates a tight spread, which is beneficial for traders as it minimizes the cost of entering and exiting positions.

In addition to the spread, JFD Bank charges a commission of $3 per lot per side. This commission-based model ensures transparency in the pricing and allows traders to see the direct cost of their trades.

Overall, the combination of tight spreads and reasonable commissions offered by JFD Bank makes the cost of trading on their platform competitive and attractive for traders. It is important to note that the specific spreads and commissions may vary across different financial instruments and trading account types, so it is recommended for traders to review the latest information on the JFD Bank website or consult with their customer support for accurate and up-to-date details.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| JFD Bank | 0.4 pips | $3 per lot per side |

| City Index | 0.5 pips | Variable commissions |

| Trading 212 | 0.9 pips | No commissions |

| XGLOBAL Markets | 0.2 pips | Variable commissions |

Please note that spreads and commissions may vary depending on market conditions, account types, and trading platforms. It's always a good idea to check with the broker directly or review their official documentation for the most up-to-date and accurate information.

Trading Platforms

JFD Bank provides its traders with access to two widely recognized and popular trading platforms, namely MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their advanced features, user-friendly interface, and robust functionality, catering to the needs of both novice and experienced traders.

The MT4 platform is a well-established and widely used trading platform in the industry. It offers a comprehensive set of tools and features for trading various financial instruments, including forex, commodities, indices, and more. Traders can benefit from real-time price quotes, advanced charting capabilities, customizable indicators, and expert advisors (EAs) for automated trading. The platform's intuitive interface allows for efficient order execution, position management, and market analysis.

On the other hand, the MT5 platform builds upon the success of its predecessor and enhances the trading experience with additional features. It offers an extended range of markets and instruments, including stocks and futures, making it suitable for traders looking to diversify their portfolios. The platform also introduces advanced analytical tools, improved charting options, and a multi-threaded strategy tester for optimizing and backtesting trading strategies.

Both platforms provide access to JFD Bank's full range of financial instruments, allowing traders to trade with ease and flexibility. They offer reliable execution, real-time market data, and a secure trading environment. Traders can choose the platform that best suits their trading style and preferences, whether it's the familiarity and versatility of MT4 or the expanded capabilities of MT5.

Overall, JFD Bank's provision of both MT4 and MT5 platforms demonstrates their commitment to meeting the diverse needs of their clients, offering them powerful tools and an optimal trading experience.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| JFD Bank | MT4, MT5 |

| City Index | Advantage Web, AT Pro |

| Trading 212 | Trading 212 Web, App |

| XGLOBAL Markets | MT4 |

Deposits & Withdrawals

JFD Bank provides traders with a variety of convenient and widely accepted payment methods to facilitate deposit and withdrawal transactions. Traders can fund their accounts using major credit and debit cards, such as VISA and MasterCard, allowing for quick and secure transactions. Additionally, bank wire transfers offer a traditional and reliable method for transferring larger amounts of funds.

For those who prefer alternative payment solutions, JFD Bank supports various e-wallet options, including Skrill, WireCard, SafeCharge, GiroPay, iDeal, and ePay. These e-wallets offer fast and seamless transactions, providing traders with flexibility and convenience.

JFD Bank imposes a minimum deposit requirement of $500, which may be considered relatively higher compared to some other brokers in the industry. Traders should ensure that they meet this requirement before opening an account with JFD Bank.

JFD Bank minimum deposit vs other brokers

| JFD Bank | Most other | |

| Minimum Deposit | $500 | $100 |

When it comes to withdrawals, JFD Bank aims to process them efficiently and promptly. The broker does not provide specific details regarding withdrawal processing time on their website. However, it is common for withdrawals to undergo a verification process to ensure security and compliance with regulations. The time it takes for funds to reach the trader's account may vary depending on the chosen withdrawal method and the respective banking or payment system's processing time.

Note that additional fees or charges may apply when depositing or withdrawing funds from JFD Bank. Traders should review the broker's terms and conditions or contact their customer support for detailed information on any potential fees associated with depositing or withdrawing funds from their trading accounts.

Customer Service

JFD Bank places a strong emphasis on customer service and provides support to its clients throughout the trading week. Traders can access assistance 24 hours a day, 5 days a week, ensuring that support is available during most trading hours. This round-the-clock support is valuable for traders who may have inquiries or require assistance outside of regular business hours.

The customer service team at JFD Bank is multilingual, allowing clients to communicate in their preferred language. This is particularly beneficial for international traders who may require support in different languages. Support is available via phone, email, and online messaging, providing multiple channels for clients to reach out and receive assistance.

Phone and live chat support are available from Sunday 23:00 CET to Friday 23:00 CET, covering the majority of the trading week. This availability ensures that traders can quickly resolve any urgent matters or receive real-time support during active trading sessions. Other support departments, such as email inquiries, operate from 08:00 to 17:00 CET Monday to Friday, excluding Cyprus Bank Holidays.

JFD Bank's presence on various social networks, including Twitter, Facebook, YouTube, and LinkedIn, allows traders to stay updated on the latest news, market insights, and developments from the broker. Following JFD Bank on these platforms provides an additional avenue for traders to engage with the broker, access educational content, and stay connected with the community.

Overall, JFD Bank offers a robust customer service experience, combining round-the-clock support, multilingual assistance, and multiple communication channels. Traders can expect timely and knowledgeable responses to their inquiries, helping to ensure a smooth trading experience and addressing any concerns they may have.

| Pros | Cons |

| • 24/5 customer support availability | • Lack of 24/7 customer support |

| • Multilingual support | • No live chat support |

| • Support for various communication channels | • No FAQ section |

| • Active presence on social media platforms |

Note: These pros and cons are subjective and may vary depending on the individual's experience with JFD Bank's customer service.

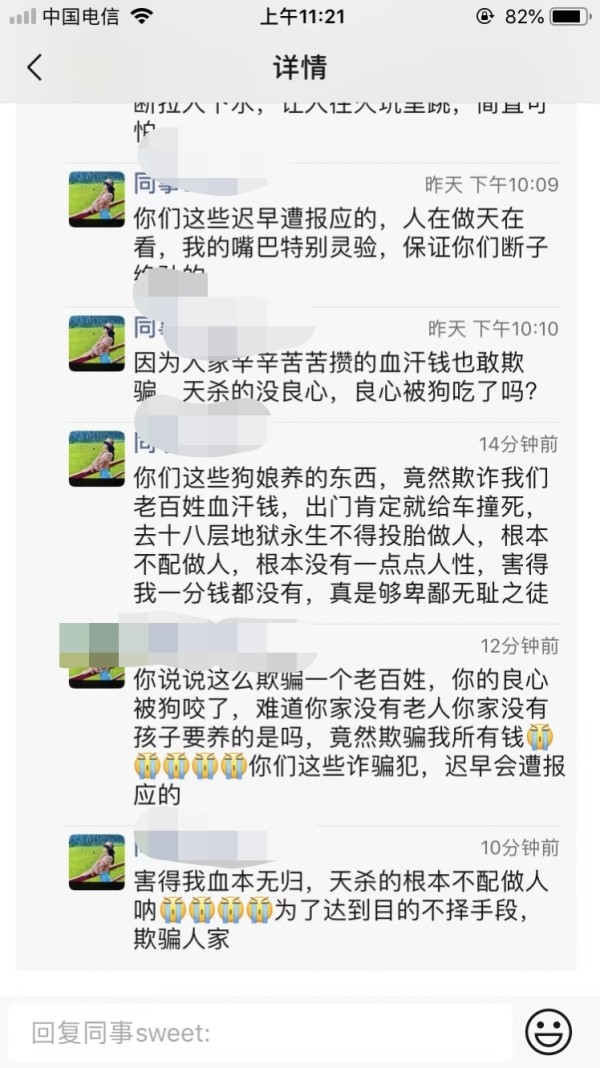

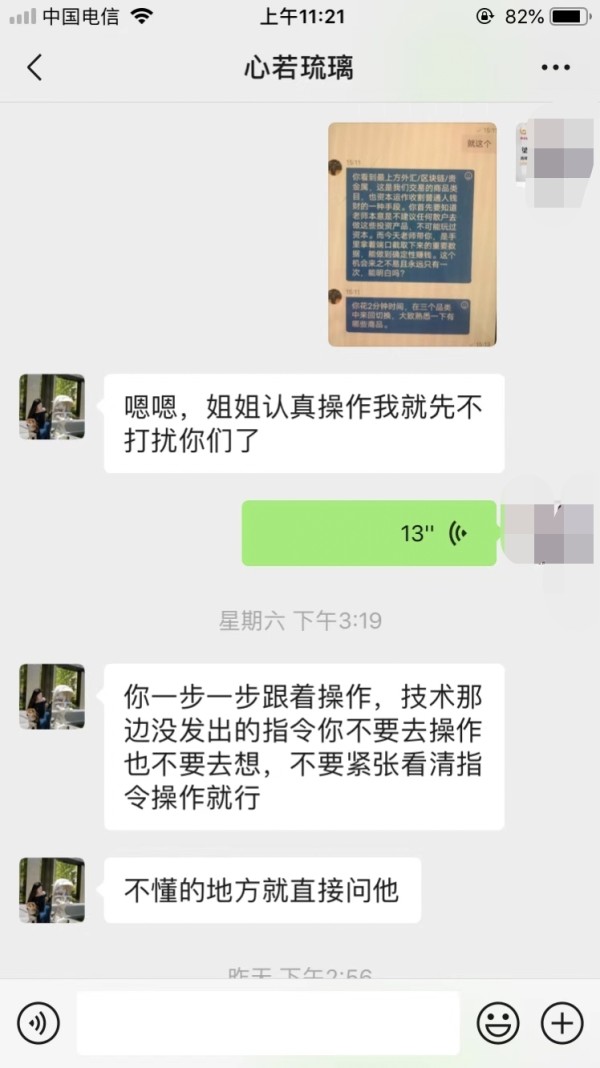

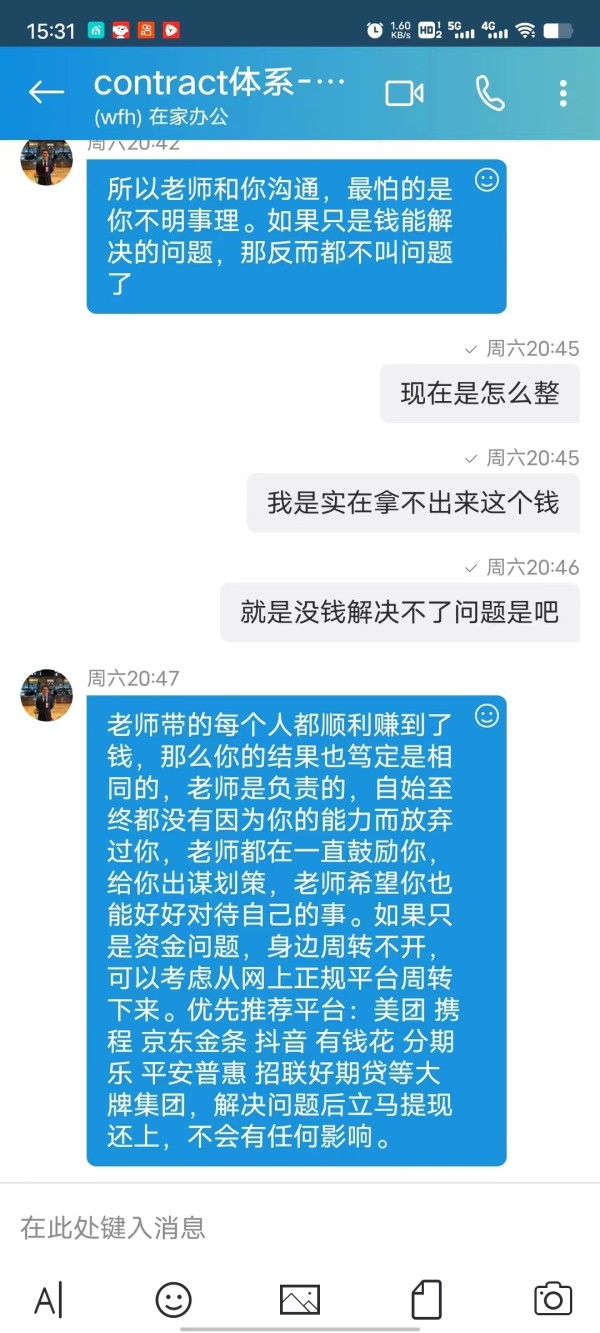

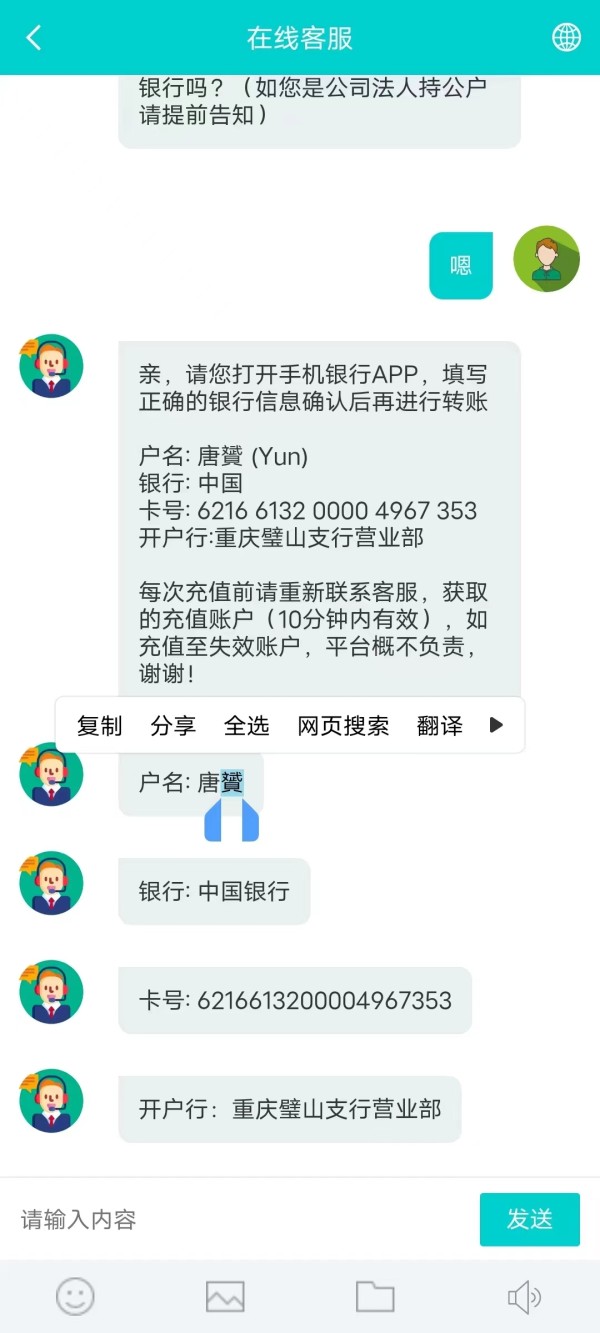

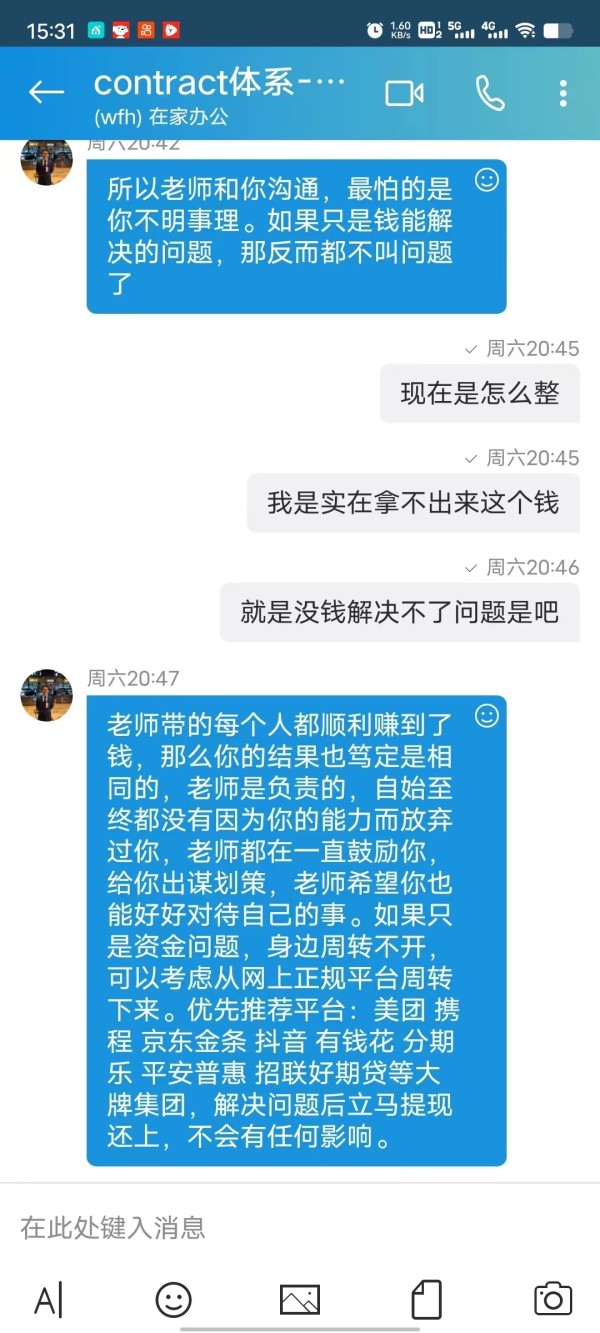

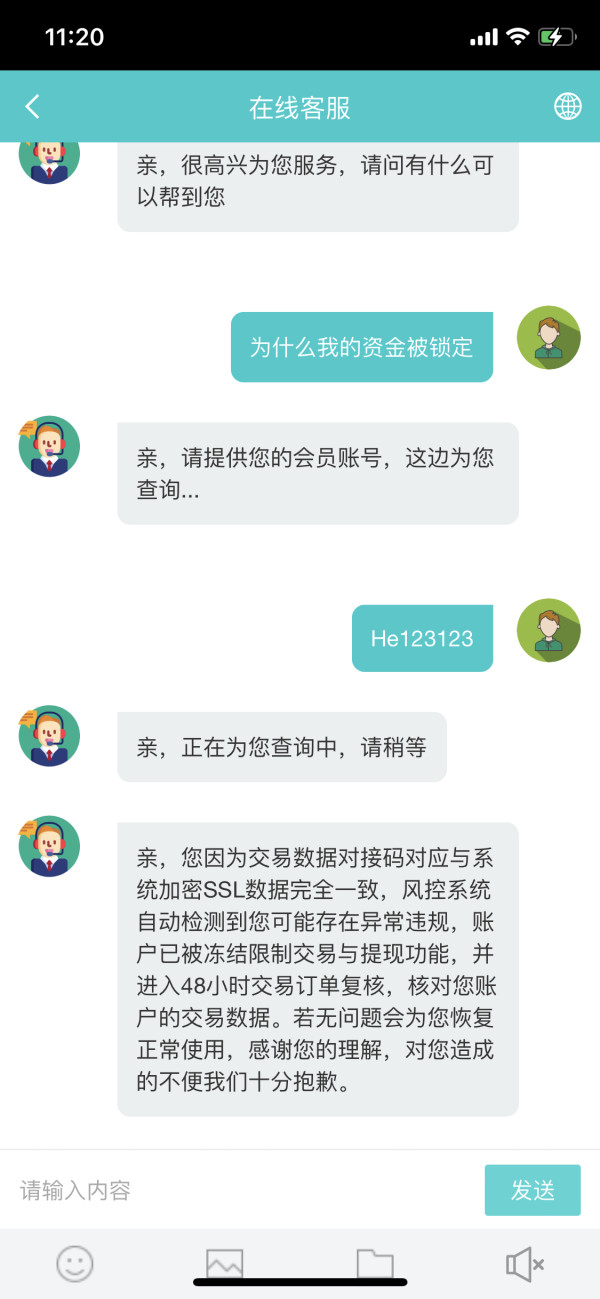

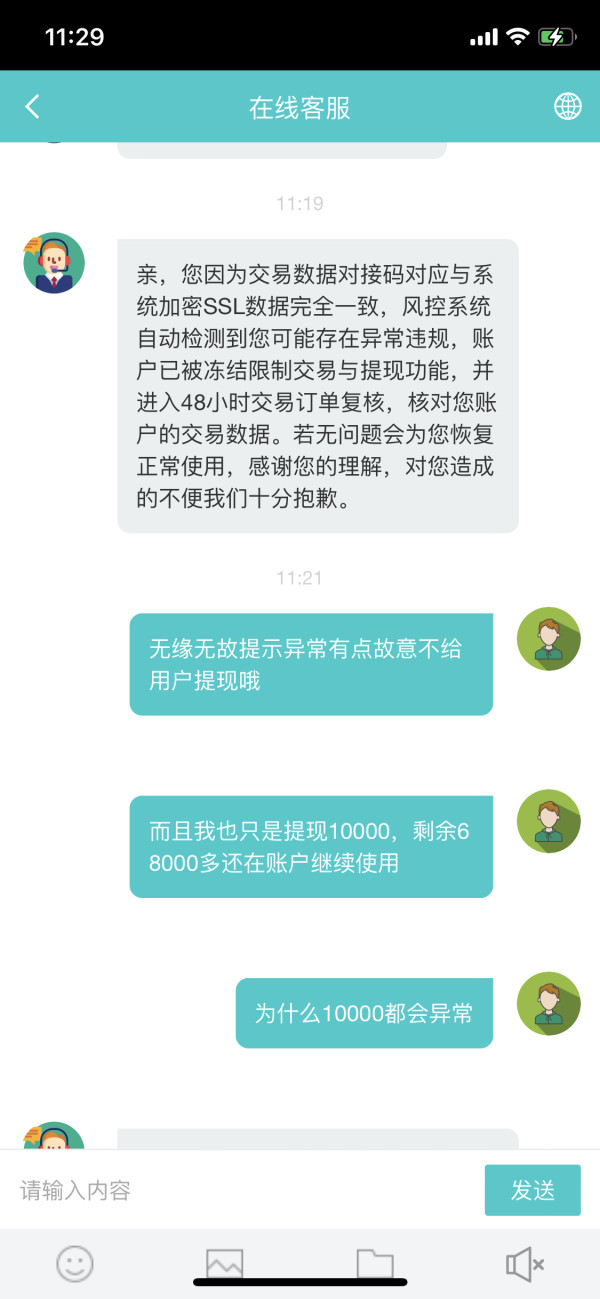

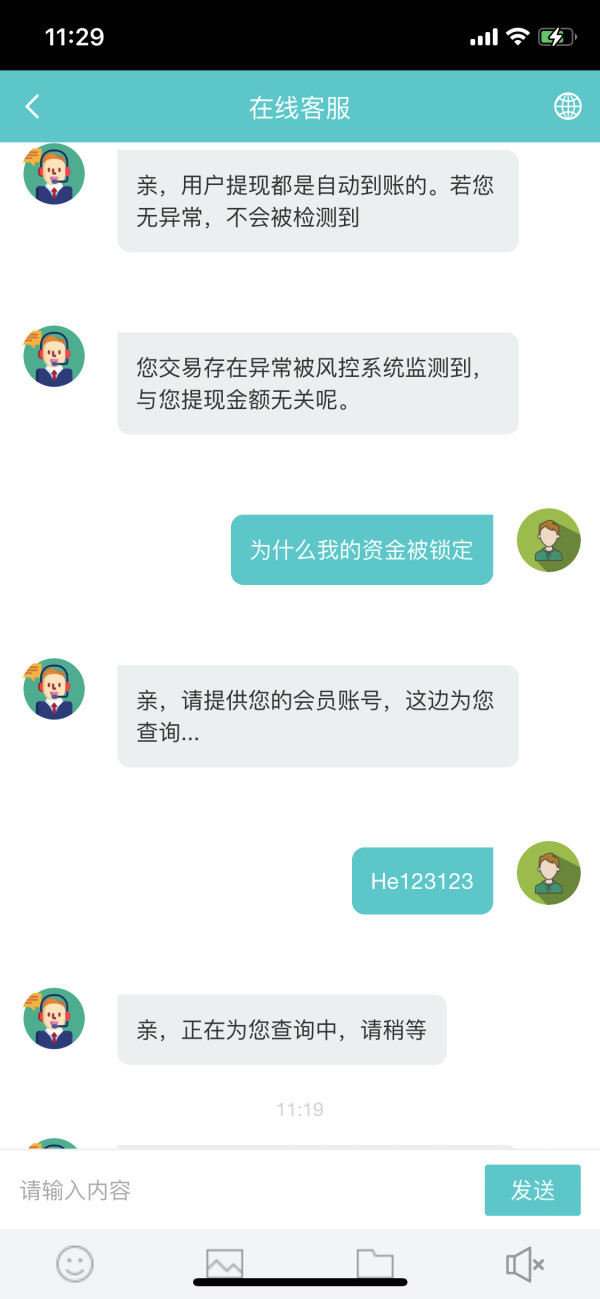

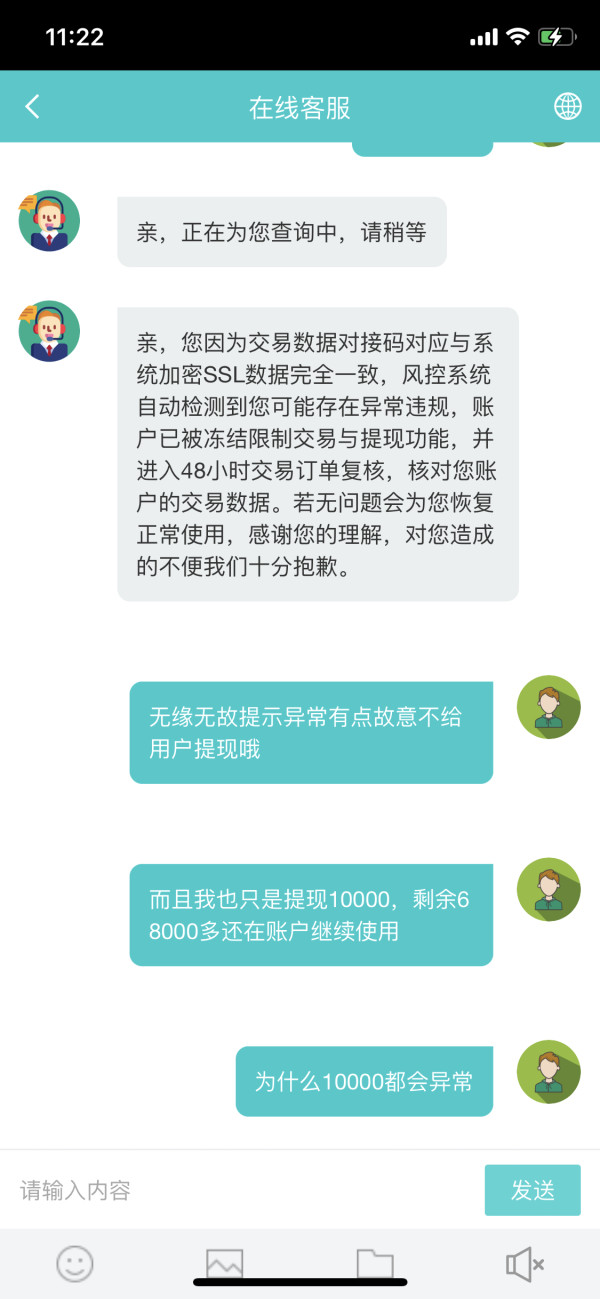

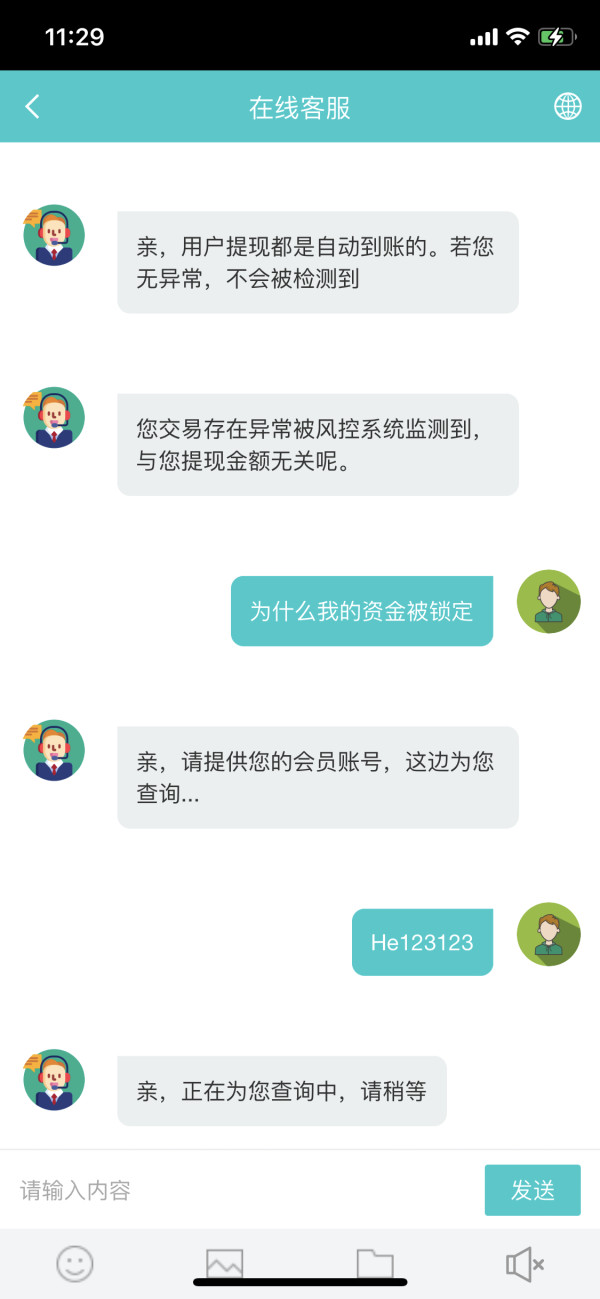

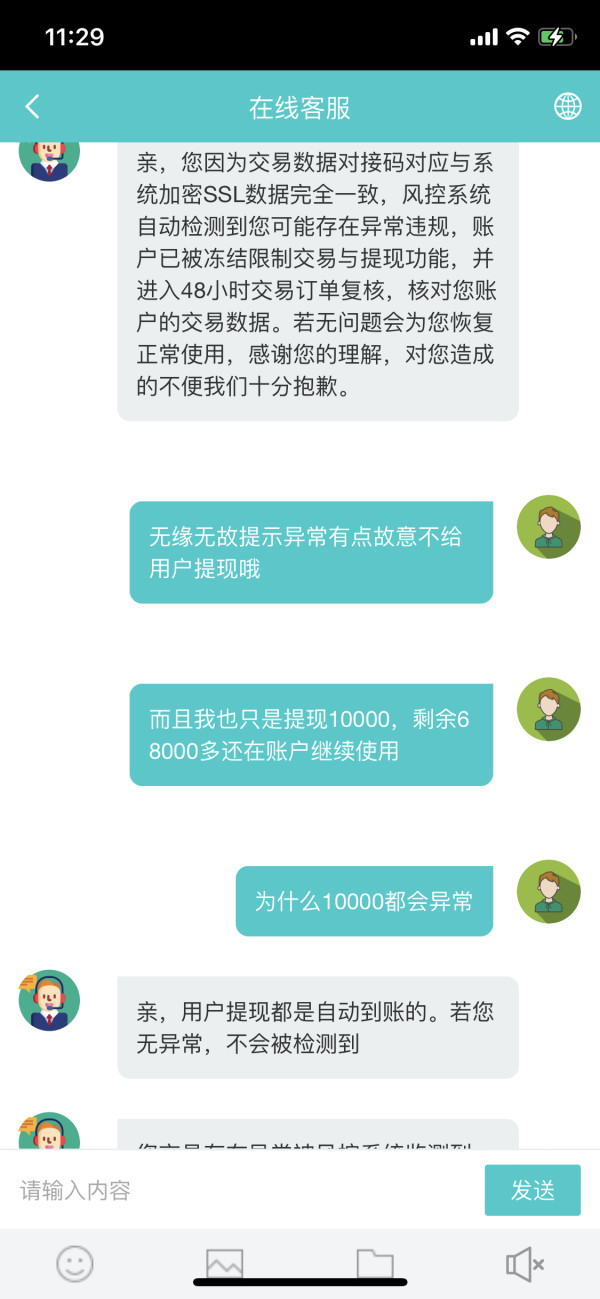

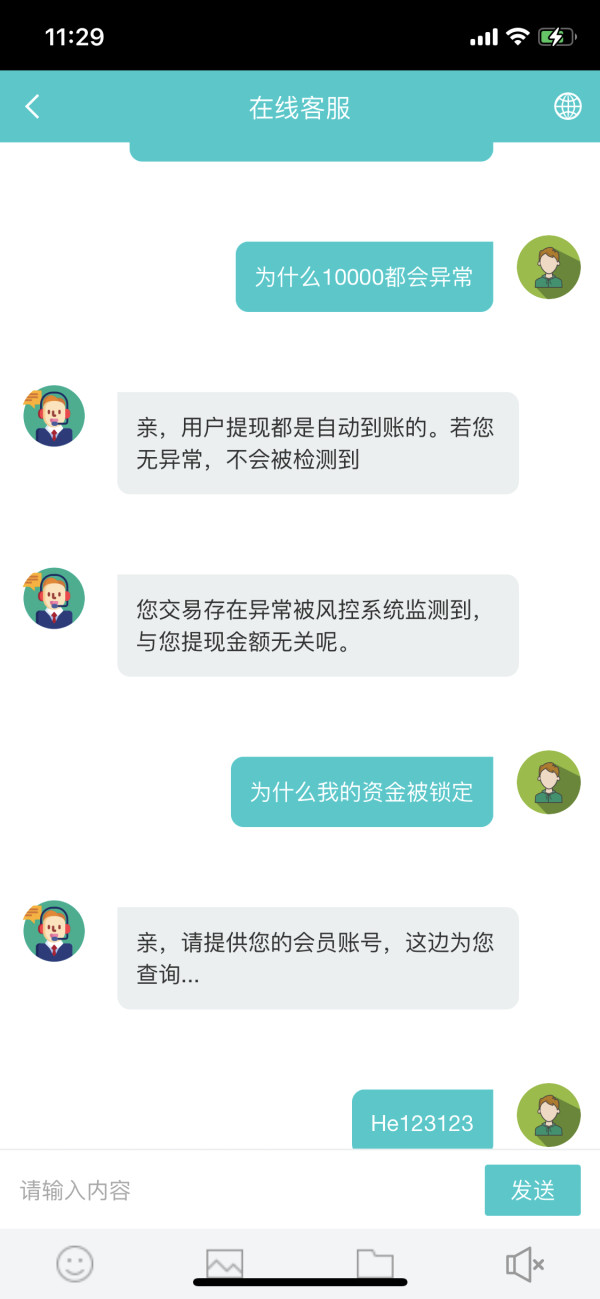

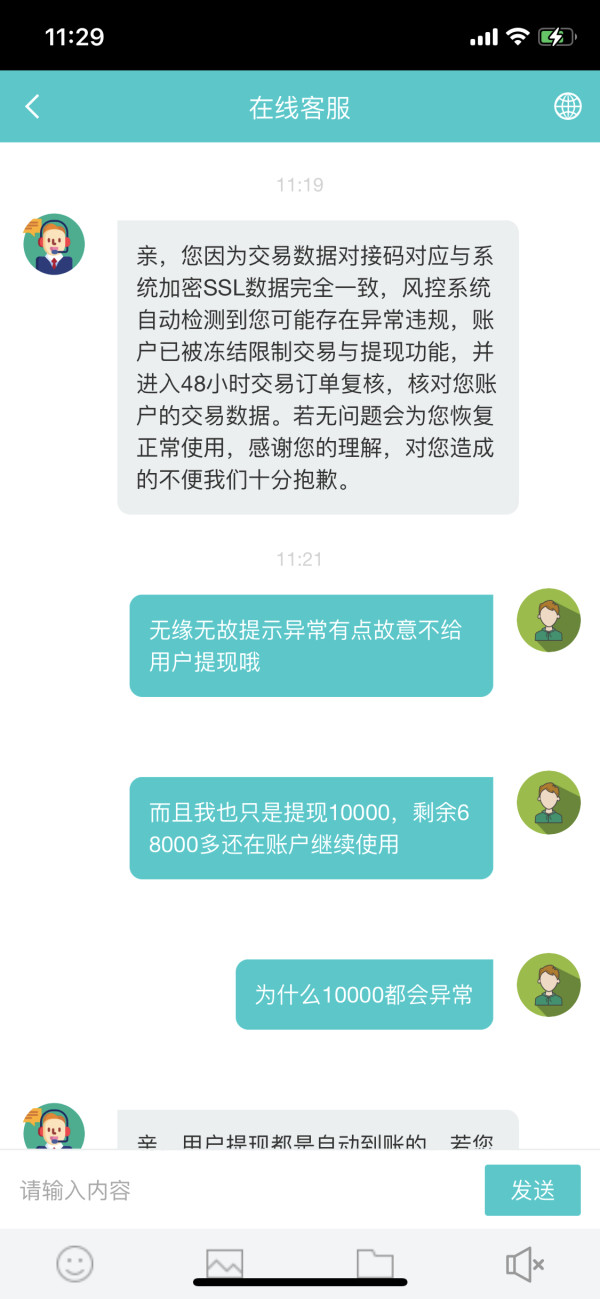

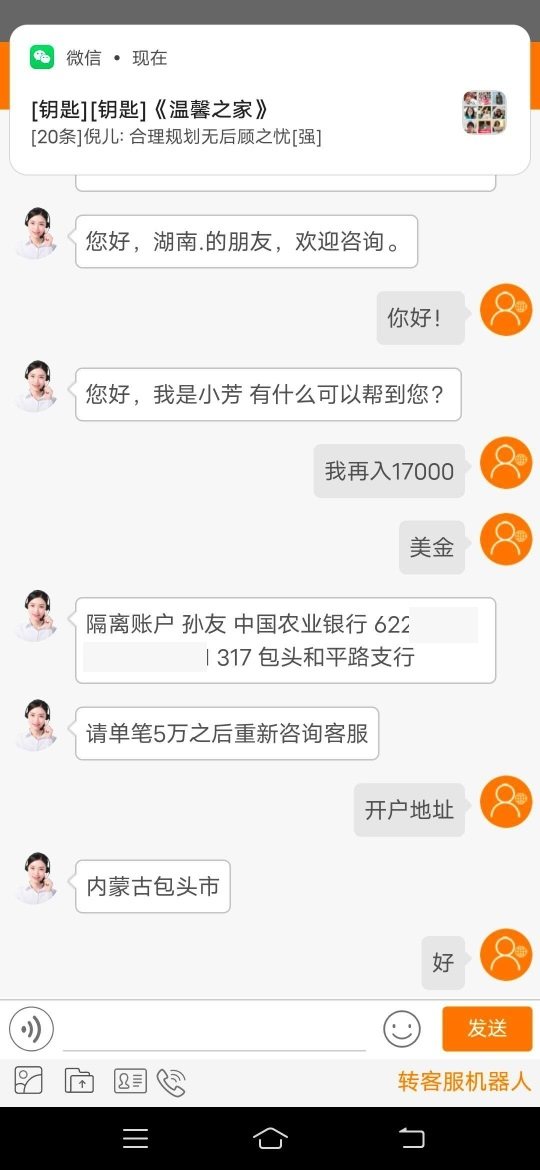

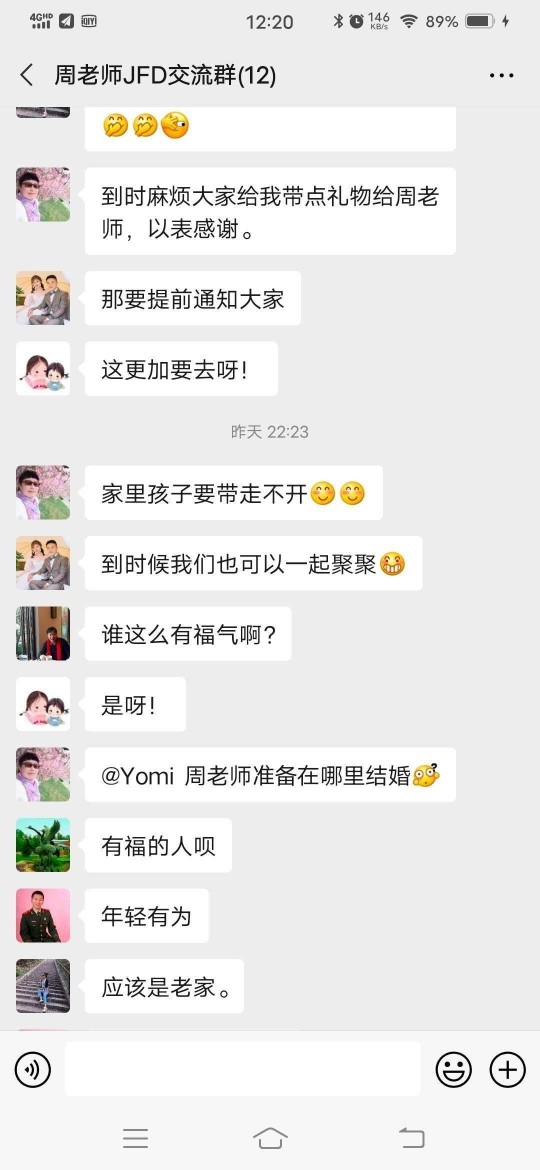

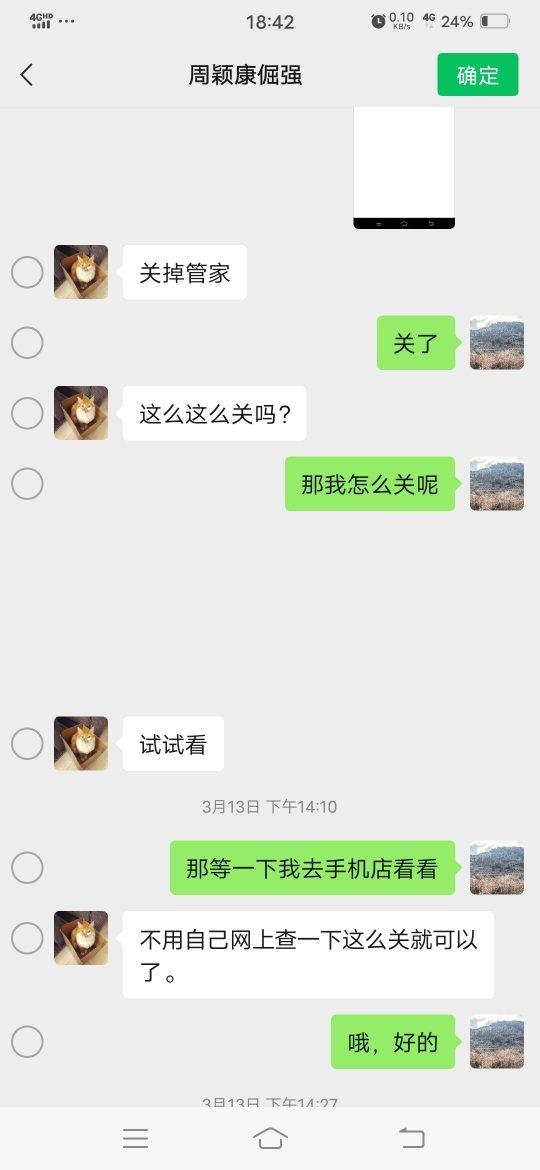

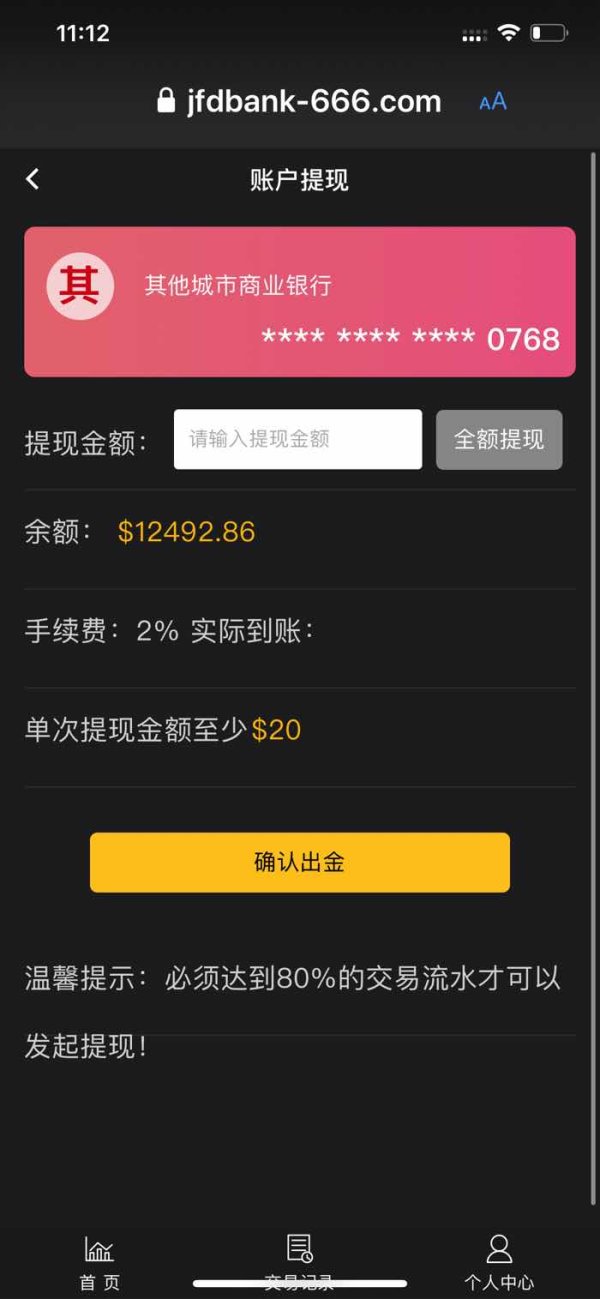

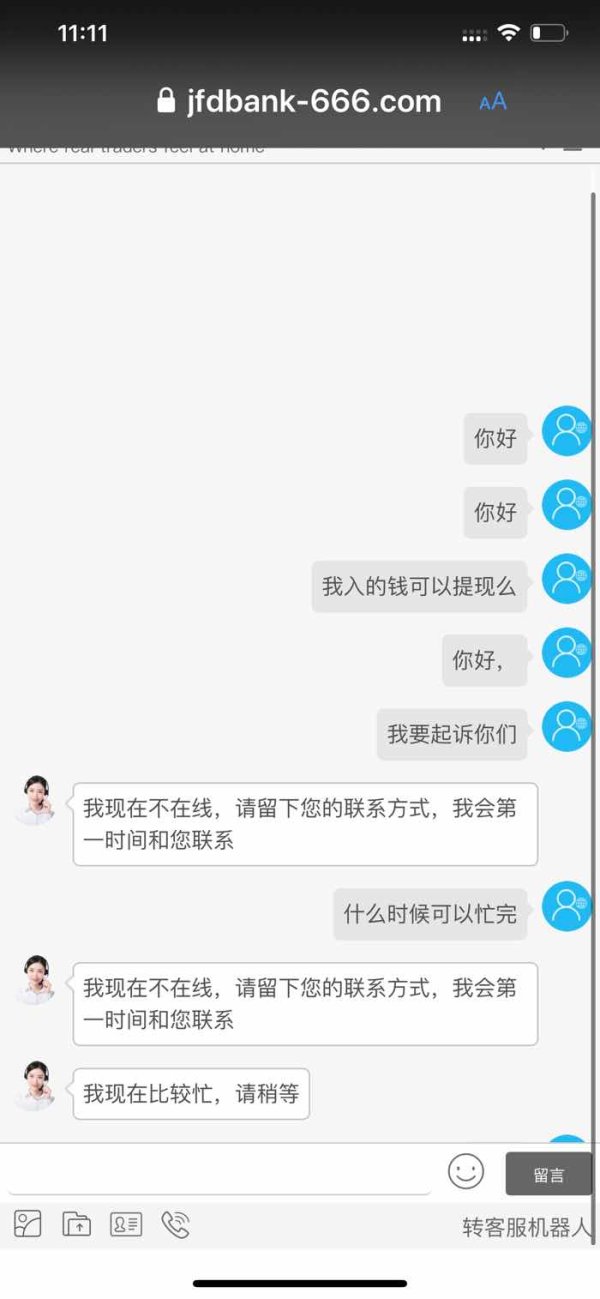

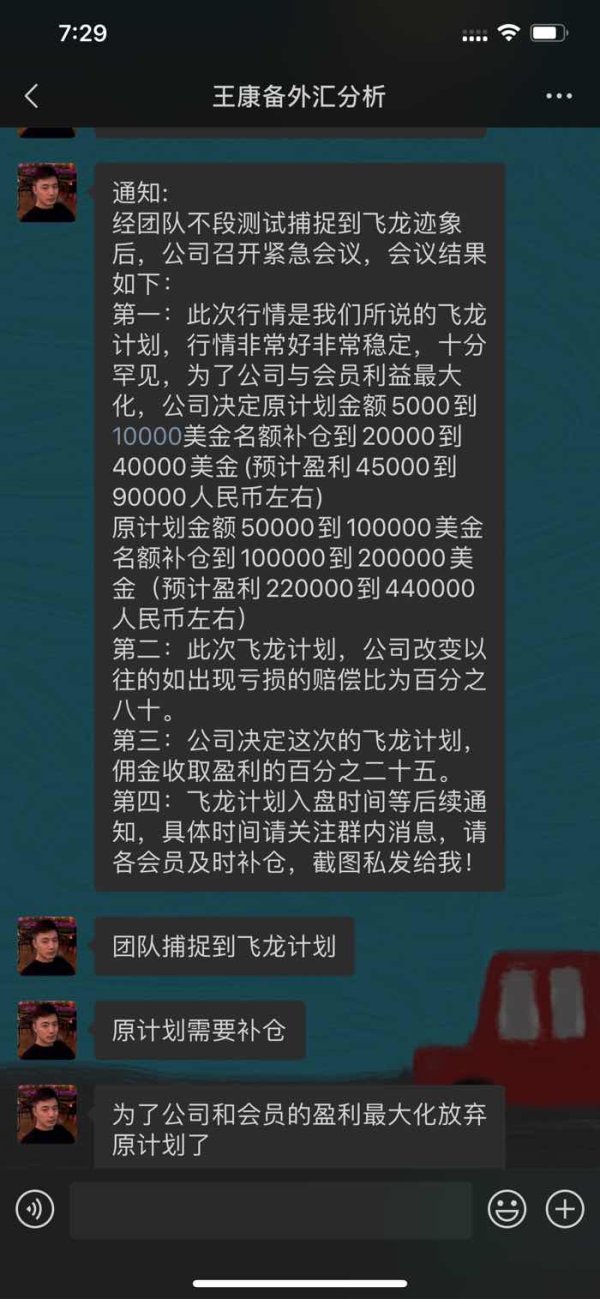

User Exposure at WikiFX

On our website, you can see that reports of scams and unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

In conclusion, JFD Bank is an unregulated broker with limited information available on its website. While it offers a diverse selection of trading instruments and competitive trading conditions through the popular MT4 and MT5 platforms, there have been reports of issues with withdrawals and potential scams associated with the company. These reports raise concerns about the reliability and trustworthiness of JFD Bank as a financial service provider. It is advisable for potential investors and traders to exercise caution and thoroughly research alternative regulated brokers with a stronger track record and reputation for ensuring the safety and security of client funds.

Frequently Asked Questions (FAQs)

| Q 1: | Is JFD Bank regulated? |

| A 1: | No. VFSC license is offshore regulatory), BaFin license is exceeded, and CYSEC license is a suspicious clone. |

| Q 2: | Does JFD Bank offer the industry leading MT4 & MT5? |

| A 2: | Yes. It supports MT4 and MT5. |

| Q 3: | What is the minimum deposit for JFD Bank? |

| A 3: | The minimum initial deposit to open an account is as high as $500. |

| Q 4: | Is JFD Bank a good broker for beginners? |

| A 4: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its lack of transparency and high minimum deposit requirement. |

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Suspicious Overrun

- High potential risk

News

News WIKIFX REPORT: JFD Bank Rebrands As “JFD Brokers” - Releases New Website

JFD Bank has officially rebranded its business to JFD Brokers, which the company says is due to a "renewed strategic focus of JFD on its core DNA as a multi asset brokerage house".

2022-08-31 14:25

News WikiFX report: DELTA AIRLINES STOCK IS INCREASING ALTITUDE

Although airlines are difficult long-term investments, short-term speculators prize them, as evidenced by Delta Air Lines, Inc.'s (NYSE: DAL) short-term volatility.

2022-04-18 17:01

News REMOVAL OF TECHNIPFMC’S PHYSICAL STOCK

JFDBrokers is a forex broker. JFD Brokers offers the MT4 and MT5 trading currency platforms. JFDBrokers.com offers over 60 forex currency pairs, cfds, commodities, stocks, indices, gold, silver, oil, bitcoin and other cryptocurrencies for your personal investment and trading options. “JFD Bank” is a brand name and registered trademark owned and used by the JFD group of companies, which includes: JFD Group Ltd (ex. JFD Brokers Ltd), a company with registration number HE 282265, authorized and regulated by the Cyprus Securities and Exchange Commission - CySEC (Licence number: 150/11). Previously, it can be noted that the broker offers Now as the broker announced in their official website that they want to notify their clients and the General public that today (25/11/2021), theye will remove Technipfmc’s (FTI.P.EX) physical stock from JFD’s offering.

2021-12-07 15:14

News IS BRENT CRUDE OIL PREPARING FOR A LOWER LOW?

Brent is the name given to a relatively light crude oil made from a blend of crudes from 19 oil fields in the North Sea. Brent Crude is one of the three main benchmarks for crude oil prices per barrel, along with West Texas Intermediate (WTI) from North America and Dubai Crude from the Persian Gulf. Brent is also the name of an oil field located in the North Sea off the coast of Scotland, which was discovered in 1971 and started production in 1976. Brent is an acronym for Broom, Rannoch, Etive, Ness and Tarbert – the five geological formations that form the Middle Jurassic field.

2021-12-06 12:28

News EUR/NOK RALLIES ABOVE 10.00 AND LOOKS READY TO CONTINUE SURGING

As it was observed from the markets analysis that EUR/NOK traded higher on Friday, breaking above the 10.00 zone, and specifically above the resistance (later turned into support) of 10.025, marked by the high of November 18th. Then, the rate hit resistance at 10.085, and pulled back to test the 10.025 zone as a support this time, But before rebounding back again. Above all, the rate remains above the upside support line drawn from the low of October 20th, which combined with the latest rally paint a positive near-term picture.

2021-12-06 12:13

News EUR/GBP TRADES BELOW A PRIOR UPSIDE SUPPORT LINE

EUR/GBP traded lower on Monday Last week 22nd November, 2021. after hitting resistance at 0.8537. Since Friday, the pair has been trading below an upside support line drawn from the low of October 26th, while it started forming lower highs even before that. With that in mind, we will consider the short-term outlook to have turned cautiously negative.

2021-12-06 12:10

Review 18

Content you want to comment

Please enter...

Review 18

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

莹17

Hong Kong

The major platforms exposed this gang of scammers. Its WeChat ID is: Xinruoliuli. It is this scammer who specially induces others to invest in downloading a JFD bank software. Let people recharge tens of thousands, saying that there are technical teachers who teach how to make money. Seeing that virtual reality is profitable, let you continue to transfer money and recharge money to another account. Money will all flow into overseas accounts, making you lose everything, and even if the account is frozen, you will not be able to log in. This is a bloody lesson, everyone must be careful. Don't listen to this person's tricks and download software, or you will lose your fortune.

Exposure

2023-07-10

被骗的小女孩

Hong Kong

Expose a clone Firm of JFD (bank) platform, deceive rechargeand transfer to private account, then pretend to be a teamleader to operate. Unable to withdraw! I hope this platform can be blocked!

Exposure

2023-06-28

FX2697278006

Hong Kong

In the beginning, you will be cheated $100-200, and then millions of USD. In the end, you'll lose all

Exposure

2021-04-01

不糖的甜

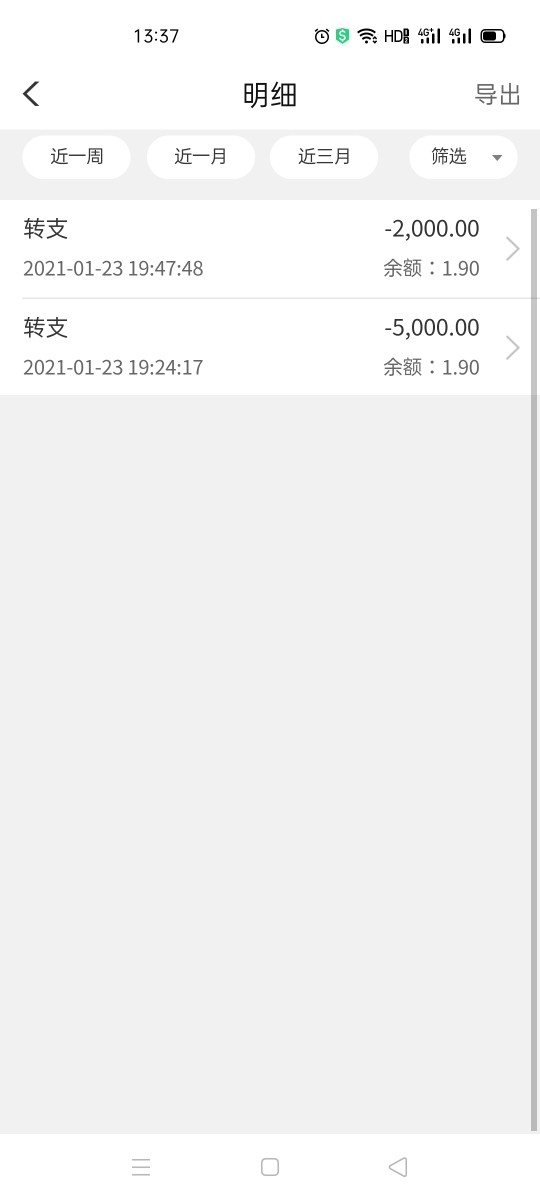

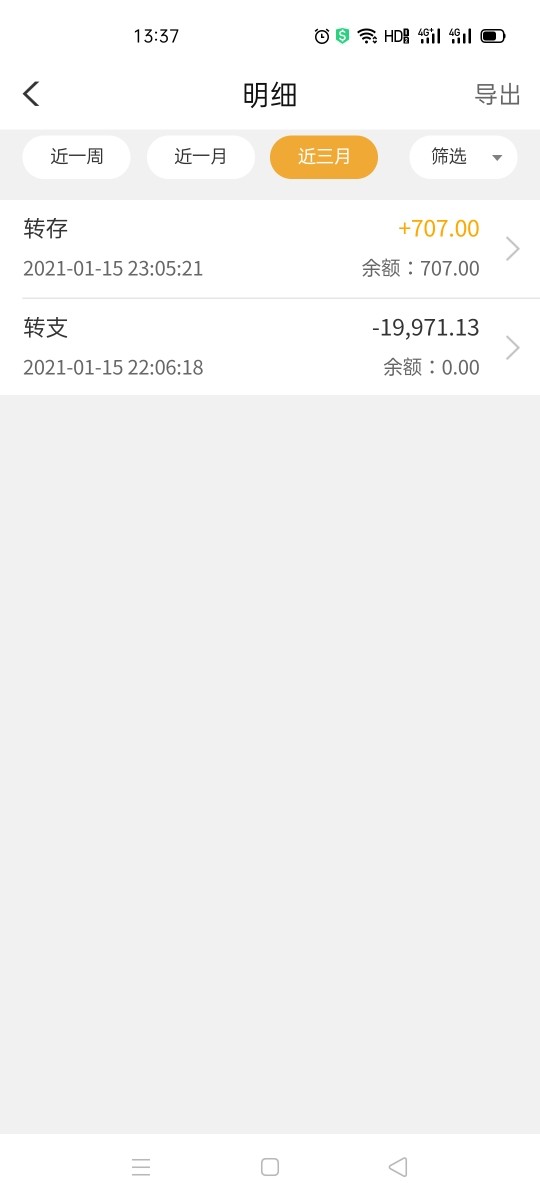

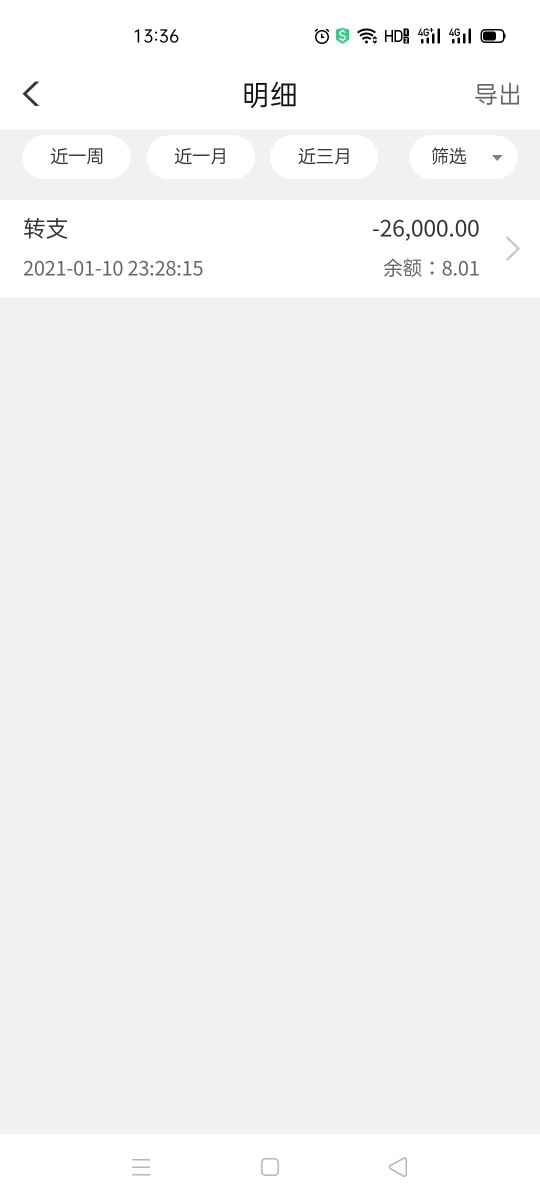

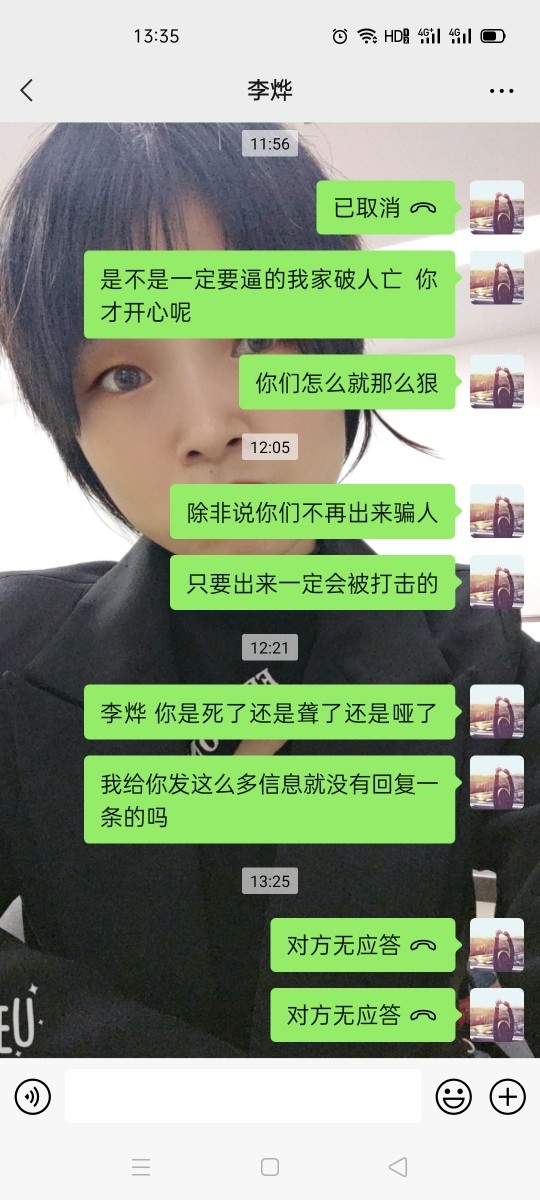

Hong Kong

I don't save our chat history so there are just some tansfer history and WeChat photos. And you should take note to protect your owm money.

Exposure

2021-02-20

王馨晨

Hong Kong

Induce consumption step by step, let you recharge first. Fearing that the quota is not enough, I have been replenishing the position. The platform has been out of reach for 4 days claiming market changes. I borrowed from my credit cards and Ant Credit Pay. Now something went wrong with my family and I need money urgently.

Exposure

2021-02-13

热爱可抵岁月漫长32696

Hong Kong

The platform colludes with salesmen to scam money. The first two times the funds can be withdrawn, but the latter cannot withdraw funds and you have to follow their instructions, and in the end you will lose money

Exposure

2021-02-03

LF56502

Hong Kong

Taxes must be paid for withdrawals, and the fund account is also frozen, saying that by default, tax will be confiscated without paying taxes within 24 hours

Exposure

2021-02-03

德佑 刘瑶 (新房免佣金)

Hong Kong

The platform we lost money in is not the regular JFD platform because the URL is different

Exposure

2021-02-02

热爱可抵岁月漫长32696

Hong Kong

The platform colluded with salesman to cheat money, and finally made the investors lose money. I invested 10,000 US dollars, and finally refused to withdraw funds. Later, they let the money be invested. Finally, the 70,000 principal was left with only more than 10,000. I don’t want to recover profit, I just wanna my principal of 50,000 back

Exposure

2021-02-02

热爱可抵岁月漫长32696

Hong Kong

I was cheated into investing. I declined and then the attitude of the salesman was changed. In the end, they want me to follow their recommendations to cheat my money. They even persuaded me to use credit card to invest.

Exposure

2021-02-02

宋翠

Hong Kong

The entire foreign exchange fraud platform is a scam. As long as you don’t deposit or follow the plan, your account will be told to upgrade, or the APP can’t be opened directly, and the account balance can’t be withdrawn. You are told that consumption must exceed the recharge of the day to 80% to withdraw. In the end, the tutor disappeared. I hope you guys who invest in foreign exchange can invest carefully!

Exposure

2021-01-30

德佑 刘瑶 (新房免佣金)

Hong Kong

This platform is a dealing desk, partnering with scammers, and let me lose more than 1 million on it

Exposure

2021-01-30

FX3152374370

Hong Kong

The platform said that the transaction turnover on the day did not exceed 80% and the withdrawal could not be made. It would take 5 to 7 working days to apply for the withdrawal. Now it is the eighth day, and I did not get a statement. It has been delayed.

Exposure

2021-01-27

FX3152374370

Hong Kong

I want to withdraw. The above shows that the transaction turnover on the day exceeds 80%. I went to the customer service. The customer service said that it takes 5 to 7 working days to apply for withdrawal. As a result, my withdrawal on the 20th has not been accounted for 7 days today. Is this a fraud?

Exposure

2021-01-27

FX3152374370

Hong Kong

I want to make a complaint. I have not applied for withdrawal within five days. Does it take so long to withdraw cash?

Exposure

2021-01-25

Ende Tan

Hong Kong

Awful experience with JFD BROKER on forex trading I lost a big sum of money, for my order was forced to close, and they did not give me any response…

Neutral

2023-02-14

FX1200787341

Venezuela

this JFD Bank company is nothing more than an online scammer. Now we cannot see their website, but the complaints from the victims show the illegitimate and immoral behavior of the broker.

Positive

2023-02-13

FX1026586608

Philippines

JFD broker’s customer support is quite good, they answer me very quick it uses mt4, mt5, some educational resources are here… I open a demo account on its website several days, and everything performs well… Recommend this broker.

Positive

2022-11-22