Score

Emar Markets

South Africa|2-5 years|

South Africa|2-5 years| https://emarmarkets.com/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:EMAR MARKETS (PTY) LTD

License No.:53070

- This broker exceeds the business scope regulated by South Africa FSCA(license number: 53070)National Futures Association-UNFX Non-Forex License. Please be aware of the risk!

Basic Information

South Africa

South AfricaAccount Information

Users who viewed Emar Markets also viewed..

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IronFX

- 15-20 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Website

emarmarkets.com

Server Location

Netherlands

Website Domain Name

emarmarkets.com

Server IP

160.153.137.184

Company Summary

| Emar Markets | Basic Information |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Founded in | 2022 |

| Tradable Assets | Forex, commodities, indices, Stock, and cryptocurrencies |

| Account Types | Cent, Standard, Pro |

| Demo Accounts | Yes |

| Minimum Deposit | $1 |

| Maximum Leverage | 1:3000 |

| Spreads | From 0.1 pips |

| Trading Platforms | MetaTrader 5, cTrader |

| Deposit & Withdrawals | Bank Transfer, Bitcoin, MasterCard, VISA, Neteller, FPX, Tether |

| Customer Support | 24/ 5 live chat, email, and phone support |

| Educational Resources | Video tutorials, webinars, and trading guides |

| Bonus Offers | Yes |

*Please note that the information in this table is subject to change and you should always refer to the broker's official website for the most up-to-date information.

Overview of Emar Markets

Emar Markets is a retail forex and CFD broker that was established in 2022 and is registered in Saint Vincent and the Grenadines. The broker offers its clients access to trade a range of financial instruments, including forex, commodities, indices, and cryptocurrencies, via the popular MetaTrader 4 (MT4) trading platform.

In terms of account types, Emar Markets offers three live trading accounts, including Cent, Standard, and Pro accounts. Each account type has different features and trading conditions, such as minimum deposit requirements, maximum leverage, and commission fees. The broker also offers a demo account for traders to practice trading with virtual funds.

Emar Markets operates an ECN/STP model, which means that it aggregates liquidity from multiple providers and passes on the best available bid/ask prices to its clients. In addition, Emar Markets offers its clients a range of trading tools and resources, such as market analysis, trading signals, and educational materials.

Is Emar Markets legit or a scam?

Emar Markets is not currently regulated by any major financial authority. It is registered in Saint Vincent and the Grenadines, which is a well-known offshore jurisdiction. It is important to note that trading with an unregulated broker can carry higher risks, as there is no oversight to ensure compliance with industry standards and regulations. Traders should exercise caution and thoroughly research any broker before opening an account with them. Emar Markets also provides clients with the popular MetaTrader 5 trading platform, as well as cTrader, which is known for its advanced charting tools, customizable interface, and algorithmic trading capabilities.

Pros and Cons

Emar Markets offers a range of trading instruments including forex, commodities, indices, and cryptocurrencies. The broker offers a range of account types to suit different trading styles, including a demo account for those who want to practice their trading skills. One of the notable advantages of trading with Emar Markets is the low minimum deposit requirement for their various account types, making it accessible for traders with different levels of trading experience.

However, Emar Markets is not regulated by any reputable financial authority, which may raise concerns for some traders. Another drawback is the lack of online chat support, which may lead to a lag in addressing clients' trading problems.

| Pros | Cons |

| Wide range of trading instruments including forex, stocks, indices, and commodities, and Cryptos | Not regulated by a reputable financial authority such as the FCA or ASIC |

| Multiple account types to choose from | Limited information provided on the company's background and ownership |

| High leverage of up to 1:3000 available | A young forex broker |

| Demo accounts supported | Some trading conditions may not be favorable for traders, such as high swap fees for |

| Low minimum deposit requirements | Limited educational and research resources provided for traders |

| MT5 and cTrader supported | No 24/7 customer support available |

| Multiple deposit and withdrawal methods | No online chat support |

Market Intruments

Emar Markets offers a variety of financial instruments for trading, including forex currency pairs, stocks, commodities, indices, and cryptocurrencies.

Traders can access over 35 currency pairs, including major, minor, and exotic pairs, providing a wide range of options for currency trading. In addition, the broker offers trading in popular commodities such as gold, silver, and oil, as well as indices like the NASDAQ and the S&P 500. Cryptocurrency trading is also available, with Bitcoin, Ethereum, and Litecoin being among the digital assets offered for trading. With this broad range of market instruments, traders can diversify their portfolios and find opportunities across different markets.

| Pros | Cons |

| A good selection of trading instruments | Limited selection of cryptocurrencies |

| Access to global markets and exchanges | No information provided about the number of available assets |

| Ability to trade with leverage, up to 1:3000 | High leverage can also magnify losses |

| No commissions charged on trades | Limited tradable currency pairs compared with other brokers |

| Hedging and scalping allowed |

Account Types

Emar Markets offers three types of trading accounts, each with varying minimum deposit requirements and unique features to cater to the trading needs of different investors.

The Cent account has a minimum deposit of $1 and is tailored to new traders or those who wish to test their trading strategies in small amounts.

The Standard account, which also has a minimum deposit of $1, is suitable for experienced traders who require higher leverage and a more extensive range of trading tools.

The Pro account is designed for professional traders who are comfortable trading large volumes and require a comprehensive suite of trading tools and personalized support. This account only requires a minimum deposit of $100.

Please note that standard account currency pairs are available in USD, GBP, EUR, KWD, and MYR, while the cent account only supports deposits in USD.

Stop Out: 20%, Margin Call: 50%.

| Pros | Cons |

| Low minimum deposit from $1, very friendly to beginners | Multil-currency accounts only for standard and pro accounts |

| Generous leverage up to 1:3000 | |

| Swap-free for all three types of accounts | |

How to open an account?

To open an account with Emar Markets, you need to follow a few simple steps.

First, you need to visit their website and click on the “Register” button.

Then, you will be required to fill out a registration form, which includes personal details such as your name, email address, and phone number.

After completing the form, you will need to verify your identity by providing the necessary documents, including a government-issued ID and a utility bill.

Once your account is verified, you can choose the account type that suits your trading needs and deposit the required minimum amount. The next step is to download the trading platform and log in to your account. You can then start trading various financial instruments, including forex, commodities, and stocks.

Leverage

Emar Markets offers high leverage for its traders, with the maximum trading leverage reaching up to 1:3000. This high level of leverage allows traders to open larger positions with a smaller amount of capital, potentially amplifying their profits. However, it is important to note that high leverage also increases the risks of trading and can lead to significant losses, particularly for inexperienced traders. It is therefore advisable for traders to use leverage carefully and to have a solid risk management plan in place to protect their trading capital.

Here is a table comparing the maximum leverage offered by Emar Markets with three other forex brokers:

| Broker Name | Maximum Leverage |

| Emar Markets | Up to 1:3000 |

| Exness | Up to 1:2000 |

| FP Markets | Up to 1:500 |

| IC Markets | Up to 1:500 |

Spreads & Commissions (Trading Fees)

Emar Markets offers its clients competitive trading fees in the form of spreads, which vary according to the type of trading account chosen. For cent and standard accounts, the spreads start from as low as 1 pip, while for pro accounts, the spreads can be as low as 0.1 pip. It is important to note that Emar Markets does not disclose any information on commissions charged. While Emar Markets offers competitive spreads starting from 1 pip in cent and standard accounts, and as low as 0.1 pips in pro accounts, the lack of transparency around commission rates can be concerning for traders. Hidden commission charges can add up and affect profitability, making it difficult for traders to accurately assess the true cost of trading with this broker.

| Pros | Cons |

| Competitive spreads, from 0.1 on pro account | Commission information not disclosed |

| High spreads on cent and standard accounts | |

| Hidden trading fees may apply | |

| Spreads on particular instruments not specific |

Non-Trading Fees

Emar Markets imposes certain non-trading fees, which can affect traders' profits. One of the significant fees charged by the broker is the inactivity fee. If there is no activity in the trading account for 180 days, Emar Markets charges a monthly inactivity fee of $50. Additionally, the broker charges a withdrawal fee of 3.5% of the amount being withdrawn, which is comparatively higher than other brokers. However, the broker does not charge any deposit fees, which can be an advantage for traders who frequently deposit funds into their trading accounts.

| Pros | Cons |

| No deposit fees | Inactivity fee of $50/month |

| a withdrawal fee of 3.5% applied |

Trading Platform

Emar Markets offers its clients two popular trading platforms: the MetaTrader 5 (MT5) and cTrader. MT5 is a well-known platform in the industry, widely used by many traders for its advanced features, user-friendly interface, and support for automated trading strategies. It offers a range of technical indicators, charting tools, and other features to help traders analyze the market and make informed decisions. The cTrader platform, on the other hand, is a popular choice for traders who prioritize speed and order execution. cTrader is a multi-asset CFD and Forex trading platform developed in 2010 and it is one of the most well-known trading platforms in the world. It offers advanced charting, one-click trading, and a wide range of customizable features to help traders tailor the platform to their specific needs.

Here's a table comparing the trading platforms offered by Emar Markets, TNFX, IC Markets, and FxPro:

| Broker | Trading Platform |

| Emar Markets | MT5, cTrader |

| TNFX | MT4 |

| IC Markets | MT4, MT5, cTrader |

| FxPro | MT4, MT5, cTrader, FXpro trading platform |

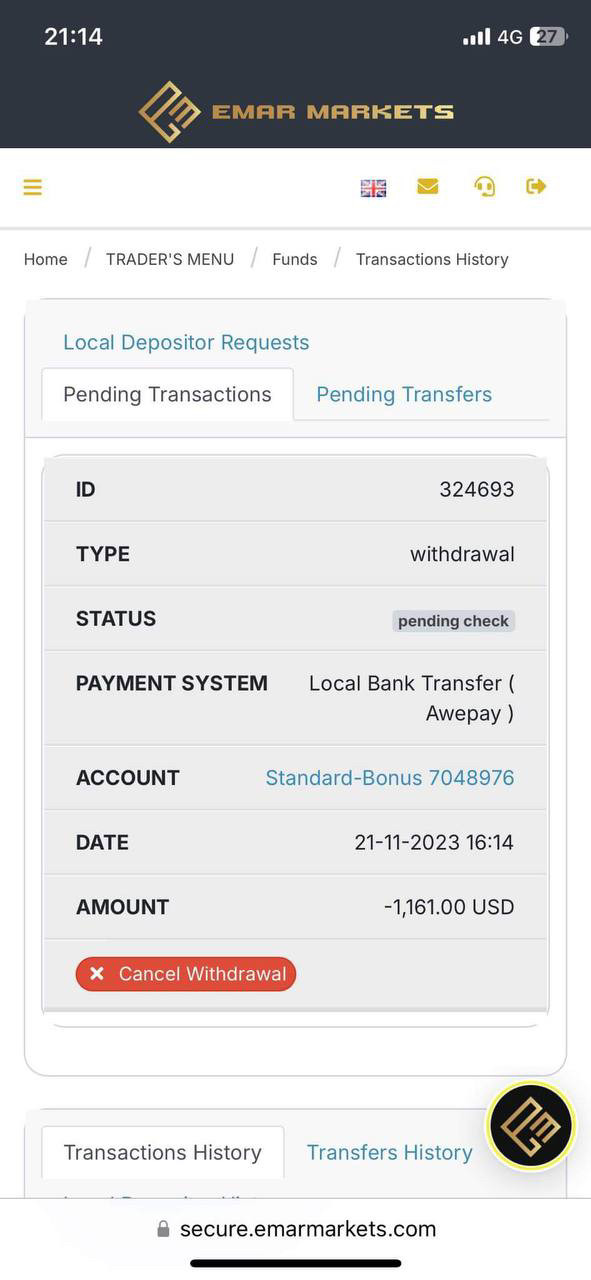

Deposit & Withdrawal

Emar Markets offers a variety of payment methods for both deposits and withdrawals, including bank transfer, Bitcoin, MasterCard, VISA, Neteller, FPX, and Tether. The availability of these payment options may vary based on the client's country of residence. It is important to note that Emar Markets does not charge any deposit fees. However, there may be fees associated with withdrawals depending on the payment method chosen.

Bank transfer may take 1-3 business days for deposits and 3-5 business days for withdrawals. Bitcoin deposits and withdrawals are usually processed within 24 hours, while Neteller and Skrill deposits are usually instant. Clients can also use credit or debit cards to deposit funds instantly. It is important to note that the withdrawal request will be processed back to the same payment method used for depositing funds.

Emar Markets doesn't charge deposit fees. However, there may be withdrawal fees depending on the payment method used. For example, bank wire transfers have a withdrawal fee of $30 for transactions under $2000, and $50 for transactions above $2000. Cryptocurrency withdrawals have a fee of 0.5%. It is important for traders to review the fees and conditions for each payment method before making deposits or withdrawals.

Bonuses Offered

Emar Markets offers a $50 welcome bonus and 100% deposit bonus to clients who meet certain conditions. While bonuses may seem attractive, it's important to note that they often come with terms and conditions that clients need to fulfill before being able to withdraw the bonus funds. This can include a certain trading volume requirement, time limit, or other conditions. Traders should carefully review the terms and conditions of any bonus offer before accepting it.

Customer Support

Emar Markets does not appear to offer email or telephone support for its clients. However, the broker provides a comprehensive FAQ section on its website that covers various topics related to trading with Emar Markets. In addition, the broker can be contacted via its official social media pages, such as Facebook, Instagram and Telegram.

Educational Resources

It seems that they do not offer any specific educational resources for their clients. They do not have a designated education section or provide access to any educational materials such as webinars, courses, or e-books. However, they do have a FAQ section that covers basic topics related to account opening, trading, and funding.

It is important to note that lack of educational resources may be a disadvantage for beginner traders who require guidance and support to improve their trading skills and knowledge. Without adequate educational resources, traders may struggle to develop profitable trading strategies and increase their chances of success in the markets. Therefore, traders should carefully consider this aspect before choosing a broker.

Restricted Areas

EMAR Markets LTD does not offer and does not provide services to residents and citizens of certain jurisdictions, including Australia, Canada, the EU and EEA, Japan, the United Kingdom, the United States of America, and countries sanctioned by the EU.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience. The information presented in this article is intended solely for reference purposes.

Conclusion

In conclusion, Emar Markets is an online forex and CFD broker registered in Saint Vincent and the Grenadines that offers trading in a variety of instruments, including forex, stocks, and cryptocurrencies. The broker offers a range of trading accounts, including Cent, Standard, and Pro accounts, with competitive leverage up to 1:3000, as well as popular trading platforms such as MT5 and cTrader. However, the broker's customer support is limited to a FAQ section and social media, and it does not provide any educational resources.

FAQs

Q: Is Emar Markets a regulated broker?

A: Emar Markets is registered in Saint Vincent and the Grenadines and does not have any known regulatory oversight.

Q: What is the maximum leverage offered by Emar Markets?

A: The maximum trading leverage offered by Emar Markets is up to 1:3000.

Q: What trading platforms are offered by Emar Markets?

A: Emar Markets offers both the MT5 and cTrader trading platforms.

Q: What payment methods are available for deposit and withdrawal at Emar Markets?

A: Emar Markets offers a variety of payment methods, including bank transfer, Bitcoin, MasterCard, VISA, Neteller, FPX, and Tether.

Q: Does Emar Markets charge deposit and withdrawal fees?

A: Emar Markets does not charge deposit or withdrawal fees, but there may be fees imposed by payment providers.

Q: What customer support options are available at Emar Markets?

A: Emar Markets does not offer email or telephone support but does have a FAQ section and social media presence for customer inquiries.

Q: Does Emar Markets provide educational resources for traders?

A: No, Emar Markets does not offer any educational resources for traders。

Keywords

- 2-5 years

- Regulated in South Africa

- Financial Service Corporate

- Suspicious Scope of Business

- Suspicious Overrun

- Medium potential risk

Review 8

Content you want to comment

Please enter...

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

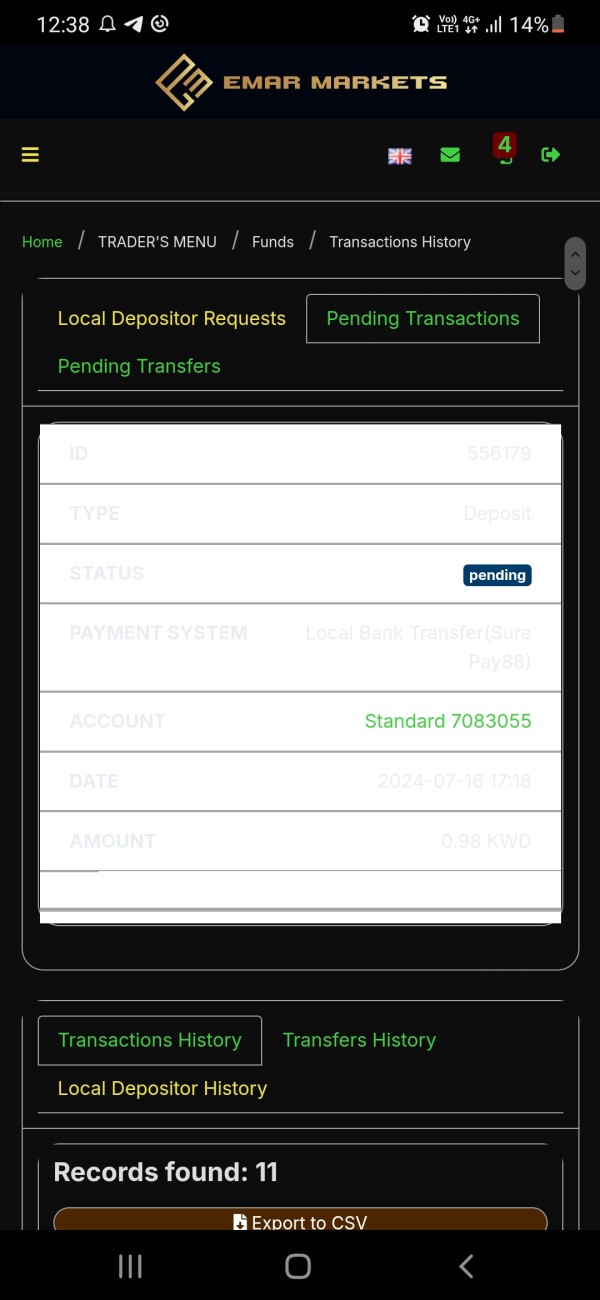

harvy1130

Malaysia

I have a problem with the deposit not being included in my trader's acc.. the platform is very disappointing..

Exposure

2024-07-22

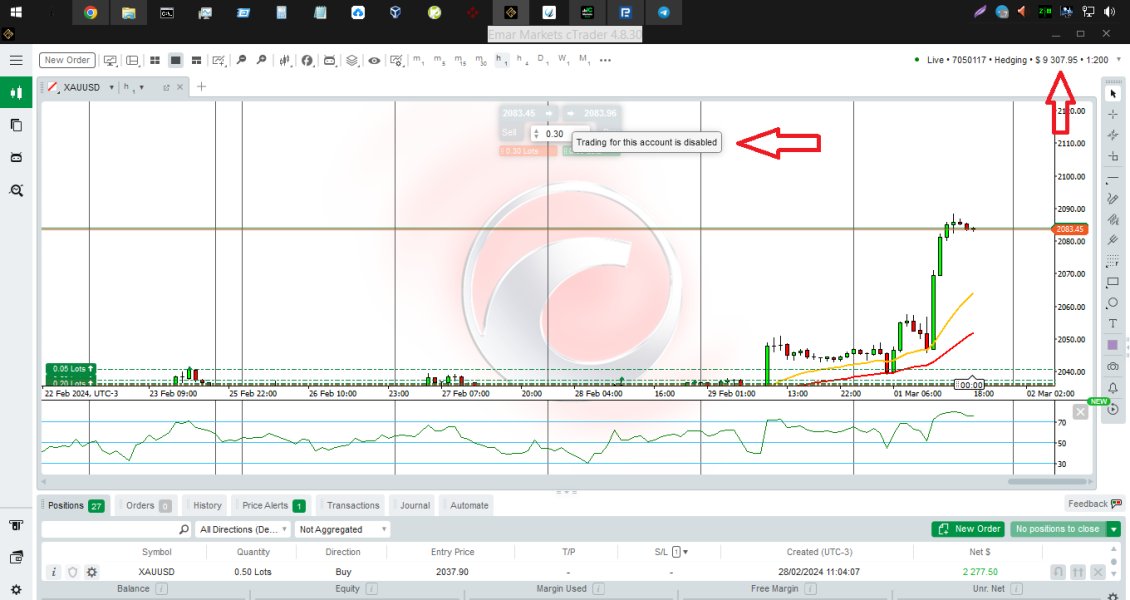

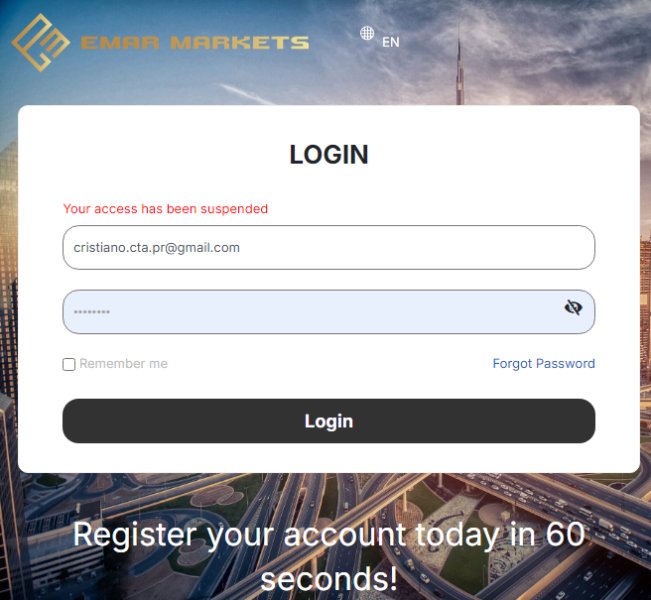

Cristiano Cezarino Pereira

Brazil

This broker deactivated my account claiming that I had operations that were not in accordance with the operator's rules, I have my own strategies, it's not my fault if I always manage to win, and now they don't want to refund my account balance, I don't know what else to do for her to refund my money, I have already contacted her via the email she provided, but to no avail, this discourages any trader, the broker should help us, but ends up hurting us!

Exposure

2024-03-04

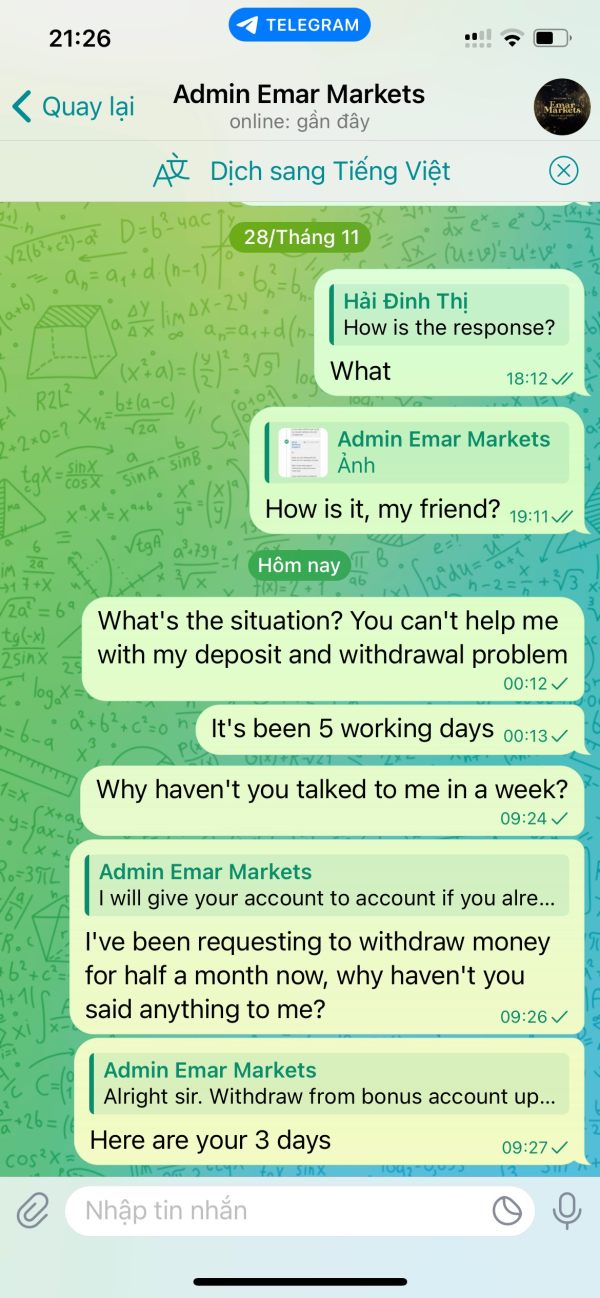

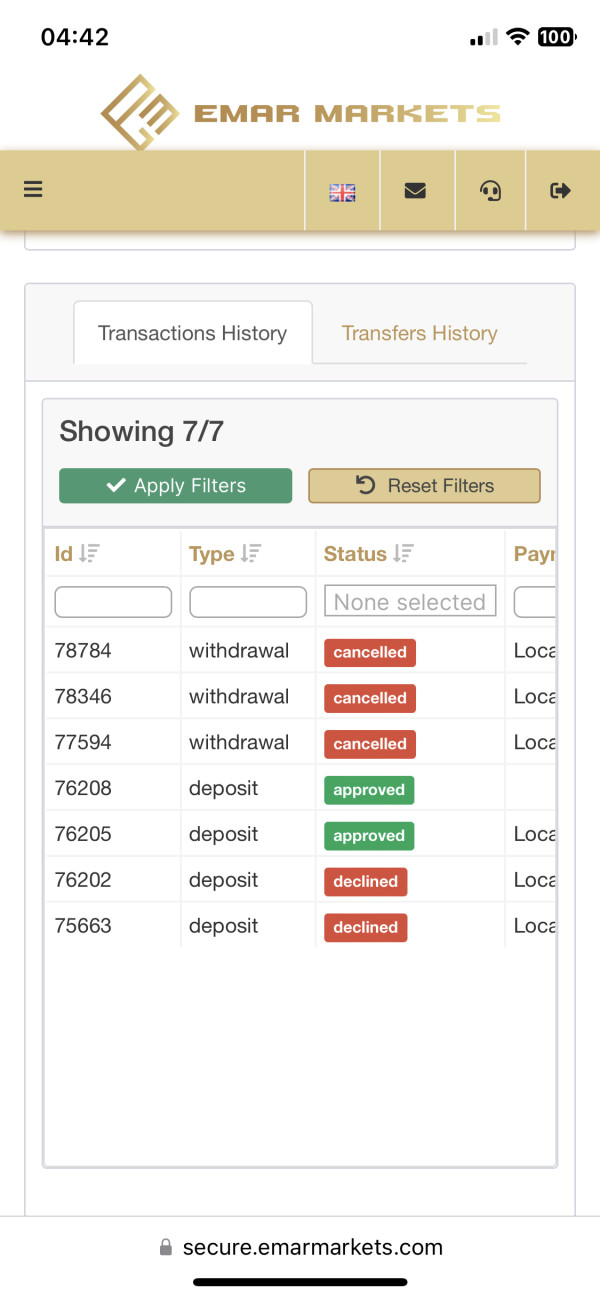

Dinh Thi Hai

Vietnam

The broker scammed me and I made a withdrawal order 10 days ago and they did not approve the withdrawal request

Exposure

2023-11-30

vu van thin

Vietnam

Can't withdraw money from scam platform

Exposure

2023-03-25

攻城略地

United Arab Emirates

I have had consistent profits with Emar Markets, thanks to their reliable trading platform and low fees. However, their customer service can be slow to respond, which can be frustrating in urgent situations.

Neutral

2023-02-27

FX1046967589

Malaysia

Very user friendly broker. Easy to close all 100 layers with one click button. Very smooth execution and fast withdrawal. Strongly suggest for newbies. Very good broker!

Positive

2023-05-03

Mat Yub

Malaysia

Has been trading on this platform for months. Fast withdrawal and low spread.

Positive

2023-02-12

张艺凡爸爸

Taiwan

I have moved over to use them as my main trading account for 2 months now. Fast withdrawals and an easy platform and leverage are better than most others out there. Can’t see myself changing ever again.

Positive

2022-12-16