Score

Smart Contract

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.smartcontractslimited.com/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Smart Contract Ltd

Smart Contract

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 29 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | 100 |

| Minimum Spread | 1.3 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | 1000 |

| Minimum Spread | 0.1 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Smart Contract also viewed..

XM

Exness

CPT Markets

FBS

Smart Contract · Company Summary

Note: Smart Contracts official site - https://www.smartcontractlimited.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| Smart Contract Review Summary in 10 Points | |

| Founded | N/A |

| Registered Country/Region | United Kingdom |

| Regulation | NFA (unauthorized) |

| Market Instruments | forex currency pairs, commodities, shares, indices, and cryptocurrencies |

| Demo Account | N/A |

| Leverage | 1:500 |

| EUR/USD Spread | From 1.3 pips (STD) |

| Trading Platforms | MT4/5 |

| Minimum deposit | $100 |

| Customer Support | |

What is Smart Contract?

Smart Contract is a multi-asset broker based in the United Kingdom, providing traders with access to a diverse range of trading instruments through the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). However, it is important to note that the NFA license of Smart Contract is unauthorized, which raises concerns about the regulatory status of the broker. Additionally, the current unavailability of the broker's website further adds to the uncertainty surrounding its operations.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Wide range of trading instruments | • Unauthorized NFA license |

| • MT4/5 supported | • Unavailable website |

| • Popular payment methods available | • Reports of withdrawal issues and scams |

| • Only email support |

Smart Contract Alternative Brokers

Vantage FX - for traders seeking a wide range of trading instruments and competitive trading conditions.

Forex Club - for beginner traders looking for comprehensive educational resources and user-friendly trading platforms.

Global Prime - for experienced traders seeking a reputable and regulated broker with competitive pricing and excellent customer service.

There are many alternative brokers to Smart Contract depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Smart Contract Safe or Scam?

Based on the information available, it appears that Smart Contract operates without valid regulation and holds an unauthorized National Futures Association (NFA, License No. 0538567) license. This lack of regulation and authorization raises concerns about the safety and legitimacy of the platform. Additionally, the website is down currently. It is important for traders to exercise caution and conduct thorough research before engaging with unregulated platforms, as they may pose higher risks.

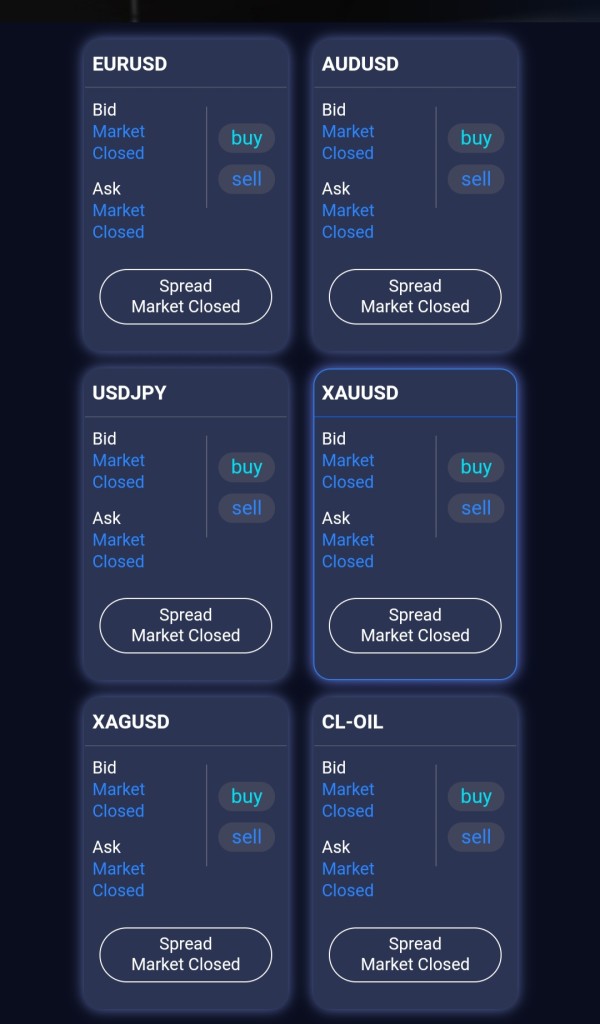

Market Instruments

Smart Contract claims to offer a variety of tradeable assets, including forex currency pairs, commodities, shares, indices, and cryptocurrencies. These market instruments provide traders with a diverse range of options to engage in different financial markets.

Forex currency pairs allow traders to speculate on the exchange rate movements between various currency pairs. Commodities, such as gold, silver, and oil, provide opportunities to trade based on supply and demand dynamics in the global commodity markets. Shares allow traders to invest in individual stocks of publicly traded companies. Indices represent a basket of stocks and provide an opportunity to trade on the overall performance of a specific market. Lastly, cryptocurrencies, like Bitcoin and Ethereum, offer traders the ability to participate in the growing digital currency market.

However, it's important to note that due to the unregulated nature and unavailable website of Smart Contract, the actual availability and reliability of these market instruments cannot be independently verified.

Accounts

Smart Contract offers two types of trading accounts: STD (Standard) and Prime. The STD account requires a minimum deposit of $100, making it accessible for traders with smaller capital. This account type may be suitable for beginners or those who want to start with a lower investment.

On the other hand, the Prime account requires a higher minimum deposit of $1,000, indicating that it is designed for more experienced traders or those who are willing to commit a larger amount of capital.

Leverage

Smart Contract offers leverage of up to 1:500, which provides traders with the opportunity to amplify their trading positions. With a leverage ratio of 1:500, traders can control a larger position in the market compared to their available capital. This high leverage allows for the potential of magnified profits, but it's important to note that it also carries an increased level of risk.

While leverage can enhance trading opportunities, it also exposes traders to higher potential losses. It is crucial for traders to exercise caution and employ effective risk management strategies when utilizing high leverage. It is recommended that traders fully understand the implications of using leverage and consider their risk tolerance and trading objectives before engaging in leveraged trading with Smart Contract or any other platform.

Spreads & Commissions

Smart Contract offers competitive spreads for both of its account types. For the STD account, the spreads start from 1.3 pips, which is relatively competitive within the industry. On the other hand, the Prime account offers even tighter spreads, starting from as low as 0.1 pips. These low spreads can potentially benefit traders by reducing their trading costs and improving their overall trading experience.

However, it is important to note that there is no specific information available regarding commissions. Traders should review the platform's terms and conditions or contact customer support to obtain accurate information about any potential commissions that may apply to their trading activities. It is always recommended to have a clear understanding of all costs involved, including spreads and commissions, before engaging in trading with Smart Contract or any other broker.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Smart Contract | 1.3 pips (STD) | N/A |

| Vantage FX | 1.2 pips | $7 round-turn |

| Forex Club | 1.0 pips | Varies by account type |

| Global Prime | 0.0 pips | $7 round-turn |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

Trading Platforms

Smart Contract provides traders with access to two widely recognized and popular trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their advanced features, user-friendly interface, and robust trading capabilities. MT4 and MT5 offer a wide range of tools and functionalities that cater to the needs of both beginner and experienced traders.

Traders can benefit from comprehensive charting tools, technical indicators, and a variety of order types for precise trade execution. The platforms also support automated trading through the use of expert advisors (EAs) and allow traders to develop and implement their own trading strategies.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Smart Contract | MT4, MT5 |

| Vantage FX | MT4, MT5, WebTrader |

| Forex Club | Libertex, MetaTrader 4 |

| Global Prime | MetaTrader 4, cTrader |

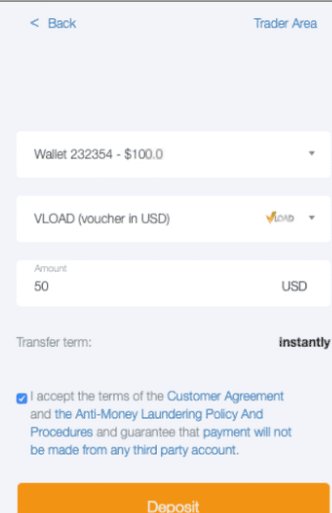

Deposits & Withdrawals

Smart Contract accepts credit/debit cards, wire transfer, and a couple of alternative methods. The minimum deposit requirement is stated to be $100. However, we didnt find any more detailed information about fees and processing time.

Smart Contract minimum deposit vs other brokers

| Smart Contract | Most other | |

| Minimum Deposit | $100 | $100 |

Customer Service

Smart Contract provides customer support primarily through email communication. Traders can reach out to the support team via email to address any inquiries, concerns, or issues they may have. While email support can be effective in addressing various matters, it is important to note that the lack of alternative contact methods such as phone support or live chat may limit the immediacy of assistance.

| Pros | Cons |

| N/A | • No 24/7 customer support |

| • Limited customer service channels (only email) | |

| • Lack of live chat or phone support |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Smart Contract's customer service.

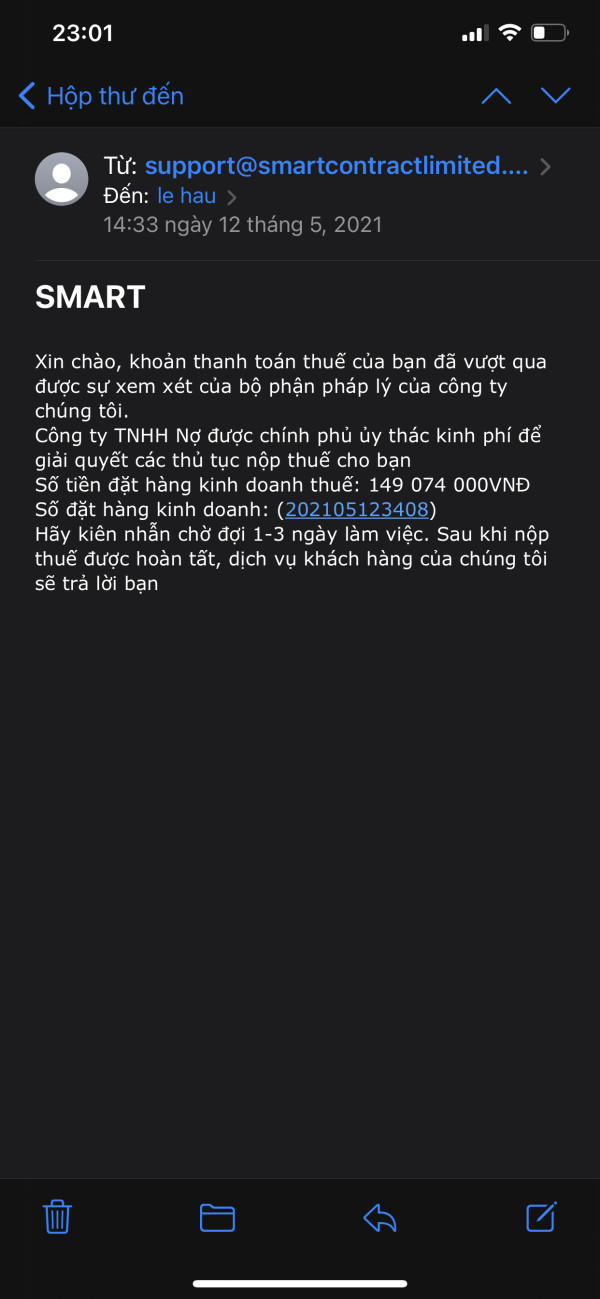

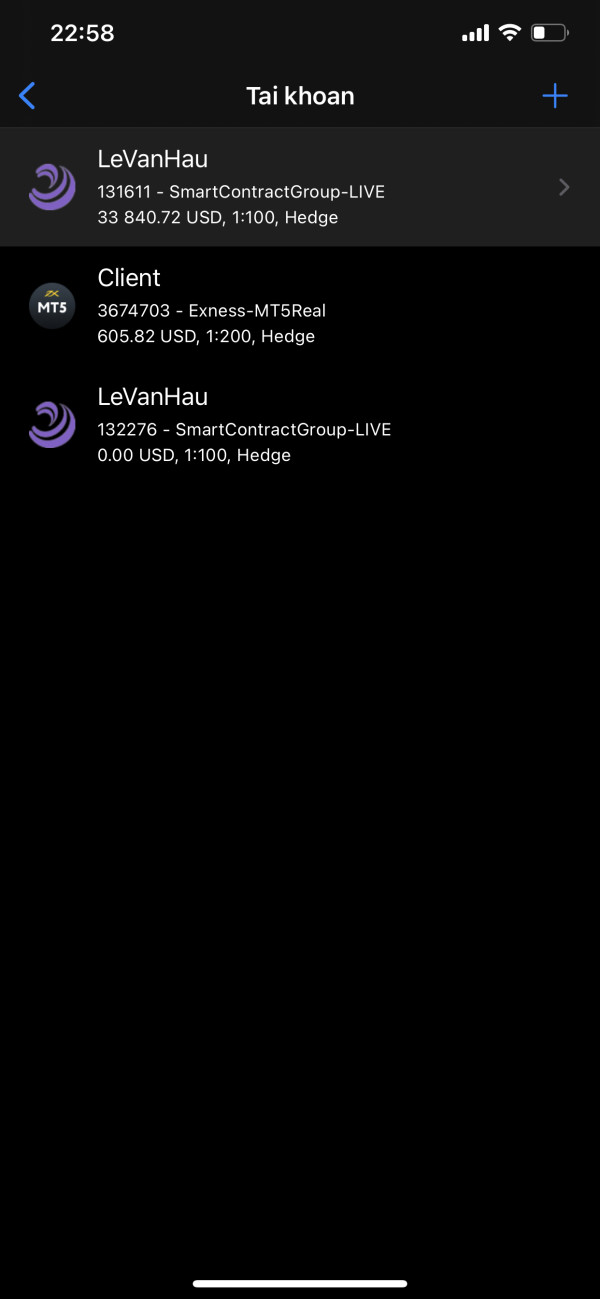

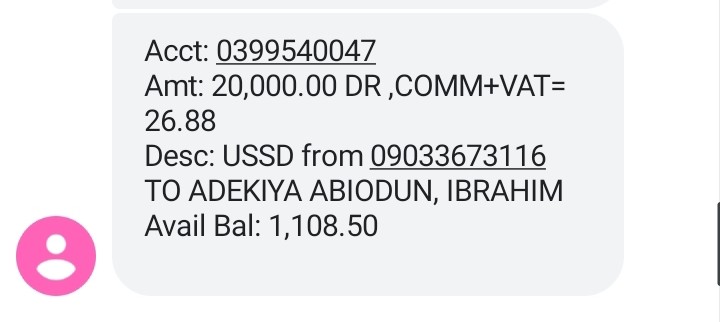

User Exposure on WikiFX

On our website, you can see that some reports of unable to withdraw and scams. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

As a whole, Smart Contract is an unregulated platform, and there have been reports of withdrawal issues and scams associated with it. Traders are advised to exercise caution and thoroughly research the platform before engaging in any transactions. The lack of regulatory oversight and the potential risks involved in trading on an unregulated platform should be carefully considered. It is recommended to explore regulated and reputable alternatives that prioritize investor protection and adhere to industry standards.

Frequently Asked Questions (FAQs)

| Q 1: | Is Smart Contract regulated? |

| A 1: | No. Smart Contract National Futures Association (NFA, License No. 0538567) license is unauthorized. |

| Q 2: | Does Smart Contract offer the industry leading MT4 & MT5? |

| A 2: | Yes. It supports MT4 and MT5. |

| Q 3: | What is the minimum deposit for Smart Contract? |

| A 3: | The minimum initial deposit to open an account is $100. |

| Q 4: | Is Smart Contract a good broker for beginners? |

| A 4: | No. It is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

Review 33

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now